Quartix Technologies PLC Interim Results Timetable and Trading Update (4125F)

10 Luglio 2023 - 8:00AM

UK Regulatory

TIDMQTX

RNS Number : 4125F

Quartix Technologies PLC

10 July 2023

Quartix Technologies plc

("Quartix", "the Group" or "the Company")

Interim Results Timetable and Trading Update

Quartix Technologies plc, a leading supplier of

subscription-based vehicle tracking systems, analytical software

and services, is pleased to announce that it will publish interim

results for the six-month period ending 30 June 2023 (the "Period")

on Monday 31 July 2023. They will be posted on the Company's

website that morning, together with accompanying presentations.

H1 Trading

The Company is pleased to report year-on-year growth in our

subscription base during the first half of 2023 of 14%.

Year-on-year subscription base growth in H1 was moderate, as Q1

2022 benefited from a large annualised order in the UK, however Q2

saw growth resume to expected levels. New units installed totalled

33,400 units, which was a record number of new subscriptions for a

6-month period. As a consequence, the vehicle subscription base as

at 30 June 2023 increased to 252,000 vehicles, with the annualised

subscription base value increased by GBP2.1m (2022 GBP2.6m) on a

constant-currency (1) basis to GBP28.0m.

Recurring revenues remained high at 94% of sales. Price erosion

over 12 months, calculated at constant currency rates, continues to

improve and was 4.6% compared to 4.8% in the same period in 2022.

Attrition has been higher at 13.5% (11.6% PY), primarily due to an

increase in business closures and customers downsizing their fleet

sizes, caused by external market conditions. The cash balance as at

30 June was GBP3.2m. For the full year the Board expects revenue,

adjusted EBITDA, and free cash flow to be in line with consensus

market forecasts (2) .

Year-on-year subscription base growth in France and our other

European territories was excellent at 32% and 53% respectively. Our

more mature UK operation continues to perform well and saw 6%

year-on-year growth. Strategic changes have redirected investment

from our wider US business to territories that will present

improved returns on investment in the shorter term. The US strategy

will therefore have a narrower, field sales approach, focused

specifically on Texas moving forward .

Year-on-year growth in subscription bases by geography as at

30(th) June are shown in the table below. Exact totals may vary

slightly in preparation of the interim results.

H1 2023 H1 2022 Growth

UK 140,991 133,020 6%

-------- -------- -------

France 61,298 46,387 32%

-------- -------- -------

USA 30,352 29,888 2%

-------- -------- -------

Spain, Italy,

Germany 19,146 12,505 53%

-------- -------- -------

Total 251,787 221,800 14%

-------- -------- -------

Richard Lilwall, Chief Executive Officer of Quartix

commented:

"Quartix has performed well in the first half of 2023.

Subscriptions to new customers have been particularly pleasing, and

mitigated economic headwinds impacting both repeat units from

existing customers, which are much more sensitive to business

confidence, and attrition, which has seen an increase from customer

insolvencies and fleet downsizing.

I am particularly pleased with the performance of our France

based operations, which saw investments in field-sellers over the

previous two years deliver excellent returns. Our other European

territories also showed excellent levels of subscription base

growth. In the UK, where economic challenges are more significant

due to the larger subscription base, growth was supported by a

strong performance in new customer acquisition, which significantly

mitigated this impact. In the US we have made several strategic

decisions including a focus on field sellers and a single

State.

We have a strong sales pipeline for the second half for both our

core platform and upsell product lines, EVolve and Qcheck, and have

confidence in achieving market expectations in 2023."

([1]) Based on currency rates as at 30 June 2023.

([2]) The Board believes that consensus market expectations for

2023, prior to this announcement, were as follows: Revenue

GBP30.8m, Adjusted EBITDA GBP6.2m, and Free Cash Flow of

GBP4.3m

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 as retained as part of UK

law by virtue of the European Union (Withdrawal) Act 2018 as

amended.

For further information, please contact:

Quartix (www.quartix.net)

Richard Lilwall, Chief Executive

Officer

Emily Rees, Chief Financial Officer 01686 806 663

finnCap (Nominated Adviser and

Broker)

Matt Goode / Seamus Fricker (Corporate

Finance)

Alice Lane / Sunila de Silva (Corporate

Broking) 020 7220 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSTDIIDIIV

(END) Dow Jones Newswires

July 10, 2023 02:00 ET (06:00 GMT)

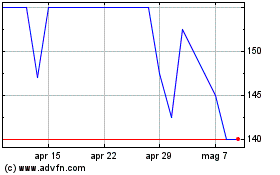

Grafico Azioni Quartix Technologies (LSE:QTX)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Quartix Technologies (LSE:QTX)

Storico

Da Mag 2023 a Mag 2024