TIDMLGRS

RNS Number : 8328U

Loungers PLC

28 November 2023

28 November 2023

Loungers plc

Results for the 24 weeks ended 1 October 2023

Continued strong like for like sales performance accompanied by

acceleration in new site roll-out and margin improvement

16 new sites opened in the period; on-track to open 34 new sites

this year and to end the year with 256 sites

Loungers, a leading operator of all day café/bar/restaurants

across the UK under the Lounge, Cosy Club and Brightside brands, is

pleased to announce its unaudited results for the 24 weeks ended 1

October 2023 ("the period").

Financial Highlights

24 weeks 24 weeks

ended 1 October ended 2 October

2023 2022

GBP'000 GBP'000

Revenue 149,619 122,326

Adjusted EBITDA(1) 23,862 19,307

Adjusted EBITDA margin (%) 15.9% 15.8%

Adjusted EBITDA (IAS17) 17,284 13,482

Adjusted EBITDA (IAS17) margin

(%) 11.6% 11.0%

Operating profit 7,774 6,056

Operating profit margin (%) 5.2% 5.0%

Profit before tax 3,936 2,831

Diluted earnings per share (p) 2.6 2.3

Cash generated from operating activities 23,402 14,613

1 October 2 October

2023 2022

GBP'000 GBP'000

Non-property net debt 14,259 9,457

Net debt 156,136 134,246

(1) Adjusted EBITDA is calculated as operating profit before

depreciation, impairment, pre-opening costs, exceptional costs, and

share-based payment charges.

-- Revenue growth of 22.3% versus H1 2023 reflects like for like

("LFL") sales growth of +7.7% and the addition of a net 32 new

sites

-- Adjusted EBITDA of GBP23.9m (H1 2023: GBP19.3m), up 23.6%

-- Adjusted EBITDA (IAS17) of GBP17.3m (H1 2023: GBP13.5m) up 28.2%

-- IAS17 Adjusted EBITDA margin of 11.6% up 0.6% on H1 2023

-- Cash generated from operating activities increased to GBP23.4m (H1 2023: GBP14.6m)

Operational Highlights

-- Consistently strong trading driven by both mature estate

(with LFL sales 25% ahead of pre Covid levels) and new sites

-- Continued evolution of our offer, including further food menu

innovation and the introduction of a new blended drinks and iced

coffees range

-- Headline four-year LFL sales growth of +25.0% is testament to

the strength of our brands, the flexibility of our offering, and

the quality of our teams

-- Margins benefitting from an easing of inflationary pressures

and on track to return to pre Covid levels

-- New site roll out accelerated with 16 sites opened in the

period (H1 2023 11 sites) - 14 Lounges and two Brightsides. New

sites performing very well and the pipeline remains strong

Current Trading and Outlook

-- The business has continued to trade well over the first eight

weeks of Q3, with LFL sales growth across the 32 weeks to 26

November of 7.6%

-- A further six sites have opened post the 1 October half year

end - five Lounges and one Cosy Club

-- With the consumer remaining robust and continuing evidence of

moderating inflationary pressure we are optimistic as we look ahead

to the Christmas trading period

-- The current financial year will be a 53 week accounting year to 21 April 2024

Nick Collins, Chief Executive Officer of Loungers said:

"This has been another period of strong financial and

operational growth for Loungers. The fact that we have delivered

increases of 22.3% and 23.6% in our revenue and EBITDA respectively

should be taken as yet another reminder that it is not all doom and

gloom in the UK hospitality sector. We are living proof that

businesses which can provide outstanding hospitality, great food

and drink and excellent value are still capable of thriving, and we

see more growth potential for Loungers than ever before.

Our accelerated site roll-out programme continues at pace, and

we are on track to open 34 in FY24, which means that we will end

the year with more than 250 sites. The opening of every new Lounge

means an investment of nearly GBP1m into the local high street, and

the increased footfall creates a positive knock-on effect on all of

the businesses around us. By the end of 2023, we will have added

another 1,000 people to our team during the year, and we are

particularly pleased that one in eight of those new jobs is in

areas that the government wants to 'level up' by creating better

opportunities and standards of living."

Analyst Presentation Webcast

An analyst presentation will be held today, Tuesday 28 November

2023, at 9.00am (GMT). Participants wishing to join the webcast

should contact loungers@powerscourt-group.com to request

details.

Use of Alternative Performance Measures

The Half Year Results include both statutory and alternative

performance measures ("APMs"). Further background to the use of

APM's and reconciliations between statutory measures and APM's are

presented on page 17.

