TIDMCTEA

RNS Number : 0792O

Catenae Innovation PLC

29 September 2023

29 September 2023

Catenae Innovation PLC

("Catenae", the "Company" or the "Group")

Half Year Results

Convertible Loan Update

Catenae Innovation PLC (AIM: CTEA), the AIM quoted provider of

digital media and technology, announces its half-yearly report for

the six months ended 30 June 2023.

As this is the first six months since the change of the year-end

to 31 December, comparative figures are for the six months to 31

March 2022.

Financial overview

-- Loss of GBP185,267 in the period under review (2022:

GBP287,168) with revenues of GBP22,173 (2022: GBP17,500).

-- Net (liability)/asset position GBP(314,846) (2022: GBP110,033).

Post period end

-- As announced on 6 September 2023, the Company's 51%

subsidiary ceased trading due to losses incurred.

The Company continues to carefully manage its working capital

position.

Convertible Loan Update

As announced on 30 September 2022, the Company entered into an

agreement for a convertible loan facility for up to GBP250,000

("Convertible Loan") with Sanderson Capital Partners Limited

("Sanderson Capital"), which consists of an initial drawdown of

GBP125,000 followed by a further drawdown expected three months

thereafter.

As at 30 June 2023, an advance of GBP30,000 had been received

against the GBP125,000 and no shares or warrants issued. As at 28

September 2023, a total advance of GBP61,000 had been received

against the GBP125,000 and no shares or warrants have been

issued.

At each GBP125,000 drawdown, the Company will issue new ordinary

shares to Sanderson Capital equal to 10 percent of the drawdown

value at an issue price of the 10-day volume weighted average price

prior to the date of drawdown. A further announcement will be made

on the date of each drawdown event.

Sanderson Capital will be able to convert part or all of the

Convertible Loan facility in minimum increments of GBP5,000, with

the conversion price being fixed at the lower of i) 0.25p; or ii)

90% of the 5-day volume weighted average price from the first day

of dealings of the Company's restoration to trading on AIM. The

Convertible Loan facility is interest-free.

As part of the Convertible Loan facility agreement, Sanderson

Capital will be issued new ordinary shares and a warrant over new

ordinary shares in the Company, of which the issue price and

exercise price is 0.25 pence per share, being the closing mid-price

of the Company's ordinary shares on 30 September 2022, the first

day of dealings following the release of the Company's final

results for the year ended 30 September 2021, and the interim

results for the period ended 31 March 2022 which enabled the

lifting of the suspension and restoration to trading of the

Company's ordinary shares on AIM.

The new ordinary shares and warrants over new ordinary shares

will be issued after the next general meeting of the Company and a

further announcement setting out the details will be made at the

time of issue.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation. The person who arranged for

release of this announcement on behalf of the Company was Guy

Meyer, Chief Executive Officer of the Company and the Directors of

the Company are responsible for the release of this

announcement.

For further information please contact:

+44 (0)191 580

Catenae Innovation PLC 8545

Guy Meyer, Chief Executive Officer

Cairn Financial Advisers LLP (Nominated Adviser) +44(0)20 7213 0880

Liam Murray / Jo Turner

+44 (0)20 7186

Shard Capital Partners LLP (Broker) 9952

Damon Heath

Notes to Editors:

About Catenae Innovation PLC

Catenae Innovation is an AIM quoted provider of digital media

and technology services. The Company specialises in Distributed

Ledger Technology solutions that solve commercial challenges and

create opportunities for its clients. The Company has an

experienced IT team of project managers and integrators who have

deployed systems across corporate, government and educational

sectors.

www.catenaeinnovation.com

Consolidated Statement of Comprehensive Income

For the Period Ended 30 June 2023

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 31 March 31 December

2023 2022 2022

GBP GBP GBP

Revenue 22,173 17,500 152,437

Cost of sales (2,315) (6,000) (12,600)

------------ ------------ -------------

Gross profit 19,858 11,500 139,837

Administrative expenses (205,125) (298,668) (667,002)

Loss from operations (185,267) (287,168) (527,165)

Net Finance income/(expense) - - -

Loss before taxation (185,267) (287,168) (527,165)

Taxation - - 3,668

------------ ------------ -------------

Total comprehensive loss

for the year (185,267) (287,168) (523,497)

------------ ------------ -------------

Loss attributable to:

Owners of the parent (183,023) (280,260) (514,695)

Non-controlling interest (2,244) (6,908) (8,802)

Consolidated Statement of Financial Position

For the Period Ended 30 June 2023

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 31 March 31 December

2023 2022 2022

GBP GBP GBP

Non-current assets

Tangible Assets 4,345 6,518 5,431

Intangible assets 1 1 1

4,346 6,519 5,432

Current assets

Trade and other receivables 17,893 30,514 81,913

Cash and cash equivalents 2,015 337,183 65,443

------------- ------------- -------------

19,908 367,697 147,356

Current liabilities

Trade and other payables (339,100) (264,183) (279,086)

(339,100) (264,183) (279,086)

Non-current liabilities

Interest-bearing loans - - -

Total Liabilities (339,100) (264,183) (279,086)

