TIDMBHL

RNS Number : 7454A

Bradda Head Lithium Ltd

24 January 2024

24 January 2024

Bradda Head Lithium Ltd

("Bradda Head", "BHL" or the "Company")

Additional Near Surface, High Grade, Lithium Discoveries made at

Morning Star Pegmatites in the San Domingo District Play

Bradda Head Lithium Ltd (AIM:BHL, TSX-V:BHLI,), the North

America-focused lithium development group, announces further

results from the Phase 2 core drilling at San Domingo ("SD"),

Arizona. This is the third and final set of assays released from

the Company's 18,950 feet (5,776m) programme, completed December 2,

2023 and focuses on the Morning Star and Morning Star South

targets, located southwest of the Central Targets. The programme

has delivered an abundance of encouraging results over the December

holiday break.

Ian Stalker, Executive Chair, commented:

"As we reach the end of this current San Domingo drilling

exploration program, our objectives have been met and indeed

surpassed and, as a result our expectations heightened. It is worth

reflecting that total drilled metres at SD, from both programmes is

only 13,076 meters, covering less than 1% of the total property.

These were the first two drilling programmes of any note undertaken

at this historic and road accessible lithium mining camp in the

USA. In today's world the return on investment in these two

campaigns has been substantial and we will build on this as we move

forward. In other words, when the Lithium market bounces back, as

we believe it will, we will be ready to maximise value from our

total Lithium Portfolio including of course San Domingo. The

strategic location in the USA of our 'ready to move forward

projects' should not be discounted. America remains hungry for its

own 'home produced lithium!!'

"Our portfolio of pegmatites are emerging as viable and

potentially extractable near surface resources. The shallow and

high-grade intercepts seen at Morning Star are very exciting and we

look forward to building 3-D models that may lead to follow-up

drilling later this year. The abundance of tantalum, tin, and

beryllium are a bonus, potentially adding value to this maiden

drill programme at Morning Star. The obvious LCT (

lithium-caesium-tantalum geochemical signature, e.g., Kathleen

Valley signature) style of mineralisation confirms our belief that

we have a formidable district with massive upside potential."

"The fact that Morning Star contains high grade lithium as well

as being rich in tantalum, beryllium, tin with massive zones of

potassium feldspar means that we could have an exciting, diverse

and economic deposit. We have more 3D modeling to explore and,

given what we have discovered to date, this could significantly

change the way we examine not only Morning Star, but the rest of

the San Domingo pegmatite trend within our 33km(2) property."

"Parallel to our field work, and complements to our team that

delivered these results, we have streamlined our corporate

overhead. The net effect of this combined effort - business

management and technical know how - means that despite a very poor

Lithium market back drop we are now well placed financially and

geologically to be able to move with speed and with our in-house

skills to grow this investment opportunity. In the meantime, we

continue with our 'steady as she goes' approach with no superfluous

costs and intend to move back on the resource growth plan at Basin,

Arizona."

Summary :

-- High grade lithium mineralisation found at intervals such as

4.14m at 2.07% Li(2) O at a depth of 54.56m in drill hole

SD-DH23-104 and 5.40m of 1.70% Li(2) O at a depth of 31.39m in 093,

both at the Morning Star pegmatites (all holes are abbreviated from

SD-DH23-)

-- Again, favoured coarse-grained spodumene crystals are

observed as the dominant lithium mineral with minor amounts of

lepidolite and montebrasite

-- Large, cohesive, and mostly vertical pegmatite bodies were

verified at Morning Star, which were strongly zoned with massive

quartz, fine-grained albite, and minor schorl as well as massive

zones of potassium feldspar

-- Pathfinder elements of tin, tantalum ("Ta(2) O(5) "), and

beryllium ("BeO") are found to be highly anomalous in the drilling,

such as 6.76m at 145ppm Sn in hole 100, 872ppm Ta(2) O(5) with

0.23% BeO in drill hole SD-DH23-088 over 2.90m

-- Morning Star drill hole 088 contains high-grade Ta(2) O(5)

with an interval of 872ppm Ta(2) O(5) ppm and anomalous tin over

2.90m at a depth of 39.26m and 477 Ta(2) O(5) ppm over 5.34m at

75.74m depth

-- Lithium, plus the bonus of ore grade Ta(2) O(5) with discrete

anomalous tin and BeO in the Morning Star drill holes in a shallow

environment, bodes well for the potential of open cut mining.

