TIDMIPU

LEGAL ENTITY IDENTIFIER: 549300K1D1P23R8U4U50

Invesco Perpetual UK Smaller Companies Investment Trust plc

Annual Financial Report Announcement for the Year Ended 31 January 2023

The following text is extracted from the Annual Financial Report of the Company

for the year ended 31 January 2023. All page numbers below refer to the Annual

Financial Report which will be made available on the Company's website.

Investment Objective

The Company is an investment trust whose investment objective is to achieve

long-term total returns for shareholders primarily by investment in a broad

cross-section of small to medium sized UK quoted companies.

Financial Highlights

Total Return Statistics (with dividends reinvested)

Change for the year (%) 2023 2022

Net asset value(1)(2) -17.5 +18.8

Share price(1)(2) -17.0 +21.9

Benchmark Index(2)(3) -12.4 +11.6

Capital Statistics

At 31 January 2023 2022 Change

Total shareholders' funds (£'000) 174,915 220,753 -20.8%

Net asset value per share ('NAV') 517.09p 652.60p -20.8%

Share price(1)(2) 451.00p 570.00p -20.9%

Discount(1) (12.8)% (12.7)%

Gearing(1):

- gross gearing nil nil

- net gearing nil nil

- net cash 2.9% 0.7%

Maximum authorised gearing 8.6% 6.8%

For the year ended 31 January 2023 2022

Return(1) and dividend per ordinary share:

Revenue return 11.99p 8.30p

Capital return (124.70)p 97.85p

Total return (112.71)p 106.15p

First interim dividend 3.75p 3.75p

Second interim dividend 3.75p 3.75p

Third interim dividend 3.75p 3.75p

Final dividend 6.79p 11.55p

Total dividends 18.04p 22.80p -20.9%

Dividend Yield(1) 4.0% 4.0%

Dividend payable for the year (£'000):

- from current year net revenue 4,055 2,808

- from capital reserve (2022: from capital reserve) 2,047 4,905

6,102 7,713

Capital dividend as a % of year end net assets(1) 1.2% 2.2%

Ongoing charges(1) 0.95% 0.92%

Notes: (1) Alternative Performance Measure (APM). See Glossary of

Terms and Alternative Performance Measures on pages 66 to 68 of the financial

report for details of the explanation and reconciliations of APMs.

(2) Source: Refinitiv.

(3) From 1 February 2022, the Benchmark Index of the

Company changed to the Numis Smaller Companies + AIM (excluding Investment

Companies) Index with dividends reinvested. For the year to 31 January 2022,

the Benchmark Index of the Company was the Numis Smaller Companies (excluding

Investment Companies) Index with dividends reinvested.

Chairman's Statement

Highlights

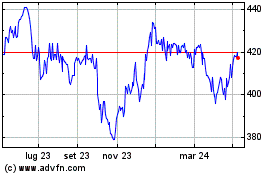

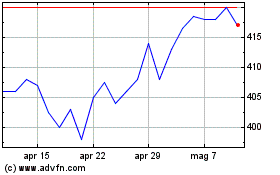

* Net asset value return of -17.5% and share price return of -17.0%, compared

to benchmark return of -12.4%, all based on total return with dividends

reinvested. The share price is showing signs of recovery from lows

following the mini-Budget in September 2022.

* Dividend of 18.04p per share for the year, providing a yield of 4.0% based

on the year end share price.

Dear Shareholders,

Performance

Against a backdrop of energy supply issues and concerns about inflation, with

both heightened by the continuing hostilities in Ukraine, it is perhaps

unsurprising that for the year ended 31 January 2023 your Company returned

-17.5% in Net Asset Value ('NAV') terms, underperforming its Benchmark Index,

the Numis Smaller Companies + AIM (excluding Investment Companies) Index, which

returned -12.4%, (in each case measured on total return with dividends

reinvested).

The Company's share price total return for the year was -17.0% (with dividends

reinvested).

This weak one year return should not be viewed out of context as in 2022 our

Portfolio Managers delivered strong results in terms of both NAV and share

price total returns and their longer term performance shown in the graph on the

preceding page in the Annual Financial Report, speaks for itself.

As at the latest practicable date prior to the publication of this report,

being 17 April 2023, the discount stands at 12.3% and the Company's share price

has fallen by 3.7%, the NAV has fallen by 4.2% and the Benchmark Index is down

by 3.9% over the period between 1 February and 17 April 2023. This reflects the

ongoing difficult trading environment for many UK listed smaller companies and

investment trusts that invest in them including your Company and many of its

peers.

Discount

During the year the Company's shares traded at a discount to its NAV ranging

between 9.8% to 18.6%. Many other trusts investing in UK smaller companies also

continue to trade at wider discounts than their historic averages. We hope that

shareholders and potential investors recognise the Company has continued to

deliver a yield in excess of the average yield of its UK smaller company

investment trust peers through investment in a broad cross-section of small to

medium sized UK quoted companies.

The Board continues to monitor the level at which the Company's shares trade

and may seek to limit any future volatility through the prudent use of both

share issuance and share buybacks, as the circumstances require.

Dividend and Dividend Policy

The Board has decided that the Company will propose a final dividend of 6.79p

per share to bring the total dividends paid for the year to 18.04p per share

(2022: 22.80p).

The total dividend of 18.04p per share is in line with the Company's stated

dividend policy which includes a target dividend yield of 4.0% of year end

share price which was 451.00p as at 31 January 2023. This represents all of the

available revenue earned by the Company's portfolio over the year, together

with 6.05p per share from realised capital profits.

The Company's revenue per share has increased from 8.30p per share last year to

11.99p per share this year, which means that the resulting balance of dividend

being paid from realised capital profits represents 1.2% of net assets at the

year end and it continues to represent a relatively small proportion of the

longer-term total returns achieved by the Portfolio Managers.

The Company's dividends are paid quarterly in September, December, March and

June. For the year ended 31 January 2023, three interim dividends of 3.75p per

share each have already been paid and the Board has proposed a final dividend

of 6.79p per share, making a total for the year of 18.04p per share. The final

dividend will be payable, subject to shareholder approval, on 13 June 2023 to

shareholders on the register on 12 May 2023 and the shares will go ex-dividend

on 11 May 2023.

Board Composition

As planned, and reported in the Interim Report, I will retire as a Director and

Chairman of the Company at the conclusion of the AGM to be held in June 2023.

Bridget Guerin will be appointed Chairman of the Board and of the Nomination

Committee on my retirement. Mike Prentis will take over as Senior Independent

Director and as Chairman of the Management Engagement Committee.

The Nomination Committee has commenced the search to find a new non-executive

director and will report the results of this process to shareholders in due

course.

Annual General Meeting ('AGM')

This year's meeting will be held in person at Invesco's London office at

12.00pm on Thursday 8 June 2023. As well as the Company's formal business,

there will be a presentation from Jonathan Brown and Robin West, the

opportunity to ask questions of the Portfolio Managers and Directors and to

chat informally with all of us over lunch. Shareholders may bring a guest to

these meetings. The Directors and I look forward to meeting as many of you as

possible. For those unable to attend in person, we will record a special

version of the presentation and post it onto our website after the AGM.

Shareholders wishing to lodge questions in advance of the AGM should do so by

email to the Company Secretary at investmenttrusts@invesco.com or, by letter,

to 43-45 Portman Square, London W1H 6LY.

Concluding Thoughts

As your Portfolio Managers have highlighted in their report on the following

pages, over the past year, equity markets have been adversely affected by the

ongoing conflict in Ukraine, UK politics and more recently, renewed worries

about the global banking system.

