TIDMLIV

RNS Number : 0404O

Livermore Investments Group Limited

29 September 2023

28 September 2023

LIVERMORE INVESTMENTS GROUP LIMITED

UNAUDITED INTERIM RESULTS FOR SIX MONTHSED 30 JUNE 2023

Livermore Investments Group Limited (the "Company" or

"Livermore") today announces its unaudited interim results for the

six months ended 30 June 2023 . These results will be made

available on the Company's website today.

For further investor information please go to

www.livermore-inv.com .

Enquiries:

Livermore Investments Group Limited +41 43 344 3200

Gaurav Suri

Strand Hanson Limited (Financial & Nominated Adviser and

Broker) +44 (0)20 7409 3494

Richard Johnson / Ritchie Balmer

Chairman's and Chief Executive's Review

Introduction

We are pleased to announce the interim financial results for

Livermore Investments Group Limited (the "Company" or "Livermore")

for the six months ended 30 June 2023. References to the Company

hereinafter also include its consolidated subsidiary (note 8).

The economic developments in 2023 surprised positively. The

Eurozone escaped a deep recession as a mild winter helped cool

energy prices and the expectations for China re-opening its economy

after a long Covid-zero policy increased European export demand.

The US also performed much better than expected as consumers

continued to spend on the back of excess savings accumulated over

the recent years and a lower interest rate sensitivity of the

corporate and consumer sectors. Inflation in the US continued to

trend downwards without unemployment increasing. High nominal GDP

allowed most companies to maintain profit margins and equity

markets performed strongly in the first half of the year. The US

Dollar continued to weaken supporting investor risk appetite.

Developed market central banks continued to increase short term

interest rates as inflation stayed higher than expected. Fixed

income markets generally fared poorly despite a brief rally in

March after Credit Suisse and a few US regional banks failed. The

US treasury and the Federal Reserve, however, created facilities

that supported the regional banking sector in the US and markets

staged a significant recovery as key risk to the financial system

was reduced.

US loans performed well during the first half of the year as

higher short-term rates provided significant distributions. Most

borrowers did not need to address their loan maturities as strong

market conditions in 2021 allowed them to extend their maturities

at low credit spreads. Lower leveraged buy-outs and M&A

transactions further constrained supply and supported a move higher

in loan prices. On the other hand, these borrowers are paying

higher interest costs and may face earnings reductions and

liquidity issues in the near future, and management is focused on

such situations as they arise. CLO equity performance for long

reinvestment period positions was strong but remained weak for

positions with post-reinvestment CLOs.

During the first half of the year, management continued its

defensive stance and stayed invested in primarily US treasury

bills. The Company's cash and marketable securities position

increased further as CLO distributions were not reinvested in the

CLO market and management has no open warehouses. The CLO portfolio

performed relatively well as default rates, although higher than in

2021 and 2022, were lower than expected. CLO equity issued in 2021

and later performed well but transactions that have exited their

reinvestment periods continue to experience higher stress due to

higher exposure to seasoned and weaker credits and lower manager

flexibility. The Company's CLO portfolio generated USD 11.0m of

cashflow during the period.

As at 30 June 2023, the Company held USD 55.4m in cash and

marketable securities (June 2022: USD 37.3m). This should allow

management to deploy capital opportunistically into a hopefully

weaker market when the US economic cycle bottoms.

During the first half of 2023, the Company recorded a net gain

of USD 3.9m (June 2022: net loss of USD 21.6m). The cashflow from

the CLO portfolio was somewhat offset by valuation declines of USD

4.8m, primarily from post-reinvestment period CLO transactions. The

NAV as at 30 June 2023 was USD 0.80 per share. Management continues

to actively manage its financial portfolio and remain in regular

contact with CLO managers and market participants.

Financial Review

The NAV of the Company as at 30 June 2023 was USD 131.6m (31

December 2022: USD 127.7m). The profit after tax for the first half

of 2023 was USD 3.9m, which represents earnings per share of USD

0.02.

The overall change in the NAV is primarily attributed to the

following:

30 June 202 3 30 June 202 2 31 December 20 22

US $m US $m US $m

-------------- -------------- ------------------

Shareholders' funds at beginning of period 12 7 .7 17 7 .7 17 7.7

-------------- -------------- ------------------

----- ----- -----

-------------- -------------- ------------------

Income from investments 11.5 13.7 23.7

-------------- -------------- ------------------

Other income 0.3 - -

-------------- -------------- ------------------

Unrealised losses on investments (5.8) (35.8) (46.3)

-------------- -------------- ------------------

Operating expenses (1.7) (1.4) (3.0)

-------------- -------------- ------------------

Net finance c osts (0.3) (0.2) (0.2)

-------------- -------------- ------------------

Tax charge (0.1) - (0.2)

-------------- -------------- ------------------

----- ----- -----

-------------- -------------- ------------------

Increase / (decrease) in net assets from operations 3.9 (23.7) (26.0)

-------------- -------------- ------------------

Dividends paid - (24.0) (24.0)

-------------- -------------- ------------------

----- ----- -----

-------------- -------------- ------------------

Shareholders' funds at end of period 131.6 130.0 127.7

-------------- -------------- ------------------

----- ----- -----

-------------- -------------- ------------------

Net Asset Value per share US $0. 80 US $0. 79 US $0. 77

-------------- -------------- ------------------

Livermore's Strategy

The Company's primary investment objective is to generate high

current income and regular cash flows. The financial portfolio is

constructed around fixed income instruments such as Collateralized

Loan Obligations ("CLOs") and other securities or instruments with

exposure primarily to senior secured and usually broadly syndicated

US loans. The Company has a long-term oriented investment

philosophy and invests primarily with a buy-and-hold mentality,

though from time to time the Company will sell investments to

realize gains or for risk management purposes.

Strong emphasis is given to maintaining sufficient liquidity and

low leverage at the overall portfolio level and to re-invest in

existing and new investments along the economic cycle.

Dividend & Buyback

The Board of Directors will decide on the Company's dividend

policy for 2023 based on profitability, liquidity requirements,

portfolio performance, market conditions, and the share price of

the Company relative to its NAV.

