RNS No 4063v

CLS HOLDINGS PLC

9 April 1999

Results for the year ended 31st December 1998

HIGHLIGHTS

Total return on shareholders' funds of 18.3% (1997 : 18.3%)

NAV per share up 15% to 184.1p (1997 :160.3p)

Profit before tax up 6% to #11.1 million (1997 : #10.5 million)

Year end available cash up 53% to #29 million (1997 : #18.9 million)

Property sales produced a profit of #3.2 million (1997 : #0.4 million)

Portfolio valued at #404.7 million (1997 : #374.4 million)

Gearing reduced by 11% to 93% (1997: 104%)

Total distribution to shareholders (including dividend & buybacks) 10.0p per

share (1997: 5.75p)

Interest cover of 1.6 times (1997: 1.6 times)

The year ended 31 December 1998 was another successful year of organic growth

and the Group is reporting record net asset value per share and increased

profits.

The Group's long term performance is continuing to improve and the 1998

results show a total return on shareholders' funds of 18.3 per cent based on

movement in shareholders' funds, dividends declared and share buy backs

implemented during the year.

We are focused on cash flow and profitability as a means of delivering

shareholder value.

We have continued to improve our portfolio through acquisitions, disposals,

new lettings and refurbishment.

Sten Mortstedt, Executive Chairman

For further information please contact:

Glyn Hirsch, CLS Holdings plc 0171-582-7766

Brian Basham / Adam Reynolds, Basham & Co 0171-242-8005

Chairman's Statement

Introduction. The year ended 31 December 1998 was another successful year of

organic growth and the Group is reporting record net asset value per share and

increased profits.

The Group's long term performance is continuing to improve and the 1998

results show a total return on shareholders' funds of 18.3 per cent based on

movement in shareholders' funds, dividends declared and share buy backs

implemented during the year. This follows returns of 13.9 per cent and 18.3

per cent in 1996 and 1997 respectively.

Results for the Year. For the year ended 31 December 1998 the Group achieved a

5.5 per cent increase in profit before tax to #11.1 million (1997: #10.5

million). Profit after tax was up by 3.5 per cent to #10.1 million (1997:

#9.8 million). Gross rental income, represented by rents and service charge

income received from tenants, increased slightly to #32.5 million from #32.3

million in 1997. This increase would have been greater but for empty space in

the course of refurbishment and the timing of acquisitions and disposals. The

planned timing of our refurbishment programme was anticipated to cause a

temporary reduction in rental income in 1998 and 1999.

Disposals during the year have ensured continuing growth in profits. These

amounted to a total of #3.2 million of which #2.6 million related to

investment properties and #0.6 million to trading properties.

At the year-end our portfolio was valued by Allsop & Co at #404.7 million and

as at that date was producing net rental income of #30.3 million (on an

annualised basis) equating to a yield of 7.5 per cent per annum. This should

increase to at least #36.8 million (8.8 per cent) assuming the letting of

vacant space following further investment on property improvements of

approximately #14.7 million. The rental increase does not include any

potential uplift from rental growth in the portfolio. Nearly all of this

further investment will be bank financed leaving our cash resources available

for further expansion.

As a result of increased rents, refurbishment and new lettings, we have

achieved an improvement in the value of our London properties. In addition,

the Swedish property market has continued to improve since our acquisition of

Vanerparken, which was valued at the year end at #3.5 million above cost (a

near 100% return on equity). These factors have resulted in a 14.8 per cent

increase in net assets per share to 184.1 pence (1997: 160.3 pence). This

increase is calculated after taking into account a dividend payment of 2.4

pence per share for 1998 and the tender offer buy back of 3.1 pence net of

tax, but does not include the 4.5 pence capital dividend currently proposed.

The group has adopted the requirements of FRS 13, which deals with the

extension of disclosure in relation to derivatives and other financial

instruments. If loans were held at fair value, the notional after tax

adjustment to NAV that could be made, would equate to a reduction of 20.4

pence per share. A substantial amount of this is attributable to one long term

loan secured against a property with government covenanted income for the

period of the loan, which is sufficient (without any increase in rent over the

term of the lease) to cover both the interest and capital repayment of the

loan. It should also be noted that a tax liability of #15.1 million or 13.3

pence per share would arise on the sale of the entire portfolio at current

valuations. Even if these two notional adjustments were taken into account the

NAV would be 150.4 pence per share.

Gearing at 31 December 1998 was 93 per cent (104 per cent at 31 December

1997).

