TIDMDVNO

RNS Number : 8481U

Develop North PLC

30 March 2023

To: RNS

From: Develop North PLC

LEI: 213800EXPWANYN3NEV68

Date: 30 March 2023

Subject: Annual Financial Report

Chairman's Statement

Highlights

-- Net Asset Value total return of 2.3% (2021: 4.8%)

-- Increase in earnings per share from 3.1p to 3.7p

-- Total dividends of 4 pence per share paid or payable for the year

-- Loan facility with Shawbrook Bank Limited renewed to May 2023

-- Change of name to reflect more accurately the nature of the Company's activities

INTRODUCTION

I am pleased to present the Company's results for the year ended

30 November 2022, during which the Company entered its sixth year

of trading. Key themes during 2022 have been rising interest rates,

soaring inflation, much of it driven by rising energy prices after

Russia's invasion of Ukraine and post-Covid supply chain issues. As

to the real estate sector in which Develop North operates,

potential property buyers are effectively being left with less

money in their pockets just as mortgage rates have begun to

rise.

Meanwhile building supplies and building energy costs have gone

up along with domestic product affecting the market place. Later in

the year, the destabilising effects of a government U-turn,

covering a broad range of policies from windfall tax to fracking

were reversed within weeks, which seriously unsettled business

confidence, including the financial and foreign exchange

markets.

This was the background against which Develop North continued to

go about its business during the year, adding new and strongly

financed project loans to the portfolio while managing older

projects as they gradually exited.

OBJECTIVE; MANAGERIAL ARRANGEMENTS; COMPANY NAME

The Company seeks to achieve its investment objective through a

diversified portfolio of fixed rate loans secured over land and/or

property in the UK.

During the financial year under review, the Company changed its

name to Develop North PLC. The change of name took effect on 4 May

2022. The London Stock Exchange stock ticker symbol, previously

PBLT, became DVNO with effect from 6 May 2022. The Company's ISIN,

SEDOL and LEI designations remain unchanged.

The Directors believe that the new name reflects the Company's

refreshed investment strategy, existing portfolio exposure and

regionally focused investment objective, while the underlying

investment policy remains unchanged.

PERFORMANCE; REVENUE AND DIVIDS

Despite the testing market conditions described above, the

Company has adhered to the dividend policy established in 2021,

namely to pay dividends at a rate of 1 penny per share per quarter,

equivalent to 4 pence per share per year in aggregate.

Depending upon the performance of the investment portfolio and

considering broader market conditions, a final balancing payment

may be made at the end

of the financial year to ensure that the Company continues to

comply with HMRC's investment trust qualification criteria.

Revenue for the year to 30 November 2022 increased to 3.68 pence

per share (2021: 3.09 pence). The Board has declared and paid three

quarterly interim dividends of 1.0 pence per share for the year

ended 30 November 2022 and I am pleased to report that a fourth

interim dividend of 1.0 pence per share has been declared. This

dividend will be paid on 31 March 2023 to shareholders on the

register at the close of business on 17 March 2023 (ex-dividend

date 16 March 2023).

NET ASSET VALUE

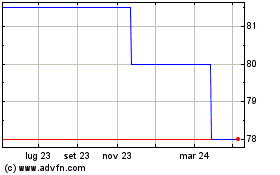

The Company's net asset value ('NAV') fell to 81.8 pence per

share as at 30 November 2022, having been 83.9 pence twelve months

earlier. Taking into account dividends paid and declared for the

period, this equates to a positive net asset value total return for

the financial year of approximately 2.3% and after an impairment

charge reflecting tougher economic conditions expected in the year

ahead.

This figure may be placed into context by comparison with the

total return figures over the same period of the Association of

Investment Companies' ('AIC') 'Property-Debt' sector, of which the

Company is a component member, of +5.2% and of the AIC's

'Debt-Loans' sector of +6.6% (Source: AIC).

GEARING

Loan facilities during the year consisted of a GBP6.5 million

credit facility with Shawbrook Bank Limited, with GBP4.0 million

drawn down at the financial year end and GBP0.5 million repaid

since the year end. The facility provided by Shawbrook Bank Limited

was renewed to May 2023. The Directors understand from discussions

with Shawbrook that the facility will be renewed and it is intended

that this will take place in advance of its expiry date.

INVESTMENT PORTFOLIO; NEW INVESTMENTS; PROJECT IMPAIRMENTS

The total value of the Company's portfolio now stands at

GBP25.5m, from 17 projects, an increase of GBP7.3m since last

year.

New Investments The Company agreed two new loans during the

year, including a GBP2.2 million, nine month facility to fund the

construction of four family homes in Morpeth, Northumberland, and a

GBP1.9 million facility to fund the construction of executive homes

across two sites in Darras Hall, Ponteland and Stocksfield,

Northumberland.

In addition, further funds were invested in facilities created

during the second half of the previous financial year. This has led

to a significant increase in the total size of the loan book which

will support portfolio revenues over future months and years. The

change in interest rate environment is also being reflected in the

net rates of interest on new and refinanced projects. This will

help to mitigate the higher interest and higher inflation that the

Company is facing.

Exits There were three portfolio exits, bringing total exits to

fifteen since inception. In addition, partial redemptions occurred

for six other projects in the portfolio.

Impairments As specified by the requirements of accountancy

standard IFRS 9, the Company has reflected the more uncertain

economic conditions resulting in an increased general provision at

year end.

All loans are written balancing risk and return, whereby

contingencies are put in place, typically in the form of

capital/equity in the projects subordinate to the Company's loan.

This arrangement protects the Company in the event that the

underlying properties being supported do not realise the full

expected value and/or that the return of capital could be delayed

by sales taking longer. The Board and the Investment Adviser

believe that this substantially mitigates the risks associated with

the downturn.

The Investment Adviser's Report provides more detail on

performance and the activity within the loan portfolio. This

includes information on deployment of capital, progress on projects

undertaken as well as any profit share received, impairments and

uplifts on loans and loan redemptions.

BOARD OF DIRECTORS

As described in last year's annual report, new and slightly

lower levels of remuneration for board members were put in place

during the financial year. The revised scheme was put before

shareholders at the 2022 Annual General Meeting ('AGM') and the

Resolution was approved.

In accordance with the requirements of the UK Corporate

Governance Code all Directors will stand for re-appointment at the

AGM.

CHANGE OF AUDITOR

The appointment by the Directors of MHA MacIntyre Hudson as the

Company's auditor last year was ratified at the 2022 AGM, together

with their reappointment this year.

ANNUAL GENERAL MEETING

The Company's AGM will be held at The Grey Street Hotel, 2-12

Grey Street, Newcastle on Thursday, 27 April 2023 at 12 noon.

The Board strongly encourages all shareholders to exercise their

votes in respect of the meeting in advance, by completing and

returning their proxy forms. This will ensure that the votes are

registered. In addition, shareholders are encouraged to raise any

questions in advance of the AGM with the Company Secretary via

email to cosec@MaitlandGroup.com or by post to the Company

Secretary at the address set out in the Annual Report. Any

questions received will be replied to by the Company after the

AGM.