In the face of all of the macroeconomic problems and political turmoil, I am

pleased to report that your Portfolio Managers have continued to manage your

portfolio according to their investment philosophy, namely seeking out well

managed, growing businesses with outstanding products or services, with the

prospect of taking market share from competitors and which are also profitable

and cash generative.

Conviction that UK smaller companies continue to provide investment

opportunities with which to deliver long-term total returns for shareholders

remains a constant, regardless of the investment conditions which prevail. This

year it has led Jonathan and Robin to a more 'barbell' portfolio construction

with investments typically categorised as cyclical or defensive to find balance

in the uncertain market conditions in which they have been working. Such

pragmatism has meant that the quality and valuation metrics your Portfolio

Managers seek for the portfolio have not been sacrificed.

The year ahead will doubtless see the portfolio evolve further as conditions

change again, hopefully for the better. While I will not be witnessing those

changes as a director of your Company, I shall look forward to following them

as a shareholder.

Jane Lewis

Chairman

18 April 2023

Portfolio Managers' Report

Q What were the key influences on the market over the year?

A The war in Ukraine and its impact on energy prices was the dominant

feature of the year. Hopes that inflation would be transitory were dashed and

markets began to factor in materially higher interest rates. The shift from the

ultra-low interest rate environment in the decade following the Global

Financial Crisis to a level more in line with historical norms had a dramatic

impact on asset prices. Equities tumbled both in the UK and overseas, and bond

prices fell sharply as traders factored in the rapidly changing outlook. The

sell-off initially focussed on highly rated growth and technology stocks but

broadened into consumer related sectors as the cost-of-living crisis began to

bite.

The situation was further exacerbated by political turmoil in the UK. The

short-lived Liz Truss government unsettled markets with a package of tax

give-aways and spending pledges which led some commentators to question how the

UK could fund itself. A run on Sterling and significantly higher gilt yields

paved the way for further change, with Truss becoming the shortest lived Prime

Minister in UK history. The Sunak government reversed many of the policies of

his predecessor, which prompted the beginning of a market rally, reversing some

of the declines of the previous year.

Q How did the portfolio perform over the period?

A The Net Asset Value total return for the portfolio over the period

was -17.5%, compared with the Benchmark Index, the Numis Smaller Companies +

AIM (excluding Investment Companies) Index, which returned -12.4% on the same

basis. This performance compares to a return of -16.8% for the Investment

Association UK Smaller Companies sector.

Q What factors led to the underperformance versus the benchmark?

A In a difficult year for the market, very few sectors ended the

period in positive territory. However, in the wake of the Russian invasion of

Ukraine, Oil & Gas, Defence and Mining all performed strongly. Whilst we have

some exposure to these areas, it is not always possible to find companies that

meet our quality criteria in these sectors, and therefore we were underweight

relative to the benchmark.

Q Which stocks contributed to and detracted from performance?

A The best performing stocks over the period included: Online

promotional products business, 4imprint (+64%), which is the leading player in

its sector in the US. Management's decision to continue investing in the

business through the pandemic saw it emerge from the downturn with a stronger

market position. The stock benefitted from a series of upgrades to analysts'

earnings expectations. Keywords Studios (+13%), which is a global leader in

providing outsourced services to the computer games industry, continued to grow

strongly, driven by a mixture of above market growth and acquisitions. The

computer games industry, which is now a £220bn per year sector, continues to

grow and is ever more reliant on outsourcers to help manage the creation of new

titles. Oil & Gas business, Energean (+23%), benefitted from improved sentiment

towards the sector as the Ukraine conflict elevated the price of energy. The

business achieved initial production from its substantial gas discovery in the

eastern Mediterranean and also had further drilling success in the region.

Coats (+11%) is a world leading supplier of thread and other components to

global apparel manufacturers. The business benefitted from two acquisitions,

giving it market leadership in the casual footwear segment, and from a recovery

in the sector following the pandemic. Defence business, Ultra Electronics

(+14%), was taken over for an attractive price at the beginning of the period.

It was a difficult period for markets so inevitably there were more poorly

performing holdings than usual:

Hilton Food (-36%) saw its margins squeezed by raw material price increases.

Russian trawlers are a significant source of white fish and sanctions imposed

following the invasion of Ukraine led to a surge in prices. The business was

unable to quickly pass this on to its supermarket customers and saw a shortfall

in profit. We believe the business can navigate through this issue and still

has significant growth potential. We used the decline in the share price to add

to our holding. Media business, Future (-52%), a publisher of online and

magazine content, has historically been an excellent performer in the

portfolio. Although the business continued to trade well, it initially fell

along with many other growth and technology businesses earlier in the year, and

then declined further when its CEO announced she would be retiring at the end

of 2023. We have taken substantial profits from the holding over the last few

years, and although the recent decline is disappointing, we believe the

business could be significantly more valuable in future. Law business, Knights

(-76%), a legal and professional services business, suffered a profit warning

which management attributed to Covid-19 related staff absences. We believe

there is evidence of other issues within the company, so we sold the holding

shortly before your Company's year end. Inspecs (-71%), which manufactures

eyewear, initially retreated due to an accounting irregularity in its small US

subsidiary, and then from a sudden decline in demand from its German customers

following the Russian invasion of Ukraine. The US issue has been resolved and

German demand has rebounded, however, we have reduced the holding and will

continue to closely assess the performance of the business and the new CEO.

Q What is the current portfolio strategy?

A Our investment philosophy remains unchanged. The current portfolio

is comprised of 70-80 stocks with the sector weightings being determined by

where we are finding attractive companies at a given time, rather than by

allocating assets according to a "top down" view of the economy. We continue to

seek growing businesses, which have the potential to be significantly larger in

the medium term. These tend to be companies that either have great products or

services, that can enable them to take market share from their competitors, or

companies that are exposed to higher growth niches within the UK economy or

overseas. We prefer to invest in cash generative businesses that can fund their

own expansion, although we are willing to back strong management teams by

providing additional capital to invest for growth.

The sustainability of returns and profit margins is vital for the long-term

success of a company. The assessment of the position of a business within its

supply chain and a clear understanding of how work is won and priced are key to

determining if a company has "pricing power", which is particularly important

in the current inflationary environment. It is also important to determine

which businesses possess unique capabilities, in the form of intellectual

property, specialist know-how or a scale advantage in their chosen market. We

conduct around 300 company meetings and site visits a year, and these areas are

a particular focus for us on such occasions.

In terms of portfolio construction, we are currently opting for a "barbell"

approach, with a balance of both cyclical (economically sensitive) stocks, and

more defensive businesses that should be more resilient in a downturn. Whilst

cyclical stocks could see weaker trading in event of a recession this year,

this is to some extent factored into profit expectations and valuations, which

in many cases are already "pricing in" an economic downturn. These stocks could

outperform when the market starts to look through the current weakness to the

recovery ahead. Counterbalancing this are more defensive businesses that should

continue to trade resiliently even if the economy struggles more than

anticipated. These stocks offer a greater degree of certainty, and this is

often reflected in higher valuations. The future is unpredictable, so we

believe that running a balanced portfolio and maintaining our focus on quality

and valuation will serve us best in this environment. We would expect to tilt

the barbell as more clarity emerges on the economic outlook.

Q What are the major holdings in the portfolio?

A The 5 largest holdings in the portfolio at the end of the year were:

. 4imprint (4.7% of the portfolio) sells promotional materials such as

pens, bags and clothing which are emblazoned with company logos. The business

gathers orders through online and catalogue marketing, which are then routed to

their suppliers who produce and dispatch the products to customers. As a result

of outsourcing the majority of manufacturing, the business has a relatively low

capital requirement and can focus on marketing and customer service. Continual

reinvestment of revenue into marketing campaigns has enabled the business to

generate an enviable long term growth record whilst maintaining margins.

