TIDMHDD

RNS Number : 7853T

Hardide PLC

25 November 2013

Hardide plc

("Hardide" or "the Group" or "the Company")

Preliminary results for the year ended 30 September 2013

Hardide plc (AIM: HDD), the provider of advanced surface coating

technology, announces its preliminary results for the twelve months

ended 30 September 2013.

Financial Results

-- Group turnover reduced by 17% to GBP2.4m (2012: GBP2.9m),

predominantly as a result of a sudden and significant inventory

adjustment by one major customer.

-- Gross profit decreased by 29% to GBP1.5m (2012: GBP2.1m).

-- Group EBITDA loss of GBP0.2m (2012: profit GBP0.5m) impacted

by a strategic decision to strengthen the UK and US sales teams

along with associated increased marketing expenditure.

-- UK operation, Hardide Coatings Limited: EBITDA of GBP0.5m (2012: GBP1.2m).

-- Group loss before tax of GBP0.9m (2012: profit GBP0.3m) after

GBP0.4m provision for onerous lease under IAS37 and GBP0.1m

impairment of fixed assets relating to the hibernated Houston

facility.

-- UK operation, Hardide Coatings Limited: profit before tax of GBP0.4m (2012: GBP1.1m).

-- US sales up 17% to GBP0.7m (2012: GBP0.6m).

-- Loss per share 0.08p (2012: profit 0.03p).

-- Cash at bank at 30 September 2013 of GBP1.0m (2012 year end: GBP1.4m).

-- In January 2013, a loan note holder converted its convertible

loan note of GBP225,000 into 50,000,000 new ordinary shares of the

Company ("New Ordinary Shares").

-- A Technology Strategy Board (TSB) grant of up to GBP250,000

awarded to part--fund development of a new coating for downhole

tool and other high-wear applications.

Business and Operational Highlights

-- The number of active accounts rose by 31% to 38 from 29 in

the previous year and the number of qualified prospects rose by

40%.

-- Supply agreement for a new coating developed as a result of

the TSB grant. Patent applications have been made for this

product.

-- Commercial agreement with a US-based, blue chip provider of highly-engineered products.

-- Business development activity strengthened by the appointment

of two additional managers, a sales consultant and an agent in

Germany.

-- Test programmes by Airbus and AgustaWestland (AW) continue to

make progress. The expected completion date for generic testing by

Airbus has slipped slightly and our current best estimate is that

both programmes will be completed before mid-2014.

Post Period Events

-- Promising start for sales of the new coating for oil &

gas tools developed with the TSB grant support.

-- Coating for first hydraulic fracturing (fracking) tool

application now on test with a major oil and gas company.

-- Marketing partner is being sought for the pump, valve and power generation markets in Italy.

-- Good signs of recovery of demand from major customer.

Commenting on the results, Robert Goddard, Chairman of Hardide

plc, said:

"Diversification remains a crucial strategic goal and to this

end, there has been further investment in technical development,

sales activity and marketing. Increased investment in these areas

has been budgeted for 2013-14 because the Board maintains its view

that this is required to realise new applications and to fuel

business growth; thereby adding value to the Company.

"Looking forward, the Board expects to see the first results of

these investments in the second half of this coming financial

year.

"The Board remains confident about the Group's prospects in its

key markets and that investment to increase sector penetration and

customer diversity is in the shareholders' best interests."

For further information:

Hardide plc

Robert Goddard, Chairman Tel: +44 1869 353 830

Philip Kirkham, Chief Executive jrobinson@hardide.com

Officer www.hardide.com

Jackie Robinson, Communications

Manager

N+1 Singer

Andrew Craig, Ben Wright Tel: +44 207 496 3000

www.n1singer.com

Notes to editors:

Hardide develops, manufactures and applies nano-structured

tungsten carbide-based coatings to a wide range of engineering

components. The Group's patented technology is unique in combining

a mix of abrasion, erosion and corrosion resistant properties in

one material and its ability to coat interior surfaces and complex

shapes uniformly. When applied to metal components in aggressive

environments, the material is proven to offer dramatic improvements

in component life resulting in cost savings through reduced

downtime and increased operational efficiency. Customers include

leading companies operating in oil and gas exploration and

production, valve and pump manufacturing, nuclear, advanced

engineering and aerospace industries.

chairman's and ceo's statement

SUMMARY

The Company experienced a 17% decline in revenue. This was due

to an inventory reduction by a major customer that began in the

latter part of H1 which we highlighted to shareholders at the time

and which continued throughout H2, adversely affecting the full

year result. However, there are good signs that this slowdown is

coming to an end. The drop in demand was particularly disappointing

because the Company is making very good headway in other areas,

including product and technical development, building sales and

marketing momentum and strengthening the patent portfolio.

