TIDMHDD

RNS Number : 7751N

Hardide PLC

21 May 2015

21 May 2015

Hardide plc

("Hardide" or "the Group" or "the Company")

Interim Results

for the six months ended 31 March 2015

Key Points

Financial

-- Encouraging progress - supported by increased demand in H1

-- Revenue increased by 36% to GBP1.78m (H1 2014: GBP1.31m) - record six month high

-- Gross profit increased by 38% to GBP1.21m (H1 2014: GBP0.88m)

-- Operating loss reduced to GBP0.08m (H1 2014: loss of GBP0.19m)

-- EBITDA of GBP3,000 (H1 2014: EBITDA loss of GBP0.13m)

-- Strong balance sheet - cash at bank at 31 March 2015 of GBP3.25m

Operational

-- Programme to significantly expand capacity commenced:

- additional coating reactor in UK has increased capacity by almost 50%

- new manufacturing facility in North America under construction

-- Extension of major supply contract with General Electric Company Inc. ("GE")

- now three year contract to 2017 and extendable up to five years

-- Diversification of the customer base continues

-- Board expects continuing progress

Commenting on the interim results, Robert Goddard, Chairman of

Hardide plc, said:

"We are pleased to report encouraging first half results, with

revenues up 36% to GBP1.78m, a new record high for a six month

period. This reflects a rise in demand from existing customers as

well as new customer wins.

"Plans for the expansion of our coatings capacity are on track.

A third large reactor is now operational in our UK plant,

increasing capacity by almost 50%, and the opening of our new US

production facility is scheduled for late 2015. We are also pleased

to see the extension of our relationship with GE and continuing

good progress with test programmes for new customers, including

Airbus.

"We made a strong start to the second half. Looking ahead, and

as previously reported, we are cautious in the short term about the

potential impact of the fall in the oil price on demand from some

customers. Nonetheless, Hardide is moving forward positively on

many fronts and the Board remains confident about the longer-term

prospects for the business."

- Ends -

For further information:

Hardide plc

Philip Kirkham, CEO Tel: +44 (0) 1869 353

Jackie Robinson, Communications 830

Manager www.hardide.com

finnCap

Stuart Andrews / Grant Tel: +44 (0)20 7220

Bergman 0500

www.finncap.com

KTZ Communications

Katie Tzouliadis Tel: +44 (0)20 3178

6378

www.ktz.co.uk

Notes to editors:

Hardide develops, manufactures and applies advanced technology

tungsten-carbide coatings to a wide range of engineering

components. Its patented technology is unique in combining in one

material a mix of hardness and toughness together with resistance

to abrasion, erosion and corrosion; and with the ability to coat

accurately interior surfaces and complex geometries. The material

is proven to offer dramatic improvements in component life,

particularly when applied to components that operate in very

aggressive environments. This results in cost savings through

reduced downtime and increased operational efficiency. Customers

include leading companies operating in oil and gas exploration and

production, valve and pump manufacturing, nuclear, advanced

engineering and aerospace industries.

CHAIRMAN'S STATEMENT

Introduction

First half results for the six months to 31 March 2015 were very

encouraging, with sales up 36% to GBP1.78m, a new record high for a

six month period. These results reflect increased demand from

existing customers as well as new customer gains, assisted by the

continuing expansion of our product offering into new

applications.

Financial Results

Revenue for the six months increased by 36% to GBP1.78m (2014:

GBP1.31m). Gross profit rose by 38% to GBP1.21m (H1 2014:

GBP0.88m). As expected, after the refurbishment of the

pre-treatment line and the investment in business development and

marketing resource, the Group generated an operating loss of

GBP0.08m, which nonetheless represented a substantial improvement

on the same period last year (2014: loss of GBP0.19m). Earnings

before interest, tax, depreciation and amortisation ("EBITDA") was

GBP3,000, which included GBP0.08m of costs relating to the new US

production facility. This compared with an EBITDA loss of GBP0.13m

in the same period last year.

The balance sheet remains strong, with a cash balance of

GBP3.25m (FY 2014: GBP3.47m) despite much increased capital

expenditure of GBP0.37m (H1 2014: GBP0.10m).