Richard Rosenberg Noam Lanir

Non-Executive Chairman Chief Executive

28 September 2023

Review of Activities

Economic & Investment Environment

In the first quarter of 2023, advanced economies experienced

modest growth, although hindered by tighter monetary policies,

escalating inflation, and energy challenges in Europe. Meanwhile,

China's economy gained momentum after lifting coronavirus

restrictions. Global economic activity remained subdued, with a dip

in global trade. Inflation, particularly core inflation, persisted

above central banks' targets, leading to gradual tightening of

monetary policies. The global outlook remains cautious due to

lingering inflation and tighter policies, with risks including

prolonged high inflation in certain countries and a potential

energy crisis in Europe in late 2023 and early 2024.

In the US, first-quarter GDP growth was 2% and second quarter

GDP growth was 2.1%. Private consumption and exports expanded, but

a drop in inventory investment weighed on overall growth.

Employment figures continued to rise, with unemployment at a low of

3.7% in May. The Eurozone grew by 0.1% in both quarters although

high inflation and stricter monetary policy impacted domestic

demand and export growth. Despite lower gas prices,

energy-intensive industries showed only slight recovery, while

manufacturing contracted. At the same time, employment remained

positive and domestic services sector performed well. Japan's

economic recovery continued with 2.7% GDP growth in the first

quarter. Domestic demand and service exports improved, but goods

exports declined, and industrial output contracted. Unemployment,

though slightly higher at 2.6% in April, remained historically low

and core inflation increased to 2.5%. China experienced an initial

rebound with 9.1% GDP growth in the first quarter, driven by the

services sector. However, manufacturing remained subdued due to

weaker foreign demand and structural problems in the Chinese

property sector. The People's Bank of China lowered official

interest rates in June, and the government proposed additional

stimulus measures.

Global Markets experienced gains driven by enthusiasm for

Artificial Intelligence (AI) and technology stocks. Rising yields

and deposit outflow from banks caused severe liquidity issues in

the US regional banking sector, and in March, Credit Suisse and a

few regional banks failed as a result. The new financing facilities

put in place by the US Federal Reserve helped contain the situation

and risk assets rallied sharply again. In the first half of 2023,

the SPX Index was up 15.9% excluding dividends while the Nasdaq 100

index rose 38.45%. Yields rose globally, with the UK and Australia

showing weaker performance due to higher-than-expected inflation.

Major central banks raised interest rates throughout the period

although the rate of increase was slower than in 2022. Japanese

shares experienced strong momentum while the Yen continued to stay

weak due to potential extended expansionary policy in Japan. India,

South Korea, and Taiwan recorded gains driven by technology stocks

and investor enthusiasm for AI-related technologies.

The performance of the US dollar varied against major currencies

since the start of 2023. Notably, the dollar saw a significant

depreciation against the Mexican peso due to Mexico's robust

economic growth and stringent monetary policies. Conversely, the

dollar experienced a modest increase against Asian currencies,

attributed to diminished external demand in the region and

expanding interest rate gaps.

Commodity prices, particularly Brent crude oil, fluctuated

around USD 80 per barrel, settling at around USD 77. The S&P

GSCI Index recorded a negative performance, with industrial metals

and energy sectors underperforming. Livestock prices rose. Precious

metals like gold and silver ended in negative territory.

US Leveraged Loans generated significant gains in the first half

of 2023 after a poor showing in 2022. High Libor/SOFR rates

increased the income received by loan investors, and low supply due

to fewer private equity and merger and acquisition transactions

kept loan prices elevated. The loan market generated 6.33% total

return in the period as measured by the Credit Suisse Leveraged

Loan Index. Trailing 12-month par-weighted default rate ticked up

to 1.71% as compared to 0.72% as at the end of 2022 but remain

below historical average. At the same time, recoveries on these

defaults are expected to be lower than historical averages. Despite

a strong performance in the first half, higher rates for longer are

expected to increase stress on loan borrowers and we anticipate

increased downgrades by rating agencies in the near to

mid-term.

CLO debt tranches also performed well as high coupons and price

convexity increased their appeal. Further, a slow new issue CLO

market constrained supply, driving price performance. CLO equity

continued to pay strong distributions as default rates stayed

limited. However, price performance varied between those

transactions with long reinvestment periods and those with short

reinvestment periods. Long reinvestment period transactions

performed well, however post-reinvestment deals continued to see

subdued demand.

Sources: Swiss National Bank (SNB), European Central Bank (ECB),

US Federal Reserve, Bloomberg, JP Morgan, S&P Capital IQ

Financial Portfolio and trading activity

The Company manages a financial portfolio valued at USD 122.2m

as at 30 June 2023, which is invested mainly in fixed income and

credit related securities.

The following is a table summarizing the financial portfolio as

at 30 June 2023:

30 June 30 June 31 December

2023 2022 2022

US $m US $m US $m

Investment in the loan market

through CLOs 64.2 77.0 66.6

Public equities 2.6 1.9 2.3

Short term government bonds 36.1 13.8 24.6

Long term government bonds 4.2 - 8.3

Corporate bonds 3.8 4.6 4.6

----- ----- -----

Invested total 110.9 97.3 106.4

Cash 11.3 18.9 11.0

----- ----- -----

Total 122.2 116.2 117.4

----- ----- -----

Senior Secured Loans and CLOs

In the first half of 2023, the US senior secured loan market

(leveraged loan market) performed well generating 6.63% of total

return as measured by the Credit Suisse Leveraged Loan Index. The

performance was driven by high coupon distributions and increased

prices. The average price increased from 91.89 at the beginning of

the year to 93.55 as of end of June 2023. Default rates, while

higher than in 2021 and 2022, remained below historical averages.

As of 30 June 2023, the par-weighted 12-month default rate was at

1.71%, up from 0.72% at the beginning of the year. Concerns over

the weakening credit environment, however, prompted investors to

withdraw USD 18.9 billion from mutual funds and ETFs. New issue

supply was muted compared to prior years but steady refinancing

activity has contributed to a 50% reduction in loans maturing in

2024 and a 25% reduction in loans maturing in 2025.

New issue CLO market was also slower than in previous years

recording USD 56 billion in new issuance as compared to USD 73

billion in 2022. CLO liability spreads remained wider than returns

offered by loans and modelled new issue equity returns appeared

weak. Secondary market, especially for CLO debt tranches were,

however, active as high coupons and price convexity incited

investors to add risk.

While defaults were lower than expected, we anticipate

recoveries to be lower than historical averages and impact seasoned

CLO equity tranches and potentially a handful of lower rated CLO

debt tranches as well. Increasing interest expenses are likely to

prompt increased downgrade activity especially if nominal growth

rates slow down, and we anticipate older CLOs to face pressure on

their over-collateralization tests. 2021 and 2022 vintage CLOs are

likely to perform much better.

