Clarkson (Horace) - Final Results

19 Marzo 1999 - 8:31AM

UK Regulatory

RNS No 3527e

HORACE CLARKSON PLC

19th March 1999

Horace Clarkson PLC, which is the holding company for Clarksons, one of the

world's largest shipbrokers, announces preliminary results for the twelve

months ended 31 December 1998.

* Turnover of US$47.0 million (#28.4 million), down from US$54.2 million

(#33.1 million) in 1997.

* Profit before tax of #2.0 million (1997: #3.2 million) including

exceptional gain on asset sales of #0.9 million.

* Effective tax rate down to 34.8% (1997: 40.7%).

* Tender Offer successfully carried out.

* Final dividend maintained at 2.5 pence per share, making a total for

the year of 4.0 pence (1997: 4.0 pence).

Michael Beckett, Chairman, Horace Clarkson PLC, commented:

"Despite the difficult market conditions experienced last year, particularly

in the dry bulk sector, we have maintained our pre-eminent market position in

all the major sectors in which we operate. The tanker division in particular

has maintained its level of commission earnings by increasing its market

share.

"A continuous effort has been made to contain costs, however we believe it is

essential to maintain critical mass in the core areas of our business so that

we are well positioned to take advantage of any economic upturn as and when it

arises."

19 March 1999

Enquiries:

HORACE CLARKSON PLC Tel: 0171 283 8955

Michael Beckett

Robert Ward

CHAIRMAN'S STATEMENT

INTRODUCTION

PROFIT BEFORE TAX for the year ended 31 December 1998 was #2.0 million (1997:

#3.2 million) and includes an exceptional gain on asset sales of #0.9 million.

Turnover was #28.4 million (1997: #33.1 million).

REVIEW OF OPERATIONS

Overview

TURNOVER in US dollars, in which most of our business is transacted, decreased

to US$47.0 million (#28.4 million), from US$54.2 million (#33.1 million),

reflecting lower freight rates.

Despite the difficult market conditions experienced last year, particularly in

the dry bulk sector, we have maintained our pre-eminent market position in all

the major sectors in which we operate.

Dry Cargo

THE YEAR SAW a weakening dry bulk market, following an already difficult 1997.

Average vessel earnings decreased for all size ranges with rates for all

sectors the lowest since the mid 1980's.

Trade in most seaborne dry bulk commodities decreased in 1998, with the Asia

economic crisis the largest single factor in the downturn. The Panamax and

Handymax fleets grew by about 2% and 3% respectively, while the Capesize fleet

decreased by some 2%.

These adverse market conditions had a severe impact on this division's

commission earnings.

Tankers

TANKER MARKET performance varied by sector. The year's average freight rates

for modern VLCC and Suezmax tankers decreased by 6% and 11% from 1997 levels.

A strong first half of 1998 was offset by weakness in the second half, as

agreements to restrict crude oil production took effect.

Lower than expected growth in short haul crude trades and 35 new vessels

delivering in 1998 reduced average Aframax earnings to about US$15,600 per day

from US$21,200 per day in 1997. In the product tanker sector, decreasing

demand and a large number of deliveries contributed to lower vessel earnings.

Chemical tanker rates decreased during 1998 due to reduced Asian demand and

fleet growth, while the stable gas carrier fleet kept 1998 average freight

rates near 1997 levels.

However, the effect of generally lower freight rates was offset by an improved

market share which largely compensated for reduced commission earnings.

Sale and Purchase

ALTHOUGH NEW bulk vessel contracting has fallen significantly between 1997

(50.6 million tonnes) and 1998 (30.4 million tonnes) the division has

maintained a high profile in the newbuilding sector where it has again been

particularly active placing a large number of new orders with Korean

shipbuilders.

Apart from demolition, which performed well, the secondhand market was

extremely disappointing in 1998 with volume almost halved from the previous

year.

The division maintained its position in the market but saw reduced commission

earnings due to the general inactivity in the market.

Futures

FREIGHT DERIVATIVES broking volume has increased by 25% in 1998 despite

deteriorating conditions in the dry bulk market. Our Biffex market share has

risen from 35% to 45%, a direct result of an assertive marketing campaign. We

now offer a futures broking service to clients across the Capesize, Panamax,

Handymax and Handy dry cargo sectors. We also cover tanker market

derivatives, mainly in the VLCC trades. Option volumes have increased during

1998 confirming our position as a dominant force in freight derivatives

broking.

Research and Publications

THIS YEAR SAW another important step forward for our research and publications

activities. Over the last seven years Clarkson Research Studies has grown

rapidly, extending its activities from the publication of registers to an

extensive range of market reports and electronic products as well as

consultancy.

Clarkson Research Studies now operates as the Research and Publications

division of H Clarkson & Company Limited and as an independent profit centre

of the group. This brings Research and Publications closer to the broking

divisions, whilst at the same time giving the division better access to the

information flowing through the business. It continues to provide shipping

clients with an informed and independent view of the market.