Dividend. Since flotation, in May 1994, the Group has maintained a

progressive dividend policy with the annual dividend distribution increasing

from #5.53 million in 1995 to #6.47 million in 1997. Total cash distributions

to shareholders, since flotation have amounted to #17.4 million.

We are focused on cash flow and profitability as a means of delivering

shareholder value. With current share price levels at a considerable discount

to net asset value your board believes there are significant benefits in

distributing cash as capital dividends to shareholders by way of a tender

offer buy back. The Board has therefore decided to recommend that instead of

the payment of a final income dividend, the Company utilises a similar amount

of cash for a tender offer buy back of 1 in 30 shares held at a price of 135

pence per share, which will enhance net asset value per share. This is

equivalent in cash terms to a final net dividend of 4.5 pence per share.

The Mortstedt family have indicated their intention to take up the tender

offer in respect of their shareholding.

Property Activities. We have continued to improve our portfolio through

acquisitions, disposals, new lettings and refurbishment.

Acquisitions during 1998 totalled #43.1 million, and rents increased by #4

million per annum.

During the same period disposals totalled #41.4 million and showed a profit of

#2.6 million. The properties sold had a rental income of #3 million per annum.

The net effect of acquisitions and disposals has been a significant increase

in cash, since acquisitions required #4 million of our own equity and

disposals realised #14 million.

As reported at the interim stage all of our available residential units have

been sold at a profit of #0.6 million.

Our current refurbishment projects have considerable potential for further

expected income of #4.3 million per annum, of which #2.2 million is already

contracted.

Progress is continuing with our planned retail leisure scheme at Vauxhall and

we expect to submit a planning application shortly.

Strategy. Our aim remains to provide shareholders with high returns from a

secure base. In 1998 total return to shareholders was 18.3 per cent.

We have made strategic acquisitions and disposals to enhance returns and by

efficient financing have ensured cash is available for expansion. At the year

end we held #29 million of cash reserves.

The success of Citadel Holdings plc, in which we hold 12.31% of its share

capital and whose results were announced on 7th April, has demonstrated our

expertise in overseas markets. This together with Vanerparken illustrates the

attractive investment opportunities available outside the UK.

Our acquisition of Vanerparken shows the significant returns available from

well financed investments with long term secure cash flows from strong

tenants. We believe that there are considerable opportunities available from

these types of investments outside the UK. In order to clearly define these

non-UK investments we have formed a new wholly owned intermediate holding

company and this will enable us to manage and account for our international

investments separately from the core London portfolio.

Our refurbishment programme provides a high return on investment and underpins

further growth as well as upgrading the quality of our properties.

During the year we have taken the opportunity to strengthen our management

team to ensure our refurbishment projects and acquisition programme is

adequately resourced.

Since the year end we have purchased 4,775,907 ordinary shares in the market

at 111 pence per share for cancellation. The company now has 107,971,786

ordinary shares in issue prior to the proposed buyback.

Prospects. Interest rates are historically low, our rents are increasing and

we are continuing to find attractive investment opportunities, both in London

and overseas.

Refinancing activities and disposals have put us in a strong cash position to

move forward.

Our refurbishment activities are creating significant contracted future rent

increases.

The year has started extremely well with the receipt of #8 million from

Hoechst UK Ltd for the surrender of their lease at the rebranded Vista Office

Centre and the letting of Citadel House. This surrender will generate a

one-off profit in the first half of 1999 of at least #2.0 million. We have

already let 48,000 square feet at the Vista Office Centre to produce income of

#660,000 per annum, which demonstrates the increasing potential of this

investment.

Board. Having been a non-executive Director since flotation, Sir David

Rowe-Ham is leaving the Board today and we wish to thank him for his

contribution. He is replaced by James Dean FRICS, who is aged 44 and as a

director of Savills PLC will bring additional property expertise to the Board.

I take this opportunity to thank my fellow Directors, our staff, professional

advisers and shareholders for their support during the year.

Sten Mortstedt

Executive Chairman

Property Review

Introduction. During 1998 we have made significant progress with our portfolio

through acquisitions, disposals and the enhancement of existing buildings. At

the year end the group portfolio comprised 39 properties of 210,212sq m.

(2,262,780sq.ft.) of which 198,117sq.m. (2,132,583sq. ft.) or 94.2% was fully

let. At the year end our annualised net rental income was #30.3 million. On

the basis of our year end portfolio valuation of the #404.7 million this gives

an initial yield of 7.5%

Group Property Strategy. Our aim is to generate significant returns on equity

and our work with our existing portfolio and through acquisitions and

disposals is focused on achieving this and consequently providing increased

value for shareholders.