. CVS (2.9% of the portfolio) is a leading veterinary services business,

which owns over 500 vet surgeries and specialist centres, predominantly in the

UK. The scale of the business gives it purchasing power, allowing it to

generate a higher margin than individual surgeries. The business has been a

leading consolidator of the UK market and has recently entered continental

Europe. The business is relatively immune to the economic cycle and, with ever

more being spent on the wellbeing of the nation's pets, can continue to grow

for many years to come.

. JTC (2.8% of the portfolio) is a financial administration business

providing services to real estate and private equity funds, multinational

companies, and high net worth individuals. The business has a strong culture, a

reputation for quality and has augmented its organic growth with acquisitions.

Margins and returns on capital are strong and the business benefits from long

term contracts, giving it excellent earnings visibility.

. Hollywood Bowl (2.7% of the portfolio) is a leisure business operating

ten pin bowling alleys in the UK and Canada. The sector had historically been

woefully underinvested in the UK and management have successfully grown the

business by acquiring and modernising existing sites and by opening new sites

in leisure and retail parks. The low ticket, family friendly nature of the

activity has allowed the business to grow even in more difficult economic

conditions. Management recently acquired a business in Canada, where they

believe there is a similar opportunity to consolidate and modernise the sector.

. Hill & Smith (2.5% of the portfolio) is a supplier of products and

services into the infrastructure sectors in the UK, US and Europe. Its

proprietary steel and composite products are used in the rail, roads, water and

energy sectors. The business also provides galvanizing services to protect

steel structures, and leases temporary road barriers and security products. The

company generates good margins and benefits from exposure to growing

infrastructure investment.

Q What were the new holdings added over the period?

A We took advantage of the significant de-rating of a number of

technology/growth stocks that we have known for some time, and in some cases

owned previously, to start positions in these businesses - for example Auction

Technology, GB Group and AJ Bell discussed below.

. XP Power manufactures power conversion units for the semiconductor,

healthcare and industrial technology sectors. Power converters convert high

voltage alternating current from the main grid into the stable, low voltage

direct current required for electronic equipment. Its products are sold

globally, with North America accounting for 63% of revenue, Europe 28% and Asia

9%. Whilst clearly cyclical, the business has a good long term growth record

and a strong level of repeat revenue once designed into a product. Although

there is not significant intellectual property in the business, its reputation

for quality, reliability and service levels enables it to generate circa 20%

margins. It is a business we have followed for some time and the 40% share

price decline presented us with an opportunity to start building a position.

. Auction Technology is a business we have previously held in the

portfolio. The origin of the business was as the publisher of the Auction Trade

Gazette, the trade magazine for the UK antiques industry. The business moved

into providing an online platform for auction houses (the-saleroom.com) to

augment the "in-room" bidding. This pulls in a significantly larger pool of

bidders and improves pricing, which has led to rapid adoption by auctioneers in

both the UK, US and continental Europe. The business has also diversified into

the auction of used industrial equipment in the US, which is a very sizable

market. The company generates very high margins, but these have potential to

grow further as its largely fixed cost base is leveraged by increasing revenue.

We decided to rebuild the position following a circa 50% decline in its share

price.

. GB Group helps online companies to validate and verify the identity

and locations of their customers. It enables organisations to offer a better

user experience, protect themselves against fraud, and ensure regulatory

compliance. Services include ID verification, credit risk checking, anti-money

laundering compliance, age verification and document validation. The business

has a strong long-term organic growth record which it augments via acquisition.

The circa 50% decline in its share price provided us with an interesting entry

point.

. AJ Bell provides online investment platform and stockbroking services.

The business has two main products: Direct-to-Consumer platform, AJ Bell, and

Investcentre, a Business-to-Consumer platform focussed on the IFA market. It is

one of the UK's leading players with around £75 billion of assets under

administration and aims to offer lower fee rates than its main rivals. The

company has an enviable long-term growth record and still has plenty of scope

for market share gains. We like the financial characteristics of the business

(cash generative, high margins, strong balance sheet), although revenue is

impacted by market levels. We have owned the business historically and believe

the recent 30%+ decline in the share price offered a good opportunity to

rebuild the holding.

. Marshalls is the UK's leading hard landscaping manufacturer, supplying

natural stone and innovative concrete products to the construction, home

improvement and landscape markets. Its products include paving blocks, walling,

drainage systems, greenhouses, garages, and street furniture. Public sector and

commercial end markets are the largest users of Marshalls' products. The UK

accounts for about 95% of Marshalls' total revenue. The business recently

acquired Marley, which is the UK leading supplier of roof tiles. Clearly the

business is facing cost headwinds and a weaker demand environment. However, we

believe this is more than reflected in its valuation following a 65% decline in

its share price.

. Ergomed is a contract research organisation focussed on the

pharmaceutical industry. Around two thirds of revenue is derived from

pharmacovigilance, which collects data for on-market drugs, particularly around

adverse events associated with the drug. A third of revenue is derived from

clinical research services, which provides services to pharma and biotech

business which facilitate the process of conducting medical trials and

ultimately achieving regulatory approval for new products. The business

focusses on the niche areas of oncology and rare diseases, which offer higher

potential growth rates. Services include patient recruitment, project

management, clinical monitoring, data management and medical writing. The

business has a good long term growth record, both organically and via

acquisition.

. Next Fifteen Communications is part advertising agency and part

digital transformation consultancy. The company helps businesses market

themselves more effectively and improves the way they interact with customers

online. It counts 57 of the top 100 "best loved" global brands as clients,

generating around 60% of revenue from the US. The business has a good track

record of winning clients and then expanding the range of services that they

supply, which often results in multi-year relationships with major businesses.

The company has a very good long term growth record.

Q What is the managers approach to gearing?

A Gearing decisions are taken after reviewing a variety of metrics

including valuations, earnings momentum, market momentum, bond spreads and a

range of economic indicators. After analysing this data and following

discussions with the Board, we concluded that the Company should not be geared

at this point, although we have reduced the cash position towards the year end.

We will continue to monitor these factors and look to gear the Company when the

indicators turn more positive.

Q How does Environment, Social and Governance ('ESG') factor in the

investment process?

A ESG issues are increasingly a focus for many investors and analysis

of these factors has always been a core part of our investment process. Invesco

has significant resources focussed on ESG, both at a group and individual team

level. Our proprietary ESGintel system draws in company specific data from a

broad range of sources and enables ESG related metrics to be quantified. This

provides fund managers with clear overview of areas of concern, allowing

targeted engagement with businesses to bring about positive change.

Environmental liabilities, socially dubious business practises and poor

corporate governance can have a significant impact on share prices. We assess

environmental risks within a business, and analyse the steps being taken to

reduce its environmental impact. We like businesses with strong cultures and

engaged employees, and avoid businesses which, whilst acting within the law,

run the risk of a public backlash, or being constrained by new legislation.

When it comes to governance, board structure and incentivisation, we

proactively consult with all the businesses we own and vote against resolutions

where standards fall short of our expectations. We believe that high standards

of governance and incentivisation that aligns management with shareholders, are

the most important aspects of ESG for driving shareholder returns within the

smaller companies sector. Further details of the ESG process of the Manager is

disclosed on pages 19 to 22.

A recent example of engagement was with a company that provides equipment for

rental and associated services to a range of end markets including

infrastructure, construction, and oil and gas. We engaged as part of a regular

update with the company and discussed both environmental and governance

factors.

