TIDMGAMA

RNS Number : 3401L

Gamma Communications PLC

05 September 2023

5 September 2023

Gamma Communications plc

Unaudited results for the six months ended 30 June 2023

Healthy first half performance, continued strong cash generation

and positive business momentum leading to full year outlook in the

top half of market expectations

Gamma Communications plc ("Gamma" or "the Group"), a leading

provider of Unified Communications as a Service ("UCaaS") into the

UK and European business markets, is pleased to announce its

unaudited results for the six months ended 30 June 2023.

Six months ended

30 June

Change

2023 2022 (%)

----------------------------------- ---------- ---------- -------

Revenue GBP256.2m GBP234.7m 9%

Gross profit GBP131.2m GBP120.4m 9%

Gross margin 51% 51%

Profit from operations GBP42.2m GBP38.7m 9%

Adjusted EBITDA* GBP56.5m GBP51.9m 9%

Profit before tax ("PBT") GBP43.5m GBP38.4m 13%

Adjusted PBT* GBP48.3m GBP43.1m 12%

Earnings Per Share ("EPS") (fully

diluted) 33.8p 31.9p 6%

Adjusted EPS (fully diluted)* 37.5p 35.6p 5%

Interim dividend per share 5.7p 5.0p 14%

Cash generated by operations GBP57.1m GBP49.5m 15%

Cash generated by operations

/ adjusted EBITDA* 101% 95%

Cash and cash equivalents less

borrowings ("Net cash")* GBP121.7m GBP72.6m 68%

----------------------------------- ---------- ---------- -------

*All adjusted measures set out above and throughout this

document which are described as "adjusted" represent Alternative

Performance Measures ("APMs") and are separately presented within

the statement of profit or loss or reconciled in note 2 or our

segment note and are applied consistently. Where reference is made

to adjusted EPS this is stated on a fully diluted basis.

Definitions of APMs and our policy on their use are included in

note 2. APMs are not considered to be a substitute for, or superior

to, IFRS measures. Constant currency movements for the statement of

profit or loss are calculated by applying the prior period average

exchange rates to the results for the period ended 30 June

2023.

Key Financials

The Group continued to perform well in the first six months of

the year delivering good gross profit growth flowing through to

both adjusted EBITDA and adjusted PBT, with strong cash

generation.

-- Revenue and gross profit grew by 9% to GBP256.2m and GBP131.2m respectively (H1 2022: GBP234.7m

and GBP120.4m), with gross margin being maintained and adjusted EBITDA growing by 9% to GBP56.5m

(H1 2022: GBP51.9m).

-- Recurring revenue (being revenue which is recognised "over time" as per note 3) in the period

grew to GBP229.7m (H1 2022: GBP208.7m) remaining high at 90% (H1 2022: 89%) of total revenue.

-- Gamma Business continued to grow strongly, primarily driven by our UCaaS portfolio. Revenue

growth has also been supported through targeted price rises. Gross profit increased by 8%

to GBP86.8m (H1 2022: GBP80.2m(#) ) with a stable gross margin.

-- Gamma Enterprise grew gross profit by 6% to GBP25.4m (H1 2022: GBP24.0m (#) ). As expected,

gross margin decreased slightly as a result of higher hardware sales which are lower margin.

-- European Business delivered reported gross profit growth of 17% to GBP19.0m (H1 2022: GBP16.2m(##)

). After current year immaterial alignment of European commission presentation between cost

of sales and operating expenses, and on a constant currency basis, the comparable growth was

7%. In all instances this represented an improved gross margin.

-- We continue to see growth in our voice enablement product set, particularly where we are supporting

Microsoft Teams ("MS Teams"), with Operator Connect and MS Teams Direct Routing, and other

third party voice applications. We have included supplementary information on product volumes

at the end of the Chief Executive Review.

-- The attachment rates on "bolt-ons" which can be bought alongside our core Cloud PBX product

(Horizon) continue to increase which supports our Average Revenue Per User ("ARPU").

-- Adjusted earnings per share (fully diluted) for the year increased by 5% to 37.5p (H1 2022:

35.6p). The growth has been impacted by the change in the UK statutory tax rate. If the prior

year group effective tax rate had been applied the growth would have been 11%.

-- Cash conversion ( Cash generated by operations / adjusted EBITDA) was higher than prior periods

at 101% primarily as a result of favourable working capital movements.

(#) See Note 3 for segmental change information and restated

comparatives.

(##) In H2 2022 there was a review and alignment of European

commission presentation between cost of sales and operating

expenses resulting in an immaterial GBP0.8m reduction in cost of

sales and equivalent increase in operating expenses in H1 2022.

Acquisition

On 16 August 2023, we acquired Satisnet Limited ("Satisnet"), a

UK-based cyber security company (a Managed Security Services

Provider) of software and services to the medium/large enterprise

market. See note 12 for events after the reporting date for further

detail. The business will become part of Gamma Enterprise. We

expect the acquisition to be immediately earnings enhancing

although not materially so, given its small size relative to the

Group.

Outlook

Following a healthy first half performance, growth is expected

to continue into the second half and adjusted EBITDA and adjusted

EPS are now anticipated to be in the top half of the range of

market expectations(+) .

Andrew Belshaw, Chief Executive Officer, commented:

"We continue to deliver good financial growth and our broadened

product set is resonating with channel partners and enterprise

customers alike. In the UK the impending PSTN switch off has led to

good early growth in our PhoneLine+ product. Outside the UK, we

have worked hard to improve the underlying performance in our

European businesses and have made good progress.

We have seen excellent cash conversion in the period and the

strength of Gamma's balance sheet has enabled us to continue to

acquire capability, whether through product development or

acquisition. We have recently broadened our offering into the

adjacent managed cyber security sector through the acquisition of

Satisnet. We continue to see M&A as a way to supplement our

organic growth and capabilities. Our resilient business model

allows us to look forward with confidence."

(+) Company compiled range is based on known sell side analyst

estimates. The ranges are adjusted EBITDA GBP 110. 4m - GBP 117. 2m

and adjusted EPS (fully diluted) 70.0 pence - 77.0 pence.

Enquiries:

Gamma Communications plc Tel: +44 (0)333 006 5972

Andrew Belshaw, Chief Executive CompanySecretary@gamma.co.uk

Officer

Bill Castell, Chief Financial Officer

Rachael Matzopoulos, Company Secretary

Investec Bank plc (NOMAD & Broker) Tel: +44 (0)207 597 5970

Patrick Robb / Virginia Bull

Teneo (PR Adviser) Tel: +44 (0)207 353 4200

James Macey White / Matt Low / Rebecca Gamma@teneo.com

Hamer

Chief Executive Review

We had a healthy first half financial performance with revenue,

gross profit and adjusted EBITDA all growing by 9% compared to the

same period in the previous year. We generated GBP57.1m in cash

from operations and increased our net cash balance to GBP121.7m at

the end of the period.

Our markets and performance

More than 50% of businesses in the UK, and almost 70% in the

European countries in which we operate, still have a physical

hardware PBX rather than a Cloud-based software PBX solution. This

presents an ongoing opportunity for us to continue to increase

sales of our Hosted PBX solution (Horizon, in the UK), as well as

to upsell the additional services we offer such as call recording

and Horizon Contact (our omni-channel product which enables

communication with customer agents). These bolt-ons help us to

maintain the ARPU on each seat that we sell in a market where price

discounting is common.

During the first half we added 31,000 UK Cloud PBX seats in the

UK of which 26,000 were Horizon seats. We have been pleased with

the level of gross additions in the Horizon base. Churn has

increased slightly as some customers have reduced the number of

seats taken when re-contracting, following downsizing of their

business during the Covid period. Our track record of consistently

adding cloud PBX seats and additional functionality bolt-ons,

evidences the growing demand for solutions that improve customer

communication.

