Final Results

Octopus Apollo VCT plc

Final Results

Octopus Apollo VCT plc today announces the final results for the

year ended 31 January 2024.

Octopus Apollo VCT plc (‘Apollo’ or the

‘Company’) is a Venture Capital Trust (VCT) which aims to provide

shareholders with attractive tax-free dividends and long-term

capital growth by investing in a diverse portfolio of predominantly

unquoted companies.

The Company is managed by Octopus Investments

Limited (‘Octopus’ or the ‘Investment Manager’) via its investment

team, Octopus Ventures.

KEY FINANCIALS

|

|

Year to

31 January 2024 |

Year to

31 January 2023 |

|

Net assets (£’000) |

£390,294 |

£349,493 |

|

(Loss)/profit after tax (£’000) |

£(435) |

£34,541 |

|

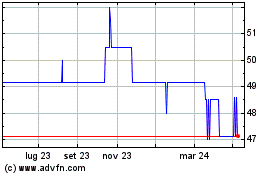

NAV per share1 |

50.5p |

53.2p |

|

Cumulative dividends paid since launch |

87.4p |

84.7p |

|

Total value per share2 |

137.9p |

137.9p |

|

Dividends paid in the year |

2.7p |

2.6p |

|

Dividend yield |

5.1% |

5.2% |

|

Dividend declared3 |

1.3p |

1.3p |

|

Total return per share %4 |

0.0% |

11.2% |

1.

NAV per share is an

alternative performance measure (APM) calculated as net assets

divided by total number of shares, as described in the glossary of

terms.

2. Total value per

share is an APM calculated by adding together NAV per share and

cumulative dividends paid since launch.

3. The declared

second interim dividend of 1.3p per Ordinary share for the year

ended 31 January 2024 was paid on 2 May 2024 to all Ordinary

shareholders on the register on 12 April 2024.

4. Total return per

share % is an APM calculated as movement in NAV in the period plus

dividends paid in the period, divided by the NAV at the beginning

of the period, as described in the glossary of terms.

CHAIR’S STATEMENT

Highlights

- Apollo’s latest fundraise: £50 million

- Five-year Total Return: 41.8%

Performance

I am pleased to present the annual results for

Apollo for the year ended 31 January 2024. The net asset value

(NAV) plus cumulative dividends per share at 31 January 2024 was

137.9p, which is flat on the prior year’s results from

31 January 2023. The NAV per share decreased during the year

from 53.2p to 50.5p which represents, after adding back the 2.7p of

dividends paid in the year, a flat return for the year compared to

11.2% in the previous year. I am satisfied with this stable and

consistent result when it is set against the challenging global

macroeconomic backdrop of the past few years, and it is a testament

to the resilience of the underlying portfolio companies.

In the twelve months to 31 January 2024, we

utilised £70.3 million of our cash resources, comprising

£33.0 million in new and follow-on investments,

£14.7 million in dividends (net of the Dividend Reinvestment

Scheme), £7.4 million in management fees, £6.7 million in share

buybacks, £4.5 million in current asset investments, and £4.0

million in other running costs such as accounting and

administration services and trail commissions. The cash and cash

equivalents balance of £61.2 million at 31 January 2024 represented

15.7% of net assets at that date, compared to 14.1% at January

2023.

Dividends

It is your Board’s policy to maintain a regular dividend flow where

possible to take advantage of the tax-free distributions a VCT can

provide, and work towards the targeted 5% annual dividend yield

policy.

I am pleased to confirm that the Board declared

a second interim dividend of 1.3p per share in respect of the year

ended 31 January 2024. This is in addition to the 1.4p per share

interim dividend paid during the year and brought the total

dividends declared to 2.7p per share for the year, a tax-free yield

of 5.1%. The dividend was paid on 2 May 2024 to shareholders

on the register at 12 April 2024. Since inception, we have now

paid 88.7p in tax-free dividends per share, including the recently

paid dividend.

Apollo’s dividend reinvestment scheme (DRIS) was

introduced in November 2014 and to date 20% of shareholders take

advantage of it as it is an attractive scheme for investors who

would prefer to benefit from additional income tax relief on their

reinvested dividend. I hope that shareholders will find this scheme

beneficial. During the year to 31 January 2024, 8,713,356 shares

were issued under the DRIS, equating to a reinvested amount of

£4.5 million.

Fundraise and share

buybacks

On 16 November 2023, the Company launched a new offer to raise up

to £35 million, with an over-allotment facility of up to £15

million. We were pleased to raise £50 million utilising the

over-allotment facility so the offer closed fully subscribed on 19

March 2024. We would like to take this opportunity to welcome all

new shareholders and thank all existing shareholders for their

continued support. The success of the fundraise and good

performance led the Board to announce, on 19 April 2024, its

intention to increase the offer from £50 million to

£85 million, with applications re-opening on 29 April

2024.

Apollo has continued to buy back and cancel

shares as required. Subject to shareholder approval of resolution

11 at the forthcoming Annual General Meeting (AGM), this facility

will remain in place to provide liquidity to investors who may wish

to sell their shares, subject to Board discretion. Details of the

share buybacks undertaken during the year can be found in the

Directors’ Report.

Dividends, whether paid in cash or reinvested

under the DRIS, and share buybacks are always at the discretion of

the Board, are never guaranteed and may be reviewed when

necessary.

VCT sunset clause

We were pleased in the November Autumn Statement that the

Chancellor extended the VCT sunset clause, meaning VCT relief will

be available to subscribers for shares issued before April 2035,

rather than April 2025.

Board of Directors

Having completed a structured recruitment process, led and managed

by an independent, third-party specialist, I am pleased to announce

the appointment of Gillian Elcock as an independent Non-Executive

Director of the Company, who joined the Board on 1 December 2023.

Gillian was the founder of Denny Ellison, an independent investment

research and training company, and was its Managing Director for

ten years. She is a Non-Executive Director of Melrose Industries

plc, International Biotechnology Trust plc and STS Global Income

& Growth Trust plc. She is also a member of the board of the

CFA Society of the UK. We look forward to benefiting from her

wealth of experience.

AGM

The AGM will be held on 10 July 2024 at 10am. Full details of the

business to be conducted at the AGM are given in the Notice of the

Meeting. Shareholders may recall that in prior years, we have

hosted an online shareholder event. However, having conducted a

review of attendance, this year we will have an Investment

Manager’s update at the AGM, supported by a filmed update from the

Investment Manager which will be available on the website at

https://octopusinvestments.com/apollovct/.

Shareholders’ views are important, and the Board

encourages shareholders to vote on the resolutions by using the

proxy form, or electronically at www.investorcentre.co.uk/eproxy.

The Board has carefully considered the business to be approved at

the AGM and recommends shareholders to vote in favour of all the

resolutions being proposed.

Outlook

2023 has been another challenging year for the UK and global

economies, so I am satisfied to be able to announce a stable total

return (NAV plus dividends paid) for the Company. The geo-political

turbulence and macro-economic headwinds have impacted the

underlying portfolio companies. We have seen growth rates slow down

resulting in lower valuations as companies work through the tougher

trading environment, including elongated sales cycles. Some have

proactively slowed their growth to reduce their cash burn and focus

on efficiency and profitability (where possible) due to the

scarcity and higher cost of capital. There have also been some

company specific performance issues, with several having been more

affected than others by the unpredictable market conditions.