On environmental factors, the company is investing in greener, more

environmentally friendly equipment. In many cases this new equipment is no more

expensive than replacing the old petrol equipment. The company has continued to

make good progress in their engagement with customers and supply chain partners

to deliver sustainable fleet solutions as they strive to reduce emissions. They

are investing further in battery and solar powered equipment and in lower

emission commercial vehicles and as a result are seeing increased demand from

customers. The heavier equipment they provide is more difficult to convert to

electric and hydrogen may be longer term solution for this area.

With regard to governance factors, we successfully engaged with the company

regarding refreshment of the board given the long tenure of two non-executive

directors ('NEDs'). The change was instigated with a view to improving board

independence. We are pleased with the improvements made on governance factors

and are content to maintain the position.

Q What is the dividend policy of the Company?

A The Company pays out all the income earned within the portfolio and

enhances it using a small amount of realised capital profits to target a

dividend yield of 4% based on the year end share price. This provides

shareholders with an attractive and consistent yield whilst allowing us to

target businesses that we believe will deliver the best total return, without

having to compromise on quality to achieve an income target.

Q What are your expectations for the year ahead?

A The last three years have been unusually volatile, however we can

see a more stable picture emerging. Energy prices have declined substantially

from their peak, with oil and gas prices now below the level they were a year

ago. Whilst there is always a lag to this feeding through to the cost of

living, it seems likely that inflation will return towards its historical

average of 4-5% as we move through the middle of the year. Tight labour markets

are a blessing for job hunters, but wage demands could potentially cause

inflation to be quite stubborn around this level. We would expect the Bank of

England to halt interest rate increases this year, and this should be a

positive for markets, but it seems less likely that we will see cuts to base

rates in the short term.

The UK smaller companies sector is very cheap when compared to both its own

history and other global markets. A more stable political situation in the UK,

a peaking of the interest rate cycle and the prospect of economic recovery

could all provide the catalyst for this discount to narrow. We continue to see

interesting opportunities across a range of sectors and will continue to take

advantage of these as they arise. So, whether we see a recession or not this

year, we believe that the UK smaller companies sector continues to offer a

wealth of opportunity for investors.

Jonathan Brown Robin West

Portfolio Managers Deputy Portfolio Manager

18 April 2023

Principal Risks and Uncertainties

The Directors confirm that they have carried out a robust assessment of the

emerging and principal risks facing the Company, including those that would

threaten its business model, future performance, solvency or liquidity. Most of

these risks are market related and are similar to those of other investment

trusts investing primarily in listed markets. The Audit Committee reviews the

Company's risk control summary at each meeting, and as part of this process,

gives consideration to identify emerging risks. Emerging risks, such as

evolving cyber threat, geo-political tension and climate related risks, have

been considered during the year as part of the Directors' assessment.

Principal Risk Description Mitigating Procedures and Controls

Market (Economic) Risk The Directors have assessed the market

Factors such as fluctuations in stock markets, impact of the ongoing uncertainty from the

interest rates and exchange rates are not under conflict in Ukraine and the resulting

the control of the Board or the Portfolio sanctions imposed on Russia, and the

Managers, but may give rise to high levels of concerns regarding the global banking

volatility in the share prices of investee system through regular discussions with the

companies, as well as affecting the Company's Portfolio Managers and the Corporate

own share price and the discount to its NAV. Broker. The Company's current portfolio

The risk could be triggered by unfavourable consists of companies listed on the main UK

developments globally and/or in one or more equity market and those listed on AIM. The

regions, contemporary examples being the market Company does not have direct investments in

uncertainty in relation to the ongoing invasion Russia or hold stocks with significant

of Ukraine by Russia and renewed concerns links to Russia. To a limited extent,

regarding the global banking system. futures can be used to mitigate the market

(economic) risk, as can the judicious

holding of cash or other very liquid

assets. Futures are not currently being

used.

Investment Risk The Portfolio Managers' approach to

The Company invests in small and medium-sized investment is one of individual stock

companies traded on the London Stock Exchange selection. Investment risk is mitigated via

or on AIM. By their nature, these are generally the stock selection process, together with

considered riskier than their larger the slow build-up of holdings rather than

counterparts and their share prices can be more the purchase of large positions outright.

volatile, with lower liquidity. In addition, as This allows the Portfolio Managers,

smaller companies may not generally have the cautiously, to observe more data points

financial strength, diversity and resources of from a company before adding to a position.

larger companies, they may find it more The overall portfolio is well diversified

difficult to overcome periods of economic by company and sector. The weighting of an

slowdown or recession. investment in the portfolio tends to be

loosely aligned with the market

Furthermore, the risk of climate change and capitalisation of that company. This means

matters concerning ESG could affect the that the largest holdings will often be

valuation of companies held in the portfolio. amongst the larger of the smaller companies

available. The Portfolio Managers are

relatively risk averse, look for lower

volatility in the portfolio and seek to

outperform in more challenging markets. The

Portfolio Managers remain cognisant at all

times of the potential liquidity of the

portfolio. There can be no guarantee that

the Company's strategy and business model

will be successful in achieving its

investment objective. The Board monitors

the performance of the Company, giving due

consideration to how the Manager has

incorporated ESG considerations including

climate change into their investment

process. Further details can be found on

pages 19 to 22. The Board also has

guidelines in place to ensure that the

Portfolio Managers adhere to the approved

investment policy. The continuation of the

Manager's mandate is reviewed annually.

Shareholders' Risk The Board reviews regularly the Company's

The value of an investment in the Company may investment objective and strategy to ensure

go down as well as up and an investor may not that it remains relevant, as well as

get back the amount invested. reviewing the composition of the

shareholder register, peer group

performance on both a share price and NAV

basis, and the Company's share price

discount to NAV per share. The Board and

the Portfolio Managers maintain an active

dialogue with the aim of ensuring that the

market rating of the Company's shares

reflects the underlying NAV; both share buy

back and issuance facilities are in place

to help the management of this process.

Reliance on the Manager and other Third-Party Third-party service providers are subject

Service Providers to ongoing monitoring by the Manager and

The Company has no employees and the Board the Board.

comprises non-executive directors only. The

Company is therefore reliant upon the The Manager reviews the performance of all

performance of third-party service providers third-party providers regularly through

for its executive function and service formal and informal meetings.

provisions. The Company's operational structure

means that all cyber risk (information and The Audit Committee reviews regularly the

physical security) arises at its third-party performance and internal controls of the

service providers, including fraud, sabotage or Manager and all third-party providers

crime against the Company. The Company's through audited service organisation

operational capability relies upon the ability control reports, together with updates on

of its third-party service providers to information security, the results of which

continue working throughout the disruption are reported to the Board.

caused by a major event such as the Covid-19

pandemic. Failure by any service provider to The Manager's business continuity plans are

carry out its obligations to the Company in reviewed on an ongoing basis and the

accordance with the terms of its appointment Directors are satisfied that the Manager

could have a materially detrimental impact on has in place robust plans and

the operation of the Company and could affect infrastructure to minimise the impact on

the ability of the Company to successfully its operations so that the Company can

pursue its investment policy. The Company's continue to trade, meet regulatory

main service providers, of which the Manager is obligations, report and meet shareholder

the principal provider, are listed on page 65. requirements. The Board receives regular

The Manager may be exposed to reputational update reports from the Manager and

risks. In particular, the Manager may be third-party service providers on business

exposed to the risk that litigation, continuity processes and has been provided

misconduct, operational failures, negative with assurance from them all insofar as

publicity and press speculation, whether or not possible that measures are in place for

it is valid, will harm its reputation. Damage them to continue to provide contracted

to the reputation of the Manager could services to the Company.

potentially result in counterparties and third

parties being unwilling to deal with the

Manager and by extension the Company, which

carries the Manager's name. This could have an

adverse impact on the ability of the Company to

pursue its investment policy successfully.

