TIDMMARS

RNS Number : 6288V

Marston's PLC

05 December 2023

5 December 2023

MARSTON'S PLC

PRELIMINARY RESULTS FOR THE 52 WEEKSED 30 SEPTEMBER 2023

IMPROVED UNDERLYING PROFITABILITY, POSITIVE CASH FLOW AND

CONTINUED STRATEGIC MOMENTUM

Marston's, a leading UK operator of 1,414 pubs, today announces

its Preliminary Results for the 52 weeks ended 30 September 2023.

The period under review commenced on 2 October 2022.

Underlying Total

2023 2022 2023 2022

--------- ---------- ---------- ----------

Total revenue GBP872.3 GBP799.6 GBP872.3 GBP799.6

m m m m

--------- ---------- ---------- ----------

Pub operating profit GBP124.8 GBP115.4 GBP90.2 GBP 142.1

m m m m

--------- ---------- ---------- ----------

Share of associate GBP9.9 m GBP3.3 m GBP9.9 m GBP 3.3 m

--------- ---------- ---------- ----------

Profit/(loss) before GBP35.5 GBP27.7 m GBP(20.7) GBP 163.4

tax m m* m

--------- ---------- ---------- ----------

Net profit/(loss) GBP32.0 GBP27.5 m GBP(9.3) GBP 137.2

m m m

--------- ---------- ---------- ----------

Earnings/(loss) per

share 5.1 p 4.3 p (1.5)p 21.7p

--------- ---------- ---------- ----------

Net cash inflow GBP34.4 GBP26.2 m GBP34.4 GBP26.2 m

m m

--------- ---------- ---------- ----------

NAV per share GBP1.01 GBP1.02

--------- ---------- ---------- ----------

Underlying operating

margin 14.3% 14.4%

--------- ---------- ---------- ----------

*Includes a GBP21.6 million net loss in respect of interest rate

swap movements, a partial reversal of the GBP109.2 million net gain

reported in FY2022, and GBP31.2 million of charges in respect of

the impairment of freehold and leasehold properties.

Revenue and underlying pub operating profit growth, despite

macroeconomic environment

-- Continued progress on 'Back to a Billion' sales and net debt

targets, with revenue up 9.1% to GBP872.3 million

-- Like-for-like sales up 10.1% vs last year

-- Both drink and food sales were encouraging, demonstrating the

trading resilience of the Group's predominantly community pub

estate

-- 8% increase in underlying pub operating profit: GBP124.8 million (FY2022: GBP115.4 million)

-- Underlying operating margin effectively flat at 14.3% (2022:

14.4%), preserving margins in a high inflation environment

-- Improved share of CMBC's profits: GBP9.9 million (FY2022:

GBP3.3 million) and GBP21.6 million of dividends received

Positive cash generation and debt reduction

-- Operating cash inflow of GBP141.2 million (FY2022: GBP134

million) and net cash inflow for the period of GBP34.4 million

(FY2022: GBP26.2 million)

-- Continued progress with debt reduction strategy: net debt

excluding IFRS 16 lease liabilities reduced by GBP31 million to

GBP1,185 million (FY2022: GBP1,216 million)

-- GBP54.5 million generated from non-core strategic disposals, proceeds ahead of net book value

-- Successfully secured amendment and extension of banking

facilities totalling GBP340 million, comprising GBP300 million RCF

and GBP40 million private placement

Continued evolution of pub portfolio

-- Continued market outperformance with a well-positioned,

predominantly freehold pub estate, with limited exposure to city

centres, and community pubs continuing to benefit from consumer

lifestyle changes

-- Simplified pub estate evolution delivering positive momentum

with food and drink spend per head up 8.1% and 8.6% respectively

and gross margin up 0.6%

-- Successful trial of franchise-style model in food-led managed

pubs; sales growth significantly exceeding that of the broader food

business

-- Completed 41 capital schemes and GBP4m garden investment;

GBP50-55m of capex investment earmarked for FY2024

Current trading and outlook

-- Positive current trading, with like-for-like sales since year end +7.4% vs. last year

-- Christmas bookings tracking well and ahead of last year

-- Continuing to manage inflationary challenges within our

control: energy costs secured with electricity fixed until end of

FY2024 and gas until end of March 2025; offsetting other costs

through efficiencies and pricing strategies

-- Improved business resilience: targeting margin improvement of

at least 200bps in the medium term

-- Over and above the progress already made, the Group will

continue to find efficiencies to improve margin

-- Justin Platt joins as CEO on 10 January 2024

Commenting, William Rucker, Chair said:

" We have continued to make positive progress on our key goals

and strategic initiatives. The consumer has remained resilient

despite the macro backdrop and Marston's continues to trade well,

achieving market outperformance.

We anticipate an improving outlook in which cost headwinds are

largely abating and like-for-like sales are up over 7% since the

year end. This, together with the actions we have taken this year

to drive further efficiencies, leave us confident that Marston's

remains well-placed to continue to outperform and to grow revenue,

margin and profitability.

We look forward to welcoming Justin Platt who joins the Group as

CEO in January. The business is in good shape and well-positioned

to take advantage of the future opportunities open to us to create

value for our shareholders under his stewardship. "

ENQUIRIES:

Marston's PLC Tel: 01902 329516 Instinctif Partners Tel: 020 7457 2020

William Rucker, Chair Justine Warren

Hayleigh Lupino, Chief Financial Officer Matthew Smallwood

Joe Quinlan

NOTES TO EDITORS

-- Marston's is a leading pub operator with a 40% holding in

Carlsberg Marston's Brewing Company

-- It operates an estate of 1,414 pubs situated nationally,

comprising managed, franchised and leased pubs

-- Marston's employs around 11,000 people

-- The Group uses a number of alternative performance measures

(APMs) to enable management and users of the financial statements

to better understand elements of financial performance in the

period. APMs are explained and reconciled in the appendix to the

financial statements

GROUP OVERVIEW

2023 PERFORMANCE OVERVIEW

2023 has been a year of focusing on the core estate and our

strategic aims with a clear objective to create a simplified ,

high-quality, predominantly community pub business, with minimal

exposure to city centres where demand is more volatile.

Our strategy continues to be centred upon delivering affordable

pub experiences for our guests in a quality environment, both

inside and out. The level of consumer demand remains reassuring,

and we have continued to make positive progress on guest

satisfaction measures and standards over the year, through our

engaged and focused pub teams.

We have traded well during the year, outperforming the market,

and have made encouraging earnings progress on last year, despite

the challenging macroeconomic environment. In addition, as

described below, we have taken cost actions to improve the

resilience of the business model and improve profitability for the

coming year.

The successful trial of our franchise-style model in our

food-led managed pubs, with sales growth significantly exceeding

that of our broader food business, provides positive momentum and

additional options in optimising our estate.

The performance supports the progress we are making against our

strategy and the transformation which has been implemented across

the business during the last two years. Our two primary corporate

goals remain: to reach two GBP1 billion financial targets over

time, namely to reduce the Group's debt (excluding IFRS 16 lease

liabilities) to below GBP1 billion by 2026 and the achievement of

GBP1 billion of sales. We continue to make progress on both of

these goals.

Trading

Revenue increased by 9.1% to GBP872.3 million (2022: GBP799.6

million), total retail sales in the Group's managed and franchised

pubs for the 52-week period were +9.8% on last year, and

like-for-like retail sales for the year as a whole were up 10.1%

versus FY2022.

Both drink sales and food sales have been strong, demonstrating

the resilience and appeal of our business. We continue to have

confidence that our pub strategy is delivering positive momentum

through the challenging macroeconomic environment.

Underlying operating profit excluding income from associates was

GBP124.8 million (2022: GBP115.4 million). Underlying operating

margins were effectively flat compared to last year, with a margin

of 14.3% (2022: 14.4%); managing price increases, product mix and

efficiencies to preserve margins in a period of high cost

inflation. H1 margin was 10.6% and H2 margin was 17.6%.

