TIDMKGP

RNS Number : 0657C

Kingspan Group PLC

18 February 2022

KINGSPAN GROUP PLC

PRELIMINARY RESULTS

Year Ended 31 December 2021

KINGSPAN GROUP PLC

RESULTS FOR THE YEARED 31 DECEMBER 2021

Kingspan, the global leader in high-performance insulation and

building envelope solutions, reports its preliminary results for

the year ended 31 December 2021.

Financial Highlights:

-- Revenue up 42% to EUR6.5bn, (pre-currency, up 42%).

-- Trading profit up 49% to EUR755m, (pre-currency, up 49%).

-- Acquisitions contributed 12% to sales growth and 11% to trading

profit growth in the year.

-- Group trading margin of 11.6%, an increase of 50bps.

-- Basic EPS up 48% to 305.6 cent.

-- Final dividend per share of 26.0 cent giving a total dividend

for the year of 45.9 cent.

-- Year end net debt(1) of EUR756.1m (2020: EUR236.2m). Net

debt(4) to EBITDA(4) of 0.88x (2020: 0.4x).

-- ROCE of 19.5% (2020: 18.4%).

Operational Summary:

-- Unprecedented raw material inflation with strong price recovery

effort.

-- Strong underlying volume growth of 13% and 11% in Insulated

Panels and Insulation respectively.

-- Insulated Panels sales increase of 45% driven by strong momentum

generally in construction activity, raw material led price

growth further enhanced by strong demand in high growth sectors.

Year end order backlog volume 28% ahead of the same point

in 2020. 66% growth in sales value of QuadCore (TM) .

-- Insulation sales increase of 50% reflecting strong demand

in key markets and inflation recovery on pricing. Strong

development activity during the year including acquisition

of Logstor, a leading global supplier of technical insulation

solutions.

-- Light & Air sales growth of 24% reflecting the acquisition

of Colt Group in Q2 2020 and the acquisition of Skydome in

2021. Strong backlog at year end.

-- Water & Energy sales increase of 29% reflecting a strong

performance across all key markets, with the exception of

Australasia.

-- Data & Flooring sales growth of 21% reflecting strong datacentre

activity and ongoing development of the European operations.

-- Invested a total of EUR714m in acquisitions, capex and financial

investments during the period.

-- Since period end, approximately EUR800m committed on three

transactions subject to customary approvals.

Summary Financials:

FY'21 FY'20 change

------------------- ------ ------ --------

Revenue EURm 6,497 4,576 +42%

Trading Profit(2)

EURm 755 508 + 49%

Trading Margin(3) 11.6% 11.1% + 50bps

EBITDA(5) EURm 893 630 +42%

Profit after tax

EURm 571 385 + 48%

EPS (cent) 306 206 + 48%

------------------- ------ ------ --------

(1) Net Debt pre-IFRS 16

(2) Operating profit before amortisation of intangibles

(3) Trading profit divided by total revenue

(4) Net debt to EBITDA ratio is pre-IFRS 16 per banking

covenants

(5) Earnings before finance costs, income taxes, depreciation

and amortisation. Prior period comparative has been re-presented to

reflect this revised definition.

Gene M. Murtagh, Chief Executive Officer of Kingspan

commented:

"The business delivered an exceptional performance last year,

with our growing sales to customers in the technology, online

distribution, and automotive sectors instrumental in the results.

Whilst dramatic input price inflation was a major feature, our cost

recovery efforts helped ensure continued margin improvement.

We continue to drive expansion through acquisition, with over

half a billion euro invested in buying new businesses during the

year. This was complemented by our organic growth activity as we

opened 5 new manufacturing facilities or production lines this

year, and plan for a further 25 over the next four years. Since

year end we have committed a further EUR800m on three transactions,

subject to customary approval, that create exciting new global

platforms for further development.

We have made good progress on our Planet Passionate targets,

achieving an absolute reduction in Scope 1 and 2 GHG emissions for

the second year of the programme, with a 4.3% reduction achieved

this year. We will also implement a EUR70 per tonne internal carbon

charge from 2023 to accelerate the pace of decarbonisation across

our global business.

Despite a slower fourth quarter, with a large order backlog we

are cautiously optimistic about the outlook for this year, whilst

mindful of the high bar in comparison with last year's performance.

High energy costs and supply threats around the world are a

catalyst for a focus on conservation measures, which is likely to

accelerate the demand for lower energy solutions which we believe

will be supportive of demand for our products."

For further information contact:

Murray Consultants Tel: +353 (0) 1 4980 300

Douglas Keatinge

Business Review

2021 was a year marked by extraordinary volatility in supply

chains and wider society. Whilst this dynamic created significant

challenges to our business, and indeed our industry, underlying

demand remained strong through the year, albeit somewhat weaker in

quarter four. Our key raw materials also saw dramatic price

inflation, and in all, in the region of EUR700m of cost increases

were required to be passed through to market. The result of all of

this was a record performance by the Group with revenue growing by

42% to EUR6.5bn, and trading profit growth of 49% to EUR755m. Basic

EPS grew by 48%.

Activity was strong across most of our markets in both

residential and industrial construction, newbuild and RMI. Order

intake trends displayed in the first half eased off over the course

of the second half. That said, the Insulated Panels global order

backlog finished the year ahead by 28% in volume. North and South

America, France and Britain were particular stand-out positives.

The Group's growing presence in the tech, online distribution and

automotive segments was instrumental in delivering this

performance.

The demand for significantly more efficient materials and

methods of construction is clearly gaining much needed momentum

and, with the prevailing energy cost and supply threats around the

world, it is likely that the drive toward conservation will be

accelerated.

Planet Passionate

2021 was the second year of our ambitious ten-year programme to

further boost the environmental ethos of Kingspan. This builds upon

the foundations laid over our previous ten-year Net Zero Energy

programme that completed successfully in 2020. The current

programme encompasses stretching goals across twelve targets (see

below).

We have recently announced revised 1.5 C aligned science-based

targets bringing them in line with our Planet Passionate programme

goals to reduce Scope 1, 2 and 3 greenhouse gas (GHG) emissions.

The Group has now committed to reducing absolute Scope 1 and 2 GHG

emissions by 90% by 2030 from a 2020 base year. It has also pledged

to reduce absolute Scope 3 GHG emissions by 42% within the same

timeframe. We will also implement a EUR70 per tonne internal carbon

charge from 2023 which will galvanise full alignment across the

organisation.

Planet Passionate Targets Target 2020 2021** Change 2022

Year (f/c)

Net Zero Carbon Manufacturing

- scope 1 & 2(1) GHG

Carbon emissions (t/CO2e) 2030 312,640* 299,077 -4.3% 287,000

--------------------------------- -------- --------- --------- ------- --------

50% reduction in product

CO2e intensity from

primary supply chain

partners (%) 2030 0 0 - 0

--------------------------------- ---------------------- --------- --------- ------- --------

Zero emission company

funded cars (annual

replacement %) 2025 11 29 164% 30

--------------------------------- ---------------------- --------- --------- ------- --------

60% Direct renewable

Energy energy (%) 2030 19.5* 26.1 34% 28

--------------------------------- -------- --------- --------- ------- --------

20% On-site renewable

energy generation (%) 2030 4.9* 4.8 -2.0% 6

--------------------------------- ---------------------- --------- --------- ------- --------

Solar PV systems on

all wholly owned facilities

(%) 2030 21.7* 28.4 31% 34

--------------------------------- ---------------------- --------- --------- ------- --------

Net Zero Energy (%) 2020 100 100 - 100

--------------------------------- ---------------------- --------- --------- ------- --------

Zero Company waste to

Circularity landfill (tonnes) 2030 18,642* 16,294 -13% 15,000

--------------------------------- -------- --------- --------- ------- --------

Recycle 1 billion PET

bottles into our manufacturing

processes (million bottles) 2025 573 843 47% 900

--------------------------------- ---------------------- --------- --------- ------- --------

QuadCore(TM) products

utilising recycled PET

(% sites) 2025 5 5 - 15

--------------------------------- ---------------------- --------- --------- ------- --------

Harvest 100 million

litres of rainwater

Water (million litres) 2030 20.1* 20.6 2.5% 35

--------------------------------- -------- --------- --------- ------- --------

Support 5 Ocean Clean-Up

projects (No.) 2025 1 2 100% 3

--------------------------------- ---------------------- --------- --------- ------- --------

(1) excluding biogenic emissions

*Restated figures due to improved data collection methodologies

**Scope and boundaries: Planet Passionate targets include manufacturing

& assembly sites within the Kingspan Group in 2020 and organic

growth.