For further information please contact:

Loungers plc Via Powerscourt

Nick Collins, Chief Executive Officer

Gregor Grant, Chief Financial Officer

Houlihan Lokey UK Limited (Financial Adviser Tel: +44 (0) 20

and NOMAD) 7484 4040

Sam Fuller / Tim Richardson

Liberum Capital Limited (Joint Broker) Tel: +44 (0) 20

Andrew Godber / John Fishley 3100 2000

Peel Hunt LLP (Joint Broker) Tel: +44 (0)20 7418

Dan Webster / Andrew Clark 8900

Powerscourt (Financial Public Relations) Tel: +44 (0) 207

Rob Greening / Nick Hayns / Elizabeth Kittle 250 1446

Notes to Editors

Loungers operates through its three established complementary

brands - Lounge, Cosy Club and Brightside - in the UK hospitality

sector. A Lounge is a neighbourhood café/bar combining elements of

coffee shop culture, the British pub and dining. There are 205

Lounges nationwide. Lounges are principally located in secondary

suburban high streets and small town centres. The sites are

characterised by informal, unique interiors with an emphasis on a

warm, comfortable atmosphere, often described as a "home from

home".

Cosy Clubs are more formal bars/restaurants offering

reservations and table service but share many similarities with the

Lounges in terms of their broad, all-day offering and their focus

on hospitality and culture. Cosy Clubs are typically located in

city centres and large market towns. Interiors tend to be larger

and more theatrical than for a Lounge, and heritage buildings or

first-floor spaces are often employed to create a sense of

occasion. There are 36 Cosy Clubs nationwide.

Brightside is a roadside dining concept and was launched in

November 2022. The first Brightside location opened on the A38,

south of Exeter, in February 2023, with the second opening in

Saltash near Plymouth in June 2023 and the third in Honiton on the

A303 in August 2023.

CHIEF EXECUTIVE REVIEW

Operating review

Continuing the consistently strong sales performance post

Covid

Our sales performance continues to be consistently strong. We

achieved like for like sales of +7.7%, whilst our four year LFL

result of +25.0% reflects the resilience of our sales performance

in the post Covid period. There is always noise around weather,

sporting events, public holidays and the impact on sales, but from

our perspective the sales story across Lounge and Cosy Club has

been consistently good. Our customer base is relatively robust and

represents a very broad demographic which enjoys our hospitality

across the day. Historically our sales growth has been dominated by

volume growth and us serving more customers. Over the last six

months it is predominantly price that has been driving that growth.

There are a number of different dynamics in the marketplace: - some

consumers are spending less, many operators are pushing through

aggressive price increases, supply has and continues to come out of

the market, and everyone is working hard to impress the consumer.

The last point is particularly important: Covid and the economic

environment have caused everyone to up their game (and their

prices). That our sales volumes have grown in the post-Covid period

whilst most have seen have their volumes shrink considerably is

both impressive and encouraging . I am optimistic that against this

backdrop we will see a return to more significant volume growth in

the short to medium term.

Pleasing margin progression

We talked in July about our goal to return to pre-Covid levels

of EBITDA margin in the medium-term, and these results demonstrate

our firm progress on that journey. Our impressive margin growth

(IAS17 Adjusted EBITDA margin at 11.6% vs 11.0% last year) reflects

not just our increasing scale and resultant ability to mitigate

inflationary pressure, but also our recent focus on efficiency.

Over the course of the last six months we have been working on

projects looking at our efficiency in respect of oil, cellar gas,

print, waste and energy. The majority are at relatively early

stages, but they are demonstrating that there's significant

opportunity.

Successful new openings

Our new openings continue to perform very well and above

average, and the pipeline remains in good shape to deliver at our

current roll-out rate of around 34 sites per year. Geographically

we are seeing more opportunities in the north east as we gradually

move towards Scotland, but there still remains a great deal for us

to go for across England and Wales. We are enjoying strong trading

in mixed use retail/leisure parks and coastal locations, alongside

our "bread and butter" of suburban and small town high street

locations. Our strength of performance across this variety of site

types gives us real confidence in our conservative targets of 600

Lounges and 65 Cosy Clubs.

A relentless focus on innovation

The strong sales performance is achieved by an unrelenting

restlessness to deliver better for our customers. The spirit of

innovation and entrepreneurialism within the business has never

been stronger. Given our significant growth, we often see a

cyclical effect with periods that are more dominated by change and

innovation followed by those that are more dominated by

implementation and consolidation. We are currently in the former,

and the strength and depth of our senior team is allowing us to

really push on. Recent food menu launches in both Lounge and Cosy

Club have been excellent, and our flexibility around being able to

focus on emerging food trends - without being wedded to a specific

cuisine - is a significant point of difference. We serve just as

many bacon butties as vegetarian cauliflower dishes. And this

restlessness is not just on the food side; we have also rolled out

major improvements to our blended drinks, iced coffees, and

cocktails and are embarking on a major project to improve our

already strong coffee offer, which represents 10% of our sales in

the Lounge estate.