Underlying operating profit including income from associates was

GBP134.7 million (2022: GBP118.7 million), an increase of

13.5%.

Underlying profit before tax was GBP35.5 million (2022: GBP27.7

million). Statutory loss before tax was GBP(20.7) million (2022:

profit of GBP163.4 million), reflecting the impact of

non-underlying items explained later.

Property and net assets

Net assets were GBP640.1 million (2022: GBP648.1 million), with

net asset value stable at GBP1.01 per share (2022: GBP1.02).

The carrying value of the estate remains GBP2.1 billion (2022:

GBP2.1 billion). As a result of the valuation and leasehold

impairment review there is an effective freehold impairment of

GBP24.3 million and a leasehold impairment of GBP4.9 million. The

valuation of non-core pubs and an increase in discount rates have

contributed to the impairment. Importantly, despite the valuation

reflecting a challenging macroeconomic environment, the value of

the core estate has been maintained.

During the year we generated GBP54.5 million of non-core pub

disposal proceeds (net of VAT), which comprised GBP51.3 million

proceeds net of GBP1.1 million fees and GBP2.1 million lease

liabilities. The net proceeds were above book value.

Debt and financing

The vast majority of our borrowings are long-dated and

asset-backed, including the securitisation debt of c.GBP611

million, which has low interest rates in the current environment

and a payment structure that reduces debt. The weighted average

fixed interest rate payable by the Group on its securitised debt at

30 September 2023 was 5.1%. The Group has confidence in the loan to

value of its debt, which is improving year on year and is currently

68% for debt excluding IFRS 16 lease liabilities and 53% for the

securitisation debt.

93% of our borrowings are hedged and therefore not at risk from

any changes in interest rate movements that may occur during the

year. Further detail is set out in the Performance and Financial

Review.

Net debt, excluding IFRS 16 lease liabilities, was GBP1,185

million, a reduction of GBP31 million from last year (2022:

GBP1,216 million). Total net debt of GBP1,566 million (2022:

GBP1,594 million) includes IFRS 16 lease liabilities of GBP380

million (2022: GBP378 million).

Carlsberg Marston's Brewing Company (CMBC)

Income from associates was GBP9.9 million (2022: GBP3.3

million), which is the Group's share of the statutory profit after

tax generated by CMBC. CMBC's results show an improvement from last

year.

Dividends from associates of GBP21.6 million were received

(2022: GBP19.4 million), the prior year dividend having primarily

resulted from one-off working capital movements. We remain

confident that we will continue to receive future dividends from

CMBC as its trading continues to improve.

Dividend

The Board confirms that given its priority to reduce the overall

level of borrowing and the continued macroeconomic uncertainty, no

dividends will be paid in respect of financial year 2023. The Board

is cognisant of the importance of dividends to shareholders and

intends to keep potential future dividends under review.

OUTLOOK

New CEO

Post the year end, the Group announced that Andrew Andrea had

agreed with the Board that he would step down as Chief Executive

Officer as of 17 November 2023, albeit he is available to the

business for a period to ensure a smooth handover of

responsibilities. The Board wishes to take this opportunity to

express its gratitude to Andrew for his commitment to Marston's

over his tenure, which extends over 20 years.

Following an external process, Justin Platt has been appointed

as Chief Executive Officer with effect from 10 January 2024. With

over 30 years' experience in hospitality and consumer-facing

businesses, Justin spent the last 12 years at Merlin Entertainments

- most recently as Chief Strategy Officer and prior to that in a

variety of operational leadership roles. William Rucker, Chair,

will support the management transition in the short interim period

with the Executive team reporting directly into him prior to Justin

being in situ.

Costs

As highlighted in our October trading update, as a consequence

of pursuing the operational strategy of simplifying the business

and driving efficiencies, and following a review of the business

structure over the summer, we have reduced head office headcount

costs by approximately GBP5 million, generating savings in FY2024

onwards.

The Group is highly confident of delivering cost efficiencies of

at least a further GBP3 million in FY2024, principally from savings

in energy usage and pub labour costs as described in the strategic

review below, further improving operating profit margin. These cost

reductions are expected to translate into higher pub operating

profitability in future years than was previously anticipated. This

cost efficiency delivery is not impacted by the changes to National

Minimum (Living) Wage ("NLW") rates.

As previously guided, we have fixed our energy costs for FY2024

and have secured a significant proportion of our food and drink

costs for the year, providing us with a high degree of confidence

for the next financial year.

With regard to interest costs as described above, our borrowings

are largely long-dated and asset-backed. 93% of our borrowings are

hedged and therefore not at risk of changes in interest rate

movements that may occur during the year.

It is anticipated that the increases to the NLW rates, which

were announced in the recent Autumn Statement will be c.GBP1

million for H2 of FY2024 (c.GBP2 million annualised). We intend to

mitigate this increase through a variety of actions including the

acceleration of our cost efficiency programme, together with price

increases where appropriate. Other Autumn Statement measures

announced, such as the changes to business rates, are expected to

have minimal impact.

Current trading

The positive trading momentum from last year has continued, with

like-for-like sales in our managed and franchised pubs since year

end up 7.4% vs the same period last year, with growth in both.

Bookings for the Christmas period are promising and tracking

ahead of last year. As always, walk-in trade represents a

significant proportion of overall sales over the period; however,

the booking momentum demonstrates that, despite economic pressures,

people still want to go out and celebrate in a pub.

We remain cognisant of the current macroeconomic environment,

and the resulting challenges this brings in respect of cost

inflation and the potential impact on disposable income. However,

pubs have historically demonstrated their resilience as an

affordable treat and there is no discernible evidence in our

trading performance to suggest that there has been a material

change to consumer behaviour.

Outlook

Looking forward, the combination of our strategy and the

principally community location of our pub portfolio positions us

well to withstand the challenging consumer environment. In

addition, the actions to dispose of non-core pubs and introduce our

franchise-style model in our food-led pubs will ensure we have a

portfolio of well-invested pubs which will continue to deliver

high-quality earnings and sustainable future growth.

An improving outlook in which cost headwinds are abating,

together with the actions we have taken this year to drive further

efficiencies, leaves us confident that Marston's remains

well-placed to continue to outperform in the current macroeconomic

environment, grow revenue and profitability, as well as deliver

improved margin in the year ahead.

STRATEGIC PRIORITIES

Market Dynamics

Last year saw the first restriction-free financial year of

trading since 2019 and, as such, it was the first 'clean' year in

which to understand the behaviour of consumers following the

pandemic.

We have learnt a great deal to inform our future trading

strategies. It is clearer than ever before that delivering a great

guest experience is key. Consumers are increasingly demanding in

this regard, and our guests are prepared to spend more money when

they visit our pubs. Red letter days are becoming more and more

important and, from an impulse perspective, the Google search "Best

place for" is increasingly used by consumers, whether for a great

pub garden, televised sport, or dog friendliness. The evolution of

working from home is stabilising and, in our view, this behavioural

change is best suited to community pub businesses such as Marston's

with limited exposure to city centres.

However, inflationary pressures have continued this year, and

the UK has seen significant increases in interest rates, both of

which have presented challenges to consumers and businesses alike.

Despite this, what is clear is that the demand to go out and

socialise and enjoy the everyday treat of going to the local pub,

remains core to many people's lives.

Strategy

Our vision and strategy is unchanged. That is creating 'Pubs to

be proud of', comprising a high-quality, predominantly community

pub business, with minimal exposure to city centres.

Operationally, we are focused on the core pillars of driving

guest satisfaction in a great environment served by engaged and

motivated teams. This remains relevant despite the macroeconomic

challenges continuing to impact the consumer.