Given the uncertain outlook, in light of higher rates for

longer, management had already paused investments into CLO equity

tranches since April 2022. The Company has no open warehouses as of

30 June 2023. During the period, the portfolio generated cashflow

of USD 11.0m. Consistent and robust cashflow from the existing

portfolio has allowed the Company to increase its cash and

marketable securities position substantially. We are monitoring the

CLO and loan market closely and anticipate investing in the market

when opportunities present themselves.

The Company's CLO portfolio is divided into the following

geographical areas:

30 June 2023 30 June 2022 31 December 2022

US $000 Percentage US $000 Percentage US $000 Percentage

US CLOs 64,217 100.0% 77,077 100.0% 66,576 100.0%

------ ------ ------ ------ ------ ------

Private Equity and Fund Investments

The Company has invested in some small private companies with

robust growth and potential.

The following summarizes the book value of the fund investments

at 30 June 2023:

US $m

Fetcherr Ltd 1.8

Phytech (Israel) 2.6

Other investments 2.0

---

Total 6.4

---

Fetcherr Ltd ("Fetcherr"): Fetcherr is an Israeli start-up that

has developed a proprietary AI-powered goal based enterprise

pricing and workflow optimization system. Founded in 2019 by

experts in deep learning, Algo-trading, e-commerce, and

digitization of legacy architecture, Fetcherr aims to disrupt

traditional rule-based (legacy) revenue systems through

reinforcement learning methodologies, beginning with the airline

industry. The Company invested USD 2m in 2021. In 2023, Fetcherr

raised over USD 10m in the form of a convertible instrument with a

valuation cap of USD 100m. Post balance-sheet, the Company

purchased additional shares from an ex-employee of Fetcherr at a

valuation of about USD 67m.

Phytech Ltd ("Phytech"): Phytech is an agriculture-technology

company in Israel providing end-to-end solutions for achieving

higher yields on crops and trees. In September 2020, Phytech raised

USD 25m at a pre-money valuation of USD 105m. As part of the

capital raise, the manager of the investment reduced its holding in

Phytech and distributed USD 471k (versus our investment of USD

394k) in cash. Following these transactions, Livermore continues to

hold 12.2% in Phytech Global Advisors Ltd, which in turns now holds

11.95% on a fully diluted basis in Phytech Ltd.

The following table reconciles the review of activities to the

Group's financial assets at 30 June 2023.

US $m

Financial portfolio 110.9

Fund investments 6.4

-----

117.3

-----

Financial assets at fair value through profit or

loss (note 4) 110.9

Financial assets at fair value through other comprehensive

income (note 5) 6.4

-----

117.3

-----

Events after the reporting date

There were no material events after the reporting date, which

have a bearing on the understanding of these interim condensed

consolidated financial statements.

Litigation

Information is provided in note 22 to the interim condensed

consolidated financial statements.

Going Concern

The Directors have reviewed the current and projected financial

position of the Company, making reasonable assumptions about cash

and short-term holdings, interest and distribution income, future

trading performance, valuation projections and debt requirements.

On the basis of this review, the Directors have a reasonable

expectation that the Company has adequate resources to continue in

operational existence for the foreseeable future. Accordingly, they

continue to adopt the going concern basis in preparing the interim

condensed consolidated financial statements.

Livermore Investments Group Limited

Condensed Consolidated Statement of Financial Position

at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

Note Unaudited Unaudited Audited

Assets US $000 US $000 US $000

Non-current assets

Property, plant and equipment 45 50 43

Right-of-use asset 45 126 87

Financial assets at fair value through profit or loss 4 64,217 77,077 66,576

Financial assets at fair value through other

comprehensive income 5 6,424 10,376 7,596

Investments in subsidiaries 8 5,700 6,484 6,546

------ ------- -------

76,431 94,113 80,848

------ ------- -------

Current assets

Trade and other receivables 9 689 325 72

Financial assets at fair value through profit or loss 4 46,733 20,304 39,800

Cash and cash equivalents 10 13,273 18,947 10,971

------- ------- -------

60,695 39,576 50,843

------- ------- -------

Total assets 137,126 133,689 131,691

------- ------- -------

Equity

Share capital 11 - - -

Share premium and treasury shares 11 163,130 163,130 163,130

Other reserves (21,295) (20,128) (21,214)

Accumulated losses (10,245) (13,045) (14,191)

------- ------- -------

Total equity 131,590 129,957 127,725

------- ------- -------

Liabilities

Non-current liabilities

Lease liability - 42 -

------- ------- -------

Current liabilities

Bank overdrafts 10 1,985 - -

Trade and other payables 12 3,351 3,606 3,733

Lease liability - current portion 45 84 87

Current tax liability 155 - 146

------- ------- -------

5,536 3,690 3,966

------- ------- -------

Total liabilities 5,536 3,732 3,966

------- ------- -------

Total equity and liabilities 137,126 133,689 131,691

------- ------- -------

Net asset value per share

Basic and diluted net asset value per share (US $) 14 0.80 0.79 0.77

------- ------- -------

Livermore Investments Group Limited

Condensed Consolidated Statement of Profit or Loss

for the six months ended 30 June 2023

---------------------------------------------------------------------------------------------------

Six months Six months Year

Note ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Investment income

Interest and distribution income 16 11,468 13,748 23,665

Fair value changes of investments 17 (5,786) (33,734) (44,637)

------- ------- -------

5,682 (19,986) (20,972)

Other income 294 - -

Operating expenses 18 (1,651) (1,430) (3,000)

------- ------- -------

Operating profit / (loss) 4,325 (21,416) (23,972)

Finance costs 19 (382) (250) (265)

Finance income 19 37 3 42

------- ------- -------

Profit / (loss) before taxation 3,980 (21,663) (24,195)

Taxation charge (31) - (167)

------- ------- -------

Profit / (loss) for period / year 3,949 (21,663) (24,362)

------- ------- -------

Earnings / (loss) per share

Basic and diluted earnings / (loss) per share (US $) 20 0.02 (0.13) (0.15)

------- ------- -------

Livermore Investments Group Limited

Condensed Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Profit / (loss) for the period / year 3,949 (21,663) (24,362)

Other comprehensive income :

Items that will be reclassified subsequently to profit or loss

Foreign exchange gains / (losses) on the translation of

subsidiaries 30 (43) (29)

Items that are not reclassified subsequently to profit or loss

Financial assets designated at fair value through other comprehensive income

- fair value

losses (114) (2,059) (1,606)

------ ------ ------

Total comprehensive income / (loss) for the period / year 3,865 (23,765) (25,997)

------ ------ ------

The total comprehensive income / (loss) for the period / year is

wholly attributable to the owners of the Company.

