Halfords Group PLC (HFD)

Halfords Group PLC: Annual Financial Report

02-Aug-2023 / 07:05 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Halfords Group plc

Annual Report and Accounts for period ended 31 March 2023

including the Notice of Annual General Meeting ("AGM") - convened for 6 September 2023

The Company announces that the Annual Report and Accounts for the period ended 31 March 2023 and Notice of Annual

General meeting of the Company, have been posted or otherwise made available to shareholders and published on its

website www.halfordscompany.com.

The Company's 2023 AGM will be held at Halfords Group plc, Support Centre, Icknield Street Drive, Washford West,

Redditch, B98 0DE on Wednesday 6 September 2023 commencing at 3:00pm.

As detailed in the Notice of AGM, we strongly encourage shareholders to vote on all resolutions by casting their votes

through the use of a proxy (details of how to do this can be found in the Notice of AGM).

The Board is committed to ensuring that shareholders can exercise their right to ask questions, and as in previous

years, shareholders will be able to submit questions to the Directors in advance of the AGM via email to the Company

Secretary (tim.ogorman@halfords.co.uk) Written answers to all questions received will be sent directly to shareholders

by email and answers to frequently asked questions will, to the fullest extent practicable, be published on the

Company's website ahead of the meeting or, to the extent that has not been possible, will be addressed at the meeting

itself.

In accordance with Listing Rule 9.6.1, a copy of the Annual Report and Accounts and the Notice of Annual General

Meeting of the Company have been uploaded to the National Storage Mechanism and will be available for viewing shortly

at https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Tim O'Gorman

Company Secretary

Halfords Group plc

The Appendix to this announcement is a supplement to our preliminary statement of Financial Results made on 21 June

2023 (the "Final Results Announcement"). It contains the information required pursuant to Disclosure Guidance and

Transparency Rule 6.3.5 that is in addition to the information communicated in the Final Results Announcement and

should be read together with the Final Results Announcement. This information is not a substitute for reading the full

Annual Report and Accounts for the year ended 31 March 2023.

Appendix

The Chief Financial Officer's Report in the preliminary statement of the Final Results Announcement issued on 21 June

2023 includes a commentary on the principal commercial and financial risks and uncertainties to achieving the Group's

objectives.

Further details of other principal risks and uncertainties relating to the Halfords Group are set out on pages 76 to 81

of the 2023 Annual Report and Accounts. Specific financial risks (e.g. credit risk, foreign currency) are detailed in

note 21 to the Financial Statements on pages 198 to 202 of the 2023 Annual Report and Accounts.

The following is extracted in full and unedited form from the 2023 Annual Report and Accounts.

Our Principal Risks and Uncertainties

Capability and Capacity to Effect Change

Failure to build sufficient capacity and capability (in terms of our people, processes, and systems) to successfully

implement the transformation required across the business, may result in the expected benefits of our strategy not

being delivered, thereby risking the future sustainability of the business.

Current Mitigation Focus in 2024

. Continue to align our

change plan with the key

. A dedicated Transformation and Change team lead by the Group Strategy Director and objectives of the corporate

supported by experienced Programme and Project Managers has supported the successful strategy.

delivery of change projects.

. Further enhance tracking

. The continued advancement of our change programme is managed through a Transformation and monitoring of project

Board, providing the necessary governance for delivery of the strategy. The Transformation progress and delivery

Board ensures there is a robust approval process for each project, allocates resource and through use of software.

monitors progress. Programme and Project Managers are in place within the business to whom

projects can be assigned and this has been supplemented by specialist resource to boost

capability. In affecting change, Halfords is requiring all contributing colleagues to

observe the principles of Responsible, Accountable, Consulted, and Informed ("RACI"). . Enhance change capability

more broadly across the

wider business.

Stakeholder Support and Confidence in Strategy

Failure to secure and maintain our stakeholders' (investors,

suppliers, colleagues) support for our strategy, will mean they may

lose confidence in the business and withdraw their resources.

Current Mitigation Focus in 2024

. Maintain progress on the delivery of our strategic objectives.

. Throughout the year we have sought to engage

internal and external stakeholders to ensure their . Continue to proactively engage with investors through scheduled

understanding of our performance and strategy. events and transparent and regular communication, demonstrating

progress against the targets laid out at our Capital Markets Day.

. The CMD in April 2023 provided further support and

understanding . Enhance understanding of colleague engagement through more

regular surveys throughout the year and continuing our regular

listening groups.

