TIDMNXT

RNS Number : 8502U

Next PLC

04 August 2022

NEXT PLC

Trading Statement - 4 August 2022

OVERVIEW

Sales in the first half of the year have been dominated by a

sharp reversal of last year's lockdown trends. Sales in Retail

stores recovered, while Online growth appears to have reverted back

to its longer term trajectory. Many product trends have also

returned to pre-pandemic norms. Lockdown winners such as Home and

sportswear retreated, while formalwear returned to favour. As

anticipated, Online returns rates and surplus stock also reverted

to pre-lockdown levels.

HEADLINES

-- Q2 full price sales (1) up +5.0% (2) versus last year, GBP50m

ahead of our previous guidance.

-- Full price sales guidance for the second half maintained at +1.0%.

-- Full year profit guidance increased by +GBP10m to GBP860m (+4.5% versus last year).

-- Earnings Per Share (EPS) guidance increased to +7.2% versus last year.

(1) Full price sales are total sales excluding VAT, less items

sold in our Sale events, Clearance operations and Total

Platform.

(2) Full price sales against last year, excluding Russia and

Ukraine, were up +6.3%.

FULL PRICE SALES PERFORMANCE

Full price sales in the quarter were +4.7% stronger than we

expected. In part, we believe this over-performance has been the

result of unusually warm and dry weather in June and July. A marked

return to formal dressing, perhaps driven by pent up demand for

social events (weddings etc.), has also played to the strengths of

the NEXT brand.

Retail and Online Sales Trends

At first sight, our full price sales performance against last

year suggests that (1) growth Online has ground to a halt and that

(2) Retail is having something of a renaissance. This is certainly

the case on a one year basis. But we think that these changes

reflect a short term reversal of pandemic trends, and are unlikely

to be indicative of longer term trends in consumer behaviour.

Last year, our stores were closed for most of the first quarter.

Even when they reopened we believe that many customers remained

wary of visiting shops. During this time we think Online shopping

was inflated by at least as much as Retail sales were depressed.

The charts below show the sales performance of our Online and

Retail businesses against one year (red line) and the compound

annual growth rate (CAGR) against the last pre-pandemic year, three

years ago (blue line). The three year CAGR is much more consistent

than the growth against last year and, we believe, gives a clearer

picture of long term consumer trends.

Click or paste the following link into your web browser to view

the charts titled 'Online Full Price Sales Performance by Month'

and 'Retail Full Price Sales Performance by Month'. Refer to page 1

for these charts.

http://www.rns-pdf.londonstockexchange.com/rns/8502U_1-2022-8-3.pdf

Quarterly Sales by Business

A more detailed breakdown of our sales performance by business

division is given in the tables below for the first and second

quarter. The first table shows the comparison against last year and

the second against three years ago.

One Year Comparison Versus 2021/22

Full price sales (VAT exclusive)

by division Q1 to 30 April Q2 to 30 July

================================= ============== =============

Online - 11.1% +0.2%

Retail +284.5% +12.0%

============== =============

Total Product full price sales +22.1% +4.5%

Finance interest income +11.4% +13.0%

============== =============

Total full price sales including

interest income +21.3% +5.0%

Three Year Comparison Versus 2019/20

Full price sales (VAT exclusive)

by division Q1 to 30 April Q2 to 30 July

================================= ============== =============

Online +47.0% +44.4%

Retail - 8.2% +4.7%

============== =============

Total Product full price sales +21.3% +25.5%

Finance interest income - 2.2% +2.4%

============== =============

Total full price sales including

interest income +19.5% +23.8%

A Resurgence in Retail?

During Q2, Retail's full price sales performance has been much

better than we had anticipated and up (+4.7%) against three years

ago. We had planned that our stores would be down against 2019,

following the long run of negative like-for-like retail sales we

have experienced since 2016.

