TIDMHDD

RNS Number : 9269M

Hardide PLC

22 July 2014

22 July 2014

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

SHALL NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR THE SOLICITATION

OF AN OFFER TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY NEW

ORDINARY SHARES OF HARDIDE PLC IN ANY JURISDICTION IN WHICH ANY

SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL.

Hardide plc

("Hardide" or the "Company")

Conditional Placing of 167,875,000 new Ordinary Shares to raise

GBP2.7 million

Hardide plc, provider of advanced surface-coating technology,

today announces that it has conditionally raised GBP2.7 million

before expenses, by the placing (the "Placing") for cash by

finnCap, acting as agent for the Company, of 167,875,000 new

ordinary shares of 0.1 pence each ("Ordinary Shares") (the "Placing

Shares") at 1.6 pence per Placing Share (the "Issue Price").

Summary of the Placing

-- Placing of 167,875,000 new Ordinary Shares at 1.6 pence to

raise GBP2.7m before expenses (GBP2.5m net of expenses)

-- Support from new and existing institutional shareholders

-- Fundraising subject to approval of the Company's shareholders

at a General Meeting to be held on 14 August 2014

-- Proceeds to be used for investment in additional capacity in

the UK and a new facility in the US

Commenting on the placing, Philip Kirkham, Chief Executive of

Hardide, said:

"We are delighted to have received such strong support from

existing and new institutional shareholders. This fundraising will

allow Hardide to take advantage of the increasing demand for

Hardide coatings from the UK, Europe and North America."

Background to and reasons for the Placing

The Directors believe that overall demand for the Company's

products has increased recently due to greater business development

efforts, recovery in demand from existing customers and the

generation of new accounts. Examples of such developments include

the recently-announced contract with General Electric and the

further progress made with testing by Airbus, specifically the

Group's Hardide-A coating as a potential alternative to hard chrome

plating in certain aerospace applications. The Company has been

informed by Airbus of completion of the first stages of testing of

its coating following a technical performance review of Hardide-A

in a laboratory environment, which has encouraged Airbus to

investigate further its technical performance capabilities for

potential use on some specific Airbus aircraft components. The

Board believes this represents an important step towards the

possible approval of the coating for use on component parts for

Airbus aircraft.

In order to meet future projected demand, the Directors believe

the Company will require additional capacity both in the UK and the

US, giving a dual site capability, particularly for serving

aerospace markets. The aim is to provide security of supply and to

satisfy the logistical needs of current and future customers,

particularly in North America. The Directors also believe that a

strengthened balance sheet will allow for greater customer

confidence when considering long-term business with the

Company.

The Company has therefore been considering possible ways to

achieve the objectives set out above and to further enhance growth

and increase Shareholder value in the longer term. The Placing is

believed by the Board to be a necessary step towards realising this

strategy.

Use of Proceeds

The Group intends to use the net proceeds of the Placing to

invest in capacity to meet future projected demand, including an

additional coating reactor in the UK which the Board expects will

increase available capacity there by approaching 50 per cent., and

the creation of a processing facility in North America.

It is intended by the Group that installation of capacity at the

North American facility will be phased to match demand as it

develops. The current plan envisages three coating reactors which,

once in place, the Directors believe would provide a physical

capacity equivalent to the expanded capacity at the UK site. The

Company is in discussions with local government representatives on

possible grant aid to support the creation of the North American

facility.

In addition, the net proceeds of the Placing will be used to

cover the projected start-up losses of the North American facility

as well as the initiation, in the medium term, of a research and

development function in the UK and to grow the Company's global

business development team.

General Meeting

A notice convening a General Meeting, to be held at the offices

of finnCap Ltd, 60 New Broad Street, London EC2M 1JJ at 11.00 a.m.

on 14 August 2014 is being posted to Shareholders today. At the

General Meeting, resolutions will be proposed to: (i) authorise the

Directors, pursuant to section 551 of the Act, to allot shares or

grant rights to subscribe for or convert any security into shares

in the Company up to a maximum nominal value of GBP420,208

representing approximately one-third of the nominal value of the

Enlarged Share Capital which will be in substitution for the

Company's existing authority granted at its Annual General Meeting

held in February this year; and (ii) empower the Directors to

dis-apply statutory pre-emption rights in respect of, inter alia,

the allotment of the Placing Shares. These authorities will expire

at the conclusion of the next Annual General Meeting of the Company

to be held after the passing of the Resolutions.

The purpose of seeking Shareholder approval to the taking of

authorities in addition to those required for the Placing is to

allow the Directors to have available to them for allotment,

following the Placing, a number of Ordinary Shares, which is

proportionally equivalent to that approved for allotment on a non

pre-emptive basis at the last Annual General Meeting of the

Company. While the Directors have no present intention of

exercising the additional authorities proposed to be conferred by

the Resolutions, they believe that the granting of such authorities

will preserve the Board's flexibility to take advantage of further

opportunities when they arise.

Details of the Placing

The Placing, which is not being underwritten, has been

undertaken pursuant to the Placing Agreement. Under the terms of

the Placing Agreement finnCap has agreed to use its reasonable

endeavours to procure institutional and other investors to

subscribe for Placing Shares.

The Placing Agreement is conditional on, amongst other

things:

-- the passing of the Resolutions (without material amendment) at the General Meeting; and

-- Admission becoming effective by not later than 8.00 a.m. on

15 August 2014 (or such later time and/or date as the Company and

finnCap may agree (being not later than 8.00 a.m. on 28 August

2014)).

