TIDMREAT

RNS Number : 3042E

React Group PLC

29 June 2023

29 June 2023

REACT Group plc

("REACT", the "Group" or the "Company")

Half Year Results FY 2023

REACT Group plc (AIM:REAT.L), the leading specialist cleaning,

hygiene and decontamination company announces its unaudited results

for the six-month period ended 31 March 2023.

Financial Summary

HY 2023 HY 2022

---------------------------------------- -------- --------

Revenue (GBP'000) 9,320 5,125

Gross profit (GBP'000) 2,484 1,156

Gross profit margin 26.7% 22.6%

Adjusted EBITDA (GBP'000)* 927 162

Adjusted profit before amortisation

of acquired intangible assets and

exceptional items (GBP'000) * 773 88

Net loss for the period (GBP'000) (86) (92)

Adjusted earnings per share (basic)

(pence) 0.07 0.02

Adjusted earnings per share (diluted)

(pence) 0.07 0.01

Net debt (excluding lease liabilities)

(GBP'000) 257 43

*These measures are explained and reconciled in the Alternative

Performance Measures section in Note 5 below.

Highlights (including post period highlights):

-- Revenue increased by 82% to GBP9,320k (2022: GBP5,125k)

-- Adjusted EBITDA up materially to GBP927k (2022: GBP162k)

-- Gross margins up at 27% from 23% in H1 2022

-- GBP800k multi-year contract win to provide services, through

a coordinated programme from all three segments of the business to

a large fast-service restaurant chain across c. 350 sites in the

UK

-- GBP500k 18-month contract with a sizeable Midlands-based

school alongside numerous contract renewals which include another

school worth around GBP540k over three years and an annual contract

with an NHS Trust worth almost GBP200k

-- Improved mix of recurring revenue as well as higher margins

provides the business with greater visibility and a more dependable

revenue stream

Commenting on the results Shaun Doak, Chief Executive Officer of

REACT, said:

"We are delighted to report a strong trading performance for the

business with revenue and profit at record levels. All three

divisions have traded well in the period and this momentum has

continued into the second half.

"The Group has benefitted from notable customer wins including

an GBP800k contract to provide services, through a coordinated

programme from all three segments of the business to a large

fast-service food chain across all its sites in the UK. This major

contract win illustrates how strategic acquisitions provide

significant cross-selling opportunities for the Group once

successfully integrated.

"The enhanced mix of recurring revenue and increased margins

provides the business with greater visibility and a more dependable

revenue stream. This combined with the strength of our pipeline for

the remainder of the year provides the Board with cautious optimism

and reinforces its confidence in achieving full-year results in

line with market expectations.

"On behalf of the Board, I would once again like to thank all my

colleagues for their ongoing support, commitment, tenacity and

quality of work."

For more information:

REACT Group Plc

Shaun Doak, Chief Executive Of cer Tel: +44 (0) 1283 550

Andrea Pankhurst, Chief Financial Officer 503

Mark Braund, Chairman

Singer Capital Markets

(Nominated Adviser / Broker)

Phil Davies / James Moat (Corporate Finance) Tel: +44 (0) 207 496

3000

IFC Advisory

( Financial PR / IR)

Graham Herring / Zach Cohen Tel: +44 (0) 20 3934

6630

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"). Upon the publication of this

announcement via the Regulatory Information Service, this inside

information is now considered to be in the public domain.

RESULTS SUMMARY & STRATEGY

Strategy

The REACT business performed strongly during the six months to

31 March 2023, trading in the period has been robust and the

positive contract win momentum has continued with good sales growth

across all three divisions of the business.

