Petrofac Limited ( PFC)

Petrofac Limited: Trading Update

20-Dec-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

This announcement contains inside information

PETROFAC LIMITED

TRADING UPDATE

Petrofac issues the following pre-close trading update for the year ending 31 December 2023.

FINANCIAL AND STRATEGIC UPDATE:

-- Second contract award under the six-project, USUSD14 billion, multi-year Framework Agreement with TenneT

announced today. Petrofac's portion of the second contract valued at approximately USUSD1.4 billion.

-- Performance guarantee secured for the first contract awarded under the Framework Agreement with TenneT.

Performance guarantee terms agreed for the first ADNOC Habshan contract - expected to be issued by year end. Active

discussions ongoing to secure guarantees required for other new contracts.

-- Net debt(1) expected to be modestly higher than at the interim results, with positive free cash flow

generation by the business in the second half offset by an increase in collateral required for guarantees.

-- Near-term focus remains on strengthening the balance sheet with ongoing review of strategic and financial

options.

OPERATIONAL PERFORMANCE:

-- Asset Solutions and IES underlying performance in line with guidance, before a one-off bad debt provision

in Asset Solutions of approximately USUSD12 million.

-- Expect a full year EBIT loss in E&C of approximately USUSD215 million, including USUSD110 million one-off

write downs in contract settlements to protect cash flows.

-- Good progress in reaching contractual settlements in the second half, with approximately USUSD180 million

collected year-to-date.

-- Completion of remaining legacy E&C contracts progressing in line with guidance.

-- Thai Oil Clean Fuels project progress remains on track, with negotiations ongoing to recover additional

committed costs.

BACKLOG AND OUTLOOK:

-- Exceptional new order intake(2) across both E&C and Asset Solutions, totalling approximately USUSD6.8

billion in the year-to-date, with Group backlog(3) expected to be approximately USUSD8.0 billion at the end of the

year.

-- Robust business outlook underpinned by strong backlog and a healthy Group pipeline scheduled for award in

the next 18 months of USUSD62 billion, including the remaining projects in the TenneT multi-platform Framework

Agreement.

Tareq Kawash, Petrofac's Group Chief Executive, commented:

"Our focus on rebuilding the backlog and unwinding historic working capital has resulted in tangible progress against

our organic plan to strengthen the Group's financial position.

"To further accelerate progress, my near-term priority, and that of our Board and leadership, remains on improving

liquidity and materially strengthening the Group's balance sheet, to deliver on our long-term potential.

"We are completing contracts in the legacy portfolio as planned, we continue to deliver well in the initial phases of

the contracts awarded in 2023, and, as a result of excellent order intake, we enter 2024 with a high-quality backlog in

both traditional and renewable energy of approximately USUSD8 billion. This provides us with good revenue visibility and

demonstrates the continued confidence customers have in Petrofac's delivery."

FINANCIAL AND STRATEGIC UPDATE

The Group has made good progress on its near-term priorities, since its announcement on 4 December 2023. Today, we

announced that the Group has secured the performance guarantee for the first contract awarded under its Framework

Agreement with TenneT, which was also supplemented with the second contract award under the agreement. The Group

remains in active discussion with credit providers and its clients to secure the guarantees required for other new

contracts in its portfolio.

Cash flow and net debt(1)

The Group has continued to advance contractual settlements, collecting approximately USUSD180 million in the year to

date. As referenced in the business update on 4 December 2023, due to the delays in securing guarantees, the Group no

longer expects to collect advance payments on new contracts before the year-end.

Measures taken by management resulted in positive free cash flow in the second half, even in the absence of advance

payment receipts, albeit this was offset by an increase of over USUSD100 million in collateral for guarantees. As a

result, net debt at year-end is expected to be modestly higher than at the interim results (30 June 2023: USUSD584

million).

The Group has continued to maintain liquidity above its financial covenant.

