RNS No 6879x

HODDER HEADLINE PLC

24 May 1999

Part 1

Not for release, distribution or publication

in or into the USA, Canada, Australia or Japan

WH Smith Group PLC ("WH Smith")

Recommended cash offer for Hodder Headline PLC ("Hodder Headline")

WH Smith today (24 May 1999) announced a recommended cash offer for Hodder

Headline, a leading UK consumer and educational publisher.

The Offer values each Hodder Headline Share at 525p payable in cash and there

is a Loan Note Alternative. The Offer represents a premium of 43 per cent.

to the Hodder Headline share price of 367.5p at the close of business on 21

May 1999, the last dealing day prior to this announcement, and values Hodder

Headline's issued ordinary share capital at #185 million.

Hodder Headline has an 8.5 per cent. market share in UK consumer publishing

and 6.4 per cent. of the total UK market. It is currently the third largest

UK consumer publisher and the second largest UK mass-market paperback

publisher. Hodder Headline also operates in the educational publishing

market producing textbook series, as well as home learning guides including

the world famous "Teach Yourself" brand.

Hodder Headline has produced compound annual growth in profit before tax of

19 per cent. over the past three years. In the year ended 31 December 1998,

Hodder Headline increased sales by 10 per cent. to #102 million and generated

profit on ordinary activities before taxation of #9.4 million, an increase of

15 per cent. In the first four months of 1999, Hodder Headline achieved

turnover growth of 9.4 per cent. At the end of April, unaudited results

indicated that Hodder Headline's trading continued to move ahead of internal

expectations. Performance in the second half of the year will be helped by

the strength of publishing lists for that period.

Reasons for the Offer

The management of WH Smith believes that the future of the Company will be in

strengthening and leveraging the WHSmith brand by creating and providing core

products to meet its customer needs. Ownership and control of product and of

the gateways to the consumer will enable WH Smith to achieve increased

competitive advantage through differentiation of its customer offer and

reduced reliance on commodity product.

Investing in and developing the best and most innovative publishing and other

content provision will be key to WH Smith's future. By acquiring one of

Britain's largest and most successful book publishers, with a strong position

in both consumer and educational publishing, WH Smith is taking an important

step in that direction.

This acquisition is expected to achieve the following benefits:

1. A high quality management team to manage and develop further WH Smith's

important objectives in the fields of education, reference and consumer

publishing;

2. The addition to the Group of a successful, innovative and growing

publishing business in its own right;

3. The capacity to strengthen and accelerate WH Smith's own brand

development programme, with an emphasis on educational, reference and

children's product;

4. Provide additional creative capability and product content for

developing online' products;

5. Ownership of a number of widely respected publishing imprints including:

Hodder & Stoughton, Sceptre, Coronet, New English Library, Flame, Lir,

Headline, Review, Hodder Children's Books, Hodder Headline Audiobooks,

Arnold, Hodder & Stoughton Educational and Teach Yourself;

6. Opportunities to enhance and support Hodder Headline's consumer

publishing business in a number of positive ways including the provision

of market research information and direct access to WH Smith's club card

holders and online customers;

7. Opportunities for significant supply chain and related cost savings; and

8. A new revenue stream for the future growth of the Group.

Hodder Headline will operate as a separate business with Tim Hely Hutchinson

as its Chief Executive and Richard Handover as its Chairman. WH Smith will

apply its financial control systems, while Hodder Headline will maintain high

levels of operating autonomy including having independent publishing

divisions.

Hodder Headline will continue in its policy of striving for excellence and

seeking to offer its authors and customers unrivalled editorial, marketing

and distribution expertise.

Management

WH Smith attaches considerable importance to retaining the skills and

expertise of the management and employees of the Hodder Headline Group. The

Hodder Headline executive directors have confirmed that they intend to remain

with the business. Tim Hely Hutchinson will be joining the main board and

executive committee of WH Smith, reporting directly to Richard Handover.

Financial effects

The management of the two companies have identified annualised cost savings

of at least #2 million, including the elimination of duplicated supply chain

and related costs and the elimination of the expenses of maintaining a

separately listed company.

It is expected that the acquisition will be earnings positive before the

future trading benefits that will arise (note 2). The Board of WH Smith is

confident that the acquisition will enhance the value of the Group.

