TIDMEZJ

RNS Number : 7488N

easyJet PLC

25 January 2023

25 January 2023

easyJet plc

('easyJet')

easyJet Trading Update for the quarter ended 31 December

2022

Strong bookings see easyJet improve its first quarter

performance by GBP80 million year on year, driven by its

transformed network and much improved revenue capability with

momentum continuing into Q2

-- Q1 headline loss before tax GBP133 million (Q1 22 GBP213 million loss)

o Passenger growth +47% YoY

o RPS +36% YoY

-- Load factor +10 ppts YoY

-- Ticket yield +21% YoY

-- Ancillaries continue to grow with yield increasing 20% YoY

(+85% vs Q1 FY19)

o easyJet holidays delivers GBP13 million profit (Q1 22 GBP1

million loss)

-- Strong booking momentum:

o Q2 RPS expected to continue year on year trend from Q1

o Airline and easyJet holidays deliver record revenue booking

days in January

o Bookings strength continues across Q2 and into summer 2023

-- easyJet holidays upgrades expectations from >30% to c.50%

customer growth YoY

-- Strong UK demand: 11 new routes just released to popular

holiday destinations

-- Expect H1 loss before tax to be significantly better vs H1 22

-- H2 ticket yields continuing the trend from H1, although load

factors behind FY19 levels as later booking pattern continues

-- Whilst we remain mindful of the uncertain macroeconomic

outlook across the globe, based on current high levels of demand

and strong bookings, easyJet anticipates beating the current market

profit expectations(1) for FY23

Summary

easyJet's first quarter financial performance was ahead of

expectations as yields strengthened, with revenue per seat

increasing 36% year on year. Airline ancillary revenue continued to

perform well, at GBP20.12 per seat, also increasing 36% year on

year. easyJet holidays remains the UKs fastest growing major

holiday company, with a 161% increase year on year in customers as

demand for travel in the UK remains strong.

Moving into the second quarter of this financial year, easyJet

expects RPS growth year on year to continue the trend experienced

in Q1. This is driven by yield and load factor growth alongside the

continued delivery of ancillary products. easyJet holidays will

continue to see customer growth through the quarter, alongside

investment into marketing and advertising as part of the turn of

year sale campaign.

easyJet's leading low-cost proposition at primary airports

provides a key differentiator for customers making it easy to

travel, whilst offering great value. Demand for our network is

strong demonstrated through record turn of year bookings. Easter,

which sits in Q3, is currently trading very well with sold ticket

yields +24% vs FY19, noting the later booking window. With strong

UK demand, easyJet holidays is now over 60% sold for this summer,

based on the previously guided 30% growth year on year. With the

holidays business not constrained and considering current levels of

demand, we now expect to see growth of circa 50% on FY22.

Johan Lundgren, CEO of easyJet, said:

"We have seen strong and sustained demand for travel over the

first quarter, carrying almost 50% more customers compared with

last year. Many returned to make bookings during the traditional

turn of year sale where we filled five aircraft every minute in the

peak hours, which culminated in three record-breaking weekends for

sales revenue this month.

"This strong booking performance, aided by the airline's step

changed revenue capability, has driven an GBP80m year on year boost

in the first quarter with continued momentum as customers

prioritise spending on holidays for the year ahead. easyJet

holidays, the fastest growing holidays company in the UK, is

upgrading its ambitious growth plans for the year given the strong

demand.

"In summary, we expect to see our winter loss reduce

significantly over the first half compared to last year. This will

set us firmly on the path to delivering a full year profit, where

we anticipate beating the current market expectation enabling us to

create value for customers, investors and the economies we

serve."

Capacity

During Q1 easyJet flew 20.2 million seats, in line with

guidance, a significant increase on the same period last year when

easyJet flew 15.5 million seats. Load factor was 87% (Q1 FY22:

77%), due to increased customer demand coupled with

restriction-free travel.

Passenger(3) numbers in the quarter increased to 17.5 million

(Q1 FY22: 11.9 million).

October November December Q1 Q1

2022 2022 2022 FY23 FY22

Number of flights 49,071 28,907 34,914 112,892 85,618

-------- --------- --------- -------- -------

Peak operating aircraft 313 254 261 313 251

-------- --------- --------- -------- -------

Passengers (3) (thousand) 7,505 4,543 5,433 17,481 11,891

-------- --------- --------- -------- -------

Seats flown (thousand) 8,732 5,178 6,250 20,159 15,471

-------- --------- --------- -------- -------

Load factor (4) 86% 88% 87% 87% 77%

-------- --------- --------- -------- -------

Sustainability

During the quarter, easyJet's CO2 emissions per RPK reduced 11%

year on year. Alongside this, our partnership with Rolls-Royce set

a new aviation milestone with the world's first run of a modern

aeroplane engine fuelled by green hydrogen. To further underpin the

commitment to achieving our net zero roadmap, easyJet announced a

partnership with Airbus, Bristol Airport and EDF Hynamics, with the

objective of turning Bristol Airport into a hydrogen hub.

