TIDMHDD

RNS Number : 7718U

Hardide PLC

27 October 2017

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA, THE REPUBLIC OF IRELAND OR ANY OTHER JURISDICTION IN WHICH

SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

SHALL NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR THE SOLICITATION

OF AN OFFER TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY NEW

ORDINARY SHARES OF HARDIDE PLC IN ANY JURISDICTION IN WHICH ANY

SUCH OFFER, ISSUE OR SOLICITATION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

27 October 2017

Hardide plc

("Hardide" or the "Company")

Fundraising to raise GBP2.54 million

Hardide plc (AIM: HDD), the provider of advanced surface coating

technology, is pleased to announce that the Company has

conditionally raised a total of GBP2.54 million (before expenses)

via an oversubscribed fundraising (the "Fundraising") at a price of

1.7 pence per new ordinary shares of 0.1p each ("Ordinary

Shares").

The Fundraising will enable the Company to make a number of

capital investments in order to create capacity to take advantage

of the demand expected by management.

The Fundraising is taking place pursuant to existing authorities

established at the Company's last Annual General Meeting on 20

February 2017 and comprises two tranches, being (i) the "Initial

Fundraising" of the Placing and the Initial Subscription (each as

defined below) to raise a total of GBP1.72 million subject to

customary conditions including admission to trading on AIM of the

relevant new Ordinary Shares becoming effective, and (ii) the

"Deferred Fundraising" to raise GBP0.82 million, subject

principally to the Company having, within a period of five months,

received advance assurance from HM Revenue & Customs ("HMRC")

that this additional sum will be eligible for EIS and/or VCT tax

relief (the "Tax Clearance") as well as other customary

conditions.

Further information on the Fundraising, including its

conditionality, is set out below.

Highlights

-- The Fundraising comprises the Initial Fundraising to raise

GBP1.72 million and the Deferred Fundraising to raise GBP0.82

million, all at a price of 1.7 pence per new Ordinary Share;

-- Net proceeds of the Fundraising of approximately GBP2.45

million will be used primarily to:

o fund two additional reactors at the Company's US facility;

o enhance existing equipment at UK and US sites;

o increase sales and marketing resource; and

o strengthen the Company's balance sheet.

-- Management's expectation of future new business in US justifies additional capacity;

-- Benefits from first additional reactor expected in FY19;

-- Framework supply agreement signed with a major North American

international operator in the oil and gas sector;

-- Indications received from Martinsville-Henry County Economic

Development Corporation ("MCEDC") that it intends to advance a

US$240,000 loan in support of Hardide's expansion plans for its

Martinsville facility;

-- Financial results for the year ended 30 September 2017

expected to be in line with the Board's expectations and with a

cash balance of GBP1.21m as at that date; and

-- Hardide expects to release its results for the year ended 30

September 2017 on 11 December 2017.

Philip Kirkham, Chief Executive Officer of the Company,

commented:

"We are delighted to have received such strong support from

investors for this Fundraising. The new funding will principally

allow us to invest in up to two new reactors in the US which will,

when deployed, create the capacity required at the Company's

existing facilities to accommodate projected new business. We are

very mindful of ensuring that funds are deployed in a prudent

manner to match our expectations of forthcoming demand. The loan we

expect from MCEDC will further evidence support for the Company's

growth plans for the Martinsville facility and we thank them for

the support Hardide has received since opening the facility in

2016.

"We are excited by the recent progress made regarding two new

commercial agreements, one being a signed framework agreement with

a major international operator in the oil and gas sector. The

Company is also in the final stages of discussion with a well-known

manufacturer of drilling and production tools. These agreements

underpin existing market forecasts and the Board's belief in the

Company's further growth."

Enquiries:

Hardide plc Tel: +44 (0)

Robert Goddard, Non-Executive 1869 353830

Chairman

Philip Kirkham, CEO

Jackie Robinson, Communications

Manager

IFC Advisory Tel: +44 (0)

Graham Herring / Heather Armstrong 20 3053 8761

finnCap Tel: +44 (0)

Henrik Persson / James Thompson 20 7220 0500

/ Alex Price

FURTHER INFORMATION

Background to the Fundraising, current trading and financial

prospects

The Company expects to report preliminary year-end results in

line with current market expectations, having benefited from a

nascent recovery in the oil and gas market and from new business,

both in oil and gas and precision engineering. As announced in the

Company's interim results, the positive trends in underlying market

conditions seen in the first half of the financial year have

continued through into the full year.