However, the recurring revenue models of most of the companies in

the portfolio have offered some protection against the current

market volatility.

We are starting to see some green shoots of

recovery with more activity on the listed markets, interest rates

starting to stabilise and inflation beginning to moderate. However,

we anticipate a slow and unpredictable route to recovery. The UK

general election creates some uncertainty, global economies are

projected to experience growth below their typical rates and there

is no certainty on geopolitical stability.

The Octopus Ventures team continues to actively

monitor the portfolio companies to be able to understand the full

impact of any challenges that may arise. Members of the team

typically take a seat on the Board of the companies so that they

can provide their expertise and introduce relevant contacts from

their network. The Octopus People and Talent team draws upon years

of experience to offer tailored advice and support to the

portfolios’ management teams and equip them with the tools they

need to succeed and grow as a business.

VCTs have long provided a compelling opportunity

for UK investors to invest in businesses in a tax-efficient way,

and we look forward to Apollo continuing to do so in the coming

year. I would like to conclude by thanking both the Board and the

Octopus team on behalf of all shareholders for their hard work.

Murray Steele

Chair

INVESTMENT MANAGER’S REVIEW

At Octopus our focus is on managing your

investments and providing open communication. Our annual and half

year updates are designed to keep you informed about the progress

of your investment.

Investment Strategy

Most companies in the portfolio operate in sectors where there is a

strong opportunity for growth. In general, we invest in technology

companies in the software-as-a-service (SaaS) space that have

recurring revenues from a diverse base of customers. We also seek

to invest in companies that will provide an opportunity for Apollo

to realise its investment typically within three to seven

years.

Apollo total value growth

The total value has seen a significant increase over the five years

from 118.2p to 137.9p at 31 January 2024. This increase in total

value of 19.7p represents a 41.8% increase on the NAV of 47.1p as

at 31 January 2019. A total of over £77 million has also been

distributed back to shareholders in the form of tax-free dividends.

This includes dividends reinvested as part of the DRIS.

Focus on performance

Apollo made a flat total return per share in the year to 31 January

2024, which I am satisfied with given the challenging economic

environment. The NAV per share decreased from 53.2p to 50.5p,

solely because 2.7p per share of dividends were paid in the period,

representing a dividend yield of 5.1% and bringing cumulative

dividends paid as at 31 January 2024 to 87.4p and the total return

(NAV plus cumulative dividends) to 137.9p per share.

The performance over the five years to 31

January 2024 is shown below:

|

Year ended |

NAV |

Dividends paid in year |

Cumulative

dividends |

NAV + cumulative dividends |

Total return % |

|

31 January 2020 |

45.7p |

3.0p |

74.1p |

119.8p |

3.4% |

|

31 January 2021 |

49.2p |

2.3p |

76.4p |

125.6p |

12.7% |

|

31 January 2022 |

50.2p |

5.7p |

82.1p |

132.3p |

13.6% |

|

31 January 2023 |

53.2p |

2.6p |

84.7p |

137.9p |

11.2% |

|

31 January 2024 |

50.5p |

2.7p |

87.4p |

137.9p |

0.0% |

Over the year, there have been valuation

increases across 22 portfolio companies, delivering a collective

increase of £37.3 million. These increases reflect businesses which

have successfully grown their customer base and revenues through

the period. The majority of strong performers are the B2B

technology companies that Apollo has invested in over recent years,

with notable strong performers including Lodgify, Hasgrove and

Dyscova.

Conversely, 18 companies saw a decrease in

valuation, collectively totalling £30.5 million. The businesses

that saw the most significant reductions were Ryte, Ubisecure, Sova

and Delio. Growth has decelerated in all these companies due to

lengthening enterprise software sales cycles, as well as there

being some company-specific performance issues.

Although this resulted in a net increase in

portfolio company valuations of £6.8 million, the overall return

for Apollo was flat due to the net impact of share allotments,

share buybacks, income received and expenditure.

As part of liquidity management, Apollo

regularly invests in and withdraws from MMFs in order to meet cash

requirements. During the year, on a net basis, an additional £5.6

million was invested in MMFs. Apollo also invested an additional

£4.5 million into the Sequoia Economic Infrastructure Fund (SEQI)

during the year. These investments, in combination with the

previously held investments in SEQI and the MMFs, took the total

liquid investments at 31 January 2024 to £56.4 million (including

interest earned during the year on MMF deposits).

Disposals

Two profitable disposals completed in the year. Firstly, The

Safeguarding Company (TSC) being acquired by Tes Global, a provider

of online educational services and software. Apollo first invested

in TSC in August 2019 and during the investment period, TSC almost

doubled its headcount and expanded its product functionality and

international presence. The exit offered Apollo a 2.5x total return

on its equity investment. Then in November, Apollo sold its shares

in the listed company Ergomed plc, realising £5.1 million in

proceeds which represented a very strong 8.7x total return for

Apollo. Both of these saw Apollo exit its full shareholding in the

companies.

Apollo also received deferred proceeds from the

sale of Luther Pendragon (which originally completed in 2022) and

Countrywide Healthcare repaid the loan that Apollo invested in

2014. In the year, all disposals and loan repayments have in

aggregate returned £18.3 million to Apollo.

|

|

Period ended 31 January 2020 |

Year ended 31 January 2021 |

Year ended 31 January 2022 |

Year ended 31 January 2023 |

Year ended 31 January 2024 |

Total |

|

Dividends (£'000) |

8,345 |

7,471 |

28,366 |

14,323 |

19,165 |

77,670 |

|

Disposal proceeds (£'000) |

17,794 |

3,356 |

53,939 |

3,591 |

18,292 |

96,972 |

New and follow-on

investments

Apollo completed follow-on investments in seven companies and made

four new investments. Together, these totalled £33 million (made up

of £17.8 million invested in the existing portfolio and £15.2

million in new companies). This compares with nine new investments

and eight follow-on investments in the year to 31 January 2023,

together totalling £69.4 million. This slowing of investment rate

is a result of a reduced volume of businesses seeking funding, as

they looked to reduce reliance on further funding or take steps to

make their existing capital go further in the more challenging

macro-economic environment.

Apollo’s new investments were in:

- Zipline Cloud Pty Ltd (t/a

Pendula) £3.9 million – A two-way customer communication

software platform that helps organisations automate high impact

customer engagement to improve customer retention, satisfaction and

drive additional revenue.

- Vaultspeed £6.5

million – A data transformation automation software tool

for organisations undertaking complex IT projects.

- Magic Orange £2.2

million – A provider of IT Financial Management software

that allows customers to better understand and visualise their IT

spend through reporting dashboards.

- Harbiz £2.6

million – A customer engagement focused solution for

wellness professionals and small businesses, offering both booking

and scheduling services, as well as customer interaction to boost

customer experience.

Q&A

How do you value a portfolio company?

Apollo’s unquoted portfolio companies are valued in accordance with

UK Generally Accepted Accounting

Practice (GAAP) accounting standards and the International Private

Equity and Venture Capital (IPEV) valuation guidelines. This means

we value the portfolio at Fair Value, with all companies being

valued at least twice yearly, for our interim (July) and annual

(January) accounts.

What do you mean by ‘Fair

Value’?

When we say Fair Value, we mean the price we expect people would be

willing to buy or sell an asset for, assuming they had all the

information available we do, are knowledgeable parties with no

pre-existing relationship, and that the transaction is carried out

under the normal course of business.

