TIDMIGV

RNS Number : 6178C

Income & Growth VCT (The) PLC

14 June 2023

THE INCOME & GROWTH VCT PLC

LEI: 213800FPC15FNM74YD92

UNAUDITED HALF-YEAR RESULTS FOR THE SIX MONTHS TO 31 MARCH 2023

The Income & Growth VCT plc ("the Company") today announces its Half-Year

results for the six months to 31 March 2023.

You may, in due course, view the Half-Year Report, comprising the

Unaudited Condensed Financial Statements of the Company by visiting

www.incomeandgrowthvct.co.uk.

Financial Highlights

As at 31 March 2023:

Net assets: GBP122.93 million

Net asset value ("NAV") per share: 79.38 pence

Results for the six months to 31 March 2023:

* Net asset value ("NAV") total return(1) per share was (0.4)%.

* Share price total return(1) per share was (3.1)%.

* The Board has declared an interim dividend in respect

of the current year of 4.00 pence per share which was

paid to Shareholders on 26 May 2023.

* The Company made two new investments of GBP1.01 million.

* Proceeds of GBP9.13 million were received from

realisations, generating net realised gains of

GBP0.41 million.

(1) Alternative Performance Measure ("APM"). See Glossary of Terms

in the Half-Year Report.

PERFORMANCE SUMMARY

The table below shows the recent past performance of the Company's

existing class of shares for each of the last five years, and the

current year to date.

Reporting Net NAV Share Cumulative Cumulative total Dividends

date assets per Price(1) dividends return per share per share

Share paid to shareholders(2) paid

per share and

proposed

in respect

of

each year

(NAV (Share price

basis) basis)

As at (GBPm) (p) (p) (p) (p) (p) (p)

31 March

2023 122.93 79.38 75.00 148.50 227.88 223.50 4.00(3)

30

September

2022 108.42 83.73 81.50 144.50 228.83 226.00 8.00

30

September

2021 119.09 100.45 93.00 136.50 236.95 229.50 9.00

30

September

2020 83.13 70.06 59.50 131.50 201.56 191.00 14.00

30

September

2019 81.73 79.12 75.50 113.00 192.12 188.50 6.00

30

September

2018 82.58 78.32 69.50 108.00 186.32 177.50 6.00

(1) Source: Panmure Gordon & Co (mid-market price).

(2) Cumulative total return per share comprises the NAV per share

(NAV basis) or the mid-market price per share (share price basis)

plus cumulative dividends paid since launch of the current share class.

(3) An interim dividend of 4.00 pence per share, referred to in the

Financial Highlights above, was paid to Shareholders on 26 May 2023.

This dividend has subsequently reduced the NAV per share to 75.38

pence and increased cumulative dividends paid per share to 152.50

pence.

Detailed performance data, including a table of dividends paid to

date for all share classes and fundraising rounds, is shown in the

Performance Data appendix in the Half-Year Report. The tables, which

give information by allotment date on NAVs and dividends paid per

share, are also available on the Company's website at www.incomeandgrowthvct.co.uk

where they can be accessed by clicking on "table" under "Reviewing

the performance of your investment" on the home page.

Chair's Statement

I present the Company's Half-Year Report for the six months to 31

March 2023.

Overview

The first six months of the Company's financial year occurred against

a backdrop of challenging UK economic conditions. Increasing inflation

and rising interest rates have both impacted consumer and business

confidence which has pulled down market valuation benchmarks and caused

a general softening of trading performance. In line with this, the

Company's NAV total return fell marginally by 0.4%.

So far in 2023, despite the wider market concerns, stock market multiples

appeared to stabilise following the material downward re-rating of

growth stocks experienced over much of 2022. However, the collapse

of Silicon Valley Bank and other similar failures mean that confidence

remains fragile. The ongoing threat of a potential UK recession will

likely result in additional challenges for your portfolio companies.

However, the portfolio is well diversified and the Company is well

prepared for most scenarios via its strong liquidity available to

support the winners in the portfolio.

The Company continued to be an active investor and provided new investment

finance to two new companies, Connect Earth and Cognassist. The Company

also delivered two highly successful exits, Equip Outdoor Technologies

(EOTH) and Tharstern Group.

