Halfords Group PLC (HFD)

Halfords Group PLC: 20-Week Trading Update: Financial Year 2024

06-Sep-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

6 September 2023

Halfords Group plc

20-Week Trading Update: Financial Year 2024

Strong market share gains across the Group with +7.8% Group LFL revenue performance.

Halfords Group plc ("Halfords" or the "Group"), the UK's leading provider of Motoring and Cycling services and

products, today announces its trading update for the 20 weeks to 18 August 2023 (the "Period").

Headlines

-- Strong trading across the Group with total revenue up +14.1% driven by needs-based categories, with

Autocentres +34.6% and Retail +3.7%.

-- Strong Services and B2B performance accounting for 48% of Group revenue (+6ppts YOY) and 29% (+5ppts YOY)

respectively, with B2B winning a significant nationwide contract with Yodel.

-- Market share gains across all categories and in line with expectations as set out at our Capital Markets

Day ("CMD") in April.

-- Underlying Services markets remain robust, whilst discretionary categories have been softer in Q2 to-date

vs Q1.

-- Trading year to date in line with expectations. Full underlying profit before tax ("PBT") expected to be

between GBP48m and GBP58m(1).

Graham Stapleton, Chief Executive Officer, commented:

"It's been a good start to the year for Halfords, and our ongoing focus on essential maintenance and servicing is

driving a strong performance in our Autocentre and Retail Motoring business. Group Motoring, which now accounts for

over 75% of our total sales, is a resilient sector and we're progressing with our long-term plans to become a

one-stop-shop for motoring ownership.

"We're continuing to do everything that we can to support our customers through the cost-of-living crisis and are

determined to offer them unrivalled value. For instance, our research shows that motorists who use manufacturers'

franchised dealerships can pay over 50% more for repairs compared with Halfords. With the average cost of car ownership

pushing GBP300 a month, the last thing hard pressed motorists need, is to pay over the odds for repairs. That's why,

today, we're launching a campaign called Dealer or No Dealer, designed to raise motorists' awareness of the choice and

cost savings available to them for servicing and repairs, and that any work carried out by Halfords will not affect

their manufacturer warranty."

Group revenue summary

Group Financial Summary 1-Year vs FY23

Total LFL

Halfords Group +14.1% +7.8%

Autocentres +34.6% +16.6%

Retail +3.7% +3.4%

Motoring +7.7% +7.5%

Cycling -1.7% -2.7%

Financial performance:

-- The Group produced a strong like-for-like performance of

+7.8%, with Autocentres +16.6% and Retail +3.4%,despite the

unfavourable weather conditions throughout Spring and July to

August.

-- Within Retail, needs-based products and services drove a

strong Motoring LFL of +7.5% whereas the morediscretionary areas of

Cycling, Car Cleaning and Touring were adversely impacted by

unfavourable weather and lowconsumer confidence. Cycling, which now

only represents 25% of total revenue, was down -2.7% LFL.

-- Growth in market share across all categories and ahead of the

year one targets underpinning our CMDprojections set out in

April.

-- Market conditions were more varied, with Services stronger

than CMD assumptions, but Tyres, Motoringproducts and Cycling

tracking behind. Our strong market share performance helped

mitigate the marketunder-performance.

-- Group service-related sales accounted for 48% of Group

revenue (+6ppts YOY).

-- B2B sales accounted for 29% of Group revenue (+5ppts YOY),

with particularly strong performance inCycle2Work and Commercial

Fleet Services.

-- Stock continues to be well managed across the business and in

line with expectations.

Strategic and operational update:

-- Cost and efficiency programme on track to deliver year one

target of GBP30m across product cost andoperating cost

reductions.

-- Following the Lodge Tyre acquisition in October 2022, our

enlarged Commercial Fleet Service business haswon a significant

nationwide contract - with Yodel, the UK parcel carrier, providing

service support for its entireUK truck and van fleet.

-- Ongoing focus on garage utilisation has driven a year-on-year

improvement in utilisation in every monthso far this year. A

targeted local marketing approach has supported a 40% reduction in

the number of under-utilisedgarages.