Results from the Morning Star and South Morning Star targets are

highlighted by the following intervals:

-- 4.14m at 2.07% Li(2) O in drill hole 104 at Morning Star

-- 5.40m of 1.70% Li(2) O followed by 4.18m of 1.63% Li(2) O

(within 14.63m at 0.54% Li(2) O) plus 0.67m of 1.21% BeO, all above

55.93m depth in drill hole 093 at Morning Star

-- 5.55m of 1.03% Li(2) O in hole 099 at South Morning Star

-- 6.67m at 0.82% Li(2) O in drill hole 100 at South Morning Star

-- 2.01m at 1.84% Li(2) O in drill hole 091 at Morning Star

-- 2.80m at 0.65% Li(2) O in drill hole 090 at Morning Star

-- Morning Star surface samples of 4.35% and 3.67% Li(2) O above

holes 093 and 104 highlight open pit potential

-- Wide-open potential >100m depth, virtually unexplored by

this second program and presents impressive opportunities district

wide

Figure 1 : Cross section through Morning Star, drill hole

SD-DH23-093 and SD-DH23-104 high grade intercepts, surface samples

up to 0.92% Li(2) O

Drilling at Morning Star, located 1.0km southwest of the Central

Targets, commenced in late October with holes 088 through 098 and

104 for a total of 12 holes totalling 2,159m. Most holes were

drilled perpendicular to the main northeast trending and steeply

dipping pegmatite bodies, all of which encountered variable amounts

of pegmatite with visible spodumene and minor segments of

lepidolite and montebrasite. Holes 093 and 104 contain the

highest-grade intercepts with 5.40m at 1.70% starting at 31.39m

followed by 4.18m at 1.63% Li(2) O at 51.66m in hole 093, and 4.14m

at 2.07% Li(2) O at 54.56m followed by 4.57m at 1.12% Li(2) O at

66.75m in hole 104. Theses intercepts are compelling and

justification to follow-up on the high-grade intercepts discovered

in holes 093 and 104 with future exploration drilling. Notably, two

surface samples near the collars of 093 and 104 returned 4.35% and

3.67% Li(2) O, highlighting the potential connectivity with the

subsurface drill hole samples and open cut potential.

Ta(2) O(5) is highly anomalous at Morning Star, occurring with

or without lithium mineralisation such as in hole 088 where there

is 2.90m of 872 Ta(2) O(5) ppm with 0.46% Li(2) O and 0.23% BeO

including 1.13m of 2,220 Ta(2) O(5) represented as fine grained

tantalite in drill core.

High potassium values are found as massive potassium feldspar

with samples up to 12.00% K and an interval of 22.52m at 10.72% K

identified drill hole 104, isolated above the lithium rich

intervals at Morning Star. Further investigations into the

potassium distribution are planned as this could be a viable source

of potassium feldspar.

Immediately to the south is South Morning Star where a mine

exposes coarse grained spodumene crystals and was the target of

holes 099 through 103, cutting multiple zones of lithium

mineralization, see Figure 3 below for target location. Drill hole

099 intersected shallow mineralization with 6.69m of 0.58% Li(2) O

at 8.53m depth followed by 5 .55m of 1.03% Li(2) O at 31.03m. Hole

100 was drilled from the same site at a steeper angle (-75 degrees)

and cut multiple intervals of lithium mineralization, again quite

shallow highlighted by 3.04m at 0.68% Li(2) O and 123ppm Sn at

16.50m depth, followed by 6.75m at 0.82% Li(2) O and 145ppm Sn at

32.92m depth, both within 28.77m of 0.36% Li(2) O and 91ppm Sn. New

surface work will focus on collecting channel samples across the

prospect that will contribute to expansion of this very shallow and

potential open cut resource.