At the end of 2025 the UK's Public Switched Telephony Network

("PSTN") is undergoing a fundamental change. The PSTN and

Integrated Services Digital Network ("ISDN") are scheduled to be

turned off and replaced with new technology based on Voice over

Internet Protocol ("VoIP") products. The onus is on businesses to

convert before the end of 2025. The future demise of ISDN has been

a driver of the growth of our SIP business for some years now. The

PSTN gets turned off at the same time and there are over three

million single telephony lines relying on the old technology which

are used by micro-businesses of fewer than ten employees. Each of

the businesses will need to find a new solution for their voice

communications. This presents a sizeable opportunity for Gamma and

our channel partners. Gamma has developed our own cloud solution

for customers, called PhoneLine+, which replaces the simple single

line used by micro-businesses. PhoneLine+ is a cost effective

product which appeals to users who do not need the full

functionality of our Horizon product. PhoneLine+ has had good early

sales with 5,000 seats in the period.

The PSTN switch off in the UK will also accelerate the migration

of data services from legacy products (such as ADSL) to newer

products which are not centred on the existence of the PSTN (such

as SoGEA). This will continue to provide Gamma with an opportunity

for volume growth but with lower margins on those new additional

sales of data products.

We also added 2,000 Cloud PBX seats in Europe in the first half,

which is lower than the previous run rate, because we are focussing

on Operator Connect sales in the Netherlands (rather than Cloud PBX

where the market is more competitive), and we did not have any

large seat wins in Germany as we did at the end of 2022.

As well as the growth in Cloud PBX, we also see increasing

adoption of voice-enablement solutions, particularly MS Teams. In

the UK, the number of SIP Trunks supporting Hardware PBXs fell very

slightly but we are not yet seeing a trend (which will be positive

for us) of customers migrating to Cloud PBX from hardware solutions

which are supported by SIP. We saw significant growth in SIP Trunks

supporting MS Teams and other third-party voice applications.

During the half we added 38,000 MS Teams users in the UK and 5,000

in Europe. We see this as a significant future growth area.

Through our European acquisition strategy, we have a presence in

Germany, the Netherlands and Spain. Between them, these countries

already have more than twice as many potential UCaaS business users

as the UK, but the average penetration rate across those three

countries remains much lower than the UK, leaving scope for

long-term future growth.

The rate of Cloud PBX adoption in our European markets continues

to be slower than market analysts had been predicting several years

ago. Our German business showed 8% growth in the number of cloud

seats and we continued to see the contribution from the

newly-acquired Neotel business drive performance in Spain. In the

Netherlands, the PBX market is more mature and competitive, so we

have been focusing that business on the voice enablement of MS

Teams and we are benefitting from being early to the market,

securing deals from larger customers which we had not previously

been able to serve with our Cloud PBX offering.

Strategic update

Develop a common pan-European product set for UCaaS and CCaaS

for SMEs.

We have acquired businesses in Germany, the Netherlands and

Spain and as a consequence we sell a mixture of business solutions

in different countries. Supporting this varied product set will

become inefficient in the long term and hence we have a multi-year

programme to move to a common product set across all of Gamma's

geographic operations. This solution set will be a mixture of

third-party products and Gamma's own IP which, when combined with

our excellent service wrap, will meet the communications

requirements of a wide range of end users.

During the first half of 2023, our Technology teams across

Europe have come together to form one single team. By working

collaboratively they have been able to launch our Operator Connect

product (which voice enables MS Teams) in Germany, Spain and

Belgium (as well as continuing sales in the UK and the Netherlands

where we had already launched it).

In addition, we have used the platform we built in the UK for

our PhoneLine+ and Horizon Connect products to test launch a new

Cloud PBX product in the Spanish market.

Develop multiple routes to market in each country in which we

operate.

We have now launched our "digital first" offering, CircleLoop,

in Germany and the Netherlands alongside the UK - this is based on

the same platform as PhoneLine+. This "low touch" solution gives

access to Gamma for small customers who wish to buy solutions

digitally, and will allow us to involve channel partners who want

to work on a referral model (i.e. gaining commission from directing

their own customers to our website).

We have also started a programme to review our user portals in

each country. In every country in which we operate we have a portal

where customers and end users can interact with us. These are

hosted using different technologies and provide varying degrees of

customer service. We have embarked on a multi-year project to build

a common portal across Europe which will give all of our customers

the same experience.

Become a trusted partner to Enterprises across Europe,

transforming their communications estates.

Our Enterprise business continued to see good client wins.

Notable wins in the first half of this year were Lidl (SD-WAN),

Shawbrook Bank (CCaaS), NHS (SIP & CCaaS) and The Home Office

(Mobile).

We continue to strengthen our relationships with both Microsoft

and Amazon as we see an important role for us to help our customers

implement solutions involving products from the "digital giants".

Indeed, we are also receiving inbound opportunities from these

partners that are helping us to expand our Enterprise business

outside of the UK.

After the period end we acquired Satisnet which is a Managed

Security Services Provider. Cyber security has become increasingly

important for our customers, many of whom have asked us whether we

are able to support them in this area. We expect to be able to

accelerate the growth of the Satisnet business by taking its

services to our Enterprise customer base. Following an extensive

search to find the right partner, I am pleased to be able to

welcome John McCann and the Satisnet team to Gamma. We can now

provide our customers with a Managed Security Service, offering,

for example, managed firewalls, a 24x7 managed Security Operations

Centre ("SOC") and incident response. Services are purpose built to

meet the specific requirements of each customer. We have already

secured a Managed Security solution for Reed (a current customer)

and we have a number of opportunities from our existing customer

base who have asked us to provide the services which Satisnet can

offer.

Create an organisation that engages all our people with a common

set of values and goals.

We cannot execute our strategy without our great people.

We have acquired businesses with complementary values to our

own; however, we did not have a common language to describe them.

During the first half of 2023, we codified the four Gamma Values:

we're there and we care; we love to grow; we step up and own it;

and we do the right thing.

As part of our values programme we now recognise our Gamma

Values Champions quarterly. These champions could be colleagues

going out of their way to help and support each other, finding

better and simpler ways of doing things, stepping up and owning

challenges and opportunities, or doing the right thing for the

business, their colleagues and our customers.

I am very proud of them and everyone else who makes Gamma what

it is. The products and services which we provide to our customers

are critical for them to run their own businesses; but Gamma can

only provide those products and services because we have 1,800

people who live our values on a daily basis.

During the first half of the year, we also launched an

initiative called "You Belong" aiming to encourage, attract, retain

and develop both current and prospective employees to Gamma with

the core values that we launched. We held the first set of

community meetings which bring together different demographics of

employees within Gamma to support and develop our colleagues'

experiences at work. The first four groups we have formed are

focussing on Women, Multicultural, Early Careers and Wellbeing

groups and we hope that other groups will also form, driven by

employee needs.

Board and corporate governance

The first half of 2023 has seen two of our long-standing

colleagues retire from the Board. On behalf of everyone at Gamma, I

would like to thank Richard Last, our former Chair, and Martin Lea,

Non-Executive Director and former Senior Independent Director, for

their service since we listed in 2014. I am also pleased to welcome

Martin Hellawell to the Board as our new Chair. Martin brings a

wealth of experience into Gamma and my executive team and I are

already working well with him.

As a leading communications company, Gamma will comply with the

Telecommunications Security Act. We are currently investing in the

systems which will ensure we are fully compliant.