Revenue, Cost and Liquidity

Revenue continued to benefit from strong demand for easyJet's

leading network, the continued outperformance of ancillary products

and easyJet holidays. Significant fuel price increases year on year

and the strengthened USD have resulted in fuel cost per seat being

76% (GBP8.44) more than the same period last year. One-off costs

were incurred during the quarter as 15 wet leased aircraft utilised

in summer 22 left the fleet at the end of October.

Financing costs benefitted from the strengthening of sterling

versus the USD over the quarter which has driven a non-operating,

non-cash FX gain of GBP13 million (Q1 FY22: GBP15 million gain)

from balance sheet revaluations.

Q1'23 Q1'22 Variance

Passenger revenue (GBP'm) 975 547 78%

-------- -------- ---------

Airline ancillary revenue (GBP'm) 406 230 77%

-------- -------- ---------

Holidays revenue(2) (GBP'm) 93 28 232%

-------- -------- ---------

Group revenue (GBP'm) 1,474 805 83%

-------- -------- ---------

Fuel costs (GBP'm) (393) (171) (130)%

-------- -------- ---------

Airline headline EBITDAR costs (GBP'm) (959) (647) (48)%

-------- -------- ---------

Holidays EBITDAR costs(2) (GBP'm) (80) (29) (176)%

-------- -------- ---------

Group headline EBITDAR costs (GBP'm) (1,432) (847) (69)%

-------- -------- ---------

Group headline EBITDAR (GBP'm) 42 (42) 200%

-------- -------- ---------

Group depreciation & amortisation

(GBP'm) (164) (153) (7)%

-------- -------- ---------

Group LBIT (GBP'm) (122) (195) 37%

-------- -------- ---------

Financing costs excluding balance

sheet revaluations (GBP'm) (24) (33) 27%

-------- -------- ---------

Balance sheet revaluations (GBP'm) 13 15 (13)%

-------- -------- ---------

Group headline LBT (GBP'm) (133) (213) 38%

-------- -------- ---------

Airline passenger revenue per seat

(GBP) 48.35 35.37 37%

-------- -------- ---------

Airline ancillary revenue per seat

(GBP) 20.12 14.84 36%

-------- -------- ---------

Total airline revenue per seat

(GBP) 68.47 50.21 36%

-------- -------- ---------

Airline headline cost per seat ex

fuel (GBP) (56.21) (52.90) (6)%

-------- -------- ---------

Airline fuel cost per seat (GBP) (19.50) (11.06) (76)%

-------- -------- ---------

Airline headline total cost per

seat (GBP) (75.71) (63.96) (18)%

-------- -------- ---------

Cash and money market deposits (GBP'bn) 3.0 2.9 3%

-------- -------- ---------

Net debt (GBP'bn) 1.1 1.2 8%

-------- -------- ---------

Capacity outlook

o H1 c.38m seats, c.25% increase YoY

o H2 c.56m seats, c.9% increase YoY

o Q4 capacity around pre-pandemic levels

Fuel & FX Hedging

Jet Fuel H1'23 H2'23 USD H1'23 H2'23

Hedged position 78% 59% Hedged position 75% 62%

----- ----- ----- -----

Average hedged rate

($/MT) $819 $900 Average hedged rate (USD/GBP) 1.29 1.24

----- ----- ----- -----

Current spot ($/MT)

at 24.01.23 c. $1,110 Current spot (USD/GBP) at 24.01.23 c. 1.23

------------ ------------

For further details please contact easyJet plc :

Institutional investors and analysts:

Michael Barker Investor Relations +44 (0) 7985 890 939

Adrian Talbot Investor Relations +44 (0) 7971 592 373

Media:

Anna Knowles Corporate Communications +44 (0) 7985 873 313

Edward Simpkins FGS Global +44 (0) 7947 740 551 / (0) 207 251

3801

Dorothy Burwell FGS Global +44 (0) 7733 294 930 / (0) 207 251

3801

A copy of this Trading Statement is available at

http://corporate.easyjet.com/investors

1 ) Current market profit expectations for FY23 is a GBP126

million profit before tax for FY23.

2) easyJet holidays numbers include elimination of intercompany

airline transactions

3) Represents the number of earned seats flown. Earned seats

include seats which are flown whether or not the passenger turns

up, as easyJet is a no refund airline and once a flight has

departed, a no-show customer is generally not entitled to change

flights or seek a refund. Earned seats also include seats provided

for promotional purposes and to staff for business travel.

4) Represents the number of passengers as a proportion of the

number of seats available for passengers. No weighting of the load

factor is carried out to recognise the effect of varying flight (or

"sector") lengths.

This announcement may contain statements which constitute

'forward-looking statements'. Although easyJet believes that the

expectations reflected in these forward-looking statements are

reasonable, it can give no assurance that these expectations will

prove to have been correct. Because these statements involve risks

and uncertainties, actual results may differ materially from those

expressed or implied by these forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUAAGUPWGRC

(END) Dow Jones Newswires

January 25, 2023 02:00 ET (07:00 GMT)

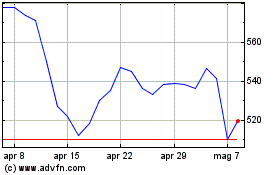

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Easyjet (LSE:EZJ)

Storico

Da Apr 2023 a Apr 2024