Intensity Indicators Change YoY

---------------------------------- --------------

Carbon Intensity (tCO(2) e/EURm) 29% reduction

--------------

Energy Intensity (MWh/EURm) 15% reduction

--------------

Landfill Waste Intensity (t/EURm) 35% reduction

--------------

Water Intensity (million lt/EURm) 14% reduction

--------------

Expansion

Over the course of the year we invested a total of EUR714m on

acquisitions, capex and financial investments. The largest of these

was Logstor Group, a European based provider of highly insulated

district heating infrastructure, acquired in June 2021 for EUR245m.

The acquisition of Romania based TeraSteel also completed in the

period. Additionally, we entered the Uruguay Insulated Panel market

with the acquisition of 51% of Bromyros, and enhanced our

insulation channel in Australia and New Zealand with the

acquisition of Thermakraft. We also became a founding investor in

the ground breaking H2 Green Steel in Sweden that aims to become

the world's first zero carbon steel facility. In the second half of

2021 we acquired California based Solatube International, an

exciting bolt-on to our North American Light & Air

offering.

Organically, we commissioned 5 new manufacturing facilities or

lines across the globe in 2021, enabling the ongoing conversion to

high-performance materials. We have plans for approximately 25 new

manufacturing facilities or lines over the next four years to

support the growth of our full spectrum of building envelope

solutions.

Acquisitions After Year End

Following year end we have reached agreement to acquire Ondura

Group ('Ondura') from Naxicap. Ondura, headquartered in France, is

a leading global provider of roofing membranes and associated

roofing solutions with 14 manufacturing sites and a distribution

network in 100 countries worldwide. The business recorded sales in

2021 of EUR424m with EBITDA of EUR63m. The consideration is EUR550m

payable in cash on completion and conditional on obtaining

customary approvals. The acquisition of Ondura is fully aligned

with Kingspan's long stated strategy to develop multiple

technologies in roofing applications and will serve as our global

platform for advancing these solutions.

We have also reached agreement, subject to customary approvals,

to acquire Troldtekt, a leading Danish headquartered manufacturer

of natural low carbon acoustic insulation. In addition we have

acquired THU Perfil, an architectural and ceilings solutions

business in Spain.

Innovation

PowerPanel(TM) (an engineered combination of QuadCore(TM)

insulated panel and solar PV) development completed during the

period and a large scale project on an in-house roof was completed

in quarter three. This is now fully operational with real time

energy monitoring underway. The approval process is nearing

completion which should pave the way for a full scale market launch

during quarter two, in Britain and Ireland initially. We are also

fine-tuning our Rooftricity(TM) proposition, a funded solution

whereby the customer outlay for a re-roof or newbuild incorporating

PowerPanel(TM) will be minimal. Encouragingly, the soft launch

project pipeline is ahead of our expectations.

QuadCore(TM) 2.0 is also progressing and in a coldstore

application, the product reached a 120 minute fire rating, which is

a dramatic leap forward and will in many cases match if not exceed

the performance of synthetic mineral fibre cored products.

QuadCore(TM) sales value grew by 66% globally in 2021.

The team at our IKON Innovation Hub has also developed a low

carbon insulated panel in collaboration with our suppliers. This is

a prime example of how our Planet Passionate agenda is translating

into market leading, sustainable products. Initial testing suggests

the development panel will have c.25% less embodied carbon and

contain upwards of 45% recycled content.

In addition, projects are underway to achieve an 'A'

classification for Optim-R(R) , AlphaCore(R) , and 'B'

classification for key Kooltherm(R) applications. Significant

progress is also being made on entering the 'natural' insulation

category.

Product Integrity

The Group's product integrity audit and compliance programme is

extensive. Over the course of the year, 576 third party external

product and system audits took place. A further 90 manufacturing

sites were internally audited under the process overseen by the

Audit & Compliance Committee of the Group's Board.

ISO37301 is the leading global standard for establishing,

developing and monitoring compliance systems. We have embarked on a

programme of widespread adoption of this standard across the Group

and during 2021, the standard's first year of implementation, 9

manufacturing facilities across Kingspan achieved it. During 2022,

we anticipate adding another 25 locations, including the Kingscourt

Insulated Panels facility which will be the first of its kind in

Europe. Two of our US plants in Modesto and Deland were fully

approved in 2021 making them joint first in the world.

Insulated Panels

FY '21 FY '20 Change

---------------- -------- -------- ---------

Turnover EURm 4,229.2 2,917.4 +45%(1)

Trading Profit

EURm 519.8 321.3 +62%

Trading Margin 12.3% 11.0% + 130bps

---------------- -------- -------- ---------

(1) Comprising underlying +38%, currency -1% and acquisitions +8%. Like-for-like volume +13%.

Activity was particularly strong throughout the year in our

largest segment. Sales volumes reached a record at almost 80

million m(2) , order intake by volume was up by 20% and the volume

backlog ended the year ahead by 28%. QuadCore(TM) comprised 16% of

global insulated panel order intake value and we again expect that

to increase in the year ahead.

Non-residential newbuild construction has been buoyant in many

of our key markets, and coupled with our growing segmental exposure

to high growth end markets combined to deliver a record year. Raw

material expectations were instrumental in driving demand early in

the year and as inflation topped out, so too did order intake

leading to a reduction in backlog, albeit finishing the year

comfortably ahead of prior year.

Raw material movements for 2022 are unclear and we will respond

appropriately with pricing of our own products in the event of any

significant movement.

The organic volume expansion we are experiencing necessitates a

number of new greenfield facilities across the world. These

expansion projects are, or will be shortly, underway in France,

Romania, the US, Brazil, Vietnam and Australia.

Insulation

FY '21 FY '20 Change

--------------------- -------- ------- -----------

Turnover EURm 1,182.9 787.0 +50%(1)

Trading Profit EURm 146.7 110.1 +33%

Trading Margin 12.4% 14.0% -160bps

--------------------- -------- ------- -----------

(1) Comprising underlying +26%, currency +1% and acquisitions

+23%. Like-for-like volume +11%.

Sales volumes in the first half of the year were particularly

healthy, easing back somewhat in the latter half as the

distribution network began to unwind high inventories accumulated

during the period of rising prices earlier in the year. In total,

volume for the year was ahead by 11% accounting to just over 70

million m(2) of deliveries globally. Kooltherm(R) volume was

modestly ahead for the full year. Industrial insulation sales,

including applications like pipe, ducting and district

heating/cooling were in the region of EUR300m for the full year,

including EUR150m from the acquisition of Logstor in the second

half. We believe industrial applications are a real opportunity for

significant growth potential over the longer term.

To support future organic growth we are either underway with, or

planning, new facilities for Optim-R(R) in the US, PIR board in

France, industrial pipe insulation in the Benelux, PIR board in

Saudi Arabia and are carrying out a viability assessment for a

district heating pipe insulation plant in either Britain or

Ireland. Conversion of waste heat from manufacturing and data

warehousing processes will increasingly be captured and

re-distributed through such infrastructure.

We are relentless in our commitment to offer an unparalleled

spectrum of insulation solutions. In addition to the technologies

referred to in the innovation section, early feasibility work has

begun on entering the production of stone wool to support our

existing and future requirement of that material.

Light & Air

FY '21 FY '20 Change

--------------------- ------- ------- ------------

Turnover EURm 552.2 445.5 +24% (1)

Trading Profit EURm 36.0 31.2 +15 %

Trading Margin 6.5% 7.0% -50bps

--------------------- ------- ------- ------------

(1) Comprising underlying +1% and acquisitions +23%

This relatively new segment for the Group has been evolving

rapidly with global revenue for the year of EUR552.2m. Organic

growth in 2021 amounted to a modest 1%, and the contribution of the

Colt acquisition in 2020 delivered EUR178m revenue in 2021. The

recovery of cost inflation has been slower than expected owing to

the long contract lead time with customers. Recovery is now well

underway and should deliver a positive margin evolution during

2022.

France and Germany were both strong performers whilst the US

slipped back a little against very strong project comparatives in

2020.

In addition to bedding down the Colt acquisition, a number of

bolt-ons were added during 2021 including Solatube International

and Major Industries in the US. The former creates a wider global

opportunity for the transmission of natural light into buildings

via tubular daylighting systems, whilst Major Industries adds to

our existing range of architectural wall daylighting solutions.

