TIDMESCT

RNS Number : 4751P

European Smaller Companies Tst PLC

10 October 2023

Legal Entity Identifier: 213800N1B1HCQG2W4V90

THE EUROPEAN SMALLER COMPANIES TRUST PLC

Financial results for the year ended 30 June 2023

This announcement contains regulated information

Investment Objective

The Company seeks capital growth by investing in smaller and medium

sized companies which are quoted, domiciled, listed or have operations

in Europe (ex UK).

Total return performance to 30 June 2023

(including dividends reinvested and excluding transaction costs)

1 year 3 years 5 years 10 years

% % % %

------------------------- -------- -------- -------- ------------------

NAV(1,5) 16.4 50.3 43.4 259.9

Benchmark(2) 10.0 24.3 25.5 162.6

Average sector NAV(3) 11.2 26.0 31.0 190.3

Share price(4,5) 13.6 56.9 37.1 271.5

Average sector share

price(3,5) 10.1 27.5 25.8 192.6

------------------------- -------- -------- -------- ------------------

Financial highlights at 30 June 2023 at 30 June 2022

------------------------------------------- ------------------ --------------------

Shareholders' funds

Net assets (GBP'000) 738,642 652,464

NAV per ordinary share 184.26p 162.76p

Share price 154.00p 140.00p

------------------------------------------- ------------------ --------------------

Year ended Year ended

30 June 2023 30 June 2022

Profit for year

Net revenue profit (GBP'000) 20,927 20,703

Net capital profit/(loss) profit

(GBP'000) 83,454 (195,415)

------------ ------------

Profit/(loss) for the year 104,381 (174,712)

======= =======

Total return per ordinary share

Revenue 5.22p 5.16p

Capital 20.82p (48.75p)

------------- -------------

Total return per ordinary share 26.04p (43.59p)

======= =======

Ongoing charge excluding performance

fee(6) 0.65% 0.65%

Ongoing charge including performance

fee(6) 1.67% 1.37%

1. Net asset value (NAV) total return per ordinary share

2. Euromoney Smaller European Companies (ex UK) Index up to 30 June

2022, thereafter MSCI Europe ex UK Small Cap Index

3. The sector is the AIC European Smaller Companies sector

4. Share price total return including dividends reinvested and using

closing price

5. NAV per share, NAV total return, share price total return and ongoing

charge are regarded as Alternative Performance Measures. More information

on these can be found in the Annual Report 2023

6. Calculated using the methodology prescribed by the Association

of Investment Companies

Sources: Morningstar Direct, Janus Henderson Investors

Chairman's Statement

After a challenging year to June 2022 for European small caps where

the benchmark(1) fell 17.3% and the NAV of your Company by 21%, the

year ended June 2023 has been a welcome improvement, notwithstanding

that the challenges of 2022 such as surging inflation, rising interest

rates, disrupted energy markets and conflict in Ukraine having persisted.

The spectre of recession has hung over the global economy for much

of the last year, but it has been far more resilient than the bears

have suggested it would be. It seems increasingly probable that a

'soft landing' is achievable as supply chain bottlenecks have begun

to clear, relieving inflationary pressure, and the labour market has

proved to be robust enough for the consumer to be cushioned from the

burden of rising interest rates. Smaller companies are a good indicator

of the economic cycle improving and normally rally before the economic

data confirms the trend. The fund management team has always preached

their valuation discipline and we are optimistic that they will be

able to take advantage at this stage of the cycle.

Performance

Despite stock markets that have been extremely volatile and a bias

to smaller companies that have, in aggregate, underperformed midcap

companies, the net asset value ('NAV') total return performance of

the Company for the year ended 30 June 2023 was 16.4%, 6.4% ahead

of the benchmark return of 10.0%. The share price total return for

the period was 13.6%, ahead of the average of the AIC European Smaller

Companies sector, but showing a widening discount against the NAV.

Discount management

The Company's shares have traded at an average discount of 15.1% over

the twelve months to 30 June 2023. This is against the backdrop where

the investment trust sector as a whole averaged 13.1% for the same

period and widened to an average of 15.8% in the subsequent period

from July through September. Our discount reflects the fact that smaller

European companies remain out of favour with investors, but also suggests

that we have more work to do in terms of communicating our unique

proposition to investors.

The Board regularly monitors the discount level, though we are of

the view that it is not a variable fully in our control. Following

regular discussion at Board meetings, we have resolved to practice

share buybacks opportunistically when our Fund Manager thinks it will

be more accretive to the long-term value creation of the portfolio

than other investment opportunities.

Post the financial year-end and after temporarily widening, the discount

to NAV narrowed on the back of weakness in equity markets. Given the

significant price dislocation in the market reflected by the discount

of the investment trust sector as a whole, we have not as yet believed

it to be in the interests of all shareholders to repurchase our own

shares in such an environment.

Performance Fee

We will be paying a performance fee of GBP7.2m to the investment manager

for the returns achieved over the

three-year period to 30 June 2023. To put this into context the Company

has delivered an NAV total return outperformance of 26.0%2 relative

to the benchmark over this period. This is nearly double the return

of our nearest competitor in the AIC European Smaller Companies sector.

The Board regularly revisits the merit of having a very low base fee

alongside the performance fee as part of the

arrangements with the investment manager and considers that this approach

is bene cial to shareholders over time. This mechanism permits the

investment manager to earn a higher fee where excellent performance

has been achieved over a three-year period, but reduces significantly

should performance be poor.