On 5 October 2022, the Company launched an Offer for Subscription

alongside the three other Mobeus VCTs ("Offers") with the full amount

being raised in a matter of weeks. The Board was very pleased with

this support and extends a warm welcome to new and existing investors.

Performance

The Company's NAV total return per share was (0.4)% for the six months

to 31 March 2023 (2022: 2.3%), and the share price total return was

(3.1)% pence (2022: 1.6%). The difference between the NAV total return

and share price total return figures above arises principally due

to the timing of NAV announcements which are usually made retrospectively.

The fall in NAV total return for the period was principally the result

of unrealised declines in the value of investments. Two successful

portfolio exits generated realised gains for the Company, however

these were partially offset by impairments applied to the holdings

of two other companies.

Investment portfolio

In the current challenging environment, a number of investee companies

experienced a decline in consumer confidence with a resultant impact

on trading. The overall value decreased by a modest GBP(0.60) million

(2022: GBP4.20 million), or (0.8)% (2022: 4.8%) on a like-for-like

basis, compared to the opening portfolio value at 1 October 2022 of

GBP73.08 million. This net decrease comprised net realised gains of

GBP0.41 million and net unrealised declines in portfolio valuations

of GBP(1.01) million, over the period.

At the period-end, the portfolio was valued at GBP64.36 million after

taking account of investments purchased and sold in the period, together

with the net realised gains and net unrealised losses referred to

above.

As the portfolio continues its move from being comprised mainly of

MBO investments made under the previous strategy, towards predominantly

growth capital investments which have a more variable return profile,

shareholders should note that the likelihood of investee company failures

is higher. A further impact of the strategy change in 2015 is that

at 31 March 2023, nearly 60% of the portfolio is comprised by the

top five assets by value. The Investment adviser ensures that all

necessary focus is on these higher value assets.

During the six months under review, the Company invested GBP1.01 million

into two new investments:

Connect Earth GBP0.34 million

Environmental data provider

Cognassist GBP0.67 million

Education and neuro-inclusion solutions

The Company generated a total of GBP9.06 million in proceeds from

realisations alongside loan repayments of GBP0.07 million. The Company

therefore generated total proceeds of GBP9.13 million in the six months

to 31 March 2023. More detail on these realisations is provided below.

In November 2022, it was pleasing to exit the equity investment held

in EOTH (trading as Rab and Lowe Alpine), receiving GBP7.34 million

including preference share dividends received upon completion. This

exit generated a realised gain in the period of GBP0.42 million. Total

proceeds received over the life of this investment are GBP9.54 million

to date, a 6.9x multiple of cost and an IRR of 23.2%. The Company

has retained its interest yielding loan stock to continue to generate

income for the VCT in the future.

In March 2023, the Company achieved a full exit of Tharstern Group

Limited generating proceeds of GBP2.85 million and a realised gain

of GBP0.86 million. Over the life of this investment, the Company

has received GBP4.00 million which equates to a multiple on cost of

2.6x and an IRR of 15.0%.

After the period end, Spanish Restaurant Group Limited (trading as

Tapas Revolution) went into administration. Tapas Revolution had experienced

very challenging conditions since COVID-19 and under the HMRC Financial

Health Test (more detail below), the Company was unable to invest

further in this portfolio company. It was therefore necessary for

an Administrator to be appointed. A total of GBP0.87 million has been

recognised as a realised loss in the period across two companies (including

Tapas Revolution) which are experiencing significant trading issues.

Shareholders should be aware that the Financial Health test is an

effective tightening of the interpretation of HMRC policy and practice

in a technical aspect of the VCT financing rules, now resulting in

the restriction of potential follow-on investments to support certain

companies. The Board continues to monitor developments in the interpretation

of this area of legislation carefully and supports the lobbying of

HMRC by the VCTA to change its stance.

After the period-end, the Company invested GBP0.63 million into Dayrize

B.V., a sustainability impact assessment tool provider.

Further details of this investment activity and the performance of

the portfolio are contained in the Investment Adviser's Review and

the Investment Portfolio Summary of the Half-Year Report.

Revenue account

The results for the period are set out in the Unaudited Condensed

Income Statement and show a revenue return (after tax) of 0.60 pence

per share (2022: 0.51 pence per share). The revenue return for the

period of GBP0.87 million represents an increase from last year's

comparable figure of GBP0.61 million. This is due primarily to higher

dividend receipts and interest income.