A key driver of our strategy is simplification. We have two core

propositions: Community is our entry point offer, and Signature is

our more premium mainstream offer for pubs with a more affluent

customer base. Whilst food is clearly important in many of our

pubs, we are focused on ensuring that, regardless of food mix, all

our pubs are regarded as a place to socialise and have a drink in a

welcoming environment. This year we have also undertaken a detailed

estate review which enabled us to consider a number of future

operational strategies from a rich and relevant data source, from

targeted capital expenditure to opportunities linked to cluster

planning, including potential acquisitions or disposals. The estate

review has been one of the main contributing factors to the

increase in our disposals guidance for FY2024.

Financially, we are focused on three key priorities which we are

confident will deliver shareholder value in the medium to long term

by creating a sustainable business that is growing sales, earnings

and cash generation, whilst reducing debt levels and increasing

returns.

Borrowings Below GBP1 Billion by 2026

This corporate goal is our main strategic focus and where we see

the greatest shareholder value creation opportunity. Our actions to

achieve this are twofold:

-- Accelerated disposal of non-core assets : in 2023 we

generated GBP55 million of disposal proceeds (net of VAT) from the

sale of non-core assets. Following a further strategic review of

the estate we are targeting around GBP50 million in financial year

2024. Thereafter we are anticipating returning to a natural churn

rate of GBP10-15 million of disposals per annum.

-- Growth of Free Cash Flow: in achieving the borrowings target

we are seeking to maximise the free cash flow of the business which

provides us with optionality on the allocation of capital in

future, including additional capital expenditure and the

reintroduction of dividend payments. Given the hedged debt profile

of the business, outside pub EBITDA, the future cash flows are

predictable with interest charges falling as we pay down debt and

the cessation of pension payments targeted by 2025.

The effective use of capex remains key in both maintaining the

quality of the estate and driving future growth. Underpinning the

estate repositioning described above is a comprehensive capital

programme focused on deploying capital as efficiently as possible

and maximising returns. During the year we completed 41 capital

schemes and we invested GBP4 million in our pub gardens. The Group

has GBP50-55 million of capex investment earmarked for FY2024.

Sales Above GBP1 Billion

To complement our debt reduction strategy, we will continue the

progress made this year on this corporate goal by driving sales and

gaining market share. There are five key actions to achieve

this:

-- Clear pub goals : we have previously set out the three core

pub goals of high guest satisfaction scores, engaged teams and

strong pub standards, and there is a clear correlation between

attainment of pub goals and sales. We have made excellent progress

on all three measures this year with an average Google star rating

of 4.4 and a Reputation score of 766, high employee engagement with

an average score of 8.2 and aggregated participation rate of 84%,

and 93% of our managed and partnership pubs have a 5* EHO

rating.

-- Driving a harder sales culture : our internal call-to-action

on driving sales is 'Never Full Fancy Another' and this is focused

on ensuring that we maximise spend per visit and we can always

accommodate a guest, regardless of how busy a pub is. During the

year, as part of the garden investment programme, we developed our

order and pay system further and have seen continued increased

usage. In addition, in the final quarter, we launched a drinks

incentive for hourly paid team members which increased both drinks

volumes and spend per visit and this will be continued into 2024.

We also refined our booking system to ensure an improved booking

experience for guests and our pub teams alike.

-- Effective category management: we continue to simplify our

product proposition to make our supply chain as efficient as

possible and make it simple for our teams to recommend and serve

quality drink or food, without compromising guest choice. We have

launched a new drinks strategy based on similar principles, which

is delivering enhanced margins in the form of upsell opportunities,

improved speed of service and reduced stock holding requirements

and wastage.

-- Efficient digital and marketing strategy : an effective

marketing strategy underpins increasing footfall and our focus is

on ensuring any marketing expenditure is deployed efficiently with

the emphasis on maximising activity returns. We have continued to

evolve and develop our digital strategy during the year with

improved pub websites and the introduction of card-linked

partnerships from which we anticipate an uplift in 2024. In

addition, our targeted door-drop and digital campaigns in 2023

generated a pleasing return on investment and we shall continue

this in the coming year.

-- Development of Marston's franchise-style agreements : the

partnership model has been extremely successful in our wet-led pubs

since it launched in 2009 and now operates in c.730 pubs. Key to

its success is that the model ensures all stakeholders are focused

on maximising sales and the 'owner driver' mentality of the partner

has delivered consistently strong results. The estate review and

simplification of the business has now enabled us to launch the

model into food-led pubs with 19 pubs now operating as food-led

partnerships. The initial results have been very encouraging and we

are targeting 50 pubs (c.11% of our food-led pubs) to be operating

under this model by the end of 2024.

Improved Business Resilience: Margin Improvement of at least

200bps in the medium term

Whilst driving the top line is key to delivering growth, it is

equally critical to ensure that those sales are effectively

converted into profit. As reported, operating margins effectively

remained flat in 2023 following a year of significant inflation,

and we are one of the highest margin operators in the sector.

Regardless of this already strong position, we believe there are

clear opportunities to drive margins harder in the next 2-3 years,

including:

-- Pub support centre and culture : the simplification of the

business has enabled us to refine our structure and we reduced

central payroll costs by GBP5 million, of which the vast majority

will be realised in 2024. In addition, we have internally launched

a focus on cost reduction and 'Every Penny Counts' which is aimed

at embedding a culture of reviewing any expenditure across the

business, no matter how small.

-- Pub labour : during the year, we rolled out our labour

scheduling system, the final modules of which were implemented in

November 2023, providing us with a system to ensure we are

deploying labour in our pubs in the most efficient way.

-- Energy : the increased cost of energy has been widely

reported and whilst we are seeing an improvement in energy costs

for 2024, we do not anticipate those costs falling back to

pre-pandemic levels. The focus is therefore to reduce underlying

energy usage through a combination of investment and

incentivisation and seek opportunities through innovative power

purchasing. We have now completed the rollout of smart meters

across the managed and partnership estate and integrated this into

our reporting systems, which enables us to monitor usage and

identify usage savings at a more granular level.

People

Our people are the main underpin to the performance of our

business - in short, happy engaged teams deliver great guest

experiences, which deliver higher sales. Our engagement scores have

improved in the year and survey participation is extremely high -

over 80% of our people have participated in at least one of our

monthly surveys during the year. Employee turnover has reduced

during the year and licensee stability remains an important metric

in ensuring we have the right operator in every pub, first

time.

From a recruitment perspective, we continue to evolve the use of

social media platforms and media to attract talent. In addition, we

are looking at alternative talent pools, and this year we have made

excellent progress on our Excel programme (formerly Latitude) which

supports ex-offenders with employment and training opportunities.

We have recently launched the 'Lock Inn' in collaboration with HMP

Liverpool, which is a training facility inside the prison that we

have converted to look and feel like a Marston's pub and will

provide guaranteed job opportunities for any ex-offenders that

complete the training course upon their release.

The development of internal talent is also key to long-term

success. Our Aspire programme which develops deputy managers was

successfully launched this year and we plan to extend this in 2024

to increase the pipeline of new licensees, whether that be as a

manager or Pub Partner. We have a well-established apprenticeship

programme with 306 apprentices within the business at a retention

rate of over 75%.

Doing more to be proud of

As we have previously reported, our environmental, social and

governance (ESG) strategy is embedded and supports our business

strategy through our 'Doing more to be proud of' (DM2BPO)

initiative and our four core pillars: Planet, People, Product and

Policy. The People and Planet-positive practices resonate and

reflect our core values and strategic priorities, whilst being

underpinned by strong Policy - that is good governance, risk

management processes and stewardship. Earlier this month, we

published our inaugural Insight Report which sets out our aims,

targets, and intentions, and shines a light on our focus areas,

positive impacts and where we can improve.