Livermore Investments Group Limited

Condensed Consolidated Statement of Changes in Equity

for the period ended 30 June 2023

Share Treasury shares Translation Investment Retained Total

premium reserve revaluation earnings

reserve

US $000 US $000 US $000 US $000 US $000 US $000

Balance at 1

January 2022 169,187 (6,057) 84 (18,110) 32,618 177,722

Dividends - - - - (24,000) (24,000)

------- ------- ------- ------- ------- -------

Transactions

with owners - - - - (24,000) (24,000)

------- ------- ------- ------- ------- -------

Loss for the

year - - - - (24,362) (24,362)

Other

comprehensive

income:

Financial

assets at fair

value through

other

comprehensive

income - fair

value losses - - - (1,606) - (1,606)

Foreign

exchange

losses on the

translation of

subsidiaries - - (29) - - (29)

Transfer of

realised gains - - - (1,553) 1,553 -

------- ------- ------- ------- ------- -------

Total

comprehensive

loss for the

year - - (29) (3,159) (22,809) (25,997)

------- ------- ------- ------- ------- -------

Balance at 31

December 2022 169,187 (6,057) 55 (21,269) (14,191) 127,725

Profit for the

period - - - - 3,949 3,949

Other

comprehensive

income:

Financial

assets at fair

value through

other

comprehensive

income - fair

value losses - - - (114) - (114)

Foreign

exchange gains

on the

translation of

subsidiaries - - 30 - - 30

Transferred of

realised

losses - - - 3 (3) -

------- ------- ------- ------- ------- -------

Total

comprehensive

income for the

period - - 30 (111) 3,946 3,865

------- ------- ------- ------- ------- -------

Balance at 30

June 2023 169,187 (6,057) 85 (21,380) (10,245) 131,590

------- ------- ------- ------- ------- -------

Share Treasury shares Translation Investment Retained Total

premium reserve revaluation earnings

reserve

US $000 US $000 US $000 US $000 US $000 US $000

Balance at 1

January 2022 169,187 (6,057) 84 (18,110) 32,618 177,722

Di vidends - - - - (24,000) (24,000)

------- ------- ------- ------- ------- -------

Transactions

with owners - - - - (24,000) (24,000)

------- ------- ------- ------- ------- -------

Loss for the

period - - - - (21,663) (21,663)

Other

comprehensive

income:

Financial assets

at fair value

through other

comprehensive

income - fair

value losses - - - (2,059) - (2,059)

Foreign exchange

losses on the

translation of

subsidiaries - - (43) - - (43)

------- ------- ------- ------- ------- -------

Total

comprehensive

income for the

period - (43) (2,059) (21,663) (23,765)

------- ------- ------- ------- ------- -------

Balance at 30

June 2022 169,187 (6,057) 41 (20,169) (13,045) 129,957

------- ------- ------- ------- ------- -------

Livermore Investments Group Limited

Condensed Consolidated Statement of Cash Flows

for the period ended 30 June 2023

Six months Six months Year

Note ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Cash flows from operating activities

Profit / (loss) before taxation 3,980 (21,663) (24,195)

Adjustments for:

Depreciation expense 64 63 102

Interest expense 19 21 22 36

Interest and distribution income 16 (11,468) (13,748) (23,665)

Bank interest income 19 (37) (3) (42)

Fair value changes of investments 17 5,786 33,734 44,637

Exchange differences 19 361 228 229

------- ------- -------

(1,293) (1,367) (2,898)

Changes in working capital

Increase in trade and other receivables (623) (24) (62)

Decrease in trade and other payables (382) (3,335) (2,928)

------- ------- -------

Cash flows used in operations (2,298) (4,726) (5,888)

Interest and distributions received 11,505 13,751 23,707

Tax paid (22) (36) (32)

------- ------- -------

Net cash from operating activities 9,185 8,989 17,787

------- ------- -------

Cash flows from investing activities

Acquisition of investments (21,719) (51,896) (74,283)

Proceeds from sale of investments 13,301 41,037 46,729

------- ------- -------

Net cash used in investing activities (8,418) (10,859) (27,554)

------- ------- -------

Cash flows from financing activities

Lease liability payments (68) (63) (127)

Interest paid 19 (21) (22) (36)

Dividends paid - (24,000) (24,000)

------- ------- -------

Net cash used in financing activities (89) (24,085) (24,163)

------- ------- -------

Net increase / (decrease) in cash and cash equivalents 678 (25,955) (33,930)

Cash and cash equivalents at beginning of the period / year 10,971 45,130 45,130

Exchange differences on cash and cash equivalents 19 (361) (228) (229)

------- ------- -------

Cash and cash equivalents at the end of the period / year 10 11,288 18,947 10,971

------- ------- -------

Notes to the Interim Condensed Consolidated Financial

Statements

1. Accounting policies

The interim condensed consolidated financial statements of

Livermore have been prepared on the basis of the accounting

policies stated in the 2022 Annual Report, available on

www.livermore-inv.com .

The application of the IFRS pronouncements that became effective

as of 1 January 2023 has no significant impact on the Company's

consolidated financial statements.

2. Critical accounting judgements

In preparing the interim condensed consolidated financial

statements, management made judgements and assumptions. The actual

results may differ from those judgements and assumptions. The

critical accounting judgements applied in the interim condensed

consolidated financial statements were the same as those applied

and disclosed in the Company's last annual consolidated financial

statements for the year ended 31 December 2022.

3. Basis of preparation

These unaudited interim condensed consolidated financial

statements for the six months ended 30 June 2023, have been

prepared in accordance with IAS 34 "Interim Financial Reporting" as

adopted by the European Union. They do not include all the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Company for the year ended 31 December 2022.

The financial information for the year ended 31 December 2022 is

extracted from the Company's consolidated financial statements for

the year ended 31 December 2022 which contained an unqualified

audit report.

Investment entity status

Livermore meets the definition of an investment entity, as this

is defined in IFRS 10 "Consolidated Financial Statements".

In accordance with IFRS 10, an investment entity is exempted

from consolidating its subsidiaries, unless any subsidiary which is

not itself an investment entity mainly provides services that

relate to the investment entity's investment activities. In

Livermore's situation and as at the reporting date, one of its

subsidiaries provide such services. Note 8 shows further details of

the consolidated and unconsolidated subsidiaries.