Operational Overview

The Group made encouraging progress over several fronts in the

period. A particularly important development has been the expansion

of our coating capacity to support further sales growth in both the

UK and North America. In October 2014, we commissioned a third

large reactor at our UK manufacturing facility, increasing capacity

by almost 50%. As well as enabling us to increase production

volumes, this extra capacity is now available for our research and

development programme, which underpins our planned expansion into

new applications, as well as continuing innovation with existing

technologies. In January 2015, we began construction of a new

production facility in Martinsville, Virginia and this is on track

for production to commence towards the end of 2015. Two senior

employees have now been recruited to manage the plant and will

undergo training in the UK for several months in advance of its

opening.

Alongside the expansion of capacity, we continue to diversify

our customer base, both in terms of end user markets and geography.

Sales increased across the UK, Europe and North America. In North

America sales rose by 139% against the same period last year, with

volumes benefitting from our major supply agreement with GE. This

agreement, signed in February 2014, was extended by a further year

to three years in March 2015. As previously reported, under the

current terms, minimum total sales of c.$2.0million are guaranteed

over its three year term to February 2017 and the contract may be

extended up to five years. We continue to develop our newer

territories of Germany and Italy and have invested further in sales

and marketing. Customer trials there are progressing well.

Our research and development programme is supporting our

expansion into new markets, including civil aerospace, plastics

processing and injection moulding. As we have previously reported,

an important objective is to build our currently-modest position in

the aerospace sector and to this end we have recruited a

specialised Business Development Manager. Our progress towards the

global aerospace Nadcap accreditation continues and we expect to

apply for final certification under this scheme before the end of

2015.

Our coating qualification programme with Airbus is also

advancing well. Document preparation, approval and signature by

numerous individuals is a necessary although very time--consuming

part of this process. However, with an Airbus Industries Process

Specification (AIPS) now issued for a 'CVD-deposited tungsten

carbide coating', the programme is moving at a faster pace.

Development with AgustaWestland continues, although progress has

slipped due to delays in receiving test parts.

We continue to invest in raising market awareness of our

coatings technology and are implementing a comprehensive programme

including industry editorial, direct e-marketing, technical

presentations and selective exhibiting.

Board Appointment

At the beginning of March we were pleased to appoint Jan Ward to

the Board as a non-executive director. She is the founder and chief

executive of Corrotherm International, a supplier of specialist

metals for critical applications in the energy and aerospace

sectors and brings extensive relevant experience. Her understanding

of the high-technology engineering sector and connections in our

key markets further strengthens the Board. We thank William

Zakroff, whom Jan replaces, for his valuable contribution to

Hardide as non-executive director over many years.

Summary and Outlook

Hardide made very encouraging progress in the first half and has

had a good start to the second half of the year. While the dramatic

fall in the oil price had no marked impact on demand from our major

oil and gas service company customers in the first seven months of

the year, the Board takes a cautious view on likely demand in the

remaining months given reduced global oil and gas exploration and

drilling spending and the limited forward visibility from these

customers. In all other markets and areas of the oil and gas

industry, demand remains encouraging.

The Company's balance sheet is strong with a cash balance of

GBP3.25m. Despite the likely adverse effects on trading in H2 from

the low oil price, the Board expects further good progress to be

made on technical, customer and market developments during the

second half of the year.

Robert Goddard

Chairman

21 May 2015

Consolidated Statement of Comprehensive Income

For the period ended 31 March 2015

GBP 000 6 months 6 months Year to

to to

31 March 31 March 30 September

2015 2014 2014

(unaudited) (unaudited) (audited)

Revenue 1,777 1,311 3,030

Cost of Sales (564) (433) (944)

Gross profit 1,213 878 2,086

----------------------------- ------------- ------------- --------------

Administrative expenses (1,210) (1,011) (1,964)

Depreciation (78) (59) (121)

Exceptional items:

Impairment of fixed

assets - - 72

Provision for onerous

lease - - 103

Operating (loss)/

profit (75) (192) 176

----------------------------- ------------- ------------- --------------

Finance income 8 4 9

Finance costs (1) (48) (75)

Loss on ordinary activities

before tax (68) (236) 110

----------------------------- ------------- ------------- --------------

Tax (1) - 51

Loss on ordinary activities

after tax (69) (236) 161

----------------------------- ------------- ------------- --------------

Consolidated Statement of Changes in Equity

For the period ended 31 March 2015

GBP 000 6 months 6 months Year to

to to

31 March 31 March 30 September

2015 2014 (unaudited) 2014

(unaudited) (audited)

Total equity at start

of period 3,956 617 617

----------------------- ------------- ------------------- --------------

Profit / (loss) for

the period (69) (236) 161

Issue of new shares - 199 3,157

Exchange differences

on translation of

foreign operation (16) 8 (4)