Highlights this year include:

-- Launching our Diversity & Inclusion strategy where our

people are encouraged to 'come as you are'.

-- E stablished our carbon baseline in conjunction with the Zero

Carbon Forum and development of our roadmap to Net Zero.

-- Over 170 pubs with live EV charging points, with over 40

million miles travelled by electric vehicles from our pubs since

inception.

-- 302,575 pints per day saving from identification and resolution of water inefficiencies.

-- Over 23,000 carvery meals rescued from waste, being resold

with Too Good to Go, saving c.60 tonnes of CO(2) e.

-- Increasing our FTSE4Good Score to 4.

PERFORMANCE AND FINANCIAL REVIEW

Revenue

Revenue increased by 9.1% to GBP872.3 million (2022: GBP799.6

million), demonstrating the resilience and appeal of our

predominantly community pub estate in the still-challenging

macroeconomic environment and with momentum from strong drink and

food sales. Our guests still want to visit our pubs for an

affordable treat.

Like-for-like retail sales for the year as a whole were up 10.1%

versus FY2022, showing positive momentum. Both drink sales and food

sales have been strong.

Total retail sales in the Group's managed and franchised pubs

for the 52-week period increased by 9.8% to GBP806.1 million (2022:

GBP 734.1 million) and total outlet sales increased by 10.0% to

GBP832.8 million (2022: GBP757.2 million).

Within our pub business we operated 230 pubs under the

traditional tenanted and leased model generating revenues of

GBP39.5 million (2022: GBP42.4 million) . It is still our intention

to convert the remainder of the tenanted and leased estate to

turnover based models in the medium term.

Accommodation sales grew to GBP35.6 million (2022: GBP33.1

million), benefitting from the continuing demand for UK

staycations.

Profit

Underlying operating profit excluding income from associates was

GBP124.8 million (2022: GBP115.4 million). Underlying operating

margins were effectively flat compared to last year, with a margin

of 14.3% (2022: 14.4%); managing price increases, product mix and

efficiencies to preserve margins in a period of high cost

inflation. Due to the seasonal nature of the Group's business, the

majority of profit is typically earned in the second half of the

year. H1 margin was 10.6% and H2 margin was 17.6%.

Underlying EBITDA excluding income from associates increased to

GBP170.3 million (2022: GBP159.6 million).

Underlying profit before tax increased to GBP35.5 million (2022:

GBP27.7 million) and statutory loss before tax was GBP(20.7)

million (2022: profit of GBP163.4 million), reflecting the impact

of non-underlying items.

The difference between underlying profit before tax and profit

before tax is GBP56.2 million of non-underlying items, which

includes a GBP21.6 million net loss in respect of interest rate

swap movements, GBP31.2 of impairments to the freehold and

leasehold property values, GBP2.9 million of reorganisation,

restructuring and relocation costs and GBP0.5 million of pension

past service costs.

Interest

Our borrowing is largely long-dated and asset-backed. The

securitisation is in place until 2035 which provides financing

security and high visibility of future cash flows; this is of

particular importance in an environment where interest rates have

been rising to curb inflation. The securitisation is fully hedged

until 2035. Other lease related borrowings are index linked, capped

and collared at 1%-4%, providing protection against high inflation.

Of our GBP300 million bank facility, GBP120 million is now hedged.

Overall, we are 93% hedged, providing significant protection

against changes in interest rate movements that may occur during

the year.

The GBP60 million forward floating-to-fixed interest rate swap,

which was due to take effect from April 2025, was brought forward

and started in October 2022.

Taxation

Underlying profit before tax was GBP35.5 million (2022: GBP27.7

million) upon which the underlying tax charge was GBP3.5 million

(2022: GBP0.2 million). This gives an underlying tax rate of 9.9%.

The effective tax rate is lower than the standard rate of

corporation tax primarily due to the post-tax share of income from

associates, additional deductions on which tax relief is available

including super-deductions, and an adjustment to the deferred tax

on property calculation relating to the prior period.

The total tax credit is GBP11.4 million (2022: charge of GBP26.2

million) on total loss before tax of GBP(20.7) million (2022:

profit of GBP163.4 million), with an effective tax rate of 55.1%.

The key drivers outlined above increase the tax rate (credit) on

the total loss for the year, and there is a further positive impact

due to the additional tax credits associated with PPE impairments,

and the rate difference between current tax and deferred tax.

Non-underlying items

There is a net non-underlying charge of GBP56.2 million before

tax and GBP41.3 million after tax.

The GBP56.2 million charge primarily relates to a GBP21.6

million net loss in respect of interest rate swap movements and a

GBP31.2 million net impairment to the freehold and leasehold

property values following the external estate valuation of the

Group's effective freehold properties and the impairment review of

the Group's leasehold properties undertaken during the year.

Other non-underlying items comprise GBP2.9 million of

reorganisation, restructuring and relocation costs, including the

reduction to head office costs detailed earlier, and GBP0.5 million

of pension past service costs.

The tax credit relating to these non-underlying items is GBP14.9

million.

Earnings per share

Total earnings per share were (1.5) pence loss per share (2022:

21.7 pence per share). Underlying earnings per share were 5.1 pence

per share (2022: 4.3 pence per share).

Capital expenditure and disposals

Capital expenditure was GBP65.3 million in the year, including

property acquisitions of GBP0.4 million (2022: GBP70.1 million). We

expect that capital expenditure will be around GBP50-GBP55 million

in 2024, as we focus on the most effective use of our capital spend

for our well-invested pubs.

During the year we generated GBP54.5 million of non-core pub

disposal proceeds (net of VAT), which comprised GBP51.3 million

proceeds net of GBP1.1 million fees and GBP2.1 million lease

liabilities. The net proceeds were above book value.

We have concluded a further strategic assessment of assets and

in FY2024 we expect to dispose of around GBP50 million of

additional non-core properties.

Property

The Group has an annual external valuation of its properties and

all pubs are inspected on a rotational basis, with approximately

one third of the estate being inspected each year and the remainder

subject to a desktop valuation . Christie & Co undertook an

external valuation in July 2023 and the results have been reflected

in the full year accounts.

The carrying value of the estate remains GBP2.1 billion (2022:

GBP2.1 billion). As a result of the valuation and leasehold

impairment review there is an effective freehold impairment of

GBP24.3 million and a leasehold impairment of GBP4.9 million. The

valuation of non-core pubs and an increase in discount rates have

contributed to the impairment. Importantly, despite the valuation

reflecting a challenging macroeconomic environment, the value of

the core estate has been maintained.

Share of Associate - Carlsberg Marston's Brewing Company

(CMBC)

Included in our Group income statement is income from associates

of GBP9.9 million (2022: GBP3.3 million), which is the Group's

share of the statutory profit after tax generated by CMBC. CMBC's

results show encouraging recovery from last year.

The Group also benefits from dividends received from CMBC, as

shown in our Group cash flow statement. Dividends from associates

of GBP21.6 million were received (2022: GBP19.4 million), the prior

year dividend having primarily resulted from one-off working

capital movements. Dividends in respect of CMBC's calendar

financial year are paid in September in year (for January - June)

and March the following year (for July - December). The dividends

are generated from CMBC's operating cash flows adjusted for working

capital and other movements.

We remain confident we will continue to receive future dividends

from CMBC as its trading continues to improve and produce positive

results.

Pensions

The balance on our final salary scheme was a GBP12.9 million

surplus at 30 September 2023 (2022: GBP15.1 million surplus). This

change has primarily been driven by the increase in the discount

rate assumption, from 5.2% in October 2022 to 5.6% in October 2023,

and a fall in asset values. The net annual cash contribution is

c.GBP6m and is only expected to continue for the short term. The

results of the next triennial valuation are expected in early

2024.