Value Proposition

If investment in our motoring product value proposition and

group value perception is insufficient to retain existing customers

and/or attract new ones, and/or we lose market share to online

retailers and discounters, the impact could be a loss of sales

volume. Pricing decisions will be important in the current

environment. There is a risk that investing in price without a

corresponding increase in volume leads to a diminution of financial

returns and equally that increasing prices outside of market

movements, could damage our value perception.

Current Mitigation Focus in 2024

. Maintaining an agile trading

. Our strategy emphasises the importance of creating value for customers by plan, flexing promotions to respond

delivering advice and services alongside the sale of a product and during the year to a changing customer landscape.

we rolled out solution selling across the business to ensure that we were meeting

customers needs.

. Enhancing our financial services

proposition to offer more flexible

. We also invested to support customers in a cost of living crisis, reducing payment options to customers.

thousands of prices across our motoring category and launching our "Never Beaten On

Price" campaign on a number of fitted product categories, including tyres. In

addition, we continued to improve our financial services offering, cycle to work

proposition and pre-loved bike offer, making our products accessible to more . Growing and enhancing the

customers. Motoring Loyalty Club to help even

more customers enjoy savings and

benefits.

Our value proposition was further enhanced by the Motoring Loyalty Club, which grew

to 1.7m members during the year. This provided members with access to a wide range

of benefits and discounts. Introducing dynamic pricing in

garages to enable customers to make

their own choices around price and

convenience.

Brand Appeal and Market Share

Investment in awareness of our brand and our services is

insufficient to increase our brand relevance, in which case we will

be unable to maintain and grow our customer base or improve our

customer shopping frequency and spend and correspondingly build

market share.

Current Mitigation Focus in 2024

. Continuing to drive personalisation and

relevance through effective use of data

. During the year we grew market share across our core categories of Motoring and CRM, as we begin to know more about

Product, Cycling and Tyres, supported by a strong customer proposition, customers vehicles than they do.

investment in price, our Motoring for Less campaign, and a range of

enhancements to our on line customer journey.

. Enhancing the cycle to work platform to

make the proposition accessible to more

. The integration of National Tyres and the acquisition of Lodge Tyres during companies, particularly SMEs.

the year gave customers access to even more touch points at which to enjoy

our products and services.

. Extending ranges in categories such as

car parts where market share is currently

. The Motoring Loyalty Club bought hundreds of thousands of new customers to low.

Halfords, increasing brand appeal through our free and premium propositions.

. Continuing to grow the Motoring Loyalty

Club and starting work to develop a

Cycling Loyalty Club.

Climate Change and Electrification

The climate crisis is already having a profound effect through extreme weather events - floods, drought and raising sea

levels - all of which have the ability to disrupt our supply chains and impact our ability to operate our business

effectively. These risks have been assessed in detail and whilst flooding is likely to impact select Halfords stores

and garages across the UK, our most material climate related risks and opportunities are in response to the evolving

regulatory landscape; in particular, the ban on new internal combustion engine (ICE) vehicles being sold in the UK from

2030 as part of the UK Government's net zero ambitions. More sustainable mobility options, including Electric Vehicles,

E-Bikes and E-Scooters are therefore going to be crucial over the next decade as the country prepares for the shift

away from conventional fuel sources and transition to a lower carbon economy. This transition will impact our motoring

and cycling business in the short, medium and long-term.

Failure to respond adequately to the demand for sustainable mobility options through our products and servicing offers

could lead to a loss in confidence, market position and revenue.

Our service proposition does not match customer demand for electrification solutions in motoring and cycling, leading

to profound disruption in our core markets. Failure to deliver against our climate strategy and net zero targets,

leading to a loss in confidence from our stakeholders and potential reputational damage.

Failure to respond adequately to the demand for sustainable mobility options through our products and servicing offers

could lead to a loss in confidence, market position and revenue.

Current Mitigation Focus in 2024

. Halfords has an ESG Committee that meets regularly to monitor legislative . Our e mobility proposition continues to

changes, climate related due diligence and reporting requirements as well as evolve to support sustainable choices,

monitoring of the regulatory environment for changes to policies around e.g., with new options like EV servicing on the

sale of ICE vehicles, tax breaks for e-mobility or infrastructure drive through Halfords Mobile Experts.

developments. Reporting and risk management follow a roadmap to support the

requirements of the Taskforce on Climate Related Financial Disclosure (TCFD).

Strong progress has been made and will continue in the collection of supply

chain emissions, to measure, monitor and reduce our scope 3 emissions - which . Our investment in training and

make up a significant proportion of our overall carbon footprint. equipment continues to ensure we lead as

the No. 1 choice for electric mobility.