OUTLOOK

While market conditions are clearly testing, there are signs on

the horizon of improving markets. The British Chamber of Commerce

('BCC') recently estimated that core inflation, which passed 11% in

the fourth quarter of 2022 should slow to 5% by the final quarter

of 2023 and, optimistically, the BCC suggests inflation will return

to the Bank of England's target of 2% per annum by late 2024.

Interest rates are also not expected to rise indefinitely.

According to the Office of Budgetary Responsibility, the Bank Rate

is expected to peak at 4.8% by the end of 2023 before falling

back.

While economic forecasts may remain challenging in the months

ahead, Develop North will continue to seek out investment

opportunities of the highest quality. We are pleased to have

successfully delivered on last year's aims of increasing deployment

and investment income and by reducing the risk within the loan

book. We expect more of the same in the year ahead.

John Newlands

Chairman

30 March 2023

Investment Adviser's RePORT:

REVIEW OF THE 12 MONTHS TO 30 NOVEMBER 2022

Investment Adviser's Highlights:

-- Investment interest increased by 8% to GBP1.8m.

-- GBP11m deployed into 6 projects, reflecting an increase of

40.9% in the size of the loan book by year end.

-- NAV Total Return of 2.3% and an annualised dividend yield of

4.7% resulting in GBP1.1m of income distributed to

shareholders.

-- Exits of three portfolio projects, bringing the number of exits since inception to fifteen.

-- Loan to Value (LTV) has dropped to 66.8% from 71%, delivering

on our strategy to build risk resilience and improve the credit

quality of our loan book.

-- 68% of funds deployed in North East England reflecting the

Company's ongoing commitment to focus operations on our chosen

regional markets.

This Annual Report and Accounts covers the fifth full year of

performance and sixth audit review of the Company since its listing

in January 2017.

The Company's investment objective is to provide debt finance to

the property sector. The Company also benefits from a small number

of equity positions attained at nil cost in six of the borrowing

entities which it supports. In addition, the Company benefits from

exit fees on redemption of other projects that additionally

contributes to the Senior and Profit lending type.

This financial year has seen the base rate increase above 1% for

the first time since the global financial crisis of 2008. Market

expectations see these increases continuing into 2023 with a peak

of between 4% and 5%. These rises are the Bank of England's

response to the return of inflation in the UK which reached double

digit percentages during 2022. As a result, the UK economy is

likely to go into recession during 2023, but that is forecast to be

shallower yet longer than initially feared prior to the November

2022 government Autumn statement.

2022 saw house prices in the UK grow sharply with the forecast

for 2023 to be a reversal of some of those increases before a

return to moderate price rises from 2024 onwards. Build cost

inflation and labour shortages in the construction sector have

placed significant strain on development budgets and project

profitability. Build costs are expected to return to more stable

levels in 2023 which will relieve some of the challenges developers

are facing.

We expect the changes in the economy to provide challenges and

opportunities for the Company over the next twelve months and

beyond. Interest rate rises will increase the weighted average cost

of capital of the Company but we are already taking the opportunity

to increase the net income by charging higher rates on new loans

and to the existing loan book. The high street banks have withdrawn

further from development finance and the Company is taking the

opportunity to win further business by providing finance to

experienced developers with strong track records.

Deployment

Despite the ongoing uncertainties faced, we are pleased to

report an active year for new transactions, deployments to existing

projects together with full and partial exits.

The Company agreed two new facilities during the year:

-- Fairmoor, North East England - GBP2.2m 9-month facility

-- Moor Lane, North East England - GBP1.9m 18-month facility

During the year a total of GBP11.0m was deployed into six

projects including the two new projects mentioned above.

At the year-end, fund deployment totalled GBP25.5m, with 10.0%

headroom for net growth. The quality of the underlying loan book

continues to improve with the Loan to Value moving from 70.9% at 30

November 2021 to 66.8% at year end.

Portfolio Exits

Three loans were repaid during the year, bringing the number of

exits in the portfolio to fifteen since inception.

Partial Redemptions

During the year there were GBP3.5m of partial redemptions across

seven of the portfolio projects, including the three exits in the

year.

Impairments

In accordance with IFRS 9, the Company recognises the gross

interest receivable on all its loans and then recognises an

impairment charge if that interest is not paid by the borrower and

there is not a clear expectation that this can be recovered

subsequently. During the year, there were two projects unable to

meet their interest requirements in full.

IFRS 9 also requires the Company to consider various credit loss

scenarios and assign a risk weighting to these. This calculation

generates a provision which is taken as a further impairment for

the year. In this period the Company has increased the provision to

GBP114,000 from the GBP33,000 that was in place at 30 November

2021. This provision is based on forward looking scenarios to

withstand market-related shocks reflecting current economic

uncertainties.

Gearing

In May 2022, the Company renewed its committed revolving credit

facility with Shawbrook Bank for a further year. Again, the key

driver was headroom and liquidity and its renewal for a fifth year

demonstrates the support that the Company has from its lender, and

the growing confidence in future deployment given the current

strength of pipeline. As noted in the Chairman's Statement on page

5, it is intended that the facility will be renewed in advance of

its expiry.

PROFIT SHARE PROJECTS

There are currently six Profit Share projects in the portfolio

(November 2021: six).

REBRAND

In May 2022 the Company changed its name to Develop North PLC.

The Investment Adviser supports the view that the new name reflects

the Company's refreshed investment strategy, existing asset base

exposures and regionally focused investment objective.

OUTLOOK

Economic Outlook

Residential

As at 30 November 2022, 70.4% of deployed funds were invested

across 12 projects with a residential focus, with a further GBP0.3m

committed to live projects.

The housing market has seen considerable increases over the past

12 months but the outlook from Savills is a reduction in house

prices by some 8.5% in the North East and 9% in Scotland in 2023,

ahead of growing 20% and 19% in the four years thereafter. That

immediate decline is both lower than the UK average and is seen as

a correction of steep rises in the post-Covid period, with house

prices remaining significantly ahead of their 2016 to 2019

average.

Mortgage availability and affordability is also important to

consider. There was significant disruption and uncertainty during

September and October 2022 as the markets reacted to the short

premiership of the then new prime minister. Stability quickly

returned by the year end, rates dropped and there is no evidence of

a contraction in bank liquidity or in mortgage lenders seeking to

exit the market in the North. Our view, based on experience from

within the portfolio, is that the mortgage market is still robust.

It is worth noting that around 50% of house transactions

nationally, according to Nationwide, were bought with either cash

or mortgages at less than 50% LTV suggesting limited pressure on

affordability of mortgages.

Turning to cost pressures, construction cost increases have been

the biggest threat in the sector, with significant price rises

absorbed by developers and contractors in the post-Covid recovery

period across 2021 and 2022. Going forward, cost increases will

remain, but at lower levels with BCIS forecasts for both materials

and labour being far closer to the Bank of England target inflation

rate of 2% in each of the next 5 years.

The Company's residential exposure is predominantly in the North

East (90.5%). This will continue to be a key focus as this region

continues to offer affordability for house buyers, despite the

recent increase in prices. Projects are appraised using the views

of market experts for sales values, build cost and delivery, with

all assumptions stress tested.

Commercial

As at 30 November 2022, 29.6% of deployed funds were invested

across five projects with a commercial focus.