Following approval by Airbus and Nadcap accreditation, the

prospects for additional aerospace business are encouraging. Well

under way are the development and trialling of safety--critical

parts for aerospace customers and this augurs well for future

sales.

Since the year-end, a three-year agreement has been signed with

a North American based, major international operator in the oil and

gas sector which sets out a framework for future orders for the

coating of downhole components. Technical work with this client

with a view to beginning production is progressing well. A further

agreement is being finalised with a manufacturer of land-based

drilling and production tools.

The first orders under these agreements are expected to be

received in early 2018 and combined, initial sales are expected to

be worth up to GBP1 million per annum with good potential for this

to grow. These two agreements underpin the management's

expectations for revenue growth in the financial years to September

2019 and 2020.

The US coatings facility in Virginia is performing well.

Management expects that the facility would, based on expected

orders and its existing reactors, likely require additional

capacity in the second half of the 2018 financial year.

The Company expects to release its preliminary results for the

year ended 30 September 2017 on 11 December 2017.

Use of proceeds

The Company intends to apply the net proceeds of the Initial

Fundraising, being approximately GBP1.63 million, to acquire a new

coating reactor to add to the existing two reactors at its US

facility in Martinsville at an expected cost of approximately

GBP0.6 million. This reactor will be ordered shortly following

completion of the Initial Fundraising, and is expected to be

operational by August 2018.

The Company subsequently intends to place an order for a second

reactor at a cost of approximately GBP0.85 million during the

course of 2018, aiming for that to be operational in the course of

2019, in line with the directors' anticipation of a continued

increase in demand. It is intended that this reactor will have

significantly greater volume than the Company's existing reactors,

enabling the coating of larger parts, as well as increasing

efficiency. At the same time the Company will expand the size of

its pre-treatment facility in order to accommodate these larger

parts at a cost of approximately GBP0.25 million. The Company is

excited by the new commercial opportunities that this will open

up.

The Company also intends to upgrade at least one more of its

current reactors in the UK to aerospace standards and to seek to

obtain aerospace accreditation for the US facility. This is in

preparation for and to create usable capacity to satisfy future

potential orders from aerospace companies in Europe and North

America.

In addition, the directors have identified certain other capital

projects intended to improve further the Company's operations.

These include investments in additional analytical equipment and

the upgrading of pre-treatment processes in the UK.

The remaining net proceeds of the Fundraising will be deployed

and used to invest further in the business development, general

working capital and the strengthening of the Company's balance

sheet.

MCEDC loan

The Company's US subsidiary has received a written indication

from MCEDC that it intends, subject to contract, to advance a

US$240,000 loan in support of the Company's expansion plans for its

Martinsville facility (the "Loan"). If made, the Loan will be

secured over assets and guaranteed by the Company and carry a

coupon of 2 per cent. per annum. The Loan and all interest due

thereon will be repayable in full on a monthly or quarterly basis

on or before the fifth anniversary of drawdown.

Details of the Placing, Subscription and the Placing

Agreement

The Company has received advance assurance from HMRC that the

new Ordinary Shares to be issued pursuant to the Initial

Fundraising will rank as 'eligible shares' for the purposes of EIS

and will be capable of being a 'qualifying holding' for the

purposes of investment by VCTs. The Company has committed to taking

all steps necessary to seek further advance assurance from HMRC

with respect to the new Ordinary Shares to be issued pursuant to

the Deferred Fundraising as soon as possible. Accordingly, the

Fundraising has been split between the Initial Fundraising, for

which such advance assurance has already been received, and the

Deferred Fundraising.

Investors should note that whilst the Company has no reason to

consider that the Tax Clearance will not be received for the

Deferred Fundraising, there can be no assurance in that regard at

this time and therefore the Company cannot guarantee that the

Deferred Fundraising will proceed.

The Placing

Under the terms of the Placing, 86,235,294 new Ordinary Shares

(the "Placing Shares") have been conditionally placed by finnCap on

behalf of the Company.