Regulatory Risk The Manager reviews the level of compliance

The Company is subject to various laws and with tax and other financial regulatory

regulations by virtue of its status as an requirements on a regular basis. The Board

investment trust, its listing on the London regularly considers all risks, the measures

Stock Exchange and being an Alternative in place to control them and the

Investment Fund under the UK AIFMD regime. A possibility of any other risks that could

loss of investment trust status could lead to arise. The Manager's Compliance and

the Company being subject to corporation tax on Internal Audit team produce annual reports

the chargeable capital gains arising on the for review by the Company's Audit

sale of its investments. Other control Committee. Further details of risks and

failures, either by the Manager or any other of risk management policies as they relate to

the Company's service providers, could result the financial assets and liabilities of the

in operational or reputational problems, Company are detailed in note 16 of this

erroneous disclosures or loss of assets through Annual Financial Report.

fraud, as well as breaches of regulations.

Viability Statement

In accordance with provision 31 of the UK Code of Corporate Governance 2018,

the Directors have assessed the prospects of the Company over a longer period

than 12 months. The Company is an investment trust, a collective investment

vehicle designed and managed for long term investment. While the appropriate

period over which to assess the Company's viability may vary from year to year,

the long term for the purpose of this viability statement is currently

considered by the Board to be at least five years, with the life of the Company

not intended to be limited to that or any other period.

The main risks to the Company's continuation are: poor investment performance

over an extended period; shareholder dissatisfaction through failure to meet

the Company's investment objective; or the investment policy not being

appropriate in prevailing market conditions. Accordingly, failure to meet the

Company's investment objective, and contributory market and investment risks

are deemed by the Board to be principal risks of the Company and are given

particular consideration when assessing the Company's long term viability.

Despite the current impact on global markets resulting from the invasion of

Ukraine by Russia, the Directors remain confident that the Company's investment

strategy will continue to serve shareholders well over the longer term.

The investment objective of the Company has been substantially unchanged for

many years. The 2015 amendment to dividend policy gave some additional weight

to targeting increased dividend income to shareholders. This change does not

affect the total return sought or produced by the Portfolio Managers but was

designed to increase returns distributed to shareholders. The Board considers

that the Company's investment objective remains appropriate. This is confirmed

by contact with major shareholders.

Performance derives from returns for risk taken. The Portfolio Managers' Report

on pages 9 to 12 sets out their current investment strategy. There has been no

material change in the Company's investment objective or policy.

Demand for the Company's shares and performance are not things that can be

forecast, but there are no current indications that either or both of these may

decline substantially over the next five years so as to affect the Company's

viability.

The Company is a closed end investment trust and can pursue a long term

investment strategy and make use of gearing to enhance returns through

investment cycles without the need to maintain liquidity for investor

redemptions.

Based on the above analysis, including review of the revenue forecast for

future years along with stress testing of both the revenue forecast and the

portfolio valuation, reverse stress testing of debt covenants and dividend

sensitivity analysis, the Directors confirm that they expect the Company will

continue to operate and meet its liabilities, as they fall due, during the five

years ending January 2028.

Investments in Order of Valuation

AT 31 JANUARY 2023

Ordinary shares unless stated otherwise

Market

Value % of

Company Sector £'000 Portfolio

4imprint Media 8,068 4.7

CVSAIM Consumer Services 4,938 2.9

JTC Investment Banking and Brokerage 4,845 2.8

Services

Hollywood Bowl Travel and Leisure 4,709 2.7

Hill & Smith Industrial Metals and Mining 4,375 2.5

Advanced Medical SolutionsAIM Medical Equipment and Services 4,255 2.5

Alfa Financial Software Software and Computer Services 3,955 2.3

Energean Oil, Gas and Coal 3,833 2.2

Hilton Food Food Producers 3,613 2.1

Keywords StudiosAIM Leisure Goods 3,585 2.1

Top Ten Holdings 46,176 26.8

Brooks MacdonaldAIM Investment Banking and Brokerage 3,572 2.1

Services

Essentra Industrial Support Services 3,501 2.0

discoverIE Electronic and Electrical Equipment 3,500 2.0

Serco Industrial Support Services 3,417 2.0

AJ Bell Investment Banking and Brokerage 3,407 2.0

Services

Coats General Industrials 3,382 2.0

Marshalls Construction and Materials 3,344 1.9

RWSAIM Industrial Support Services 3,281 1.9

Chemring Aerospace and Defence 3,154 1.8

Videndum Industrial Engineering 3,065 1.8

Top Twenty Holdings 79,799 46.3

Kainos Software and Computer Services 3,007 1.7

Learning TechnologiesAIM Software and Computer Services 2,897 1.7

Alpha Financial Markets Industrial Support Services 2,826 1.6

ConsultingAIM

FDM Industrial Support Services 2,818 1.6

Aptitude Software Software and Computer Services 2,810 1.6

Johnson ServiceAIM Industrial Support Services 2,744 1.6

FocusriteAIM Leisure Goods 2,711 1.6

Jadestone EnergyAIM Oil, Gas and Coal 2,702 1.6

Volution Construction and Materials 2,696 1.6

Future Media 2,645 1.5

Top Thirty Holdings 107,655 62.4

Robert Walters Industrial Support Services 2,540 1.5

LoungersAIM Travel and Leisure 2,459 1.4

The Gym Travel and Leisure 2,405 1.4

Crest Nicholson Household Goods and Home Construction 2,326 1.3

CLS Real Estate Investment and Services 2,279 1.3

Churchill ChinaAIM Household Goods and Home Construction 2,258 1.3

Ricardo Construction and Materials 2,252 1.3

Young & Co's Brewery - Travel and Leisure 2,220 1.3

Non-VotingAIM

PZ Cussons Personal Care, Drug and Grocery Stores 2,217 1.3

Genuit Construction and Materials 2,186 1.3

Top Forty Holdings 130,797 75.8

VP Industrial Transportation 2,102 1.2

Wickes Retailers 2,058 1.2

Secure Trust Bank Banks 2,028 1.2

Severfield Construction and Materials 1,972 1.1

Vistry Household Goods and Home Construction 1,959 1.1

Gresham HouseAIM Closed End Investments 1,954 1.1

Auction Technology Software and Computer Services 1,910 1.1

James Fisher and Sons Industrial Transportation 1,898 1.1

GB GroupAIM Software and Computer Services 1,809 1.1

MidwichAIM Industrial Support Services 1,732 1.0

Top Fifty Holdings 150,219 87.0

RestoreAIM Industrial Support Services 1,654 1.0

Restaurant Group Travel and Leisure 1,642 1.0

Avon Protection Aerospace and Defence 1,634 0.9

MarloweAIM Industrial Support Services 1,578 0.9

Workspace Real Estate Investment Trusts 1,538 0.9

Mitchells & Butlers Travel and Leisure 1,441 0.9

M&C SaatchiAIM Media 1,272 0.7

Topps Tiles Retailers 1,258 0.7

FD TechnologiesAIM Software and Computer Services 1,247 0.7

XP Power Electronic and Electrical Equipment 1,188 0.7

Top Sixty Holdings 164,671 95.4

Treatt Chemicals 1,118 0.6

Dunelm Retailers 1,022 0.6

Savills Real Estate Investment and Services 895 0.5

ErgomedAIM Pharmaceuticals and Biotechnology 856 0.5

Gooch & HousegoAIM Technology Hardware and Equipment 826 0.5

InspecsAIM Personal Goods 825 0.5

Next Fifteen CommunicationsAIM Media 805 0.5

CohortAIM Aerospace and Defence 690 0.4

ThruvisionAIM Electronic and Electrical Equipment 530 0.3

Tyman Construction and Materials 405 0.2

Top Seventy Holdings 172,643 100.0

Total Investments (70) 172,643 100.0

AIM Investments quoted on AIM.