Dividends

The Board is pleased to have declared an Interim dividend of 4.00

pence per share for the year ending 30 September 2023.

This dividend was paid on 26 May 2023, to Shareholders on the Register

on 21 April 2023, and combined with a 4.00 pence dividend paid in

November 2022 in respect of the previous financial year has brought

cumulative dividends paid per share to 152.50 pence per share.

The Company intends to maintain its target of paying a dividend of

at least 6.00 pence per share in respect of each financial year and

this has been achieved in each of the last eleven financial years.

The Board continues to monitor the sustainability of its dividend

target given the continued movement of the portfolio to a larger share

of younger growth capital investments which have the potential for

increased volatility, which may affect the return in a given year.

Offer for Subscription and Dividend Investment Scheme

The Board approved a further fundraise for the 2022/23 tax year in

October 2022 after considering the future cash requirements of the

Company and the potential demand for the Company's shares following

the successful fundraise in January 2022. Having provided a period

of time between the launch of the prospectus and acceptance of applications,

the Board was pleased that the initial amount of GBP14 million (as

well as an over-allotment facility of a further GBP8 million), launched

on 5 October 2022, was fully subscribed by 8 November 2022. Shares

were allotted in November 2022 and February 2023.

The Company's Dividend Investment Scheme ("DIS") provides Shareholders

with the opportunity to reinvest their cash dividends into new shares

in the Company at the latest published NAV per share (adjusted for

any subsequent dividends). New VCT shares attract the same tax reliefs

as shares purchased through an Offer for Subscription. There were

1,197,652 shares allotted through the DIS during the period at a price

of 79.73 pence.

Shareholders can opt-in to the DIS by completing a mandate form available

on the Company's website at: www.incomeandgrowthvct.co.uk or can opt-out

by contacting Link Group, using the details provided in the Half Year

Report. Please note that instructions take 15 days to become effective.

Cash Available for investment

The Board continues to monitor credit risk in respect of its cash

balances and to prioritise the security and protection of the Company's

capital. Cash and liquidity fund balances as at 31 March 2023 amounted

to GBP58.52 million. This figure has been bolstered by the funds raised

under the Offer and includes GBP52.58 million held in money market

funds with AAA credit ratings and GBP5.94 million held in deposit

accounts with two well-known financial institutions. The rises in

the Bank of England base rate over recent months have significantly

increased the yield on these balances which will help provide future

returns to Shareholders.

Share buybacks

During the six months ended 31 March 2023, the Company bought back

and cancelled 2.41 million of its own shares, representing 1.9% (2022:

0.4%) of the shares in issue at the beginning of the period, at a

total cost of GBP1.84 million (2022: GBP0.40 million), inclusive of

expenses.

It is the Company's policy to cancel all shares bought back in this

way. The Board regularly reviews its buyback policy, where its priority

is to act prudently and in the interest of remaining Shareholders,

whilst considering other factors, such as levels of liquidity and

reserves, market conditions and applicable law and regulations. Under

this policy, the Company seeks to maintain the discount at which the

Company's shares trade at no more than 5% below the latest published

NAV.

Shareholder Event & Communications

May I remind you that the Company has its own website which is available

at: www.incomeandgrowthvct.co.uk . The Investment Adviser last held

a Shareholder Event on behalf of the Mobeus VCTs on the afternoon

of 23 March 2023 with a live Q&A session which we hope you were able

to join. Double the number of attendees joined the meeting compared

to last year. A recording of the event is available via a link on

the Company's website.

Fraud Warning

Shareholders continue to be contacted in connection with sophisticated

but fraudulent financial scams which purport to come from the Company

or to be authorised by it. This is often by a phone call or an email

usually originating from outside of the UK, claiming or appearing

to be from a corporate finance firm offering to buy your shares at

an inflated price.

Further information and fraud advice plus details of who to contact,

can be found in the Shareholder Information section in the Half-Year

Report.

Environmental, Social and Governance ("ESG")

The Board and the Investment Adviser believe that the consideration

of environmental, social and corporate governance ("ESG") factors

throughout the investment cycle will contribute towards enhanced shareholder

value.