Commenting on the offer, Richard Handover, Group Chief Executive of WH Smith,

said:

"Hodder Headline is an excellent company with a first class management team

and a superb range of authors and titles. We have a lot of confidence in its

future. This transaction will strengthen both WH Smith and Hodder Headline.

"Our main retailing businesses are being driven forward vigorously. Hodder

Headline gives us the opportunity to accelerate this by allowing us to

develop and offer our customers more differentiated products and market them

more creatively both through the WHSmith retailing stores and our on-line

capability.

"For us, the transaction is a step in securing the position of WH Smith for

the long term. We appreciate that it is a major change. Successfully

establishing the future of WH Smith is about our continuing ability to drive

change."

Tim Hely Hutchinson, Group Chief Executive of Hodder Headline, said:

"My Board colleagues and I are delighted to be able to recommend this offer to

our shareholders.

"By joining the WH Smith Group, with its substantial resources, we have

established a way forward for the Company which will give us the opportunity

to develop as a leading international publisher of consumer and educational

titles. Hodder Headline will be able to join forces with WH Smith to operate

in the fast-developing area of electronic publishing and online selling of

books to consumers."

24 May 1999

_____________________________________________________________________________

PRESS ENQUIRIES

WH Smith 0171 514 9622/3/4

Richard Handover, Group Chief Executive

Keith Hamill, Finance Director

Tim Blythe, Corporate Affairs Director

Schroders 0171 658 6000

Robert Swannell

Cazenove 0171 588 2828

David Mayhew

Brunswick 0171 404 5959

Alan Parker

Hodder Headline 0171 873 6000

Tim Hely Hutchinson, Group Chief Executive

Rothschild 0171 280 5000

Tim Hancock

Brunswick 0171 404 5959

John Sunnucks

A presentation to analysts will take place this morning at 10.15 a.m. at The

Brewery, Chiswell Street, London EC2.

Notes

1. The full text of the conditions and certain further terms of the Offer

form part of, and should be read with, this announcement.

2. This statement is not intended to be a profit forecast for WH Smith and

should not be interpreted to mean that future earnings per share of WH

Smith following the Offer will necessarily be greater than the historic

published earnings per share of WH Smith. It is currently anticipated

that the quality of Hodder Headline's assets will result in annual

impairment test goodwill writedowns, if any, under FRS 10 not being

significant.

The Offer, including the Loan Note Alternative, will not be made, directly or

indirectly, in or into, or by use of the mails or any other means or

instrumentality (including, without limitation, facsimile transmission, telex

or telephone) of interstate or foreign commerce of, or any facilities of a

national securities exchange of, the USA, Canada, Australia or Japan and will

not be capable of acceptance by any such use, means, instrumentality or

facilities or from within the USA, Canada, Australia or Japan. Accordingly,

copies of this announcement are not being, and must not be, mailed or

otherwise distributed or sent in or into or from the USA, Canada, Australia

or Japan.

Schroders, which is regulated by The Securities and Futures Authority

Limited, is acting for WH Smith and no one else in connection with the Offer

and will not be responsible to anyone other than WH Smith for providing the

protections afforded to the customers of Schroders or for providing advice in

relation to the Offer or any matter referred to herein or in the Offer

Document.

Rothschild, which is regulated by The Securities and Futures Authority

Limited, is acting for Hodder Headline and no one else in connection with the

Offer and will not be responsible to anyone other than Hodder Headline for

providing the protections afforded to the customers of Rothschild or for

providing advice in relation to the Offer or any matter referred to herein or

in the Offer Document.

Not for release, distribution or publication

in or into the USA, Canada, Australia or Japan

WH Smith Group PLC ("WH Smith")

Recommended cash offer for Hodder Headline PLC ("Hodder Headline")

1. The Offer

WH Smith and Hodder Headline have agreed terms for a recommended cash offer

to be made by Schroders on behalf of WH Smith for the entire issued and to be

issued share capital of Hodder Headline.

The Offer values each Hodder Headline Share at 525p payable in cash and there

is a Loan Note Alternative. The Offer represents a premium of 43 per cent.

to the Hodder Headline share price of 367.5p at the close of business on 21

May 1999, the last dealing day prior to this announcement, and values Hodder

Headline's issued ordinary share capital at #185 million.