Innovation and change within the business isn't limited to the

customer experience. Challenging how we can adapt and improve

organisationally to make life easier for our site teams whilst

maintaining and enhancing the culture within the business is also

critically important. Our ambition is to ensure that we benefit

from the advantages that scale brings, whilst not succumbing to the

red-tape risk that comes with being a 250-site business. On the

commercial side, we are investing more in operational support,

procurement and supply chain, risk management and maintenance,

recognising that we can do more centrally, to ensure our site teams

can focus solely on their customers and their own teams. Within our

operational structure, we have now introduced regional maintenance

managers, community managers and talent and recruitment managers. A

degree of devolution and accountability at a regional level are

critical to our continued success.

Brightside progressing to plan

During the summer we opened our second and third Brightsides and

the team have done a fantastic job at delivering well for their

customers in what has been an intense period due to the openings

coinciding with school summer holidays. This year we have achieved

a gross average weekly level of sales of GBP22.5k across the sites

and we expect this to grow as we continue to build our brand

awareness. In the main we are pleased with Brightside's performance

to date, and most importantly are proud of the hospitality we are

providing, and the choice we have introduced to passing motorists

as well as to local residents. As we continue to trade, and with

the benefit of the two further planned openings in FY25, we will

build a view on Brightside's returns on capital and whether there

is an opportunity to roll it out as a national brand. Whilst it's

an exciting time for this new brand, I believe the strength of

these interim results firmly demonstrates that Brightside has in no

way distracted from our focus on or the performance of the Lounge

and Cosy Club brands.

Aiming to be the number one choice for careers in

hospitality

On the people side we have continued to focus on how we reward

and incentivise our teams across the business. We have adapted our

site team bonus structures to ensure that they are fully aligned

with our operational priorities. We have also enhanced the focus on

development and succession planning. One of our core attributes -

and one of the parts of the business of which I am most proud - is

our ability to build careers in hospitality. We're good at this and

have many great examples of people who have worked up through the

ranks, but there is still plenty of scope for us to do more and to

be better. The next couple of years will see us really double-down

in terms of investing in learning and development, and ensuring

that we are making the most of the career opportunities that our

growth creates. We want to be the number one choice for anyone

pursuing a career in the hospitality industry in the UK.

At an exec level we have welcomed Lucy Knowles into the business

as Cosy Club Managing Director. Cosy Club is a fantastic brand that

complements our Lounges and continues to perform well. It achieves

strong sales and returns on capital in line with the Lounge

business, but our instinct is that there is more that we can do to

maximise sales and I am excited about the impact Lucy will have on

the business.

Financial review

Financial Performance

It is pleasing to be able to report for the first time in four

years current and prior year numbers that are not impacted by

Covid, and all the more pleasing to be reporting such a strong year

on year performance, with:

-- Total revenue ahead by 22.3%;

-- Adjusted EBITDA ahead by 23.6%

-- Operating profit ahead by 28.4%

Total revenue growth of 22.3% reflects the positive impact of

LFL sales growth of 7.7% allied to the continued strength of our

new site opening programme, with 16 sites opened in the first half

and a net 32 new sites opened in the past 12 months. The sales

performance again demonstrates both the resilience of the Loungers

business and the consistency we have seen in consumer

behaviour.

Adjusted EBITDA margins are ahead by 0.1% to 15.9% on the IFRS16

basis. However the margin expansion is more marked when looked at

on the IAS17 basis with rent costs included, showing an increase to

11.6% from 11.0% in H1 2023. The 60bps improvement in IAS17

Adjusted EBITDA margin reflects:

-- Gross margin improvement of 60bps;

-- Fixed property cost leverage benefit of 60bps; offset by

-- Negative impact of higher energy costs of 50bps

-- Negative impact of other costs of 10bps

The gross margin improvement has been largely driven by

improvements in food and drink gross margin as the business

continues to benefit from its growing scale allied to a moderation

in inflationary pressures. The maintenance of strong property

discipline assists in delivering improvements in fixed property

cost leverage, with a rent to revenue ratio of 4.4% in the first

half. As anticipated these benefits have been partially offset by

higher energy costs. Whilst the business will continue to benefit

from its May 2020 energy hedge through to September 2024, the new

site roll out means that only approximately 70% of the estate is

covered by that original hedge, with the negative margin impact

coming from sites opened post May 2020.

Profit before tax of GBP3.9m (H1 2023 GBP2.8m) represents an

uplift of 39.0%. The tax charge of GBP1.2m relates wholly to

deferred tax, with the business benefitting from the introduction

of the 100% main pool first year allowance. The effective tax rate

of 30.4% reflects the impact of non-deductible depreciation on

capital expenditure not eligible for capital allowances and the

deferred tax accounting for share based payments.