Environmental

Gamma remains committed to advancing from a Carbon Neutral

business to a Carbon Net-Zero business by 2042, and we expect to

reduce our Scope 1 and 2 emissions (made directly and indirectly)

by 90% by 2030. We were awarded an A- for our Supplier Engagement

Score by the Carbon Disclosure Project earlier this year,

reflecting the work that we have done to understand our supplier

emissions. This ties into our work on Company-wide emission

reductions under the Science-Based Target initiative (SBTi). We

will seek validation of our target within the 24-month SBTi

timeframe.

Outlook

I am pleased with our first half performance. We expect our

growth to continue into the second half and now anticipate adjusted

EBITDA and adjusted EPS will be in the top half of the range of

current market expectations.

We continue to deliver against our short and longer-term growth

strategy. We will invest in both our product set and the systems

which are used by customers to order from us. We are able to do

this because we are in a strong financial position. We continue to

evaluate acquisition opportunities which will provide additional

capability or take us into new parts of the market, increasing our

relevance to our customer base.

As a result of the market opportunity and the investments we are

making, the Board is positive about the outlook for the Group in

2024 and beyond. We believe that more and more businesses of all

sizes are seeing the advantages that UCaaS can bring and we expect

to see continuing growth.

Andrew Belshaw

Chief Executive Officer

Supplementary information on product volumes

The table below shows the movements in the number of SIP Trunks

which provide voice enablement to various hardware PBXs and voice

applications:

Voice Enablement - UK & June December Change

Europe 2023 2022 (%)

(000's)

SIP Trunks enabling traditional hardware PBX

* UK 1,042 1,053 -1

-------- ----------- ---------

* Europe 192 183 5

-------- ----------- ---------

SIP Trunks enabling a non-Gamma Cloud PBX

* UK 378 367 3

-------- ----------- ---------

- - n/a

* Europe

-------- ----------- ---------

Voice enabled MS Teams users (either Operator Connect or MS

Teams Direct Routing)

* UK 394 356 11

-------- ----------- ---------

* Europe 6 1 500

-------- ----------- ---------

The table below shows the number of Cloud PBX seats in UK and

Europe:

Cloud PBX seats - UK & Europe June December Change

(000's) 2023 2022 (%)

UK - Horizon 777 751 3

------ --------- -------

UK - PhoneLine+ 8 3 167

------ --------- -------

UK - Total 785 754 4

------ --------- -------

Europe 163 161* 1

------ --------- -------

* 3,000 CCaaS seats were previously included in the total

"European Cloud" seats and are now included in the CCaaS table

below.

The table below shows the number of units of the various

bolt-ons which are sold to enhance the functionality of UK Cloud

PBX (Horizon):

Horizon bolt-ons - UK June December Change

(000's) 2023 2022 (%)

Collaborate 76 73 4

------ --------- -------

Call Recording 108 96 13

------ --------- -------

Horizon for MS Teams 9 7 29

------ --------- -------

Horizon Contact 14 11 27

------ --------- -------

The table below shows the number of CCaaS seats:

CCaaS seats - UK & Europe June December Change

(000's) 2023 2022 (%)

UK - Horizon Contact** 14 11 27

------ --------- -------

UK - SmartAgent 11 8 38

------ --------- -------

UK - Total 25 19 32

------ --------- -------

Europe*** 3 3 0

------ --------- -------

**All Horizon Contact users also take a "Base Horizon" seat

(separately disclosed within Cloud PBX seats); for the avoidance of

doubt, these 14,000 seats are the same as the seats in the table

above.

*** The Neotel acquisition in October 2022 included 3,000 CCaaS

seats.

Financial Review

Revenue and gross profit

Gamma has performed well during the six months ended 30 June

2023, increasing overall revenue by 9% to GBP256.2 (H1 2022:

GBP234.7m) and gross profit by 9% to GBP131.2m (H1 2022:

GBP120.4m). The UK businesses have seen growth in revenue of

GBP18.7m (+9%) and gross profit of GBP8.0m (+8%) and Europe has

seen growth in revenue of GBP2.8m (+8%) and gross profit of GBP2.8m

(+17%).

Gamma Business

GBPm H1 2023 H1 2022* Increase

-------------- -------- --------- ---------

Revenue 164.8 150.4 10%

Gross Profit 86.8 80.2 8%

Gross Margin 52.7% 53.3%

* See Note 3 for segmental change information and restated

comparatives.

Overall, the growth in the Gamma Business unit has been strong.

Growth was primarily driven by our UCaaS portfolio, which includes

our Horizon Cloud PBX solution as well as those SIP trunks

supporting MS Teams implementations and other non-Gamma Cloud PBX

solutions. UCaaS unit growth continued with PhoneLine+ (Gamma's own

software solution) take up accelerating, whilst Horizon Cloud PBX

and additional module bolt-ons net growth was lower than in prior

periods (partially due to some switching from Horizon to

PhoneLine+). Revenue growth has also been supported through

targeted price rises. Gross margin has been stable with previous

periods, which is in line with expectations, as the mix of UCaaS

and connectivity products is now reasonably consistent.

Gamma Enterprise

GBPm H1 2023 H1 2022* Increase

-------------- -------- --------- ---------

Revenue 53.0 48.7 9%

Gross Profit 25.4 24.0 6%

Gross Margin 47.9% 49.3%

* See Note 3 for segmental change information and restated

comparatives.

Gamma Enterprise has seen a number of significant contract wins,

including an organisation-wide mobile solution for the Home Office

in the public sector, and an SD-WAN for Lidl's UK store network.

Additionally, there have been several wins for our omni-channel

contact centre management solution, Smart Agent, within the NHS.

Our MS Teams voice enablement services continued to grow in the

first half with the pipeline remaining strong. The gross margin

decrease is due to product mix as a result of a higher number of

hardware sales which are lower margin as expected.

Europe

GBPm H1 2023 H1 2022** Increase

-------------- -------- ---------- ---------

Revenue 38.4 35.6 8%

Gross Profit 19.0 16.2 17%

Gross Margin 49.5% 45.5%

** In H2 2022 we reviewed and aligned European commission

presentation between cost of sales and operating expenses resulting

in an immaterial GBP0.8m reduction in cost of sales and equivalent

increase in operating expenses in 2022. For comparative purposes,

applying this alignment in H1 2022 gross profit would have been

GBP17.0m resulting in year-on-year growth of 12%, with gross margin

at 47.8%.

Growth in UCaaS supported a good first half financial

performance. Results were further bolstered by positive foreign

exchange movements, with a Euro that strengthened against Sterling

compared to the prior year. After alignment of immaterial European

commission presentation between cost of sales and operating

expenses, and on a constant currency basis, the equivalent gross

profit growth was 7%.

Operating expenses

Operating expenses grew from GBP81.7m in H1 2022 to GBP89.0m. We

break these down as follows:

GBPm H1 2023 H1 2022 Change

Expenses included within cash

generated from

operations 74.7 68.5 9%

Depreciation & amortisation 14.3 13.2 8%

Total Operating Expenses 89.0 81.7 9%

-------- -------- -------

Of the movements in "Expenses included within cash generated

from operations" shown above, which increased by 9% (or an 8%

increase when taking into account the immaterial GBP0.8m German

commission reclassification from cost of sales to operating

expenses):

-- The UK Businesses' operating expenses grew by 7% (compared to

gross profit growth of 8%). These expenses (the majority of which

relate to staff) have been actively controlled with offset product

price changes where appropriate given the inflationary

environment.

-- Increase in European costs was 10%, after taking into account

the immaterial reallocation of GBP0.8m between cost of sales and

operating costs. This was adversely impacted by the stronger Euro

and general inflationary pressures. On a constant currency basis

the growth was 6%.