Debt and financing

The Group remained focused on cash management during the year

and continued to prioritise cash preservation whilst maintaining an

appropriate level of pub investment to ensure our pubs are well

positioned to deliver our strategy.

The Group generated a net cash inflow for the period of GBP34.4

million including IFRS 16 (GBP29.3 million excluding IFRS 16). The

net cash inflow would have been GBP63.4 million were it not for the

working capital outflows of GBP29.0 million, principally comprising

one-off cash flows arising from the final settlement following our

transitional services agreement with CMBC. Future recurring cash

flows are expected to be in line with our debt reduction plans, as

part of which we are targeting debt reduction of at least GBP60

million in FY2024.

Net debt, excluding IFRS 16 lease liabilities, was GBP1,185

million, a reduction of GBP31 million from last year (2022:

GBP1,216 million). Total net debt of GBP1,566 million (2022:

GBP1,594 million) includes IFRS 16 lease liabilities of GBP380

million (2022: GBP378 million).

There was an operating cash inflow of GBP141.2 million in the

year, ahead of last year (2022: GBP134.0 million), principally

reflecting higher profits in the year. The operating cash inflow

would have been GBP170.2 million were it not for the working

capital outflows of GBP29.0 million.

As set out in our Interim Results, we successfully secured an

amendment and extension ('A&E') to our banking facility and

private placement to the end of January 2025. The revised GBP340

million facilities are comprised of a GBP300 million Revolving

Credit Facility (the 'RCF') with the continued support of all of

our existing banks and with two new banks keen to join the

syndicate, together with a restatement of our current GBP40 million

private placement. The RCF replaces the Group's existing GBP280

million facility. The facility cost is variable: to be determined

by the level of leverage or drawings from time to time alongside

changes in the SONIA rate, together with issue costs. As previously

reported, GBP120 million of the facility is hedged.

During the period and prior to the A&E, we secured the

covenant amendments that we required, as reported in our 2022

financial results, again demonstrating the good relationship and

support we continue to have with our banking group and private

placement provider. No further covenant amendments have been

required.

The Group anticipates commencing formal discussions with the RCF

banks and private placement holder in early 2024 in order to secure

the refinancing of these facilities to beyond January 2025. Whilst

there is no guarantee, based on the successful A&E to the RCF

and private placement during the period, and the positive

conversations held to date, the Directors are confident that they

would expect to be able to secure refinancing on similar terms.

The vast majority of our borrowings are long-dated and

asset-backed, including the securitisation debt of c.GBP611

million, which has low interest rates in the current environment

and a payment structure that reduces debt. The weighted average

fixed interest rate payable by the Group on its securitised debt at

30 September 2023 was 5.1%. The Group has confidence in the loan to

value of its debt, which is improving year on year and is currently

68% for debt excluding IFRS 16 lease liabilities and 53% for the

securitisation debt.

The Group's financing, providing an appropriate level of

flexibility and liquidity for the medium term, comprises:

-- GBP300 million bank facility to January 2025 - at the year

end GBP229 million was drawn providing headroom of GBP71 million

and non-securitised cash balances of GBP10 million

-- GBP40 million private placement in place until January 2025

-- Seasonal overdraft of GBP5-GBP20 million, depending on dates

- which was not used at the period end

-- Long-term securitisation debt of approximately GBP611 million

- at the year end GBP10 million of the GBP120 million

securitisation liquidity facility had been utilised, which was

repaid in October 2023.

-- Long-term other lease related borrowings of GBP338 million

-- GBP380 million of IFRS 16 leases

The securitisation is fully hedged to 2035. Other lease related

borrowings are index-linked capped and collared at 1% and 4%. There

are GBP120 million of floating-to-fixed interest rate swaps against

the bank facility: GBP60 million is fixed at 4.03% until 2031 and

GBP60 million is now fixed at 3.45% until 2029.

In summary, we have adequate cash headroom in our bank facility

to provide operational liquidity. Importantly, c.93% of our medium

to long-term financing is hedged thereby minimising any exposure to

interest rate increases that may arise over the next few years.

Going Concern

As part of the annual reporting process, we are formally

required to assess the extent to which our forecasts and therefore

our financing requirements may or may not affect our going concern

assumption in preparing the accounts. In performing this

assessment, we have considered the Group's financial position and

exposure to principal risks, including the cost-of-living crisis

and inflationary pressure. The Group's forecasts assume moderate

sales price increases, operational costs that have not been secured

rising broadly in line with inflation. We have also considered a

severe but plausible downside scenario, incorporating a 5%

reduction in sales volume as a consequence of the cost-of-living

crisis and current inflationary pressures along with a reasonably

plausible increase in costs compared to the base case forecast.

The conclusion of this assessment was that the Directors are

satisfied that the Group has adequate liquidity and is not forecast

to breach any covenants within its banking group, private placement

or securitisation in its base case forecast. The Directors are also

satisfied that the Group has adequate liquidity to withstand the

severe but plausible downside scenario. However, in this severe but

plausible forecast only, even after factoring in mitigations under

the control of management such as reductions in discretionary

spend, the Group would be required to obtain covenant amendments in

respect of its Interest Cover covenant associated with the Group's

bank and private placement borrowings in the outer quarters of the

going concern period.

In such a severe but plausible downside, the Group could

leverage the supportive relationship it has with its lenders and

renegotiate the terms of its financing in advance of any covenant

amendment being required or it would seek a covenant amendment.

Whilst there is no guarantee, based on covenant amendments

previously secured, the successful amend and extend to the RCF and

private placement during the period and the continued positive

relationships, the Directors would be very confident that they

would be able to secure any such amendments. Accordingly, the

financial statements continue to be prepared on the going concern

basis, but with a material uncertainty arising from the current

macroeconomic environment. Full details are included in Note 1.

CMBC: Due to the size of Marston's investment in CMBC, and the

potential sensitivity of the recoverable amount of the investment

to a change in assumptions, an impairment review was undertaken

under IAS 36 'Impairment of Assets'. The recoverable amount of our

investment was estimated on a value in use basis. This was based on

forecast cash flows approved by the board of CMBC, which were

reviewed by management and CMBC's external auditors. The impairment

review indicated there was sufficient headroom over the carrying

amount and consequently no impairment has been recognised. A number

of different potential downside scenarios were considered and

changing each key assumption to the limit of the reasonably

possible downside did not result in impairment. A severe downside

scenario which considered a combination of reduced dividends

together with a decrease in growth rate and a large increase in

discount rate could lead to a small impairment.

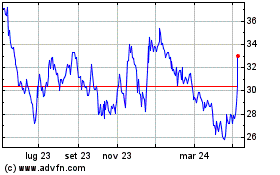

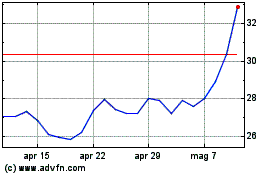

Market Capitalisation: Uncertainty and restricted trading during

the last few years, including the pandemic and cost-of-living

crisis, have negatively impacted our share price. This share price

suppression, which also affects our industry peers and other UK

listed entities to varying extents, has resulted in a gap between

our market capitalisation and asset values. The Group has performed

a market capital gap analysis to determine whether an impairment of

the asset values is required. The analysis showed that there is

sufficient headroom between the total asset value and enterprise

value such that no impairment is required.

Key estimates and significant judgements

Under IFRS the Group is required to make estimates and

assumptions that affect the application of policies and reported

amounts. Estimates and judgements are continually evaluated and are

based on historical experience and other factors including

expectations of future events that are believed to be reasonable

under the circumstances. Actual results may differ from these

estimates. The Group's key assumptions and significant judgements

are:

-- Non-underlying items - determination of items to be classified as non-underlying.

-- Property, plant, and equipment - valuation of effective freehold land and buildings.