Acquisition & Disposals. The market for London investments was particularly

strong during the first 9 months of the year and we took the opportunity to

sell a number of investment properties for a total of #41.4 million at an

average yield of 7.9%. This provided a surplus over book value of #2.6

million. During the first half of the year we also sold our remaining

available residential units at a total profit of #0.6 million. Our

involvement in the residential market has proved profitable and timely.

In September we purchased Vanerparken in Vanersborg, Sweden for a total cost

of SEK516.8 million (#38.9 million). The total net rent from the property at

the date of acquisition was SEK 50.5 million (#3.8 million) which rises

upwards annually in line with inflation representing a net yield of 9.8%. 80%

of the income is secured until 2015 and most of the remainder to 2006, all

from Swedish government covenants. We have fixed our external funding for

this investment at under 6% on SEK 460 million (#34.7 million). This provides

a return of 48% per annum on our cash investment of #3.6 million.

In August we acquired Bus Space Studios, London W10 for #2.0 million. The

property, which consists of a business centre, comprises 2,512 sq.m. (27,035

sq. ft.) and produced a net annual income of #195,943 per annum giving an

initial yield of 9.87%. Since acquisition we have increased this to #223,171

per annum.

In December we acquired two freehold nightclub properties in Ipswich and

Wolverhampton. Although these acquisitions were outside our usual

geographical area for UK investments at the time of completion we were able to

simultaneously sign new 25 year leases with a leisure operator at rents which

rise annually with inflation. The initial yield on the acquisitions was 16.6%

Portfolio Management. Last year we reported that we had agreed terms with NIG

Skandia our tenant at Citadel House, Fetter Lane, London EC4 to enable us to

refurbish the property. Our refurbishment is now completed and we have fully

let the building. In September we announced the letting of the office space

at a rent of #1,037,026 per annum - #336.38 per sq. m. (#31.25 per sq. ft.).

Since the year end we have let the remaining space on the ground floor,

basement and subbasement to Whitbread Plc for a 25 year term at a rising rent

which averages #194,000 over the first five years. Our total additional net

income after completion of the refurbishment is #1.23 million per annum.

During 1998 we let 14,229 sq. m (153,160 sq. ft.) of the vacant space in the

portfolio generating income for the group #2,324,126 per annum (although with

rent free periods not all of this will become income producing until later in

1999). In particular we have let the remaining space at Brent House 3,215 sq.

m. (34,600 sq. ft.) to Air France and Dialog Corporation.

At the year end the portfolio's annualised rent amounted to #30.3 million.

The letting of vacant space following improvement will bring approximately

#6.5 million of additional annual rental income. Of this amount, #3.9 million

is already contracted.

We continue to make good progress on the redevelopment of One Leicester Square

with the construction of a major new entertainment venue and anticipate

completion of our works this Spring with the venue opening in the late Summer.

We are currently commencing refurbishment at Conoco House SE1 and Coventry

House SW1. These projects will require a further investment of approximately

#11.4 million and once completed will contribute approximately an additional

#4.3 million to annual rental income.

We have continued to work with the London Borough of Lambeth to develop a

major leisure/retail development at Spring Gardens, Vauxhall. The scheme

totalling approximately 139,340 sq. m. (1.5 million sq. ft.) of leisure and

retail activities, a cinema complex and other ancillary use, including private

and social housing should be formally submitted for planning approval very

shortly. This demonstrates our ability to take a long term view of projects,

which have the potential to generate significant returns.

Our three business centres now comprise 5,346 sq. m. (57,731 sq. ft) and

produce a total gross rent of #934,317 p.a.. Our success in this sector of the

market has led us to look at other centres and also the benefits of the short

term letting market where we can achieve premium rents for giving occupiers

flexibility.

At Ingram House WC2 we have re-let three floors of unrefurbished accommodation

within three months of the space becoming vacant on short term leases at very

good rents. All the leases in the building now expire in 2001/2002, which

gives us the ability to refurbish or redevelop the building.

During the year we have successfully completed a number of varied projects

including the construction of 20 flats in SE11, the refurbishment of Citadel

House EC4, and the refurbishment of both Cambridge House and Brent House for

incoming tenants. All of these projects have provided us with excellent

returns on the equity invested.