The Board of Hodder Headline, which has been so advised by Rothschild,

considers the terms of the Offer to be fair and reasonable and in the best

interests of Hodder Headline Shareholders as a whole and unanimously

recommends Hodder Headline Shareholders to accept the Offer. In providing

advice to the Board of Hodder Headline, Rothschild has taken into account the

Hodder Headline Directors' commercial assessments.

WH Smith has received binding irrevocable undertakings to accept the Offer

from those Hodder Headline Directors holding (or whose immediate family

members hold) Hodder Headline Shares representing, in aggregate, 2.8 per

cent. of Hodder Headline's issued share capital.

WH Smith attaches considerable importance to retaining the skills and

expertise of the management and employees of the Hodder Headline Group. The

Hodder Headline executive directors have confirmed that they intend to remain

with the business. Tim Hely Hutchinson will be joining the main board and

executive committee of WH Smith, reporting directly to Richard Handover.

Cazenove & Co. are acting as brokers to the Offer.

Appendix II contains the definitions used in this announcement.

2. Terms of the Offer

(a) The Offer

The Offer will be made on the following basis:

for each Hodder Headline Share 525p in cash

The Offer represents a premium of 43 per cent. to the Hodder Headline share

price of 367.5p at the close of business on 21 May 1999, the last dealing day

prior to this announcement, and values Hodder Headline's issued ordinary

share capital at approximately #185 million.

(b) The Loan Note Alternative

A Hodder Headline Shareholder who validly accepts the Offer may elect to

receive Loan Notes instead of some or all of the cash consideration to which

he would otherwise be entitled under the basic terms of the Offer on the

following basis:

for every #1 of cash consideration #1 nominal of Loan Notes

The principal terms of the Loan Notes are set out in Part C of Appendix I.

3. Background to the Offer

In October 1997, WH Smith set out a strategy of focusing on the WHSmith

business and core products. This strategy involved the disposal of

diversified retailing businesses including Waterstones, Virgin Our Price and

The Wall, which were sold for proceeds of #465 million. The Company has

subsequently returned capital of #191 million to its shareholders. In the 12

months ended 31 August 1998, WH Smith achieved an 8 per cent. increase in

retailing sales, record profit on ordinary activities of #142 million and 15

per cent. growth in earnings per share.

In May 1998, in order to significantly strengthen its core retailing

activities, WH Smith acquired the John Menzies retail chain, which had sales

in the year ended 30 April 1998 of #280 million, for #70 million.

In July 1998, WH Smith acquired The Internet Bookshop for approximately #10

million. This represented an important step in developing new routes to

market. Subsequently, in January 1999, WH Smith acquired Helicon for

approximately #6 million. Helicon is a specialist publisher of consumer and

educational reference material in the UK, including the Hutchinson

Encyclopedia. Helicon has also developed leading technology in converting

reference and educational material into digital form for use in on-line

applications.

WH Smith has also been developing the next stages of its online activities.

In April 1999, it announced the launch of WHSmith Online, a service offering

a living library of educational and entertainment material, a virtual

shopping mall of retail activities and free access to the Internet. In

addition, WH Smith also announced in April 1999 that it had reached an

agreement with British Interactive Broadcasting to sell core products through

"Open", an interactive digital TV service.

4. Information on the WH Smith Group

In the 12 months ended 31 August 1998, WH Smith reported profits before tax

and exceptional items of #142 million (1997: #129 million) and sales from

continuing operations of #2,095 million (1997: #2,021 million). Earnings per

share before exceptional items were 35.5p (1997: 31.0p).

The results for the six months to 28 February 1999 were sales of #1,276

million, profit before tax of #105 million and earnings per share of 30.1p.

Since the announcement of its results for the six months to 28 February 1999,

there has been no material change in the financial or trading position of WH

Smith.

WH Smith's UK market shares are approximately 17.5 per cent. for books, over

20 per cent. for retail stationery and 18 per cent. for magazines. It also

has approximately a 12 per cent. share of the UK video market and an 8 per

cent. share of the UK music market.

The business of WH Smith consists of:

WHSmith High Street

WHSmith High Street operates 546 stores with 3.0 million square feet of sales

space. In the 12 months ended 31 August 1998, the base business generated

sales of #840 million (up 5 per cent. like for like) and profits of #51

million.