References to the Company hereinafter also includes its

consolidated subsidiary (note 8 ).

4. Financial assets at fair value through profit or loss

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Non-current assets

Fixed income investments (CLOs) 64,217 77,077 66,576

------ ------ ------

Current assets

Fixed income investments 44,137 18,431 37,519

Public equity investments 2,596 1,873 2,281

------ ------ ------

46,733 20,304 39,800

------ ------ ------

For description of each of the above categories, refer to note

6.

The above investments represent financial assets that are

mandatorily measured at fair value through profit or loss.

The Company treats its investments in the loan market through

CLOs as non-current investments as the Company generally intends to

hold such investments over a period longer than twelve months.

The movement in financial assets at fair value through profit or

loss was as follows:

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

At 1 January 106,376 119,220 119,220

Purchases 20,780 51,896 73,963

Sales (11,304) (17,523) (19,662)

Settlements - (23,514) (23,514)

Fair value losses (4,902) (32,698) (43,631)

------- ------- -------

At 30 June / 31 December 110,950 97,381 106,376

------- ------- -------

5. Financial assets at fair value through other comprehensive income

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Non-current assets

Fund investments 6,424 10,376 7,596

------ ------ ------

For description of each of the above categories, refer to note

6.

The above investments are non-trading equity investments that

have been designated at fair value through other comprehensive

income.

The movement in financial assets at fair value through other

comprehensive income was as follows:

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

At 1 January 7,596 12,435 12,435

Purchases 939 - 320

Settlements (1,997) - (3,553)

Fair value losses (114) (2,059) (1,606)

------ ------ ------

At 30 June / 31 December 6,424 10,376 7,596

------ ------ ------

6. Financial assets at fair value

The Company allocates its non-derivative financial assets at

fair value (notes 4 and 5) as follows:

-- Fixed income investments relate to fixed and floating rate

bonds, perpetual bank debt, investments in the loan market through

CLOs, and investments in open warehouse facilities.

-- Public equity investments relate to investments in shares of

companies listed on public stock exchanges.

-- Fund investments relate to investments in the form of equity

purchases in both high growth opportunities in emerging markets and

deep value opportunities in mature markets. The Company generally

invests directly in prospects where it can exert influence. Main

investments under this category are in the fields of real

estate.

7. Fair value measurements of financial assets and liabilities

The table in note 7.2 below presents financial assets measured

at fair value in the consolidated statement of financial position

in accordance with the fair value hierarchy. This hierarchy groups

financial assets and liabilities into three levels based on the

significance of inputs used in measuring the fair value of the

financial assets and liabilities. The fair value hierarchy has the

following levels:

-- Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities that the entity can access at the

measurement date;

-- Level 2: inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly or indirectly; and

-- Level 3: unobservable inputs for the asset or liability.

The level within which the financial asset is classified is

determined based on the lowest level of significant input to the

fair value measurement.

7.1 Valuation of financial assets and liabilities

-- Fixed Income Investments and Public Equity Investments are

valued per their closing market prices on quoted exchanges, or as

quoted by market maker. Investments in open warehouse facilities

that have not yet been converted to CLOs, are valued based on an

adjusted net asset valuation.

The Company values the CLOs based on the valuation reports

provided by market makers. CLOs are typically valued by market

makers using discounted cash flow models. The key assumptions for

cash flow projections include default and recovery rates,

prepayment rates and reinvestment assumptions on the underlying

portfolios (typically senior secured loans) of the CLOs.

Default and recovery rates: The amount and timing of defaults in

the underlying collateral and the amount and timing of recovery

upon a default are key to the future cash flows a CLO will

distribute to the CLO equity tranche. All else equal, higher

default rates and lower recovery rates typically lead to lower cash

flows. Conversely, lower default rates and higher recoveries lead

to higher cash flows.

Prepayment rates: Senior loans can be pre-paid by borrowers.

CLOs that are within their reinvestment period may, subject to

certain conditions, reinvest such prepayments into other loans

which may have different spreads and maturities. CLOs that are

beyond their reinvestment period typically pay down their senior

liabilities from proceeds of such pre-payments. Therefore, the rate

at which the underlying collateral prepays impacts the future cash

flows that the CLO may generate.

Reinvestment assumptions: A CLO within its reinvestment period

may reinvest proceeds from loan maturities, prepayments, and

recoveries into purchasing additional loans. The reinvestment

assumptions define the characteristics of the loans that a CLO may

reinvest in. These assumptions include the spreads, maturities, and

prices of such loans. Reinvestment into loans with higher spreads

and lower prices will lead to higher cash flows. Reinvestment into

loans with lower spreads will typically lead to lower cash

flows.

Discount rate: The discount rate indicates the yield that market

participants expect to receive and is used to discount the

projected future cash flows. Higher yield expectations or discount

rates lead to lower prices and lower discount rates lead to higher

prices for CLOs.

-- Fund investments are valued using market valuation techniques

as determined by the Directors, mainly on the basis of valuations

reported by third-party managers of such investments. Real Estate

entities are valued by independent qualified property valuers with

substantial relevant experience on such investments. Underlying

property values are determined based on their estimated market

values.

-- Investments in subsidiaries are valued at fair value as

determined on a net asset valuation basis. The Company has

determined that the reported net asset value of each subsidiary

represents its fair value at the end of the reporting period.

7.2 Fair Value Hierarchy

Financial assets measured at fair value are grouped into the

fair value hierarchy as follows:

30 June 2023 US $000 US $000 US $000 US $000

Level 1 Level Level Total

2 3

Fixed income investments 44,137 64,217 - 108,354

Fund investments - - 6,424 6,424

Public equity investments 2,596 - - 2,596

Investments in subsidiaries - - 5,700 5,700

------ ------ ------ ------

46,733 64,217 12,124 123,074

------ ------ ------ ------

30 June 2022 US $000 US $000 US $000 US $000

Level 1 Level Level Total

2 3

Fixed income investments 18,431 77,077 - 95,508

Fund investments - - 10,376 10,376

Public equity investments 1,873 - - 1,873

Investments in subsidiaries - - 6,484 6,484

------ ------ ------ ------

20,304 77,077 16,860 114,241

------ ------ ------ ------

31 December 2022 US $000 US $000 US $000 US $000

Level 1 Level Level Total

2 3

Fixed income investments 37,519 66,576 - 104,095

Fund investments - - 7,596 7,596

Public equity investments 2,281 - - 2,281

Investments in subsidiaries - - 6,546 6,546

------ ------ ------ ------

39,800 66,576 14,142 120,518

------ ------ ------ ------

The Company has no financial liabilities measured at fair

value.