The percentage of the portfolio by value invested in AIM stocks at the year end

was 32.8% (2022: 30.9%). There were 26 AIM stocks held at the year end,

representing 37.1% of the 70 stocks (2022: 26 AIM stocks held representing

34.2% of the 76 stocks held).

Directors' Responsibilities Statement

The Directors are responsible for preparing the Annual Financial Report in

accordance with United Kingdom applicable law and regulations.

Company law requires the Directors to prepare financial statements for each

financial year. Under the law the Directors have elected to prepare financial

statements in accordance with UK-adopted international accounting standards.

Under company law, the Directors must not approve the financial statements

unless they are satisfied that they give a true and fair view of the state of

affairs of the Company and of the profit or loss of the Company for that

period.

In preparing these financial statements, the Directors are required to:

. select suitable accounting policies in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors and then apply

them consistently;

. make judgements and estimates that are reasonable and prudent;

. present information, including accounting policies, in a manner that

provides relevant, reliable, comparable and understandable information;

. present additional disclosures when compliance with the specific

requirements in IFRSs is insufficient to enable users to understand the impact

of particular transactions, other events and conditions on the group and

company financial position and financial performance;

. state whether UK-adopted international accounting standards have been

followed, subject to any material departures disclosed and explained in the

financial statements; and

. prepare the financial statements on the going concern basis unless it

is inappropriate to presume that the Company will continue in business.

The Directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions and disclose with

reasonable accuracy at any time the financial position of the Company and

enable them to ensure that the financial statements comply with the Companies

Act 2006. They are also responsible for safeguarding the assets of the Company

and hence for taking reasonable steps for the prevention and detection of fraud

and other irregularities.

Under applicable law and regulations, the Directors are also responsible for

preparing the Strategic Report, a Corporate Governance Statement, a Directors'

Remuneration Report and a Directors' Report that comply with the law and

regulations.

The Directors of the Company each confirm to the best of their knowledge, that:

. the financial statements, prepared in accordance with UK adopted

international accounting standards, give a true and fair view of the assets,

liabilities, financial position and profit of the Company;

. this Annual Financial Report includes a fair review of the development

and performance of the business and the position of the Company together with a

description of the principal risks and uncertainties that it faces; and

. they consider that this Annual Financial Report, taken as a whole, is

fair, balanced and understandable and provides the information necessary for

shareholders to assess the Company's position and performance, business model

and strategy.

Signed on behalf of the Board of Directors

Jane Lewis

Chairman

18 April 2023

Statement of Comprehensive Income

FOR THE YEARED 31 JANUARY

2023 2022

Revenue Capital Total Revenue Capital Total

Notes £'000 £'000 £'000 £'000 £'000 £'000

(Loss)/profit on 9 - (41,010) (41,010) - 34,552 34,552

investments held at fair

value

Profit on foreign - 5 5 - - -

exchange

Income 2 4,646 - 4,646 3,448 - 3,448

Investment management 3 (206) (1,165) (1,371) (254) (1,440) (1,694)

fees

Other expenses 4 (384) (3) (387) (385) (5) (390)

(Loss)/profit before

finance costs and 4,056 (42,173) (38,117) 2,809 33,107 35,916

taxation

Finance costs 5 (1) (7) (8) (1) (7) (8)

(Loss)/profit before 4,055 (42,180) (38,125) 2,808 33,100 35,908

taxation

Taxation 6 - - - - - -

(Loss)/profit after 4,055 (42,180) (38,125) 2,808 33,100 35,908

taxation

Return per ordinary 7 11.99p (124.70)p (112.71)p 8.30p 97.85p 106.15p

share

The total column of this statement represents the Company's statement of

comprehensive income, prepared in accordance with UK-adopted international

accounting standards. The (loss)/profit after taxation is the total

comprehensive (loss)/income. The supplementary revenue and capital columns are

both prepared in accordance with the Statement of Recommended Practice issued

by the Association of Investment Companies. All items in the above statement

derive from continuing operations of the Company. No operations were acquired

or discontinued in the year.

Statement of Changes in Equity

FOR THE YEARED 31 JANUARY

Capital

Share Share Redemption Capital Revenue

Capital Premium Reserve Reserve Reserve Total

Notes £'000 £'000 £'000 £'000 £'000 £'000

At 31 January 2021 10,642 22,366 3,386 154,986 - 191,380

Total comprehensive

income for the year - - - 33,100 2,808 35,908

Dividends paid 8 - - - (3,997) (2,538) (6,535)

At 31 January 2022 10,642 22,366 3,386 184,089 270 220,753

Total comprehensive

loss for the year - - - (42,180) 4,055 (38,125)

Dividends paid 8 - - - (4,905) (2,808) (7,713)

At 31 January 2023 10,642 22,366 3,386 137,004 1,517 174,915

The accompanying accounting policies and notes are an integral part of these

financial statements.

Balance Sheet

AS AT 31 JANUARY

2023 2022

Notes £'000 £'000

Non-current assets

Investments held at fair value through profit or loss 9 172,643 219,818

Current assets

Other receivables 10 400 157

Cash and cash equivalents 5,055 1,530

5,455 1,687

Total assets 178,098 221,505

Current liabilities

Other payables 11 (3,183) (752)

Total assets less current liabilities 174,915 220,753

Net assets 174,915 220,753

Capital and reserves

Share capital 12 10,642 10,642

Share premium 13 22,366 22,366

Capital redemption reserve 13 3,386 3,386

Capital reserve 13 137,004 184,089

Revenue reserve 13 1,517 270

Total shareholders' funds 174,915 220,753

Net asset value per ordinary share

Basic 14 517.09p 652.60p

The financial statements were approved and authorised for issue by the Board of

Directors on 18 April 2023.

Signed on behalf of the Board of Directors

Jane Lewis

Chairman

The accompanying accounting policies and notes are an integral part of these

financial statements.

Statement of Cash Flows

FOR THE YEARED 31 JANUARY

2023 2022

£'000 £'000

Cash flow from operating activities

(Loss)/profit before finance costs and taxation (38,117) 35,916

Adjustments for:

Purchase of investments (37,739) (55,442)

Sale of investments 46,313 57,863

8,574 2,421

Loss/(profit) on investments held at fair value 41,010 (34,552)

(Increase)/decrease in receivables (195) 31

(Decrease)/increase in payables (26) 39

Net cash inflow from operating activities 11,246 3,855

Cash flow from financing activities

Finance cost paid (8) (8)

Dividends paid - note 8 (7,713) (6,535)

Net cash outflow from financing activities (7,721) (6,543)

Net increase/(decrease) in cash and cash equivalents 3,525 (2,688)

Cash and cash equivalents at start of the year 1,530 4,218

Cash and cash equivalents at the end of the year 5,055 1,530

Reconciliation of cash and cash equivalents to the Balance

Sheet is as follows:

Cash held at custodian 80 155

Invesco Liquidity Funds plc - Sterling, money market fund 4,975 1,375

Cash and cash equivalents 5,055 1,530

Cash flow from operating activities includes:

Dividends received 4,447 3,481

Interest received 2 -

As the Company did not have any long term debt at both the current and prior

year ends, no reconciliation of the financial liabilities position is

presented.