-- Central costs have increased from the prior period due to

continued growth in the Group functions required to support the

businesses we have acquired around Europe as well as an increase in

governance and professional fee costs.

Depreciation and amortisation on tangible and intangible assets

(excluding business combinations) has increased to GBP14.3m (H1

2022: GBP13.2m). The annual depreciation and amortisation charge is

below the annual capital expenditure spend but is expected to

increase in future as more of our own developed software products

come into service.

Exceptional Items

There were no exceptional items in the period or in H1 2022.

Alternative performance measures

Our policy for alternative performance measures and definitions

is set out in note 2.

EBITDA (and also "adjusted EBITDA")

Adjusted EBITDA, as defined in note 2, grew from GBP51.9m to

GBP56.5m (9%). There were no exceptional items in the period or in

H1 2022.

Taxation

The effective tax rate was 24% (2022: 19%) based on applying the

expected full year effective rate. This increase is as a result of

the statutory UK rate rising from 19% to 25% in April 2023. The tax

rate in future years will continue to increase as a result of a

full year of the UK tax rate increase to 25%, and the higher rates

in the main European countries within which we operate.

Net cash and cash flows

The Group has net cash of GBP121.7m (H1 2022: GBP72.6m). The

cash and cash equivalents balance at the end of the period was

GBP123.5m and the Group had borrowings of GBP1.8m which are held by

trading subsidiaries outside of the UK and pre-date their

acquisition by Gamma.

Cash generated by operations was GBP57.1m (H1 2022: GBP49.5m).

The cash conversion was higher than prior periods at 101% (H1 2022:

95%) primarily as a result of favourable working capital

movements.

Items which are not directly related to trading were:

-- Capital spend was GBP10.5m, which is an increase from GBP7.8m

in the comparative period, as a result of the increase in overall

development spend (as seen in H2 2022). This is discussed further

below.

-- GBP9.7m was paid as dividends to shareholders (H1 2022: GBP8.5m).

-- GBP2.4m was paid as contingent consideration for the

acquisition of Mission Labs (H1 2022: GBP1.6m).

-- GBP1.5m was received from interest income (H1 2022: GBP0.2m).

-- GBP0.1m was received from the issue of shares (H1 2022: GBP0.3m).

Gamma's Group treasury policy is governed by the Audit

Committee. Gamma manages cash centrally and seeks to maximise value

and return whilst balancing associated risks. The policy manages

concentration risk by setting an appropriate limit on the amount

that can be placed with any one institution and manages credit risk

by setting a minimum requirement around the credit rating of the

financial institution. Given 85% of Group revenue is generated from

our UK business, all deposit balances are held with large

established UK financial institutions. Cash in Europe is held for

working capital purposes and follows the same Group policy as set

out above.

Capital spend

Capital spend in H1 2023 was GBP10.5m (H1 2022: GBP7.8m) as

follows:

-- GBP7.8m was the capitalisation of development costs incurred

during the period (H1 2022: GBP5.6m). This is a similar level of

capitalised development cost to H2 2022. Research costs expensed

through the statement of profit or loss increased to GBP8.4m versus

H1 2022 (GBP7.6m), again in line with H2 2022.

-- GBP1.8m related to the core network, including increasing

capacity as well as other minor items such as IT and fixtures and

fittings (H1 2022: GBP2.2m).

-- GBP0.9m was spent with third-party software vendors for the

software which underpins our Cloud PBX products (H1 2022: nil).

Adjusted EPS (fully diluted) and Statutory EPS (fully

diluted)

Adjusted EPS (fully diluted) increased from 35.6p to 37.5p (5%).

Adjusted EPS is EPS as adjusted for exceptional items (if any,

there are none in the period or in H1 2022) and other items as

defined and reconciled to the statutory measure in note 2. The

growth rate has been impacted by the change in the UK statutory tax

rate. If the prior year effective tax rate had been applied the

growth would have been 11%.

Statutory EPS (fully diluted) grew from 31.9p to 33.8p (6%). The

growth is slightly higher than the adjusted metric because, in the

current period, the depreciation and amortisation relating to

business combinations has grown at a slower rate. The growth rate

has been impacted by the change in the UK statutory tax rate. If

the prior year effective tax rate had been applied the growth would

have been 12%.

Going Concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

are consistent with those set out in the Annual Report for the year

ended 31 December 2022. In assessing going concern management the

Board has considered:

-- The principal risks faced by the Group are set out in note 1

to the interim financial statements and are consistent with those

found in the Annual Report for the year ended 31 December 2022.

-- The financial position of the Group.

-- The strong cash position - at 30 June 2023 the Group had cash

and cash equivalents of GBP123.5m. Net cash (being cash and cash

equivalents less borrowings) was GBP121.7m. All borrowings were

acquired with acquisitions made in previous years.

-- Budgets, financial plans and associated future cash flows

including liquidity and borrowings.

-- Sensitivity analysis, which has shown that EBITDA would have

to decrease by over 100% between the period end date and December

2024 for the Group to need additional borrowing (assuming no

mitigating actions had been taken). We consider this to be highly

unlikely.

The Directors are satisfied that the Group has adequate

financial resources to continue in operational existence for the

foreseeable future, being a period of at least twelve months from

the date of this report. Accordingly, the going concern basis of

accounting continues to be used in the preparation of the condensed

consolidated financial statements.

Dividends

The Board has declared an interim dividend of 5.7p (2022: 5.0p).

This is an increase of 14% and is in line with our progressive

dividend policy. The interim dividend is payable on Thursday 19

October 2023 to shareholders on the register as at Friday 22

September 2023.

Bill Castell

Chief Financial Officer

Management Statement

This Interim Management Report ("IMR") has been prepared solely

to provide additional information to shareholders to assess the

Group's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

The IMR contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the

information available to them up to the time of their approval of

this report but such statements should be treated with caution due

to the inherent uncertainties, including both economic and business

risk factors, underlying any such forward-looking information.

Responsibility Statement

We confirm that to the best of our knowledge:

-- the condensed set of interim financial statements has been

prepared in accordance with IAS 34 "Interim Financial

Reporting";

-- the IMR includes a fair review of the information required by

DTR 4.27R (indication of important events and their impact during

the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

-- the IMR includes a fair review of the information required by

DTR 4.28R (disclosure of related party transactions and changes

therein).

By the order of the Board

4 September 2023

Independent Review Report to Gamma Communications plc

Conclusion

We have been engaged by Gamma Communications plc ("the company")

and its subsidiaries (together "the group") to review the condensed

set of financial statements in the half-yearly financial report for

the six months ended 30 June 2023 which comprises the condensed

consolidated statement of profit or loss, the condensed

consolidated statement of comprehensive income, the condensed

consolidated statement of financial position, the condensed

consolidated statement of cash flows, the condensed consolidated

statement of changes in equity and related notes 1 to 12.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with United Kingdom adopted International Accounting Standard 34

and the AIM Rules of the London Stock Exchange.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" issued by the Financial Reporting Council for use in the

United Kingdom (ISRE (UK) 2410). A review of interim financial

information consists of making inquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with United Kingdom adopted

international accounting standards. The condensed set of financial

statements included in this half-yearly financial report has been

prepared in accordance with United Kingdom adopted International

Accounting Standard 34, "Interim Financial Reporting".

Conclusion Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

Conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This Conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410; however, future events or

conditions may cause the entity to cease to continue as a going

concern.

Responsibilities of the directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the AIM rules of the London

Stock Exchange.