The new investment strategy implemented in 2021 allows the

Company to be more selective in the level of exposure to commercial

developments. We believe that a selective approach to the Company's

deployment in the commercial property sector will continue to

create shareholder value. The sectors within the commercial

property space that the Company currently has exposure to are:

-- bereavement (crematorium);

-- strategic land; and

-- shared office space.

Each of the above sub-sectors offer downside protection in the

current uncertain economic times. Our current pipeline offers

further opportunities to increase our exposure to other sectors

that we anticipate will be similarly resilient. We will continue to

identify and support professional, experienced and reliable

management teams who have a clear vision and robust plan.

PIPELINE

There is currently GBP2.5m at various stages of deployment

across three projects with 47.0% in the North East.

The quality and experience of each management team that we are

in discussions with will continue to enhance the Company's

portfolio and strengthen its reputation in the market. This should

lead to the creation of shareholder value that is sustainable in

the longer term.

With input cost stability predicted to emerge, relative

confidence in property as an asset class, a continuing shortage in

housing and an increasing ability to compete in debt markets, we

are looking forward to growing fund deployment post the year

end.

Ian McElroy

Tier One Capital Ltd

30 March 2023

THE INVESTMENT PORTFOLIO AS AT 30 NOVEMBER 2022

Sector % of LTV* Loan Value LTV* Loan Value

Portfolio (Nov 22) (Nov 22) (Nov 21) (Nov 21)

GBP'000s GBP'000s

Residential 67.8% 69.0% 17,111 73.7% 10,480

----------- ---------- ----------- ---------- -----------

Commercial 29.7% 61.9% 7,508 66.7% 7,043

----------- ---------- ----------- ---------- -----------

Cash 2.5% - 638 - 4,545

----------- ---------- ----------- ---------- -----------

General Impairment - - (114) - (33)

----------- ---------- ----------- ---------- -----------

Total/Weighted Average 100.0% 66.8% 25,143 70.9% 22,035

----------- ---------- ----------- ---------- -----------

*LTV has been calculated using the carrying value of the loans

as at the balance sheet date

PRINCIPAL AND EMERGING RISKS

The Board of Directors has overall responsibility for risk

management and internal control within the context of achieving the

Company's objectives.

The Directors confirm that they have carried out a robust

assessment of the principal and emerging risks facing the Company,

including those that would threaten its business model, future

performance, solvency or liquidity, as they operated during the

year and up to the approval of the Annual Report.

The Board agrees the strategy of the Company, taking into

consideration the Company's risk appetite. With the assistance of

the Investment Adviser, the Board has drawn up a risk matrix, which

identifies the key risks to the Company, as well as emerging risks.

In assessing the risks and how they can be mitigated, the Board has

given particular attention to those risks that might threaten the

viability of the Company. These key risks fall broadly under the

following categories:

-- Investment and strategy risk

The Company's targeted returns are targets only and are based on

estimates and assumptions about a variety of factors including,

without limitation, yield and performance of the Company's

investments, which are inherently subject to significant business,

economic and market uncertainties and contingencies, all of which

are beyond the Company's control and which may adversely affect the

Company's ability to achieve its targeted returns. Accordingly, the

actual rate of return achieved may be materially lower than the

targeted returns, or may result in a partial or total loss, which

could have a material adverse effect on the Company's

profitability, the Net Asset Value and the price of Ordinary

shares.

Borrowers under the loans in which the Company invests may not

fulfil their payment obligations in full, or at all, and/or may

cause, or fail to rectify, other events of default under the

loans.

The Board is responsible for setting the investment strategy to

achieve the targeted returns and for monitoring the performance of

the Investment Adviser and the implementation of the agreed

strategy.

An inappropriate strategy could lead to poor capital performance

and lower than targeted income yields.

This risk is mitigated through regular reviews and updates with

the Investment Adviser, monitoring of the portfolio sectors against

the investment restrictions on a quarterly basis and tracking of

loan to value ratios of the underlying property projects.

-- Market risk

The Company's investment strategy relies in part upon local

credit and real estate market conditions. Adverse conditions may

prevent the Company from making investments that it might otherwise

have made leading to a reduction in yield and an increase in the

default rate. The Board has considered and continues to keep under

review the political, economic and investment risks to the Company

associated with the UK's withdrawal from the EU at the beginning of

2021 and the UK's future relations with the EU. This withdrawal

might lead to a reduced or increased demand for the Company's

shares as a result of investor sentiment which may be reflected in

a widening or narrowing of the discount.

The Company holds 100% of its assets in the United Kingdom.

To mitigate the market risks, the Board receives quarterly

updates from the Investment Adviser containing information on the

local market conditions and trends. This information is reviewed

alongside the sector split of the portfolio to ensure the portfolio

is aligned to meet future challenges.

-- Financial risk

The Company's activities expose it to a variety of financial

risks that include interest rate risk, liquidity risk and credit

risk. Further details on these risks and the way in which they are

mitigated are disclosed in the notes to the financial

statements.

-- Operational risk

The Company has no employees and relies upon the services

provided by third parties. It is primarily dependent on the control

systems of the Investment Adviser and Administrator who

respectively maintain the assets and accounting records.

Failure by any service provider to carry out its obligation in

accordance with the terms of their appointment could have a

detrimental effect on the Company.

To mitigate these risks, the Board reviews the overall

performance of the Investment Adviser and all other third party

service providers on a regular basis and has the ability to

terminate agreements if necessary. The business continuity plans of

key third parties are subject to Board scrutiny.

-- Legal and Regulatory risk

In order to qualify as an investment trust, the Company must

comply with section 1158 of the Corporation Tax Act 2010. The

Company has been approved by HM Revenue & Customs as an

investment trust. The Company is listed on the London Stock

Exchange. Non--compliance with the taxes act or a breach of listing

rules could lead to financial penalties and reputational loss.

These risks are mitigated by the Board's review of quarterly

financial information and the compliance with the relevant

rules.

Management Report and Directors' Responsibility Statement

Management report

Listed companies are required by the DTRs to include a

management report in their Financial Statements. The information is

included in the Strategic Report (together with the sections of the

Annual Report and Accounts incorporated by reference) and the

Directors' Report within the Annual Report. Therefore, a separate

management report has not been included.

Directors' responsibility statement

The Directors are responsible for preparing the Annual Report

and Financial Statements, in accordance with applicable law and

regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

have elected to prepare the financial statements in accordance with

UK adopted International Financial Reporting Standards ("UK adopted

IFRS") and with the Companies Act 2006, as applicable to companies

reporting under international accounting standards.

Under Company law the Directors must not approve the financial

statements unless they are satisfied that, taken as a whole, they

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's position and

performance, business model and strategy and that they give a true

and fair view of the state of affairs of the Company and of the

total return or loss of the Company for that period. In order to

provide these confirmations and in preparing these financial

statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable and prudent;

-- state whether applicable UK adopted IFRS have been followed,

subject to any material departures disclosed and explained in the

financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business and the Directors confirm that they have done

so.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006, where

applicable. They are responsible for taking such steps as are

reasonably open to them to safeguard the assets of the Company and

to prevent and detect fraud and other irregularities.

The financial statements are published on www.DevelopNorth.co.uk

which is a website maintained by the Company's Investment Adviser.