Water & Energy

FY '21 FY '20 Change

---------------- ------- ------- ---------

Turnover EURm 261.3 202.7 +29%(1)

Trading Profit

EURm 20.0 16.3 +23%

Trading Margin 7.6% 8.0% -40bps

---------------- ------- ------- ---------

(1) Comprising underlying +14%, currency +4% and acquisitions +11%

This division delivered a good performance despite the headwinds

presented by market constraints evident in Australia.

The focus of this business unit is water related storage,

heating, treatment and harvesting solutions all of which present

attractive opportunities across the world. The business has focused

to date on Europe and Australia and the Americas is a real

development opportunity and will therefore become a region of

growing focus.

Separately, a product development initiative on hydrogen storage

for the transportation sector is underway and expected to be an

interesting opportunity over the longer term.

Data & Flooring

FY '21 FY '20 Change

---------------- ------- ------- ----------

Turnover EURm 271.4 223.4 +21%(1)

Trading Profit

EURm 32.3 29.3 +10%

Trading Margin 11.9% 13.1% -120bps

---------------- ------- ------- ----------

(1) Comprising underlying +21%

This business unit offers solutions to both office flooring and

multiple data centre offerings, primarily designed to conserve the

use of power in the storage and management of data. Whilst the

office sector has been comparatively subdued, data applications are

expanding apace worldwide. Our aim is to partner with the leading

global providers in helping optimise energy consumption and related

emissions.

Financial Review

The Financial Review provides an overview of the Group's

financial performance for the year ended 31 December 2021 and of

the Group's financial position at that date.

Overview of results

Group revenue increased by 42% to EUR6.5bn (2020: EUR4.6bn) and

trading profit increased by 49% to EUR754.8m (2020: EUR508.2m) with

an increase of 50 basis points in the Group's trading profit margin

to 11.6% (2020: 11.1%). Basic EPS for the year was 305.6 cent

(2020: 206.2 cent), representing an increase of 48%.

The Group's underlying sales and trading profit growth by

division are set out below:

Sales Underlying Currency Acquisition Total

------------------ ----------- --------- ------------ ------

Insulated Panels +38% -1% +8% +45%

Insulation +26% +1% +23% +50%

Light & Air +1% - +23% +24%

Water & Energy +14% +4% +11% +29%

Data & Flooring +21% - - +21%

------------------ ----------- --------- ------------ ------

Group +30% - +12% +42%

------------------ ----------- --------- ------------ ------

The Group's trading profit measure is earnings before interest,

tax and amortisation of intangibles:

Trading Profit Underlying Currency Acquisition Total

------------------ ----------- --------- ------------ ------

Insulated Panels +52% - +10% +62%

Insulation +16% +1% +16% +33%

Light & Air +3% - +12% +15%

Water & Energy +4% +3% +16% +23%

Data & Flooring +11% -1% - +10%

------------------ ----------- --------- ------------ ------

Group +38% - +11% +49%

------------------ ----------- --------- ------------ ------

The key drivers of sales and trading profit performance in each

division are set out in the Business Review.

Finance costs (net)

Finance costs for the year increased by EUR11.3m to EUR36.3m

(2020: EUR25.0m). A net non-cash charge of EURnil (2020: charge of

EUR2.0m) was recorded in respect of swaps on USD private placement

notes which were fully repaid during the year. The Group's net

interest expense on borrowings (bank and loan notes net of interest

receivable) was EUR32.2m (2020: EUR19.3m). This increase reflects

higher average gross debt levels in 2021. In particular, this

includes a full year interest expense for the Green Private

Placement loan notes issued in December 2020, as well as a negative

return on Euro denominated cash balances. Lease interest of EUR3.7m

(2020: EUR3.6m) was recorded for the year. EUR0.2m (2020: EUR0.1m)

was recorded in respect of a non-cash finance charge on the Group's

defined benefit pension schemes.

Taxation

The tax charge for the year was EUR118.4m (2020: EUR74.9m) which

represents an effective tax rate of 17.2% (2020: 16.3%). The

increase in the effective rate reflects, primarily, the change in

the geographical mix of earnings year on year.

Dividends and share buyback

The Board has proposed a final dividend of 26.0 cent (2020: 20.6

cent) per ordinary share payable on 6 May 2022 to shareholders

registered on the record date of 25 March 2022. An interim dividend

of 19.9 cent per ordinary share was declared during the year (2020:

nil). In summary, therefore, the total dividend for 2021 is 45.9

cent compared to 20.6 cent for 2020. This is in line with the

previously announced revised shareholder returns policy.

During the year, the Company issued 405,588 shares in

satisfaction of obligations falling under share schemes which

comprised newly issued shares of 189,444 and the reissuance of

216,144 treasury shares.

Separately, the Company repurchased 600,000 shares at a weighted

average price of EUR78.16 during the year. This is consistent with

an objective of maintaining a broadly constant issued share capital

over time.

Retirement benefits

The primary method of pension provision for current employees is

by way of defined contribution arrangements. The Group has three

legacy defined benefit schemes in the UK which are closed to new

members and to future accrual. In addition, the Group has a number

of smaller defined benefit pension liabilities in Mainland Europe.

The net pension liability in respect of all defined benefit schemes

was EUR28.0m as at 31 December 2021 (2020: EUR45.9m) with the

decrease reflecting, primarily, the impact of actuarial gains in

the year.

Intangible assets and goodwill

Intangible assets and goodwill increased during the year by

EUR440.3m to EUR2,001.8m (2020: EUR1,561.5m). Intangible assets and

goodwill of EUR418.9m (2020: EUR57.3m) were recorded in the year

relating to acquisitions completed by the Group. An increase of

EUR50.9m (2020: decrease of EUR72.4m) arose due to year end

exchange rates used to translate intangible assets and goodwill

other than those denominated in euro. There was an annual

amortisation charge of EUR29.5m (2020: EUR23.5m).

Financial key performance indicators

The Group has a set of financial key performance indicators

(KPIs) which are presented in the table below. These KPIs are used

to measure the financial and operational performance of the Group

and to track ongoing progress and also in achieving medium and long

term targets to maximise shareholder return.

Key performance indicators 2021 2020

---------------------------- ------ ------

Basic EPS growth 48% 1%

Sales performance +42% -2%

Trading margin 11.6% 11.1%

Free cashflow (EURm) 127.1 479.7

Return on capital employed 19.5% 18.4%

Net debt/EBITDA 0.88x 0.40x

---------------------------- ------ ------

(a) Basic EPS growth. The growth in EPS is accounted for

primarily by a 49% increase in trading profit partially offset by

an increase in the Group's effective tax rate by 90 basis points to

17.2% and an increase in minority interest. The effective tax

increased due to the geographical mix of earnings year on year. The

minority interest amount increased year on year due to a strong

performance at the Group's operations which have minority

stakeholders.

(b) Sales performance of +42% (2020: -2%) was driven by a 30%

increase in underlying sales and a 12% contribution from

acquisitions. The increase in underlying sales reflected a

combination of strong price growth due to raw material inflation,

volume growth due to ongoing structural adoption and buoyant

construction markets worldwide.

(c) Trading margin by division is set out below:

2021 2020

------------------ ------ ------

Insulated Panels 12.3% 11.0%

Insulation 12.4% 14.0%

Light & Air 6.5% 7.0%

Water & Energy 7.6% 8.0%

Data & Flooring 11.9% 13.1%

------------------ ------ ------

The Insulated Panels division trading margin advanced year on

year reflecting the market mix of sales as well as positive

operating leverage driven by 13% volume growth in the year. The

trading margin decrease in the Insulation division reflects, in the

main, a strong margin performance in 2020 reflecting a positive lag

effect on raw material prices in the early part of 2020 and short

term overhead curtailment with both factors not applying in 2021.

The reduced trading margin in Light & Air reflects a lag in

inflation recovery and investment in specification and other

processes as the division continues to scale up. The Water &

Energy trading margin decrease reflects the category and geography

mix and overhead curtailment in the prior year. The decrease in

trading margin in Data & Flooring reflects the geographic

market and product mix of sales year on year and impact of

increased raw material prices.

(d) Free cashflow is an important indicator and reflects the

amount of internally generated capital available for re-investment

in the business or for distribution to shareholders.