Dividend

A final dividend of 3.25p (2022: 3.10p) per ordinary share will be

put to shareholders for approval at the annual general meeting to

be held on 27 November 2023. Together with the interim dividend of

1.45p (2021: 1.25p), this is an increase of 8.0%. The dividend will

be paid on 1 December 2023 to shareholders on the register at 3 November

2023. The shares will trade without the dividend on 2 November 2023.

We are confident that the Company will continue to be able to deliver

progressive dividend growth. We would like to emphasize to our shareholders

that the valuation aware investment style employed by the fund management

team has led them to certain high yielding stocks in recent years

and the extent of recent dividend growth may not be sustainable as

portfolio repositioning occurs. In line with the investment objective,

the fund management team's focus continues to be prioritising capital

growth.

Succession planning

In keeping with the Board's succession plan, Alexander Mettenheimer

retired at the annual general meeting in

November 2022. We continue to refresh the Board and engaged recruitment

consultants to help with the search to find my replacement. Following

successful conclusion of that process, we were pleased to announce

the appointment of James Williams on 9 October 2023. He will join

the Board with effect from 1 November 2023. He brings with him over

30 years' international business experience, including nearly 20 years

in the investment banking industry. He is very familiar with the investment

trust sector and financial markets, and has a strong suite of leadership

skills. James will offer himself for election by shareholders at the

annual general meeting later this year. It is my intention to retire

at the conclusion of the annual general meeting in 2024, following

a suitable hand-over period.

We have further agreed a timeline for the retirement of Simona Heidempergher,

who, at the time of the forthcoming annual general meeting, will have

been on the Board for nine years. We will report to you further on

this in due course.

Annual General Meeting

We are pleased to invite shareholders to attend the 33(rd) Annual

General Meeting which will be held at our registered office, 201 Bishopsgate,

London, EC2M 3AE on Monday 27 November 2023 at 12.30pm.

The event provides the opportunity for shareholders to meet the directors

and the Fund Manager, along with members of his team. The Fund Manager

will give his usual presentation on the year under review and will

discuss the outlook for the year ahead. The directors and fund management

team will also be available to answer questions.

If you are unable to attend in person, you will be able to watch the

meeting live via the internet by visiting www.janushenderson.com/trustslive.

Voting will be held on a poll so we encourage all shareholders to

submit their proxy form, or instruct their share dealing platform

how they wish their shares to be voted, ahead of the respective deadlines.

Voting on a poll means shareholders will have one vote for every share

they own and give a clear indication of shareholders' wishes. The

results of the poll will be published on the Company's website shortly

after the meeting.

Outlook

I have warned of the prospect of inflation since the Annual Report

2020, but the Board does not expect inflation to remain at the high

levels we have been experiencing recently. We are, however, of the

view that moderate inflation and elevated interest rates, compared

to the recent past, are likely to be a persistent feature of the global

economy going forward. The dislocations in the global economy between

the USA and China appear structural. Supply chain resilience is clearly

now a priority of the corporate sector and will alter the disinflationary

dynamic of the last twenty years, notwithstanding that China exiting

Zero-Covid should help ameliorate short term inflationary pressures.

The 'Green Transition' will require substantial capital expenditure

that will also be inflationary. Exciting technologies such as Artificial

Intelligence will no doubt create some disinflationary pressure, but

we doubt it will be as significant as the advent of the internet.

The valuation aware approach employed by the fund management team

should be able to flourish in a market that has some very exciting

companies trading at extremely low valuations. Whilst Europe doesn't

have the global tech titans which have dominated the market in recent

years, the plumbing of the new economy has been delivered by smaller

companies based in Europe and we are confident that the fund management

team can continue to deliver attractive returns for you.

Christopher Casey

Chairman

9 October 2023

1 Euromoney Smaller European Companies (ex UK) Index up to 30 June

2023, thereafter the MSCI Europe ex UK Small Cap Index

2 Calculated using the Euromoney Smaller European Companies (ex UK)

Index for the years ended 30 June 2021 and 2022, and the MSCI Europe

ex UK Small Cap Index for the year ended 30 June 2023

FUND MANAGER'S REPORT

Introduction

After a disappointing year ended June 2022, where the portfolio lagged

the benchmark(1) by 3.7%, the year to June 2023 proved more gratifying,

with a total return of 16.4% outperforming the benchmark by 6.4%.

Outperformance over the twelve months to 30 June 2023 was primarily

driven by bottom-up stock selection, with Dutch wealth manager Van

Lanschot Kempen and German pump manufacturer KSB adding handsomely

to returns. In addition to stock selection, the Company gained from

its overweight position in cheap financials in the first half of the

financial year where the normalisation of interest rates allowed banks

to earn a net interest margin for the first time since the global

financial crisis. Our view that valuation matters, especially in the

absence of 'free money', was positive for performance. In the first

part of 2023 the portfolio benefitted from its exposure to the industrial

sector as the highly publicised fear of energy shortages did not come

to pass. In the remainder of the financial year, the Company performed

reasonably well versus the index despite having a lower average market

capitalisation during the periods of small cap underperformance and

amid the return of growth outperformance on the back of the hype surrounding

Artificial Intelligence.

Since November, equity markets have been largely rangebound, with

ongoing fear that higher interest rates to combat the inevitable post-Covid

inflation would lead to a recession. Technically, the latter has occurred

in some counties like Germany. The good news is that even if recession

does come, it will be the most widely anticipated recession ever.

We take the view that inflation should drop in the second half of

the 2023 calendar year, but that positive inflation and positive interest

rates are likely to be part of the new normal.