The Directors are responsible for the maintenance and integrity of

the corporate and financial information included on the Company's

website. Legislation in the UK governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Under applicable UK law and regulations, the Directors are also

responsible for preparing a Strategic Report, a Directors' Report,

Statement of Corporate Governance and Directors' Remuneration

Report that complies with that law and those regulations.

Directors' confirmation statement

Each of the Directors, whose names and functions appear in the

Annual Report, confirm that to the best of their knowledge:

-- the financial statements, prepared in accordance with UK

adopted IFRS and with the Companies Act 2006, as applicable to

companies reporting under international accounting standards, give

a true and fair view of the assets, liabilities and financial

position and total return or loss of the Company; and

-- The Management Report, referred to herein, which comprises

the Chairman's Statement, the Investment Adviser's Report,

Strategic Report (including risk factors) and note 17 of the

Financial Statements includes a fair review of the development and

performance of the business and position of the Company, together

with the principal risks and uncertainties that it faces.

The Directors consider that the Annual Report and Accounts taken

as a whole, is fair, balanced and understandable and it provides

the information necessary to assess the Company's position and

performance, business model and strategy.

On Behalf of the Board

John Newlands, Chairman

30 March 2023

INCOME STATEMENT

Year ending Year ending

30 November 2022 30 November 2021

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

REVENUE

Investment interest 2 1,787 - 1,787 1,643 - 1,643

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Total revenue 1,787 - 1,787 1,643 - 1,643

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

(Losses)/gains on investments

held at fair value through profit

or loss 4, 8 (36) (342) (378) (136) 190 54

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Total net income 1,751 (342) 1,409 1,507 190 1,697

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Expenditure

Investment adviser fee 3 (67) - (67) (68) - (68)

Impairments on investments held

at amortised cost 4, 9 (12) (136) (148) (139) (69) (208)

Other expenses 4 (548) - (548) (467) (24) (491)

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Total expenditure (627) (136) (763) (674) (93) (767)

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Profit/(loss) before finance

costs and taxation 1,124 (478) 646 833 97 930

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Finance costs

Interest payable (132) - (132) (1) - (1)

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Profit/(loss) before taxation 992 (478) 514 832 97 929

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Taxation 5 - - - - - -

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Profit/(loss) for the year 992 (478) 514 832 97 929

------------------------------------ ------ --------- --------- --------- --------- --------- ---------

Basic earnings per share 7 3.68p (1.78)p 1.90p 3.09p 0.36p 3.45p

The total column of this statement represents the Company's

Income Statement, prepared in accordance with UK adopted IFRS. The

supplementary revenue return and capital return columns are both

prepared under guidance published by the Association of Investment

Companies.

All revenue and capital items in the above statement derive from

continuing operations.

There is no other comprehensive income as all income is recorded

in the statement above.

Statement of Financial Position

As at As at

30 November 2022 30 November 2021

----------------------------------------------- ------ ------------------ ------------------

Notes GBP'000 GBP'000

Non-current assets

Loans at amortised cost 9 12,659 7,929

----------------------------------------------- ------ ------------------ ------------------

12,659 7,929

----------------------------------------------- ------ ------------------ ------------------

Current assets

Investments held at fair value through profit

or loss 8 4,874 7,589

Loans at amortised cost 9 7,948 2,629

Other receivables and prepayments 10 11 27

Cash and cash equivalents 638 4,545

----------------------------------------------- ------ ------------------ ------------------

13,471 14,790

----------------------------------------------- ------ ------------------ ------------------

Total assets 26,130 22,719

----------------------------------------------- ------ ------------------ ------------------

Current liabilities

Loan facility 11 (4,000) -

Other payables and accrued expenses 12 (109) (135)

----------------------------------------------- ------ ------------------ ------------------

Total liabilities (4,109) (135)

----------------------------------------------- ------ ------------------ ------------------

Net assets 22,021 22,584

----------------------------------------------- ------ ------------------ ------------------

Share capital and reserves

Share capital 13 269 269

Share premium 9,094 9,094

Special distributable reserve 12,849 13,093

Capital reserve (644) (166)

Revenue reserve 453 294

----------------------------------------------- ------ ------------------ ------------------

Equity shareholders' funds 22,021 22,584

----------------------------------------------- ------ ------------------ ------------------

Net asset value per ordinary share 81.79p 83.88p

The notes below form an integral part of the financial

statements.

These financial statements were approved by the Board of

Directors of Develop North PLC (a public limited company

incorporated in England and Wales with company number 10395804) and

authorised for issue on 30 March 2023. They were signed on its

behalf by:

John Newlands

Chairman

Statement of Changes in Equity

Special

For the year ending 30 Share Share distributable Capital Revenue

November 2022 capital premium reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- --------------- --------- --------- --------

At beginning of the year 269 9,094 13,093 (166) 294 22,584

Total comprehensive profit

for the year:

Profit for the year - - - (478) 992 514

Transactions with owners

recognised directly in

equity:

Dividends paid - - (244) - (833) (1,077)

---------------------------- --------- --------- --------------- --------- --------- --------

At 30 November 2022 269 9,094 12,849 (644) 453 22,021

Special

For the year ending 30 Share Share distributable Capital Revenue

November 2021 capital premium reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- --------------- --------- --------- --------

At beginning of the year 269 9,094 13,497 (263) - 22,597

Total comprehensive profit

for the year:

Profit for the year - - - 97 832 929

Transactions with owners

recognised directly in

equity:

Dividends paid - - (404) - (538) (942)

---------------------------- --------- --------- --------------- --------- --------- --------

At 30 November 2021 269 9,094 13,093 (166) 294 22,584

Cash Flow Statement

Year ending Year ending

30 November 30 November

2022 2021

------------------------------------------ ------ ------------- -------------

Notes GBP'000 GBP'000

Operating activities

Profit before taxation 514 929

Losses on investments held at fair

value through profit and loss 342 152

Impairments on loans at amortised

cost 136 542

Gains on investments held at fair

value through profit and loss - (342)

Uplifts on loans at amortised cost - (473)

(Increase)/decrease in loan interest

receivable on investments held

at fair value through profit and

loss (147) 30

Increase in loan interest receivable

on loans at amortised cost (249) (156)

Interest expense 132 1

Changes in working capital

Decrease/(increase) in other receivables 16 (6)

(Decrease)/(increase) in other

payables (26) 4

------------------------------------------ ------ ------------- -------------

Net cash inflow from operating

activities after taxation 718 681

------------------------------------------ ------ ------------- -------------

Investing activities

Loans given (10,986) (8,266)

Loans repaid 3,570 13,221

------------------------------------------ ------ ------------- -------------

Net cash (OUTFLOW)/inflow from

investing activities (7,416) 4,955

------------------------------------------ ------ ------------- -------------

Financing

Equity dividends paid (1,077) (942)

Bank loan drawn down 14 4,251 -

Repayment of bank loan 14 (251) (1,150)

Interest paid (132) (1)

------------------------------------------ ------ ------------- -------------

Net cash INFLOW/(outflow) from

financing 2,791 (2,093)

------------------------------------------ ------ ------------- -------------

(DECREASE)/Increase in cash and

cash equivalents (3,907) 3,543

Cash and cash equivalents at the

start of the year 4,545 1,002

------------------------------------------ ------ ------------- -------------

Cash and cash equivalents at the

end of the year 638 4,545

------------------------------------------ ------ ------------- -------------

Notes to the Financial Statements

1. Accounting Policies

Significant Accounting Policies

(a) Basis of Preparation

The financial statements of Develop North plc have been prepared

in accordance with UK adopted International Financial Reporting

Standards ("UK adopted IFRS") and with the Companies Act 2006, as

applicable to companies reporting under international accounting

standards. The financial statements were also prepared in

accordance with the Statement of Recommended Practice, Financial

Statements of Investment Trust Companies and Venture Capital Trusts

("SORP") issued by the AIC (as issued in July 2022), where this

guidance is consistent with UK adopted IFRS.