In preparing the half-yearly financial report, the directors are

responsible for assessing the group's ability to continue as a

going concern, disclosing as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's Responsibilities for the review of the financial

information

In reviewing the half-yearly financial report, we are

responsible for expressing to the company a conclusion on the

condensed set of financial statements in the half-yearly financial

report. Our Conclusion, including our Conclusion Relating to Going

Concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

This report is made solely to the company in accordance with

ISRE (UK) 2410. Our work has been undertaken so that we might state

to the company those matters we are required to state to it in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company, for our review work, for this

report, or for the conclusions we have formed.

Deloitte LLP

Statutory Auditor

Reading, United Kingdom

4 September 2023

Condensed consolidated statement of profit or loss

For the six months ended 30 June 2023

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

Note Unaudited Unaudited Audited

Revenue 3 256.2 234.7 484.6

Cost of sales (125.0) (114.3) (236.9)

----------- ----------- -------------

Gross profit 131.2 120.4 247.7

Operating expenses (89.0) (81.7) (182.3)

Earnings before depreciation, amortisation

and exceptional items 56.5 51.9 105.1

Exceptional items - - (12.5)

----------- ----------- -------------

Earnings before depreciation and

amortisation 56.5 51.9 92.6

Depreciation and amortisation (excluding

business combinations) (9.5) (8.5) (17.7)

Depreciation and amortisation arising

due to business combinations (4.8) (4.7) (9.5)

-------------------------------------------- ----- ----------- ----------- -------------

Profit from operations 42.2 38.7 65.4

Finance income 1.7 0.2 0.8

Finance expense (0.4) (0.5) (1.3)

Profit before tax 43.5 38.4 64.9

Tax expense 4 (10.4) (7.3) (15.4)

----------- ----------- -------------

Profit after tax 33.1 31.1 49.5

----------- ----------- -------------

Profit is attributable to:

Equity holders of Gamma Communications

plc 33.0 31.0 49.3

Non-controlling interests 0.1 0.1 0.2

33.1 31.1 49.5

=========== =========== =============

Earnings per share attributable

to the ordinary equity holders of

the Company:

Basic per Ordinary Share (pence) 5 34.1 32.2 51.1

Diluted per Ordinary Share (pence) 5 33.8 31.9 50.6

----------- ----------- -------------

Adjusted earnings per share is shown

in note 5

Condensed consolidated statement of comprehensive income

For the six months ended 30 June 2023

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

Unaudited Unaudited Audited

Profit for the period 33.1 31.1 49.5

Other comprehensive

income

Items that may be reclassified subsequently to the statement

of profit or loss (net of tax effect)

Exchange difference on translation

of foreign operations (1.3) 1.3 2.9

----------- ----------- -------------

Total comprehensive

income 31.8 32.4 52.4

=========== =========== =============

Total comprehensive income for the

period attributable to:

Equity holders of Gamma Communications

plc 31.7 32.3 52.2

Non-controlling interests 0.1 0.1 0.2

31.8 32.4 52.4

=========== =========== =============

Condensed consolidated statement of fi nancial position

As at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

Note Unaudited Unaudited Audited

Assets

Non-current assets

Property, plant and equipment 7 30.9 34.4 33.8

Right of use assets 8.5 9.9 9.1

Intangible assets 8 123.4 129.0 124.3

Deferred tax asset 5.3 5.6 5.5

Trade and other receivables 11.9 12.8 13.0

---------- ---------- ------------

180.0 191.7 185.7

Current assets

Inventories 12.6 8.5 10.2

Trade and other receivables 106.9 110.8 109.4

Cash and cash equivalents 123.5 75.6 94.6

Current tax asset 2.5 3.5 6.9

---------- ---------- ------------

245.5 198.4 221.1

---------- ---------- ------------

Total assets 425.5 390.1 406.8

---------- ---------- ------------

Liabilities

Non-current liabilities

Other payables 1.7 2.2 2.7

Borrowings 1.5 2.2 1.7

Lease Liabilities 7.6 9.5 8.6

Provisions 1.7 1.0 0.9

Contract Liabilities 7.5 7.9 7.8

Contingent consideration 9 - 1.6 1.5

Deferred tax 10.1 7.5 11.3

30.1 31.9 34.5

Current liabilities

Trade and other payables 54.5 56.2 54.0

Borrowings 0.3 0.8 0.4

Lease Liabilities 2.9 2.2 2.5

Provisions 0.4 0.7 0.7

Contract Liabilities 8.8 9.0 9.2

Contingent consideration 9 2.7 3.0 3.5

Put option liability 9 1.8 5.4 1.8

Current tax 0.7 0.3 0.5

72.1 77.6 72.6

---------- ---------- ------------

Total liabilities 102.2 109.5 107.1

---------- ---------- ------------

Net assets 323.3 280.6 299.7

========== ========== ============

Equity

Share capital 10 0.2 0.2 0.2

Share premium reserve 18.1 15.2 18.0

Other reserves 11 9.1 7.8 9.0

Retained earnings 297.2 261.8 273.9

Equity attributable to owners of

Gamma Communications plc 324.6 285.0 301.1

---------- ---------- ------------

Non-controlling interests 0.9 2.3 0.8

Written put options over non-controlling

interests (2.2) (6.7) (2.2)

---------- ---------- ------------

Total equity 323.3 280.6 299.7

========== ========== ============

Condensed consolidated statement of cash fl ows

For the six months ended 30 June 2023

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

Note Unaudited Unaudited Audited

Cash flows from operating activities

Profit for the period before tax 43.5 38.4 64.9

Adjustments for:

Depreciation of property, plant

and equipment 7 4.6 4.5 9.5

Depreciation of right of use assets 1.3 1.3 2.8

Amortisation of intangible assets 8 8.4 7.4 14.9

Impairment of goodwill - - 12.2

Change in fair value of contingent

consideration/put option liability - - (0.9)

Share based payment expense 1.3 1.8 4.3

Interest income (1.7) (0.2) (0.8)

Finance expense 0.4 0.5 1.3

Loss on disposal of subsidiary undertaking - - 0.3

57.8 53.7 108.5

Decrease/(increase) in trade and

other receivables 3.5 (12.7) (10.1)

(Increase) in inventories (2.4) (0.6) (2.6)

(Decrease)/increase in trade and

other payables (1.6) 8.2 4.1

(Decrease)/increase in contract

liabilities (0.7) 1.2 (0.4)

Increase/(decrease) in provisions

and employee benefits 0.5 (0.3) (0.4)

----------- ----------- -------------

Cash generated by operations 57.1 49.5 99.1

Taxes paid (5.3) (7.4) (14.4)

Net cash flows from operating activities 51.8 42.1 84.7

----------- ----------- -------------

Investing activities

Gain on disposal of property, plant

and equipment - 0.1 0.4

Purchase of property, plant and

equipment 7 (1.8) (2.2) (6.8)

Purchase of intangible assets 8 (8.7) (5.6) (13.9)

Interest received 1.5 0.2 0.8

Acquisition of subsidiaries net

of cash acquired (inc. contingent

consideration) (2.4) (1.6) (9.8)

Disposal of subsidiary net of disposed

cash - - (0.3)

Net cash used in investing activities (11.4) (9.1) (29.6)

----------- ----------- -------------

Financing activities

Lease liability repayments (1.3) (1.3) (2.8)

Repayment of borrowings (0.3) (0.4) (0.7)

Interest paid (0.1) (0.3) (0.1)

Share issues 0.1 0.3 3.1

Dividends (9.7) (8.5) (13.3)

----------- ----------- -------------

Net cash used in financing activities (11.3) (10.2) (13.8)