The methods and valuation techniques used for the purpose of

measuring fair value are unchanged compared to the previous

reporting period.

No financial assets have been transferred between different

levels.

Financial assets within level 3 can be reconciled from beginning

to ending balances as follows:

Six months ended

30 June 2023 At fair

value through Investments

OCI in subsidiaries

Fund investments Total

US $000 US $000 US $000

At 1 January 2023 7,596 6,546 14,142

Purchases 939 38 977

Settlement (1,997) - (1,997)

Losses recognised

in:

- Other comprehensive

income (114) (884) (998)

------ ------ ------

At 30 June 2023 6,424 5,700 12,124

------ ------ ------

Six months ended

30 June 2022 At fair At fair

value through value through

OCI profit or Investments

loss in subsidiaries

Fund investments Fixed Income

investments Total

US $000 US $000 US $000 US $000

At 1 January 2022 12,435 7,584 7,196 27,215

Purchases - 15,930 324 16,254

Settlement (23,514) - (23,514)

Losses recognised

in:

- Profit or loss - - (1,036) (1,036)

- Other comprehensive

income (2,059) - - (2,059)

------ ------ ------ ------

At 30 June 2022 10,376 - 6,484 16,860

------ ------ ------ ------

Year ended 31 December At fair

2022 At fair value through

value through profit or Investments

OCI loss in subsidiaries

Fund investments Fixed Income

investments Total

US $000 US $000 US $000 US $000

At 1 January 2022 12,435 7,584 7,196 27,215

Purchases 320 15,930 356 16,606

Settlement (3,553) (23,514) - (27,067)

Losses recognised

in:

- Profit or loss - - (1,006) (1,006)

- Other comprehensive

income (1,606) - - (1,606)

------ ------ ------ ------

At 31 December 2022 7,596 - 6,546 14,142

------ ------ ------ ------

The above recognised losses are allocated as follows:

Six months ended 30 June At fair Investments

2023 value through in subsidiaries

OCI

Fund investments Total

US $000 US $000 US $000

Profit or loss

- Financial assets held

at period-end - (884) (884)

------ ------ ------

Other comprehensive income

- Financial assets held

at period-end (114) - (114)

------ ------ ------

Total losses for period (114) (884) (998)

------ ------ ------

Six months ended 30 June At fair Investments

2022 value through in subsidiaries

OCI

Fund investments Total

US $000 US $000 US $000

Profit or loss

- Financial assets held

at period-end - (1,036) (1,036)

------ ------ ------

Other comprehensive income

- Financial assets held

at period-end (2,059) - (2,059)

------ ------ ------

Total losses for period (2,059) (1,036) (3,095)

------ ------ ------

Year ended 31 December At fair Investments

2022 value through in subsidiaries

OCI

Fund investments Total

US $000 US $000 US $000

Profit or loss

- Financial assets held

at year-end - (1,006) (1,006)

------ ------ ------

Other comprehensive income

- Financial assets held

at year-end (1,606) - (1,606)

------ ------ ------

Total losses for year (1,606) (1,006) (2,612)

------ ------ ------

The Company has not developed any quantitative unobservable

inputs for measuring the fair value of its level 3 financial

assets. Instead, the Company used prices from third-party pricing

information without adjustment.

Fund investments within level 3 represent investments in private

equity funds. Their value has been determined by each fund manager

based on the funds' net asset value. Each fund's net asset value is

primarily driven by the fair value of its underlying investments.

In all cases, considering that such investments are measured at

fair value, the carrying amounts of the funds' underlying assets

and liabilities are considered as representative of their fair

values.

Investments in subsidiaries have been valued based on their net

asset position. The main assets of the subsidiaries represent

investments measured at fair value and receivables from the Company

itself as well as third parties. Their net asset value is

considered as a fair approximation of their fair value.

A reasonable change in any individual significant input used in

the level 3 valuations is not anticipated to have a significant

change in fair values as above.

8. Investment in subsidiaries

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Unconsolidated subsidiaries

At 1 January 6,546 7,196 7,196

Additions 38 324 356

Fair value losses (884) (1,036) (1,006)

------ ------ ------

At 30 June / 31 December 5,700 6,484 6,546

------ ------ ------

All additions in 2023 and 2022 relate to the fair value of

amounts receivable from the Company's unconsolidated subsidiary

Sandhirst Ltd, that were waived by the Company as a means of

capital contribution (note 21).

The investments in which the Company has a controlling interest

as at the reporting date are as follows:

Name of Subsidiary Place of Holding Voting Principal activity

incorporation rights

and shares

held

Consolidated subsidiary

Livermore Capital Switzerland Ordinary 100% Administration

AG shares services

Unconsolidated subsidiaries

Livermore Properties British Ordinary 100% Holding of investments

Limited Virgin Islands shares

Mountview Holdings British Ordinary 100% Investment vehicle

Limited Virgin Islands shares

Sycamore Loan Strategies Cayman Islands Ordinary 100% Investment vehicle

Ltd shares

Livermore Israel Israel Ordinary 100% Holding of investments

Investments Ltd shares

Sandhirst Ltd Cyprus Ordinary 100% Holding of investments

shares

9. Trade and other receivables

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Financial items

Amounts due by related parties (note 21) - 58 -

Non-financial items

Advances to related party (note 21) 610 201 -

Prepayments 72 60 66

VAT receivable 7 6 6

------ ------ ------

689 325 72

------ ------ ------

For the Company's receivables of a financial nature, no lifetime

expected credit losses and no corresponding allowance for

impairment have been recognised, as their default rates were

determined to be close to 0%.

No receivable amounts have been written-off during either 2023

or 2022.

10. Cash and cash equivalents

Cash and cash equivalents included in the consolidated cash flow

statement comprise the following:

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Demand deposits 13,273 18,947 10,971

Bank overdraft used for cash management purposes (1,985) - -

------ ------ ------

Cash and cash equivalents 11,288 18,947 10,971

------ ------ ------

11. Share capital, share premium and treasury shares

Livermore Investments Group Limited (the "Company") is an

investment company incorporated under the laws of the British

Virgin Islands. The Company has an issued share capital of

174,813,998 ordinary shares with no par value.