We suspect that the apparent improvement in the fortunes of our

stores is, to some extent, down to the number of competing stores

that have closed in the last three years. This is supported by ONS

industry statistics (3) for February to June which suggest that the

total money spent on clothing in all UK retail stores is down -6%

compared to three years ago.

(3) Two ONS datasets are used: (1) total retail spend on

clothing in the UK and (2) the percentage of sales achieved online.

Combining these two provides the total spend in physical shops.

Data sources: (1) Retail sales pound data VaINSAT, 22 July 2022 and

(2) Retail Sales Index internet sales ISCPNSA3, 22 July 2022.

Longer Term Online Growth Rates

In the first half, the CAGR of our Online business over the last

three years is very similar to the CAGR experienced in the three

year period pre-COVID, as shown in the table below. Of course,

these numbers do not imply Online sales will continue to grow at

+13.4%, but they do demonstrate that our current Online sales

growth is not as unusual as it first appears.

Three years Three years pre-COVID

July 2019 - 2016/17 - 2019/20

July 2022

(Six months) (Full year)

=============================== =============== ======================

Online compound annual growth

in sales +13.4% +12.6%

=============== ======================

ONLINE RETURNS RATES - BACK TO PRE-COVID LEVELS

As anticipated, returns rates have reverted and are currently

close to pre-pandemic levels at 42%. This follows two years of

exceptionally low returns rates during the pandemic. The low

returns rates during the pandemic were mainly driven by product

mix, with sales of low returning categories such as Home,

childrenswear and sportswear far exceeding their normal levels.

Click or paste the following link into your web browser to view

the chart titled 'Online Full Price Returns Rates Five Year View'.

Refer to page 3 for this chart.

http://www.rns-pdf.londonstockexchange.com/rns/8502U_1-2022-8-3.pdf

OF SEASON SALE

Stock Going into the Sale

Last year, our stock for Sale was exceptionally low mainly as a

result of industry wide stock shortages. So this year Sale stock

was +30% up on last year. However, against three years ago, Sale

stock grew by +25%, broadly in line with the growth in full price

sales over that period (as set out in the table below). Once again,

it is last year's figure which is unusual, with this year's surplus

returning to more normal levels.

H1 full price

product sales H1

(exc. interest surplus Difference

income) stock in growth

========================== =============== ======== ==========

Growth versus last year

(2021/22) +12% +30% +18%

Growth versus three years

(2019/20) +23% +25% +2%

Clearance Rates

To date, our clearance rates have been below our expectations.

As mentioned earlier, warmer weather has been very helpful for full

price sales during the quarter. However, the particularly hot

weather experienced on the first two days of our Sale encouraged

customers to stay away from shops and particularly hampered

clearance of heavier weight products. The additional cost of the

lower clearance rates is reflected in our revised central profit

guidance and has been more than offset by the benefit of better

full price sales.

NEXT FINANCE

We expect NEXT Finance profit to be in line with the guidance of

GBP160m previously issued in March and for our customer receivables

balance to close the year at GBP1.28bn, which would be up +10%

versus last year and ahead of pre-COVID levels. As set out in the

table below, defaults show a marginal deterioration against last

year but are still materially better than pre-COVID levels.

July 2022 July 2021 July 2020 July 2019

======================================== ========= ========= ========= =========

Defaults as a % of customer receivables

balance 1.7% 1.6% 1.9% 2.0%

GUIDANCE FOR FULL PRICE SALES, PROFIT AND EPS

New Central Guidance

The GBP10m increase in our central guidance for profit before

tax is explained in the table below. GBP15m of additional profit

has come from better than expected full price sales in the first

half. Retail sales were a larger percentage of our total full price

sales in the quarter, which improved margin by +GBP6m, and we are

expecting a similar gain in the second half. These increases have

been partially offset by additional costs as set out in the table

below.