. A Robust Electrification strategy is in place, challenges, performance and

successes are analysed, and strategy regularly adjusted as appropriate. There . Our climate strategy is on track with

is regular landscape monitoring for electric vehicles (EVs) both from a over delivery of our ambitious scope 1

manufacturing side and consumer uptake side so that we can appropriately and 2 targets and excellent progress

respond to the rise of e-mobility. against scope 3, exceeding our data

capture target in FY23.

Sustainable Business Model

Alongside pre-existing changes in customer habits and

expectations, the recent spike in UK supply chain and consumer

inflation is creating challenging economic conditions. Unless we

can continue to mitigate the significant levels of cost inflation

(through cost mitigation and savings, growth in new business areas,

and increasing selling prices), we will be unable to maintain a

sustainable business model.

Current Mitigation Focus in 2024

. Cost Transformation programme to

. Service related sales now account for 48% of the Group's Revenue, resulting focus on short, medium and long-term

in more stable revenue streams and reduced exposure to discretionary cost reduction opportunities.

expenditure.

. Externally supported better buying

. Freight costs were well managed throughout the year to remain below spot program in place, supporting

prices, through successful negotiation. significant reduction in the cost of

goods for resale.

. During the year, our cost and efficiency program delivered over GBP20m of

savings, exceeding the FY23 target of GBP15m. . Fixed cost contracts entered into

for inflationary cost categories - e.g.

Freight and Utilities.

. Detailed price/elasticity analysis helped to optimise consumer pricing

decisions.

. Rental costs reduced through property

renegotiations; underperforming stores/

garages closed at lease renewal.

. Longstanding supplier relationships were optimised to extract value from

supplier contributions/support. . Productivity analysis ongoing through

digital technology.

. US Dollar hedging programme helped to mitigate significant weakening of

sterling, resulting in no adverse cost headwinds from FX in FY23. . Group Data Platform identifying

sales, cost and productivity

opportunities.

. Energy cost increases in FY23 were fully mitigated through buying ahead at

October 2021 pricing

. FX hedging programme in place

. Debt facilities extended.

Regulatory and Compliance

A failure to adhere to our legal and/or regulatory obligations for some, or all, of the Group's activities leads to an

inability to meet our responsibilities to stakeholders and/or the imposition of financial penalties, placing a strain

on the business.

Current Mitigation Focus in 2024

. There is continual monitoring of legal and regulatory developments for all . Continued monitoring of legal and

regions where the Group operates. A suite of policies sets out the Group's regulatory developments for all regions

commitment to conduct its business with honesty and integrity. The senior where the Group operates.

leadership team communicates tone from the top to provide guidance to

colleagues on all policy commitments.

. Improved Policy and procedures.

. Compliance training is provided to new colleagues as required with refresher

courses thereafter. Regular horizon scanning is undertaken to capture new

regulations and requirements. During the year, a Finance Risk Committee was . Compliance Monitoring and Review.

established to focus on all aspects of financial risk and compliance.

. Focussed development of the H&S

. We have a code of conduct with our suppliers whom we monitor for compliance culture through improved KPI reporting,

across ethics: environmental management; labour practices; and human rights. Investigations and training.

. Health and safety, Data Protection and Financial Conduct Authority compliance . Development of wellbeing standards.

are managed by experts reporting to dedicated committees with representatives

across the business to assess our regulatory rigour.

. Regular training and information

provided through user-friendly

. An established Whistleblowing process enables colleagues to report suspected channels.

or actual wrongdoing in confidence.

Service Quality

The services we provide fall below the quality standards to

which we are committed, placing customers at risk of harm.

Current Mitigation Focus in 2024

. External Mystery Shop in

place to monitor performance.

. All colleagues are provided with dedicated training and adhere to established quality

control and safety procedures, with compliance audits by management. We also have a

dedicated compliance team monitoring our regulated activities.

. An enhanced complaints

programme with root cause

analysis and learnings by

. In Autocentres our digital operating platform, PACE, enables increased workflow, garage.

productivity, and quality assurance. PACE drives service quality by requiring quality

controls to be completed on all workshop colleagues as determined by the Technician

Quality Rating. All our Quality Controllers follow an approved training pathway and

receive refresher training annually. . Additional training and

support in place for National

garages.

. We have a Retail Contact Centre that provides a level of call answer rates that ensures

we can provide a quality service to our customers whatever channel they choose.

. Target quality and training

in underperforming garages.

Cyber Security

If we fail to sufficiently prevent, detect, and respond to cyber

incidents and attacks, they may result in disruption of service,

compromise of sensitive data, financial penalties from regulatory

authorities, financial loss, and reputational damage.

Current Mitigation Focus in 2024

A programme of activities has matured our Governance, Risk and

Compliance function and improved our visibility, alerting and

reporting to provide a pro-active approach to cyber security.

