Marston's PLC Trading update for the 42 weeks to 22 July 2023 (1693H)

26 Luglio 2023 - 8:00AM

UK Regulatory

TIDMMARS

RNS Number : 1693H

Marston's PLC

26 July 2023

26 July 2023

MARSTON'S PLC

("Marston's" or "the Group")

Trading update for the 42 weeks to 22 July 2023

Marston's PLC issues the following trading update for the 42

weeks to 22 July 2023.

Trading

All sales comparisons are compared to the same period in

FY2022.

Like-for-like sales for the 42-week period were +10.7% vs

FY2022. Both drink sales and food sales have been strong,

demonstrating the steadfast trading resilience of our predominantly

community pub estate.

Like-for-like sales in the 16 weeks to 22 July 2023 were +10.9%

vs FY2022, reflecting the warmer weather in June, which enabled us

to maximise the return on investment in our outdoor trading areas

undertaken ahead of the summer months.

Total retail sales in the Group's managed and franchised pubs

for the 42-week period were +12.0% on last year.

The level of customer demand continues to be good, demonstrating

that the positive experiences our guests have in our pubs is

important and continues to drive demand.

As we set out in the Interim Results, we trialled rolling out

the franchise-style model in 13 of our food-led managed pubs to

complement the 717 wet-led pubs currently operated under this

model. We are very pleased with the result of the trial, with sales

growth exceeding our broader food business. As a consequence, we

expect to grow the number of food-led partnerships to over 50 pubs

in FY2024.

Outlook

Cash and debt

Dividends from CMBC are expected to be GBP11.0 million in H2 of

FY2023.

Reducing net debt, excluding IFRS 16 lease liabilities, to below

GBP1 billion continues to be a key focus of the Group's financial

strategy and our progress is in line with expectations. We

anticipate that net debt, excluding IFRS 16 lease liabilities, will

have reduced by GBP50-GBP60 million at the end of FY2023. We expect

the same level of debt reduction in FY2024.

Costs

As a consequence of pursuing the operational strategy of

simplifying the business and driving efficiencies, together with a

more positive outlook on input costs in FY2024, we anticipate being

well-placed to navigate any consumer headwinds. We believe pubs

remain an affordable treat and have consistently proved resilient

to pressures on the consumer in previous economic downturns.

Looking forward, the Group will continue to invest in the future

growth of the business and remains well-positioned to deliver

positive trading from its community pubs across the UK.

Andrew Andrea, CEO, commented:

"Marston's has delivered another strong trading performance,

validating the strategy we are implementing and demonstrating the

appeal of our pubs. We are making good progress and are beginning

to see the benefits of the actions we have taken in H1, simplifying

our trading formats and repositioning our pub portfolio, as well as

the investments we have made in our pub gardens and outside trading

areas.

"In addition, we are encouraged by the success of the trial

extending the partnership model into our food-led pubs. The trial

has been positive and we will extend this model to over 50 food-led

pubs in FY2024. Marston's pioneered the operator managed agreement

in 2009, which now operates in over 700 wet-led pubs, and we are

pleased to lead the evolution of this format and are excited about

its future growth potential for our business.

"We remain focused on delivering on our debt reduction strategy

and continue to make good progress in that regard. Whilst

macro-economic challenges persist for the time being, we remain

encouraged by the Group's trading resilience and that the pub

remains an affordable treat for our guests. An improving cost

outlook, together with the actions we are taking to maximise

efficiencies, leaves Marston's well-placed to navigate through

ongoing economic headwinds".

Forthcoming Events

Please find below the forthcoming reporting dates for Marston's,

which are also available on the investor calendar on our website -

www.marstonspubs.co.uk/investors

Year-end trading statement 11 October 2023

2023 Preliminary results 5 December 2023

ENQUIRIES:

Marston's PLC Tel: 01902 329516

Andrew Andrea, Chief Executive

Officer

Hayleigh Lupino, Chief Financial

Officer

Instinctif Partners Tel: 020 7457 2020

Justine Warren

Matthew Smallwood

Joe Quinlan

NOTES TO EDITORS

-- Marston's is a leading pub operator with a 40% holding in

Carlsberg Marston's Brewing Company

-- It operates an estate of 1,433 pubs situated nationally,

comprising managed, franchised and leased pubs

-- Marston's employs around 11,000 people

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUVRBROBUBUAR

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

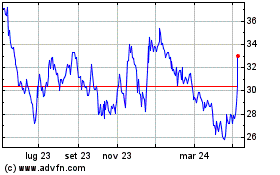

Grafico Azioni Marston's (LSE:MARS)

Storico

Da Mar 2024 a Apr 2024

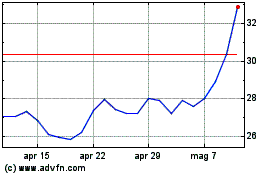

Grafico Azioni Marston's (LSE:MARS)

Storico

Da Apr 2023 a Apr 2024