Net debt

Non-property net debt (gross of arrangement fees) of GBP14.3m

represents an increase of GBP4.8m relative to 2 October 2022, and

reflects in large part the acceleration in the new site opening

programme.

During the half year the Group entered into a new senior

facilities lending agreement with its existing lenders Santander

Corporate Banking and Bank of Ireland. Under the terms of the new

agreement the Group reduced its term loan from GBP32.5m to GBP20.0m

and increased its RCF from GBP10.0m to GBP22.5m.

Finance costs for the period have increased to GBP3.9m (H1 2023:

GBP3.3m), reflecting an increase in IFRS16 lease interest charges

to GBP3.1m (H1 2023: GBP2.8m) and an increase in bank interest

payable to GBP0.9m (H1 2023: GBP0.5m).

Cash flow

Net cash generated from operating activities was GBP23.4m (H1

2023: GBP14.6m), with the improvement of GBP8.8m coming from EBITDA

growth of GBP4.1m and working capital improvements of GBP4.7m.

Capital expenditure outflows in the period increased to GBP21.0m

(H1 2023: GBP15.0m), a function of the acceleration in the new site

opening programme and the opening of 16 sites in the first half (H1

2023:11 sites). The capital expenditure incurred in the period

(excluding IFRS16 ROUA investment) of GBP22.0m (H1 2023: GBP15.9m),

included GBP15.1m related to new sites (H1 2023: GBP11.2m).

Cash outflows include GBP12.5m in connection with the

refinancing referenced above and GBP0.7m in relation to the cash

settlement of share awards and the purchase of the Group's own

shares.

Dividend policy

In the short term, the Board intends to retain the Group's

earnings to bolster liquidity and balance sheet strength and for

re-investment in the roll-out of new sites. It is the Board's

ultimate intention to pursue a progressive dividend policy, subject

to the need to retain sufficient earnings for the future growth of

the Group.

Current trading and prospects

-- The business has continued to trade well over the first eight

weeks of Q3, with LFL sales growth across the 32 weeks to 26

November of 7.6%

-- A further six sites have opened post the 1 October half year

end - five Lounges and one Cosy Club

-- With the consumer remaining robust and continuing evidence of

moderating inflationary pressure we are optimistic as we look ahead

to the Christmas trading period

-- The current financial year will be a 53 week accounting year to 21 April 2024

Nick Collins

Chief Executive Officer

28 November 2023

Condensed Consolidated Statement of Comprehensive Income

For the 24 Week Period Ended 1 October 2023

24 weeks 24 weeks Year ended

ended ended

Note 1 October 2 October 16 April

2023 2022 2023

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

Revenue 149,619 122,326 283,507

Cost of sales 90,314 (74,411) (170,350)

---------- ---------- -----------

Gross profit 59,305 47,915 113,157

Administrative expenses (51,531) (41,859) (98,406)

Operating profit 7,774 6,056 14,751

Finance income 84 61 204

Finance costs 3 (3,922) (3,286) (7,621)

Profit before taxation 3,936 2,831 7,334

Tax charge on profit 4 (1,198) (368) (405)

Profit for the period 2,738 2,463 6,929

========== ========== ===========

Other comprehensive (expense)

/ income:

Cash flow hedge - change in value

of hedging instrument - (38) (38)

Other comprehensive (expense)

/ income for the period - (38) (38)

Total comprehensive income for

the period 2,738 2,425 6,891

========== ========== ===========

Earnings per share (pence)

Basic 5 2.6 2.4 6.7

Diluted 5 2.6 2.3 6.5

---- ---- ----

Condensed Consolidated Statement of Financial Position

As at 1 October 2023

Note 2 October 2 October 16 April

2022 2022 2023

GBP000 GBP000 GBP'000

Unaudited Unaudited Audited

Assets

Non-current

Intangible assets 114,722 113,227 114,722

Property, plant and equipment 7 250,467 203,845 228,414

Deferred tax assets - 988 945

Finance lease receivable - 534 -

---------- ---------- ----------

Total non-current assets 365,189 318,594 344,081

Current

Inventories 2,450 2,031 2,475

Trade and other receivables 7,024 3,734 8,722

Cash and cash equivalents 5,741 23,044 26,370

---------- ---------- ----------

Total current assets 15,215 28,809 37,567

Total assets 380,404 347,403 381,648

========== ========== ==========

Liabilities

Current liabilities

Trade and other payables (70,411) (52,207) (69,708)

Lease liabilities (11,025) (9,153) (59)

Derivative financial instruments - - (10,247)

---------- ---------- ----------

Total current liabilities (81,436) (61,360) (80,014)