The financial statements have been prepared on a going concern

basis under the historical cost convention, except for certain

investment valuations which are measured at fair value.

The notes and financial statements are presented in pounds

sterling (being the functional currency and presentational currency

for the Company) and are rounded to the nearest thousand except

where otherwise indicated.

The Company reviews forthcoming changes to UK adopted IFRS and

does not anticipate material changes as a result of these.

NEW STANDARDS OR AMMENTS FOR 2022 FOR FORTHCOMING

REQUIREMENTS

New standards, interpretations and amendments issued which are

not yet effective and applicable for the periods beginning on or

after 1 December 2022:

IAS 1 Amendments to improve accounting policies disclosure

Effective date accounting periods on or after 1 January 2023

IAS 12 Amendments to deferred tax related assets and liabilities

arising from a single transaction

Effective date accounting periods on or after 1 January 2023

New standards, interpretations and amendments issued which are

not yet effective and not applicable for the periods beginning on

or after 1 December 2022

IFRS 17 Replacing IFRS 4 - Insurance contracts Effective date

accounting periods on or after 1 January 2023

IFRS 16 Amendment to the accounting for the sale of leases and

leaseback transactions

Effective date accounting periods on or after 1 January 2024

IAS 1 Amendments to accounting for non-current liabilities with

covenants

Effective date accounting periods on or after 1 January 2024

GOING CONCERN

The financial statements have been prepared on a going concern

basis. The disclosures on going concern set out in the Directors'

Report within the Annual Report form part of these financial

statements.

INTEREST INCOME

For financial instruments measured at amortised cost, the

effective interest rate method is used to measure the carrying

value of a financial asset or liability and to allocate associated

interest income or expense over the relevant period. The effective

interest rate is the rate that discounts estimated future cash

payments or receipts over the expected life of the financial

instrument or, when appropriate, a shorter period, to the net

carrying amount of the financial asset or financial liability. In

calculating the effective interest rate, the cash flows are

estimated considering all contractual terms of the financial

instrument but does not consider expected credit losses. The

calculation includes all fees received and paid and costs borne

that are an integral part of the effective interest rate.

On an ongoing basis the Investment Adviser assesses whether

there is evidence that a financial asset is impaired. The basis of

calculating interest income on the three stages of impairment

(detailed below) are as follows:

Stage 1 Interest is calculated on the gross outstanding

principal

Stage 2 Interest is calculated on the gross outstanding

principal

Stage 3 Interest is calculated on the principal amount less

impairment

EXPENSES

Expenses are accounted for on an accruals basis. The Company's

administration fees, finance costs and all other expenses are

charged through the Income Statement and are charged to revenue.

Fees incurred in relation to operational costs of the loan

portfolio, such as legal fees, are charged through the Income

Statement and are charged to capital.

DIVIDS TO SHAREHOLDERS

Interim dividends declared during the year are recognised when

they are paid. Any final dividends declared are recognised when

they are approved by the Shareholders at the Annual General

Meeting.

TAXATION

Taxation on the profit or loss for the period comprises current

and deferred tax. Taxation is recognised in profit or loss except

to the extent that it relates to items recognised in other

comprehensive income or directly in equity, in which case it is

also recognised in other comprehensive income or directly in equity

respectively.

Current tax is the expected tax payable on the taxable income

for the period, using tax rates and laws enacted or substantively

enacted at the reporting date.

Deferred income taxes are calculated using rates and laws that

are enacted or substantivity are expected to apply as or when the

associated temporary differences reverse. Deferred income tax is

provided using the liability method on all temporary differences at

the reporting date between the tax bases of assets and liabilities

and their carrying amounts for financial reporting purposes.

Deferred income tax assets are recognised only to the extent that

it is probable that taxable profit will be available against which

deductible temporary differences, carried forward tax credits or

tax losses can be utilised. The amount of deferred tax provided is

based on the expected manner of realisation or settlement of the

carrying amount of assets and liabilities. Deferred income is

recognised in profit or loss unless it relates to a transaction

recorded in other comprehensive income or equity, in which case it

is also recognised in other comprehensive income or directly in

equity respectively.

FINANCIAL ASSETS AND FINANCIAL LIABILITIES

The financial assets and financial liabilities are classified at

inception into the following categories:

Amortised cost:

Financial assets that are held for collection of contractual

cash flows where those cash flows represent SPPI ("solely payment

of principal and interest") and that are not designated at fair

value through profit and loss are measured at amortised cost. The

carrying amount of these assets is adjusted by any expected credit

loss allowance as described in the impairment note below.

The Company's cash and cash equivalents, other receivables,

other payables and accruals, and the Company's loan facility are

included within this category.

Fair value through profit and loss:

The Company has a number of borrower facilities in which it

received a minority equity stake or exit fee mechanism in

conjunction with providing those loan facilities. These loans are

recognised at fair value through profit and loss. The fair value of

the contracts is monitored and reviewed quarterly using discounted

cash flow forecasts based on the estimated cash flows that will

flow through from the underlying development project. A sensitivity

analysis is included in note 16.

IMPAIRMENT

At initial recognition, an impairment allowance is required for

expected credit losses ('ECL') resulting from possible default

events within the next 12 months. When an event occurs that

increases the credit risk, an allowance is required for ECL for

possible defaults over the term of the financial instrument.

The key inputs into the measurement of ECL are probability of

default ('PD'), loss given default ('LGD'), and exposure at default

('EAD'). These inputs are then considered and applied against

residential and commercial facilities in the loan book. ECL are

calculated by multiplying the PD by LGD and EAD.

PD has been determined by considering the local market where the

underlying assets are situated, economic indicators including

inflationary pressures on build costs, government policy, and

market sentiment. For residential loans this has been further

broken down into two scenarios; where only sales risk is still

present, and where both construction risk and sales risk still

exist. LGD is the magnitude of the likely loss if there is a

default. The LGD models consider the structure, collateral,

seniority of the claim, and recovery costs of any collateral that

is integral to the financial asset. LTV ratios are a key parameter

in determining LGD. LGD estimates are recalibrated for different

economic scenarios and, for lending collateralised by property, to

reflect possible changes in property prices. EAD represents the

expected exposure in the event of a default. The Company derives

the EAD from the current exposure to the borrower. The EAD of a

financial asset is its gross carrying amount at the time of

default. EAD for residential facilities has been further broken

down into two scenarios; where the build is complete, and where

construction is ongoing.

