Update and Strategic Review

01 Maggio 2009 - 4:49PM

UK Regulatory

TIDMHDD

RNS Number : 6203R

Hardide PLC

01 May 2009

Hardide plc ('Hardide' or 'the Company')

Update and Strategic Review

The Board of Hardide (AIM: HDD), the provider of unique metal surface

engineering technology, announces that constructive discussions continue with

the Company's major customers regarding the effects of the global economic

outlook on their production levels and resultant demand for Hardide's product.

As previously noted, there has been no reduction in sales as a result of

customer dissatisfaction with Hardide or its coating technology, and the Board

believes that the reduced level of ordering caused by the downturn in production

by its customers is affecting a number of similar suppliers operating in the

same market.

In light of the above, and as referred to the announcement of 3 March 2009, the

Group has now implemented

some cost reductions, which have

included hibernating the US plant and temporarily moving production back

to

the UK.

Further, the Board is now undertaking a strategic review of the options which

may be available to the Group, which may include an equity fundraising or a

trade sale, and will provide a further update as soon as it is in a position to

do so.

For further information:

+-------------------------------------------+----------------------------+

| Hardide plc | |

+-------------------------------------------+----------------------------+

| Graham Hine, Chief Executive Officer | Tel: +44 (0) 1869 353 830 |

| Jackie Robinson, Head of Communications | |

+-------------------------------------------+----------------------------+

| jrobinson@hardide.com | www.hardide.com |

+-------------------------------------------+----------------------------+

+-------------------------------------------+----------------------------+

| Seymour Pierce Limited | |

+-------------------------------------------+----------------------------+

| Nicola Marrin, Corporate Finance | Tel: +44 (0) 20 7107 8000 |

+-------------------------------------------+----------------------------+

| nicolamarrin@seymourpierce.com | |

+-------------------------------------------+----------------------------+

The Directors of the Company accept responsibility for the information contained

in this announcement. To the best of the knowledge and belief of the Directors

of the Company (who have taken all reasonable care to ensure that such is the

case) the information contained in this announcement is in accordance with the

facts and does not omit anything likely to impact the import of this

announcement.

Seymour Pierce Limited ('Seymour Pierce'), which is regulated in the United

Kingdom by the Financial Services Authority, is acting for Hardide in relation

to the matters described in this announcement and is not advising any other

person, and accordingly will not be responsible to anyone other than Hardide for

providing the protections afforded to customers of Seymour Pierce or for

providing advice in relation to the matters described in this announcement.

Relevant Securities in Issue

In accordance with Rule 2.10 of the City Code on Takeovers and Mergers, Hardide

confirms that it currently has in issue 189,642,236 ordinary shares of 1p each.

The International Securities Identification Number for Hardide's ordinary shares

is GB00B069T034.

Dealing Disclosure Requirements

Under the provisions of Rule 8.3 of the City Code on Takeovers and Mergers (the

'Code'), if any person is, or becomes, 'interested' (directly or indirectly) in

1% or more of any class of 'relevant securities' of the Company, all 'dealings'

in any 'relevant securities' of the Company (including by means of an option in

respect of, or a derivative referenced to, any such 'relevant securities') must

be publicly disclosed by no later than 3.30 pm (London time) on the London

business day following the date of the relevant transaction. This requirement

will continue until the date on which the offer becomes, or is declared,

unconditional as to acceptances, lapses or is otherwise withdrawn or on which

the 'offer period' otherwise ends. If two or more persons act together pursuant

to an agreement or understanding, whether formal or informal, to acquire an

'interest' in 'relevant securities' of the Company, they will be deemed to be a

single person for the purpose of Rule 8.3. Under the provisions of Rule 8.1 of

the Code, all 'dealings' in 'relevant securities' of the Company by the offeror

or the Company, or by any of their respective 'associates', must be disclosed by

no later than 12.00 noon (London time) on the London business day following the

date of the relevant transaction. A disclosure table, giving details of the

companies in whose 'relevant securities' 'dealings' should be disclosed, and the

number of such securities in issue, can be found on the Takeover Panel's website

at www.thetakeoverpanel.org.uk. 'Interests in securities' arise, in summary,

when a person has long economic exposure, whether conditional or absolute, to

changes in the price of securities. In particular, a person will be treated as

having an 'interest' by virtue of the ownership or control of securities, or by

virtue of any option in respect of, or derivative referenced to, securities.

Terms in quotation marks are defined in the Code, which can also be found on the

Panel's website. If you are in any doubt as to whether or not you are required

to disclose a 'dealing' under Rule 8, you should consult the Panel.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUUUMCAUPBGCG

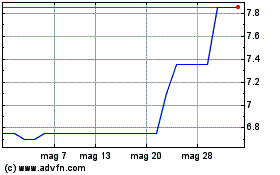

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

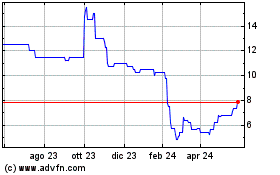

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024