Non-current liabilities

Borrowings 8 (19,709) (32,329) (32,392)

Lease liabilities (130,852) (115,636) (124,590)

Deferred tax liabilities (252) - -

Total liabilities (232,249) (209,325) (236,996)

========== ========== ==========

Net assets 148,155 138,078 144,652

========== ========== ==========

Called up share capital 9 1,139 1,133 1,133

Share premium 8,066 8,066 8,066

Treasury shares (376) - -

Other reserves - 14,278 14,278

Accumulated profits 139,326 114,601 121,175

---------- ---------- ----------

Total equity 148,155 138,078 144,652

========== ========== ==========

Condensed Consolidated Statement of Changes in Equity

For the 24 Week Period Ended 1 October 2023

Share Share Hedge Treasury Other Accumulated Total

Capital Premium Reserve Shares Reserve Profits Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 17 April 2022 1,127 8,066 38 - 14,278 110,597 134,106

Ordinary shares issued 6 - - - - (6) -

Share based payment charge - - - - - 1,547 1,547

--------- --------- --------- --------- --------- ------------ --------

Total transactions with

owners 6 - - - - 1,541 1,547

Profit for the period - - - - - 2,463 2,463

Other comprehensive expense - - (38) - - - (38)

--------- --------- --------- --------- --------- ------------ --------

Total comprehensive

income - - (38) - - 2,463 2,425

At 2 October 2022 1,133 8,066 - - 14,278 114,601 138,078

========= ========= ========= ========= ========= ============ ========

Share based payment charge - - - - - 2,108 2,108

--------- --------- --------- --------- --------- ------------ --------

Total transactions with

owners - - - - - 2,108 2,108

Profit for the period - - - - - 4,466 4,466

Total comprehensive

income - - - - - 4,466 4,466

At 16 April 2023 1,133 8,066 - - 14,278 121,175 144,652

========= ========= ========= ========= ========= ============ ========

Ordinary shares issued 6 - - - - (6) -

Share based payment charge - - - - - 1,141 1,141

Group reorganisation - - - - (14,278) 14,278 -

Purchase of own shares - - - (376) - - (376)

Total transactions with

owners 6 - - (376) (14,278) 15,413 765

Profit for the period - - - - - 2,738 2,738

Total comprehensive

income - - - - - 2,738 2,738

At 1 October 2023 1,139 8,066 - (376) - 139,326 148,155

========= ========= ========= ========= ========= ============ ========

Condensed Consolidated Statement of Cash Flows

For the 24 Week Period Ended 1 October 2023

24 Weeks 24 Weeks Year ended

ended ended

Note 1 October 2 October 16 April

2023 2022 2023

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Net cash generated from operating

activities 10 23,402 14,613 51,107

========== ========== ===========

Cash flows from investing activities

Purchase of subsidiary undertakings

(net of cash acquired) - - (2,719)

Purchase of property, plant and

equipment (21,022) (15,012) (36,978)

Interest received 84 43 204

Net cash used in investing activities (20,938) (14,969) (39,493)

========== ========== ===========

Cash flows from financing activities

Shares issued on exercise of employee

share awards (183) (183) (190)

Cash settlement of share awards (333) - -

Purchase of own shares (376) - -

Loan arrangement fees (266) - -

Bank loans repaid (12,500) - -

Interest paid (852) (455) (1,334)

Principal element of lease payments (5,533) (4,511) (8,824)

Interest paid on lease liabilities (3,050) (2,758) (6,146)

Principal element of lease receivables - 57 -

Net cash used in financing activities (23,093) (7,807) (16,494)

========== ========== ===========

Net decrease in cash and cash

equivalents (20,629) (8,206) (4,880)

Cash and cash equivalents at beginning

of the period 26,370 31,250 31,250

Cash and cash equivalents at end

of the period 5,741 23,044 26,370

========== ========== ===========

Notes to the Condensed Consolidated Interim Financial

Statements

1. General information

The Directors of Loungers plc (the "Company") and its

subsidiaries (the "Group") present their interim report and the

unaudited condensed financial statements for the 24 weeks ended 1

October 2023 ("Interim Financial Statements").

The Company is a public limited company, incorporated and

domiciled in England and Wales, under the company registration

number 11910770. The registered office of the company is 26 Baldwin

Street, Bristol BS1 1SE.

The Interim Financial Statements were approved by the Board of

Directors on 28 November 2023.

The Interim Financial Statements have not been audited or

reviewed by the auditors. The financial information shown for the

24 weeks ended 1 October 2023 does not constitute statutory

financial statements within the meaning of section 434 of the

Companies Act 2006.

The information shown for the year ended 16 April 2023 does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 and has been extracted from the Group's

Annual Report and Financial Statements for that year.