Free cashflow 2021 2020

EURm EURm

-------- --------

EBITDA* 893.2 630.2

Lease payments (38.6) (33.7)

Movement in working capital** (429.3) 107.7

Movement in provisions 6.9 (2.1)

Net capital expenditure (163.6) (126.1)

Net interest paid (34.5) (21.6)

Income taxes paid (126.8) (89.7)

Other including non-cash items 19.8 15.0

Free cashflow 127.1 479.7

-------- --------

*Earnings before finance costs, income taxes, depreciation and

amortisation. Prior period comparative has been re-presented to

reflect this revised definition.

**Excludes working capital on acquisition but includes working

capital movements since that point

Working capital at year end was EUR977.8m (2020: EUR450.8m) and

represents 13.8% (2020: 8.8%) of annualised sales based on fourth

quarter sales. This metric is closely managed and monitored

throughout the year and is subject to a certain amount of seasonal

variability associated with trading patterns and the timing of

significant purchases of steel and chemicals. Working capital

levels in the business were unusually low at the end of 2020

reflecting constrained supply chains and restricted availability at

that point. Furthermore, the 30% growth in underlying sales in 2021

required a consequential investment in working capital to support

the sales growth. The December 2021 working capital position is

untypically high reflecting higher than normal inventory levels.

The business took the opportunity to build an element of buffer

stocks as availability opened up in the second half of 2021. We

expect working capital levels to normalise during 2022.

(e) Return on capital employed, calculated as operating profit

divided by total equity plus net debt, was 19.5% in 2021 (2020:

18.4%). The creation of shareholder value through the delivery of

long term returns well in excess of the Group's cost of capital is

a core principle of Kingspan's financial strategy. The increase in

profitability was the key driver of enhanced returns on capital

during the year.

(f) Net debt to EBITDA measures the ratio of net debt to

earnings and at 0.88x (2020: 0.40x) is comfortably less than the

Group's banking covenant of 3.5x in both 2021 and 2020. The

calculation is pre-IFRS 16 in accordance with the Group's banking

covenants.

Acquisitions and capital expenditure

During the year the Group made a number of acquisitions for a

total upfront consideration of EUR540.2m.

In February 2021, the Group acquired 100% of the share capital

of TeraSteel a Romanian based manufacturer of insulated panels and

ancillary products for a consideration of EUR81.6m.

In June 2021, the Group acquired 100% of the Logstor Group a

leading global supplier of technical insulation solutions. The

total consideration, including debt acquired, amounted to

EUR244.5m.

The Group also made a number of smaller acquisitions during the

year for a combined cash consideration of EUR214.1m.

-- The Insulated Panels division acquired 51% of Bromyros in

Uruguay, the remaining 50% of Dome Solar in France, Solarsit

in France and the assets of Krohn in Russia.

-- The Insulation division acquired Thermakraft in Australasia,

Hectar in the Netherlands and the assets of Dyplast Products,

Diversifoam Products and Thermal Visions in North America.

-- The Light & Air division acquired Skydôme in Western

Europe and Major Industries and Solatube International in

North America.

-- The Water & Energy division acquired BAGA in Sweden, Heritage

Tanks in Australia and the assets of Enviro Water Tanks in

Australia.

The Group's organic capital expenditure during the year was

EUR168.8m encompassing a number of strategic capacity enhancements

and ongoing maintenance.

EU Taxonomy

New disclosures are required in the current year under the EU

Taxonomy Regulation (Sustainable finance taxonomy - Regulation (EU)

2020/852). The disclosures will be included in our Planet

Passionate Sustainability Report that will be published at a later

date within the required timeframe.

COVID-19 Pandemic

The Group took a number of steps to protect its financial

position at the outset of the global pandemic in the first quarter

of 2020. Many construction markets were severely impacted at the

early stage of the virus albeit most experienced some element of

recovery through 2020 and improving further in 2021. The key impact

in 2021 was reduced availability of materials particularly in the

first half of the year. The Group did not avail of Covid-19 related

furlough and benefits in either 2020 or 2021 having repaid in full

EUR17m in supports received in 2020.

Capital structure and Group financing

The Group funds itself through a combination of equity and debt.

Debt is funded through a syndicated bank facility and private

placement loan notes. The primary bank debt facility is a EUR700m

Planet Passionate Revolving Credit Facility arranged in May 2021,

maturing in May 2026, and which was undrawn at year end. This

substantially replaced outgoing facilities of EUR751m.

The Group's core funding is provided by six private placement

loan notes (2020: seven); one (2020: two) USD private placement

totalling $200m (2020: $400m) maturing in December 2028, and five

(2020: five) EUR private placements totalling EUR1.2bn (2020:

EUR1.2bn) which will mature in tranches between November 2022 and

December 2032. The weighted average term, as at 31 December 2021,

of all drawn debt was 6.3 years (31 December 2020: 6.3 years).

The Group had significant committed undrawn facilities and cash

balances which, in aggregate, were EUR1.3bn at 31 December

2021.

Net debt

Net debt increased by EUR519.9m during 2021 to EUR756.1m (2020:

EUR236.2m). This is analysed in the table below:

Movement in net debt 2021 2020

EURm EURm

----------------------------------- -------- --------

Free cashflow 127.1 479.7

Acquisitions (540.2) (46.1)

Purchase of financial asset (5.0) -

Share issues 0.1 -

Repurchase of treasury shares (46.9) -

Dividends paid (73.5) -

Dividends paid to non-controlling

interests (3.2) (1.2)

-------- --------

Cashflow movement (541.6) 432.4

Exchange movements on translation 21.7 (35.4)

Movement in net debt (519.9) 397.0

Net debt at start of year (236.2) (633.2)

-------- --------

Net debt at end of year (756.1) (236.2)

-------- --------

Key financial covenants

The majority of Group borrowings are subject to primary

financial covenants calculated in accordance with lenders' facility

agreements which exclude the impact of IFRS 16:

- A maximum net debt to EBITDA ratio of 3.5 times; and

- A minimum EBITDA to net interest coverage of 4 times.

The performance against these covenants in the current and

comparative year is set out below:

2021 2020

Covenant Times Times

--------------------- ------------- ------ ------

Net debt/EBITDA Maximum 3.5 0.88 0.40

EBITDA/Net interest Minimum 4.0 26.2 27.9

--------------------- ------------- ------ ------

Investor relations

Kingspan is committed to interacting with the international

financial community to ensure a full understanding of the Group's

strategic plans and its performance against these plans. During the

year, the executive management and investor team presented at eight

capital market conferences and conducted 586 institutional

one-on-one and group meetings.

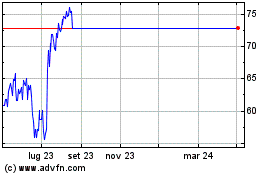

Share price and market capitalisation

The Company's shares traded in the range of EUR52.75 to

EUR105.50 during the year. The share price at 31 December 2021 was

EUR105.00 (31 December 2020: EUR57.40) giving a market

capitalisation at that date of EUR19.0bn (2020: EUR10.4bn). Total

shareholder return for 2021 was 84% (2020: 5.4%).

Financial risk management

The Group operates a centralised treasury function governed by a

treasury policy approved by the Group Board. This policy primarily

covers foreign exchange risk, credit risk, liquidity risk and

interest rate risk. The principal objective of the policy is to

minimise financial risk at reasonable cost. Adherence to the policy

is monitored by the CFO and the Internal Audit function. The Group

does not engage in speculative trading of derivatives or related

financial instruments.

Looking Ahead

2022 has started well helped by the strong order backlog at the

end of last year, although it is still early days. Raw material

prices which saw steep increases through much of 2021 remain at

elevated levels with no evidence yet of this situation changing

significantly. Our trading outlook beyond the first quarter is less

visible although the prevailing mood in our end markets, for the

most part, remains one of cautious optimism.

Our innovation pipeline is most encouraging and, in particular,

this year should see the market launch of PowerPanel(TM) and

Rooftricity(TM) our fully integrated insulated panel and solar

propositions. Our Planet Passionate agenda continues to meet all

our targeted commitments and is resonating strongly with our

customers worldwide. The Group remains well capitalised with

approximately EUR1.3 billion of cash and undrawn facilities on

hand.

Worldwide, there is a growing momentum amongst policy makers,

consumers and other stakeholders to design and occupy buildings

which consume less energy and we are evidently well positioned to

harness this over the long term.