The Placing is conditional, inter alia, upon:

i. admission ("Admission") of the new Ordinary Shares relating

to the Initial Fundraising to trading on AIM becoming effective by

not later than 8:00 am on 1 November 2017 (or such later time and

date as the Company and finnCap may agree, not being later than

8.00 a.m. on 30 November 2017);

ii. the Initial Fundraising proceeding; and

iii. the Placing Agreement, described below, becoming

unconditional in all respects (save for Admission) and not having

been terminated.

When issued and fully paid, the Placing Shares will rank in full

for any dividend or other distribution declared, made or paid after

Admission and otherwise equally in all respects with the existing

Ordinary Shares.

The Placing Agreement

i. Pursuant to the terms of a placing agreement between the

Company and finnCap (the "Placing Agreement") finnCap, as agent for

the Company, has agreed to use its reasonable endeavours to procure

placees for the Placing Shares at the Placing Price.

ii. The Placing Agreement contains warranties from the Company

in favour of finnCap in relation to, inter alia, the accuracy of

the information contained in the documents relating to the Placing

and certain other matters relating to the Company and its business.

In addition, the Company has agreed to indemnify finnCap in

relation to certain customary liabilities that it may incur in

respect of the Placing.

The obligations of finnCap under the Placing Agreement in

respect of the Placing are conditional upon, amongst other things,

Admission becoming effective on or before 8.00 a.m. on 1 November

2017 (or such later date as the Company and finnCap may agree, but

not later than 8.00 a.m. on 30 November 2017), and there being

prior to Admission no material breach of the warranties given to

finnCap.

finnCap may terminate the Placing Agreement in specified

circumstances (including for breach of warranty at any time prior

to Admission, if such breach is reasonably considered by finnCap to

be material in the context of the Placing) and on the occurrence of

a force majeure event at any time prior to Admission. If the

conditions to the Placing Agreement which apply to the Placing as a

whole are not fulfilled on or before the relevant date in the

Placing Agreement, subscription monies will be returned to placees

without interest as soon as possible thereafter.

In consideration for the services to be provided to the Company

by finnCap in connection with Admission and the Placing, the

Company has agreed to pay finnCap a corporate broking fee and

certain other costs and expenses incidental to Admission and/or the

Placing.

The Subscription

The Company has also raised up to a further GBP1.07 million

before expenses by way of a subscription for 62,999,998 new

Ordinary Shares (the "Subscription Shares") at the Placing Price by

various individuals, including Robert Goddard, Andrew Boyce, Jan

Ward and Philip Kirkham, each being directors of the Company (the

"Subscribers"). Of this amount, receipt of a total of GBP0.82

million (being the Deferred Subscription and in respect of the

issue of 48,294,117 new Ordinary Shares) is subject to the Company

receiving the Tax Clearance. Accordingly, the issue of 14,705,881

new Ordinary Shares will make up the Initial Subscription.

The Company has committed to seeking the Tax Clearance as soon

as possible and within 5 months of the date of the Initial

Fundraising. If the Tax Clearance is not received by such date (or

such longer period as the Company may agree with any subscriber in

relation to his/her subscription) the Deferred Fundraising will not

proceed.

Each of the Subscribers has agreed with the Company to subscribe

for that number of Subscription Shares set out in his or her

subscription letter (each a "Subscription Letter"). None of the

Subscription Letters is conditional on any other Subscription

Letter.

When issued and fully paid the Subscription Shares will rank in

full for any dividend or other distribution declared, made or paid

after Admission and otherwise equally in all respects with the

existing Ordinary Shares.

Application for Admission and Total Voting Rights

Application has been made to the London Stock Exchange for the

100,941,175 new Ordinary Shares relating to the Initial Fundraising

to be admitted to trading on AIM and it is anticipated that trading

in these new Ordinary Shares will commence on AIM at 8.00 a.m. on 1

November 2017.

In accordance with the UK Financial Conduct Authority's

Disclosure and Transparency Rule 5.6.1, immediately following

completion of the Initial Fundraising, the issued share capital of

the Company will be 1,635,899,479 Ordinary Shares ("Initial

Enlarged Share Capital").

The total number of voting rights in the Company will therefore

be 1,635,899,479 which may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure and

Transparency Rules.

A separate application for admission to trading on AIM of the

new Ordinary Shares relating to the Deferred Fundraising will be

made in due course and the Company will make a notification of the

resultant total voting rights at that time.