Stores acquired as part of the acquisition of John Menzies Retail achieved

sales of #188 million and profits of #3 million on a pro forma basis for the

12 months ended 31 August 1998.

WHSmith Europe Travel Retail

WHSmith Europe Travel Retail operates 184 stores, mainly in airports and

railway stations in the UK, with 195,000 square feet of selling space. In

the 12 months ended 31 August 1998, the base business generated sales of #147

million (up 11 per cent. like for like) and profits of #8 million.

Stores acquired as part of the acquisition of John Menzies Retail achieved

sales of #88 million and profits of #2 million on a pro forma basis for the

12 months ended 31 August 1998.

WHSmith USA Travel Retail

The business operates 416 stores in the USA within airports and hotels, with

445,000 square feet of selling space. In the 12 months ended 31 August 1998,

it generated sales of #171 million and profits of #9 million.

WHSmith News Distribution

This business is the UK's leading wholesaler of magazines and newspapers,

operating from 53 depots throughout England and Wales. In the 12 months

ended 31 August 1998, it generated sales of #1,025 million (including sales

to WHSmith retail businesses of #92 million) and profits of #45 million.

WHSmith Direct

On 18 May 1999, WH Smith announced that it had created a new business

division, WHSmith Direct. The division includes WHSmith Online, The Internet

Bookshop and Helicon Publishing as well as the Company's interests in digital

interactive TV through the new British Interactive Broadcasting venture,

"Open".

5. Information on Hodder Headline

Headline Book Publishing was formed in 1986 and was floated in 1991. Hodder

Headline was created following the merger with Hodder & Stoughton in 1993.

Hodder & Stoughton has been established for 130 years and publishes in most of

the key publishing categories. In 1995, Hodder Headline was instrumental in

the campaign to abolish the Net Book Agreement which resulted in a more

dynamic market for book retailing in the UK.

For the year ended 31 December 1998, Hodder Headline reported profit before

interest and taxation of #10 million on turnover of #102 million. As at 31

December 1998, Hodder Headline had net assets of #39 million. Hodder Headline

has produced compound annual growth in profit before tax of 19 per cent. over

the past three years.

Hodder Headline has an 8.5 per cent. market share in UK consumer publishing

and 6.4 per cent. of the total UK market. It is currently the third largest

UK consumer publisher and the second largest UK mass-market paperback

publisher. Hodder Headline also operates in the educational publishing market

producing textbook series, as well as home learning guides including the world

famous "Teach Yourself" brand. Hodder Headline has 37,000 titles under

contract and 13,000 live titles.

The Group operates in three main divisions:

1 UK Consumer Publishing, which generated sales of #63.2 million and

profits of #7.4 million for the 12 months ended 31 December 1998. It

consists principally of:

* Headline Book Publishing;

* Hodder & Stoughton General Publishing;

* Hodder Children's Books; and

* Hodder & Stoughton Religious Publishing.

Important fiction authors include John le Carre, Tom Clancy, Martina

Cole, Josephine Cox, Elizabeth George, Stephen King, Cathy Kelly, Dean

Koontz, James Patterson and Rosamunde Pilcher. Important non-fiction

authors include Dickie Bird, Richard Carlson, Alex Ferguson, Malcolm

Gluck, Sophie Grigson, Ken Hom and Gary Rhodes. Brands include the

Rothmans Football Yearbook and the Playfair Cricket Annual.

Children's authors and projects include the recent Whitbread winner David

Almond, Enid Blyton (Famous Five and Secret Seven series), Lucy Daniels

(Animal Ark Series), Mick Inkpen and the Hodder Home Learning Series.

Religious publishing includes the best selling modern translation of the

Bible, the New International Version.

2 UK Educational, Academic & Professional Publishing, which generated

sales of #22.2 million and profits of #2.7 million for the 12 months

ended 31 December 1998.

Hodder Headline's UK Educational, Academic & Professional publishing

business is the second largest part of the Group, generating high margins

and strong backlist sales. The main divisions are Hodder & Stoughton

Educational and Arnold. The former publishes books, software and other

materials mainly for secondary schools, colleges of Further and Higher

Education and home learning, covering a broad range of subjects. The

majority of the home learning books are published under the world famous

"Teach Yourself" brand. Arnold publishes textbooks, reference books and

journals for professionals and college and university students, mainly in

the fields of Medicine and Health Sciences, the Humanities and Applied

Science and Technology.