A financial asset is credit-impaired when one or more events

that have occurred have a significant impact on the expected future

cash flows of the financial asset. It includes observable data that

has come to our attention regarding one or more of the following

events:

-- delinquency in contractual payments of principal and interest;

-- cash flow difficulties experienced by the borrower;

-- initiation of bankruptcy proceedings;

-- the borrower being granted a concession that would otherwise not be considered;

-- observable data indicating that there is a measurable

decrease in the estimated future cash flows from a portfolio of

assets since the initial recognition of those assets, although the

decrease cannot yet be identified with the individual financial

assets in the portfolio; and

-- a significant decrease in assets values held as security.

Impairment of financial assets is recognised on a loan-by-loan

basis in stages:

-- Stage 1: A general impairment covering what may happen within

the next 12 months, based on the adoption of BIS standards as

outlined below.

-- Stage 2: Significant increase in credit risk, where the

borrower is in default, potentially in arrears, where full

repayment is expected and the underlying asset value remains

robust. The ECL calculation recognises the lifetime of the

loan.

-- Stage 3: Credit impaired, where the borrower is in default of

their loan contract, in arrears, full loan repayment is uncertain

and there is a shortfall in underlying asset value. The ECL

calculation recognises likely failure of the borrower.

As at 30 November 2022, there were sixteen loans in the

portfolio. Four of those projects supported included either an

equity stake of 25.1% for the Company or an exit fee mechanism.

Please see note 8 for details on these six projects.

The Board has deemed that five projects (2021: five); are

currently impaired and specific additional provisions have been

made against these facilities in these financial statements.

The other twelve loans have been assessed as not impaired.

The Company's response to IFRS 9 requirements has been based on

the Bank for International Settlements (BIS) Basel Supervisory

Committee liquidity risk tool recommendations.

FAIR VALUE HIERARCHY

Accounting standards recognise a hierarchy of fair value

measurements for financial instruments which gives the highest

priority to unadjusted quoted prices in active markets for

identical assets or liabilities (Level 1) and the lowest priority

to unobservable inputs (Level 3). The classification of financial

instruments depends on the lowest significant applicable input, as

follows:

-- Level 1 - Unadjusted, fully accessible and current quoted

prices in active markets for identical assets or liabilities.

Examples of such instruments would be investments listed or quoted

on any recognised stock exchange.

-- Level 2 - Quoted prices for similar assets or liabilities, or

other directly or indirectly observable inputs which exist for the

duration of the period of investment. Examples of such instruments

would be forward exchange contracts and certain other derivative

instruments.

-- Level 3 - External inputs are unobservable. Value is the

Directors' best estimate, based on advice from relevant

knowledgeable experts, use of recognised valuation techniques and

on assumptions as to what inputs other market participants would

apply in pricing the same or similar instrument.

All loans are considered Level 3.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents consist of cash in hand and short-term

deposits in banks with an original maturity of three months or less

from inception.

OTHER RECEIVABLES

Other receivables do not carry interest and are short-term in

nature. There were no irrecoverable amounts accounted for at the

year end or the prior period end.

RESERVES

SHARE PREMIUM

The surplus of net proceeds received from the issuance of new

shares over their par value is credited to this account and the

related issue costs are deducted from this account.

CAPITAL RESERVE

The following are accounted for in the capital reserve:

-- Capital charges;

-- Increases and decreases in the fair value of and impairments

of loan capital held at the year end.

As at year end the Capital Reserve comprises only unrealised

gains and losses and so does not contain distributable

reserves.

REVENUE RESERVE

The net profit/(loss) arising in the revenue column of the

Income Statement is added to or deducted from this reserve which is

available for paying dividends.

SPECIAL DISTRIBUTABLE RESERVE

Created from the Court of Session cancellation of the initial

launch share premium account and is available for paying

dividends.

SEGMENTAL REPORTING

The Chief Operating Decision Maker is the Board of Directors.

The Directors are of the opinion that the Company is engaged in a

single segment of business, being the investment of the Company's

capital in financial assets comprising loans. All loan income is

derived from the UK. The Company derived revenue totalling

GBP978,000 (2021: GBP488,000) where the amounts four (2021: two)

individual borrowers each exceeded 10% or more of the Company's

revenue. The individual amounts were GBP282,000, GBP256,000,

GBP243,000 and GBP196,000 (2021: GBP260,000, GBP228,000).

USE OF SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND

ASSUMPTIONS

The preparation of financial statements requires management to

make estimates and assumptions that affect the amounts reported for

assets and liabilities as at the reporting date and the amounts

reported for revenue and expenses during the year. The nature of

the estimation means that actual outcomes could differ from those

estimates. Estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimates are revised and in any future

periods affected.

The key driver to determine whether loans are classified as fair

value through profit or loss or amortised cost is if the facility

has an exit fee or equity stake attached. Where these are present

the loan is classified as fair value through profit or loss.

The following are areas of particular significance to the

Company's financial statements and include the use of estimates or

the application of judgement:

CRITICAL JUDGEMENTS AND ESTIMATES IN APPLYING THE COMPANY'S

ACCOUNTING POLICIES - INVESTMENTS AT FAIR VALUE THROUGH PROFIT OR

LOSS:

The Company owns profit share holdings or has exit fees

mechanism in relation to 6 of the borrowers in place as at the year

end. The loans held have been designated at fair value through

profit and loss. The determination of the fair value requires the

use of estimates. A sensitivity analysis is included in note 16.

The key uncertainties are around the timings and amounts of both

drawdown and repayments as these are determined by construction

progress and the timing of sales.

CRITICAL JUDGEMENTS AND ESTIMATES IN APPLYING THE COMPANY'S

ACCOUNTING POLICIES - LOANS AMORTISED COST CLASSIFICATION AND

IMPAIRMENTS:

The Company uses critical judgements to determine whether it

accounts for its loans at either amortised cost using the effective

interest rate method less impairment provisions or at fair value

through profit and loss. The determination of the required

impairment adjustment requires the use of estimates. The key

uncertainties are around the timings and amounts of both drawdown

and repayments as these are determined by construction progress and

the timing of sales. See notes 8 and 9 for further details.

2. INCOME

30 November 30 November

2022 2021

GBP'000 GBP'000

--------------- ------------ ------------

Interest from

loans 1,787 1,643

--------------- ------------ ------------

Total income 1,787 1,643

--------------- ------------ ------------

3. Investment Adviser's Fees

Investment Adviser

In its role as the Investment Adviser, Tier One Capital Ltd is

entitled to receive from the Company an investment adviser fee

which is calculated and paid quarterly in arrears at an annual rate

of 0.25 per cent. per annum of the prevailing Net Asset Value if

less than GBP100m; or 0.50 per cent. per annum of the prevailing

Net Asset Value if GBP100m or more.

There is no balance accrued for the Investment Adviser for the

period ended 30 November 2022 (year to 30 November 2021:

GBPnil).

There are no performance fees payable.

30 November 30 November

2022 2021

GBP'000 GBP'000

-------------------- ------------ ------------

Investment Adviser

fee 67 68

4. Operating expenses

30 November 2022 30 November 2021

Revenue Capital Revenue Capital

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------------- --------- -------- --------- --------

Legal & professional 13 - 28 24

Directors' fees 85 - 90 -

Audit fees related to the audit of the financial

statements 57 - 41 -

Fund Administration and Company Secretarial 85 - 82 -

Brokers' fees 30 - 30 -

Marketing fees 18 - - -

AIFM fee 17 - (12) -

Impairments on loans amortised at cost* 12 136 139 542

Uplifts on loans amortised at cost* - - - (473)

Losses/(gains) on investments held at fair

value through profit or loss 36 342 136 (190)

Other expenses 243 - 208 -

-------------------------------------------------- --------- -------- --------- --------

Total other expenses 596 478 742 97

-------------------------------------------------- --------- -------- --------- --------

*Loan impairments consist of impairments to interest on loans of

GBP48,000 (2021: GBP275,000) and a capital impairment on the loan

of GBP478,000 (2021: GBP542,000). Loan uplifts consist of a capital

uplift on the loans of GBPnil (2021: GBP663,000).

