TIDMCOM

RNS Number : 5025Q

Comptoir Group PLC

28 June 2022

28 June 2022

Comptoir Group plc

("Comptoir", the "Company" or the "Group")

Shareholder Action

The Board of Comptoir Group plc (the "Board") announces that it

has received a letter from Tony Kitous in his capacity as Founder

and Creative Director of the Company (the "Letter"), who is the

holder of 58,412,503 ordinary shares of 1 pence each in the capital

of the Company ("Ordinary Shares"), representing 47.6 per cent of

the issued ordinary share capital in the Company.

The Letter states that he would like to see Richard Kleiner

("Chairman") and Chaker Hanna ("Chief Executive Officer") resign as

directors of the Company. In the event that neither resigns, Mr

Kitous stated within the Letter he would be voting against the

re-election of the Chairman at the annual general meeting on 30

June 2022 (the "AGM"). His proxy form giving effect to the content

of the Letter has now been received by the Company. Furthermore, Mr

Kitous has voted against resolutions to be proposed at the AGM

giving the directors the authority to allot shares in the Company.

Thereafter, Mr Kitous has suggested that he would requisition a

general meeting to request the removal of the Chief Executive

Officer as a director of the Company. Mr Kitous also proposes the

appointment of a new Non-Executive Chair and Non-Executive Director

of the Company.

Mr Kleiner, Mr Hanna and Mr Toon (Finance Director) (being the

"Independent Directors") have, over recent months, sought to

actively engage with Mr Kitous in order to resolve matters and are

disappointed that Mr Kitous has declined to respond to requests

particularly from the Chief Executive Officer.

The Independent Directors believe the comments and proposals by

Mr Kitous within his Letter are being made to promote his own

financial gain and the actions proposed are to the detriment of all

independent shareholders (being all other shareholders, save for

Tony Kitous ("Independent Shareholders")). Furthermore, the

Independent Directors believe that by proposing the resignation of

Mr Kleiner and Mr Hanna and threatening to vote both directors off

the board, Mr Kitous is acting in direct conflict with the spirit

of his relationship agreement with the Company (put in place at the

Company's admission to trading on AIM in 2016 ("IPO") at the

request of the Company's nominated adviser), which seeks to protect

Independent Shareholders' interests. In addition, by voting against

both resolutions in respect of giving the directors authority to

allot shares in the Company, Mr Kitous, by adopting such actions,

is limiting the Company's stated growth strategy.

The Independent Directors believe that it is appropriate to

highlight to shareholders that, during 2022, Mr Kitous has offered

limited input into day to day operational and financial decisions

within the Company. This has been best demonstrated by a lack of

physical attendance at, and input into, board and senior management

meetings over the past six months (being a period of record

financial performance for the business, as set out later in this

announcement). Further, while the Company has employed Mr Kitous as

a director of the Company since its IPO, the Independent Directors

believe Mr Kitous, without the guidance of the Independent

Directors, does not possess the required business and commercial

judgement to successfully run, nor to appoint nominee directors to

run, the Company.

The Independent Directors are disappointed that as a director of

the Company, Mr Kitous is choosing to put his own financial

interests and personal profile ahead of Independent Shareholders of

the Company. The Independent Directors believe that if Mr Kitous is

successful in removing Mr Kleiner and Mr Hanna from the board, he

may lose the support of the senior team and seek to use the net

cash of the Company for his own personal gain and, over time, could

seek to de-list the Company from AIM without prior consultation

with Independent Shareholders or appropriate fair value

consideration being paid to Independent Shareholders. As such the

Independent Directors of the Company believe that Independent

Shareholders are at risk of losing part or all of their investment

within the Company if Mr Kitous succeeds in the removal of the

Chairman and Chief Executive Officer.

The Independent Directors do not believe that it is in the best

interests of Independent Shareholders for Mr Kleiner or Mr Hanna to

resign at the present time.

Background and trading update

In the Letter, Mr Kitous acknowledges Messrs Kleiner and Hanna

have contributed positively to the Company business over the last

eight years and twelve years respectively. Through their

leadership, the Company has emerged from the COVID pandemic in a

strong position, both financially and operationally.

For the year ended 31 December 2021, the Company reported

revenue of GBP20.7 million adjusted EBITDA of GBP3.0 million

(pre-IFRS16) and profit before tax of GBP1.6 million, being the

highest in the Company's history. The Company also reported

positive operating cash flow from operations of GBP4.7 million,

leading to cash and cash equivalents at the period end of GBP9.9

million and net cash of GBP7.1 million. The operating cash flow of

the Company in 2021 was the highest in the business's 12-year

history, despite the financial year being significantly disrupted

by the impact of COVID and lockdown measures.