Net Assets/(Liabilities) (314,846) 110,033 (126,298)

------------- ------------- -------------

Non-controlling Interest 472 4,611 2,716

Capital and reserves

attributable to equity

holders of the company

Ordinary share capital 570,078 570,078 570,078

Deferred share capital 3,159,130 3,159,130 3,159,130

Share premium account 19,665,457 19,665,457 19,665,457

Share reserve (83,333) (83,333) (83,333)

Merger reserve 11,119,585 11,119,585 11,119,585

Capital Redemption Reserve 2,732,904 2,732,904 2,732,904

Retained losses (37,479,139) (37,058,399) (37,292,835)

------------- ------------- -------------

Total Equity (314,846) 110,033 (126,298)

------------- ------------- -------------

Consolidated Statement of Cash Flows

For the Period Ended 30 June 2023

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 31 March 31 Dec 2022

2023 2022

GBP

GBP GBP

Loss for the period (185,267) (287,168) (523,497)

Adjustments for :

Impairment of investments - - -

Depreciation 1,086 - 1,810

Net (loss) before changes

in working capital (184,181) (287,168) (521,687)

(Increase) / decrease in

trade and other receivables 64,019 15,034 (36,677)

(Decrease) / increase in

trade and other

payables 56,734 (11,038) 3,865

------------ ------------ -------------

Cash from operations (63,428) (283,172) (554,499)

Interest received - - -

Interest paid - - -

Net cash flows from operating

activities (63,428) (283,172) (554,499)

------------ ------------ -------------

Investing activities

Purchase of plant and equipment - - (413)

------------ ------------ -------------

Net cash flows from investing

activities - - (413)

------------ ------------ -------------

Financing Activities

Issue of ordinary share

capital - 15,273 15,273

Repayment of loans - - -

New loans raised - - -

------------ ------------ -------------

Net cash flows from financing

activities - 15,273 15,273

------------ ------------ -------------

Net increase / (decrease)

in cash (63,428) (267,899) (539,639)

Cash and cash equivalents

at beginning of period 65,443 605,082 605,082

Cash and cash equivalents

at end of period 2,015 337,183 65,443

------------ ------------ -------------

Company Statement of Financial Position

For the Period Ended 30 June 2023

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 31 March 31 December

2023 2022 2022

GBP

GBP GBP

Non-current assets

Intangible assets 1 1 1

1 1 1

Current assets

Trade and other receivables 13,864 24,242 74,745

Cash and cash equivalents 99 332,209 61,922

------------- ------------- -------------

13,963 356,451 136,667

Current liabilities

Trade and other payables (366,493) (255,828) (308,508)

(366,493) (255,828) (308,508)

Non-current liabilities

Interest-bearing loans - - -

Total Liabilities (366,493) (255,828) (308,508)

Net Assets/(Liabilities) (352,529) 100,624 (171,840)

------------- ------------- -------------

Capital and reserves

attributable to equity

holders of the company

Ordinary share capital 570,078 570,078 570,078

Deferred share capital 3,159,130 3,159,130 3,159,130

Share premium account 19,665,457 19,665,457 19,665,457

Share reserve (83,333) (83,333) (83,333)

Merger reserve 11,119,585 11,119,585 11,119,585

Capital Redemption Reserve 2,732,904 2,732,904 2,732,904

Retained losses (37,516,350) (37,063,197) (37,335,661)

------------- ------------- -------------

Total Equity (352,529) 100,624 (171,840)

------------- ------------- -------------

Company Statement of Cash Flows

For the Period Ended 30 June 2023

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 31 March 31 Dec 2022

2023 2022

GBP

GBP GBP

Loss for the period (180,690) (273,069) (545,533)

Adjustments for :

Impairment of investment -

Net (loss) before changes

in working capital (180,690) (273,069) (545,533)

(Increase) / decrease in

trade and other receivables 60,882 20,995 (29,509)

(Decrease) / increase in

trade and other

payables 57,985 29,168 81,849

------------ ------------ -------------

Cash from operations (61,823) (222,906) (493,193)

Interest received - - -

Interest paid - - -

Net cash flows from operating

activities (61,823) (222,906) (493,193)

------------ ------------ -------------

Financing Activities

Issue of ordinary share

capital - 15,273 15,273

Repayment of loans - - -

New loans raised - - -

------------ ------------ -------------

Net cash flows from financing

activities - 15,273 15,273

------------ ------------ -------------

Net increase / (decrease)

in cash (61,823) (207,633) (477,920)

Cash and cash equivalents

at beginning of period 61,922 539,842 539,842

Cash and cash equivalents

at end of period 99 332,209 61,922

------------ ------------ -------------

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIAAIITFIV

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

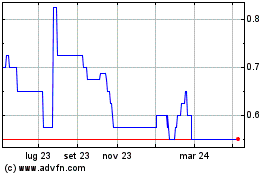

Grafico Azioni Catenae Innovation (LSE:CTEA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Catenae Innovation (LSE:CTEA)

Storico

Da Apr 2023 a Apr 2024