Intnl Greetings PLC - Interim Results

26 Gennaio 1998 - 8:30AM

UK Regulatory

RNS No 0937u

INTERNATIONAL GREETINGS PLC

26th January 1998

PRE-EXCEPTIONAL, PRE-TAX PROFIT UP 17%

INTERIM DIVIDEND UP 20%

International Greetings PLC (IG) today announces interim

results for the six months ended 30 September 1997,

showing comparable pre-exceptional, pre-tax profit up 17%

to #1.79 million, (1996: #1.53 million), earnings per

share up 33% to 8.9 pence (1996: 6.7p) and interim

dividends up 20% at 2.6 pence (1996: 2.17p)

The principal activities of the company are the design

and manufacture of gift wrapping paper, greeting cards,

crackers and other decorative accessories. IG is a major

supplier of private label greetings products to leading

UK multiples including Woolworths, Tesco and Boots.

Highlights for the period include:

* Pre-exceptional, pre-tax profit up 17% to

#1.79 million (1996: #1.53 million)

* Pre-exceptional EPS up 33% to 8.9 pence (1996: 6.7p)

* Dividend per share for the period up 20% to 2.6

pence (1996: 2.17p)

* 1997 AIM Company of the Year

* 1997 investment programme complete - 8 colour

gravure press commissioned in Wales

* Plans for near doubling of US plant size approved

* Strong Christmas 1997 sales experienced by the

majority of customers

* Projections for Christmas 1998 good

* Confident for full year results

Commenting on today's results, IG's Chairman John Elfed

Jones said:

'I am pleased to report that, for the six months to 30

September 1997, the Group has once again achieved a most

impressive set of results. On a comparable, pre-exceptional basis,

profit before taxation has increased

by 17% to #1.79m, with earnings per share increasing by

33% to 8.9p. Our continued drive for improvement in

operating margins, up from 10% to 10.8%, coupled with a

13% increase in turnover, have resulted in these

excellent figures.'

'Having been listed on AIM for just over two years, we

were delighted and honoured in October to win the

accolade of "AIM Company of the Year" at the 1997 AIM

Awards Ceremony. This public recognition for the hard

work and determination of our employees over the past 18

years confirmed International Greetings as a "well-managed,

responsible, fully accountable, dynamic business

with a solid performance to date and strong growth

prospects.'

'Our 1997 investment programme was completed with the

final commissioning of our additional eight colour

gravure printing press in Wales. In addition to providing

sufficient production capacity to fulfill our expansion

requirements in the UK, it also assists our aggressive

development plans for the US marketplace. The board has

also authorised the building of an 80,000 sq ft extension

to the US facility, thereby almost doubling its size,

which should be completed in time for the 1998 peak

season. Once again, the Company's excellent relationship

with the Local Development Authority in Georgia has

allowed us to develop swiftly and economically in this

substantial marketplace.'

'The majority of our customers experienced strong sales

growth for the 1997 Christmas season and we therefore

view the results for the full year to 31 March 1998 with

confidence. Early discussions with our customers also

augur well for the 1998 Christmas season. Accordingly,

the Board recommends an increased interim dividend up 20%

to 2.6p net per share.'

The interim dividend will be paid on 16 February 1998 to

shareholders on the register at 6 February 1998.

For further information contact:

International Greetings PLC

Nick Fisher, Joint Chief Executive

Mark Collini, Finance Director 01727 844 888

Grandfield

Michael Henman

Christian Judge 0171 417 4170

Group Profit and Loss Account

Unaudited Unaudited Audited

6 months to 6 months to Year ended

30 September 30 September 31 March

1997 1996 1997

#000 #000 #000

Turnover 21,116 18,739 48,431

======== ======== ========

Operating Profit 2,282 1,885 5,820

Exceptional surplus

on disposal of

fixed assets - 733 742

Net interest

payable (491) (359) (686)

-------- -------- --------

Profit before

taxation 1,791 2,259 5,876

Taxation (582) (666) (1,726)

-------- -------- --------

Profit after

taxation 1,209 1,593 4,150

Minority Interests (36) (21) (17)

Dividend

- equity (343) (272) (866)

- non-equity - (135) (135)

-------- -------- --------

Retained Profit 830 1,165 3,132

======== ======== ========

Earnings per

share* 8.9p 11.4p 31.7p

Earnings per

share excluding

exception items* 8.9p 6.7p 26.0p

Dividend per

ordinary share* 2.6p 2.17p 6.67p

======== ======== ========

* Dividends and earnings per share for the periods ended

30 September 1997 and 31 March 1997 have been adjusted

to reflect the bonus issue of ordinary shares made on

28 February 1997.

Notes:

1) The figures for the year ended 31 March 1997 are an

abridged version of the published accounts, which

have been reported on without qualification by the

auditors and have been delivered to the Registrar of

Companies.

2) The calculation of earnings per share is based on

13,198,500 (6 months to 30 September 1996:

12,570,000*, 12 months to 31 March 1997: 12,622,375*)

ordinary shares being the number of shares in issue

during the period.

3) The taxation charge for the 6 months ended 30

September 1997 is based on the estimated tax rate

for the full year.

Copies of this announcement are available from

International Greetings PLC, Belgrave House, Acrewood

Way, St Albans, AL4 0JY until Monday, 9 February 1998.

END

IR ALLIDLVIVFAT

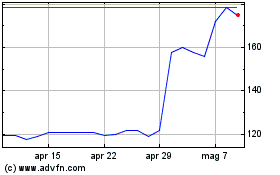

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Giu 2024 a Lug 2024

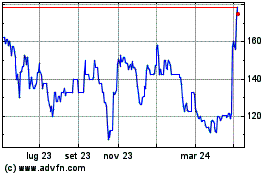

Grafico Azioni Ig Design (LSE:IGR)

Storico

Da Lug 2023 a Lug 2024