A fully functional Security Operations Centre operated by our

third party provider, TCS, provides real time analysis of

threats and a heavy focus on incident management has ensured

detection and response times are reduced.

. Moving to a tactical and operational security model by

transitioning to alignment with ISO27001 and away from

Our security partner, TCS, provides first line assurance the NIST Framework to ensure focus remains on the

security operations capabilities including vulnerability security fundamentals required.

management, email filtering, and website security.

. Identity & Access Management enhancement.

. Within our Risk Management Framework our Information

Security team provides the second line assurance role

identifying and managing cyber-related risk, and developing

and implementing our internal control framework. . Incident Management and response simulation and

training.

. Third line assurance is provided by Internal Audit.

. Further enhancing website security.

. A perpetual education and awareness campaign is provided to

all colleagues. Regular briefings promote an understanding of

the risks to our data and the benefits of good security

practices.

. The Audit Committee is regularly briefed by senior

Technology management on the business' cyber security

framework.

Colleague Engagement/Culture

Our employment model may not be sufficiently attractive to

recruit and retain the talent that we need. We do not maintain a

sufficiently positive culture, failing to support a diverse and

inclusive community.

Current Mitigation Focus in 2024

. In FY23 we have launched our colleague strategy across the key

stages of the colleague Lifecyle of 'Find Me, Train Me, Grow Me, Keep

Me' with plans across each to drive attractiveness of our employee . Launch of our Diversity and Inclusion strategy,

proposition. which will broaden our attraction to external

talent and support internal talent development.

. Further developing our colleague engagement

. We are maintaining our position as an above National Minimum Wage strategy to broaden our listening and better

employer in our retail business and maintained a skills related pay inform our actions.

progression for our skilled colleagues across the group to ensure

market competitiveness.

Skills Shortage

We may be unable to recruit, retain and develop enough people to

have the different mix of skills that we need at all levels across

the business, in the near and longer term.

Current Mitigation Focus in 2024

In FY23 we have started a review of our systems and

processes to support recruitment and retention that has

seen us reduce labour turn over by 7%, this has included:

In FY24, our focus will be across the Employee Value

. Investment in pay for key roles in our garages - MOT Proposition to drive greater retention and attraction and

Testers and Management. colleague development:

. Implementation of an enhanced referral scheme to our . Launching a technical career pathway through our Academy

internal colleagues for referring external hires. that will set out the development journey for every

technical colleague - demonstrating a career and reward

journey.

. Attraction and development of 100 garages apprentices, up

from 26 in FY22.

. Investing in a leadership development programme in our

garage services business to develop our regional and centre

managers to develop leadership capability.

. Development of 200 future retail managers through our

Aspire programme and delivery of leadership development for

our retail area managers.

. Launching 'The Academy' our digital learning system to

step change our digital learning and development

capability.

. Evolving our recruitment operating model to a centralised

support model that gives retail managers greater visibility

and ownership of their recruitment at a local level.

. Reviewing our careers website to refresh our applicant

journey and employee brand.

. Implementation of our Hybrid working approach for Support

Centre colleagues to create a balance of remote and face to

face working.

IT Infrastructure Failure

Failure in our IT system(s) may cause significant disruption to,

or prevention of, normal business-as-usual activities

Current Mitigation Focus in 2024

. Modernisation of some of

our older technologies

. Controls have been built out this year to maintain integrity of our infrastructure inherited through

through a governance of vendors and technology. acquisition.

. All changes related to infrastructure are presented under change control with specific . Network Transformation to

approval. Halfords monitoring capability has been enhanced. enhance resilience.

. A number of our critical applications have been migrated into cloud for enhanced . Replacement of Warehouse

availability. Halfords key trading systems not migrated to cloud are hosted securely within Management System.

data centres operated by a specialist company. These systems are supported by disaster

recovery arrangements, including comprehensive backup, patching and fall back strategies.

We have modernised our portable compute service to Windows 11 with enhanced availability

services and modern security tooling. . Further roll out of Pace.

. Enhancement of Service

Assurance model to

strengthen governance over

our vendors.

Disruption to end to end supply chain

The Halfords End to end (E2E) supply chain is an integration of

the process from sourcing of products (including the raw material

procurement and product design by our supply partners) through to

scheduling and delivery of goods to our customers (through our DC

network and via stores or direct to consumer).

Disruption to the E2E process creates a major impact to customer

fulfilment and/or customer facing price increases due to supply

shortages, increased demand for raw materials impacting

availability and input price, production delays that lead to an

extension in supply lead times, logistics delays in the form of

shipping of goods, or the potential closure of one of our DC's, all

of which challenges our ability to meet sales and profit

projections.