Review of strategic and financial options

On 4 December 2023, the Group announced that Aidan de Brunner had joined the Company as a Non-Executive Director to

drive engagement with finance providers, investors and other stakeholders in an active review of strategic and

financial options with the objective of materially strengthening the Company's balance sheet, securing bank guarantees

and improving short-term liquidity. Further announcements will be made as appropriate.

GROUP TRADING

The Group continues to perform well for its clients. Management expects to report Group revenue of approximately USUSD2.5

billion, in line with guidance. Full-year business performance EBIT loss is expected to be approximately USUSD180

million. This includes approximately USUSD110 million one-off write-downs in contract settlements to protect cash flows

and a one-off bad debt provision of approximately USUSD12 million for a client going into administration in the Asset

Solutions business unit.

DIVISIONAL HIGHLIGHTS

Engineering & Construction (E&C)

The financial performance in E&C reflected the low opening backlog and the maturity of its legacy contract portfolio.

Full year E&C revenues are expected to be around USUSD1.0 billion, with a full year EBIT loss of approximately USUSD215

million, including approximately USUSD110 of one-off write-downs on legacy contracts to protect and accelerate cash

flows.

Following E&C's strongest order intake in many years, it has good visibility of future revenue and profit growth.

Guidance will be provided with the Group's annual results, as usual.

Operationally, the initial phases of the new contracts secured in 2023 are progressing well. We previously guided that

five of the remaining eight legacy contracts were expected to be completed or substantially completed(4) during 2023 or

early 2024. Progress remains on track, with two reaching that milestone in 2023 and the remaining three expected to

follow in early 2024.

With respect to the Thai Oil Clean Fuels project, good progress continues to be made on the construction phases and we

are achieving our interim milestones. Negotiations are ongoing with our client and partners in relation to the

reimbursement of additional committed costs. The timing of these negotiations is not wholly within the Company's

control and therefore, there is a risk to the 2023 EBIT numbers stated above. A project and commercial update will be

provided with the publication of the Group's full year results in 2024.

Year-to-date, following the second contract award under the TenneT framework agreement, E&C has secured new orders of

approximately USUSD5.3 billion, split broadly evenly between our core markets and energy transition projects under the

TenneT framework. Backlog is expected to be approximately USUSD5.9 billion at 31 December 2023, of which almost 90%

relates to contracts secured in 2023.

Asset Solutions

Asset Solutions has had another successful year, with order intake for the year-to-date of USUSD1.5 billion comprising

renewals and extensions in core markets and new contract awards in both core markets and new geographies.

Full year revenues are expected to be USUSD1.4 billion with EBIT of between USUSD20 million and USUSD25 million, following a

bad debt provision approximately USUSD12 million relating to a customer entering administration. Excluding this one-off

event, expected underlying EBIT of between USUSD32 million and USUSD37 million reflects the completion of historic high

margin contracts in 2022 and a higher contribution of pass-through revenues.

Integrated Energy Services (IES)

IES has continued to deliver ahead of expectations. Net production is expected to be broadly in line with the prior

year (2022: 1,261kboe). The average realised oil price (net of royalties)(5) for the year to date is expected to be

approximately USUSD90/bbl, including the impact of hedging (2022: USUSD110/bbl), with the full year EBITDA expected to

marginally exceed the guided range of USUSD65 million to USUSD75 million.

ORDER BACKLOG

The Group's backlog(3) is expected to be approximately USUSD8.0 billion at 31 December 2023 (30 June 2023: USUSD6.6

billion), reflecting the exceptional order intake in both E&C and Asset Solutions.

31 December 2023 (forecast) 30 June 2023

USUSD billion USUSD billion

Engineering & Construction 5.9 4.5

Asset Solutions 2.1 2.1

Group backlog 8.0 6.6

Conference call

Tareq Kawash, Group Chief Executive and Afonso Reis e Sousa,

Chief Financial Officer, will host a conference call for analysts

and investors at 8.30am today.