All expenses are inclusive of VAT where applicable. Further

details on Directors' fees can be found in the Directors'

Remuneration Report within the Annual Report.

5. Taxation

As an investment trust the Company is exempt from corporation

tax on capital gains. The Company's revenue income from loans is

subject to tax, but offset by any interest distribution paid, which

has the effect of reducing the corporation tax. The interest

distribution may be taxable in the hands of the Company's

shareholders.

30 November 30 November

2022 2021

GBP'000 GBP'000

------------------------------------------ ------------ ------------

Current corporation tax at 19% (2021:19%) - -

Deferred taxation - -

------------------------------------------ ------------ ------------

Tax on profit on ordinary activities - -

------------------------------------------ ------------ ------------

Reconciliation of tax charge

Profit on ordinary activities before

taxation 514 929

Taxation at standard corporation tax

rate 19% (2021: 19%) 98 176

Effects of:

Income not subject to tax 91 (18)

Interest distributions (205) (153)

Utilisation of losses not recognised

for deferred tax purposes 16 (5)

------------------------------------------ ------------ ------------

Tax charge for the year - -

------------------------------------------ ------------ ------------

There is an unrecognised deferred tax asset on losses of

GBP230,408 (2021: GBP135,727) calculated at the relevant deferred

tax rate of 25%.

6. Ordinary dividends

30 November 2022 30 November 2021

Pence Pence

per per

share GBP'000 share GBP'000

--------------------------------------- ------- ---------- --------- -----------

Dividends paid in the year relating to

previous year:

Interim dividend for the quarter ended

August, paid in December 1.0 269 - -

Interim dividend for the quarter ended

November, paid in April 1.0 269 1.5 404

Dividends paid during and relating to

the year:

Interim dividend for the quarter ended

February, paid in June 1.0 269 1.0 269

Interim dividend for the quarter ended

May, paid in September 1.0 270 1.0 269

--------------------------------------- ------- ---------- --------- -----------

Total dividends paid in the year 1,077 942

Of the dividends paid in the year, GBP244,000 has been paid from

the Special Distributable reserve.

The Company intends to distribute at least 85% of its

distributable income earned in each financial year by way of

interest distribution. A third interim dividend of 1.00 pence per

share was declared on 17 November 2022, payable on 29 December

2022. On 9 March 2023, the Company declared an interim dividend of

1.0 pence per share for the quarter ended 30 November 2022, payable

on 31 March 2023.

7. Earnings per share

The revenue, capital and total return per ordinary share is

based on each of the profit after tax and on 26,924,063 ordinary

shares, being the weighted average number of ordinary shares in

issue throughout the year. During the year there were no dilutive

instruments held, therefore the basic and diluted earnings per

share are the same.

8. Investments held at fair value through profit or loss

The Company's investment held at fair value through profit or

loss represents its profit share arrangements whereby the Company

owns 25.1% or has an exit fee mechanism for four companies.

30 November 30 November

2022 2021

GBP'000 GBP'000

------------------------------------------------- ------------ ------------

Opening Balance 7,589 16,809

Loans deployed 80 904

Principal repayments (2,600) (10,284)

Movements in interest receivable 183 106

Unrealised gains/(losses) on investments

held at fair value through profit or loss (378) 54

------------------------------------------------- ------------ ------------

Total investments held at fair value through

profit and loss 4,874 7,589

------------------------------------------------- ------------ ------------

Split:

Non-current assets: Investments held at - -

fair value through profit and loss due

for repayment after one year

Current assets: Investments held at fair

value through profit and loss due for repayment

under one year 4,874 7,589

Please refer to note 16 for details of the approach to valuation and

sensitivity analysis.

9. Loans at amortised cost

30 November 30 November

2022 2021

GBP'000 GBP'000

---------------------------------------- ------------ ------------

Opening balance 10,558 6,046

Loans deployed 10,906 7,362

Principal repayments (970) (2,937)

Movements in interest receivable 261 295

Movement in impairments (148) (208)

---------------------------------------- ------------ ------------

Total loans at amortised cost 20,607 10,558

---------------------------------------- ------------ ------------

Split:

Non-current assets: Loans at amortised

cost due for repayment after one year 12,659 7,929

Current assets: Loans at amortised

cost due for repayment

under one year 7,948 2,629

The Company's loans held at amortised cost are accounted for

using the effective interest method. The carrying value of each

loan is determined after taking into consideration any requirement

for impairment provisions during the year, allowances for

impairment losses amounted to GBP148,000 (2021: GBP208,000).

Further details on impairment can be found within the accounting

policies note above.

Movements in allowances for impairment losses in the year

Nominal value

GBP'000

--------------------------------------- --------------

at 1 December 2021 3,090

Provisions for impairment losses 137

--------------------------------------- --------------

at 30 November 2022 3,227

--------------------------------------- --------------

Stage 1 provisions at 1 December 2021 33

Provisions for impairment losses 81

--------------------------------------- --------------

Stage 1 provisions at 30 November 2022 114

--------------------------------------- --------------

Stage 2 provisions at 1 December 2021 -

Provisions for impairment losses -

--------------------------------------- --------------

Stage 2 provisions at 30 November 2022 -

--------------------------------------- --------------

Stage 3 provisions at 1 December 2021 3,057

Provisions for impairment losses 56

--------------------------------------- --------------

Stage 3 provisions at 30 November 2022 3,113

--------------------------------------- --------------

Stage 1, 2, and 3 are referenced in more detail below.

10. Receivables

30 November 30 November

2022 2021

GBP'000 GBP'000

------------------ ------------ ------------

Prepayments 11 27

------------------ ------------ ------------

Total receivables 11 27

------------------ ------------ ------------

11. loan facility

30 November 30 November

2020 2021

GBP'000 GBP'000

--------- ------------ ------------

Bank loan 4,000 -

On 27 May 2022 the Company entered into a GBP6.5m committed

revolving facility with Shawbrook Bank Limited, expiring on 26 May

2023. GBP4.0m was drawn down at the year end, at an interest rate

of 7.31%. The facility is secured against a debenture over the

assets of the Company.

12. Other Payables

30 November 30 November

2022 2021

GBP'000 GBP'000

--------------------- ------------ ------------

Accruals 109 135

--------------------- ------------ ------------

Total other payables 109 135

--------------------- ------------ ------------

13. Share Capital

Nominal value Number of

GBP'000 Ordinary shares

of 1p

---------------------------------------- -------------- -----------------

At 30 November 2021 269 26,924,063

---------------------------------------- -------------- -----------------

Issued and fully paid as at 30 November

2022 269 26,924,063

---------------------------------------- -------------- -----------------

The ordinary shares are eligible to vote and have the right to

participate in either an interest distribution or participate in a

capital distribution (on a winding up).