The geopolitical environment continues to be volatile, with the Russian

invasion of Ukraine beginning to look like something of a stalemate,

giving investors an excuse to ignore Europe as a region to invest

in. However, valuations in Europe now look so cheap compared to the

US such that investors are being given considerable reward for running

that risk. Some commentators worry about China's ambitions for Taiwan,

which we struggle to assess as a risk. Should this occur, it would

certainly cause another huge disruption to the semiconductor supply

chain as well as adding another appalling conflict to the world. We

assume calm heads will prevail.

The portfolio

We invest across the entire corporate lifecycle, with a mix of early-stage

growth stocks, sensibly priced structural growth stocks, undervalued

cash generative mature names and self-help turnarounds.

We continue to think that many growth stocks in Europe remain far

too expensive, but have begun to add a few names that have fallen

to reasonable levels. For instance, we have added Dutch-listed food

processing equipment manufacturer Marel which was punished for being

slow to increase prices during the supply chain shock and is now playing

catch up. The business remains dominant in its field of meat processing,

and we think the margin rebuild will improve the return on capital

and lead to a re-rating of the shares. We also opened a position in

Danish-listed NTG Nordic Transport which is building a global freight

forwarding operation. The stock is not well known in the market and

suffered from recessionary concerns, allowing us to buy the shares

at a very attractive valuation. Despite some terrific performance

this year, the equity remains cheap and we think it has scope to deliver

far more.

In the year ended June 2022, we did not devote much capital to buying

the early-cycle growth names as we believed many lacked profitability

and started with expensive valuations. However, many of these names

sold off strongly as interest rates rose. We used this opportunity

to begin to buy stakes in companies that we believe look like winners

of the future. We opened a position in Swedish-listed podcast software

and service provider Acast. The company is the market leader in Europe

and a big challenger in the US; if you are an avid consumer of podcasts,

you will have seen its name littered over many of your favourites.

Advertising is massively underpenetrated in podcasts versus radio,

and we think this will change over the next couple of years. We also

added Italian-listed tool maker Eurogroup Laminations which is the

leading global supplier of high value-add components critical for

making electric motors for the automotive industry, an area that has

huge structural growth trends underpinning it.

Within the mature names in the portfolio, we have added German-listed

electric forklift truck and warehouse automation specialist Jungheinrich.

The company currently earns cost of capital returns, but its new management

team are focused on boosting this. We believe the structural tailwinds

in the company's end markets should help them to achieve this and

drive a re-rating of the shares. We invested in specialist high performance

material producer Alleima, which was recently divested from Sandvik.

Now that the business is free to emerge from the shadow of its parent,

we believe management can boost margins, returns and cash flow in

the quarters and years to come.

Among our turnaround names, we added Swedish-listed vertical access

solutions (or lifts as they are otherwise known!) Alimak for its purchase

of a near competitor which we believe could drive a big turnaround

in its Façade Access division. We invested in Portuguese bank

Banco Comercial Portugues as it is improving profitability and the

Portuguese economy is one of the best in Europe.

Performance attribution

The Company benefited from its exposure to the industrial and financial

sectors in the year to June 2023. Our biggest contributor was Dutch

wealth manager Van Lanschot Kempen, which is in a unique position

to consolidate the Low Countries wealth management industry. BFF Bank

in Italy was another noticeable contributor as the market has begun

to reward its strong return on equity and diligent capital return

strategy. In the industrial sector, we benefited from long-term Italian

holding SAES Getters after it disposed of its medical division at

an attractive premium and converted its Savings Shares to Ordinary

Shares. Elsewhere, Dutch-listed vision systems producer TKH made a

sizeable contribution with analysts being far too bearish on the company's

prospects in 2023.

Spanish online travel agent eDreams ODIGEO contributed to returns

after benefitting from a notable recovery in tourism following the

pandemic. Dutch-listed specialty metals producer AMG Critical Materials

gained as its capital expenditure began to bear fruit and the stock

market realised the value of its lithium assets. Dutch-listed outsourced

customer service company Majorel was bid for by competitor Teleperformance,

also adding to performance.

Detractors from performance included a combination of last year's

winners giving up some performance and certain stock specific mistakes.

US-listed Adtran (shares in which we received from the acquisition

of German tech hardware company ADVA Optical Networking) detracted

as the market reopening left too much inventory on its client's balance

sheets. Swedish-listed broadcaster of over-the-top media services

and owner of many sports rights, Viaplay, had a profit warning as

its Nordic market slowed sharply and management's growth assumptions

proved to be wildly optimistic. We subsequently sold the position.

Belgian-listed insulation manufacturer, Recticel, suffered weak demand

from the construction market and a brutal last-minute renegotiation

for the disposal of its Engineered Foams business that hurt the stock

significantly. Finally, Swedish-listed legal software and services

business Karnov mismanaged an equity placing and unnecessarily spooked

the market about its balance sheet hurting the shares.

Geographical and sector distribution

Our investment process is fundamentally a bottom-up stock picking

approach, and we don't allocate capital to specific sectors or geographies,

though we do monitor the overall structure of the portfolio to ensure

we are actively managing our risk profile. We do not invest with the

benchmark as a reference and are content to run the portfolio with

significant divergence from it. The largest geographic overweight

was France where we have found several very cash generative and lowly

valued companies. We are also heavily overweight to the Netherlands

where we added property developer CTP, which dominates the logistics

development market in South Eastern Europe and in Germany where we

added leading display advertiser Stroeer. We remain underweight the

relatively more expensive markets such as Sweden, Switzerland and

Norway.