Previous profit before tax guidance (GBPm) 850

========================================================== === ====

Q2 full price sales beats +15

Q2 increase in participation of Retail sales +6

H2 expected increase in participation of Retail sales +8

========================================================== === ====

Total increases in guidance profit +29

Lower clearance rates of surplus stock - 6

Higher logistics costs (mainly fuel) - 6

Higher Technology costs (mainly acceleration of developer

recruitment) - 4

Staff incentives / other - 3

========================================================== === ====

Total increase in guidance costs - 19

========================================================== === ====

Revised profit before tax guidance 860

Guidance Range

The stronger than expected sales performance in Q2 is not

expected to continue into the second half and we are maintaining

our sales guidance for the remainder of the year at +1%. Our

caution stems from two factors, we believe that: (1) an unusually

warm summer boosted sales in the first half and we do not expect a

similar weather windfall in the second half; and (2) the impact of

inflation on consumer spending is likely to worsen in the second

half. Our latest full price sales and profit guidance ranges for

the full year are set out in the table below.

Previous

Central central

Guidance for 2022/23 Lower guidance Upper guidance

================================== ======= ========= ======= =========

H1 full price sales versus

2021/22 (actual) +12.4% +12.4% +12.4% -

H2 full price sales versus

2021/22 - 3.0% +1.0% +5.0% -

======= ========= ======= =========

Full year full price sales

versus 2021/22 +4.0% +6.2% +8.4% +5.0%

Profit before tax GBP820m GBP860m GBP890m GBP850m

Profit before tax versus 2021/22 - 0.4% +4.5% +8.1% +3.3%

Earnings Per Share 543.3p 569.1p 588.5p 557.3p

Earnings Per Share versus 2021/22 +2.3% +7.2% +10.9% +5.0%

======= ========= ======= =========

SHARE BUYBACKS

So far, in this financial year, we have spent GBP224m on share

buybacks at an average price paid per share of GBP63.85, which

equates to 3.5m shares. This reduces the number of shares in issue

by 2.6%. If profits are in line with our guidance of GBP860m, then

the Equivalent Rate of Return (4) (ERR) on these buybacks will be

10.6%.

(4) Equivalent rate of return (ERR) is calculated by dividing

the anticipated pre-tax profits by the market capitalisation at the

start of the financial year (January 2022). NB - Market

capitalisation is calculated based on the shares in circulation, so

excludes shares in the NEXT Employee Share Option Trust.

INTERIM RESULTS

We are scheduled to announce our results for the first half of

the year on Thursday 29 September 2022.

Forward Looking Statements

Certain statements in this Trading Update are forward looking

statements. These statements may contain the words "anticipate",

"believe", "intend", "aim", "expects", "will", or words of similar

meaning. By their nature, forward looking statements involve risks,

uncertainties or assumptions that could cause actual results or

events to differ materially from those expressed or implied by

those statements. As such, undue reliance should not be placed on

forward looking statements. Except as required by applicable law or

regulation, NEXT plc disclaims any obligation or undertaking to

update these statements to reflect events occurring after the date

these statements were published.

Date: Embargoed until 07:00 hrs, Thursday

4 August 2022

Contacts: Amanda James, Group Finance Director Tel: 0333 777

(analyst calls) 8888

Alistair Mackinnon-Musson, Rowbell Tel: 020 7717

PR 5239

Photographs: https://www.nextplc.co.uk/media/image-gallery/campaign-images

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTVXLFBLVLZBBD

(END) Dow Jones Newswires

August 04, 2022 02:00 ET (06:00 GMT)

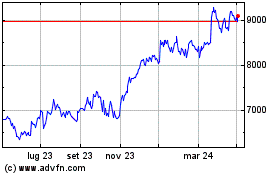

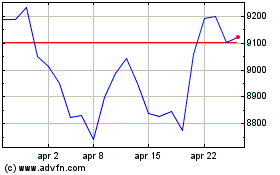

Grafico Azioni Next (LSE:NXT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Next (LSE:NXT)

Storico

Da Apr 2023 a Apr 2024