Overseas

OUR OVERSEAS companies made an increased contribution to operating profits. In

particular our Australian subsidiary, Austral Chartering (Pty) Limited,

continues to perform strongly. Seabrokers Inc. and Afromar (Pty) Limited, our

subsidiaries in the United States and South Africa, also made good

contributions.

Our offices in the Far East, which have significant exposure to the bulk cargo

trade, struggled in difficult market circumstances. However our long term

commitment to Clarkson Asia remains undiminished despite the adverse economic

conditions which presently affect these markets.

FINANCIAL

IN THE SECOND HALF of 1998, the group sold various fixed assets comprising a

long leasehold property in Westminster and various quoted investments. These

realised a profit of #861,000 which is shown as an exceptional item.

The overall tax rate for the year is 34.8% (1997: 40.7%), compared to the

current effective UK corporation tax rate of 31.0%. The exceptional profits

on fixed asset sales were offset by brought forward capital losses. The

group, however, continues to suffer a higher than standard rate of tax on

ordinary profits principally as a result of disallowable expenses in the UK

and overseas losses.

In July 1998 the company acquired 6,153,846 shares in a Tender Offer at a

price of 130 pence per share, at a cost of #8.4 million. The cost of the

Tender Offer has resulted in the fall in net cash and deposits at 31 December

1998 to #4.6 million (1997: #14.2 million).

PROSPECTS

CONTINUED LOW vessel earnings are expected for 1999, as the demand outlook

remains sluggish, while high levels of newbuildings will add to the industry

fleet. Asian recovery remains crucial for any demand-led recovery, however we

anticipate some improvement in the dry bulk market towards the end of the

current trading year. On the supply side, if vessel earnings remain low, the

high levels of scrapping seen in 1998 seem likely to continue.

In 1999 it is likely that Japanese shipbuilders will return to the export

market and in anticipation of this our Sale and Purchase division has entered

into an agreement with Sasebo Heavy Industries to market their products. This

new development is part of a more general policy to work with a number of

Japanese shipbuilders which we believe will be beneficial to all concerned and

comes at a time when the company is already placing a significant volume of

business with well established Korean shipyards.

A continuous effort has been made to contain costs, however we believe it is

essential to maintain critical mass in the core areas of our business so that

we are well positioned to take advantage of any economic upturn as and when it

arises.

DIRECTORS AND OFFICERS

IN SEPTEMBER 1998 Rex Harrington retired as a non-executive director. We

thank him for his service and wish him well for the future.

In May 1998 Martin Fairley retired as company secretary. Martin Fairley was

secretary of the company for over 20 years. He retires with our very best

wishes and our appreciation for the tremendous contribution he has made during

that time.

DIVIDEND

THE BOARD will be recommending a final dividend of 2.50 pence per share to be

paid on 25 June 1999 to shareholders on the register at the close of business

on 11 June 1999. This final dividend, together with the interim dividend paid

in October 1998, makes a total of 4.00 pence per share, the same as last year.

STAFF

THE BOARD wishes to place on record its thanks to all members of staff at home

and abroad, who have contributed to the company's continuing success.

Michael Beckett

Chairman

19 March 1999

HORACE CLARKSON PLC

CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the year ended 31 December 1998

1998 1997

(Unaudited) (Audited)

#M #M

TURNOVER 28.4 33.1

PROFIT BEFORE TAXATION 2.0 3.2

Taxation (0.7) (1.3)

----- -----

PROFIT AFTER TAXATION 1.3 1.9

Dividend (0.6) (0.8)

----- -----

RETAINED PROFIT 0.7 1.1

----- -----

EARNINGS PER SHARE - basic 7.94p 9.07p

----- -----

DIVIDEND PER SHARE 4.00p 4.00p

----- -----

It is anticipated that full financial results will be posted to shareholders

on 1 April 1999.

The figures for the year ended 31 December 1998 are unaudited and do not

constitute full accounts within the meaning of S.240 of the Companies Act

1985. The figures for the year ended 31 December 1997 have been extracted

from the full accounts for that year which have been delivered to the

Registrar of Companies and on which the auditors have issued an unqualified

audit report.

END

FR JPMRBLLABBML

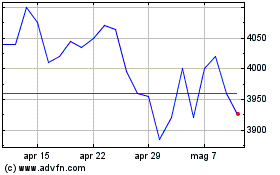

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Giu 2024 a Lug 2024

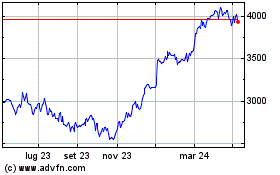

Grafico Azioni Clarkson (LSE:CKN)

Storico

Da Lug 2023 a Lug 2024