3 Overseas Operations, which generated sales of #14.9 million for the 12

months ended 31 December 1998. Hodder Headline's overseas companies

operate with the dual aim of maximising sales of the UK-originated

publishing and creating their own successful local publishing lists.

The principal overseas companies are Hodder Headline Australia, Hodder

Moa Beckett (New Zealand) and Hodder & Stoughton Educational Southern

Africa. Hodder Headline Australia's publishing emphasises practical

consumer non-fiction and children's books mostly for Australia and New

Zealand. Hodder Moa Beckett specialises in sporting and practical non-

fiction, for New Zealand and international markets, and has important

joint publishing arrangements with the internationally renowned

photographer Anne Geddes and the Automobile Association of New Zealand.

Hodder & Stoughton Educational Southern Africa publishes textbooks and

readers for primary and secondary schools mainly in South Africa,

Namibia and Botswana.

Current trading and prospects

At Hodder Headline's Annual General Meeting on 5 May 1999, Tim Hely

Hutchinson, Group Chief Executive, made the following comments on current

trading:

"We are pleased to report that sales in the first four months of the year

have been strong, reflecting our strategy of acquiring and developing high

potential titles and series and backing them with high profile marketing

campaigns. All publishing segments, in the UK and overseas, have made good

progress.

"We have put 18 titles onto The Sunday Times bestseller lists in the first

four months, 9 of which are titles by authors new to our lists. Bestsellers

that have made significant contributions include Single & Single by John le

Carre, Tomorrow the World by Josephine Cox, She's the One by Cathy Kelly, The

Girl Who Loved Tom Gordon by Stephen King and My Legendary Girlfriend by Mike

Gayle.

"We are encouraged by the Government's renewed commitment to literacy and

reading books. Our Hodder & Stoughton Educational division has gained

further market share in the first quarter of 1999 in a better funded

environment.

"Our publishing lists are very strong for the second half of the year. Major

titles include a new collection of stories by Stephen King, Hearts in

Atlantis, and new hardback novels from top bestselling authors such as In

Pursuit of the Proper Sinner by Elizabeth George and Somewhere, Someday by

Josephine Cox. High potential paperbacks include two new Net Force titles by

Tom Clancy, When the Wind Blows by James Patterson and Seize the Night by

Dean Koontz. Non-fiction titles being well supported by booksellers for

later in the year include Dickie Bird's second book White Cap and Bails and

the long-awaited Alex Ferguson autobiography, Managing My Life. There are

also powerful new ranges from our educational, academic, children's,

religious and overseas operations.

"The Board remains confident that 1999 will be another year of good progress

for the Group."

In the first four months of 1999, Hodder Headline achieved turnover growth of

9.4 per cent. At the end of April, unaudited results indicated that Hodder

Headline's trading continued to move ahead of internal expectations.

Performance in the second half of the year will be helped by the strength of

publishing lists for that period.

6. Management and employees

WH Smith attaches considerable importance to retaining the skills and

expertise of the management and employees of the Hodder Headline Group. The

Hodder Headline executive directors, comprising Tim Hely Hutchinson (Group

Chief Executive), Mark Opzoomer (Deputy Chief Executive), Richard Adam (Group

Finance Director), Amanda Ridout (Managing director of Headline), Martin

Neild (Managing director of Hodder & Stoughton General Publishing), Sue

Fletcher (Deputy managing director of Hodder & Stoughton General Publishing),

Mary Tapissier (Managing director of Hodder Children's Books), Philip Walters

(Managing director of Hodder & Stoughton Educational), Richard Stileman

(Managing director of Arnold) and Malcolm Edwards (Managing director of

Hodder Headline Australia), intend to remain with the business.

Tim Hely Hutchinson will be joining the main board and executive committee of

WH Smith, reporting directly to Richard Handover.

The Board of Hodder Headline believes that opportunities for employees at all

levels will be enhanced as a result of joining the WH Smith Group, which has

confirmed that existing terms and conditions, including pension rights, will

be fully safeguarded.