In the statement of financial position, the amount included as

'share premium and treasury shares' comprises of:

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Share premium 169,187 169,187 169,187

Treasury shares (6,057) (6,057) (6,057)

------- ------- -------

163,130 163,130 163,130

------- ------- -------

12. Trade and other payables

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Financial items

Trade payables 129 99 63

Amounts due to related parties (note 21) 3,071 3,198 3,283

Accrued expenses 151 309 387

------ ------ ------

3,351 3,606 3,733

------ ------ ------

13. Dividend

The Board of Directors will decide on the Company's dividend

policy for 2023 based on profitability, liquidity requirements,

portfolio performance, market conditions, and the share price of

the Company relative to its net asset value.

14. Net asset value per share

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Net assets attributable to ordinary shareholders (USD 000) 131,590 129,957 127,725

------------- ------------- -------------

Closing number of ordinary shares in issue 165,355,421 165,355,421 165,355,421

------------- ------------- -------------

Basic net asset value per share (USD) 0.80 0.79 0.77

------------- ------------- -------------

Number of Shares

Ordinary shares 174,813,998 174,813,998 174,813,998

Treasury shares (9,458,577) (9,458,577) (9,458,577)

------------- ------------- -------------

Closing number of ordinary shares in issue 165,355,421 165,355,421 165,355,421

------------- ------------- -------------

The diluted net asset value per share equals the basic net asset

value per share since no potentially dilutive shares exist at any

of the reporting dates presented.

15. Segment reporting

The Company's activities fall under a single operating

segment.

The Company's investment income / (losses) and its investments

are divided into the following geographical areas:

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 202 2

Unaudited Unaudited Audited

US $000 US $000 US $000

Investment income / (losses)

Other European countries (296) (773) (2,956)

United States 6,932 (17,820) (16,320)

Asia (954) (1,393) (1,696)

------- ------- -------

5,682 (19,986) (20,972)

------- ------- -------

Investments

Other European countries 6,348 1,478 6,850

United States 109,478 105,128 105,577

Asia 7,248 7,635 8,091

------- ------- -------

123,074 114,241 120,518

------- ------- -------

Investment income / (losses), comprising interest and

distribution income as well as fair value gains or losses on

investments, is allocated based on the issuer's location.

Investments are also allocated based on the issuer's location.

The Company has no significant dependencies, in respect of its

investment income, on any single issuer.

16. Interest and distribution income

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Interest income 1,057 240 1,207

Distribution income 10,411 13,508 22,458

------ ------ ------

11,468 13,748 23,665

------ ------ ------

Interest and distribution income is analysed between the

Company's different categories of financial assets, as follows:

Six months ended 30 June

2023

Interest Distribution Total

income income

Financial assets at fair value through US $000 US $000 US $000

profit or loss

Fixed income investments 1,057 10,363 11,420

Public equity investments - 48 48

------ ------ ------

1,057 10,411 11,468

------ ------ ------

Six months ended 30 June

2022

Interest Distribution Total

income income

Financial assets at fair value through US $000 US $000 US $000

profit or loss

Fixed income investments 240 13,321 13,561

Public equity investments - 187 187

------ ------ ------

240 13,508 13,748

------ ------ ------

Year ended 31 December

2022

Interest Distribution Total

income income

Financial assets at fair value through US $000 US $000 US $000

profit or loss

Fixed income investments 1,207 22,282 23,489

Public equity investments - 176 176

------ ------ ------

1,207 22,458 23,665

------ ------ ------

The Company's distribution income derives from multiple issuers.

The Company does not have concentration to any single issuer.

17. Fair value changes of investments

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Fair value losses on financial assets through profit or loss (4,751) (32,698) (43,782)

Fair value losses on investment in subsidiaries (884) (1,036) (1,006)

Fair value (losses) / gains on derivatives (151) - 151

------- ------- -------

(5,786) (33,734) (44,637)

------- ------- -------

The investments disposed in the six months ended 30 June 2023

had the following cumulative (i.e. from the date of acquisition up

to the date of disposal) financial impact in the Company's net

asset position:

Cumulative distribution or

Realised gains* interest Total financial impact

Unaudited Unaudited Unaudited

US $000 US $000 US $000

Financial assets at fair value

through profit or loss

Fixed income investments (444) 623 179

Derivatives (151) - (151)

------- ------- -------

(595) 623 28

Financial assets at fair value

through OCI

Private equities (3) - (3)

------- ------- -------

(598) 623 25

------ ------ ------

* difference between disposal proceeds and original acquisition

cost

18. Operating expenses

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Directors' fees and expenses 440 492 932

Other salaries and expenses 123 105 237

Professional and consulting fees 568 426 822

Legal expenses 2 3 13

Bank custody fees 87 60 139

Office cost 98 96 237

Depreciation 64 63 102

Other operating expenses 254 171 441

Audit fees 15 14 75

Tax fees - - 2

------ ------ ------

1,651 1,430 3,000

------ ------ ------

19. Finance costs and income

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Finance costs

Bank interest costs 21 22 36

Foreign exchange loss 361 228 229

------ ------ ------

382 250 265

------ ------ ------

Finance income

Bank interest income 37 3 42

------ ------ ------

20. Earnings / (loss) per share

Basic earnings / (loss) per share has been calculated by

dividing the profit / (loss) for the period / year attributable to

ordinary shareholders of the Company by the weighted average number

of shares in issue of the Company during the relevant financial

periods.

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Profit / (loss) for the period / year attributable to ordinary

shareholders of the parent

(USD 000) 3,949 (21,663) (24,362)

---------- ---------- ----------

Weighted average number of ordinary shares outstanding 165,355,421 165,355,421 165,355,421

---------- ---------- ----------

Basic earnings / (loss) per share (USD) 0.02 (0.13) (0.15)

---------- ---------- ----------

The diluted earnings / (loss) per share equals the basic

earnings / (loss) per share since no potentially dilutive shares

were in existence during 2023 and 2022.

21. Related party transactions

The Company is controlled by Groverton Management Ltd, an entity

owned by Noam Lanir, which at 30 June 2023 held 74.41% of the

Company's voting rights.