Admission

Application will be made for Admission to occur and for dealings

to commence in the Placing Shares on 15 August 2014. The Placing

Shares will rank pari passu with the existing Ordinary Shares

currently traded on AIM. Following Admission, there will be

1,260,626,304 Ordinary Shares in issue.

Unless otherwise defined herein, terms are as defined in the

Circular posted to Shareholders on 22 July 2014 and available on

the company's website

http://www.hardide.com/investor-relations/

For further information please contact:

Hardide plc Tel: +44 (0) 1869 353830

Philip Kirkham, CEO

Peter Davenport, Finance Director

finnCap Ltd Tel: +44 (0) 20 7220 0500

Stuart Andrews / Grant Bergman / James Thompson

PLACING STATISTICS

Number of Existing Shares 1,092,751,304

Number of Placing Shares being conditionally placed on behalf

of the Company 167,875,000

Number of Ordinary Shares in Issue immediately following Admission(1) 1,260,626,304

Placing Price 1.6 pence

Estimated net proceeds of the Placing receivable by the Company GBP2.5 million

Placing Shares as a percentage of the Enlarged Share Capital(1) 13.3 per cent.

Market capitalisation of the Company at Admission at the Placing GBP20.2 million

Price(1)

(1) Assuming that, other than the Placing Shares, no new

Ordinary Shares are issued between the date of this document and

Admission.

TIMETABLE OF PRINCIPAL EVENTS

2014

Latest time and date for receipt of Forms of Proxy 11.00 a.m. on 12 August

for the General Meeting

Time and date of General Meeting 11.00 a.m. on 14 August

Admission and commencement of dealings in Placing 8.00 a.m. on 15 August

Shares

CREST accounts credited in respect of Placing Shares 15 August

Despatch of definitive share certificates for Placing 28 August

Shares

THE MATERIAL SET FORTH HEREIN IS FOR INFORMATIONAL PURPOSES ONLY

AND IS NOT INTENDED, AND SHOULD NOT BE CONSTRUED, AS AN OFFER OF

SECURITIES FOR SALE IN THE UNITED STATES OR ANY OTHER JURISDICTION.

THE SECURITIES OF THE COMPANY DESCRIBED HEREIN HAVE NOT BEEN AND

WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS

AMENDED (THE "SECURITIES ACT"), OR WITH ANY REGULATORY AUTHORITY OR

UNDER THE LAWS OF ANY STATE OR OTHER JURISDICTION OF THE UNITED

STATES, AND MAY NOT BE OFFERED, SOLD, RE-SOLD, TRANSFERRED OR

DELIVERED, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT

SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND

OTHERWISE IN COMPLIANCE WITH THE SECURITIES LAWS OF ANY STATE OR

OTHER JURISDICTION OF THE UNITED STATES. NEITHER THE US SECURITIES

AND EXCHANGE COMMISSION NOR ANY SECURITIES REGULATORY AUTHORITY OF

ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES HAS APPROVED

OR DISAPPROVED OF AN INVESTMENT IN THE PLACING SHARES OR PASSED

UPON OR ENDORSED THE MERITS OF THE PLACING OR THE ACCURACY OR

ADEQUACY OF THE CONTENTS OF THIS ANNOUNCEMENT. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENCE IN THE UNITED STATES.

This announcement is for information purposes only and shall not

constitute an offer to buy, sell, issue, or subscribe for, or the

solicitation of an offer to buy, sell, issue, or subscribe for any

securities, nor shall there be any sale of securities in the United

States, Australia, Canada, South Africa, Japan or any other

jurisdiction in which such offer, solicitation or sale is or may be

unlawful (a "Prohibited Jurisdiction"). This announcement and the

information contained herein are not for release, publication or

distribution, directly or indirectly, to persons in a Prohibited

Jurisdiction unless permitted pursuant to an exemption under the

relevant local law or regulation in any such jurisdiction. This

announcement has been issued by and is the sole responsibility of

the Company.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by finnCap or by any of its respective

Affiliates, directors, officers, employees or agents as to, or in

relation to, the contents of this announcement, or any other

written or oral information made available to or publicly available

to any interested party or its advisers, and any responsibility or

liability therefor is expressly disclaimed.

finnCap, which is authorised and regulated in the United Kingdom

by the Financial Conduct Authority, is acting for the Company and

for no-one else in connection with the Placing, and will not be

responsible to anyone other than the Company for providing the

protections afforded to clients of finnCap or for providing advice

to any other person in relation to the Placing or any other matter

referred to herein. Apart from the responsibilities and

liabilities, if any, which may be imposed upon finnCap by the

Financial Services and Markets Act 2000 or the regulatory regime

established thereunder, finnCap does not accept any responsibility

whatsoever or makes any representation or warranty, express or

implied, concerning the contents of this announcement, including

its accuracy, completeness or verification, or concerning any other

statement made or purported to be made by it, or on its behalf, in

connection with the Company, the Placing Shares or the Placing, and

nothing in this announcement is, or shall be relied upon as, a

promise or representation in this respect, whether as to the past

or future. finnCap accordingly disclaims, to the fullest extent

permitted by law, all and any responsibility and liability whether

arising in tort, contract or otherwise (save as referred to herein)

which it might otherwise have in respect of this announcement or

any such statement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEQKDDDBBKBQOB

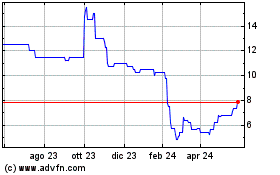

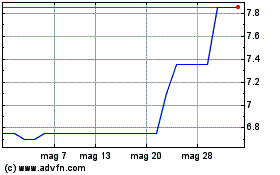

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024