The Company expects to report unaudited revenue of no less than

GBP14 million for the six months ending 30 June 2022 ("H1 2022"),

adjusted EBITDA of GBP1.6 million (pre-IFRS16) and unaudited profit

before tax of no less than GBP0.8 million and net cash and cash

equivalents of no less than GBP7.5 million. This financial result

would represent another record period of financial performance for

the Company. The Company has historically had a second half

weighting to its financial performance; as such the Independent

Directors believe the overall prospects for the Company in 2022 and

beyond remain strong.

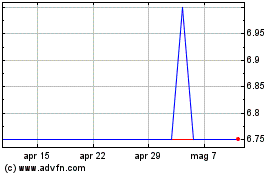

The Independent Directors acknowledge that the share price is

currently affected by the fact that the Company is a "microcap"

stock and faces the usual liquidity issues that are common with

such shares. Mr Hanna has been mandated by the board of directors

to focus on investor relations, and the Independent Directors

believe the share price of the Company will, with time, reflect the

financial results of the Company. The share price of the Company

year to date has risen approximately 60 per cent. Furthermore, the

Chairman and Canaccord Genuity Limited have engaged with Mr Hanna,

who has confirmed he has no intentions of leaving the business and

is committed to developing the business over the long term.

The current leadership team has invested significantly in the

look and feel of the Company's restaurants, having recently

refurbished six restaurants. With regard to staff training and

customer service, the Company has a very strong training programme

in place headed by its Training, Learning & Development Manager

(for "Front of House") and its Deputy Executive Chef (for "Back of

House"). The Company has also invested in external training

providers and online courses and has developed a Centre of

Excellence training venue at the Gloucester Road site and also

invested in a full development kitchen at its CPU facility.

As discussed historically with shareholders, the Board has

consistently reviewed the Company's strategy regarding expansion

over the last few years and repeatedly concluded that in light of

the significantly challenging operating market caused first by

Brexit and then Covid, the time was not right to open new sites,

and instead to focus on protecting and strengthening the existing

business. In light of recent improving trading conditions, the

current leadership team is proactively considering expansion

strategies, including but not limited to opening new sites. The

Independent Directors note in particular the opening of: Shawa in

Westfield (last September); new franchises in Stansted Airport

(last Friday); and Doha (this coming September). The Board and

operations team frequently discuss new site acquisitions and

reference to expanding the portfolio of sites was included in the

full year results of the Company published on 30 May 2022. In

addition, by voting against both resolutions in respect of giving

the directors authority to allot shares in the Company, Mr Kitous,

by adopting such actions, is limiting the Company's stated growth

strategy.

The Independent Directors believe the current directors are

therefore best placed to continue executing the Company's growth

strategy with the full support of the senior team and do not

believe the resignation of the Chief Executive Officer and Chairman

would be in the best interests of the Company or its shareholders

as a whole, would expose the Company to significant financial and

operational risk and would be extremely damaging and destabilising

to the Company at this stage of its growth.

As set out earlier, Mr Kitous has offered limited input into the

day to day operational and financial decisions of the Company over

the past six months. Further, while the Company has employed Mr

Kitous as a director of the Company since its IPO, the Independent

Directors believe Mr Kitous, without the guidance of the

Independent Directors, does not possess the required business and

commercial judgement to successfully run, nor to appoint nominee

directors to run, the Company.

The Independent Directors believe that Mr Kitous is seeking to

control the Company for his own personal profile and financial

needs by replacing key members of the Board (including the Chief

Executive Officer) with candidates of his choosing. The Independent

Directors note that one proposed director is a long-term friend and

business associate of Mr Kitous, having done business together

previously. The Independent Directors understand that this

individual has been in discussions with Mr Kitous on the proposed

structure of the Company, as early as January of this year.

Accordingly, there is some doubt as to the degree of his

independence. The Independent Directors therefore believe that the

proposals by Mr Kitous to nominate the Proposed Persons as

directors are for his own financial gain and to obtain control of

the Company.

The Independent Directors are open and fully supportive of

further appointments to the board of directors. The Independent

Directors however believe that a proper recruitment process should

take place to identify suitable candidates who enhance the

experience, skill set and corporate governance of the board, as

opposed to nominees of Mr Kitous.

Any further announcements will be made as required in due

course.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018).

The Independent Directors of the Company accept responsibility

for the content of this announcement.

For further information, please contact:

Comptoir Group plc Tel: +44 (0)20 7486 1111

Chaker Hanna, CEO

Michael Toon, CFO

Canaccord Genuity Limited (NOMAD Tel: +44 (0)20 7523 8000

and Broker)

Max Hartley

Bobbie Hilliam

Georgina McCooke

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRBDGDLIBDDGDI

(END) Dow Jones Newswires

June 28, 2022 09:00 ET (13:00 GMT)

Grafico Azioni Comptoir (LSE:COM)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Comptoir (LSE:COM)

Storico

Da Apr 2023 a Apr 2024