On behalf of the Board

Gene M. Murtagh Geoff Doherty

Chief Executive Officer Chief Financial Officer

18(th) February 2022 18(th) February 2022

Kingspan Group plc

Consolidated Income Statement

for the year ended 31 December 2021

2021 2020

EURm EURm

Note

REVENUE 2 6,497.0 4,576.0

Cost of sales (4,640.9) (3,190.5)

---------- ----------

GROSS PROFIT 1,856.1 1,385.5

Operating costs, excluding intangible

amortisation (1,101.3) (877.3)

---------- ----------

TRADING PROFIT 2 754.8 508.2

Intangible amortisation (29.5) (23.5)

OPERATING PROFIT 725.3 484.7

Finance expense 3 (36.3) (26.1)

Finance income 3 - 1.1

---------- ----------

PROFIT FOR THE YEAR BEFORE INCOME

TAX 689.0 459.7

Income tax expense (118.4) (74.9)

---------- ----------

PROFIT FOR THE YEAR FROM CONTINUING

OPERATIONS 570.6 384.8

---------- ----------

Attributable to owners of Kingspan

Group plc 554.1 373.6

Attributable to non-controlling

interests 16.5 11.2

---------- ----------

570.6 384.8

---------- ----------

EARNINGS PER SHARE FOR THE YEAR

Basic 8 305.6c 206.2c

Diluted 8 303.0c 204.4c

Kingspan Group plc

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2021

2021 2020

EURm EURm

Profit for the year 570.6 384.8

Other comprehensive income:

Items that may be reclassified subsequently to profit or loss

Exchange differences on translating

foreign operations 123.1 (129.7)

Effective portion of changes in 0.3 -

fair value of cash flow hedges

Items that will not be reclassified subsequently to profit or

loss

Actuarial gains/(losses) on defined

benefit pension schemes 21.5 (19.9)

Income taxes relating to actuarial

gains/losses on defined benefit

pension schemes (5.5) 4.1

---------- ---------

Total other comprehensive income 139.4 (145.5)

---------- ---------

Total comprehensive income for

the year 710.0 239.3

---------- ---------

Attributable to owners of Kingspan

Group plc 691.8 238.7

Attributable to non-controlling

interests 18.2 0.6

---------- ---------

710.0 239.3

---------- ---------

Kingspan Group plc

Consolidated Statement of Financial Position

as at 31 December 2021

2021 2020

EURm EURm

ASSETS

NON-CURRENT ASSETS

Goodwill 1,908.6 1,478.8

Other intangible assets 93.2 82.7

Financial asset 13.2 8.2

Property, plant and equipment 1,155.8 972.9

Right of use assets 155.5 113.0

Retirement benefit assets 17.9 8.0

Deferred tax assets 34.7 23.0

---------- ----------

3,378.9 2,686.6

---------- ----------

CURRENT ASSETS

Inventories 1,138.9 505.9

Trade and other receivables 1,228.4 799.6

Derivative financial instruments 0.3 19.8

Cash and cash equivalents 641.4 1,329.7

---------- ----------

3,009.0 2,655.0

TOTAL ASSETS 6,387.9 5,341.6

---------- ----------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 1,389.8 854.5

Provisions for liabilities 67.8 55.7

Lease liabilities 35.0 27.3

Derivative financial instruments - 0.2

Deferred contingent consideration 41.7 -

Interest bearing loans and

borrowings 77.4 209.6

Current income tax liabilities 57.7 55.9

---------- ----------

1,669.4 1,203.2

---------- ----------

NON-CURRENT LIABILITIES

Retirement benefit obligations 45.9 53.9

Provisions for liabilities 74.9 63.3

Interest bearing loans and

borrowings 1,320.1 1,376.1

Lease liabilities 123.0 87.5

Deferred tax liabilities 34.7 32.4

Deferred contingent consideration 160.6 127.6

1,759.2 1,740.8

---------- ----------

TOTAL LIABILITIES 3,428.6 2,944.0

---------- ----------

NET ASSETS 2,959.3 2,397.6

---------- ----------

EQUITY

Share capital 23.9 23.8

Share premium 94.4 95.6

Capital redemption reserve 0.7 0.7

Treasury shares (57.3) (11.6)

Other reserves (277.7) (356.8)

Retained earnings 3,108.1 2,597.2

---------- ----------

EQUITY ATTRIBUTABLE TO OWNERS

OF KINGSPAN GROUP PLC 2,892.1 2,348.9

NON-CONTROLLING INTERESTS 67.2 48.7

---------- ----------

TOTAL EQUITY 2,959.3 2,397.6

---------- ----------

Kingspan Group plc

Consolidated Statement of Changes in Equity

for the year ended 31 December 2021

Total

Cash Share Put Attributable

Capital Flow Based Option to Owners Non-

Share Share Redemption Treasury Translation Hedging Payment Revaluation Liability Retained of the Controlling Total

Capital Premium Reserve Shares Reserve Reserve Reserve Reserve Reserve Earnings Parent Interests Equity

EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm

Balance at 1

January 2021 23.8 95.6 0.7 (11.6) (229.9) 0.3 40.4 0.7 (168.3) 2,597.2 2,348.9 48.7 2,397.6

--------- --------- ------------ ---------- ------------- --------- --------- ------------- ----------- ---------- -------------- ------------- ----------

Transactions with owners recognised directly in equity

Employee share

based

compensation 0.1 - - - - - 17.7 - - - 17.8 - 17.8

Tax on employee

share

based

compensation - - - - - - 9.7 - - 3.8 13.5 - 13.5

Exercise or

lapsing of

share options - (1.2) - 1.2 - - (10.5) - - 10.5 - - -

Repurchase of

shares - - - (46.9) - - - - - - (46.9) - (46.9)

Dividends - - - - - - - - - (73.5) (73.5) - (73.5)

Transactions

with

non-controlling

interests:

Arising on

acquisition - - - - - - - - - - - 3.5 3.5

Dividends to NCI - - - - - - - - - - - (3.2) (3.2)

Fair value

movement - - - - - - - - (59.5) - (59.5) - (59.5)

Transactions

with owners 0.1 (1.2) - (45.7) - - 16.9 - (59.5) (59.2) (148.6) 0.3 (148.3)

--------- --------- ------------ ---------- ------------- --------- --------- ------------- ----------- ---------- -------------- ------------- ----------

Total

comprehensive

income

for the year

Profit for the

year - - - - - - - - - 554.1 554.1 16.5 570.6

Other

comprehensive

income:

Items that may be reclassified subsequently to profit or loss

Cash flow

hedging in

equity

- current year - - - - - 0.3 - - - - 0.3 - 0.3

- tax impact - - - - - - - - - - - - -

Exchange

differences on

translating

foreign

operations - - - - 121.4 - - - - - 121.4 1.7 123.1

Items that will not be reclassified subsequently to profit or loss

Actuarial gains

on defined

benefit pension

scheme - - - - - - - - - 21.5 21.5 - 21.5

Income taxes

relating

to actuarial

gains on

defined benefit

pension

scheme - - - - - - - - - (5.5) (5.5) - (5.5)

Total

comprehensive

income

for the year - - - - 121.4 0.3 - - - 570.1 691.8 18.2 710.0

--------- --------- ------------ ---------- ------------- --------- --------- ------------- ----------- ---------- -------------- ------------- ----------

Balance at 31

December

2021 23.9 94.4 0.7 (57.3) (108.5) 0.6 57.3 0.7 (227.8) 3,108.1 2,892.1 67.2 2,959.3

--------- --------- ------------ ---------- ------------- --------- --------- ------------- ----------- ---------- -------------- ------------- ----------

Kingspan Group plc

Consolidated Statement of Changes in Equity

for the year ended 31 December 2020

Total

Cash Share Put Attributable

Capital Flow Based Option to Owners Non-

Share Share Redemption Treasury Translation Hedging Payment Revaluation Liability Retained of the Controlling Total

Capital Premium Reserve Shares Reserve Reserve Reserve Reserve Reserve Earnings Parent Interests Equity

EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm

Balance at 1

January 2020 23.8 95.6 0.7 (11.8) (110.8) 0.3 38.9 0.7 (188.7) 2,221.6 2,070.3 50.1 2,120.4

--------- --------- ------------ ---------- ------------- --------- --------- ------------- ----------- ---------- -------------- ------------- ----------

Transactions with owners recognised directly in equity

Employee share

based

compensation - - - - - - 16.0 - - - 16.0 - 16.0

Tax on employee

share

based

compensation - - - - - - (0.9) - - 4.4 3.5 - 3.5

Exercise or

lapsing of

share options - - - 0.2 - - (13.6) - - 13.4 - - -

Repurchase of - - - - - - - - - - - - -

shares

Dividends - - - - - - - - - - - -

Transactions

with

non-controlling

interests:

Arising on

acquisition - - - - - - - - - - - (0.8) (0.8)

Dividends to NCI - - - - - - - - - - - (1.2) (1.2)

Fair value

movement - - - - - - - - 20.4 - 20.4 - 20.4

Transactions

with owners - - - 0.2 - - 1.5 - 20.4 17.8 39.9 (2.0) 37.9

--------- --------- ------------ ---------- ------------- --------- --------- ------------- ----------- ---------- -------------- ------------- ----------

Total

comprehensive

income

for the year

Profit for the

year - - - - - - - - - 373.6 373.6 11.2 384.8

Other

comprehensive

income:

Items that may be reclassified subsequently to profit or loss

Cash flow

hedging in

equity

- current year - - - - - - - - - - - - -

- tax impact - - - - - - - - - - - - -

Exchange

differences on

translating

foreign

operations - - - - (119.1) - - - - - (119.1) (10.6) (129.7)

Items that will not be reclassified subsequently to profit or loss

Actuarial losses

on defined

benefit pension

scheme - - - - - - - - - (19.9) (19.9) - (19.9)

Income taxes

relating

to actuarial

losses on

defined benefit

pension

scheme - - - - - - - - - 4.1 4.1 - 4.1

Total

comprehensive

income

for the year - - - - (119.1) - - - - 357.8 238.7 0.6 239.3

--------- --------- ------------ ---------- ------------- --------- --------- ------------- ----------- ---------- -------------- ------------- ----------

Balance at 31

December

2020 23.8 95.6 0.7 (11.6) (229.9) 0.3 40.4 0.7 (168.3) 2,597.2 2,348.9 48.7 2,397.6

--------- --------- ------------ ---------- ------------- --------- --------- ------------- ----------- ---------- -------------- ------------- ----------

Kingspan Group plc

Consolidated Statement of Cash Flows

for the year ended 31 December 2021

2021 2020

Note EURm EURm

OPERATING ACTIVITIES

Profit for the year 570.6 384.8

Add back non-operating expenses :

Income tax expense 118.4 74.9

Depreciation of property, plant and equipment 138.4 122.0

Amortisation of intangible assets 29.5 23.5

Impairment of non-current assets 3.1 2.4

Employee equity-settled share options 17.7 16.0

Finance income 3 - (1.1)

Finance expense 3 36.3 26.1

Loss/(profit) on sale of property, plant

and equipment 0.4 (1.1)

Movement of deferred consideration 0.4 (0.7)

Changes in working capital:

Inventories (525.7) 38.2

Trade and other receivables (298.8) (1.8)

Trade and other payables 395.2 71.3

Other:

Change in provisions 6.9 (2.1)

Pension contributions (1.8) (1.6)

-------- ----------

Cash generated from operations 490.6 750.8

Income tax paid (126.8) (89.7)

Interest paid (34.6) (22.6)

-------- ----------

Net cash flow from operating activities 329.2 638.5

-------- ----------

INVESTING ACTIVITIES

Additions to property, plant and equipment (168.8) (131.8)

Proceeds from disposals of property,

plant and equipment 5.2 5.7

Purchase of subsidiary undertakings (including

net debt/cash acquired) (540.2) (46.1)

Purchase of financial asset (5.0) -

Interest received 0.1 1.0

-------- ----------

Net cash flow from investing activities (708.7) (171.2)

-------- ----------

FINANCING ACTIVITIES

Drawdown of loans 5 55.1 751.2

Repayment of loans and borrowings 5 (263.2) (3.4)

Settlement of derivative financial instrument 18.5 -

Payment of lease liability 6 (38.6) (33.7)

Proceeds from share issues 0.1 -

Repurchase of shares (46.9) -

Dividends paid to non-controlling interests (3.2) (1.2)

Dividends paid 7 (73.5) -

-------- ----------

Net cash flow from financing activities (351.7) 712.9

-------- ----------

(DECREASE)/INCREASE IN CASH AND CASH

EQUIVALENTS 5 (731.2) 1,180.2

Effect of movement in exchange rates

on cash held 42.9 (41.4)

Cash and cash equivalents at the beginning

of the year 1,329.7 190.9

-------- ----------

CASH AND CASH EQUIVALENTS AT THE

OF THE YEAR 641.4 1,329.7

-------- ----------

Notes to the Preliminary Results

for the year ended 31 December 2021

1 GENERAL INFORMATION

The financial information presented in this report has been

prepared using accounting policies consistent with International

Financial Reporting Standards (IFRSs) as adopted by the European

Union and as set out in the Group's annual financial statements in

respect of the year ended 31 December 2020 except as noted below.

The financial information does not include all the information and

disclosures required in the annual financial statements. The Annual

Report will be distributed to shareholders and made available on

the Company's website www.kingspan.com in due course. It will also

be filed with the Company's annual return in the Companies

Registration Office. The auditor has consented to the publication

of this preliminary announcement. The audit of the Group's

statutory consolidated financial statements for the year ended 31

December 2021 is substantially complete and the report of the

auditor is expected to be unqualified and not contain any matters

to which attention will be drawn by way of emphasis. The principle

outstanding procedures as identified by our auditors include the

receipt of final ESEF financial statements incorporating their

observations in respect of the tagging alone, consequent completion

of subsequent event procedures and the receipt of final audit

representations from management. The financial information for the

year ended 31 December 2020 represents an abbreviated version of

the Group's statutory financial statements on which an unqualified

audit report was issued and which have been filed with the

Companies Registration Office.

Basis of preparation and accounting policies

The financial information contained in this Preliminary

Statement has been prepared in accordance with the accounting

policies set out in the last annual financial statements .

IFRS does not define certain Income Statement headings. For

clarity, the following are the definitions as applied by the

Group:

- Trading profit refers to the operating profit generated by the

businesses before intangible asset amortisation.

- Trading margin refers to the trading profit, as calculated above, as a percentage of revenue.

- Operating profit is profit before income taxes and net finance costs.

- EBITDA is earnings before finance costs, income taxes, depreciation and amortisation.

The following amendments to standards and interpretations are

effective for the Group from 1 January 2021 and do not have a

material effect on the results or financial position of the

Group:

Effective Date

- periods beginning

on or after

Amendments to IFRS 9 Financial Instruments, IAS 1 January 2021

39 Financial Instruments: Recognition and measurement,

IFRS 7 Financial Instruments: Disclosures, IFRS

4 Insurance Contracts and IFRS 16 Leases - Interest

Rate Benchmark Reform

The following standard amendment was issued for annual reporting

periods beginning on or after 1 April 2021 with earlier application

permitted and does not have a material effect on the results or

financial position of the Group:

Effective Date

- periods beginning

on or after

Amendments to IFRS 16 Leases - COVID-19 related 1 April 2021

rent concessions beyond 30 June 2021

There are a number of new standards, amendments to standards and

interpretations that are not yet effective and have not been

applied in preparing these consolidated financial statements. These

new standards, amendments to standards and interpretations are

either not expected to have a material impact on the Group's

financial statements or are still under assessment by the Group.

The principal new standards, amendments to standards and

interpretations are as follows:

Effective Date

- periods beginning

on or after

IFRS 17 Insurance Contracts 1 January 2023

Amendments to IAS 1 Presentation of Financial Statements 1 January 2023*

- Classification of Liabilities as Current or Non-current

Amendments to IAS 12 Income Taxes - Deferred Tax 1 January 2023*

Related to Assets and Liabilities Arising from

a Single Transaction

Amendment to IAS 1 Presentation of Financial Statements 1 January 2023*

and IFRS Practice Statement 2 - Disclosure of Accounting

Policies

Amendments to IAS 8 Accounting Policies, Changes 1 January 2023*

in Accounting Policies and Errors - Definition

of Accounting Estimates

Amendments to IFRS 3 Business Combinations -- Reference 1 January 2022

to the Conceptual Framework

Amendments to IAS 16 Property, Plant and Equipment 1 January 2022

- Proceeds before Intended Use

Amendments to IAS 37 Provisions, Contingent Liabilities 1 January 2022

and Contingent Assets - Onerous Contracts - Costs

of Fulfilling a Contract

Amendments to IFRS 1 First-time Adoption of International 1 January 2022

Financial Reporting Standards - Subsidiary as a

first-time adopter

Amendments to IFRS 9 Financial Instruments - Fees 1 January 2022

in the '10 per cent' test for derecognition of

financial liabilities

Amendments to IAS 41 Agriculture - Taxation in 1 January 2022

fair value measurements

* Not EU endorsed

2 SEGMENT REPORTING

In identifying the Group's operating segments, management based

its decision on the product supplied by each segment and the fact

that each segment is managed and reported separately to the Chief

Operating Decision Maker. These operating segments are monitored

and strategic decisions are made on the basis of segment operating

results.