Gresham House has a team which is focused on sustainability and the

Board views this as an opportunity to enhance the Company's existing

protocols and procedures through the adoption of the highest industry

standards. The future FCA reporting requirements consistent with the

Task Force on Climate-related Financial Disclosures, which commenced

on 1 January 2021, do not currently apply to the Company but will

be kept under review, the Board being mindful of any recommended changes.

Consumer Duty

The Financial Conduct Authority (FCA) has introduced the concept of

Consumer Duty, the rules and principles of which come into effect

in July 2023. Consumer Duty is an advance on the existing concept

of 'treating customers fairly'. It sets higher and clearer standards

of consumer protection across financial services and requires all

firms to put their customers' needs first.

As the Company is not regulated by the FCA it does not directly fall

into the scope of Consumer Duty. However, Gresham House as the Investment

Adviser and any IFAs or financial platforms used to distribute future

fundraising offers, are subject to Consumer Duty.

It is incumbent on all parties to uphold the principles behind Consumer

Duty and to that end we are working with the Investment Adviser to

review the information we should provide to assist consumers and their

advisers to discharge their obligations under Consumer Duty.

Outlook

The geopolitical and economic context for the next year is liable

to be challenging. However, this can also provide an opportunity for

the Company to source and make high quality investments whilst building

strategic stakes in existing portfolio businesses with great potential

for the future. The prospects for new investment flow are good. Notwithstanding

the successful exits of EOTH and Tharstern, the exit environment will

likely be subdued in comparison to recent years. However, the Company

has ample liquidity and is not time-limited. The combined impact of

inflation, interest rates and restrictions in Government spending

can be expected to impact both consumer and business confidence in

the near term. We therefore anticipate that further stresses will

become evident over the forthcoming year. We expect that all sectors

will be vulnerable, although the Company has a large and well diversified

portfolio, managed by a professional and capable investment team,

which helps to mitigate the challenges that lie ahead.

I would like to take this opportunity once again to thank all Shareholders

for your continued support and to extend a warm welcome to new Shareholders.

Maurice Helfgott

Chair

13 June 2023

Investment ADVISER'S Review

Portfolio review

The continuing harsh economic conditions continue to create challenging

circumstances for portfolio companies. UK business has seen both demand

and operating margins come under pressure in the face of marked increases

in inflation and interest rates which have not been experienced by

a generation of management teams.

In the latter months of 2022 and into 2023, market multiples began

to stabilise. However, portfolio companies' trading performance has

now begun to experience the impact of declining consumer confidence

and business investment.

Whilst inflation is expected to moderate following the rises in base

rates, it is still at a very high level and has impacted economic

growth expectations. In contrast to this, there are early signs that

supply chains are returning to normality, that labour shortages are

easing and that there are pockets of positive market sentiment. Furthermore,

the direct impact of high interest rates on the Company's portfolio

is negligible as most portfolio companies do not have any significant

third-party debt. The outlook is therefore mixed, and the emphasis

is thus on robust funding structures and being prepared for all eventualities.

The Gresham House non-executive directors who sit on each portfolio

company board have responded by working with their management teams

to ensure that appropriate scenario planning has been done to achieve

the best results during these uncertain times. There is also now a

greater focus on cash management and capital efficiency. With ample

liquidity following the recent fund raise, the Company is also well

placed to support portfolio companies with follow-on funding where

it is appropriate and can be structured on attractive terms. Strong

liquidity will also benefit the attractive new investment environment

for the Company which, in our view is strong and we are seeing a number

of interesting investment propositions.

There are some specific highs in the portfolio such as Preservica

which continues to see strong trading and is out-performing budget.

The exits from EOTH and Tharstern were also excellent results after

long running processes which had to negotiate numerous economic and

geo-political hurdles. By contrast, there were also some significant

falls, the largest were MyTutor and Connect Childcare with a further

fall in the quoted share price of Virgin Wines UK plc. Disappointingly,

after experiencing very difficult trading conditions since the onset

of COVID-19, Tapas Revolution has entered administration since the

period-end with no expected recovery for the VCTs.