What is the valuation process and

what oversight is there?

The Octopus Investment Managers involved with the portfolio

companies, usually in the capacity of a Director or Observer on the

Board, will draft a trading update and then the Lead Fund Manager

will meet with our dedicated valuations team to offer a verbal

update on each company.

The valuations team, utilising these portfolio

updates, the portfolio companies’ financial reports, progress

towards their KPIs and analysing the wider market in which they

operate, will draft the initial valuation proposals. These are then

reviewed, challenged, and ultimately approved by our Valuations

Lead and Lead Fund Manager. These proposed valuations will then be

sent to the Octopus Valuations Committee and Apollo Board who will

meet to discuss them in detail, revise as necessary and ultimately

sign them off.

There are also more high level valuation

checkpoints throughout the year in advance of share allotments,

DRIS allotments, share buybacks and other share-related

transactions, which means that the portfolio’s valuation is

reviewed to ensure NAV is fairly represented prior to these

corporate actions.

BDO LLP are the external auditors of Apollo and

perform a statutory audit of the annual accounts, which includes

valuations. As part of our continuous improvement processes, we

periodically review the actual realised value of our investments

compared to their last holding value and refine our valuation

methodologies accordingly. This firmly underpins the robustness of

the Apollo valuation process.

Valuations

Methodologies include:

• ‘Price of Recent Investment’ (PRI) is utilised

when there has been a recent transaction which is generally

assessed to be the best indicator of Fair Value as of the

transaction date;

• ‘Market approach’ involves the application of an appropriate

multiple to a performance measure (typically a revenue metric, but

potentially also profit) to derive the value of the business. The

multiple is derived by referring to comparable listed companies or

comparable transactions; and

• ‘Scenario analysis’ is utilised where there is uncertainty around

the potential outcomes available to a company, so a

probability-weighted scenario analysis is considered.

|

Valuation methodology |

By value |

By number of companies |

|

Market Approach |

54.4% |

51.2% |

|

Scenario analysis |

4.7% |

19.4% |

|

PRI |

40.9% |

23.3% |

|

Write-off |

- |

6.2% |

Case studies

Lodgify

lodgify.com

Vacation rental software to help grow bookings

- £9.5 million invested to support

product development.

- £30 million raised in Series B

fundraise

- 100+ countries where Lodgify hosts

have properties

Lodgify empowers vacation rental hosts with the

tools to start and grow their businesses independently. Its

software-as-a-service platform enables hosts to easily create a

website, accept direct bookings and commission-free payments, and

is integrated with today’s popular booking channels like Airbnb,

Vrbo, and Booking.com. It centralises all guest reservations and

communications into a single, user-friendly interface so hosts can

prioritise increasing occupancy and providing excellent service to

their guests.

In 2023, Lodgify launched its AI Assistant, a

messaging tool designed to enhance guest communications by

generating personalised responses with a click of a button. The

company also recently announced its collaboration with Google,

automatically enabling Lodgify-powered websites to appear on top of

organic Google searches to further boost their visibility with

high-intent travellers.

ValueBlue

www.valueblue.com

Accelerating business transformation with enterprise

architecture

- £10 million

invested to scale the team and grow internationally.

- 220 customers

experience more efficient and effective transformation initiatives

thanks to BlueDolphin

- 60% timesaving

on project architecture design

- 45% reduction in operational IT

spend achieved by businesses using BlueDolphin

ValueBlue is the company behind BlueDolphin, an

Enterprise Architecture (EA) SaaS platform that helps organisations

to plan, design and manage business transformation. It allows more

effective collaboration across the entire business and drives

successful outcomes for IT transformation projects.

ValueBlue helps organisations gain insight into

their complex IT landscape, spotting weaknesses, risks, and

opportunities for improvement. Based on these insights, ValueBlue

is used to plan and execute transformation projects, speeding up

innovation and lowering project costs. The company was recently

named a Challenger in the 2023 Gartner Magic Gartner® Magic

Quadrant™ for EA tools.

Top ten investments by value as at 31

January 2024

We are pleased to report a net increase in the value of the

portfolio of £6.8 million since 31 January 2023. This represents an

increase of 2.2% on the value of the portfolio at the start of the

year, leaving total return flat after the impact of income,

expenses and other activities throughout the year. Here, we set out

the cost and valuation of the top ten holdings, which account for

over 54% of the value of the portfolio.

|

|

Portfolio: |

Investment cost (£’000) |

Total valuation including cost (£’000) |

|

1 |

Natterbox |

£17,490 |

£37,558 |

|

2 |

Sova |

£12,250 |

£21,037 |

|

3 |

Lodgify |

£9,541 |

£19,445 |

|

4 |

Interact |

£308 |

£16,125 |

|

5 |

FableData |

£6,000 |

£15,000 |

|

6 |

MentionMe |

£15,000 |

£15,000 |

|

7 |

Tri |

£3,800 |

£14,791 |

|

8 |

ValueBlue |

£10,071 |

£13,926 |

|

9 |

FuseUniversal |

£8,000 |

£12,933 |

|

10 |

Turtl |

£10,000 |

£12,729 |

Top ten

1

N2JB Limited (trading as Natterbox)

Natterbox is a London-based provider of

business-to-business cloud telephone services that are uniquely

integrated into Customer Resource Management (CRM) software

platforms, most notably Salesforce.

www.natterbox.com

|

Investment date: |

March 2018 |

|

Equity held: |

8.5%

(2023: 8.5%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

£150,000

(2023: £150,000) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

£17,092,000

(2021: £14,309,000) |

|

Consolidated loss before tax: |

£(2,568,000)

(2021: £(7,249,000)) |

|

Consolidated net assets: |

£1,022,000

(2021: £2,899,000) |

2

Sova Assessment Limited

Sova Assessment is a UK based end-to-end digital

candidate assessment SaaS platform targeting large blue-chip

organisations conducting large volumes of hiring.

www.sovaassessment.com

|

Investment date: |

November 2020 |

|

Equity held: |

37.2%

(2023: 31.9%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

£93,000

(2023: £83,000) |

|

Last submitted accounts: |

31 March 2023 |

|

Consolidated turnover: |

£5,611,000

(2022: £3,892,000) |

|

Consolidated loss before tax: |

£(5,360,000)

(2022: £(3,344,000)) |

|

Consolidated net assets: |

£(3,593,000)

(2022: £(1,654,000)) |

3

Codebay Solutions Limited (trading as Lodgify)

Lodgify provides a SaaS platform for vacation

rental hosts and property managers to manage their business and

process their bookings.

www.lodgify.com

|

Investment date: |

September 2022 |

|

Equity held: |

11.9%

(2023: 11.9%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

n/a

(2023: n/a) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

€9,315,000

(2021: €6,084,000) |

|

Consolidated loss before tax: |

€(6,239,000)

(2021: €(1,291,000)) |

|

Consolidated net assets: |

€16,946,000

(2021: €4,183,000) |

4

Hasgrove Limited

Hasgrove is the holding company for Interact, a

SaaS business which provides an intranet product which focuses on

the communication and collaboration requirements of large

organisations.