The Interim Financial Statements should be read in conjunction

with the Group's Annual Report and Financial Statements for the

year ended 16 April 2023, which were prepared in accordance with UK

adopted International Accounting Standards and those parts of the

Companies Act 2006 applicable to companies reporting under those

standards. The Group's Annual Report and Financial Statements for

the year ended 16 April 2023 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Group's Annual

Report and Financial Statements for the year ended 16 April 2023

was unqualified, did not draw attention to any matters by way of

emphasis, and did not contain a statement under 498(2) or 498(3) of

the Companies Act 2006.

2. Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS34, 'Interim Financial Reporting' and the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority. They do not include all of the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last financial statements.

The Interim Financial Statements are presented in Pounds

Sterling, rounded to the nearest thousand Pounds, except where

otherwise indicated; and under the historical cost convention as

modified through the recognition of financial liabilities at fair

value through the profit and loss.

The Directors consider that the principal risks and

uncertainties faced by the Group are as set out in the Group's

Annual Report and Financial Statements for the year ended 16 April

2023.

The accounting policies adopted in the preparation of the half

year financial statements are consistent with those followed in the

preparation of the Group's financial statements for the 52 weeks

ended 16 April 2023. The Group has not early adopted any standard,

interpretation or amendment that has been issued but is not yet

effective.

Going concern

In concluding that it is appropriate to prepare the Group's

interim financial statements on the going concern basis attention

has been paid both to the current sector headwinds in terms of

consumer confidence and inflationary pressures and also longer

terms risks such as climate change.

As at the 1 October 2023 the Group had cash balances of GBP5.7m

and unutilised facilities of GBP22.5m providing total liquidity of

GBP28.2m.

In order to assess the Group's going concern position the Board

has considered a base case and a downside case scenario of the

Group's business plan. The going concern period covers the period

to December 2024.

-- The base case assumes below inflation selling price increases

and flat volumes and reflects current assumptions in respect of

future cost inflation and incorporates increases in energy costs to

reflect the continued opening of new sites whose energy costs are

hedged at current rates and the 30 September 2024 end date of the

May 2020 energy hedge. The base case scenario indicates that the

Group has significant headroom in respect of both its liquidity

position and its banking covenants.

-- In the downside scenario it has been assumed that sales

volumes fall by 10% from the base case with an associated reduction

in labour and variable cost efficiency and a resultant 50% decline

in adjusted EBITDA over the year to December 2024. This significant

sales decline has been mitigated by a cessation of the new site

roll out programme from May 2024 onwards.

In the downside scenario the Group continues to have significant

liquidity and banking covenant headroom and accordingly the

Directors have concluded that it is appropriate to prepare the

Interim Financial Statements on the going concern basis.

ESG and TCFD requirements

The Group reported under the TCFD framework in its full year

report and accounts to 16 April 2023. The Group continues to evolve

its ESG strategy, with initiatives undertaken in the first half of

the financial year including the rollout of its Community

initiatives strategy, a waste management trial and the launch of

its first group-wide Environmental Policy.

At the half year, the Group is not aware of any climate related

risks that would have a material financial impact upon the Group's

ability to operate, but the Board continues to monitor this as part

of their ongoing risk assessments.

Accounting estimates and judgements

In preparing these financial statements, management has made

judgements, estimates and assumptions that affect the application

of accounting policies and the reported amounts of assets and

liabilities, income and expense. Actual results may differ from

these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the Group's

consolidated financial statements for the year ended 16 April

2023.

The Group tests for impairment on an annual basis or earlier if

there are indicators that an asset might be impaired. At the 1

October 2023 the Group was not aware of any specific events that

would require a site to be impaired. The Group has reviewed its

FY23 impairment calculations, flexing assumptions for potential

increases in discount rates and is satisfied that there is no

requirement to recognise additional impairment.

3. Finance costs

24 Weeks 24 Weeks Year ended

ended ended

1 October 2 October 16 April

2023 2022 2023

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

Bank interest payable 872 528 1,475

Finance cost on lease liabilities 3,050 2,758 6,146

3,922 3,286 7,621

========== ========== ===========

4. Tax on profit

24 Weeks 24 Weeks Year ended

ended ended

1 October 2 October 16 April

2023 2022 2023

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

Taxation charged to the income

statement

Current income taxation - - -

Adjustments for current tax - -

of prior periods

---------- ---------- -----------

Total current income taxation - - -

========== ========== ===========

Deferred Taxation

Origination and reversal of

temporary differences - - 1,069

Current period 1,198 368 -

Adjustments to tax charge in

respect of prior periods - - (911)

Adjustment in respect of changes

in tax rates - - 247

---------- ---------- -----------

Total deferred tax 1,198 368 405

========== ========== ===========

Total taxation charge in the

consolidated income statement 1,198 368 405

========== ========== ===========

The income tax expense was recognised based on management's best

estimate of the effective income tax rate expected for the full

financial year, applied to the profit before tax for the 24 weeks

ended 1 October 2023. The effective tax rate of 30.4% is above the

standard rate of income tax due to the impact of non-deductible

depreciation on fixed asset additions that are not eligible for

capital allowances and the impact of share based payment

charges.