The accompanying accounting policies and notes are an integral part of these

financial statements.

Notes to the Financial Statements

1. Principal Accounting Policies

Accounting policies describe the Company's approach to recognising and

measuring transactions during the year and the position of the Company at the

year end.

The principal accounting policies adopted in the preparation of these financial

statements together with the approach to recognition and measurement are set

out below. These policies have been consistently applied during the current

year and the preceding year, unless otherwise stated.

The financial statements have been prepared on a going concern basis on the

grounds that the Company's investment portfolio (including cash) is

sufficiently liquid and significantly exceeds all balance sheet liabilities,

there are no unrecorded commitments or contingencies and its gearing facilities

remain undrawn. The disclosure on going concern on page 29 in the Directors'

Report provides further detail. The Directors believe the Company has adequate

resources to continue in operational existence for the foreseeable future and

has the ability to meet its financial obligations as and when they fall due for

a period until at least 30 April 2024.

(a) Basis of Preparation

(i) Accounting Standards Applied

The financial statements have been prepared on a historical cost basis, except

for the measurement at fair value of investments which for the Company are

quoted bid prices for investments in active markets at the Balance Sheet date

and therefore reflect market participants' view of climate change risk and in

accordance with the applicable UK-adopted international accounting standards.

The standards are those that are effective at the Company's financial year end.

Where presentational guidance set out in the Statement of Recommended Practice

('SORP') 'Financial Statements of Investment Trust Companies and Venture

Capital Trusts', updated by the Association of Investment Companies in July

2022, is consistent with the requirements of UK-adopted international

accounting standards. The Directors have prepared the financial statements on a

basis compliant with the recommendations of the SORP. The supplementary

information which analyses the statement of comprehensive income between items

of a revenue and a capital nature is presented in accordance with the SORP.

The Directors have considered the impact of climate change on the value of the

listed investments that the Company holds. In the view of the Directors, as the

portfolio consists of listed equities, their market prices should reflect the

impact, if any, of climate change and accordingly no adjustment has been made

to take account of climate change in the valuation of the portfolio in these

financial statements.

(ii) Critical Accounting Estimates and Judgements

The preparation of the financial statements may require the Directors to make

estimations where uncertainty exists. It also requires the Directors to make

judgements, estimates and assumptions, in the process of applying the

accounting policies. There have been no significant judgements, estimates or

assumptions for the current or preceding year.

(b) Foreign Currency and Segmental Reporting

(i) Functional and Presentation Currency

The financial statements are presented in Sterling, which is the Company's

functional and presentation currency and the currency in which the Company's

share capital and expenses are denominated, as well as a majority of its assets

and liabilities.

(ii) Transactions and Balances

Foreign currency assets and liabilities are translated into Sterling at the

rates of exchange ruling at the balance sheet date. Transactions in foreign

currency, are translated into Sterling at the rates of exchange ruling on the

dates of such transactions, and profit or loss on translation is taken to

revenue or capital depending on whether it is revenue or capital in nature. All

are recognised in the statement of comprehensive income.

(iii) Segmental reporting

The Directors are of the opinion that the Company is engaged in a single

segment of business of investing in equity and debt securities, issued by

companies operating and generating revenue mainly in the UK.

(c) Financial Instruments

(i) Recognition of Financial Assets and Financial Liabilities

The Company recognises financial assets and financial liabilities when the

Company becomes a party to the contractual provisions of the instrument. The

Company offsets financial assets and financial liabilities if the Company has a

legally enforceable right to set off the recognised amounts and interests and

intends to settle on a net basis.

(ii) Derecognition of Financial Assets

The Company derecognises a financial asset when the contractual rights to the

cash flows from the asset expire, or it transfers the right to receive the

contractual cash flows on the financial asset in a transaction in which

substantially all the risks and rewards of ownership of the financial asset are

transferred. Any interest in the transferred financial asset that is created or

retained by the Company is recognised as an asset.

(iii) Derecognition of Financial Liabilities

The Company derecognises financial liabilities when its obligations are

discharged, cancelled or expired.

(iv) Trade Date Accounting

Purchases and sales of financial assets are recognised on trade date, being the

date on which the Company commits to purchase or sell the assets.

(v) Classification of Financial Assets and Financial Liabilities

Financial assets

The Company classifies its financial assets as measured at amortised cost or

measured at fair value through profit or loss on the basis of both: the

entity's business model for managing the financial assets; and the contractual

cash flow characteristics of the financial asset.

Financial assets measured at amortised cost include cash, debtors and

prepayments.

A financial asset is measured at fair value through profit or loss if its

contractual terms do not give rise to cash flows on specified dates that are

solely payments of principal and interest ('SPPI') on the principal amount

outstanding or it is not held within a business model whose objective is either

to collect contractual cash flows, or to both collect contractual cash flows

and sell. The Company's equity investments are classified as fair value through

profit or loss as they do not give rise to cash flows that are SPPI.

Financial assets held at fair value through profit or loss are initially

recognised at fair value, which is usually the transaction price and are

subsequently valued at fair value.

For investments that are actively traded in organised financial markets, fair

value is determined by reference to stock exchange quoted bid prices at the

balance sheet date.

Financial liabilities

Financial liabilities, including borrowings, are initially measured at fair

value, net of transaction costs and are subsequently measured at amortised cost

using the effective interest method, where applicable.

(d) Cash and Cash Equivalents

Cash and cash equivalents include any cash held at custodian and approved

depositories, holdings in Invesco Liquidity Funds plc - Sterling, a triple-A

rated money market fund and overdrafts. Cash and cash equivalents are defined

as cash itself or being readily convertible to a known amount of cash and are

subject to an insignificant risk of change in value.

(e) Income

All dividends are taken into account on the date investments are marked

ex-dividend; other income from investments is taken into account on an accruals

basis. Where the Company elects to receive scrip dividends (i.e. in the form of

additional shares rather than cash), the equivalent of the cash dividend

foregone is recognised as income in the revenue account and any excess in value

of the shares received over the amount of the cash divided recognised in

capital. Deposit interest is taken into account on an accruals basis. Special

dividends representing a return of capital are allocated to capital in the

Statement of Comprehensive Income and then taken to capital reserves. Dividends

will generally be recognised as revenue however all special dividends will be

reviewed, with consideration given to the facts and circumstances of each case,

including the reasons for the underlying distribution, before a decision over

whether allocation is to revenue or capital is made.

(f) Expenses and Finance Costs

All expenses and finance costs are accounted for in the Statement of

Comprehensive Income on an accruals basis.

The investment management fee and finance costs are allocated 85% to capital

and 15% to revenue. This is in accordance with the Board's expected long term

split of returns, in the form of capital gains and income respectively, from

the portfolio.

Investment transaction costs such as brokerage commission and stamp duty are

recognised in capital in the Statement of Comprehensive Income. All other

expenses are allocated to revenue in the Statement of Comprehensive Income.

(g) Taxation

Tax represents the sum of tax payable, withholding tax suffered and deferred

tax. Tax is charged or credited in the statement of comprehensive income. Any

tax payable is based on taxable profit for the year, however, as expenses

exceed taxable income no corporation tax is due. The Company's liability for

current tax is calculated using tax rates that have been enacted or

substantially enacted by the balance sheet date.

Deferred taxation is recognised in respect of all temporary differences that

have originated but not reversed at the balance sheet date, where transactions

or events that result in an obligation to pay more tax in the future or right

to pay less tax in the future have occurred at the balance sheet date. This is

subject to deferred tax assets only being recognised if it is considered

probable that there will be suitable profits from which the future reversal of

the temporary differences can be deducted. Deferred tax assets and liabilities

are measured at the tax rates expected to apply in the period when the

liability is settled or the asset realised.