At the sector level, we are overweight industrials and consumer discretionary,

though we have focused our latter overweight on more robust areas

such as travel related verticals with companies such as Irish-listed

hotel company Dalata, which has had robust trading. We have an overweight

in the information technology sector, primarily driven by technology

hardware with investments such as Finnish-listed Detection Technology

that produces scanning and imaging technology for the medical, industrial

and security markets.

We are underweight to the health care sector where we struggle to

find sensibly priced investments. We remain underweight to the real

estate sector, which has benefited the Company in the rising interest

rate environment, although we have reduced the underweight position

by adding selectively chosen positions such as Swedish-listed Castellum

that we took the opportunity to buy at an attractive valuation when

they raised money to repair their balance sheet. We remain underweight

in the consumer staples sector, where we struggle to find many exciting

investment opportunities.

Additions and disposals

Other notable additions to the portfolio include Italian truck manufacturer,

Iveco, which was recently spun out of CNH. The stock is extremely

cheap, has a meaningful opportunity to improve margins and has an

exciting line in electric buses. We re-initiated a position post a

de-rating in German-listed manufacturer of semiconductor equipment,

PVA TePla, that sells furnaces for producing silicon carbide crystals.

Increasingly silicon carbide wafers are replacing pure silicon in

end markets such as electric vehicles.

We disposed of our position in Irish-listed bank, AIB, after seeing

a considerable return as the market recognised the undervaluation

and boost of an improved net interest margin environment. We exited

our position in Italian bank, Finecobank, as we considered the market

to have too optimistic a view of their earnings. We disposed of German-listed

Commerzbank on the concern that the investment was too consensual.

This resulted in our meaningful overweight in the financial sector

becoming broadly neutral.

We sold our position in Norwegian marine services business Froy after

it was bid for, Greek renewable energy producer and refiner Motor

Oil, after earning considerable profit and Swedish-listed manufacturer,

Thule, as we thought forecasts had begun to look too optimistic. We

capitulated on our investment in Swedish-listed kitchen maker Nobia

as we became concerned by the balance sheet after some ill-timed major

capital expenditure. Finally, we exited our position in Belgian cinema

operator Kinepolis as our conviction that audiences would return to

the cinemas in the same numbers as pre-pandemic waned.

Currency

The Company is denominated in Sterling, while investing in largely

Euro-denominated assets. We do not hedge this currency exposure.

Outlook

Last year we warned that central banks could overreact to inflation

by pushing rates too high and into an energy shock. Today, we think

that may still be the case. Concerns of too-high-too-soon rates and

the resulting recession has created a fear factor that has dissuaded

many from investing in European smaller companies.

Our fundamental belief is that there is considerable value to be found

in European smaller companies currently, with valuation multiples

looking extremely attractive. Much of our investment universe is already

priced for a recession. The resilience of labour markets suggest that

there is a reasonable chance that the global economy has a 'soft landing'.

In such an environment, European smaller companies should be a good

area to invest: it is the area of the market that could deliver greater

growth and is currently trading at a discount to its more pedestrian

larger European counterparts. Throughout, we continue to believe that

remaining valuation-aware when seeking out the small cap winners of

tomorrow is a key discipline for delivering value for our shareholders.

Ollie Beckett, Rory Stokes and Julia Scheufler

9 October 2023

1 Euromoney Smaller European Companies (ex UK) Index for the year

ended 30 June 2022, the MSCI Europe ex UK Small Cap Index for the

year ended 30 June 2023.

Geographic exposure at 30 June 2023 (% of

portfolio excluding cash)

-----------------------------------------------

2023 2022

% %

----------------------- ---------- ----------

Germany 17.4 17.1

France 14.6 14.1

Netherlands 11.9 10.6

Italy 10.3 8.5

Sweden 10.0 8.8

Switzerland 8.1 6.6

Spain 5.4 6.0

Belgium 4.2 4.8

Greece 3.2 2.0

Finland 3.0 4.6

Denmark 2.8 2.4

Ireland 2.5 4.9

Norway 2.3 3.8

Austria 2.0 2.9

Portugal 1.3 1.9

Malta 1.0 1.0

100.0 100.0

---------- ----------

Sector exposure at 30 June 2023 (% of portfolio

excluding cash)

-----------------------------------------------------

2023 2022

% %

-------------------------------- --------- --------

Industrials 38.6 34.1

Consumer Discretionary 20.9 22.5

Financials 13.0 13.1

Technology 11.6 12.0

Basic Materials 3.2 2.1

Utilities 3.1 5.1

Health Care 3.1 2.1

Real Estate 2.3 1.2

Consumer Staples 2.0 4.1

Energy 1.7 2.0

Telecommunications 0.5 1.7

---------

100.00 100.0

--------- --------

MANAGING risks

Principal risks

Investing, by its nature, carries inherent risk. The Board, with the

assistance of the investment manager, carries out a robust assessment

of the principal and emerging risks and uncertainties facing the Company

which could threaten the business model and future performance, solvency

and liquidity of the portfolio. A matrix of these risks, along with

the steps taken to mitigate them, is maintained and is kept under

regular review. The mitigating measures include a schedule of investment

limits and restrictions within which the fund management team must

operate.

The principal risks which have been identified and the steps we have

taken to mitigate these are set out below. We do not consider these

risks to have changed during the period.

Investment strategy and objective

The investment objective or policy is not appropriate in the prevailing

market or sought by investors, leading to a wide discount and hostile

shareholders.

Investment mandate limits established by the Board are inappropriate

leading to out-of-scope investments which may negatively impact shareholder

value.