-- Retirement benefits - actuarial assumptions in respect of the

defined benefit pension plan, which include discount rates, rates

of increase in pensions, inflation rates and life expectancies.

-- Financial instruments - valuation of derivative financial instruments.

-- CMBC - recoverable amount of the investment in associate estimated on a value in use basis.

Notes:

-- Prior period was a 52-week period to 1 October 2022.

-- The Group uses a number of alternative performance measures

(APMs) to enable management and users of the financial statements

to better understand elements of financial performance in the

period. APMs are explained and reconciled in the appendix to the

financial statements.

GROUP INCOME STATEMENT

For the 52 weeks ended 30 September 2023

2023 2022

-------------------------------------- -----------------------------------------

Non-

underlying Non-

Underlying(1) (1) Total Underlying(1) underlying(1) Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 872.3 - 872.3 799.6 - 799.6

Net operating expenses (747.5) (34.6) (782.1) (684.2) 26.7 (657.5)

Income from associates 9.9 - 9.9 3.3 - 3.3

Operating profit/(loss) 134.7 (34.6) 100.1 118.7 26.7 145.4

----------------------------- -------------- ------------ -------- -------------- --------------- --------

Finance costs (100.4) - (100.4) (91.9) - (91.9)

Finance income 1.2 - 1.2 0.9 0.5 1.4

Interest rate swap

movements - (21.6) (21.6) - 109.2 109.2

Contingent consideration

fair value movement - - - - (0.7) (0.7)

----------------------------- -------------- ------------ -------- -------------- --------------- --------

Net finance (costs)/income (99.2) (21.6) (120.8) (91.0) 109.0 18.0

--------

Profit/(loss) before

taxation 35.5 (56.2) (20.7) 27.7 135.7 163.4

Taxation (3.5) 14.9 11.4 (0.2) (26.0) (26.2)

----------------------------- -------------- ------------ -------- -------------- --------------- --------

Profit/(loss) for

the period attributable

to equity shareholders 32.0 (41.3) (9.3) 27.5 109.7 137.2

----------------------------- -------------- ------------ -------- -------------- --------------- --------

The results for the current period reflect the 52 weeks ended 30

September 2023 and the results for the prior period reflect the 52

weeks ended 1 October 2022.

2023 2022

Earnings/(loss) per share: p p

------------------------------------------ ------ -----

Basic (loss)/earnings per share (1.5) 21.7

Basic underlying(1) earnings per share 5.1 4.3

Diluted (loss)/earnings per share (1.5) 21.4

Diluted underlying(1) earnings per share 5.1 4.3

------------------------------------------- ------ -----

(1) Alternative performance measures (APMs) are defined and

reconciled to a statutory equivalent in the APM section of these

Preliminary Results.

GROUP STATEMENT OF COMPREHENSIVE INCOME

For the 52 weeks ended 30 September 2023

2023 2022

GBPm GBPm

----------------------------------------------------------- ------- -------

(Loss)/profit for the period (9.3) 137.2

------------------------------------------------------------ ------- -------

Items of other comprehensive income that may subsequently

be reclassified to profit or loss

(Losses)/gains arising on cash flow hedges (3.0) 23.9

Transfers to the income statement on cash flow

hedges 11.4 17.0

Other comprehensive income/(expense) of associates 0.8 (0.8)

Tax on items that may subsequently be reclassified

to profit or loss (2.1) (10.2)

------------------------------------------------------------ ------- -------

7.1 29.9

------------------------------------------------------------ ------- -------

Items of other comprehensive income that will

not be reclassified to profit or loss

Remeasurement of retirement benefits (9.2) 23.3

Unrealised surplus on revaluation of properties 95.6 105.8

Reversal of past revaluation surplus (93.9) (34.3)

Tax on items that will not be reclassified to profit

or loss (0.2) (20.5)

------------------------------------------------------------ ------- -------

(7.7) 74.3

------------------------------------------------------------ ------- -------

Other comprehensive (expense)/income for the period (0.6) 104.2

------------------------------------------------------------ ------- -------

Total comprehensive (expense)/income for the period

attributable to equity shareholders (9.9) 241.4

------------------------------------------------------------ ------- -------

The results for the current period reflect the 52 weeks ended 30

September 2023 and the results for the prior period reflect the 52

weeks ended 1 October 2022.

GROUP CASH FLOW STATEMENT

For the 52 weeks ended 30 September 2023

2023 2022

GBPm GBPm

---------------------------------------------------------- -------- --------

Operating activities

(Loss)/profit for the period (9.3) 137.2

Taxation (11.4) 26.2

Net finance costs/(income) 120.8 (18.0)

Depreciation and amortisation 45.5 44.2

Working capital movement (29.0) (31.8)

Non-cash movements 12.3 (30.4)

Decrease in provisions and other non-current liabilities (0.8) (7.0)

Difference between defined benefit pension contributions

paid and amounts charged (7.6) (7.3)

Dividends from associates 21.6 19.4

Income tax (paid)/received (0.9) 1.5

----------------------------------------------------------- -------- --------

Net cash inflow from operating activities 141.2 134.0

----------------------------------------------------------- -------- --------

Investing activities

Interest received 1.8 0.9

Sale of property, plant and equipment and assets

held for sale 51.3 9.9

Purchase of property, plant and equipment and

intangible assets (65.3) (70.1)

Disposal of subsidiary - 28.2

Finance lease capital repayments received 2.5 2.7

Net transfer (to)/from other cash deposits (0.1) 0.2

Net cash outflow from investing activities (9.8) (28.2)

----------------------------------------------------------- -------- --------

Financing activities

Interest paid (93.1) (79.4)

Arrangement costs of bank facilities (4.0) -

Repayment of securitised debt (39.4) (37.4)

Advance of bank borrowings 14.0 25.0

Net repayments of capital element of lease liabilities (5.1) (8.5)

Repayment of other borrowings (5.0) (10.0)

Net cash outflow from financing activities (132.6) (110.3)

----------------------------------------------------------- -------- --------

Net decrease in cash and cash equivalents (1.2) (4.5)

----------------------------------------------------------- -------- --------

The cash flows for the current period reflect the 52 weeks ended

30 September 2023 and the cash flows for the prior period reflect

the 52 weeks ended 1 October 2022.

GROUP BALANCE SHEET

As at 30 September 2023

30 September 1 October

2023 2022

GBPm GBPm

---------------------------------- -------------- ----------

Non-current assets

Intangible assets 32.9 35.1

Property, plant, and equipment 2,064.8 2,111.0

Interests in associates 250.9 260.3

Other non-current assets 15.0 17.9

Deferred tax assets 0.9 -

Retirement benefit surplus 12.9 15.1

Derivative financial instruments 2.7 1.8

2,380.1 2,441.2

---------------------------------- -------------- ----------

Current assets

Derivative financial instruments 1.1 3.3

Inventories 14.9 12.6

Trade and other receivables 26.9 30.1

Current tax assets 0.4 -

Other cash deposits 3.1 3.0

Cash and cash equivalents 26.5 27.7

------------------------------------- -------------- ----------

72.9 76.7

Assets held for sale 1.4 4.8

------------------------------------- -------------- ----------

74.3 81.5

---------------------------------- -------------- ----------

Current liabilities

Borrowings (65.9) (64.1)

Trade and other payables (170.4) (204.4)

Current tax liabilities - (1.2)

Provisions for other liabilities

and charges (1.4) (1.0)

------------------------------------- -------------- ----------

(237.7) (270.7)

---------------------------------- -------------- ----------

Non-current liabilities

Borrowings (1,529.5) (1,560.6)

Derivative financial instruments (37.4) (25.5)

Other non-current liabilities (7.1) (6.5)

Provisions for other liabilities

and charges (2.6) (3.3)

Deferred tax liabilities - (8.0)

(1,576.6) (1,603.9)