The portfolio movements in the period are summarised as follows:

2023 2022

GBPm GBPm

--------------------------------- ------- -------

Opening portfolio value 73.08 88.15

New and follow-on investments 1.01 3.25

Disposal proceeds (9.13) (6.24)

Net realised gains 0.41 1.21

Unrealised v aluation movements (1.01) 2.99

--------------------------------- ------- -------

Portfolio value at 31 March 64.36 89.36

--------------------------------- ------- -------

Valuation changes of portfolio investments still held

The portfolio generated net unrealised losses of GBP(1.01) million

in the first half of its financial year.

The total valuation increases were GBP4.36 million. The main valuation

increases were in:

Preservica - GBP3.44 million

Aquasium - GBP0.32 million

Orri - GBP0.29 million

Preservica is performing well and increasing its recurring revenues

whilst Aquasium has started to gain significant traction with its

products. Finally, Orri has benefitted from a first time valuation

uplift due to the investment structuring.

The total valuation decreases were GBP(5.37) million. The main valuation

decreases were:

MyTutor - GBP(1.15) million

Connect Childcare - GBP(1.07) million

Virgin Wines - GBP(0.66) million

MyTutor has been impacted by declining sector multiples combined with

slower than anticipated growth over the year. Connect Childcare has

not grown revenues as quickly as hoped and is now prioritising capital

efficiency. Virgin Wines continues to suffer from negative sentiment

across the consumer sector. Following announcements of operational

issues over its key Christmas period, it has seen a further decline

in its quoted share price, although underlying trading remains resilient

and compares very favourably to its peers.

The Company's investment values have been insulated partially from

market movements and lower revenue growth by the preferred investment

structures employed in many of the portfolio companies. This acts

to moderate valuation swings and the net result is a more modest decline

in portfolio value.

The portfolio's valuation changes in the period are summarised as

follows:

Investment Portfolio Capital Movement 2023 2022 2020

GBPm GBPm GBPm

------------------------------------------------- ------- ------- ---------

Increase in the value of unrealised investments 4.36 11.98 26.68

Decrease in the value of unrealised investments (5.37) (8.99) (0.61)

------------------------------------------------- ------- ------- ---------

Net increase in the value of unrealised

investments (1.01) 2.99 26.07

------------------------------------------------- ------- ------- ---------

Realised gains 1.28 1.21 3.67

Realised losses (0.87) - (0 . 08)

------------------------------------------------- ------- ------- ---------

Net realised gains in the period 0.41 1.21 3.59

------------------------------------------------- ------- ------- ---------

Net investment portfolio movement in the

period (0.60) 4.20 29.66

------------------------------------------------- ------- ------- ---------

New investments during the period

The Company made one new investment of GBP1.01 million during the

period, as detailed below:

Company Business Date of Investment Amount of new

investment (GBPm)

Environmental

data

Connect Earth provider March 2023 0.34

---------------- --------------------- --------------------

Founded in 2021, Connect Earth (connect.earth) is a London-based

environmental data company that seeks to facilitate easy access

to sustainability data. With its carbon tracking API technology,

Connect Earth supports financial institutions in offering their

customers transparent insights into the climate impact of their

daily spending and investment decisions. Connect Earth's defensible

and scalable product platform suite has the potential to be a

future market winner in the nascent but rapidly growing carbon

emission data market, for example, by enabling banks to provide

end retail and business customers with carbon

footprint insights of their spending. This funding round is designed

to facilitate the delivery of the technology and product roadmap

to broaden the commercial reach of a proven product.

Education and

neuro-inclusion

Cognassist solutions March 2023 0.67

Cognassist (cognassist.com) is an education and neuro-inclusion

solutions company that provides a Software-as-a-Service (SaaS)

platform focused on identifying and supporting individuals with

hidden learning needs. The business is underpinned by extensive

scientific research and an extensive cognitive dataset. Cognassist

has scaled its underlying business within the education market.

This investment will empower Cognassist to continue its growth

within the education market and penetrate the enterprise market,

where demand for neuro-inclusive solutions to adequately support

employees is rapidly emerging.

Realisations during the period

The Company completed two exits during the period, as detailed below: Company Business Period of investment Total cash proceeds

over the life

of the investment/

Multiple over

cost

EOTH Branded clothing October 2011 to GBP9.54 million

(Rab and Lowe November 2022 6.9x cost

Alpine)

The Company realised its equity investment in EOTH for GBP7.34

million (realised gain in the period: GBP0.42 million) including

preference dividends. Total proceeds received over the life of

the investment were GBP9.54 million compared to an original investment

cost of GBP1.38 million, representing a multiple on cost of 6.9x

and an IRR of 23.2%. The Company has retained its interest yielding

loan stock investment. Once repaid, this should increase the multiple

on cost to 7.9x.