Table 1 : San Domingo, Morning Star and South Morning Star Drill

Hole Highlights

Hole number From To Int Li(2) Sn Ta(2) BeO Target

(m) (m) (m) O (%) (ppm) O(5) (%)

( ppm)

SD-DH23-088 28.80 31.09 2.28 0.41 620 0.06 Morning Star

------ ------- ------ ------- ------- -------- ----- --------------

28.80 45.63 16.82 0.19 164

------ ------- ------ ------- ------- -------- ----- --------------

39.26 42.15 2.90 0.46 872 0.23

------ ------- ------ ------- ------- -------- -----

46.51 49.62 3.11 223

------ ------- ------ ------- ------- -------- -----

48.77 49.62 0.85 0.49 259

------ ------- ------ ------- ------- -------- -----

75.74 102.02 21.45 0.03

------ ------- ------ ------- ------- -------- -----

75.74 81.08 5.34 477

------ ------- ------ ------- ------- -------- -----

SD-DH23-089 21.95 39.78 17.82 0.04

------ ------- ------ ------- ------- -------- -----

29.32 32.31 2.98 80

------ ------- ------ ------- ------- -------- -----

44.96 51.21 6.23 76 147

------ ------- ------ ------- ------- -------- -----

48.01 50.9 2.89 298

------ ------- ------ ------- ------- -------- -----

SD-DH23-090 6.10 22.52 17.43 0.17 75 42

------ ------- ------ ------- ------- -------- -----

6.10 10.82 4.73 116

------ ------- ------ ------- ------- -------- -----

16.25 19.05 2.80 0.65 109 48

------ ------- ------ ------- ------- -------- -----

SD-DH23-091 43.28 55.17 7.45 0.06 91

------ ------- ------ ------- ------- -------- -----

61.57 63.58 2.01 1.84 404

------ ------- ------ ------- ------- -------- -----

SD-DH23-093 5.64 11.67 6.04 151

------ ------- ------ ------- ------- -------- -----

16.76 17.83 1.07 0.31

------ ------- ------ ------- ------- -------- -----

31.39 40.39 8.99 1.20

------ ------- ------ ------- ------- -------- -----

with 31.39 36.79 5.40 1.70

------ ------- ------ ------- ------- -------- -----

44.20 58.83 14.63 0.54 71

------ ------- ------ ------- ------- -------- ----- --------------

with 51.66 55.93 4.18 1.63 100 52 Morning Star

------ ------- ------ ------- ------- -------- ----- --------------

78.64 83.39 4.75 0.04 82

------ ------- ------ ------- ------- -------- ----- --------------

SD-DH23-094 17.22 23.16 5.93 0.07

------ ------- ------ ------- ------- -------- -----

52.12 53.80 1.68 0.89 80 80

------ ------- ------ ------- ------- -------- -----

66.75 72.09 5.33 0.05

------ ------- ------ ------- ------- -------- -----

SD-DH23-095 68.64 72.24 3.6 0.04 62

------ ------- ------ ------- ------- -------- -----

SD-DH23-096 48.37 56.39 7.05 0.03

------ ------- ------ ------- ------- -------- -----

SD-DH23-097 75.29 76.23 0.94 0.12

------ ------- ------ ------- ------- -------- -----

97.99 101.59 3.60 0.04

------ ------- ------ ------- ------- -------- -----

SD-DH23-098 78.46 90.22 11.75 0.05

------ ------- ------ ------- ------- -------- ----- --------------

South Morning

SD-DH23-099 8.53 15.24 6.69 0.58 89 23 Star

26.27 27.37 1.10 0.10 160 266

------ ------- ------ ------- ------- -------- -----

31.03 36.58 5.55 1.03 99

------ ------- ------ ------- ------- -------- -----

SD-DH23-100 7.10 9.36 2.26 367

------ ------- ------ ------- ------- -------- -----

10.91 39.68 28.77 0.36 91

------ ------- ------ ------- ------- -------- -----

with 10.91 13.11 2.20 0.64 81

------ ------- ------ ------- ------- -------- -----

plus 16.15 19.20 3.05 0.68 123

------ ------- ------ ------- ------- -------- -----

and 32.92 39.68 6.76 0.82 145

------ ------- ------ ------- ------- -------- -----

SD-DH23-100 5.03 6.71 1.68 0.49 55 48

------ ------- ------ ------- ------- -------- -----

SD-DH23-101 13.56 15.85 2.29 0.30 80 58

------ ------- ------ ------- ------- -------- -----

18.80 20.85 1.37 0.12 58

------ ------- ------ ------- ------- -------- -----

SD-DH23-102 39.08 42.37 3.29 0.04

------ ------- ------ ------- ------- -------- -----

SD-DH23-103 7.32 14.02 6.70 0.07 77 41

------ ------- ------ ------- ------- -------- -----

SD-DH23-104 8.84 10.52 1.68 0.65 Morning Star

54.56 58.70 4.14 2.07 67

------ ------- ------ ------- ------- -------- -----

66.75 71.32 4.57 1.12 76 32

------ ------- ------ ------- ------- -------- -----

71.32 77.69 6.36 0.10 149