Mainly as a result of this fall back in demand by the major

customer, sales were 17% lower than last year and fixed factory

overheads meant that the gross profit was GBP0.6m down and as a

percentage of sales slipped to 65% (2012: 72%).

Administrative expenses rose to GBP1.8m from GBP1.6m last year

on the back of increased sales and marketing expenditure, with

additional business development resources recruited in the UK,

Europe and the USA.

The net effect of these movements was a GBP0.7m reduction in

EBITDA to a loss of GBP0.2m.

Diversification remains a challenge in the short-term due to the

long sales cycle. However, progress is being made, with an increase

of over 30% in customer numbers over the year and the successful

completion of one long-term supply agreement and good progress on

another with a major US-based customer. The Board is confident that

the correct strategy is in place to achieve further

diversification.

We remained sufficiently confident during the year to continue

to invest in sales, marketing, product testing and development. As

long as business performance remains as currently projected,

expenditure of this nature will continue to increase ahead of the

sales growth expected in the coming year.

FINANCIAL OVERVIEW

Whilst the Company has reduced its dependence on a small number

of major customers, the progress was not sufficient to mitigate the

effect of the dramatic inventory reduction by one such customer.

This adjustment, combined with delays in other customers' testing

programmes and product introductions across several sectors, led to

a fall back in full year sales revenue by 17% to GBP2.4m (2012:

GBP2.9 m). This is in line with market expectations but

disappointing against a background of our technology performing

exceptionally well and the many positive technical and commercial

developments achieved in the year.

Group gross profit fell by 29% to GBP1.5m (2012: GBP2.1

million), and EBITDA to a loss of GBP0.2m (2012: profit GBP0.5m).

The Group made a loss before tax of GBP0.9m (2012: profit

GBP0.3m).

A prudent view has been taken on the remaining term of the lease

on our Houston facility which is currently mothballed and partially

sublet. We have provided GBP0.4m for the 'onerous' lease and a

further GBP0.1m impairment loss on the remaining plant and

machinery. Excluding these one-off items, Group loss before tax was

GBP0.4m.

Cost of sales remained the same as FY2012 at GBP0.8m; attributed

to fixed production salaries and the mix of components that were

processed, resulting in gross margin reducing to 65% (2012:

72%).

Two new business development staff, a sales consultant, an agent

in Germany and increased marketing spend accounted for the majority

of the 13% increase in expenses to GBP1.8m (2012: GBP1.6m).

In January 2013, a convertible loan note of GBP225,000 was

exercised, resulting in the issue of 50,000,000 New Ordinary

Shares.

The Group was successful in its application for a Technology

Strategy Board (TSB) grant in January 2013 and awarded up to

GBP250,000 towards the project costs. During the year, income from

this grant of GBP53,000 was netted against development expenses

incurred.

BUSINESS REVIEW

Customers and Markets

Total revenue from the oil and gas sector fell by 26%, largely

due to destocking by one major customer.

Sales to the flow control sector fell by 6% due to a general

slowing in project activity but we saw a 28% rise in demand from

our major customer in this sector; the second year in succession

that they have significantly increased orders.

Advanced engineering and aerospace revenue grew by 4% from a low

base.

Across all sectors, eleven new accounts were gained, the number

of repeat customers increased by 31% and the number of qualified

prospects rose by 40%.

During the course of the year, we continued our planned

investment in sales and marketing. As well as appointing additional

sales personnel, our corporate branding and marketing literature

were refreshed and a German language version of our main brochure

was produced. The website was re-designed and more customer-focused

content incorporated. The Company exhibited at and attended many

industry events and the technology was presented at various

seminars and conferences. The Company joined the West of England

Aerospace Forum (WEAF) to reinforce its connection with major

aerospace companies. We also joined NAMTEC, the National Metals

Technology Centre, part of the Advanced Manufacturing Research

Centre (AMRC) run by the University of Sheffield, Rolls-Royce and

Boeing.

Since so many of Hardide coatings' applications are on critical

components with a high cost of failure, final acceptance often

comes only after lengthy testing, sometimes taking years. However,

once approved the coatings are truly embedded and we enjoy long

term relationships, repeat orders and enquiries for new

applications from satisfied customers. Despite great efforts to

expedite progress, we have little influence on the speed of

customers' testing and our experience is that their programmes

often extend well beyond the time and scope first indicated to

us.