Current Mitigation Focus in 2024

. Our sourcing capability and supplier relationships are delivered through

dedicated UK, Asian and Near sourcing teams. These teams maintain both

strategic and upstream supplier relationships, operate multiple sources,

dual sourcing, product engineering and are engaged in the ESG agenda.

. Our AEO accreditation review with HMRC is

scheduled for Sept 23 and the International

Trade team will lead this review.

. Our in-house expertise delivers the high global trading standards from

Authorised Economic Operator accreditation, Import/export expertise and

dedicated security at each of our Distribution Centre (DC) sites.

. We will maintain multiple, close and

direct relationships with shipping lines.

. Our 3PL relationships give expertise and options. We contract with

multiple shipping lines for flexibility and leverage, we have access to

large organisational support from Yusen Logistics, Wincanton and Clipper . Our Warehouse Management System

logistics and PWC provide external trading and compliance expertise. replacement is due to start going live

through FY24 as well as our new Customs

management system.

. Our Transformation plans reduce risk through scheduled work on the

replacement of our Warehouse Management System, a UK distribution centre

physical network review, the replacement of our forecasting and

replenishment tools and our Customs and Duty platform.

Directors' responsibilities

The directors are responsible for preparing the annual report

and the financial statements in accordance with UK adopted

international accounting standards and applicable law and

regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

are required to prepare the group financial statements in

accordance with UK adopted international accounting standards and

have elected to prepare the company financial statements in

accordance with United Kingdom Generally Accepted Accounting

Practice (United Kingdom Accounting Standards and applicable laws).

Under company law the directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the group and company and of the

profit or loss for the group for that period.

In preparing these financial statements, the directors are

required to:

. select suitable accounting policies and then apply them

consistently;

. make judgements and accounting estimates that are reasonable

and prudent;

. state whether they have been prepared in accordance with UK

adopted international accounting standards, subject to any material

departures disclosed and explained in the financial statements;

. prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the group and the

company will continue in business;

. prepare a directors' report, a strategic report and directors'

remuneration report which comply with the requirements of the

Companies Act 2006.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the company's

transactions and disclose with reasonable accuracy at any time the

financial position of the company and enable them to ensure that

the financial statements comply with the Companies Act 2006.

They are also responsible for safeguarding the assets of the

company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities. The Directors are

responsible for ensuring that the annual report and accounts, taken

as a whole, are fair, balanced, and understandable and provides the

information necessary for shareholders to assess the group's

performance, business model and strategy.

Website Publication

The Directors are responsible for ensuring the Annual Report and

the financial statements are made available on a website. Financial

statements are published on the Company's website in accordance

with legislation in the United Kingdom governing the preparation

and dissemination of financial statements, which may vary from

legislation in other jurisdictions. The maintenance and integrity

of the company's website is the responsibility of the directors.

The directors' responsibility also extends to the ongoing integrity

of the financial statements contained therein.

Directors' Responsibilities Pursuant to DTR4

The directors confirm to the best of their knowledge:

. The financial statements have been prepared in accordance with

the applicable set of accounting standards, give a true and fair

view of the assets, liabilities, financial position and profit and

loss of the group.

. The annual report includes a fair review of the development

and performance of the business and the financial position of the

group and company, together with a description of the principal

risks and uncertainties that they face.

. The Report and Financial statements, taken as a whole, is

fair, balanced and understandable and provides the information

necessary for Shareholders to assess the Group's position and

performance, business model and strategy. Approved by order of the

Board.

Approved by order of the Board.

Keith Williams

Chair

21 June 2023

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B012TP20

Category Code: ACS

TIDM: HFD

LEI Code: 54930086FKBWWJIOBI79

OAM Categories: 1.1. Annual financial and audit reports

Sequence No.: 261684

EQS News ID: 1693699

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1693699&application_name=news

(END) Dow Jones Newswires

August 02, 2023 02:05 ET (06:05 GMT)

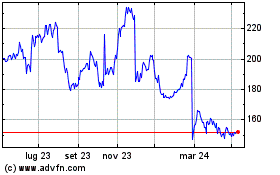

Grafico Azioni Halfords (LSE:HFD)

Storico

Da Mar 2024 a Apr 2024

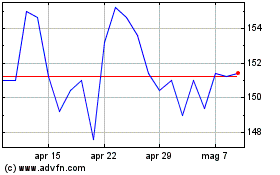

Grafico Azioni Halfords (LSE:HFD)

Storico

Da Apr 2023 a Apr 2024