Proposed Increase in Size of Offer for Subscription and Re-Opening of Offer for Subscription to Further Applications

19 Aprile 2024 - 8:00AM

UK Regulatory

Proposed Increase in Size of Offer for Subscription and Re-Opening

of Offer for Subscription to Further Applications

Octopus Apollo VCT plc

Proposed Increase in Size of Offer for

Subscription and Re-Opening of Offer for Subscription to Further

Applications

Further to the announcement released by Octopus

Apollo VCT plc (the ‘Company’) on 19 March 2024 relating to the

Company's offer for subscription to raise up to £50 million (£35

million with an over-allotment facility of a further £15 million)

in the 2023/2024 and 2024/2025 tax years (the ‘Offer’), the Company

is pleased to announce that it intends, due to investor demand, to

increase the size of the Offer from £50 million to £85 million in

the 2024/2025 tax year (the ‘Offer Increase’) and to reopen the

Offer to further applications on a date to be announced.

Pursuant to an agreement relating to the Offer

Increase between inter alia, the Company and Octopus Investments

Limited, the Company’s investment manager (the ‘Manager’), which

constitutes a smaller related party transaction within Listing Rule

11.1.10 R, the Manager will receive:

- an initial charge of 3 per cent. of

the gross funds raised under the Offer by the Company; and

- a further charge of up to 2.5 per

cent of gross funds raised under the Offer by the Company from

investors who have not invested their money through a financial

intermediary (“Direct Investors”); and

- an additional ongoing charge of

0.5% of the net asset value of the investment amount received by

the Company under the Offer from Direct Investors, payable for up

to nine years, provided the Direct Investors continue to hold the

shares subscribed for under the Offer.

Applicants whose valid applications are received

prior to 5pm on 31 May 2024 will benefit from the costs of the

Offer being reduced by 2%. Applicants whose valid applications are

received after 31 May 2024 and prior to 5pm on 28 June 2024 will

benefit from the costs of the Offer being reduced by 1%. Applicants

will receive these reductions in the form of additional new shares,

which will be paid for by the Manager.

In addition, Applicants who are existing

shareholders of any Octopus managed VCT will be entitled to a 1%

loyalty discount, this discount is available throughout the full

duration of the fundraise. Applicants will receive this reduction

in the form of additional new shares, which will be paid for by the

Manager.

For further enquiries, please contact:

Rachel Peat

Octopus Company Secretarial Services Limited

Tel: +44 (0)80 0316 2067

LEI: 213800Y3XEIQ18DP3O53

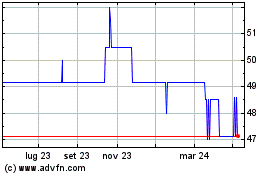

Grafico Azioni Octopus Apollo Vct (LSE:OAP3)

Storico

Da Dic 2024 a Gen 2025

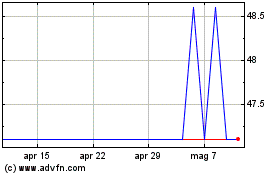

Grafico Azioni Octopus Apollo Vct (LSE:OAP3)

Storico

Da Gen 2024 a Gen 2025