Operating segments

The Group has the following five operating segments:

Insulated Panels Manufacture of insulated panels, structural framing

and metal facades.

Insulation Manufacture of rigid insulation, technical insulation

and engineered timber systems.

Light & Air Manufacture of daylighting, smoke management

and ventilation systems.

Water & Energy Manufacture of energy and water solutions and

all related service activities.

Data & Flooring Manufacture of data centre storage solutions

and raised access floors.

Analysis by class of business

Segment revenue and disaggregation of revenue

Insulated Insulation Light & Water & Data

Panels Air Energy & Total

EURm EURm EURm EURm Flooring EURm

EURm

Total revenue

- 2021 4,229.2 1,182.9 552.2 261.3 271.4 6,497.0

Total revenue

- 2020 2,917.4 787.0 445.5 202.7 223.4 4,576.0

Disaggregation of revenue 2021

Point of Time 4,210.9 1,152.0 296.3 258.8 240.1 6,158.1

Over Time & Contract 18.3 30.9 255.9 2.5 31.3 338.9

---------- ----------- -------- -------- ---------- --------

4,229.2 1,182.9 552.2 261.3 271.4 6,497.0

---------- ----------- -------- -------- ---------- --------

Disaggregation of revenue 2020

Point of Time 2,908.4 759.8 227.3 200.9 199.8 4,296.2

Over Time & Contract 9.0 27.2 218.2 1.8 23.6 279.8

---------- ----------- -------- -------- ---------- --------

2,917.4 787.0 445.5 202.7 223.4 4,576.0

---------- ----------- -------- -------- ---------- --------

The disaggregation of revenue by geography is set out in more

detail below.

The segments specified above capture the major product lines

relevant to the Group.

The combination of the disaggregation of revenue by product

group, geography and the timing of revenue recognition capture the

key categories of disclosure with respect to revenue. Typically,

individual performance obligations are specifically called out in

the contract which allow for accurate recognition of revenue as and

when performances are fulfilled. Given the nature of the Group's

product set, customer returns are not a significant feature of our

business model. No further disclosures are required with respect to

disaggregation of revenue other than what has been presented in

this note.

Inter-segment transfers are carried out at arm's length prices

and using an appropriate transfer pricing methodology. As

inter-segment revenue is not material, it is not subject to

separate disclosure in the above analysis. For the purposes of the

segmental analysis, corporate overheads have been allocated to each

division based on their respective revenue for the year.

Segment result (profit before net finance expense)

Insulated Insulation Light Water Data Total Total

Panels & & & 2021 2020

EURm EURm Air Energy Flooring EURm EURm

EURm EURm EURm

Trading profit

- 2021 519.8 146.7 36.0 20.0 32.3 754.8

Intangible amortisation (13.7) (8.6) (5.8) (1.2) (0.2) (29.5)

Operating profit

- 2021 506.1 138.1 30.2 18.8 32.1 725.3

---------- ----------- ------- -------- ----------

Trading profit

- 2020 321.3 110.1 31.2 16.3 29.3 508.2

Intangible amortisation (13.7) (4.6) (4.1) (0.9) (0.2) (23.5)

Operating profit

- 2020 307.6 105.5 27.1 15.4 29.1 484.7

---------- ----------- ------- -------- ----------

Net finance expense (36.3) (25.0)

-------- --------

Profit for the

year before tax 689.0 459.7

Income tax expense (118.4) (74.9)

Net profit for

the year 570.6 384.8

-------- --------

Segment assets

Insulated Insulation Light Water Data Total Total

Panels & & & 2021 2020

EURm EURm Air Energy Flooring EURm EURm

EURm EURm EURm

Assets - 2021 3,266.4 1,309.4 665.0 243.5 227.2 5,711.5

Assets - 2020 2,350.4 787.1 474.0 183.5 174.1 3,969.1

Derivative financial instruments 0.3 19.8

Cash and cash equivalents 641.4 1,329.7

Deferred tax assets 34.7 23.0

---------- ----------

Total assets as reported in the Consolidated Statement

of Financial Position 6,387.9 5,341.6

---------- ----------

Segment liabilities

Insulated Insulation Light Water Data Total Total

Panels & & & 2021 2020

EURm EURm Air Energy Flooring EURm EURm

EURm EURm EURm

Liabilities -

2021 (1,240.7) (307.1) (218.1) (98.4) (74.4) (1,938.7)

Liabilities -

2020 (778.8) (192.9) (184.1) (72.8) (41.2) (1,269.8)

Interest bearing loans and borrowings (current and

non-current) (1,397.5) (1,585.7)

Derivative financial instruments (current and non-current) - (0.2)

Income tax liabilities (current and deferred) (92.4) (88.3)

---------- ----------

Total liabilities as reported in the Consolidated

Statement of Financial Position (3,428.6) (2,944.0)

---------- ----------

Other segment information

Insulated Insulation Light Water Data

Panels & & & Total

EURm EURm Air Energy Flooring EURm

EURm EURm EURm

Capital investment -

2021 * 164.3 94.2 32.3 8.4 5.5 304.7

Capital investment -

2020 * 92.5 17.4 40.6 2.8 3.7 157.0

Depreciation included

in segment result - 2021 (77.7) (32.2) (15.8) (7.0) (5.7) (138.4)

Depreciation included

in segment result - 2020 (73.4) (23.9) (12.9) (6.5) (5.3) (122.0)

Non-cash items included

in segment result - 2021 (10.2) (3.4) (1.4) (1.1) (1.6) (17.7)

Non-cash items included

in segment result - 2020 (9.0) (3.2) (1.1) (1.0) (1.7) (16.0)

* Capital investment also includes fair value of property, plant

and equipment and intangible assets acquired in business

combinations.

Analysis of segmental data by geography

Western Central

& Southern &

Europe Northern Rest of

** Europe Americas World Total

EURm EURm EURm EURm EURm

Income Statement

Items

Revenue - 2021 3,239.8 1,629.8 1,269.8 357.6 6,497.0

Revenue - 2020 2,377.2 997.8 916.0 285.0 4,576.0

Statement of Financial Position Items

Non-current assets

- 2021 * 1,535.8 842.2 720.8 245.4 3,344.2

Non-current assets

- 2020 * 1,407.7 520.1 546.4 189.4 2,663.6

Other segmental

information

Capital investment

- 2021 97.3 130.6 66.3 10.5 304.7

Capital investment

- 2020 81.0 42.2 32.1 1.7 157.0

* Total non-current assets excluding derivative financial

instruments and deferred tax assets.

** Prior year figures have been re-presented to include Britain

in Western & Southern Europe.

The Group has a presence in over 70 countries worldwide. Foreign

regions of operation are as set out above and specific countries of

operation are highlighted separately below on the basis of

materiality where revenue exceeds 15% of total Group revenues.

Revenues, non-current assets and capital investment (as defined

in IFRS 8) attributable to France were EUR988.3m (2020: EUR683.0m),

EUR251.2m (2020: EUR183.0m) and EUR29.3m (2020: EUR11.7m)

respectively. Revenues, non-current assets and capital investment

(as defined in IFRS 8) attributable to Britain were EUR999.8m

(2020: EUR743.6m), EUR424.9m (2020: EUR388.8m) and EUR14.3m (2020:

EUR10.8m) respectively.

Revenues, non-current assets and capital investment (as defined

in IFRS 8) attributable to the country of domicile (Ireland) were

EUR206.0m (2020: EUR150.7m), EUR89.0m (2020: EUR72.6m) and EUR19.3m

(2020: EUR16.4m) respectively.

The country of domicile is included in Western & Southern

Europe. Western & Southern Europe also includes France,

Benelux, Spain and Britain while Central & Northern Europe

includes Germany, the Nordics, Poland, Hungary, Romania, Czech

Republic, the Baltics and other South Central European countries.

Americas comprises the US, Canada, Central Americas and South

America. Rest of World is predominantly Australasia and the Middle

East.

There are no material dependencies or concentrations on

individual customers which would warrant disclosure under IFRS 8.

The individual entities within the Group each have a large number

of customers spread across various activities, end-uses and

geographies.