www.interactsoftware.com

|

Investment date: |

December 2016 |

|

Equity held: |

5.7%

(2023: 5.4%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

n/a

(2023: n/a) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

£29,388,000

(2021: £23,046,000) |

|

Consolidated profit before tax: |

£8,099,000

(2021: £6,196,000) |

|

Consolidated net assets: |

£13,136,000

(2021: £6,132,000) |

5

Fable Data Limited

Fable Data provides anonymised, pan-European

consumer transaction data and analysis to institutional investors,

businesses, governments and academics.

www.fabledata.com

|

Investment date: |

December 2022 |

|

Equity held: |

6.2%

(2023: 6.4%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

n/a

(2023: n/a) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

Not available1

(2021: Not available1) |

|

Consolidated loss before tax: |

Not available1

(2021: Not available1) |

|

Consolidated net assets: |

£2,111,000

(2021: £(2,064,000)) |

|

|

|

6

Mention Me Limited

Mention Me is a referral engineering SaaS

platform that helps business to consumer (B2C) businesses acquire

new customers more successfully through their referral channel.

www.mention-me.com

|

Investment date: |

December 2021 |

|

Equity held: |

19.4%

(2023: 19.4%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

n/a

(2023: n/a) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

£10,244,000

(2021: £8,043,000) |

|

Consolidated loss before tax: |

(£5,621,000)

(2021: (£2,765,000) |

|

Consolidated net assets: |

£10,173,000

(2021: £10,162,000) |

7

Triumph Holdings Limited

Triumph has developed a risk based quality

management and monitoring platform for the life sciences

industry.

www.tritrials.com

|

Investment date: |

October 2018 |

|

Equity held: |

52.0%

(2023: 52.0%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

£171,000

(2023: £132,000) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

Not available1

(2021: Not available1) |

|

Consolidated loss before tax: |

Not available1

(2021: Not available1) |

|

Consolidated net assets: |

£2,875,000

(2021: £2,957,000) |

8

Value Blue B.V.

Value Blue is a Netherlands based provider of

enterprise architecture management software, that is growing in the

UK. The product allows companies to map their existing technology

architecture in a single location to easily plan, collaborate and

execute both large scale transformational and everyday IT

projects.

www.valueblue.com

|

Investment date: |

January 2022 |

|

Equity held: |

20.3%

(2023: 14.2%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

£19,000

(2023: n/a) |

|

Last submitted accounts: |

Not available1 |

|

Consolidated turnover: |

Not available1

(2023: Not available1) |

|

Consolidated loss before tax: |

Not available1

(2023: Not available1) |

|

Consolidated net assets: |

Not available1

(2023: Not available1) |

9

Fuse Universal Limited

Fuse is a business-to-business software provider

of a cloud-based learning technology platform for corporates,

founded in 2008 and based in London (with further offices in South

Africa and Australia).

www.fuseuniversal.com

|

Investment date: |

August 2019 |

|

Equity held: |

0%

(2023: 0%) |

|

Valuation basis: |

Fair value of

accrued return |

|

Income received in year to 31 January 2024: |

£100,000

(2023: £100,000) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

£9,338,000

(2021: £9,912,000) |

|

Consolidated loss before tax: |

£(2,816,000)

(2021: £(6,201,000)) |

|

Consolidated net assets: |

£(3,682,000)

(2021: £(2,479,000)) |

10

Turtl Surf & Immerse Limited

Turtl is an enterprise SaaS product which

enables corporates to produce high quality, brand consistent and

personalised marketing collateral at scale.

https://turtl.co/

|

Investment date: |

September 2021 |

|

Equity held: |

13.6%

(2023: 13.6%) |

|

Valuation basis: |

Revenue multiple |

|

Income received in year to 31 January 2024: |

n/a

(2023: n/a) |

|

Last submitted accounts: |

31 December 2022 |

|

Consolidated turnover: |

£8,085,000

(2021: £6,153,000) |

|

Consolidated loss before tax: |

£(4,401,000)

(2021: £(2,098,000) |

|

Consolidated net assets: |

£4,907,000

(2021: £9,189,000) |

- These numbers

are not available per the latest public filings on Companies House

or the company is Non-U.K.

Outlook

There has been a slowing of growth across the

portfolio, as companies look to preserve cash and seek greater

capital efficiency to extend cash runways. We are reassured that

the portfolio is well funded with around 30% of the portfolio based

on NAV not requiring further funding, as they are profitable, and

this increases to 80% with more than twelve months’ cash runway. As

well as a suppressed funding market, we have also seen similar in

the exit environment, with a substantial reduction in the number

and value of merger and acquisition (M&A) transactions over

2023*. Despite this, we were pleased to successfully realise our

holdings in the Safeguarding Company and Ergomed in the period and

we hope to see a continued series of profitable realisations over

the next year.

We have also seen a decline in Apollo’s

investment rate when compared to the prior year, as fewer

businesses have looked to raise money due to limited capital

availability and the higher cost of capital. However, we are

starting to see signs of recovery, with a strong pipeline of

exciting opportunities converting into one new deal and six

follow-on investments completing since the year end.

Alongside this, we were delighted with the

support we’ve received from Apollo’s new and existing investors,

with the latest fundraise closing fully subscribed, including the

over-allotment facility. These funds will allow Apollo to continue

to support the existing portfolio in their growth plans and invest

in new opportunities, which have great potential to become

successful and deliver good returns to shareholders.

The ongoing need for exciting, high-growth

companies to raise funding for growth provides ample opportunity to

make successful future investments in line with the existing

now-proven strategy. We remain optimistic and confident about

Apollo’s future investment prospects and its current diverse

portfolio. We think this breadth of scope will provide Apollo with

the opportunities it needs for continued success.

*Source: Atomico, State of European Tech –

December 2023 – p.226.

RISKS AND RISK MANAGEMENT

The Board assesses the risks faced by Apollo

and, as a board, reviews the mitigating controls and actions, and

monitors the effectiveness of these controls and actions.

Emerging and principal risks, and

risk management

The Board is mindful of the ongoing risks and

will continue to make sure that appropriate safeguards are in

place, in addition to monitoring the cash flow forecasts to make

sure that the Company has sufficient liquidity.

The Board carries out a regular review of the

risk environment in which the Company operates.

Emerging risks

The Board has considered emerging risks. The

Board seeks to mitigate emerging risks and those noted below by

setting policy, regular review of performance and monitoring

progress and compliance. In the mitigation and management of these

risks, the Board applies the principles detailed in the Financial

Reporting Council’s Guidance on Risk Management, Internal Control

and Related Financial and Business Reporting.

The following are some of the potential emerging

risks management and the Board are currently monitoring:

- adverse changes in global

macroeconomic environment;

- rising cost of living;

- geopolitical tensions; and

- climate change.