Set out below is an analysis of the portfolio:

Property Area Area Year Yield Receivable Rent ERV Yield

Type sq.m sq.ft End based Rent Contracted of based on

(000's)(000's)Book on Not yet unlet receivable

Value receiv- receivable space rent +

able potential

rent rents

#m % #m #m #m %

Intern- 48.6 523.5 45.5 9.90 4.5 - - 9.9

ational

London 45.7 491.3 126.2 7.13 9.0 1.6 - 8.4

Property

let > 10

years

London 53.0 570.3 115.2 8.07 9.3 0.1 0.4 8.51

Property

let 5-10

years

London 36.9 397.6 48.9 10.63 5.2 - 0.1 10.84

Property

let <

5 years

Refurb- 26.0 280.1 68.9 3.34 2.3 2.2 2.1 -

ishment

projects

Totals 210.2 2,262.8 404.7 7.49 30.3 3.9 2.6 -

The above table shows the categories of assets we own and the future potential

available from new lettings and refurbishments.

FINANCIAL REVIEW

Results. During the course of 1998 the Group has delivered record results with

pre-tax profit of #11.1 million showing a growth of 5.5% over the previous

year. The Balance Sheet has been further strengthened with net asset value

increasing to 184.1 p per share, an increase of 15%. Gearing has reduced by

11% to 93% and cash reserves of #29 million were held at the balance sheet

date.

The underlying strength of the current year's results combined with the

imaginative redevelopment of a number of significant properties provide the

Group with a solid platform on which future growth will be based.

Net Rental Income. Due to the divestment of a number of properties during the

year, net rental income has fallen slightly to #29.8 million. The acquisition

in September 1998 of Vanerparken, a major Swedish property portfolio,

significantly increased the contribution of international net rental income to

#1.5 million.

Other Property Related Income. Other property related income increased by 53%

to #2.7 million. The three main elements were a profit of #0.8 million

relating to a dilapidation receipt at Conoco House, a profit of #0.6 million

on the sale of our remaining available residential units and the management

charge to Citadel Holdings plc of #0.5 million.

Administration Expenses. Administration expenses increased by #0.7 million to

#3.4 million. This is mainly as a result of the addition of a number of

senior staff, strengthening our team in the areas of development,

international investment and finance. Of the annual increase, #0.2 million was

recovered through an increased management charge to Citadel Holdings plc.

Net Property Expenses. Net property expenses increased by #1.2 million to

#2.5 million. Of the increase, #0.3 million relates to business centre costs

(business centre rents of #0.9 million are included in rental income). Also

included is letting fees and non-recoverable costs in respect of vacant space

being refurbished.

Gains from the Sale of Investment Properties and the Sale of a Subsidiary

Company. During the year a number of properties were sold, contributing #2.6

million to profit (1997 : #0.4 million), of which #1.7 million related to the

sale of Princes Court.

Financial Costs. Net interest and financial charges at #18.2 million showed

no increase over expenditure in 1997.

Increased interest payable and related charges at #20.3 million (1997 : #19.3

million), was partially offset by interest receivable and other financial

income of #2.1 million (1997 : #1.0 million), of which #0.7 million related

to treasury activities. The reduction in the base rate during the latter part

of the year was reflected in the average cost of borrowing falling to 8.8 per

cent at 31 December 1998 (1997 : 9.7 per cent).

A substantial development programme for a number of properties has been

undertaken during the year. This has resulted in interest amounting to # 0.7

million having been incurred on properties for which no rental income has been

received for the duration of the works. The interest has been expensed

through the profit and loss account as it is incurred.

Financial costs also include the depreciation of interest rate caps amounting

to #0.8 million.

Taxation. The Group's taxation charge is maintained at a relatively low rate

as a result of substantial corporation tax losses brought forward in some

subsidiaries and significant capital allowances on many of the Group's

properties. These factors should continue to benefit the Group in the

immediate future.

The Group has made a tax payment in order to utilise surplus ACT. The

utilisation of ACT increases the tax losses which are available to be offset

against future tax liabilities.

Financial Results by Location. The results of the Group analysed by location

are set out below:

Total London International

#000's #000's #000's

Turnover 32,533 30,985 1,548

Operating expenses (5,891) (5,418) (473)

Operating profit 26,642 25,567 1,075

Gains from sale of investment properties 2,596 2,596 -

Net interest payable and related charges (18,184) (17,544) (640)

Profit on ordinary activities before tax 11,054 10,619 435

Investment Properties. The investment property assets of the group have

increased by 8.1% to #404.7 million (1997 : #374.4million) . During the year

the quality of the portfolio was substantially improved with additional

properties acquired at a cost of #43.1 million. Net cash received from the

sale of investment properties amounted to #41.4 million.