Tharstern Software based July 2014 to March GBP4.00 million

management information 2023 2.6x cost

systems

The Company realised its investment in Tharstern Group for GBP2.85

million (realised gain in period: GBP0.86 million). Total proceeds

received over the life of the investment were GBP4.00 million

compared to an original cost of GBP1.54 million, representing

a multiple on cost of 2.6x and an IRR of 15.0%.

Loan repayments and other proceeds in the period

The Company received a loan repayment from Jablite Holdings Limited

of GBP0.07 million.

Investment portfolio yield

In the period under review, the Company received the following amounts

in loan interest and dividend income:

Investment Portfolio Yield 2022 2022

GBPm GBPm

Interest received in the period 0.31 0.84

Dividends received in the period 0.56 0.40

------------------------------------------ ------ ------

Total portfolio income in the period(1) 0.87 1.24

------------------------------------------ ------ ------

Portfolio Value at 31 March 64.36 89.36

------------------------------------------ ------ ------

Portfolio Income Yield (Income as a % of

Portfolio value at 31 March) 1.4% 1.4%

------------------------------------------ ------ ------

(1) Total portfolio income in the period is generated solely from

investee companies within the portfolio

New investments made after the period-end

The Company made one new investment of GBP0.63 million after the period-end,

as detailed below:

Company Business Date of Investment Amount of further

investment (GBPm)

Sustainability

impact assessment

Dayrize tool provider May 2023 0.63

----------------------- ---------------------- ---------------------

Founded in 2020, Amsterdam-based Dayrize has developed a rapid

sustainability impact assessment tool that delivers product-level

insights for consumer goods brands and retailers, enabling them

to be leaders in sustainability. Its proprietary software platform

and methodology bring together an array of data sources to provide

a single holistic product-level sustainability score that is comparable

across product categories in under two seconds. This funding round

is to drive product development and develop its market strategy

to build on an opportunity to emerge as a market leader in the

industry.

Environmental, Social, Governance considerations

Gresham House is committed to sustainable investment as an integral

part of its business strategy. During the year, the Investment Adviser

has formalised its approach to sustainability and has put in place

several processes to ensure environmental, social and governance factors

and stewardship responsibilities are built into asset management across

all funds and strategies, including venture capital trusts, for example,

individual members of the investment team now have their own individual

ESG objectives set which align with the wider ESG goals of Gresham

House. For further details, Gresham House published its third Sustainable

Investment Report in April 2023, which can be found on its website

at: www.greshamhouse.com .

Outlook

Whilst the period under review has once again been marked with volatility

and uncertainty as a result of a number of factors affecting both

the global and UK economy, the portfolio has continued to trade well

under the circumstances. Rising costs and recessionary pressures will

place further strains on the portfolio. However, the portfolio is

well diversified and Gresham House has an experienced team working

closely with them to help them navigate the challenges that lie ahead.

In terms of new investment, evidence shows that investing through

the economic cycle has the potential to yield strong returns and Gresham

House is seeing a number of opportunities, both new deals and further

investment into the existing portfolio, which have the potential to

drive shareholder value over the medium term.

Gresham House Asset Management Limited

Investment Adviser

13 June 2023

Half-Year Report

Copies of this statement are being sent to all shareholders. Further

copies are available free of charge from the Company's registered

office, 5 New Street Square, London, EC4A 3TW, or can be downloaded

via the Company's website at www.incomeandgrowthvct.co.uk .

Contact

Gresham House Asset Management Limited

Company Secretary

mobeusvcts@greshamhouse.com

+44 20 7382 0999

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FXLLFXQLBBBE

(END) Dow Jones Newswires

June 14, 2023 02:00 ET (06:00 GMT)

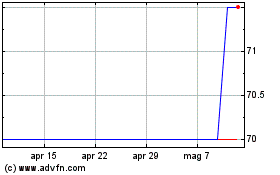

Grafico Azioni Income & Growth Vct (LSE:IGV)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Income & Growth Vct (LSE:IGV)

Storico

Da Apr 2023 a Apr 2024