Principal risks

|

Risk |

Mitigation |

Change |

|

Investment performance: |

|

|

|

The focus of Apollo’s investments is in unquoted, small and

medium-sized VCT qualifying companies which, by their nature,

entail a higher level of risk and may have lower cash reserves than

investments in larger quoted companies. Poor performance across

these investments may impact Apollo’s ability to raise new funds

from investors. |

Octopus has significant experience and a strong track record of

investing in unquoted companies, and appropriate due diligence is

undertaken on every new investment. A member of the Octopus

Ventures team is typically appointed to the board of a portfolio

company, and regular board reports are prepared by the portfolio

company management and examined by the Investment Manager. This

arrangement allows Apollo to play a prominent role in a portfolio

company’s ongoing development and strategy. Although investment

strategy is focused on B2B software, the overall risk in the

portfolio is mitigated by diversifying investment across a wide

spread of holdings in terms of the underlying sub-sector served by

the portfolio companies, and their financing stage, age, industry

sector and business models. The Board reviews the investment

portfolio with the Investment Manager on a regular basis. The

Investment Manager is incentivised to make sure Apollo performs

well, via a Performance Incentive Fee (charged annually) for

exceeding certain performance hurdles. |

Increased exposures reflected in the previous period remain due to

the difficult macro environment and challenging trading conditions

for some portfolio companies continuing. |

|

Risk |

Mitigation |

Change |

|

VCT qualifying status risk: |

|

|

Apollo is required at all times to observe the conditions for the

maintenance of HMRC- approved VCT status. The loss of such approval

could lead to Apollo and its investors losing access to the tax

benefits associated with VCT status and, in certain circumstances,

to investors being required to repay the initial income tax

relief on their investment. |

Prior to making an investment, the Investment Manager seeks

assurance from Apollo’s VCT status adviser that the investment will

meet the legislative requirements for VCT investments.

On an ongoing basis, the Investment Manager monitors Apollo’s

compliance with VCT regulations on a current and forecast basis to

ensure ongoing compliance with VCT legislation. Regular updates are

provided to the Board throughout the year.

The VCT status adviser formally reviews Apollo’s compliance with

VCT regulations on a bi-annual basis and reports its results to the

Board. |

VCT status monitoring by independent advisers continues to reduce

the risk of an issue causing a loss of VCT status. |

|

Risk |

Mitigation |

Change |

|

Operational – reliance on third parties: |

|

|

|

The Board is reliant on the Investment Manager to manage

investments effectively, and manage the services of a number of

third parties, in particular the registrar and tax advisers. A

failure of the systems or controls at the Investment Manager or

third-party providers could lead to an inability to provide

accurate reporting and to ensure adherence to VCT and other

regulatory rules. |

The Board reviews the system of internal control, both financial

and non-financial, operated by the Investment Manager (to the

extent the latter are relevant to Apollo’s internal controls).

These include controls that are designed to ensure that Apollo’s

assets are safeguarded and that proper accounting records are

maintained, as well as any regulatory reporting. Feedback on other

third-parties is reported to the Board on at least an annual basis,

including adherence to Service Level Agreements where

relevant. |

No overall change in risk exposure on balance. |

|

Risk |

Mitigation |

Change |

|

Information security: |

|

|

|

A lack of suitable controls could result in a data breach and

fines. The Board is reliant on the Investment Manager and third

parties to take appropriate measures to prevent a loss of

confidential customer information. |

Annual due diligence is conducted on third parties, which includes

a review of their controls for information security. The Investment

Manager has a dedicated information security team and a third party

is engaged to provide continual protection in this area. A security

framework is in place to help prevent malicious events. The

Investment Manager reports to the Board on an annual basis to

update it on relevant information security arrangements.

Significant and relevant information security breaches are

escalated to the Board when they occur. |

No overall change on balance, although cyber threat remains a

significant risk area faced by all service providers. |

|

Risk |

Mitigation |

Change |

|

Economic: |

|

|

|

Events such as an economic recession, movement in interest rates,

inflation, political instability and rising living costs could

adversely affect some smaller companies’ valuations, as they may be

more vulnerable to changes in trading conditions or the sectors in

which they operate. This could result in a reduction in the value

of Apollo’s assets. |

Apollo invests in a portfolio of companies serving markets across a

diverse range of sectors, which helps to mitigate against the

impact of performance in any one sector. Apollo also maintains

adequate liquidity to make sure that it can continue to

provide follow-on investment to those portfolio companies that

require it and which is supported by the individual investment

case.

The Investment Manager monitors the impact of macroeconomic

conditions on an ongoing basis and provides updates to the Board at

least quarterly. |

Increased exposures reflected in the previous period remain as

economic uncertainty persists through high inflation, high interest

rates and other economic factors. |

|

Risk |

Mitigation |

Change |

|

Legislative: |

|

|

A change to the VCT regulations could adversely impact Apollo by

restricting the companies Apollo can invest in under its current

strategy. Similarly, changes to VCT tax reliefs for investors could

make VCTs less attractive and impact Apollo’s ability to raise

further funds.

Failure to adhere to other relevant legislation and regulation

could result in reputational damage and/or fines.

We are also pleased that the sunset clause in place for April 2025,

regarding eligibility of VCTs for tax relief, has been extended and

seems likely to be removed. |

The Investment Manager engages with HM Treasury and industry bodies

to demonstrate the positive benefits of VCTs in terms of growing UK

companies, creating jobs and increasing tax revenue, and to help

shape any change to VCT legislation.

The Investment Manager employs individuals with expertise across

the legislation and regulation relevant to Apollo. Individuals

receive ongoing training and external experts are engaged where

required. |

Risk exposure has continued to reduce since the previous period

following the extension of the sunset clause to 2035 being

agreed. |

|

Risk |

Mitigation |

Change |

|

Liquidity: |

|

|

|

Apollo invests in smaller unquoted companies, which are inherently

illiquid as there is no readily available market for these shares.

Therefore, these may be difficult to realise for their fair market

value at short notice. |

The Investment Manager prepares cash flow forecasts to make sure

cash levels are maintained in accordance with policies agreed with

the Board. Apollo’s overall liquidity levels are monitored on a

quarterly basis by the Board, with close monitoring of available

cash resources. Apollo maintains sufficient cash and readily

realisable securities, including MMFs and OEICs, which can be

accessed at short notice. At 31 January 2024, 85% of current asset

investments were held in MMFs, realisable within one business day,

and 15% in OEICs, realisable within seven business days. |

Risk exposure remains unchanged from the previous period. |

|

Risk |

Mitigation |

Change |

|

Valuation: |

|

|

|

While investments within the portfolio are valued in accordance

with International Private Equity and Venture Capital (IPEV)

valuation guidelines, for smaller companies establishing a fair

value can be difficult due to the lack of readily available market

data for similar shares, resulting in limited number of external

reference points. |

Valuations of portfolio companies are performed by appropriately

experienced staff, with detailed knowledge of both the portfolio

company and the market in which it operates. These valuations are

then subject to review and approval by the Octopus Valuations

Committee, comprised of staff who are independent of Octopus

Ventures and with relevant knowledge of unquoted company

valuations. The Board reviews valuations after they have been

agreed by the Octopus Valuations Committee. |

Risk exposure remains unchanged from the previous period due to

economic uncertainty within valuation modelling. |

VIABILITY STATEMENT

In accordance with provision 36 of the AIC Code

of Corporate Governance, the Directors have assessed the prospects

of the Company over a period of five years, consistent with the

expected investment holding period of a VCT investor. Under VCT

rules, subscribing investors are required to hold their investment

for a five-year period in order to benefit from the associated tax

reliefs. The Board regularly considers strategy, including investor

demand for the Company’s shares, and a five-year period is

considered to be a reasonable time horizon for this.

The Board carried out a robust assessment of the

emerging and principal risks facing the Company and its current

position.

This includes risks which may adversely impact

its business model, future performance, solvency or liquidity, and

focused on the major factors which affect the economic, regulatory

and political environment. Particular consideration was given to

the Company’s reliance on, and close working relationship with, the

Investment Manager. The principal risks faced by the Company and

the procedures in place to monitor and mitigate them are set out

above.