----------- ----------- -------------

Net increase in cash and cash equivalents 29.1 22.8 41.3

Cash and cash equivalents at beginning

of period 94.6 52.8 52.8

Effects of exchange rate changes on

cash and cash equivalents (0.2) - 0.5

Cash and cash equivalents at end

of period 123.5 75.6 94.6

=========== =========== =============

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2023

Share Share Other Retained Total Non-controlling Written Total

capital premium reserves earnings interests put equity

reserve options

over

non-controlling

interests

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

1 January 2022 0.2 14.9 4.5 239.1 258.7 2.2 (6.7) 254.2

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Issue of shares - 0.3 (0.2) 0.2 0.3 - - 0.3

Share-based

payment

expense - - 2.2 - 2.2 - - 2.2

Dividends paid - - - (8.5) (8.5) - - (8.5)

------ ---------------- ----------------- --------

Transactions

with

owners - 0.3 2.0 (8.3) (6.0) - - (6.0)

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Profit for the

period - - - 31.0 31.0 0.1 - 31.1

Other

comprehensive

income - - 1.3 - 1.3 - - 1.3

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Total

comprehensive

income - - 1.3 31.0 32.3 0.1 - 32.4

30 June 2022 0.2 15.2 7.8 261.8 285.0 2.3 (6.7) 280.6

========= ========= ========== ========== ====== ================ ================= ========

1 January 2023 0.2 18.0 9.0 273.9 301.1 0.8 (2.2) 299.7

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Issue of shares - 0.1 - - 0.1 - - 0.1

Share-based

payment

expense - - 1.4 - 1.4 - - 1.4

Dividends paid - - - (9.7) (9.7) - - (9.7)

------ ---------------- ----------------- --------

Transactions

with

owners - 0.1 1.4 (9.7) (8.2) - - (8.2)

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

-

Profit for the

period - - - 33.0 33.0 0.1 - 33.1

Other

comprehensive

expense - - (1.3) - (1.3) - - (1.3)

--------- --------- ---------- ---------- ------ ---------------- ----------------- --------

Total

comprehensive

expense/income - - (1.3) 33.0 31.7 0.1 - 31.8

30 June 2023 0.2 18.1 9.1 297.2 324.6 0.9 (2.2) 323.3

========= ========= ========== ========== ====== ================ ================= ========

Notes to the interim financial information

For the six months ended 30 June 2023

1. Basis of preparation

The condensed consolidated interim financial information

(interim financial information) included in this half -- yearly

financial report has been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting', as adopted by

the United Kingdom. The interim financial statements do not

constitute statutory accounts within the meaning of the Companies

Act 2006 and should be read in conjunction with the Group's Annual

Report and Accounts for the year ended 31 December 2022, which was

prepared in accordance with IFRS as adopted by the United

Kingdom.

There are no additional standards or interpretations requiring

adoption that are applicable to the Group for the accounting period

commencing 1 January 2023.

Principal risks and uncertainties

The principal risks faced by the Group continue to be that

product development becomes misaligned with market needs, unplanned

service disruption, data loss and cyber-attacks, over-reliance on

key suppliers, inability to attract and retain top talent, failure

to adapt and develop new routes to market, uncertain competitive

landscape causes loss of market share, unsuccessful M&A

activities and legal and regulatory non-compliance. Further details

can be found in the Annual Report for the year ended 31 December

2022.

2. Accounting policies, judgements and estimates

The accounting policies adopted are consistent with those

followed in the preparation of the audited statutory financial

statements for the year ended 31 December 2022.

Preparation of the interim financial information requires the

Group to make certain estimations, assumptions and judgements

regarding the future. Estimates and judgements are continually

evaluated based on historical experience and other factors,

including best estimates of future events. In the future, actual

experience may differ from these estimates and assumptions. The key

judgements and sources of estimation uncertainty reported in the

financial statements for the year ended 31 December 2022 are still

relevant.

Alternative Performance Measures

Adjustments to the Statement of Profit or Loss have been

presented because the Group believes that adjusted performance

measures (APMs) provide additional information for users of the

financial statements in assessing the Group's performance, and also

represent the underlying performance of the Group. These are also

used by the Board and management as KPIs to understand how the

business is performing. Moreover, they provide information on the

trading performance of the business that Management is more

directly able to influence and on a comparable basis from year to

year. Reference to 'underlying' reflects the trading results of the

Group without the impact of depreciation and amortisation of

acquired intangible assets, changes in fair value consideration and

any tax related effects that would otherwise impact the users

understanding of the Group's performance. The Directors believe

that adjusted results provide additional useful information on the

core operational performance of the Group, and review the results

of the Group on an adjusted basis internally.

The measures are adjusted for the following items:

(a) Depreciation and amortisation

Depreciation and amortisation relate to the assets which were

acquired by the Group. These are omitted from adjusted operating

expenses to allow users of the accounts to compare against other

external data sources.

(b) Depreciation and amortisation arising due to business

combinations

This adjustment is made to improve the comparability between

acquired and organically grown operations, as the latter cannot

recognise as wide a range of internally generated intangible

assets. Adjusting for depreciation and amortisation provides a more

consistent basis for comparison between the two.

(c) Adjusting tax items

Where movements to tax balances arise and these do not relate to

the underlying trading current year tax charge, these are adjusted

in determining certain APMs as they do not reflect the underlying

performance in that year.

The table below reconciles the alternative performance measures

used in this document:

Depreciation

& amortisation

Statutory from business Adjusting Adjusted

Measure basis combinations tax items basis

2023

PBT (GBPm) 43.5 4.8 - 48.3

PAT* (GBPm) 33.0 4.8 (1.2) 36.6

EPS (FD) (p) 33.8 4.9 (1.2) 37.5

------------- ---------- ---------------- ----------- ---------

2022

PBT (GBPm) 38.4 4.7 - 43.1

PAT* (GBPm) 31.0 4.7 (1.1) 34.6

EPS (FD) (p) 31.9 4.8 (1.1) 35.6

------------- ---------- ---------------- ----------- ---------

* Profit After Tax ("PAT") is the amount attributable to the

ordinary equity holders of the Company

We believe that these measures provide a user of the accounts

with important additional information by providing the following

alternative performance metrics:

-- Profit before tax is adjusted for the depreciation and

amortisation of intangibles which were created on acquisition. This

enables a user of the accounts to compare performance irrespective

of whether the Group has grown by acquisition or organically.

-- Profit after tax is adjusted in the same way as Profit before

tax but it also considers the tax impact of these items. To exclude

the items without excluding the tax impact would not give a

complete picture.

-- Adjusted earnings per share takes into account all of the

factors above and gives users of the accounts information on the

performance of the business that management is more directly able

to influence and on a basis comparable from year to year.

In addition to the above adjustments to statutory measures, we

add back the depreciation and amortisation charged in the year to

Profit from Operations (H1 2023: GBP42.2m; H1 2022: GBP38.7m) to

calculate a figure for EBITDA (H1 2023: GBP56.5m; H1 2022:

GBP51.9m) which is commonly quoted by our peer group

internationally and allows users of the accounts to compare our

performance with those of our peers. We further adjust EBITDA for

exceptional items as this gives a reader of the accounts a view of

the underlying trading picture which is comparable from year to

year. There were no exceptional items in the period or in H1

2022.

An adjustment to the cash has been presented because the Group

believes that adjusted performance measures (APMs) provide valuable

additional information for users of the financial statements in

assessing the Group's performance as Net Cash is a better measure

of liquidity. We do not consider contingent consideration or IFRS

16 lease liabilities as debt for the purpose of quoting a net cash

figure.