7. Management of Hodder Headline following the acquisition

Hodder Headline will continue to be run by its existing management, retaining

its name and range of imprints. Hodder Headline will operate as a separate

business with Tim Hely Hutchinson as its Chief Executive and Richard Handover

as its Chairman. WH Smith will apply its financial control systems while

Hodder Headline will maintain high levels of operating autonomy including its

independent publishing divisions. The business will continue to operate from

its existing premises.

Hodder Headline will pursue its current policy of striving for excellence in

every department and especially of seeking to offer its authors and customers

unrivalled editorial, marketing and distribution expertise. Hodder Headline

will develop its business with WH Smith in such a way as not to disadvantage

its other customers. By means of Hodder Headline joining the WH Smith Group,

the management of Hodder Headline has established a way forward for the

company that will give it the opportunity to develop as a leading

international publisher of both consumer and educational books, and will

provide it with an opportunity to play a central role in the fast-developing

areas of electronic publishing and online selling of books to consumers.

8. Further details of the Offer

The Hodder Headline Shares will be acquired by WH Smith fully paid and free

from all liens, equities, charges, encumbrances and other interests and

together with all rights now or hereafter attaching thereto, including the

right to receive and retain all dividends and other distributions declared,

made or paid hereafter.

9. Hodder Headline Share Options

The Offer will extend to any Hodder Headline Shares which are unconditionally

allotted or issued while the Offer remains open for acceptance (or by such

earlier date as WH Smith may, subject to the City Code, determine) including

any such shares allotted or issued pursuant to the exercise of Hodder Headline

Options. WH Smith intends to offer holders of Hodder Headline Options the

opportunity, in return for a cash payment, to surrender exercisable options

(through cash cancellation) to the extent that such options have not been

exercised, subject to the Offer becoming or being declared unconditional in

all respects.

10. General

Neither WH Smith nor, so far as WH Smith is aware, any person presumed to be

acting in concert with WH Smith owns or controls any Hodder Headline Shares

or has any option to acquire Hodder Headline Shares.

The Offer will be on the terms and will be subject, inter alia, to the

conditions which are set out in Appendix I hereto, to those terms which will

be set out in the formal Offer Document and to such further terms as may be

required to comply with the rules and regulations of the London Stock

Exchange and the provisions of the City Code.

The formal Offer Document setting out details of the Offer including the Loan

Note Alternative together with the Form of Acceptance will be despatched to

Hodder Headline Shareholders by Schroders as soon as practicable.

The availability of the Offer to Hodder Headline Shareholders not resident in

the UK may be affected by the laws of the relevant jurisdiction. Hodder

Headline Shareholders who are not resident in the UK should inform themselves

about and observe any applicable requirements.

24 May 1999

_____________________________________________________________________________

The Offer, including the Loan Note Alternative, will not be made, directly or

indirectly, in or into, or by use of the mails or by any other means or

instrumentality (including, without limitation, facsimile transmission, telex

or telephone) of interstate or foreign commerce of, or any facilities of a

national securities exchange of, the USA, Canada, Australia or Japan and will

not be capable of acceptance by any such use, means, instrumentality or

facilities or from within the USA, Canada, Australia or Japan. Accordingly,

copies of this announcement are not being and must not be, mailed or

otherwise distributed or sent in or into or from the USA, Canada, Australia

or Japan.

Schroders, which is regulated by The Securities and Futures Authority

Limited, is acting for WH Smith and no one else in connection with the Offer

and will not be responsible to anyone other than WH Smith for providing the

protections afforded to the customers of Schroders or for providing advice in

relation to the Offer or any matter referred to herein or in the Offer

Document.

Rothschild, which is regulated by The Securities and Futures Authority

Limited, is acting for Hodder Headline and no one else in connection with the

Offer and will not be responsible to anyone other than Hodder Headline for

providing the protections afforded to the customers of Rothschild or for

providing advice in relation to the Offer or any matter referred to herein or

in the Offer Document.

MORE TO FOLLOW

OFFPBUBWABGBUMC

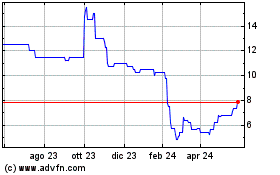

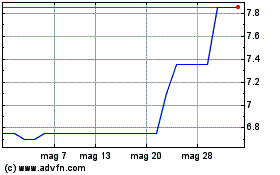

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Hardide (LSE:HDD)

Storico

Da Lug 2023 a Lug 2024