Share options 15 13 25

Total equity at end

of period 3,886 601 3,956

----------------------- ------------- ------------------- --------------

Consolidated Statement of Financial Position

As at 31 March 2015

GBP 000 31 March 31 March 30 September

2015 2014 2014

(unaudited) (unaudited) (audited)

Assets

Non-current assets

Investments - - -

Goodwill 69 69 69

Intangible assets 4 2 5

Property, plant &

equipment 684 290 383

----------------------------- ------------- ------------- -------------

Total non-current

assets 757 361 457

----------------------------- ------------- ------------- -------------

Current assets

Inventories 67 32 50

Trade and other receivables 588 474 571

Other current financial

assets 98 96 199

Cash and cash equivalents 3,254 944 3,467

----------------------------- ------------- ------------- -------------

Total current assets 4,007 1,546 4,287

----------------------------- ------------- ------------- -------------

Total assets 4,764 1,907 4,744

----------------------------- ------------- ------------- -------------

Liabilities

Current liabilities

Trade and other payables 536 386 463

Financial liabilities 16 504 16

Provision for lease

obligation 144 84 132

----------------------------- ------------- ------------- -------------

Total current liabilities 696 974 611

----------------------------- ------------- ------------- -------------

Net current assets 3,311 572 3,676

----------------------------- ------------- ------------- -------------

Non-current liabilities

Financial liabilities 29 50 37

Provision for lease

obligation 153 282 140

----------------------------- ------------- ------------- -------------

Total non-current

liabilities 182 332 177

----------------------------- ------------- ------------- -------------

Total liabilities 878 1,306 788

----------------------------- ------------- ------------- -------------

Net assets 3,886 601 3,956

----------------------------- ------------- ------------- -------------

Equity attributable

to equity holders

of the parent

Share capital 3,041 2,777 3,041

Share premium 8,935 6,240 8,934

Retained earnings (7,576) (8,077) (7,507)

Share-based payment

reserve 142 288 127

Translation reserve (656) (627) (639)

----------------------------- ------------- ------------- -------------

Total equity 3,886 601 3,956

----------------------------- ------------- ------------- -------------

Consolidated Statement of Cash Flows

For the period ended 31 March 2015

GBP 000 6 months 6 months Year to

to to

31 March 31 March 30 September

2015 2014 2014

(unaudited) (unaudited) (audited)

Cash flows from operating

activities

Operating profit /

(loss) (75) (192) 176

Impairment of intangibles 1 0 1

Depreciation 77 59 120

Impairment of fixed

assets - - (72)

Share option charge 14 13 25

(Increase) / decrease

in inventories (17) 9 (9)

(Increase) / decrease

in receivables 28 (28) (175)

Increase / (decrease)

in payables 73 104 180

Increase / (decrease)

in provisions - - (104)

Cash generated from

operations 101 (35) 142

------------------------------- ------------- ------------- --------------

Finance income 8 4 9

Finance costs (1) (27) (51)

Tax received / (paid) 53 42 42

Net cash generated

from operating activities 161 (16) 142

------------------------------- ------------- ------------- --------------

Cash flows from investing

activities

Purchase of property,

plant, equipment (366) (104) (189)

Net cash used in investing

activities (366) (104) (189)

------------------------------- ------------- ------------- --------------

Cash flows from financing

activities

Net proceeds from

issue of ordinary

share capital - 200 3,158

Loans repaid - (232) (734)

Finance lease inception - 65 65

Finance lease repayment (8) (6) (12)

Net cash used in financing

activities (8) 27 2,477

------------------------------- ------------- ------------- --------------

Net increase / (decrease)

in cash and cash equivalents (213) (93) 2,430

------------------------------- ------------- ------------- --------------

Cash and cash equivalents

at the beginning of

the period 3,467 1,037 1,037

------------------------------- ------------- ------------- --------------

Cash and cash equivalents

at the end of the

period 3,254 944 3,467

------------------------------- ------------- ------------- --------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BGGDULXDBGUG

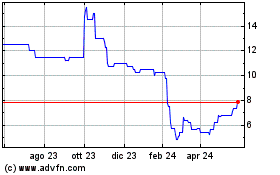

Grafico Azioni Hardide (LSE:HDD)

Storico

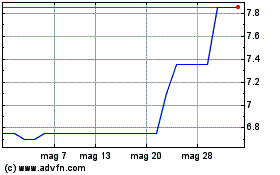

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024