2023 2022

GBPm GBPm

Cash and cash equivalents 123.5 75.6

Borrowings (1.8) (3.0)

------ ------

Net Cash 121.7 72.6

====== ======

3. Segment information

The Group's main operating segments are outlined below:

-- Gamma Business - This division sells Gamma's products to

smaller businesses in the UK, typically to those with fewer than

250 employees. This division sells through different routes to

market, including the channel, direct and digital, as well as

through other carriers who sell to smaller businesses in the UK. It

contributed 64% (2022: 64%) of the Group's external revenue.

-- Gamma Enterprise - This division sells Gamma's products to

larger businesses in the UK, typically to those with more than 250

employees. Larger organisations have more complex needs so this

division sells Gamma's and other suppliers' products to Enterprise

and Public Sector customers, together with an associated managed

service wrap and ordinarily sells directly. It contributed 21%

(2022: 21%) of the Group's external revenue.

-- European - This division consists of sales made in Europe

through Gamma's German, Spanish and Dutch businesses. It

contributed 15% (2022: 15%) of the Group's external revenue.

-- Central functions - This comprises the central management team and wider Group costs.

Change in segmental reporting

In recent years, Gamma has widened its product and

solution/services set to address the communications needs of a

broader range of businesses. Post pandemic, customer requirements

have evolved in respect of their telecommunications and IT

infrastructure and methods of procurement for such products and

services have broadened. Because of this, the Group's business unit

responsibilities have been realigned to allow the business units to

focus more directly on customer needs and preferences.

Our two UK business units are now aligned with customer groups

rather than routes to market. We have therefore updated our

segmental reporting structure to reflect the way in which the Group

now manages its operations.

Previously the reported segments were UK Indirect, UK Direct,

Europe and Central Functions. The new segments are Gamma Business,

Gamma Enterprise, Europe and Central Functions. Gamma Business

consists of the former UK Indirect business with the addition of

some customers and associated costs from the UK Direct business

(now Gamma Enterprise). This has resulted in a GBP13.5m revenue

movement between segments for FY 2022 (3% of group revenue) with no

change in Executive Committee leadership.

This change in reporting structure has taken effect for

reporting in 2023. In advance of the announcement of our H1 results

for the six months ended 30 June 2023, we provided a restated view

of our HY22 and FY22 financial results under this new segmentation

to provide the correct comparability. Going forward, the assets and

liabilities of the segments along with their depreciation and

amortisation, which were previously provided as supplementary

information, will no longer be shown.

Measurement of operating segment profit or loss, assets and

liabilities

The accounting policies of the reporting segments are the same

as those described in the summary of significant accounting

policies. The Group evaluates performance on the basis of profit or

loss from operations but excludes non-recurring losses, such as

goodwill impairment. Inter-segment sales are priced in line with

sales to external customers, with an appropriate discount being

applied to encourage use of Group resources at a rate acceptable to

local tax authorities. This policy was applied consistently

throughout the current and prior period.

Gamma Gamma Central

Business Enterprise European functions Total

Period to 30 June 2023 GBPm GBPm GBPm GBPm GBPm

--------------------------------- ---------- ------------ --------- ----------- -------

Segment revenue 177.0 53.5 38.6 - 269.1

Inter-segment revenue (12.2) (0.5) (0.2) - (12.9)

---------- ------------ --------- ----------- -------

Revenue from external

customers 164.8 53.0 38.4 - 256.2

---------- ------------ --------- ----------- -------

Timing of revenue recognition

At a point in time 7.6 5.4 13.5 - 26.5

Over time 157.2 47.6 24.9 - 229.7

---------- ------------ --------- ----------- -------

164.8 53.0 38.4 - 256.2

Total gross profit 86.8 25.4 19.0 - 131.2

Earnings before depreciation,

amortisation and exceptional

items 41.6 14.5 5.0 (4.6) 56.5

---------- ------------ --------- -----------

Exceptional - - - - -

Earnings before depreciation

and amortisation 41.6 14.5 5.0 (4.6) 56.5

--------------------------------- ---------- ------------ --------- ----------- -------

External customer revenue has been derived principally in the

geographical area of the operating segment and no single customer

contributes more than 10% of revenue.

Gamma Gamma Central

Business Enterprise European functions Total

Period to 30 June 2022 GBPm GBPm GBPm GBPm GBPm

(restated)

--------------------------------- ---------- ------------ --------- ----------- -------

Segment revenue 163.5 49.4 35.6 - 248.5

Inter-segment revenue (13.1) (0.7) - - (13.8)

---------- ------------ --------- ----------- -------

Revenue from external

customers 150.4 48.7 35.6 - 234.7

---------- ------------ --------- ----------- -------

Timing of revenue recognition

At a point in time 7.9 2.9 15.2 - 26.0

Over time 142.5 45.8 20.4 - 208.7

---------- ------------ --------- ----------- -------

150.4 48.7 35.6 - 234.7

Total gross profit 80.2 24.0 16.2 - 120.4

Earnings before depreciation

and amortisation 38.1 13.7 4.3 (4.2) 51.9

---------- ------------ --------- -----------

Exceptional - - - - -

Earnings before depreciation

and amortisation 38.1 13.7 4.3 (4.2) 51.9

--------------------------------- ---------- ------------ --------- ----------- -------

External customer revenue has been derived principally in the

geographical area of the operating segment and no single customer

contributes more than 10% of revenue.

4. Taxation on profit on ordinary activities

Tax expense is recognised based on management's best estimate of

the weighted average effective annual tax rate expected for the

full financial year. The estimated average annual tax rate used for

the period to 30 June 2023 is 24%, compared to 19% for the six

months ended 30 June 2022. This increase is as a result of the

statutory UK rate rising from 19% to 25% in April 2023.

5. Earnings per share

Six months Six months

ended ended

30 June 30 June

23 22

Earnings per Ordinary Share - basic (pence) 34.1 32.2

Earnings per Ordinary Share - diluted (pence) 33.8 31.9

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months Six months

ended ended

30 June 30 June

23 22

GBPm GBPm

Earnings

Profit after tax attributable to equity

holders of the Company 33.0 31.0

============= ===========

Shares Number Number

Basic weighted average number of Ordinary

Shares 96,872,058 96,341,184

Effect of dilution resulting from share

options 642,984 836,273

-------------

Diluted weighted average number of Ordinary

Shares 97,515,042 97,177,457

============= ===========

Adjusted earnings per share is detailed below:

Six months Six months

ended ended

30 June 30 June

23 22

Adjusted earnings per Ordinary Share - basic

(pence) 37.8 35.9

Adjusted earnings per Ordinary Share - diluted

(pence) 37.5 35.6

Adjusted profit used in the calculation of adjusted earnings per

share is detailed below:

Six months Six months

ended ended

30 June 30 June

23 22

Earnings GBPm GBPm

Profit for the period attributable to equity

holders of the Company 33.0 31.0

Amortisation arising on business combinations 4.8 4.7

Adjusting tax items (1.2) (1.1)

Adjusted profit after tax for the period 36.6 34.6

=========== ===========

6. Dividends

A final dividend of 10p was paid on 22 June 2023 (2022: 8.8p).

The Board has declared an interim dividend of 5.7p per share

payable on Thursday 19 October 2023 to shareholders on the register

as at Friday 22 September 2023. In the prior year an interim

dividend of 5.0p was paid.