Analysts and investors can access the call on: +44 (0) 330 551

0200. Password: Quote 'Petrofac Trading Update' when prompted by

the operator.

NOTES 1. Net debt comprises interest-bearing loans and

borrowings less cash and short-term deposits (i.e.excluding IFRS 16

lease liabilities). 2. New order intake is defined as new contract

awards and extensions, net variation orders and the

rollingincrement attributable to Asset Solutions contracts which

extend beyond five years. 3. Backlog consists of: the estimated

revenue attributable to the uncompleted portion of Engineering

&Construction division projects; and, for the Asset Solutions

division, the estimated revenue attributable to thelesser of the

remaining term of the contract and five years. 4. Completed and

substantially completed contracts: contracts where (i) a

Provisional Acceptance Certificate(PAC) has been issued by the

client, (ii) transfer of care and custody (TCC) to the client has

taken place, or(iii) PAC or TCC are imminent, and no substantive

work remains to be performed by Petrofac. 5. Average net realised

price is inclusive of royalties and hedging gains or losses. It is

based on salesvolumes, which may differ from production due to

under/over-lifting in the period.

ENDS

Disclaimer:

This announcement contains forward-looking statements relating

to the business, financial performance and results of Petrofac and

the industry in which Petrofac operates. These statements may be

identified by words such as "expect", "believe", "estimate",

"plan", "target", or "forecast" and similar expressions, or by

their context. These statements are made on the basis of current

knowledge and assumptions and involve risks and uncertainties.

Various factors could cause actual future results, performance or

events to differ materially from those expressed in these

statements and neither Petrofac nor any other person accepts any

responsibility for the accuracy of the opinions expressed in this

presentation or the underlying assumptions. No obligation is

assumed to update any forward-looking statements.

For further information contact:

Petrofac Limited

+44 (0) 207 811 4900

James Boothroyd, Head of Investor Relations

James.boothroyd@petrofac.com

Sophie Reid, Group Director of Communications

Sophie.reid@petrofac.com

Teneo (for Petrofac)

+44 (0) 207 353 4200

petrofac@teneo.com

NOTES TO EDITORS

Petrofac

Petrofac is a leading international service provider to the

energy industry, with a diverse client portfolio including many of

the world's leading energy companies.

Petrofac designs, builds, manages and maintains oil, gas,

refining, petrochemicals and renewable energy infrastructure. Our

purpose is to enable our clients to meet the world's evolving

energy needs. Our four values - driven, agile, respectful and open

- are at the heart of everything we do.

Petrofac's core markets are in the Middle East and North Africa

(MENA) region and the UK North Sea, where we have built a long and

successful track record of safe, reliable and innovative execution,

underpinned by a cost effective and local delivery model with a

strong focus on in-country value. We operate in several other

significant markets, including India, South East Asia and the

United States. We have 8,500 employees based across 31 offices

globally.

Petrofac is quoted on the London Stock Exchange (symbol:

PFC).

For additional information, please refer to the Petrofac website

at www.petrofac.com

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B0H2K534

Category Code: TST

TIDM: PFC

LEI Code: 2138004624W8CKCSJ177

Sequence No.: 292987

EQS News ID: 1800591

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1800591&application_name=news

(END) Dow Jones Newswires

December 20, 2023 02:00 ET (07:00 GMT)

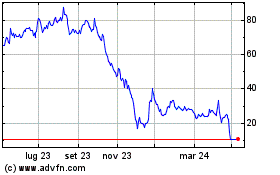

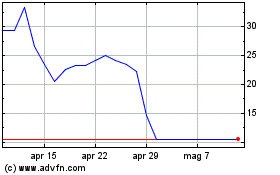

Grafico Azioni Petrofac (LSE:PFC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Petrofac (LSE:PFC)

Storico

Da Apr 2023 a Apr 2024