Poor investment performance over an extended period of time, driven

by either external (political uncertainty, financial shock, pandemic,

climate change, etc.) or internal factors (poor stock selection, poor

management of gearing, loss of key members of the fund management

team, etc.), leading to shareholders voting to wind up the Company.

The investment manager periodically reviews the investment objective

and policy in line with best practice and taking account of investor

appetites. The Board receives regular updates on professional and

retail investor activity from the investment manager, and reports

from the corporate broker, to inform themselves of investor sentiment

and how the Company is perceived in the market. From time to time,

research may be undertaken by a third-party consultant to specifically

ascertain the views of retail investors.

The Board reviews compliance with the investment limits at each meeting.

The Board considers the Key Performance Indicators ('KPIs') at each

meeting and reviews the investment manager's approach to environmental,

social and governance matters. The fund management team incorporate

environmental, social and governance considerations in investment

selection and maintains a diversified portfolio with a view to spreading

risk. Consideration is given to the possible impact of climate change

on the value of the portfolio as part of the Company's overall risk

assessment.

Operational

Failure of, disruption to or inadequate service levels provided by

principal third-party service providers leading to a loss of shareholder

value or reputational damage. This includes cyber security risks which

may compromise the integrity of data and the effective operation of

third-party service providers.

The Board engages reputable third-party service providers and formally

evaluates their performance, and terms of engagement, at least annually.

The Audit Committee assesses the effectiveness of internal controls

in place at the Company's key third-party service providers through

review of their ISAE 3402 reports, quarterly internal control reports

from the investment manager and monthly reporting on compliance with

the investment limits established by the Board.

Legal and regulatory

Loss of investment trust status, breach of the Companies Act 2006,

Listing Rules, Prospectus and/or Disclosure Guidance and Transparency

Rules or the Alternative Fund Managers Directive and/or legal action

brought against the Company and/or directors and/or the investment

manager leading to a decrease in shareholder value and reputational

damage.

The Board engages reputable third-party service providers and formally

evaluates their performance, and terms of appointment, at least annually.

The Audit Committee assesses the effectiveness of internal controls

in place at the Company's key third-party service providers through

review of their ISAE 3402 reports and, in respect of the investment

manager's investment trust operations, reporting from the investment

manager's internal audit function. The investment manager's Compliance

function has reporting obligations under AIFMD, with any non-compliance

being captured in the investment manager's quarterly internal control

reporting to the Board.

Financial

Market, liquidity and/or credit risk, inappropriate valuation of assets

or poor capital management leading to a loss of shareholder value.

The Board determines the investment limits and monitors compliance

with these at each meeting. The directors review the portfolio liquidity

at each meeting and periodically consider the appropriateness of hedging

the portfolio against currency risk.

The Board reviews the portfolio valuation at each meeting.

Investment transactions are carried out by a large number of approved

brokers whose credit standard is periodically reviewed and limits

are set on the amount that may be due from any one broker, cash is

only held with the depositary/custodian or reputable banks.

The Board monitors the broad structure of the Company's capital including

the need to buy back or allot ordinary shares and the extent to which

revenue in excess of that which is required to be distributed, should

be retained.

Assessing our viability

In keeping with provisions of the Code of Corporate Governance issued

by the Association of Investment Companies (the 'AIC Code'), the Board

has assessed the prospects of the Company over a period longer than

the 12 months required by the going concern provision.

We consider the Company's viability over a three-year period as we

believe this is a reasonable timeframe reflecting the longer term

investment horizon for the portfolio, but acknowledges the inherent

shorter term uncertainties in equity markets.

As part of the assessment, we have considered the Company's financial

position, as well as its ability to liquidate the portfolio and meet

expenses as they fall due. The following aspects formed part of our

assessment:

* the closed-end nature of the Company which continued

to be focused on long-term returns and does not need

to account for redemptions;

* a robust assessment of the principal risks and

uncertainties facing the Company, including the

challenges posed by climate change, which concluded

that no materially adverse issues had been

identified;

* the nature of the portfolio remained diverse and

comprised a wide range of stocks which are traded on

major international exchanges meaning that, in normal

market conditions, three quarters of the portfolio

could be liquidated in ten days;

* the level of the Company's revenue reserves and size

of the bank overdraft facility; and

* the expenses incurred by the Company, which are

predictable and modest in comparison with the assets

and the fact that there are no capital commitments

currently foreseen which would alter that position.

As well as considering the principal risks and financial position

of the Company, the Board has made the following assumptions:

* investors will continue to wish to have exposure to

investing in European small cap companies;

* investors will continue to invest in closed-end

funds;

* the Company's performance will continue to be

satisfactory; and

* the Company will continue to have access to adequate

capital when required.

Based on the results of the viability assessment, we have a reasonable

expectation that the Company will be able to continue its operations

and meet its expenses and liabilities as they fall due for our assessment

period of three years. Forecasting over a longer period is imprecise

given the nature of the portfolio. We will revisit this assessment

annually and provide shareholders with an update on our view in the

annual report.

Related party transactions

The Company's transactions with related parties in the year were with

the directors and the investment manager.

There have been no material transactions between the Company and its

directors during the year. The only amounts paid to them were in respect

of remuneration and expenses for which there were no outstanding amounts

payable at the year end.

In relation to the provision of services by the investment manager,

other than fees payable by the Company in the ordinary course of business

and the provision of marketing activities, there have been no material

transactions affecting the financial position of the Company during

the year under review.