---------------------------------- -------------- ----------

Net assets 640.1 648.1

Shareholders' equity

Equity share capital 48.7 48.7

Share premium account 334.0 334.0

Revaluation reserve 412.1 417.1

Capital redemption reserve 6.8 6.8

Hedging reserve (44.4) (50.7)

Own shares (110.6) (110.9)

Retained earnings (6.5) 3.1

------------------------------------- -------------- ----------

Total equity 640.1 648.1

------------------------------------- -------------- ----------

GROUP STATEMENT OF CHANGES IN EQUITY

For the 52 weeks ended 30 September 2023

Equity Share Capital

share premium Revaluation redemption Hedging Own Retained Total

capital account reserve reserve reserve shares earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

At 2 October 2022 48.7 334.0 417.1 6.8 (50.7) (110.9) 3.1 648.1

Loss for the period - - - - - - (9.3) (9.3)

Remeasurement of

retirement benefits - - - - - - (9.2) (9.2)

Tax on remeasurement

of retirement benefits - - - - - - 2.3 2.3

Losses on cash flow

hedges - - - - (3.0) - - (3.0)

Transfers to the

income statement

on cash flow hedges - - - - 11.4 - - 11.4

Tax on hedging reserve

movements - - - - (2.1) - - (2.1)

Other comprehensive

income of associates - - - - - - 0.8 0.8

Property revaluation - - 95.6 - - - - 95.6

Property impairment - - (93.9) - - - - (93.9)

Deferred tax on

properties - - (2.5) - - - - (2.5)

Total comprehensive

(expense)/income - - (0.8) - 6.3 - (15.4) (9.9)

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

Share-based payments - - - - - - 0.4 0.4

Sale of own shares - - - - - 0.3 (0.3) -

Transfer disposals

to retained earnings - - (5.0) - - - 5.0 -

Transfer tax to

retained earnings - - 0.8 - - - (0.8) -

Changes in equity

of associates - - - - - - 1.5 1.5

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

Total transactions

with owners - - (4.2) - - 0.3 5.8 1.9

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

At 30 September

2023 48.7 334.0 412.1 6.8 (44.4) (110.6) (6.5) 640.1

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

For the 52 weeks ended 1 October 2022

Equity Share Capital

share premium Revaluation redemption Hedging Own Retained Total

capital account reserve reserve reserve shares earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------- --------- --------- ------------ ------------ --------- -------- ---------------- --------

At 3 October 2021 48.7 334.0 360.5 6.8 (81.4) (111.1) (151.1) 406.4

Profit for the

period - - - - - - 137.2 137.2

Remeasurement of

retirement

benefits - - - - - - 23.3 23.3

Tax on

remeasurement

of retirement

benefits - - - - - - (5.8) (5.8)

Gains on cash flow

hedges - - - - 23.9 - - 23.9

Transfers to the

income statement

on cash flow

hedges - - - - 17.0 - - 17.0

Tax on hedging

reserve

movements - - - - (10.2) - - (10.2)

Other

comprehensive

expense of

associates - - - - - - (0.8) (0.8)

Property

revaluation - - 105.8 - - - - 105.8

Property

impairment - - (34.3) - - - - (34.3)

Deferred tax on

properties - - (14.7) - - - - (14.7)

Total

comprehensive

income - - 56.8 - 30.7 - 153.9 241.4

------------------- --------- --------- ------------ ------------ --------- -------- ---------------- --------

Share-based

payments - - - - - - 0.5 0.5

Sale of own shares - - - - - 0.2 (0.2) -

Transfer disposals

to retained

earnings - - (0.2) - - - 0.2 -

Changes in equity

of associates - - - - - - (0.2) (0.2)

------------------- --------- --------- ------------ ------------ --------- -------- ---------------- --------

Total transactions

with owners - - (0.2) - - 0.2 0.3 0.3

------------------- --------- --------- ------------ ------------ --------- -------- ---------------- --------

At 1 October 2022 48.7 334.0 417.1 6.8 (50.7) (110.9) 3.1 648.1

------------------- --------- --------- ------------ ------------ --------- -------- ---------------- --------

NOTES

For the 52 weeks ended 30 September 2023

1 Accounting policies

The Group's principal accounting policies are set out below:

Basis of preparation

These consolidated financial statements for the 52 weeks ended

30 September 2023 (2022: 52 weeks ended 1 October 2022) have been

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted within the UK and in accordance with

the requirements of the Companies Act 2006. The financial

statements have been prepared under the historical cost convention

as modified by the revaluation of certain items, principally

effective freehold land and buildings, certain financial

instruments, retirement benefits and share-based payments, as

explained below.

Going concern

The cost-of-living crisis and inflationary pressures has led to

lower underlying(1) profit and operating cashflows than would

otherwise have resulted had these macroeconomic conditions not

existed.

The Group's sources of funding include its securitised debt, a

GBP300.0 million bank facility available until January 2025 (of

which GBP229.0 million was drawn at 30 September 2023), a GBP40.0

million private placement in place until January 2025, and a GBP5.0

million seasonal overdraft facility which extends to GBP20.0

million from 25 January to 6 May and 1 July to 12 August each year

(of which GBPnil was drawn at 30 September 2023).

There are two covenants associated with the Group's securitised

debt - free cash flow to debt service coverage ratio (FCF DSCR) and

Net Worth. The FCF DSCR is a measure of free cash flow to debt

service for the group headed by Marston's Pubs Parent Limited and

is required to be a minimum of 1.1 over both a two-quarter and

four-quarter period, and the Net Worth is derived from the net

assets of that group of companies.

There are three covenants associated with the Group's bank and

private placement borrowings for the non-securitised group of

companies - Debt Cover, Interest Cover and Liquidity. The Debt

Cover covenant is a measure of net borrowings to EBITDA which is a

maximum of 4.5 times from 30 September 2023, reducing to 4.0 times

from 29 June 2024. The Interest Cover covenant is a measure of

EBITDA to finance charges, which is a minimum of 1.5 times from 30

September 2023, rising on a stepped basis to 1.75 times from 30

December 2023 and 2.0 times from 29 June 2024. The Liquidity

covenant is a measure of headroom on the Group's bank and private

placement borrowings, which is a minimum of GBP35.0 million on the

last day of each fiscal month from 30 September 2023, increasing to

GBP45.0 million from 27 July 2024.

The Directors have performed an assessment of going concern over

the period of 12 months from the date of signing these financial

statements, to assess the adequacy of the Group's financial

resources. In performing their assessment, the Directors considered

the Group's financial position and exposure to principal risks,

including the cost-of-living crisis and inflationary pressure. The

Group's base case forecasts assume moderate sales price increases

and operational costs (that have not already been secured) rising

broadly in line with inflation. On the Group's base case forecast,

no covenants are forecast to be breached within the next 12 months

and the Group has adequate liquidity throughout the going concern

period.

The Directors have also considered a severe but plausible

downside scenario, incorporating a 5% reduction in sales volume as

a consequence of the cost-of-living crisis and current inflationary

pressures along with a reasonably plausible increase in costs

compared to the base case forecast. The conclusion of this

assessment was that the Directors are satisfied that the Group has

adequate liquidity to withstand such a severe but plausible

downside scenario. However, in this severe but plausible downside

scenario only, even after factoring in mitigations under the

control of management such as reductions in discretionary spend,

the Group would be required to obtain covenant amendments in

respect of its Interest Cover covenant associated with the Group's

bank and private placement borrowings in the outer quarters of the

going concern period. In such a severe but plausible downside, the

Group has a number of options. The Group would be very confident in

leveraging the supportive relationship it has with its lenders and

renegotiate the terms of its financing in advance of any covenant

amendment being required or the Group would seek covenant

amendments. Whilst there is no certainty since it requires the

agreement of its lenders, based on covenant amendments previously

secured, the successful amend and extend to the RCF and private

placement during the period and the continued positive

relationships, the Directors believe they will be able to secure

any such amendments required.