------ ------- ------ ------- ------- -------- -----

90.83 91.78 1.23 0.14

------ ------- ------ ------- ------- -------- -----

*All drill depths are from surface

Figure 2 : San Domingo Project, Target Locations

Figure 3 : Morning Star and South Morning Star drill holes,

pegmatites, targets and land

To close out the programme, the Company drill-tested two

distinct and unusually strong, soil geochemical anomalies

(Li-Cs-Rb) with holes collaring in greenstone, but the source of

the anomalies was not determined as no pegmatites were encountered.

One hole was located to the northeast of Morning Star (see Figures

3) and the other on the Monster target (Figure 2), northwest of

Jumbo.

For further information please visit the Company's website:

www.braddaheadltd.com .

QAQC

Core samples were split on site and bagged with sample tracking

tags. Samples were shipped by the Company directly to SGS

Laboratories in Burnaby, B.C., Canada where SGS prepped then

analysed all samples using sodium peroxide fusion combined ICP-AES

and ICP-MS, method GE_ICM90A50. Certified standards were inserted

into the sample stream and reviewed by the Qualified Person. Mr.

Wilkins consents to the inclusion of the technical information in

this release and context in which it appears.

Qualified Person (BHL)

Joey Wilkins, B.Sc., P.Geo., is Chief Operating Officer at BHL

and the Qualified Person who reviewed and approved the technical

disclosures in this news release. Mr. Wilkins is a graduate of the

University of Arizona with a B.Sc. in Geology with more than 38

years of experience in mineral exploration and is a qualified

person under the AIM Rules and a Qualified Person as defined under

NI-43-101. Mr. Wilkins consents to the inclusion of the technical

information in this release and context in which it appears.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU No. 596/2014) AS IT FORMS PART

OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO

BE IN POSSESSION OF INSIDE INFORMATION.

S

Contact:

Bradda Head Lithium Limited +44 (0) 1624 639 396

Ian Stalker, Executive Chairman

Denham Eke, Finance Director

Beaumont Cornish (Nomad) +44 (0) 2076 283 396

James Biddle / Roland Cornish

Panmure Gordon (Joint Broker) +44 (0) 2078 862 500

Hugh Rich

Shard Capital (Joint Broker) +44 (0) 2071 869 927

Damon Heath / Isabella Pierre

Red Cloud (North American

Broker) +1 416 803 3562

Joe Fars

Tavistock (Financial PR) + 44 20 7920 3150

Nick Elwes / Adam Baynes braddahead@tavistock.co.uk

About Bradda Head Lithium Ltd.

Bradda Head Lithium Ltd. is a North America-focused lithium

development group. The Company currently has interests in a variety

of projects, the most advanced of which are in Central and Western

Arizona: The Basin Project (Basin East Project, and the Basin West

Project) and the Wikieup Project.

The Basin East Project has an Indicated Mineral Resource of 17

Mt at an average grade of 940 ppm Li and 3.4% K for a total of 85

kt LCE and an Inferred Mineral Resource of 210 Mt at an average

grade of 900 ppm Li and 2.8% K (potassium) for a total of 1.09 Mt

LCE. In the rest of the Basin Project SRK has determined an

Exploration Target of 250 to 830 Mt of material grading between 750

to 900 ppm Li, which is equivalent to a range of between 1 to 4 Mt

contained LCE. The Group intends to continue to develop its three

phase one projects in Arizona, whilst endeavouring to unlock value

at its other prospective pegmatite and brine assets in Arizona,

Nevada, and Pennsylvania. All of Bradda Head's licences are held on

a 100% equity basis and are in close proximity to the required

infrastructure. Bradda Head is quoted on the AIM of the London

Stock Exchange with the ticker of BHL and on the TSX Venture

Exchange with a ticker of BHLI.

Technical Glossary

Kt Thousand tonnes

Ppm Parts per million

---------------------------------------------------

Exploration Target An estimate of the exploration potential

of a mineral deposit in a defined geological

setting where the statement or estimate,

quoted as a range of tonnes and a range

of grade (or quality), relates to mineralisation

for which there has been insufficient exploration

to estimate a Mineral Resource.