Directors' responsibility STATEMENTS

Each of the directors in office at the date of this report confirm

that, to the best of their knowledge:

* the financial statements prepared in accordance with

UK Adopted International Accounting Standards give a

true and fair view of the assets, liabilities,

financial position and profit and loss of the issuer

and the undertakings included in the financial

statements as a whole; and

* the Strategic Report includes a fair review of the

development and performance of the business and the

position of the Company, together with a description

of the principal risks and uncertainties that it

faces.

For and on behalf of the Board

Daniel Burgess

Chairman of the Audit Committee

9 October 2023

Statement of Comprehensive Income

Year ended 30 June Year ended 30 June 2022

2023

Revenue Capital Total Revenue Capital Total

return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ----------- ----------- ------------ ------------- ------------- -------------

Investment income 25,054 - 25,054 25,231 - 25,231

Other income 9 - 9 - - -

Gains/(losses) on investments

held at fair value through

profit or loss - 96,206 96,206 - (185,662) (185,662)

----------- ----------- ------------ ------------- ------------- -------------

Total income 25,063 96,206 121,269 25,231 (185,662) (160,431)

Expenses

Management and performance

fee (776) (10,284) (11,060) (844) (8,906) (9,750)

Other operating expenses (760) - (760) (830) - (830)

----------- ----------- ----------- ------------- ------------- -------------

Profit/(loss) before finance

costs and taxation 23,527 85,922 109,449 23,557 (194,568) (171,011)

Finance costs (595) (2,382) (2,977) (194) (775) (969)

----------- ----------- ----------- ------------- ------------- -------------

Profit/(loss) before taxation 22,932 83,540 106,472 23,363 (195,343) (171,980)

Taxation (2,005) (86) (2,091) (2,660) (72) (2,732)

----------- ----------- ----------- ------------- ------------- -------------

Profit/(loss) for the year

and total comprehensive

income 20,927 83,454 104,381 20,703 (195,415) (174,712)

====== ====== ====== ======= ======= =======

Return per ordinary share

- basic and diluted 5.22p 20.82p 26.04p 5.16p (48.75p) (43.59p)

====== ======== ======= ======= ======= =======

The total column of this statement represents the Statement of Comprehensive

Income, prepared in accordance with UK adopted International Accounting

Standards.

The revenue return and capital return columns are supplementary to

this and are prepared under guidance published by the Association

of Investment Companies.

All revenue and capital items in this statement derive from continuing

operations.

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Equity

Year ended 30 June 2023

------------------------- ----------------------------------------------------------------------------------

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ------------ ------------ ------------ ------------ ------------ ------------

Total equity at 1

July 2022 6,264 120,364 13,964 481,409 30,463 652,464

Total comprehensive

income:

Profit for the year - - - 83,454 20,927 104,381

Costs relating to

sub-division of shares - - - 17 - 17

Ordinary dividends

paid - - - - (18,220) (18,220)

----------- ----------- ----------- ----------- ----------- -----------

Total equity at 30

June 2023 6,264 120,364 13,964 564,880 33,170 738,642

====== ====== ====== ====== ====== ======

Year ended 30 June 2022

---------------------------- ----------------------------------------------------------------------------------------

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ------------- ------------- ------------- ------------- ------------- -------------

Total equity at 1 July

2021 6,264 120,364 13,964 676,886 23,189 840,667

Total comprehensive

income:

(Loss)/profit for the

year - - - (195,415) 20,703 (174,712)

Costs relating to

sub-division

of shares - - - (62) - (62)

Ordinary dividends

paid - - - - (13,429) (13,429)

------------ ------------ ------------ ------------ ------------ ------------

Total equity at 30

June 2022 6,264 120,364 13,964 481,409 30,463 652,464

======= ======= ======= ======= ======= =======

Balance Sheet

At 30 June At 30 June

2023 2022

GBP'000 GBP'000

------------------------------------ -------------- -------------

Non current assets

Investments held at fair value

through profit or loss 835,744 725,441

------------ -----------

Current assets

Receivables 7,323 6,986

Cash and cash equivalents 2 11

------------ ----------

7,325 6,997

------------ -----------

Total assets 843,069 732,438

------------- -----------

Current liabilities

Payables (10,411) (11,155)

Bank overdrafts (94,016) (68,819)

------------ ------------

(104,427) (79,974)

------------ ------------

Net assets 738,642 652,464

======= =======

Equity attributable to equity

shareholders

Called up share capital 6,264 6,264

Share premium account 120,364 120,364

Capital redemption reserve 13,964 13,964

Retained earnings:

Other capital reserves 564,880 481,409

Revenue reserve 33,170 30,463

------------ ------------

Total equity 738,642 652,464

======= =======

Net asset value per ordinary

share - basic and diluted 184.26p 162.76p

======= =======

Cash Flow Statement

Year ended

30 June Year ended

2023 30 June 2022

GBP'000 GBP'000

----------------------------------------------------- ------------ --------------

Operating activities

Profit/(loss) before taxation 106,472 (171,980)

Add back: interest payable 2,977 969

(Less)/add back: (Gains)/losses on investments

held at fair value through profit or loss (96,206) 185,662

Sales of investments held at fair value through

profit or loss 274,632 317,888

Purchases of investments held at fair value through

profit or loss (290,536) (295,427)

Withholding tax on dividends deducted at source (3,510) (3,691)

Increase in prepayments and accrued income (881) (320)

Decrease/(increase) in amounts due from brokers 1,215 (2,462)