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

US $000 US $000 US $000

Amounts receivable from / advances to key management

Directors' current accounts - 58 - (1)

Advances to other key management personnel 610 201 - (2)

------ ------ ------

610 259 -

------ ------ ------

Amounts payable to unconsolidated subsidiaries

Livermore Israel Investments Ltd (3,046) (3,046) (3,046) (3)

------ ------ ------

Amounts payable to other related party

Loan payable - (149) (149) (4)

------ ------ ------

Amounts payable to key management

Directors' current accounts (25) (3) (88) (3)

------ ------ ------

Key management compensation

Short term benefits

Executive Directors' fees 398 398 795 (5)

Non-executive Directors' fees 42 44 87

Non-executive Directors' reward payments - 50 50

Other key management fees 200 194 385

------ ------ ------

640 686 1,317

------ ------ ------

(1) The Directors' current accounts with debit balances are

interest free, unsecured, and have no stated repayment date.

(2) The advances to other key management personnel relate to

payments made to members of key management against their

remuneration for the second half of 2023.

(3) The amounts payable to unconsolidated subsidiary and

Directors' current accounts with credit balances are interest free,

unsecured, and have no stated repayment date.

(4) A loan of USD 0.149m was payable to a related company (under

common control) Chanpak Ltd. During the period, the right to

receive the loan amount was assigned by Chanpak Ltd to Noam Lanir.

At the same time, the Company agreed with Noam Lanir to transfer

the outstanding loan amount to his Director current account.

(5) These payments were made directly to companies which are

related to the Directors.

During the period, the Company waived a receivable amount of USD

0.038m (30 June 2022: USD 0.324, 31 December 2022: USD 0.356m) from

its subsidiary Sandhirst Ltd, as a means of capital contribution to

the subsidiary (note 8).

No social insurance and similar contributions nor any other

defined benefit contributions plan costs incurred for the Group in

relation to its key management personnel in either 2023 or

2022.

22. Litigation

Fairfield Sentry Ltd vs custodian bank and beneficial owners

One of the custodian banks that the Company used faces a

contingent claim up to USD 2.1m, and any interest as will be

decided by a US court and related legal fees, with regards to the

redemption of shares in Fairfield Sentry Ltd, which were bought in

2008 at the request of Livermore and on its behalf. If the claim

proves to be successful, Livermore will have to compensate the

custodian bank since the transaction was carried out on Livermore's

behalf. The same case was also filed in BVI where the Privy Council

ruled against the plaintiffs.

As a result of the surrounding uncertainties over the outcome of

the case and over the existence of any obligation for Livermore, no

provision has been made.

23. Commitments

The Company has expressed its intention to provide financial

support to its subsidiaries, where necessary, to enable them to

meet their obligations as they fall due.

Other than the above, the Company has no capital or other

commitments at 30 June 2023.

24. Events after the reporting date

There were no material events after the reporting date, which

have a bearing on the understanding of these interim condensed

consolidated financial statements.

25. Preparation of interim financial statements

Interim condensed consolidated financial statements are

unaudited. Consolidated financial statements for Livermore

Investments Group Limited for the year ended 31 December 2022,

prepared in accordance with International Financial Reporting

Standards as adopted by the European Union, on which the auditors

gave an unqualified audit report are available on the Company's

website www.livermore-inv.com.

Review Report to the Members of Livermore Investments

Group Limited

Review Report on the interim Condensed Consolidated Financial

Statements

Introduction

We have reviewed the interim condensed consolidated financial

statements of Livermore Investments Group Limited (the "Company")

and its subsidiary (together with the Company "the Group"), which

are presented in pages 7 to 25 and comprise the condensed

consolidated statement of financial position as at 30 June 2023 and

the consolidated statements of comprehensive income, changes in

equity and for the period from 1 January 2023 to 30 June 2023, and

notes to the interim condensed consolidated financial statements,

including a summary of significant accounting policies.

The Board of Directors is responsible for the preparation and

presentation of these interim condensed consolidated financial

statements in accordance with International Financial Reporting

Standards applicable to interim financial reporting as adopted by

the European Union ('IAS34 Interim Financial Reporting'). Our

responsibility is to express a conclusion on these interim

condensed consolidated financial statements based on our

review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements 2410, 'Review of Interim Financial

Information Performed by the Independent Auditor of the Entity'. A

review of interim financial information consists of making

inquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

and consequently does not enable us to obtain assurance that we

would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the accompanying interim condensed

consolidated financial information does not present fairly, in all

material respects, the financial position of the entity as at June

30, 2023, and of its financial performance and its cash flows for

the six month period then ended in accordance with IAS 34 'Interim

Financial Reporting' as adopted by the European Union.

Emphasis of Matter

We draw attention to the note 22 of the interim condensed

consolidated financial statements which describes the uncertainty

related to the outcome of a legal claim against one of the

custodian banks that the Group and the Company uses on its behalf.

Our conclusion is not modified in respect of this matter.

Other information

The Board of Directors is responsible for the other information.

The other information comprises the information included in the

Chairman's and Chief Executive's Review and Review of Activities,

but does not include the condensed consolidated financial

statements and our review report thereon.

Our conclusion on the condensed consolidated financial

statements does not cover the other information and we do not

express any form of assurance conclusion thereon.

In connection with our review of the condensed consolidated

financial statements, our responsibility is to read the other

information and, in doing so, consider whether the other

information is materially inconsistent with the consolidated

financial statements or our knowledge obtained in the review or

otherwise appears to be materially misstated. If, based on the work

we have performed, we conclude that there is a material

misstatement of this other information, we are required to report

that fact. We have nothing to report in this regard.

Other Matter

This report, including the conclusion, has been prepared for and

only for the Group's members as a body and for no other purpose. We

do not, in giving this conclusion, accept or assume responsibility

for any other purpose or to any other person to whose knowledge

this report may come to.

Polyvios Polyviou

Certified Public Accountant and Registered

Auditor

for and on behalf of

Grant Thornton (Cyprus) Ltd

Certified Public Accountants and

Registered Auditors

Limassol, 28 September 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LVLFLXKLEBBB

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

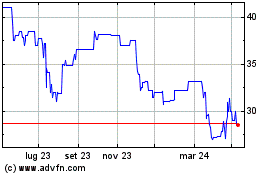

Grafico Azioni Livermore Investments (LSE:LIV)

Storico

Da Mar 2024 a Apr 2024

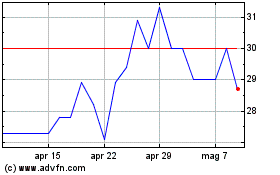

Grafico Azioni Livermore Investments (LSE:LIV)

Storico

Da Apr 2023 a Apr 2024