---------------------------------------------------

Inferred Mineral Resource That part of a Mineral Resource for which

quantity and grade (or quality) are estimated

on the basis of limited geological evidence

and sampling. Geological evidence is sufficient

to imply but not verify geological grade

(or quality) continuity. It is based on

exploration, sampling and testing information

gathered through appropriate techniques

from locations such as outcrops, trenches,

pits, workings, and drill holes. An Inferred

Mineral Resource has a lower level of confidence

than that applying to an Indicated Mineral

Resource and must not be converted to an

Ore Reserve. It is reasonably expected

that the majority of Inferred Mineral Resources

could be upgraded to Indicated Mineral

Resources with continued exploration.

---------------------------------------------------

Indicated Mineral That part of a Mineral Resource for which

Resource quantity, grade (or quality), densities,

shape and physical characteristics are

estimated with sufficient confidence to

allow the application of Modifying Factors

in sufficient detail to support mine planning

and evaluation of the economic viability

of the deposit. Geological evidence is

derived from adequately detailed and reliable

exploration, sampling and testing gathered

through appropriate techniques from locations

such as outcrops, trenches, pits, workings,

and drill holes, and is sufficient to assume

geological and grade (or quality) continuity

between points of observation where data

and samples are gathered.

---------------------------------------------------

Sn Tin

---------------------------------------------------

Ta(2) O(5) Tantalum pentoxide

---------------------------------------------------

Forward-Looking Statements

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release. This News Release includes certain "forward-looking

statements" which are not comprised of historical facts.

Forward-looking statements include estimates and statements that

describe the Company's future plans, objectives or goals, including

words to the effect that the Company or management expects a stated

condition or result to occur. Forward-looking statements may be

identified by such terms as "believes", "anticipates", "intends

to", "expects", "estimates", "may", "could", "would", "will", or

"plan". Since forward-looking statements are based on assumptions

and address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Although these statements

are based on information currently available to the Company, the

Company provides no assurance that actual results will meet

management's expectations. Risks, uncertainties, and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects, and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Forward looking information in this

news release includes, but is not limited to, following: The

Company's objectives, goals, or future plans. Factors that could

cause actual results to differ materially from such forward-looking

information include, but are not limited to: failure to identify

mineral resources; failure to convert estimated mineral resources

to reserves; delays in obtaining or failures to obtain required

regulatory, governmental, environmental or other project approvals;

political risks; future operating and capital costs, timelines,

permit timelines, the market and future price of and demand for

lithium, and the ongoing ability to work cooperatively with

stakeholders, including the local levels of government;

uncertainties relating to the availability and costs of financing

needed in the future; changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity prices; delays in the

development of projects, capital and operating costs varying

significantly from estimates; an inability to predict and

counteract the effects of COVID-19 on the business of the Company,

including but not limited to the effects of COVID-19 on the price

of commodities, capital market conditions, restriction on labour

and international travel and supply chains; and the other risks

involved in the mineral exploration and development industry, and

those risks set out in the Company's public documents filed on

SEDARplus. Although the Company believes that the assumptions and

factors used in preparing the forward-looking information in this

news release are reasonable, undue reliance should not be placed on

such information, which only applies as of the date of this news

release, and no assurance can be given that such events will occur

in the disclosed time frames or at all. The Company disclaims any

intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, other than as required by law.

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's

Nominated Adviser and is authorised and regulated by the FCA.

Beaumont Cornish's responsibilities as the Company's Nominated

Adviser, including a responsibility to advise and guide the Company

on its responsibilities under the AIM Rules for Companies and AIM

Rules for Nominated Advisers, are owed solely to the London Stock

Exchange. Beaumont Cornish is not acting for and will not be

responsible to any other persons for providing protections afforded

to customers of Beaumont Cornish nor for advising them in relation

to the proposed arrangements described in this announcement or any

matter referred to in it.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLZZGZMVDLGDZG

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

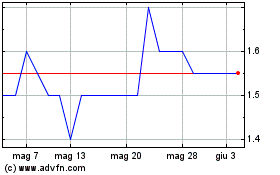

Grafico Azioni Bradda Head Lithium (LSE:BHL)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Bradda Head Lithium (LSE:BHL)

Storico

Da Mag 2023 a Mag 2024