Annualised rent at 31 December 1998 was #30.3 million equating to a yield of

7.5 %.

An analysis of the location of investment property assets and related loans is

set out below :

Total % London % International %

#m #m #m

Investment Properties 404.7 100% 359.2 88.8% 45.5 11.2%

Loan (222.0) 100% (185.9) 83.7% (36.1) 16.3%

Equity Investment 182.7 100% 173.3 94.8% 9.4 5.2%

Equity as a Percentage of 45.1% 48.2% 20.6%

Investment

Debt Structure. Financial instruments are held by the Group principally to

finance the acquisition of investment properties and to manage interest and

exchange rate risk. In addition, various other financial instruments have

arisen in the normal course of trading and the active management of Group

treasury activities. The Group's management of treasury activities includes

the purchase of shares and financial instruments together with investment in

equity options and future contracts up to a specified amount approved by the

Board.

The activities of the Group are mainly financed through share capital and

reserves and long term loans, which are secured against the properties to

which they relate.

During the last three years, the Group has pursued a financial strategy in

relation to its London based portfolio to raise floating rate long term loans

linked to interest rate caps. Caps are normally purchased on a five year

basis with interest capped at an average rate of 8.5% in order to provide

protection against a rise in interest rates.

International property acquisitions have been financed through a combination

of long term fixed rate loans at an average interest rate of 6% and floating

rate loans which have been capped at 6%. In addition, the Group entered into

forward foreign exchange commitments in order to hedge the receipts from

overseas investments.

The net borrowings of the Group at 31 December 1998 were #193.0 million, an

increase of #5.3 million over the previous year, reflecting the Group's active

investment programme of #53.8 million compared to property sales in the year

of #41.4 million.

Of the net debt at 31 December 1998, #92.5 million (48%) represented fixed

rate loans.

The fair value of the Group's fixed rate debt was in excess of book value by

an amount of #33.2 million, which net of tax at 31% equates to #23.0 million.

The contracted future cash flows from the properties securing the loans are

sufficient to meet all interest payments and repay the loans in total over

their term. Only #10.3 million (4.6%) of the Group's total debt of #222.0

million matures within the next 12 months with #96.9 million (43.7%) maturing

after five years.

In order to protect the Group from movements in foreign currency, direct

international property investments are matched with borrowings in the local

currency.

At 31 December 1998, #36.1 million (79%) of overseas asset value was financed

by local currency borrowings. These principally related to the acquisition of

Vanerparken.

Dividend. An interim dividend of 2.4p per share was paid to shareholders

during the course of the year. Your Board is recommending that in lieu of

paying a cash dividend, an offer will be made to purchase 1 share for every 30

held, at a price of 135 pence per share. This will result in a final

distribution of 4.5 pence per share. This equates to an overall return

inclusive of the tender offer in November 1998 of 10.0 pence per share.

Corporate Structure. The strategy has been to continue for the most part, to

hold individual properties within separate subsidiary companies, each with one

loan on a non-recourse basis.

Year 2000. The management of the Group is addressing the risk arising from

the Millenium date change as a matter of priority. Having taken professional

advice, the Group's approach to its in house systems and those of its

properties, where appropriate, is to carry out four essential steps. These

are:

- taking an inventory of computer environments, applications and systems,

- testing microprocessor reliant equipment and computer systems and

prioritising action,

- upgrading / replacing equipment and systems where necessary

- verifying the result.

Additionally, the Group is assessing the risk that might be encountered in

respect of tenants and suppliers. The cost of this work will be met from

existing capital and revenue budgets and is not expected to be significant.

Consolidated Profit and Loss Account...

for the year ended 31 December 1998

1998 1997

#000 #000

Turnover

Net rental income 29,792 30,535

Other property related income 2,741 1,796

32,533 32,331

Administrative expenses (3,397) (2,728)

Net property expenses (2,494) (1,305)

(5,891) (4,033)

Operating Profit 26,642 28,298

Gains from sale of subsidiary 465 -

Gains from sale of investment properties 2,131 428

Profit on Ordinary Activities Before Interest 29,238 28,726

Interest receivable and financial income 2,080 1,017

Interest payable and related charges (20,264) (19,265)

Profit on Ordinary Activities Before Taxation 11,054 10,478

Tax on Profit on ordinary activities (961) (726)

Profit For The Financial Year 10,093 9,752

Dividends (3,406) (6,473)

Retained Profit For The Year 6,687 3,279

Basic Earnings per Share 8.8p 8.7p

Diluted Earnings per Share 8.8p 8.7p

The results in the consolidated Profit and Loss account derive from continuing

operations.