7. Property, plant and equipment

Land and Network Computer Fixtures

building assets equipment and fittings Total

GBPm GBPm GBPm GBPm GBPm

2023

Cost

At 1 January 2023 4.7 67.4 13.5 2.8 88.4

Additions - 0.8 0.9 0.1 1.8

Disposals - (0.2) - - (0.2)

Exchange differences (0.1) - (0.1) - (0.2)

At 30 June 2023 4.6 68.0 14.3 2.9 89.8

---------- -------- ----------- -------------- ------

Depreciation

At 1 January 2023 0.3 41.8 10.7 1.8 54.6

Charge for the period 0.1 3.4 0.8 0.3 4.6

Disposals - (0.2) - - (0.2)

Exchange differences - - (0.1) - (0.1)

At 30 June 2023 0.4 45.0 11.4 2.1 58.9

---------- -------- ----------- -------------- ------

Net book value

At 1 January 2023 4.4 25.6 2.8 1.0 33.8

At 30 June 2023 4.2 23.0 2.9 0.8 30.9

---------- -------- ----------- -------------- ------

Land and Network Computer Fixtures

building assets equipment and fittings Total

GBPm GBPm GBPm GBPm GBPm

2022

Cost

At 1 January 2022 4.5 78.7 12.3 2.4 97.9

Additions - 1.2 1.0 - 2.2

Disposals - (6.4) - - (6.4)

Exchange differences 0.1 (0.1) (0.1) 0.5 0.4

At 30 June 2022 4.6 73.4 13.2 2.9 94.1

---------- -------- ----------- -------------- ------

Depreciation

At 1 January 2022 0.3 50.3 9.0 1.5 61.1

Charge for the period - 3.5 0.8 0.2 4.5

Disposals - (6.3) - - (6.3)

Exchange differences - 0.4 0.2 (0.2) 0.4

At 30 June 2022 0.3 47.9 10.0 1.5 59.7

---------- -------- ----------- -------------- ------

Net book value

At 1 January 2022 4.2 28.4 3.3 0.9 36.8

At 30 June 2022 4.3 25.5 3.2 1.4 34.4

---------- -------- ----------- -------------- ------

8. Intangible assets

Customer Development

Goodwill contracts Brand costs Software Total

GBPm GBPm GBPm GBPm GBPm GBPm

2023

Cost

At 1 January

2023 97.5 50.9 1.4 40.4 19.3 209.5

Additions - - - 7.8 0.9 8.7

Disposals - - - (0.2) - (0.2)

Exchange differences (1.2) (1.0) (0.1) (0.2) - (2.5)

At 30 June 2023 96.3 49.9 1.3 47.8 20.2 215.5

--------- ----------- ------ ------------ --------- ------

Amortisation

At 1 January

2023 20.8 29.1 0.7 18.0 16.6 85.2

Charge for the

period - 4.2 0.2 2.2 1.8 8.4

Disposals - - - (0.2) - (0.2)

Exchange Differences (0.4) (0.7) (0.1) (0.1) - (1.3)

At 30 June 2023 20.4 32.6 0.8 19.9 18.4 92.1

--------- ----------- ------ ------------ --------- ------

Net book value

At 1 January

2023 76.7 21.8 0.7 22.4 2.7 124.3

At 30 June 2023 75.9 17.3 0.5 27.9 1.8 123.4

--------- ----------- ------ ------------ --------- ------

Customer Development

Goodwill contracts Brand costs Software Total

GBPm GBPm GBPm GBPm GBPm GBPm

2022

Cost

At 1 January

2022 91.8 47.6 2.2 28.1 18.5 188.2

Additions - - - 5.6 - 5.6

Exchange differences - - - (0.1) - (0.1)

Reclassifications 0.6 0.9 - 0.2 - 1.7

At 30 June 2022 92.4 48.5 2.2 33.8 18.5 195.4

--------- ----------- ------ ------------ --------- ------

Amortisation

At 1 January

2022 8.7 20.2 0.9 14.8 14.3 58.9

Charge for the

period - 3.7 0.5 2.2 1.0 7.4

Disposals - - - (0.1) - (0.1)

Exchange Differences (0.1) 0.4 - (0.1) - 0.2

At 30 June 2022 8.6 24.3 1.4 16.8 15.3 66.4

--------- ----------- ------ ------------ --------- ------

Net book value

At 1 January

2022 83.1 27.4 1.3 13.3 4.2 129.3

At 30 June 2022 83.8 24.2 0.8 17.0 3.2 129.0

--------- ----------- ------ ------------ --------- ------

Amortisation on intangible assets is charged to the consolidated

statement of profit or loss and included in operating expenses.

9. Fair value of financial Instruments

The financial instruments included in the 'Consolidated

statement of financial position are measured at fair value or

amortised cost. Those financial liabilities measured at fair value

remain unchanged from the Annual Report for the year ended 31

December 2022 and include contingent consideration GBP2.7m (31

December 2022: GBP5.0m) and put option liability GBP1.8m (31

December 2022: GBP1.8m), both classified as level 3. Both the

contingent consideration and put option liability were valued using

a probability weighted expected returns methodology, using a

discount rate appropriate to the transaction. Movements in the fair

value are charged through the profit and loss.

10. Share capital

Number GBPm

1 January 2023

Ordinary Shares of GBP0.0025 each 96,847,301 0.2

------------ -----

At 1 January 2023 96,847,301

Movement:

January 7,170 (a)

February 2,221 (a)

April 5,268 (a)

May 4,132 (a)

June 109,751 (a)

At 30 June 2023 96,975,843

============

(a) Ordinary shares were issued to satisfy options

which have been exercised.

Number GBPm

30 June 2023

Ordinary Shares of GBP0.0025 each 96,975,843 0.2

------------ -----

11. Other reserves

Merger Share Foreign Own shares Total

reserve option exchange other

reserve reserve reserves

GBPm GBPm GBPm GBPm GBPm

1 January 2022 2.3 7.1 (4.2) (0.7) 4.5

--------- --------- ---------- ----------- ----------

Issue of shares - (0.2) - - (0.2)

Share-based payments - 2.2 - - 2.2

Other comprehensive income - - 1.3 - 1.3

--------- --------- ---------- ----------- ----------

30 June 2022 2.3 9.1 (2.9) (0.7) 7.8

========= ========= ========== =========== ==========

1 January 2023 2.3 8.7 (1.3) (0.7) 9.0

--------- --------- ---------- ----------- ----------

Share-based payments - 1.4 - - 1.4

Other comprehensive income - - (1.3) - (1.3)

--------- --------- ---------- ----------- ----------

30 June 2023 2.3 10.1 (2.6) (0.7) 9.1

========= ========= ========== =========== ==========

12. Events after the reporting date

On 16 August 2023 the Group acquired the entire issued share

capital of Satisnet Limited, a UK-based Managed Security Services

Provider of software and services to the medium/large enterprise

market. There was an initial payment to the sellers of GBP10.1m

(excluding amounts paid for cash acquired and working capital). In

addition, there is GBP2.8m in Gamma shares payable by October 2023

and a further GBP2.1m payable in cash. There is also an earn out

agreement based on revenue and growth profit targets for 18 months

to 31 December 2024 and 2025. This may result in an additional

consideration of up to GBP5.0m, of which 80% will be in cash and

20% by the issue of consideration shares.

Due to the proximity of the acquisitions to the publication of

this update, the Group has not yet completed the purchase price

allocation and it is impractical to give further information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCRUGDGXS

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

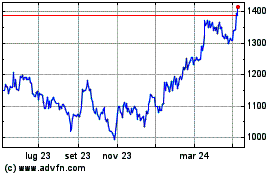

Grafico Azioni Gamma Communications (LSE:GAMA)

Storico

Da Mar 2024 a Apr 2024

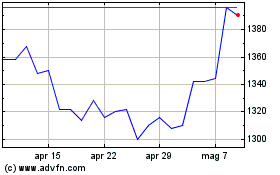

Grafico Azioni Gamma Communications (LSE:GAMA)

Storico

Da Apr 2023 a Apr 2024