(Decrease)/increase in accruals and deferred

income (451) 2,910

(Decrease)/increase in amounts due to brokers (636) 1,100

----------- ----------

Net cash (outflow)/inflow from operating activities

before interest and taxation (1) (6,924) 34,649

----------- ----------

Interest paid (2,618) (969)

Taxation recovered 749 167

----------- ----------

Net cash (outflow)/inflow from operating activities (8,793) 33,847

----------- ----------

Financing activities

Equity dividends paid (net of refund of unclaimed

dividends) (18,220) (13,429)

Costs relating to sub-division of shares - (62)

Net drawndown/(repayment) of bank overdraft 27,004 (20,345)

----------- -----------

Net cash raised/(used in) financing activities 8,784 (33,836)

----------- -----------

(Decrease)/increase in cash and cash equivalents (9) 11

Cash and cash equivalents at the start of the

year 11 -

----------- ----------

Cash and cash equivalents at the end of the

year 2 11

Comprising:

Cash at bank 2 11

----------- ----------

2 11

====== ======

1. In accordance with IAS7.31 cash inflow from dividends was GBP24,157,000

(2022: GBP24,892,000) and cash inflow from interest was GBP3,000 (2022:

GBPnil).

Notes to the Financial Statements

1. Accounting policies

Basis of preparation

The European Smaller Companies Trust PLC is a company incorporated in

England and Wales and subject to the provisions of the Companies Act

2006. The Company is domiciled in the United Kingdom. The Company financial

statements for the year ended 30 June 2023 have been prepared in accordance

with UK adopted International Accounting Standards. These comprise standards

and interpretations approved by the International Accounting Board ('IASB'),

together with interpretations of the International Accounting Standards

and Standing Interpretations Committee approved by the IFRS Interpretations

Committee ('IFRS IC') that remain in effect, to the extent that IFRSs

have been adopted by the UK Endorsement Board.

The financial statements have been prepared on a going concern basis.

They have also been prepared on the historical cost basis, except for

the revaluation of certain financial instruments at fair value through

profit and loss. The principal accounting policies adopted are set out

in the Annual Report 2023. Where presentational guidance set out in

the Statement of Recommended Practice ('SORP') for investment companies

issued by the Association of Investment Companies ('AIC') in July 2022,

is consistent with the requirements of UK adopted International Accounting

Standards, the directors have sought to prepare the financial statements

on a basis consistent with the recommendations of the SORP.

The financial position of the Company is described in the Annual Report

2023, which includes the Company's policies and process for managing

its capital; its financial risk management objectives; and details of

financial instruments and exposure to credit risk and liquidity risk.

In preparing these financial statements the directors have considered

the impact of climate change risk and concluded there was no impact

as the investments are valued based on market quoted prices.

2. Management and performance fees

2023 2022

Revenue Capital Total Revenue Capital Total

return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Management fee 776 3,104 3,880 844 3,375 4,219

Performance fee - 7,180 7,180 - 5,531 5,531

--------- --------- --------- -------- -------- --------

Total 776 10,284 11,060 844 8,906 9,750

===== ===== ===== ===== ===== =====

3. Return per ordinary share

The return per ordinary share figure is based on the net profit for

the year of GBP104,381,000 (2022 loss: GBP174,712,000) and on the weighted

average number of ordinary shares in issue during the year of 400,867,176

(2022: 400,867,176).

The return per ordinary share figure detailed above can be further analysed

between revenue and capital, as below. The Company has no securities

in issue that could dilute the return per ordinary share. Therefore

the basic and diluted return per ordinary share are the same.

2023 2022

GBP'000 GBP'000

---------------------------------------------------------------- ------------------ --------------------

Net revenue profit 20,927 20,703

Net capital (loss)/profit 83,454 (195,415)

------------ ------------

Net profit/(loss) 104,381 (174,712)

======= =======

Weighted average number of ordinary shares in

issue during the year 400,867,175 400,867,176

2023 2022

Pence Pence

---------------------------------------------------------------- ------------------ --------------------

Revenue return per ordinary share 5.22 5.16

Capital return per ordinary share 20.82 (48.75)

----------- -----------

Total return per ordinary share 26.04 (43.59)

====== ======

4. Net asset value per ordinary share

The NAV per ordinary share is based on the net assets attributable to

the ordinary shares of GBP738,642,000 (2022: GBP652,464,000) and on

the 400,867,176 ordinary shares in issue at 30 June 2023 (2022: 400,867,176).

The Company has no securities in issue that could dilute the NAV per

ordinary share (2022: same). The NAV per ordinary share at 30 June 2023

was 184.26p (2022: 162.76p).

The movements during the year in assets attributable to the ordinary

shares were as follows:

2023 2022

GBP'000 GBP'000

---------------------------------------------------------------- ------------------ --------------------

Net assets attributable to ordinary shares at

start of year 652,464 840,667

Profit/for the year 104,381 (174,712)

Dividends paid in the year (18,220) (13,429)

Costs relating to sub-division of shares 17 (62)

------------ ------------

Net assets at 30 June 738,642 652,464

======= =======

5. Dividends 2023 2022

GBP'000 GBP'000

------------------------------------------------ ---------- ----------

Amounts recognised as distributions to equity

holders in the year:

Final dividend of 3.10p for the year ended 30

June 2022 (2021: 2.10p) 12,427 8,418

Interim dividend of 1.45p per ordinary share

for the year ended 30 June 2023 (2022: 1.25p) 5,812 5,011

Unclaimed dividends from prior years (19) -

--------- ---------

18,220 13,429

===== =====

The final dividend of 3.10p per ordinary share in respect of the year

ended 30 June 2022 was paid on 2 December 2022 to shareholders on the

Register of Members at the close of business on 21 October 2022. The

total dividend paid amounted to GBP12,427,000.