Consolidated Balance Sheet...

at 31 December 1998

1998 1997

#000 #000

Fixed Assets

Tangible assets 404,966 373,719

Investments 4,435 4,294

409,401 378,013

Current Assets

Stocks - trading properties 83 1,385

Debtors - amounts falling due after more 2,594 3,203

than one year

Debtors - amounts falling due within one 4,735 4,349

year

Investments 3,217 211

Cash at bank and in hand 28,975 18,944

39,604 28,092

Creditors: amounts falling due within (29,764) (25,618)

one year

Net Current Assets 9,840 2,474

Total Assets Less Current Liabilities 419,241 380,487

Creditors: amounts falling due after more

than one year

Deferred taxation 3 -

Bank and other loans (211,674) (199,364)

Net Assets 207,570 181,123

Capital and Reserves

Called up share capital 28,187 28,245

Share premium account 49,211 46,098

Revaluation reserve 80,707 63,705

Capital Redemption Reserve 723 -

Other reserves 19,010 18,892

Profit and loss account 29,732 24,183

Total Equity Shareholders' Funds 207,570 181,123

Consolidated Cash Flow Statement...

for the year ended 31 December 1998

1998 1997

#000 #000

Net cash inflow from operating activities 28,389 28,294

Returns on investments and servicing of

finance

Interest received 2,020 976

Interest paid (18,730) (18,848)

Interest rate caps purchased (51) (281)

Net cash outflow from returns on

investments and servicing of finance (16,761) (18,153)

Taxation paid (899) (893)

Capital expenditure

Purchase and enhancement of properties (51,352) (2,242)

Sale of investment properties 41,392 11,730

Disposal of other fixed assets 53 -

Purchase of other fixed asset (296) (4,362)

Net cash (outflow)/inflow from capital (10,203) 5,126

expenditure

Acquisitions and disposals

Sale of subsidiary undertaking 2,803 -

Equity dividends paid (3,517) (3,128)

Cash (outflow)/inflow before management of (188) 11,246

liquid resources and financing

Management of liquid resources

Cash (placed) / released on short term (10,324) 596

deposits

Current asset investments (1,576) (9)

Net cash (outflow)/inflow from the (11,900) 587

management of liquid resources

Financing

Share buyback (3,614) -

Expenses paid in connection with share (9) (6)

issue

New loans 51,733 21,968

Repayment of loans (36,310) (30,049)

Net cash inflow/(outflow) from financing 11,800 (8,087)

(Decrease) / increase in cash (288) 3,746

Statement of Total Recognised Gains & Losses...

for the year ended 31 December 1998

1998 1997

#000 #000

Profit for the financial year 10,093 9,752

Unrealised surplus on revaluation of properties 19,478 18,770

Realised surplus on revaluation of properties - 1,000

Currency translation differences on foreign 118 (408)

currency net investments

Other recognised gains relating to the year 19,596 19,362

Total gains and losses recognised since last 29,689 29,114

annual report

Reconciliation of Historical Cost Profits & Losses...

For the year ended 31 December 1998

1998 1997

#000 #000

Profit for the financial year 10,093 9,752

Realisation of property revaluation gains and 2,476 (1,243)

losses of previous years

Historical cost profit for the financial year 12,569 8,509

Reconciliation of Movements in Shareholders' Funds...

for the year ended 31 December 1998

1998 1997

#000 #000

Profit for the financial year 10,093 9,752

Dividends (3,406) (6,473)

6,687 3,279

Other recognised gains/(losses) relating to the year 19,596 19,362

New share capital issued 3,787 3,097

Share buyback (3,614) -

Expenses of share issue (9) (6)

Net additions to shareholders' funds 26,447 25,732

Opening shareholders' funds 181,123 155,391

Closing shareholders' funds 207,570 181,123

END

FR NFALPEFPNEAN

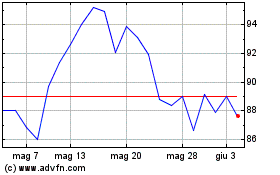

Grafico Azioni Cls (LSE:CLI)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni Cls (LSE:CLI)

Storico

Da Ago 2023 a Ago 2024