Investment trusts which have approval under Section 1158 of the Corporation Tax

Act 2010 are not liable for taxation on capital gains.

(h) Dividends

Dividends are not accrued in the financial statements, unless there is an

obligation to pay the dividends at the balance sheet date. Proposed final

dividends are recognised in the financial year in which they are approved by

the shareholders.

(i) Consolidation

Consolidated accounts have not been prepared as the subsidiary, whose principal

activity is investment dealing, is not material in the context of these

financial statements. The one hundred pounds net asset value of the investment

in Berry Starquest Limited has been included in the investments in the

Company's balance sheet. Berry Starquest Limited has not traded throughout the

year and the preceding year and, as a dormant company, has exemption under

Section 480(1) of the Companies Act 2006 from appointing auditors or obtaining

an audit.

2. Income

This note shows the income generated from the portfolio (investment assets) of

the Company and income received from any other source.

2023 2022

£'000 £'000

Income from investments:

UK dividends 4,124 3,062

UK special dividends 288 198

Overseas dividends 232 188

Deposit interest 2 -

Total income 4,646 3,448

No special dividends have been recognised in capital during the year (2022:

nil).

Overseas dividends include dividends received on UK listed investments where

the investee company is domiciled outside of the UK.

3. Investment Management Fee

This note shows the fees due to the Manager. These are made up of the

management fee calculated and paid monthly and, for the previous year. This fee

is based on the value of the assets being managed.

2023 2022

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

Investment management fee 206 1,165 1,371 254 1,440 1,694

Details of the investment management and administration agreement are given on

pages 29 and 30 in the Directors' Report.

At 31 January 2023, £109,000 (2022: £138,000) was accrued in respect of the

investment management fee.

4. Other Expenses

The other expenses of the Company are presented below; those paid to the

Directors and auditor are separately identified.

2023 2022

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

Directors' remuneration(i) 117 - 117 119 - 119

Auditor's fees(ii):

- for audit of the Company's

annual financial statements 45 - 45 45 - 45

Other expenses(iii) 222 3 225 221 5 226

384 3 387 385 5 390

(i) The Directors' Remuneration Report on page 37 provides further information

on Directors' fees.

(ii) Auditor's fees include out of pocket expenses but excludes VAT. The VAT is

included in other expenses.

(iii) Other expenses shown above include:

. amounts payable to the registrar, depositary, custodian, brokers, printers

and other legal & professional fees;

. £11,600 (2022: £10,500) of employer's National Insurance payable on

Directors' remuneration. As at 31 January 2023, the amounts outstanding on

employer's National Insurance on Directors' remuneration was £900 (2022: £900),

the amounts outstanding for Directors' fee was £9,700 (2022: £9,200); and

. custodian transaction charges of £3,200 (2022: £5,000). These are charged to

capital.

5. Finance Costs

Finance costs arise on any borrowing facilities the Company has.

2023 2022

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

Bank overdraft facility fee 1 6 7 1 7 8

Overdraft interest - 1 1 - - -

1 7 8 1 7 8

The £15 million overdraft facility was renewed on 14 September 2022 and the

interest rate is at a margin above the Bank of England base rate.

6. Taxation

As an investment trust the Company pays no tax on capital gains and, as the

Company invested principally in UK equities, it has little overseas tax. In

addition, no deferred tax is required to provide for tax that is expected to

arise in the future due to differences in accounting and tax bases.

(a) Tax charge

2023 2022

£'000 £'000

Overseas taxation - -

(b) Reconciliation of tax charge

2023 2022

£'000 £'000

(Loss)/profit before taxation (38,125) 35,908

Theoretical tax at the current UK Corporation Tax rate of 19% (7,244) 6,823

(2022: 19%)

Effects of:

- Non-taxable UK dividends (767) (563)

- Non-taxable UK special dividends (55) (38)

- Non-taxable overseas dividends (35) (36)

- Non-taxable loss/(gains) on investments 7,791 (6,565)

- Excess of allowable expenses over taxable income 309 378

- Disallowable expenses 1 1

Tax charge for the year - -

(c) Factors that may affect future tax changes

The Company has cumulative excess management expenses of £44,324,000 (2022: £

42,720,000) that are available to offset future taxable revenue.

A deferred tax asset of £11,081,000 (2022: £10,680,000) at 25% (2022: 25%) has

not been recognised in respect of these expenses since the Directors believe

that there will be no taxable profits in the future against which the deferred

tax assets can be offset.

The Finance Act 2021 increases the UK Corporation Tax rate from 19% to 25%

effective 1 April 2023. The Act received Royal Assent on 10 June 2021. Deferred

tax assets and liabilities on balance sheets prepared after the enactment of

the new tax rate must therefore be re-measured accordingly, so as a result the

deferred tax asset has been calculated at 25%.

7. Return per Ordinary Share

Return per ordinary share is the amount of gain or loss generated for the

financial year divided by the weighted average number of ordinary shares in

issue.

2023 2022

Revenue Capital Total Revenue Capital Total

Return £'000 4,055 (42,180) (38,125) 2,808 33,100 35,908

Return per ordinary share 11.99p (124.70)p (112.71) 8.30p 97.85p 106.15p

p

The returns per ordinary share are based on the weighted average number of

ordinary shares in issue during the year of 33,826,929 (2022: 33,826,929).

8. Dividends on Ordinary Shares

The Company paid four dividends in the year - three interims and a final.

The final dividend shown below is based on shares in issue at the record date

or, if the record date has not been reached, on shares in issue on the date the

balance sheet is signed. The third interim and final dividends are paid after

the balance sheet date.

2023 2022

Pence £'000 Pence £'000

Dividends paid from revenue in the year:

Third interim (prior year) 0.80 270 - -

First interim 3.75 1,269 3.75 1,269

Second interim 3.75 1,269 3.75 1,269

Total dividends paid from revenue 8.30 2,808 7.50 2,538

Dividends paid from capital in the year:

Third interim (prior year) 2.95 999 3.75 1,269

Final (prior year) 11.55 3,906 8.07 2,728

Total dividends paid from capital 14.50 4,905 11.82 3,997

Total dividends paid in the year 22.80 7,713 19.32 6,535

2023 2022

Pence £'000 Pence £'000

Dividends payable in respect of the year:

First interim 3.75 1,269 3.75 1,269

Second interim 3.75 1,269 3.75 1,269

Third interim 3.75 1,269 3.75 1,269

Final 6.79 2,295 11.55 3,906

18.04 6,102 22.80 7,713

The third interim dividend of 3.75p per share, in respect of the year ended 31

January 2023, was paid to shareholders on 14 March 2023.

The Company's dividend policy was changed in 2015 so that dividends will be

paid firstly from current year revenue and any revenue reserves available, and

thereafter from capital reserves. The amount payable in respect of the year is

shown below:

2023 2022

£'000 £'000

Dividends in respect of the year:

- from current year net revenue 4,055 2,808

- from capital reserves 2,047 4,905

6,102 7,713

Dividend payable from the capital reserves of £2,047,000 (2022: capital

reserves of £4,905,000) as a percentage of year end net assets of £174,915,000

(2022: £220,753,000) is 1.2% (2022: 2.2%). The Company has £134,201,000 (2022:

£137,089,000) of realised distributable capital reserves at the year end.

9. Investments Held at Fair Value Through Profit and Loss

The portfolio is made up of investments which are listed or traded on a