The Board has carried out robust stress testing

of cash flows which included; assessing the resilience of portfolio

companies, including the requirement for any future financial

support; and the ability to pay dividends and buybacks.

The Board has additionally considered the

ability of the Company to comply with the ongoing conditions to

make sure it maintains its VCT qualifying status under its current

investment policy.

Based on the above assessment the Board confirms

that it has a reasonable expectation that the Company will be able

to continue in operation and meet its liabilities as they fall due

over the five-year period to 31 January 2029. The Board is mindful

of the ongoing risks and will continue to make sure that

appropriate safeguards are in place, in addition to monitoring the

cash flow forecasts to make sure that the Company has sufficient

liquidity.

DIRECTORS’ RESPONSIBILITIES STATEMENT

The Directors are responsible for preparing the

Strategic Report, the Directors’ Report, the Directors’

Remuneration Report and the Financial Statements in accordance with

applicable law and regulations. They are also responsible for

ensuring that the Annual Report and Accounts include information

required by the Listing Rules of the Financial Conduct

Authority.

Company law requires the Directors to prepare

financial statements for each financial year. Under that law the

Directors have elected to prepare the financial statements in

accordance with United Kingdom Generally Accepted Accounting

Practice (United Kingdom Accounting Standards and applicable laws)

including FRS 102 – “The Financial Reporting Standard applicable in

the UK and Republic of Ireland”. Under company law the Directors

must not approve the financial statements unless they are satisfied

that they give a true and fair view of the state of affairs and

profit or loss of the Company for that period.

In preparing these financial statements, the

Directors are required to:

- select suitable accounting policies

and then apply them consistently;

- make judgements and accounting

estimates that are reasonable and prudent;

- state whether applicable UK

accounting standards have been followed, subject to any material

departures disclosed and explained in the financial

statements;

- prepare the financial statements on

the going concern basis unless it is inappropriate to presume that

the Company will continue in business; and

- prepare a Strategic Report, a

Directors’ Report and Directors’ Remuneration Report which comply

with the requirements of the Companies Act 2006.

The Directors are responsible for keeping

adequate accounting records that are sufficient to show and explain

the Company’s transactions and disclose with reasonable accuracy at

any time the financial position of the Company and enable them to

make sure that the financial statements and the Directors’

Remuneration Report comply with the Companies Act 2006. They are

also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

Insofar as each of the Directors is aware:

- there is no relevant audit

information of which the Company’s auditor is unaware; and

- the Directors have taken all steps

that they ought to have taken to make themselves aware of any

relevant audit information and to establish that the auditor is

aware of that information.

The Directors are responsible for preparing the

annual report in accordance with applicable law and regulations.

Having taken advice from the Audit and Risk Committee, the

Directors consider the annual report and the financial statements,

taken as a whole, provide the information necessary to assess the

Company’s position, performance, business model and strategy and is

fair, balanced and understandable.

The Directors are responsible for the

maintenance and integrity of the corporate and financial

information included on the Company’s website. Legislation in the

United Kingdom governing the preparation and dissemination of

financial statements may differ from legislation in other

jurisdictions.

The Directors confirm that, to the best of their

knowledge:

- the financial statements, prepared

in accordance with United Kingdom Generally Accepted Accounting

Practice, including FRS 102, give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company; and

- the Annual Report and Accounts

(including the Strategic Report), give a fair review of the

development and performance of the business and the position of the

Company, together with a description of the principal risks and

uncertainties that it faces.

On behalf of the Board

Murray Steele

Chair

INCOME STATEMENT

|

|

|

Year ended 31 January 2024 |

Year ended 31 January 2023 |

|

|

|

Revenue

£’000 |

Capital

£’000 |

Total

£’000 |

Revenue

£’000 |

Capital

£’000 |

Total

£’000 |

|

Realised (loss)/gain on disposal of fixed asset investments |

|

- |

(876) |

(876) |

- |

525 |

525 |

|

Change in fair value of fixed asset investments |

|

- |

7,633 |

7,633 |

- |

49,921 |

49,921 |

|

Change in fair value of current asset investments |

|

- |

16 |

16 |

- |

(800) |

(800) |

|

Investment income |

|

4,260 |

- |

4,260 |

2,257 |

11 |

2,268 |

|

Investment management fees |

|

(1,862) |

(5,601) |

(7,463) |

(1,437) |

(13,512) |

(14,949) |

|

Other expenses |

|

(4,006) |

- |

(4,006) |

(2,431) |

- |

(2,431) |

|

Foreign currency translation |

|

1 |

- |

1 |

7 |

- |

7 |

|

(Loss)/profit before tax |

|

(1,607) |

1,172 |

(435) |

(1,604) |

36,145 |

34,541 |

|

Tax |

|

- |

- |

- |

- |

- |

- |

|

(Loss)/profit after tax |

|

(1,607) |

1,172 |

(435) |

(1,604) |

36,145 |

34,541 |

|

(Loss)/earnings per share – basic and diluted |

|

(0.2p) |

0.1p |

(0.1p) |

(0.3p) |

6.3p |

6.0p |

- The ‘Total’ column of this

statement is the profit and loss account of Apollo; the revenue

return and capital return columns have been prepared under guidance

published by the Association of Investment Companies.

- All revenue and capital items in

the above statement derive from continuing operations.

- Apollo has only one class of

business and derives its income from investments made in shares and

securities and from bank and money market funds.

Apollo has no other comprehensive income for the

period.

The accompanying notes are an integral part of

the financial statements.

BALANCE SHEET

|

|

|

As at 31 January 2024 |

As at 31 January 2023 |

|

|

|

£’000 |

£’000 |

£’000 |

£’000 |

|

Fixed asset investments |

|

|

328,370 |

|

306,930 |

|

Current assets: |

|

|

|

|

|

|

Investments |

|

8,486 |

|

3,970 |

|

|

Money market funds |

|

47,950 |

|

40,360 |

|

|

Debtors |

|

3,752 |

|

4,866 |

|

|

Cash at bank |

|

4,868 |

|

4,990 |

|

|

Applications cash |

|

8,852 |

|

9,261 |

|

|

Total current assets |

|

73,908 |

|

63,447 |

|

|

Current liabilities |

|

(11,984) |

|

(20,884) |

|

|

Net current assets |

|

|

61,924 |

|

42,563 |

|

Net assets |

|

|

390,294 |

|

349,493 |

Share capital |

|

|

773 |

|

657 |

|

Share premium |

|

|

27,476 |

|

78,440 |

|

Special distributable reserve |

|

|

266,132 |

|

174,061 |

|

Capital redemption reserve |

|

|

172 |

|

159 |

|

Capital reserve realised |

|

|

(15,275) |

|

(20,136) |

|

Capital reserve unrealised |

|

|

115,343 |

|

119,032 |

|

Revenue reserve |

|

|

(4,327) |

|

(2,720) |

|

Total shareholders' funds |

|

|

390,294 |

|

349,493 |

|

Net asset value per share – basic and diluted |

|

|

50.5p |

|

53.2p |

The statements were approved by the Directors

and authorised for issue on 28 May 2024 and are signed on their

behalf by:

Murray Steele

Chair

Company number: 05840377

The accompanying notes are an integral part of

the financial statements.