-- Our Motoring Loyalty Club is continuing to perform well, now

exceeding 2.5m members. Club memberscontinue to shop with greater

frequency, and greater spend per visit, at +GBP266 versus non-club

members.

Outlook:

-- Trading year to date in line with expectations with services

remaining robust but discretionary marketssofter. Full year PBT

expected to be between GBP48m and GBP58m(1).

-- As communicated at our FY results in June, we expect our H1

underlying profit to be significantly belowlast year due to changes

in the valuation of foreign exchange contracts that are not hedge

accounted, and the factthat a greater proportion of our targeted

GBP30m cost savings will be delivered in the second half, helping

to offsetmaterial cost inflation present throughout FY24.

-- H2 profit is expected to be significantly ahead of last year,

with Autocentres making up a higherproportion of Group PBT

alongside increased cost and efficiency savings versus FY23.

(1) At our Preliminary results presentation in June 2023 we

shared our expectation that PBT would grow in FY24 (from FY23 PBT

of GBP51.5m) and that we were comfortable with the analyst

consensus of GBP53.3m. Current analyst consensus of PBT is

GBP53.7m, with a analyst forecasts ranging between GBP51.0m and

GBP57.7m.

Enquiries

Investors & Analysts (Halfords)

Jo Hartley, Chief Financial Officer

Neil Ferris, Group Financial Controller

Andy Lynch, Head of Investor Relations +44 (0) 7483 457 415

Media (Powerscourt) +44 (0) 20 7250 1446

Rob Greening halfords@powerscourt-group.com

Nick Hayns

Elizabeth Kittle

Results presentation

A conference call for analysts followed by Q&A will be held

today, starting at 09:00am UK time. Attendance is by invitation

only. A copy of the transcript of the call will be available at

www.halfordscompany.com in due course. For further details please

contact Powerscourt on the details above.

Next trading statement

On 22 November 2023 we will report our FY24 Interim results for

the period ending 29 September 2023.

Notes to Editors

www.halfords.com www.avayler.com www.tredz.co.uk

www.halfordscompany.com

Halfords is the UK's leading provider of motoring and cycling

services and products. Customers shop at 393 Halfords stores, 2

Performance Cycling stores (trading as Tredz and Giant), 643

garages (trading as Halfords Autocentres, McConechy's, Universal,

National Tyres and Lodge Tyre) and have access to 264 mobile

service vans (trading as Halfords Mobile Expert, Tyres on the Drive

and National), 479 commercial vans and 5 HME Cycling vans.

Customers can also shop at halfords.com and tredz.co.uk for pick up

at their local store or direct home delivery, as well as booking

garage services online at halfords.com.

Cautionary statement

This report contains certain forward-looking statements with

respect to the financial condition, results of operations, and

businesses of Halfords Group plc. These statements and forecasts

involve risk, uncertainty and assumptions because they relate to

events and depend upon circumstances that will occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. These forward-looking

statements are made only as at the date of this announcement.

Nothing in this announcement should be construed as a profit

forecast. Except as required by law, Halfords Group plc has no

obligation to update the forward-looking statements or to correct

any inaccuracies therein.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B012TP20

Category Code: TST

TIDM: HFD

LEI Code: 54930086FKBWWJIOBI79

OAM Categories: 2.2. Inside information

Sequence No.: 269422

EQS News ID: 1719551

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1719551&application_name=news

(END) Dow Jones Newswires

September 06, 2023 02:00 ET (06:00 GMT)

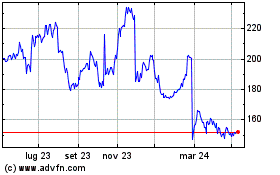

Grafico Azioni Halfords (LSE:HFD)

Storico

Da Mar 2024 a Apr 2024

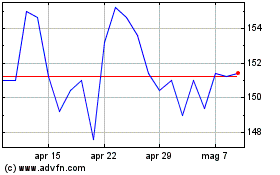

Grafico Azioni Halfords (LSE:HFD)

Storico

Da Apr 2023 a Apr 2024