3 FINANCE EXPENSE AND FINANCE INCOME

2021 2020

EURm EURm

Finance expense

Lease interest 3.7 3.6

Deferred contingent consideration 0.1 -

fair value movement

Bank loans 5.4 3.1

Private placement loan notes 26.8 17.3

Fair value movement on derivative

financial instrument - 6.4

Fair value movement on private placement

debt - (4.4)

Other interest 0.3 0.1

36.3 26.1

Finance income

Interest earned - (1.1)

Net finance expense 36.3 25.0

------ ------

EUR3.9m of borrowing costs were capitalised during the period

(2020: EUR0.2m). No costs were reclassified from other

comprehensive income to profit during the year (2020: EURnil).

4 ANALYSIS OF NET DEBT

2021 2020

EURm EURm

Cash and cash equivalents 641.4 1,329.7

Derivative financial instruments

- net - 19.8

Current borrowings (77.4) (209.6)

Non-current borrowings (1,320.1) (1,376.1)

Total Net Debt (756.1) (236.2)

---------- ----------

The Group's core funding is provided by six private placement

loan notes; one USD private placement totalling $200m (2020: $400m)

maturing in December 2028, and five EUR private placements

totalling EUR1.2bn (2020: EUR1.2bn) which will mature in tranches

between November 2022 and December 2032. The notes have a weighted

average maturity of 6.4 years (31 December 2020: 6.1 years).

The primary bank debt facility is a EUR700m revolving credit

facility, which was undrawn at year end, and which matures in May

2026. This replaces the previously held revolving credit facilities

of EUR451m and EUR300m which were scheduled to mature in June 2022.

During 2021, the bilateral 'Green Loan' of EUR50m was also

repaid.

Included in cash at bank and in hand are overdrawn positions of

EUR1,439.8m (31 December 2020: EUR1,047.2m). These balances form

part of a notional cash pool arrangement and are netted against

cash balances of EUR1,463.6m (31 December 2020: EUR1,443.0m). The

net cash pool balance of EUR23.8m (31 December 2020: EUR395.8m) is

included in the cash and cash equivalents balance above. There is a

legal right of offset between these balances and the balances are

physically settled on a regular basis.

Net debt, which is an Alternative Performance Measure, is stated

net of interest rate and currency hedges which relate to hedges of

debt. Foreign currency derivative assets of EUR0.3m (2020: EURnil)

and foreign currency derivative liabilities of EURnil (2020:

EUR0.2m) which are used for transactional hedging are not included

in the definition of net debt. Lease liabilities recognised due to

the implementation of IFRS 16 and deferred contingent consideration

have also been excluded from the calculation of net debt.

5 RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

2021 2020

EURm EURm

Movement in cash and bank overdrafts (731.2) 1,180.2

Drawdown of loans (55.1) (751.2)

Repayment of loans and borrowings 263.2 3.4

Settlement of derivative financial instrument (18.5) -

Change in net debt resulting from cash

flows (541.6) 432.4

Translation movement - relating to US

dollar loan (19.7) 13.5

Translation movement - other 42.7 (41.4)

Derivative financial instruments movement (1.3) (7.5)

---------- ----------

Net movement (519.9) 397.0

Net debt at start of the year (236.2) (633.2)

Net debt at end of the year (756.1) (236.2)

---------- ----------

Further analysis of net debt at the start and end of the year is

provided in note 4.

6 LEASES

Right of use asset

2021 2020

EURm EURm

At 1 January 113.0 121.6

Additions 28.4 17.3

Arising on acquisitions 32.2 12.8

Remeasurement 17.3 2.2

Terminations (2.9) (2.6)

Depreciation charge for the year (37.0) (32.3)

Effect of movement in exchange rates 4.5 (6.0)

At 31 December 155.5 113.0

------- -------

Lease liability

2021 2020

EURm EURm

At 1 January 114.8 122.3

Additions 27.0 17.1

Arising on acquisitions 32.1 12.6

Remeasurement 17.3 1.7

Terminations (3.0) (2.7)

Payments (38.6) (33.7)

Interest 3.7 3.6

Effect of movement in exchange rates 4.7 (6.1)

At 31 December 158.0 114.8

------- -------

Split as follows:

Current liability 35.0 27.3

Non-current liability 123.0 87.5

At 31 December 158.0 114.8

------ ------

7 DIVIDS

Equity dividends on ordinary shares: 2021 2020

EURm EURm

2021 Interim dividend 19.9 cent (2020: 36.1 -

nil cent) per share

2020 Final dividend 20.6 cent (2019: 37.4 -

nil cent) per share

73.5 -

------- -----------------------

Proposed for approval at AGM

Final dividend of 26.0 cent (2020:

20.6 cent) per share 47.2 37.4

------- -----------------------

The 2020 interim dividends were cancelled during 2020 due to the

uncertainty created by the pandemic.

This proposed dividend for 2021 is subject to approval by the

shareholders at the Annual General Meeting and has not been

included as a liability in the Consolidated Statement of Financial

Position of the Group as at 31 December 2021 in accordance with IAS

10 Events after the Reporting Period. The proposed final dividend

for the year ended 31 December 2021 will be payable on 6 May 2022

to shareholders on the Register of Members at close of business on

25 March 2022.

8 EARNINGS PER SHARE

2021 2020

EURm EURm

The calculations of earnings per

share are based on the following:

Profit attributable to ordinary

shareholders 554.1 373.6

--------------- ---------------

Number of Number of

shares ('000) shares ('000)

2021 2020

Weighted average number of ordinary

shares for

the calculation of basic earnings

per share 181,348 181,212

Dilutive effect of share options 1,565 1,598

--------------- ---------------

Weighted average number of ordinary

shares

for the calculation of diluted earnings

per share 182,913 182,810

--------------- ---------------

2021 2020

EUR cent EUR cent

Basic earnings per share 305.6 206.2

Diluted earnings per share 303.0 204.4

Dilution is attributable to the weighted average number of share

options outstanding at the end of the reporting period.

The number of options which are anti-dilutive and have therefore

not been included in the above calculations is nil (2020: nil).

9 BUSINESS COMBINATIONS

A key strategy of the Group is to create and sustain market

leading positions through acquisitions in markets it currently

operates in, together with extending the Group's footprint in new

geographic markets. In line with this strategy, the principal

acquisitions completed during the year were as follows:

In February 2021, the Group acquired 100% of the share capital

of TeraSteel a Romanian based manufacturer of insulated panels. The

total consideration, including net debt acquired amounted to

EUR81.6m.

In June 2021, the Group acquired 100% of the share capital of

the Logstor Group a leading global supplier of technical insulation

solutions. The total consideration, including net debt acquired

amounted to EUR244.5m

The Group also made a number of smaller acquisitions during the

year for a combined cash consideration of EUR214.1m:

-- The Insulated Panels division acquired 51% of Bromyros in

Uruguay, the remaining 50% of Dome Solar in France, Solarsit

in France and the assets of Krohn in Russia;

-- The Insulation division acquired Thermakraft in Australasia,

Hectar in the Netherlands, the assets of Dyplast Products,

Diversifoam Products and Thermal Visions in North America;

-- The Light & Air division acquired Skydôme in Western

Europe and Major Industries and Solatube International in

North America;

-- The Water & Energy division acquired BAGA in Sweden, Heritage

Tanks in Australia and the assets of Enviro Water Tanks

in Australia.

The table below reflects the fair value of the identifiable net

assets acquired in respect of the acquisitions completed during the

year. Any amendments to fair values will be made within the

twelve-month period from the date of acquisition, as permitted by

IFRS 3, Business Combinations.

Logstor TeraSteel Other* Total

EURm EURm EURm EURm

Non-current assets

Intangible assets 20.4 6.4 11.7 38.5

Property, plant and equipment 36.0 22.9 35.1 94.0

Right of use assets 10.8 0.3 21.1 32.2

Deferred tax asset 2.6 0.3 2.2 5.1

Current assets

Inventories 40.0 24.3 27.8 92.1

Trade and other receivables 53.6 9.4 32.7 95.7

Current liabilities

Trade and other payables (68.7) (19.5) (37.1) (125.3)

Provisions for liabilities (5.3) (2.2) (5.0) (12.5)

Lease liabilities (3.9) - (2.5) (6.4)

Non-current liabilities

Retirement benefit obligations (1.3) - (1.7) (3.0)

Lease liabilities (6.9) (0.3) (18.5) (25.7)

Deferred tax liabilities (4.2) (1.1) (2.4) (7.7)