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to equity shareholders by the weighted average number

of shares outstanding during the period, excluding unvested shares

held pursuant to the following long-term incentive plans:

-- Loungers plc Employee Share Plan

-- Loungers plc Senior Management Restricted Share Plan

-- Loungers plc Value Creation Plan

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. During the

period ended 1 October 2023 the Group had potentially dilutive

shares in the form of unvested shares pursuant to the above

long-term incentive plans.

Own shares held in Treasury are treated as cancelled for the

purpose of this calculation.

24 Weeks 24 Weeks Year ended

ended ended

1 October 2 October 16 April

2023 2022 2023

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Profit for the period after

tax 2,738 2,463 6,929

Basic weighted average number

of shares 103,657,995 103,137,035 103,243,015

Adjusted for share awards 3,338,091 2,148,438 3,375,062

Diluted weighted average number

of shares 106,996,006 105,285,472 106,618,077

Basic earnings per share (p) 2.6 2.4 6.7

Diluted earnings per share (p) 2.6 2.3 6.5

============ ============ ============

6. Share based payments

The Group had the following share-based payment arrangement in

operation during the period:

- Loungers plc Employee Share Plan

- Loungers plc Senior Management Restricted Share Plan

- Loungers plc Value Creation Plan

The Group recognised a total charge of GBP1,665,000 in respect

of the Group's three share-based payment plans.

7. Fixed assets

Freehold Leasehold Motor Fixtures Right Total

Land and Building Vehicles and Fittings of Use

Buildings Improvements Asset

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Cost

At 17 April 2022 369 67,489 210 70,606 149,381 288,055

Additions 832 6,455 - 8,640 9,698 25,625

At 2 October 2022 369 74,776 210 79,246 159,079 313,680

Additions - 10,621 - 12,633 14,821 38,075

Acquisition of subsidiaries 1,500 - - - - 1,500

Disposals (250) (451) (9) (175) - (885)

At 16 April 2023 2,451 84,114 201 91,704 173,900 352,370

----------- -------------- ---------- -------------- -------- --------

Additions 2,865 7,717 - 11,429 12,571 34,582

At 1 October 2023 5,316 91,831 201 103,133 186,471 386,952

----------- -------------- ---------- -------------- -------- --------

Depreciation

At 17 April 2022 - 17,937 66 30,658 51,031 99,692

Provided for the period - 2,079 23 3,713 4,328 10,143

At 2 October 2022 - 20,016 89 34,371 55,359 109,835

Provided for the period 14 2,692 25 4,818 5,533 13,082

Impairment - 381 - 85 2,937 3,403

Impairment reversal - (157) - - (1,639) (1,796)

Disposals - (405) (3) (160) - (568)

At 16 April 2023 14 22,527 111 39,114 62,190 123,956

----------- -------------- ---------- -------------- -------- --------

Provided for the period 42 2,606 16 4,856 5,009 12,529

At 1 October 2023 56 25,133 127 43,970 67,199 136,485

----------- -------------- ---------- -------------- -------- --------

Net book value

At 1 October 2023 5,260 66,698 74 59,163 119,272 250,467

At 16 April 2023 2,437 61,587 90 52,590 111,710 228,414

At 2 October 2022 369 54,760 121 44,875 103,720 203,845

At 17 April 2022 369 49,552 144 39,948 98,350 188,363

=========== ============== ========== ============== ======== ========

8. Borrowings

1 October 2 October 16 April

2023 2022 2023

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

Non-current

Bank loan 20,000 32,500 32,500

Loan arrangement fees (291) (171) (108)

---------- ---------- ---------

19,709 32,329 32,392

========== ========== =========

The Group's bank borrowings are secured by way of fixed and

floating charges over the Group's assets.

In June 2023 the Group completed a refinancing of it debt

arrangements leaving it with a term loan of GBP20,000,0000 and a

revolving credit facility of GBP22,500,000. The term loan is

non-amortising and bears interest at between 1.75% and 2.5% over

SONIA subject to the Group's leverage. At inception of the new

facility the Group was paying a margin of 1.75%. The term loan and

RCF are subject to financial covenants relating to leverage and

interest cover, which are unchanged from the original facility.

The Group has been compliant with all of its covenant

obligations during the 24 weeks to 1 October 2023.