Considering the above, the Directors are satisfied that the

Group and the Company have adequate resources to continue in

operational existence for the foreseeable future, being at least 12

months from the date of signing these financial statements. For

this reason, the Directors continue to adopt the going concern

basis of accounting in preparing these financial statements.

However, a material uncertainty exists as a result of the potential

requirement to obtain covenant amendments in the severe but

plausible downside scenario, which may cast significant doubt on

the Group's and the Company's ability to continue as a going

concern and, therefore, to continue realising their assets and

discharging their liabilities in the normal course of business. The

financial statements do not include any adjustments that would

result from the basis of preparation being inappropriate.

2 Segment reporting

The Group is considered to have one operating segment under IFRS

8 'Operating Segments' and therefore no disclosures are presented.

This is in line with the reporting to the chief operating decision

maker and the operational structure of the business. The measure of

profit or loss reviewed by the chief operating decision maker is

underlying(1) profit/(loss) before tax.

Geographical areas

All of the Group's revenue is generated in the UK. All of the

Group's assets are located in the UK.

3 NON-Underlying (1) items

2023 2022

GBPm GBPm

------------------------------------------------------------ ----- --------

Non-underlying (1) operating items

Impairment/(impairment reversal) of freehold and leasehold

properties 31.2 (21.6)

Special discretionary pension increase 0.5 -

Reorganisation, restructuring and relocation costs 2.9 -

VAT claims - (5.1)

34.6 (26.7)

------------------------------------------------------------ ----- --------

Non-underlying (1) non-operating items

Interest on VAT claims - (0.5)

Interest rate swap movements 21.6 (109.2)

Contingent consideration fair value movement - 0.7

21.6 (109.0)

------------------------------------------------------------ ----- --------

Total non-underlying (1) items 56.2 (135.7)

------------------------------------------------------------ ----- --------

Impairment/(impairment reversal) of freehold and leasehold

properties

At 2 July 2023 the Group's effective freehold properties were

revalued by independent chartered surveyors on an open market value

basis. The Group also undertook an impairment review of its

leasehold properties in the current and prior period.

The revaluation and impairment adjustments in respect of the

above were recognised in the revaluation reserve or income

statement as appropriate. The amount recognised in the income

statement comprises:

2023 2022

GBPm GBPm

----------------------------------------------------- ------- -------

Impairment of property, plant and equipment 70.9 48.2

Reversal of past impairment of property, plant, and

equipment (40.0) (69.8)

Impairment of assets held for sale - 0.3

Reversal of past impairment of assets held for sale - (0.6)

Valuation fees 0.3 0.3

31.2 (21.6)

----------------------------------------------------- ------- -------

Special discretionary pension increase

A past service cost of GBP0.5 million (2022: GBPnil) arose in

the current period as a result of a one-off, and discretionary,

increase to pensions in payment for members of the Marston's PLC

Pension and Life Assurance Scheme.

Reorganisation, restructuring and relocation costs

During the current period the Group commenced the implementation

of an operational programme to simplify the business and drive

efficiencies. The cost of implementing this programme in the

current period was GBP2.9 million (2022: GBPnil).

VAT claims

The Group submitted claims to HM Revenue & Customs (HMRC) in

respect of the VAT treatment of gaming machines from 1 January 2006

to 31 January 2013. Following detailed information gathering to

support the claims made the Group recognised the estimated amounts

receivable, including interest, in the prior period. The claims

were settled by HMRC in the current period.

Interest rate swap movements

The Group's interest rate swaps are revalued to fair value at

each balance sheet date. For interest rate swaps which were

designated as part of a hedging relationship a loss of GBP3.0

million (2022: gain of GBP23.9 million) has been recognised in the

hedging reserve in respect of the effective portion of the fair

value movement and GBP2.1 million (2022: GBP6.2 million) has been

reclassified from the hedging reserve to underlying(1) finance

costs in the income statement in respect of the cash paid in the

period. A loss of GBP0.6 million (2022: GBP1.3 million) in respect

of the ineffective portion of the fair value movement has been

recognised within non-underlying(1) items in the income statement.

An amount representing the cash paid of GBP1.4 million (2022:

GBP1.5 million) has subsequently been transferred from

non-underlying(1) items to underlying(1) finance costs to ensure

that underlying(1) finance costs reflect the resulting fixed rate

paid on the associated debt. As such there is an overall gain of

GBP0.8 million (2022: GBP0.2 million) recognised within

non-underlying(1) items. In addition, GBP9.3 million (2022: GBP10.8

million) of the balance remaining in the hedging reserve in respect

of discontinued cash flow hedges has been reclassified to the

income statement within non-underlying(1) items.

For interest rate swaps which were not designated as part of a

hedging relationship a loss of GBP9.5 million (2022: gain of

GBP111.2 million) in respect of the fair value movement has been

recognised within non-underlying(1) items in the income statement.

An amount representing the cash received of GBP3.6 million (2022:

cash paid of GBP8.6 million) has subsequently been transferred from

non-underlying(1) items to underlying(1) finance costs to ensure

that underlying(1) finance costs reflect the resulting fixed rate

paid on the associated debt. As such there is an overall loss of

GBP13.1 million (2022: gain of GBP119.8 million) recognised within

non-underlying(1) items, which is equal to the change in the

carrying value of the interest rate swaps in the period.

Contingent consideration fair value movement

The contingent consideration on the disposal of Marston's Beer

Company Limited was initially recognised at its fair value at the

date of disposal and was subsequently remeasured at its fair value

at 2 October 2021 and the date of settlement during the prior

period. The movement in fair value was recognised within

non-underlying(1) items in the prior period.

Impact of taxation

The current tax charge relating to the above non-underlying(1)

items amounts to GBPnil (2022: GBP1.4 million). The deferred tax

credit relating to the above non-underlying(1) items amounts to

GBP14.9 million (2022: charge of GBP24.6 million).

4 Taxation

2023 2022

Income statement GBPm GBPm

Current tax

Current period 0.1 0.2

Adjustments in respect of prior periods (0.3) (0.3)

Charge in respect of tax on non-underlying(1) items - 1.4

(0.2) 1.3

----------------------------------------------------------- ------- ------

Deferred tax

Current period 5.5 0.1

Adjustments in respect of prior periods (1.8) 0.2

(Credit)/charge in respect of tax on non-underlying(1)

items (14.9) 24.6

(11.2) 24.9

----------------------------------------------------------- ------- ------

Taxation (credit)/charge reported in the income statement (11.4) 26.2

----------------------------------------------------------- ------- ------

2023 2022

Statement of comprehensive income GBPm GBPm

Remeasurement of retirement benefits (2.3) 5.8

Impairment and revaluation of properties 2.5 14.7

Hedging reserve movements 2.1 10.2

Taxation charge reported in the statement of comprehensive

income 2.3 30.7

------------------------------------------------------------ ------ -----

The actual tax rate for the period is higher (2022: lower) than

the standard rate of corporation tax of 22% (2022: 19%). The

differences are explained below:

2023 2022

Tax reconciliation GBPm GBPm

---------------------------------------------------------- ------- ------

(Loss)/profit before tax (20.7) 163.4

---------------------------------------------------------- ------- ------

(Loss)/profit before tax multiplied by the corporation

tax rate of 22% (2022: 19%) (4.6) 31.0

Effect of:

Adjustments in respect of prior periods (2.1) (0.1)

Change in deferred tax asset not recognised 1.0 (8.5)

Net deferred tax credit in respect of land and buildings (1.2) (1.8)

Costs not deductible for tax purposes 0.1 -

Share of income of associate (2.2) (0.6)

Other amounts on which tax relief is available (1.2) (2.4)