Subject to approval at the annual general meeting in November 2023,

the proposed final dividend of 3.25p per ordinary share will be paid

on 1 December 2023 to shareholders on the Register of Members at the

close of business on 3 November 2023. The shares will be quoted ex-dividend

on 2 November 2023.

The proposed final dividend for the year ended 30 June 2023 has not

been included as a liability in these financial statements. Under UK

adopted International Accounting Standards, these dividends are not

recognised until approved by shareholders.

The total dividends payable in respect of the financial year which form

the basis of the test under s.1158 are set out below:

2023 2022

GBP'000 GBP'000

------------------------------------------------ ----------- -----------

Revenue available for distribution by way of

dividends for the year 20,927 20,703

Interim dividend of 1.45p per ordinary share

for the year ended 30 June 2023 (2022: 1.25p) (5,812) (5,011)

Proposed final dividend of 3.25p per ordinary

share for the year ended 30 June 2023 (2022:

3.10p) (based on 400,867,176 shares in issue

at 9 October 2023) (13,028) (12,427)

---------- ----------

Transfer to Revenue reserve 2,087 3,265

====== ======

The Company's undistributed revenue represents 8.3% (2022: 12.9%) of

total income.

6. Called up share capital 2023 2022

---------------------------------

number number

of shares GBP'000 of shares GBP'000

--------------------------------- ------------ --------- ------------- ---------

Allotted, issued and fully paid

ordinary shares of 1.5625p 400,867,176 6,264 400,867,176 6,264

During the year no ordinary shares were issued (2022: no shares issued)

for proceeds of GBPnil (2022: GBPnil). In the current year to date and

prior financial year, the Company has not repurchased any shares for

cancellation.

7. 2023 Financial information

The figures and financial information for the year ended 30 June 2023

are extracted from the Company's annual financial statements for that

period and do not constitute statutory accounts. The Company's annual

financial statements for the year to 30 June 2023 have been audited

but have not yet been delivered to the Registrar of Companies. The Independent

Auditors' Report on the 2023 annual financial statements was unqualified,

did not include a reference to any matter to which the auditors drew

attention without qualifying the report, and did not contain any statements

under Sections 498(2) or 498(3) of the Companies Act 2006 .

8. 2022 Financial information

The figures and financial information for the year ended 30 June 2022

are compiled from an extract of the published financial statements for

that year and do not constitute statutory accounts. Those financial

statements have been delivered to the Registrar of Companies and included

the Independent Auditor's Report which was unqualified, did not include

a reference to any matter to which the auditors drew attention without

qualifying the report, and did not contain any statements under Sections

498(2) or 498(3) of the Companies Act 2006.

9. Annual Report

The annual report will be posted to shareholders in October 2023. A

video of the Fund Manager discussing the financial results will shortly

be available on the Company's website, www.europeansmallercompaniestrust.com

along with the annual report.

10. Annual General Meeting

The annual general meeting will be held on Monday 27 November 2023 at

12.30pm at 201 Bishopsgate, London, EC2M 3AE. The Notice of Meeting

will be sent to shareholders with the annual report.

11. General information

Company Status

The European Smaller Companies Trust PLC is registered in England and

Wales, no. 2520734, has its registered office at 201 Bishopsgate, London

EC2M 3AE and is listed on the London Stock Exchange.

SEDOL/ISIN: BMCF868/GB00BMCF8689

London Stock Exchange (TIDM) code: ESCT

Global Intermediary Identification Number (GIIN): JX9KYH.99999.SL.826

Legal Entity Identifier (LEI): 213800N1B1HCQG2W4V90

Directors and Secretary

The directors of the Company are Christopher Casey (Chairman), Daniel

Burgess (Chairman of the Audit Committee), Ann Grevelius, and Simona

Heidempergher. On 9 October 2023, the Company announced the appointment

of James Williams as a director with effect from 1 November 2023. The

Corporate Secretary is Janus Henderson Secretarial Services UK Limited.

Website

Details of the Company's share price and net asset value, together with

general information about the Company, monthly factsheets and data,

copies of announcements, reports and details of general meetings can

be found at www.europeansmallercompaniestrust.com .

For further information please

contact:

Ollie Beckett

Fund Manager

The European Smaller Companies

Trust PLC Telephone: 020 7818 4331/3997

Dan Howe Harriet Hall

Head of Investment Trusts PR Manager

Janus Henderson Investors Janus Henderson Investors

Telephone: 020 7818 4458 Telephone: 020 7818 2919

Neither the contents of the Company's website nor the contents of

any website accessible from hyperlinks on the Company's website (or

any other website) is incorporated into, or forms part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FSAFMUEDSELS

(END) Dow Jones Newswires

October 10, 2023 02:00 ET (06:00 GMT)

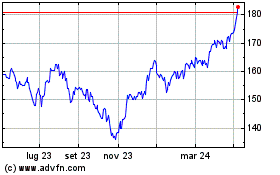

Grafico Azioni The European Smaller Com... (LSE:ESCT)

Storico

Da Mag 2024 a Giu 2024

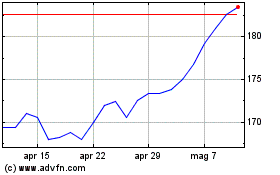

Grafico Azioni The European Smaller Com... (LSE:ESCT)

Storico

Da Giu 2023 a Giu 2024