STATEMENT OF CHANGES IN EQUITY

|

|

Share capital

£’000 |

Share premium

£’000 |

Special distributable reserves*

£’000 |

Capital redemption reserve

£’000 |

Capital reserve realised*

£’000 |

Capital reserve unrealised

£’000 |

Revenue reserve*

£’000 |

Total

£’000 |

|

As at 1 February 2023 |

657 |

78,440 |

174,061 |

159 |

(20,136) |

119,032 |

(2,720) |

349,493 |

|

Total comprehensive income for the year |

- |

- |

- |

- |

(6,477) |

7,649 |

(1,607) |

(435) |

|

Total contributions by and distributions to owners: |

|

|

|

|

|

|

|

|

|

Repurchase and cancellation of own shares |

(13) |

- |

(6,743) |

13 |

- |

- |

- |

(6,743) |

| Issue of shares |

129 |

70,927 |

- |

- |

- |

- |

- |

71,056 |

| Share issue cost |

- |

(3,912) |

- |

- |

- |

- |

- |

(3,912) |

|

Dividends paid |

- |

- |

(19,165) |

- |

- |

- |

- |

(19,165) |

|

Total contributions by and distributions to owners: |

116 |

67,015 |

(25,908) |

13 |

- |

- |

- |

41,236 |

|

Other movements: |

|

|

|

|

|

|

|

|

| Prior year fixed asset gains now

realised |

- |

- |

- |

- |

11,338 |

(11,338) |

- |

- |

| Cancellation of Share

Premium |

- |

(117,979) |

117,979 |

- |

- |

- |

- |

- |

|

Total other movements |

- |

(117,979) |

117,979 |

- |

11,338 |

(11,338) |

- |

- |

|

Balance as at 31 January 2024 |

773 |

27,476 |

266,132 |

172 |

(15,275) |

115,343 |

(4,327) |

390,294 |

* Included in these reserves is an amount of

£246,530,000 (2023: £151,204,000) which is considered distributable

to shareholders per the Companies Act.

The accompanying notes are an integral part of

the financial statements.

|

|

Share capital

£’000 |

Share premium

£’000 |

Special distributable reserves*

£’000 |

Capital redemption reserve

£’000 |

Capital reserve realised*

£’000 |

Capital reserve unrealised

£’000 |

Revenue reserve*

£’000 |

Total

£’000 |

|

As at 1 February 2022 |

52,365 |

81,600 |

58,918 |

8,441 |

(5,197) |

68,079 |

(1,247) |

262,959 |

|

Total comprehensive income for the year |

- |

- |

- |

- |

(12,976) |

49,121 |

(1,604) |

34,541 |

|

Total contributions by and distributions to owners: |

|

|

|

|

|

|

|

|

|

Repurchase and cancellation of own shares |

(17) |

- |

(8,220) |

17 |

- |

- |

- |

(8,220) |

| Issue of shares |

151 |

78,876 |

- |

- |

- |

- |

- |

79,027 |

| Share issue cost |

- |

(4,491) |

- |

- |

- |

- |

- |

(4,491) |

|

Dividends paid |

- |

- |

(14,323) |

- |

- |

- |

- |

(14,323)

|

|

Total contributions by and distributions to owners: |

134 |

74,385 |

(22,543) |

17 |

- |

- |

- |

51,993 |

|

Other movements: |

|

|

|

|

|

|

|

|

| Prior year fixed asset losses now

realised |

- |

- |

- |

- |

(1,963) |

1,963 |

- |

- |

| Cancellation of Share

Premium |

- |

(77,545) |

77,545 |

- |

- |

- |

- |

- |

| Cancellation of Capital

Redemption Reserve |

- |

- |

8,299 |

(8,299) |

- |

- |

- |

- |

| Share capital nominal value

reduction |

(51,842) |

- |

51,842 |

- |

- |

- |

- |

- |

| Transfer between reserves |

- |

- |

- |

- |

- |

(131) |

131 |

- |

|

Total other movements |

(51,842) |

(77,545) |

137,686 |

(8,299) |

(1,963) |

1,832 |

131 |

- |

|

Balance as at 31 January 2023 |

657 |

78,440 |

174,061 |

159 |

(20,136) |

119,032 |

(2,720) |

349,493 |

*Included in these reserves is an amount of

£151,204,000 (2022: £52,474,000) which is considered distributable

to shareholders per the Companies Act.

The accompanying notes are an integral part of

the financial statements.

CASH FLOW STATEMENT

|

|

|

Year to

31 January 2024

£’000 |

Year to

31 January 2023

£’000 |

|

Cash flows from operating activities |

|

|

|

|

(Loss)/ profit before tax |

|

(435) |

34,541 |

|

Adjustments for: |

|

|

|

|

Decrease/(increase) in debtors |

|

1,114 |

(977) |

|

(Decrease)/increase in creditors |

|

(8,490) |

776 |

|

Loss/(gain) on disposal of fixed asset investments |

|

876 |

(525) |

|

Gain on valuation of fixed asset investments |

|

(7,633) |

(49,921) |

|

(Gain)/ loss on valuation of current asset investments |

|

(17) |

800 |

|

In-specie dividends |

|

– |

(11) |

|

Net cash utilised in operating activities |

|

(14,585) |

(15,317) |

Cash flows from investing activities |

|

|

|

|

Purchase of fixed asset investments |

|

(32,975) |

(69,393) |

|

Proceeds on sale of fixed asset investments |

|

18,292 |

3,591 |

|

Purchase of current asset investments |

|

(4,499) |

– |

|

Transfer of current asset investments* |

|

– |

16,659 |

|

Net cash

utilised in

investing activities |

|

(19,182) |

(49,143) |

|

Cash flows from financing activities |

|

|

|

|

Movement in applications account |

|

(409) |

8,746 |

|

Purchase of own shares |

|

(6,743) |

(8,220) |

|

Proceeds from share issues |

|

66,543 |

75,662 |

|

Cost of share issues |

|

(3,912) |

(4,491) |

|

Dividends paid (net of DRIS) |

|

(14,653) |

(10,958) |

|

Net cash generated from financing activities |

|

40,826 |

60,739 |

|

Increase/(Decrease) in

cash and cash

equivalents |

|

7,059 |

(3,721) |

|

Opening cash and cash equivalents |

|

54,611 |

58,332 |

|

Closing cash and cash equivalents |

|

61,670 |

54,611 |

|

Cash and cash equivalents comprise |

|

|

|

|

Cash at bank |

|

4,868 |

4,990 |

|

Applications cash |

|

8,852 |

9,261 |

|

Money market funds |

|

47,950 |

40,360 |

|

Closing cash and cash equivalents |

|

61,670 |

54,611 |

* During the year ended 31 January 2023 Octopus

Portfolio Manager (OPM) began the process of being closed down. The

only investment remaining is in a BlackRock MMF. The classification

of this asset was therefore transferred from an OEIC to a MMF

within the accounts and is therefore classified as a cash

equivalent.

The accompanying notes are an integral part of

the financial statements.

NOTES TO THE FINANCIAL STATEMENTS

1. Significant accounting policies

Apollo is a Public Limited Company (plc)

incorporated in England and Wales and its registered office is 33

Holborn, London, EC1N 2HT.