Several test programmes reached a conclusion during the year and

eleven new accounts were gained across a range of sectors as a

result. One highlight was the success of long term testing on

critical parts for a world-leading, US-based advanced engineering

company. A strategic supply agreement with minimum guaranteed

annual volumes is now being negotiated and tests on further

components are already underway and are planned to be included in

the agreement's scope when proven.

In April 2013, the Company signed a mutually exclusive five-year

supply agreement with 'hardfacing' specialists Cutting & Wear

Resistant Developments to supply the new coating for

'superabrasive' products for use in oil and gas applications.

In the US

Our plant in Houston remains intact but will not become

operational until demand from North America has reached a

sufficient level. To this end, we are engaged in trials with

several of the world's largest valve and oil and gas service

companies for high volume parts. Lab testing was completed

successfully on our first fracking tool application for a major

oilfield services company and they intend to begin field trials

with results expected early in 2014. These developments, as well as

the appointment of a new US-based business manager are designed to

bolster demand in North America to the point at which the plant can

be re-opened. Sales in North America to new and existing customers

rose by 17% to GBP0.7m (2012: GBP0.6m).

Operations

The production team embarked on a Six Sigma lean manufacturing

programme. This has resulted in efficiency improvements, including

a sharp increase in throughput per cycle for certain components.

Two key process managers have been trained and shortly will be

awarded their Six Sigma green belt status.

In 2013, we were very pleased to recruit our first apprentice

who is being trained as a quality technician while attending

college one day a week. We believe that apprenticeships should play

an important role in our business because they have the potential

to develop skills specific to our technology and so enhance

productivity.

Our excellent safety record remains in place. No lost-time

incidents were recorded during the year and the Company surpassed

all its environmental objectives.

Technology, Research & Development

Rapid progress was made on the further development and

commercialisation of a next-generation superabrasive coating

technology. The new Hardide coating is incorporated into a

hardfacing material that extends the life of drilling and other

tools operating in extremely abrasive environments. The project was

fast-tracked from lab research stage with the support of a TSB

grant. This is the first successful high-performance adhesive

coating of its kind and we believe that the technology is

applicable to other extractive industries and to construction.

Accordingly, we have filed UK and international patent

applications.

In the second half of the year we launched two independent test

programmes. One is investigating the behaviour of the coating on

two widely-used substrates and the other is testing its resistance

to a particular wear mechanism in pumps. The programme is due to be

completed by the end of 2013 and if successful will open up

opportunities in the fast growing subsea sector and for new pump

industry applications.

Erosion tests at Southampton University on behalf of a major oil

and gas customer yielded impressive results. The coating's erosion

rate was 125 times better than stainless steel and seven times

better than HVOF, a competing high performance coating. These

results have been disseminated by our customer and we expect new

applications on the strength of our performance.

Test programmes by Airbus and AgustaWestland (AW) continue to

make progress. Since the coating will be used in safety-critical

applications, tests have had to be very wide-ranging and

detailed.

Airbus has very nearly completed its generic test programme. AW,

having already successfully completed its generic testing, is now

conducting tests on an extremely critical component. If these tests

are successful, this will also qualify the coating for use in

multiple, less-severe applications, where it is thought that there

may be major advantages to be had from using the coating.

With both of these aerospace customers, the availability of test

equipment is an important factor in the time that it takes to

complete these test programmes and grant approval. Our current best

estimate is that both programmes will be completed before

mid-2014.

The reputation of the Hardide coating as an alternative to hard

chrome plating, the production of which is shortly to be severely

restricted under EU and US health, safety and environmental

regulations, was enhanced when a customer, VelanInc authored a

peer-reviewed paper in conjunction with two universities. The

article was published in the journal "Materials Chemistry and

Physics" and concluded that the Hardide coating is a suitable

alternative to hard chrome plating in severe service valves.

Outlook

Looking forward, the Board expects 2014 to show benefits from

investment in business development, the increase in new customers

and from the recent 40% uplift in the number of qualified

prospects. There are further positive commercial and technical

developments underway and a healthy and growing pipeline of

opportunities. Activity in North America is gaining momentum and

opportunities in Germany, Italy and Norway are also being

targeted.

Investment in technology and marketing will continue, and the

Board maintains its view that expenditure ahead of revenue will

realise valuable new applications and fuel business growth and

diversification, thereby improving shareholder value.

We are confident in the outlook for sales, in our plans to

increase sector penetration and diversification, and in our ability

to improve our overall performance.

