Acquisitions

06 Settembre 2006 - 9:48AM

UK Regulatory

Release date: 6th September 2006

Embargoed until: 07:00

CLS HOLDINGS PLC ("CLS")

ANNOUNCES THREE NEW GERMAN ACQUISITIONS

The Board of CLS is delighted to announce the completion of a further three

acquisitions in Germany at a total consideration of Euro71,423,307 (�48,252,470)

inclusive of all costs. Two of the buildings are located in Munich and one in

Stuttgart.

The acquisition and financing of the Headquarters of BrainLab AG in

Feldkirchen, Munich, announced in January, has now been completed. The property

is a new development of a total of 16,100 sq m (173,299 sq ft) and 213 car

parking spaces, fully let to BrainLab on a 10 � year lease without breaks, with

an annual rent of Euro2,043,791(�1,380,754) and a rent free period of six months.

The total acquisition cost for this investment was Euro30,058,850 (�20,307,290)

with an annual return on equity, after the rent free period, of 14.3% financed

by a completed 7 year fixed interest rate loan facility of Euro24,200,000 (�

16,349,142).

The property known as Maximillian Forum is located in Planegg, Munich. The

property was constructed in 1995 and comprises 13,906 sq m (149,683 sq ft) of

offices and 232 car parking spaces. The property is fully let to various

tenants with two anchor tenants, Gambro and MedieGene, and generates a total

annual rent of Euro2,035,189 (�1,374,942). The total acquisition cost for this

investment was Euro29,322,257 (�19,809,942) including all costs. The annual return

on equity is 13.1%, based on a completed fixed 5 year fixed interest rate loan

facility of Euro21,000,000 (�14,187,272).

The property known as Step 9 is located in Stuttgart Engineering Park,

Stuttgart. The property was constructed in 2004 and comprises 5,058 sq m

(54,444 sq ft) of offices, 174 sq m (1,873 sq ft) of storage and 59 car parking

spaces. The property is fully let to various tenants and generates an annual

rental income of Euro794,090 (�536,475). The total acquisition cost was Euro

12,042,200 (�8,135,522). The annual return on equity is 16.1% based on a

completed 5 year fixed interest rate loan facility of Euro 9,300,000 (�6,282,935).

Christian Holle of IAM has acted as consultant for CLS on all these

transactions.

Executive Chairman of CLS, Sten Mortstedt, commented:

"I am pleased with these further three acquisitions of properties in Germany.

CLS is making excellent progress into building up a portfolio of new office

buildings in attractive locations in or around major cities in Germany. The

portfolio now comprises 10 buildings with a book value of Euro151 million (�102

million). The initial financial returns are attractive, with further

significant potential for asset growth through yield compression and rental

growth."

-ends-

For further information, please contact:

Sten Mortstedt, Executive Chairman

Per Sj�berg, Chief Executive Officer

Dan B�verstam, Chief Financial Officer

CLS Holdings plc

www.clsholdings.com

Tel. +44 (0)20 7582 7766

Adam Reynolds/Ben Simons

Hansard Communications

Tel. +44 (0)20 7245 1100

END

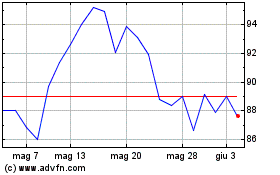

Grafico Azioni Cls (LSE:CLI)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni Cls (LSE:CLI)

Storico

Da Ago 2023 a Ago 2024