Apollo’s principal activity is to invest in a

diverse portfolio of predominantly unquoted companies with the aim

of providing shareholders with attractive tax-free dividends and

long-term capital growth.

Basis of preparation

The financial statements have been prepared under the historical

cost convention, except for the measurement at fair value of

certain financial instruments, and in accordance with UK Generally

Accepted Accounting Practice (GAAP), including Financial Reporting

Standard 102 – ‘The Financial Reporting Standard applicable in the

United Kingdom and Republic of Ireland’ (FRS 102), and with the

Companies Act 2006 and the Statement of Recommended Practice (SORP)

‘Financial Statements of Investment Trust Companies and Venture

Capital Trusts (issued 2014 and updated in April 2021 with

consequential amendments)’.

The significant accounting policies have

remained unchanged since those set out in Apollo’s 2023 Annual

Report and Accounts.

2. Investment income

Accounting policy

Fixed returns on non-equity shares and debt

securities are recognised on a time apportionment basis (including

time amortisation of any premium or discount to redemption), so as

to reflect the effective interest rate, provided it is considered

probable that payment will be received in due course. Income from

fixed-interest securities and deposit interest is accounted for on

an effective interest rate method. Investment income includes

interest earned on MMFs. Dividend income is shown net of any

related tax credit.

Dividends receivable are brought into account

when Apollo’s right to receive payment is established and it is

probable that payment will be received. Fixed returns on debt are

recognised provided it is probable that payment will be received in

due course. The nature of dividends received is assessed to

establish whether they are revenue or income dividends.

Disclosure

|

|

31

January |

31

January |

|

|

2024 |

2023 |

|

|

£’000 |

£’000 |

|

Loan note interest receivable |

1,683 |

1,600 |

Dividends receivable

MMF interest income

In-specie

dividend |

576

2,001

-

|

354

303

11 |

|

|

4,260 |

2,268 |

3. Investment management fees

|

|

31 January 2024 |

31 January 2023 |

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Investment management fee |

1,862 |

5,587 |

7,449 |

1,437 |

4,311 |

5,748 |

|

Investment performance fee |

- |

14 |

14 |

- |

9,201 |

9,201 |

|

|

1,862 |

5,601 |

7,463 |

1,437 |

13,512 |

14,949 |

For the purpose of the revenue and capital

columns in the Income Statement, the management fee has been

allocated 25% to revenue and 75% to capital, in line with the

Board’s expected long-term split of returns in the form of income

and capital gains respectively from Apollo’s investment portfolio.

The investment performance fee, explained below, is allocated 100%

to capital as it is deemed that capital appreciation on investments

has primarily driven the total return of Apollo above the required

hurdle rate at which the performance fee is payable. The management

fee, administration and accountancy fees are calculated based on

the NAV which is then multiplied by the number of shares in issue,

calculated on a daily basis.

Octopus provide investment management,

accounting and administration services and company secretarial

services to Apollo under a management agreement which may be

terminated at any time thereafter by not less than twelve months’

notice given by either party. No compensation is payable in the

event of terminating the agreement by either party, if the required

notice period is given. The fee payable, should insufficient notice

be given, will be equal to the fee that would have been paid should

continuous service be provided. The basis upon which the management

fee is calculated is disclosed within the Annual report and

financial statements.

Apollo has established a performance incentive

scheme whereby the Investment Manager is entitled to an annual

performance related incentive fee in the event that certain

performance criteria are met. Further details of this scheme are

disclosed within the Annual report and financial statements. As at

31 January 2024 £14,000 was due to the Investment Manager by way of

annual performance fee (2023: £9,201,000).

4. Other expenses

Accounting policy

All expenses are accounted for on an accruals

basis. Expenses are charged wholly to revenue, apart from

management fees charged 75% to capital and 25% to revenue,

performance fees charged wholly to capital and transaction costs.

Transaction costs incurred when purchasing or selling assets are

written off to the Income Statement in the period that they

occur.

Disclosure

|

|

31

January |

31

January |

|

|

2024 |

2023 |

|

|

£’000 |

£’000 |

|

Audit fees |

85 |

73 |

|

Accounting and administration services |

1,117 |

862 |

|

Legal fees |

12 |

33 |

|

Registrars' fees |

106 |

127 |

|

Ongoing trail commission |

1,011 |

767 |

|

Directors’ fees |

140 |

135 |

|

Other administration expenses |

582 |

434 |

|

Bad debt provision |

953 |

– |

|

|

4,006 |

2,431 |

The ongoing charges ratio of Apollo for the year

to 31 January 2024 was 2.4% (2023: 2.5%). Total annual running

costs are capped at 2.75% of average net assets (2023 cap: 3.3% of

average net assets). This figure excludes any extraordinary items,

adviser charges, impairment of interest and performance fees.

No non-audit services were provided by Apollo’s

auditor.

5. Tax

Accounting

policy

Current tax is recognised for the amount of

income tax payable in respect of the taxable profit/(loss) for the

current or past reporting periods using the current UK corporation

tax rate. The tax effect of different items of income/gain and

expenditure/loss is allocated between capital and revenue return on

the “marginal” basis as recommended in the SORP.

Deferred tax is recognised in respect of all

timing differences at the reporting date. Timing differences are

differences between taxable profits and total comprehensive income

as stated in the financial statements that arise from the inclusion

of income and expenses in tax assessments in periods different from

those in which they are recognised in financial statements.

Deferred tax assets are only recognised to the

extent that it is probable that they will be recovered against the

reversal of deferred tax liabilities or other future taxable

profits.

Disclosure

|

|

31 January 2024 |

31 January 2023 |

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

(Loss)/profit before tax |

(1,607) |

1,172 |

(435) |

(1,604) |

36,145 |

34,541 |

|

Tax at 24% (2023: 19%) |

(386) |

282 |

(104) |

(305) |

6,867 |

6,562 |

|

Effects of: |

|

|

|

|

|

|

|

Non-taxable dividend income |

(16) |

– |

(16) |

(67) |

(2) |

(69) |

|

Non-taxable capital gains on valuations and disposals |

– |

(1,628) |

(1,628) |

– |

(9,432) |

(9,432) |

|

Expenses not deductible for tax purposes |

– |

14 |

14 |

– |

7 |

7 |

|

Excess management expenses on which deferred tax not

recognised |

402 |

1,332 |

1,734 |

372 |

2,560 |

2,932 |

|

|

|

|

|

|

|

|

|

Total tax charge |

– |

– |

– |

– |

– |

– |

Approved VCTs are exempt from tax on chargeable

gains. Since the Directors intend that Apollo will continue to

conduct its affairs so as to maintain its approval as a VCT, no

deferred tax has been provided in respect of any capital gains or

losses arising on the revaluation or disposal of investments. On 1

April 2023, the main rate of Corporation Tax was increased to 25%.

Unrelieved tax losses of £50,101,000 (2023: £42,887,000) are

estimated to be carried forward at 31 January 2024 (subject to

completion of Apollo’s tax return) and are available for offset

against future taxable income, subject to agreement with HMRC.

Apollo has not recognised the deferred tax asset of £12,525,000

(2023: £10,722,000) in respect of these tax losses because there is

insufficient forecast taxable income in excess of deductible

expenses to utilise these losses carried forward. There is no

expiry period on these deductible expenses under the UK HMRC

legislation.

6. Dividends

Accounting

policy

Dividends payable are recognised as