Finally, our thanks are extended to the management team and

employees for their hard work during the year and to our

shareholders for their continued support.

Robert Goddard Philip Kirkham

Chairman CEO

25 November 2013 25 November 2013

Financial Review

While the year started promisingly, by the end of H1 it became

apparent that one of our major customers was undertaking a

destocking exercise throughout its global operations, and this

continued through the second half. While we converted a number of

new accounts during the year, revenue from these was not sufficient

to offset the decline from the major customer. Indications are that

demand from this major customer will return to more normal levels

in the new financial year.

The consequence of the 17% decline in revenue on an operation

with low variable but high fixed production costs was a larger

decline in gross profit of 29%. Overheads increased by GBP0.2m to

GBP1.8m due to increased marketing, business development and

technology improvement costs.

Revenue from our US customers increased on the back of higher

economic activity there, and we also began to see the benefits of

more active account management from our new US Business Development

Manager. However while the prospects for our North American

business are improving, we have taken the prudent view to provide

under IAS37 an amount of GBP0.4m in the P&L for the remaining

rental on the facility in Houston, less the minimum amounts due to

us from our sub-lessee. Similarly, although there remain

substantial amounts of plant and machinery in situ to facilitate a

quick re-opening should conditions allow, the absence of a decision

to do so has resulted in a write-down of its carrying value to

zero; an additional expense to the P&L of GBP0.1m.

After accounting for these one-off items, the company's pre-tax

loss was GBP0.9m (2012: GBP0.3m profit), if these are excluded,

underlying EBITDA loss was GBP0.2m, down from an EBITDA profit of

GBP0.5m in 2012.

Cash outflow in the year amounted to GBP368k including capital

expenditure of GBP69k and net interest costs of GBP59k.

The company successfully applied for funding from the Technology

Strategy Board to develop a coating variant for hardfacing

material. The grant contributes towards eligible project

expenditure for up to two years. During the year GBP50k was

received, with a further GBP3k accrued. Since these amounts relate

to costs incurred, the grant has been accounted for as a credit to

expenses, rather than income. Substantial amounts of our

developments in other areas continue to be eligible for R&D tax

credits.

The holder of a GBP225k convertible loan note converted and sold

these on ahead of their maturity into 50m ordinary shares at a

conversion price of 0.45p per share. The shares were placed with a

variety of institutional shareholders and private client brokers.

This same holder retains a GBP633k convertible loan note that

matures in the summer of 2014.

Peter Davenport

Finance Director

25 November 2013

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30 September 2013

2013 2012

GBP000 GBP000

Revenue 2,359 2,915

Cost of sales (815) (820)

Gross profit 1,544 2,095

----------------------------------------- -------- --------

Administrative expenses (1,769) (1,573)

Depreciation and amortisation (110) (108)

Impairment of fixed assets (90) (36)

Provision for onerous lease obligations (376) -

Operating (loss) / profit (801) 378

----------------------------------------- -------- --------

Finance income 2 2

Finance costs (103) (115)

(Loss) / profit on ordinary activities

before taxation (902) 265

----------------------------------------- -------- --------

Taxation 54 42

(Loss) / profit on ordinary activities

after taxation (848) 307

----------------------------------------- -------- --------

Profit / (loss) per share: Basic (0.08)p 0.03p

Profit / (loss) per share: Diluted (0.07)p 0.02p

All operations are continuing.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

at 30 September 2013

2013 2012

GBP000 GBP000

Assets

Non-current assets

Goodwill 69 69

Intangible assets 2 -

Property, plant & equipment 245 379

--------------------------------------- -------- --------

Total non-current assets 316 448

--------------------------------------- -------- --------

Current assets

Inventories 41 33

Trade and other receivables 434 549

Other current financial assets 154 98

Cash and cash equivalents 1,037 1,405

--------------------------------------- -------- --------

Total current assets 1,666 2,085

--------------------------------------- -------- --------

Total assets 1,982 2,533

--------------------------------------- -------- --------

Liabilities

Current liabilities

Trade and other payables 282 480

Financial liabilities 702 257

Provision for lease obligation 86 -

Total current liabilities 1,070 737

--------------------------------------- -------- --------

Net current assets 596 1,348

--------------------------------------- -------- --------

Non-current liabilities

Financial liabilities 5 673

Provision for lease obligation 290 -

--------------------------------------- -------- --------

Total non-current liabilities 295 673

--------------------------------------- -------- --------

Total liabilities 1,365 1,410

--------------------------------------- -------- --------

Net assets 617 1,123

--------------------------------------- -------- --------

Equity attributable to equity holders

of the parent

Share capital 2,733 2,666

Share premium 6,085 5,848

Retained earnings (7,841) (6,993)

Share-based payments reserve 275 240

Translation reserve (635) (638)

--------------------------------------- -------- --------

Total equity 617 1,123

--------------------------------------- -------- --------

The financial statements were approved and authorised for issue

by the Board on 25 November 2013.