Related Party Transactions

Hargreave Hale Ltd ("Hargreave Hale") has agreed to subscribe

for 12,444,445 Placing Shares as part of the Placing and 13,588,235

Subscription Shares as part of the Deferred Fundraising. Hargreave

Hale is a related party of the Company for the purposes of the AIM

Rules by virtue of its status as a substantial shareholder of the

Company.

The directors consider having consulted with the Company's

nominated adviser, finnCap, that the terms upon which Hargreave

Hale has participated in the Placing are fair and reasonable

insofar as the Company's shareholders are concerned.

Robert Goddard, Andrew Boyce, Jan Ward and Philip Kirkham have

each agreed to subscribe for 588,235 new Ordinary Shares

respectively as part of the Initial Fundraising. Each of them is

also a related party of the Company for the purposes of the AIM

Rules by virtue of their status as directors of the Company. The

consequent holdings of these directors is set out below:

Current Consequent Consequent shareholding

shareholding shareholding as %age of the

Initial Enlarged

Share Capital

---------- -------------- -------------- ------------------------

Robert

Goddard 6,723,050 7,311,285 0.45%

---------- -------------- -------------- ------------------------

Andrew

Boyce* 266,546,226 267,134,461 16.33%

---------- -------------- -------------- ------------------------

Jan Ward 1,250,000 1,838,235 0.11%

---------- -------------- -------------- ------------------------

Philip

Kirkham 2,004,717 2,592,952 0.16%

---------- -------------- -------------- ------------------------

* aggregate of Andrew Boyce' family and trust

holdings

--------------------------------------------------------------------

Peter Davenport and Yuri Zhuk, being independent directors of

the Company for this purpose, consider, having consulted with the

Company's nominated adviser, finnCap, that the terms upon which

those directors have participated in the Fundraising are fair and

reasonable insofar as the Company's shareholders are concerned.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1. Details of the person discharging managerial

responsibilities / person closely associated

--- ----------------------------------------------------------------

a) Name Robert Goddard

--- ------------------------------- -------------------------------

2. Reason for the Notification

--- ----------------------------------------------------------------

a) Position/status Chairman

--- ------------------------------- -------------------------------

b) Initial notification/Amendment Initial Notification

--- ------------------------------- -------------------------------

3. Details of the issuer, emission allowance

market participant, auction platform, auctioneer

or auction monitor

--- ----------------------------------------------------------------

a) Name Hardide plc

--- ------------------------------- -------------------------------

b) LEI 213800HLAUIIFKMU5G89

--- ------------------------------- -------------------------------

4. Details of the transaction(s): section to

be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

--- ----------------------------------------------------------------

a) Description of Subscription for ordinary

the Financial shares of 0.1p each

instrument, type

of instrument

---

Identification GB00B069T034

code

--- ------------------------------- -------------------------------

b) Nature of the Subscription of shares

transaction

--- ------------------------------- -------------------------------

c) Price(s) and Price(s) Volume(s)

volume(s) ----------- ----------

1.7 pence 588,235

----------- ----------

--- ------------------------------- -------------------------------

d) Aggregated information:

* Aggregated volume 588,235 ordinary shares of

0.1 each subscribed for at

1.7 pence per ordinary share

* Price

--- ------------------------------- -------------------------------

e) Date of the transaction 26 October 2017

--- ------------------------------- -------------------------------

f) Place of the London Stock Exchange, AIM

transaction Market

--- ------------------------------- -------------------------------

1. Details of the person discharging managerial

responsibilities / person closely associated

--- ----------------------------------------------------------------

a) Name Andrew Boyce

--- ------------------------------- -------------------------------

2. Reason for the Notification

--- ----------------------------------------------------------------

a) Position/status Non-Executive Director

--- ------------------------------- -------------------------------

b) Initial notification/Amendment Initial Notification

--- ------------------------------- -------------------------------

3. Details of the issuer, emission allowance

market participant, auction platform, auctioneer

or auction monitor

--- ----------------------------------------------------------------

a) Name Hardide plc

--- ------------------------------- -------------------------------

b) LEI 213800HLAUIIFKMU5G89

--- ------------------------------- -------------------------------

4. Details of the transaction(s): section to

be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

--- ----------------------------------------------------------------

a) Description of Subscription for ordinary

the Financial shares of 0.1p each

instrument, type

of instrument

---

Identification GB00B069T034

code

--- ------------------------------- -------------------------------

b) Nature of the Subscription of shares

transaction

--- ------------------------------- -------------------------------

c) Price(s) and Price(s) Volume(s)

volume(s) ----------- ----------

1.7 pence 588,235

----------- ----------

--- ------------------------------- -------------------------------

d) Aggregated information:

* Aggregated volume 588,235 ordinary shares of

0.1 each subscribed for at

1.7 pence per ordinary share

* Price

--- ------------------------------- -------------------------------

e) Date of the transaction 26 October 2017

--- ------------------------------- -------------------------------

f) Place of the London Stock Exchange, AIM

transaction Market

--- ------------------------------- -------------------------------

1. Details of the person discharging managerial

responsibilities / person closely associated

--- ----------------------------------------------------------------

a) Name Jan Ward

--- ------------------------------- -------------------------------

2. Reason for the Notification

--- ----------------------------------------------------------------

a) Position/status Non-Executive Director

--- ------------------------------- -------------------------------

b) Initial notification/Amendment Initial Notification

--- ------------------------------- -------------------------------

3. Details of the issuer, emission allowance

market participant, auction platform, auctioneer

or auction monitor

--- ----------------------------------------------------------------

a) Name Hardide plc

--- ------------------------------- -------------------------------

b) LEI 213800HLAUIIFKMU5G89

--- ------------------------------- -------------------------------

4. Details of the transaction(s): section to

be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

--- ----------------------------------------------------------------

a) Description of Subscription for ordinary

the Financial shares of 0.1p each

instrument, type

of instrument

---

Identification GB00B069T034

code

--- ------------------------------- -------------------------------

b) Nature of the Subscription of shares

transaction

--- ------------------------------- -------------------------------

c) Price(s) and Price(s) Volume(s)

volume(s) ----------- ----------

1.7 pence 588,235

----------- ----------

--- ------------------------------- -------------------------------

d) Aggregated information:

* Aggregated volume 588,235 ordinary shares of

0.1 each subscribed for at

1.7 pence per ordinary share

* Price

--- ------------------------------- -------------------------------

e) Date of the transaction 26 October 2017

--- ------------------------------- -------------------------------

f) Place of the London Stock Exchange, AIM

transaction Market

--- ------------------------------- -------------------------------

1. Details of the person discharging managerial

responsibilities / person closely associated

--- ----------------------------------------------------------------

a) Name Philip Kirkham

--- ------------------------------- -------------------------------

2. Reason for the Notification

--- ----------------------------------------------------------------

a) Position/status Chief Executive Officer

--- ------------------------------- -------------------------------

b) Initial notification/Amendment Initial Notification

--- ------------------------------- -------------------------------

3. Details of the issuer, emission allowance

market participant, auction platform, auctioneer

or auction monitor

--- ----------------------------------------------------------------

a) Name Hardide plc

--- ------------------------------- -------------------------------

b) LEI 213800HLAUIIFKMU5G89

--- ------------------------------- -------------------------------

4. Details of the transaction(s): section to

be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

--- ----------------------------------------------------------------

a) Description of Subscription for ordinary

the Financial shares of 0.1p each

instrument, type

of instrument

---

Identification GB00B069T034

code

--- ------------------------------- -------------------------------

b) Nature of the Subscription of shares

transaction

--- ------------------------------- -------------------------------

c) Price(s) and Price(s) Volume(s)

volume(s) ----------- ----------

1.7 pence 588,235

----------- ----------

--- ------------------------------- -------------------------------

d) Aggregated information:

* Aggregated volume 588,235 ordinary shares of

0.1 each subscribed for at

1.7 pence per ordinary share

* Price

--- ------------------------------- -------------------------------

e) Date of the transaction 26 October 2017

--- ------------------------------- -------------------------------

f) Place of the London Stock Exchange, AIM

transaction Market

--- ------------------------------- -------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEOKADBOBDDDKB

(END) Dow Jones Newswires

October 27, 2017 02:00 ET (06:00 GMT)

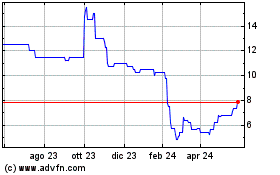

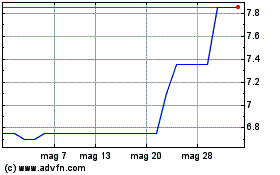

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024