14. RECONCILIATION OF LIABILITIES ARISING FROM FINANCING

ACTIVITIES

At 30 November Cash Non-cash At 30 November

2021 flows flows 2022

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ---------------- --------- --------- ---------------

Short term borrowings - 4,000 - 4,000

--------------------------------- ---------------- --------- --------- ---------------

Total liabilities from financing

activities - 4,000 - 4,000

--------------------------------- ---------------- --------- --------- ---------------

At 30 November Cash Non-cash At 30 November

2020 flows flows 2021

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------------- --------- --------- ---------------

Short term borrowings 1,150 (1,150) - -

--------------------------------- --------------- --------- --------- ---------------

Total liabilities from financing

activities 1,150 (1,150) - -

--------------------------------- --------------- --------- --------- ---------------

15. Related Parties

The Directors are considered to be related parties. No Director

has an interest in any transactions which are, or were, unusual in

their nature or significant to the nature of the Company.

The Directors of the Company received GBP85,000 fees for their

services during the year to 30 November 2022 (30 November 2021:

GBP90,000). GBPnil was payable at the year end (30 November 2021:

GBPnil).

Ian McElroy is Chief Executive of Tier One Capital Ltd and is a

founding shareholder and director of the firm.

Tier One Capital Ltd received GBP67,000 investment adviser's fee

during the year (30 November 2021: GBP68,000) and GBPnil was

payable at the year end (30 November 2021: GBPnil). Tier One

Capital Ltd receives up to a 20% margin and arrangement fee for all

loans it facilitates.

There are various related party relationships in place with the

borrowers as below:

The following related parties arise due to the opportunity taken

to advance the profit share contracts:

-- Gatsby Homes

The Company owns 25.1% of the borrower Gatsby Homes Ltd which

was disposed of during the year. The loan amount outstanding as at

30 November 2022 was GBPnil (30 November 2021: GBP468,000).

Transactions in relation to loans repaid during the year amounted

to GBP441,000 (30 November 2021: GBP797,000). Interest due to be

received as at 30 November 2022 was GBPnil (30 November 2021:

GBPnil). Interest received during the year amounted to GBP36,000

(30 November 2021: GBP136,000).

-- Thursby Homes (Springs)

The Company owns 25.1% of the borrower Thursby Homes (Springs)

Ltd. The loan amount outstanding as at 30 November 2022 was GBP1.3m

(30 November 2021: GBP2.4m). Transactions in relation to loans

repaid during the year amounted to GBP918,000 (30 November 2021:

GBP502,000). Interest due to be received as at 30 November 2022 was

GBP213,000 (30 November 2021: GBP209,000). Interest received during

the year amounted to GBP157,000 (30 November 2021: GBP261,000).

-- Northumberland

The Company owns 25.1% of the borrower Northumberland Ltd. The

loan amount outstanding as at 30 November 2022 was GBP356,000 (30

November 2021: GBP1.3m). Transactions in relation to loans repaid

during the year amounted to GBP911,000 (30 November 2021:

GBP683,000). Interest due to be received as at 30 November 2022 was

GBP3,000 (30 November 2021: GBP10,000). Interest received during

the year amounted to GBP32,000 (30 November 2021: GBP123,000).

-- Coalsnaughton

The Company owns 40.17% (30 November 2021: 25.1%) of the

borrower Kudos Partnership. The loan amount outstanding as at 30

November 2022 was GBP2.2m (30 November 2021: GBP2.3m). Transactions

in relation to loans issued during the year amounted to GBP80,000

(30 November 2021: GBP404,000). Interest due to be received as at

30 November 2022 was GBP324,000 (30 November 2021: GBP170,000).

Interest received during the year amounted to GBP196,000 (30

November 2021: GBP228,000).

-- Oswald Street

The Company owns 25.1% of the Riverfront Property Limited

Partnership. The loan amount outstanding as at 30 November 2022 was

GBP388,000 (30 November 2021: GBP408,000). Transactions in relation

to loans made during the year amounted to GBPnil (30 November 2021:

GBPnil). Interest due to be received as at 30 November 2022 was

GBP5,000 (30 November 2021: GBP5,000). Interest received during the

year amounted to GBP31,000 (30 November 2021: GBP31,000).

16. Financial Instruments

Consistent with its objective, the Company holds a diversified

portfolio of fixed rate loans secured with collateral in the form

of; land or property in the UK, charges held over bank accounts and

personal or corporate guarantees. The benefit of a related profit

share or exit fee mechanism may also be agreed. In addition, the

Company's financial instruments comprise cash and receivables and

payables that arise directly from its operations. The Company does

not have exposure to any derivative instruments.

The Company is exposed to various types of risk that are

associated with financial instruments. The most important types are

credit risk, liquidity risk, interest rate risk and market price

risk. There is no foreign currency risk as all assets and

liabilities of the Company are maintained in pounds sterling.

The Board reviews and agrees policies for managing the Company's

risk exposure. These policies are summarised below:

CREDIT RISK

Credit risk is the risk that an issuer or counterparty will be

unable or unwilling to meet a commitment that it has entered into

with the Company.

In the event of default by a borrower if it is in financial

difficulty or otherwise unable to meet its obligations under the

agreement, the Company will suffer an interest shortfall and

potentially a loss of capital. This potentially will have a

material adverse impact on the financial condition and performance

of the Company and/or the level of dividend cover. The Board

receives regular reports on concentrations of risk and the

performance of the projects underlying the loans, using loan to

value percentages to help monitor the level of risk. The Investment

Adviser monitors such reports in order to anticipate, and minimise

the impact of, default.

There were financial assets which were considered impaired at 30

November 2022, with impairments amounting to GBP148,000 (30

November 2021: GBP208,000). Our maximum exposure to credit risk as

at 30 November 2022 was GBP26,130,000 (30 November 2021:

GBP22,719,000).

All of the Company's cash is placed with financial institutions

with a long-term credit rating of A or better. Bankruptcy or

insolvency of such financial institutions may cause the Company's

ability to access cash placed on deposit to be delayed or limited.

Should the credit quality or the financial position of the banks

currently employed significantly deteriorate, cash holdings would

be moved to another bank.

Further details on the exposure to, and management of, credit

risk by the Company is included in both the Investment Advisor's

Report above and the Strategic Report in the Annual Report.

Loans held at amortised cost as at 30 November 2022

Total

GBP'000

------------------------- ---------------------------

Stage 1 20,000

Stage 2 378

Stage 3 229

------------------------- ---------------------------

20,607

------------------------- ---------------------------

Loans held at amortised cost as at 30 November 2021

Total

GBP'000

------------------------- ---------------------------

Stage 1 9,456

Stage 2 378

Stage 3 724

------------------------- ---------------------------

10,558

------------------------- ---------------------------

LIQUIDITY RISK

Liquidity risk is the risk that the Company will encounter

difficulties in realising assets or otherwise raising funds to meet

financial commitments. The Company's investments comprise

loans.

Property and property-related assets in which the Company

invests via loans are not traded in an organised public market and

are relatively illiquid assets, requiring individual attention to

sell in an orderly way. As a result, the Company may not be able to

liquidate quickly its investments in these loans at an amount close

to their fair value in order to meet its liquidity

requirements.