Robert Goddard

Director

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 30 September 2013

2013 2012

GBP000 GBP000

Cash flows from operating activities

Operating (loss) / profit (801) 378

Depreciation 110 108

Impairment of fixed assets 90 36

Share option charge 35 1

Increase in inventories (8) (9)

Decrease in receivables 114 (139)

Decrease in payables (198) 110

Increase in provisions 376 -

Cash generated from operations (282) 485

---------------------------------------------- -------- --------

Finance income 2 2

Finance costs (61) (83)

Tax received / (paid) - 45

Net cash generated from operating activities (341) 449

---------------------------------------------- -------- --------

Cash flows from investing activities

Purchase of property, plant and equipment (69) (50)

Net cash used in investing activities (69) (50)

---------------------------------------------- -------- --------

Cash flows from financing activities

Net proceeds from issue of ordinary share

capital 304 714

Loan repayment (262) -

Net cash used in financing activities 42 714

---------------------------------------------- -------- --------

Net increase / (decrease) in cash and

cash equivalents (368) 1,113

---------------------------------------------- -------- --------

Cash and cash equivalents at the beginning

of the year 1,405 292

---------------------------------------------- -------- --------

Cash and cash equivalents at the end

of the year 1,037 1,405

---------------------------------------------- -------- --------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30 September 2013

Share Share Share-based Foreign Retained Total

Capital Premium Payments Translation Earnings Equity

---------------------- --------- --------- ------------ ------------- ---------- --------

At 1 October 2011 2,541 5,259 248 (632) (7,310) 106

---------------------- --------- --------- ------------ ------------- ---------- --------

Issue of new shares 125 589 - - - 714

Share options - - (8) - 10 2

Combined instruments - - - - - -

Exchange translation - - - (6) - (6)

Profit for the

year - - - - 307 307

---------------------- --------- --------- ------------ ------------- ---------- --------

At 30 September

2012 2,666 5,848 240 (638) (6,993) 1,123

---------------------- --------- --------- ------------ ------------- ---------- --------

At 1 October 2012 2,666 5,848 240 (638) (6,993) 1,123

---------------------- --------- --------- ------------ ------------- ---------- --------

Issue of new shares 67 237 - - - 304

Share options - - 35 - - 35

Combined instruments - - - - - -

Exchange translation - - - 3 - 3

Loss for the year - - - - (848) (848)

---------------------- --------- --------- ------------ ------------- ---------- --------

At 30 September

2013 2,733 6,085 275 (635) (7,841) 617

---------------------- --------- --------- ------------ ------------- ---------- --------

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

Section 435 of the Companies Act 2006.

The consolidated statement of financial position at 30 September

2013, and the consolidated statement of comprehensive income and

consolidated statement of cash flows for the year then ended have

been extracted from the Group's 2013 statutory financial

statements. The audit report on the full financial statements has

not yet been signed by the auditor. The auditor's report is

expected to be unqualified and is not expected to include any

statement under Sections 498 (2) (accounting records or returns

inadequate or accounts not agreeing with records) or 498 (3)

(failure to obtain necessary information and explanations) of the

Companies Act 2006. Those financial statements have not yet been

delivered to the Registrar of Companies.

Accounting Policies

The preliminary announcement for the year ended 30 September

2013 has been prepared in accordance with International Financial

Reporting Standards as adopted by the European Union. The

accounting policies applied in this preliminary announcement are

consistent with those reported in the Group's annual financial

statement for the year ended 30 September 2013 with new standards

and interpretations which became mandatory for the financial

year.

Copies of the Annual Report and Financial Statements will be

posted to shareholders shortly and will be available from the

Company's registered office at 11 Wedgwood Road, Bicester OX26

4UL.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BTBRTMBJTBIJ

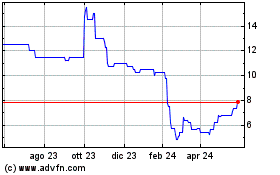

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

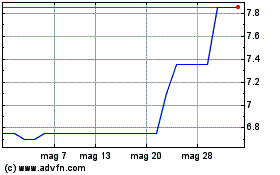

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024