At 1 October 2023 the term loan was fully drawn and GBPnil was

drawn down under the revolving credit facility.

9. Share capital

1 October 2 October 16 April

2023 2022 2023

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

Allotted, called up and fully

paid ordinary shares 1,039 1,033 1,033

Redeemable preference shares 100 100 100

1,139 1,133 1,133

============ ============ ============

Ordinary shares at GBP0.01 each 103,900,642 103,303,312 103,332,033

Redeemable preference shares 2 2 2

The table below summarises the movements in share capital for

Loungers plc during the period ended 1 October 2023:

Ordinary Redeemable GBP'000

Shares Preference

Shares

GBP0.01 GBP49,999

NV NV

------------ ----------- --------

At 16 April 2023 103,332,033 2 1,133

Shares issued 568,609 - 6

At 1 October 2023 103,900,642 2 1,139

============ =========== ========

On 4 May 2023 the Group issued 359,000 ordinary shares of 1

pence each to 718 employees pursuant to the Group's share plans. At

the same time the Group applied to increase its block listing by

477,962 shares in respect of its share plans. In the period to 1

October 2023 209,609 shares have been issued under the block

listing scheme.

10. Note to the cash flow statement

24 Weeks 24 Weeks Year ended

ended ended

1 October 2 October 16 April

2023 2022 2023

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit before tax 3,936 2,831 7,334

Adjustments for:

Depreciation of property, plant

and equipment 7,520 5,815 13,364

Depreciation of right of use assets 5,009 4,328 9,861

Impairment of property, plant and

equipment - - 309

Impairment of right of use assets - - 1,298

Share based payment transactions 1,665 1,730 4,024

Loss on disposal of fixed assets - - 317

Finance income (84) (60) (204)

Finance costs 3,922 3,286 7,621

Changes in inventories 25 (112) (557)

Changes in trade and other receivables 1,552 1,591 (3,134)

Changes in trade and other payables (143) (4,796) 10,950

Cash generated from operations 23,402 14,613 51,183

Tax paid - - (76)

Net cash generated from operating

activities 23,402 14,613 51,107

========== ========== ===========

11. Group reorganisation

As of 1 October 2023 the Group was engaged in a restructuring

exercise, to remove three intermediate holding companies (Lion /

Jenga Topco Ltd, Lion / Jenga Midco Ltd and Lion / Jenga Bidco Ltd)

from the Group structure, thereby simplifying it. As a consequence

of the capital reductions undertaken, the Condensed Consolidated

Statement of Changes in Equity at 1 October 2023 shows a reduction

in other reserves and a corresponding increase in accumulated

profits.

Reconciliation of Statutory Results to Alternative Performance

Measures

The Interim Results include both statutory and alternative

performance measures ("APMs"). APM's are included for the following

reasons:

-- They reflect the way in which management report and monitor

the financial performance of the Group internally;

-- They improve the comparability of information between

reporting periods by adjusting for one-off factors;

-- The IAS17 presentation reflects the way in which the

financial performance of the Group has been presented historically

and the basis on which the Group's financial covenants are

tested.

24 weeks 24 weeks Year ended

ended ended

1 October 2 October 16 April

2023 2022 2023

GBP000 GBP000 GBP000

Unaudited Unaudited Audited

Operating profit 7,774 6,056 14,751

Net impairment charge - - 1,607

Loss on disposal of fixed assets - - 317

Transaction costs - - 102

Share based payment charge 1,665 1,730 4,024

Site pre-opening costs 1,894 1,378 3,323

---------- ---------- -----------

Adjusted operating profit 11,333 9,164 24,124

Depreciation (pre IFRS 16 right

of use asset charge) 7,520 5,815 13,364

IFRS 16 Right of use asset depreciation 5,009 4,328 9,861

Adjusted EBITDA (IFRS 16) 23,862 19,307 47,349

Adjusted EBITDA % (IFRS 16) 15.9% 15.8% 16.7%

IAS 17 Rent charge (6,816) (5,959) (13,459)

IAS 17 Rent charge included in

IAS 17 pre-opening costs 238 134 331

Adjusted EBITDA (IAS 17) 17,284 13,482 34,221

========== ========== ===========

Adjusted EBITDA % (IAS 17) 11.6% 11.0% 12.1%

The Group references Like for Like sales growth as a key APM.

Like for Like sales growth excludes the sales from sites that have

been open for less than 18 months.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DZMZMZNFGFZZ

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

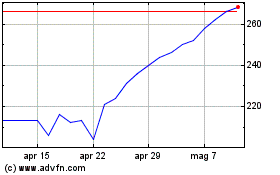

Grafico Azioni Loungers (LSE:LGRS)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Loungers (LSE:LGRS)

Storico

Da Mag 2023 a Mag 2024