The Group achieved record revenue and profit growth during the

six-month period. The combination of growing recurring revenue as

well as higher margins provides the business with greater

visibility and a more dependable revenue stream. Recurring revenue

is key to our strategy and the contract maintenance segment of the

business typically allows customers to purchase our services over a

contracted period of several years. Within these contracts, price

increases are implemented at certain points to mitigate

wage-inflation pressures. The Group has benefitted from its ability

to cross sell other business services into existing and new

customers. Evidence of this is the recent contract win, with an

estimated value of GBP800k in the current financial year, to

provide services, through a coordinated programme from all three

segments of the business to a large fast-service food restaurant

across all its sites in the UK. This positive contract win momentum

has continued, with good sales growth in all three divisions of the

business across the six-month period.

In May last year, the Group acquired LaddersFree, one of the

largest commercial window cleaning businesses in the UK. The

business has been integrated well and its revenues have grown by

over 25% in its first year as part of the Group. This has been

achieved despite the gloom on the UK high street resulting in

customer site closures and economic pressures over the last year.

The Board is looking to scale the business whilst professionalising

its operating systems. LaddersFree continues to be awarded

contracts to provide services for retailers, restaurants, hotels

and car dealerships amongst others. The division continues to

attract higher margin contracts helping to deliver a considerable

contribution to Group profits.

It has now been over two years (March 2021) since the Group

acquired Fidelis Contract Services ("Fidelis"), a contract cleaning

and facilities maintenance business. Fidelis had a slightly slower

start to H1, this then improved greatly reporting record revenues

over the latter stages of the six-month period. Fidelis has been

awarded a GBP500k 18-month contract with a sizeable Midlands-based

school and alongside this, numerous contract renewals which include

another school worth around GBP540k over three years and an annual

contract with an NHS Trust worth almost GBP200k.

The Fidelis business is now generating twice as much revenue as

it was in the 12-months prior to acquisition, demonstrating not

only its strategic value to the Group but also the manner in which

the Company has been able to integrate and grow the business,

adding a more scalable management team and more sophisticated

systems to support its continuing growth ambitions.

The REACT business, which primarily provides a solution to

emergency and specialist cleaning situations, both through

long-term framework agreements and on an ad-hoc basis, has had a

buoyant period of business as its bespoke services remain in

demand. Margins remain a focus of this division as these continue

to rise as a result of a changing mix of business.

People

The Group performs bespoke training and development projects

and, as a consequence, has been able to develop the roles of a

number of important personnel and promote internally. As an

aspiring expanding Group, it continues to take efforts to invest in

its people to promote greater performance and job satisfaction of

all employees.

Due to the nature of REACT's service delivery department, this

is undertaken by people who are considered experts in their field,

supported by a dedicated customer-centric team, who have now fully

adapted to working conditions since all COVID restrictions have

been lifted. The strong financials reported in H1 are bolstered by

the efforts of the entire team and each individual has played a

crucial role in our collective achievements.

I would like to take this opportunity to extend our gratitude

and appreciation to our esteemed colleagues for their unwavering

dedication and hard work. It is through their collective efforts

and commitment that we have achieved our targets during this period

and reached new heights.

Outlook

Trading in the second half of the year has continued well

building on the momentum of the first half. The enhanced mix of

recurring revenue and increased margins provides the business with

greater visibility and a more dependable revenue stream. This

combined with the strength of our pipeline for the remainder of the

year provides the Board with cautious optimism and reinforces its

confidence in achieving full-year results in line with market

expectations.

Shaun Doak

Chief Executive Officer

29 June 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 March 2023

Unaudited Unaudited Audited

6 months 6 months Year ended

ended ended 30 September

31 March 31 March 2022

2023 2022

Note GBP'000 GBP'000 GBP'000

Continuing Operations

Revenue 9,320 5,125 13,671

Cost of Sales (6,836) (3,969) (10,414)

---------- ---------- --------------

Gross Profit 2,484 1,156 3,257

Administrative expenses (2,499) (1,241) (3,768)

Adjusted operating profit

before amortisation of acquired

intangible assets and exceptional

items 844 91 775

Amortisation of acquired intangible

assets (821) (147) (743)

Exceptional costs (38) (29) (543)

------------------------------------- ----- ---------- ---------- --------------

Operating loss (15) (85) (511)

Finance cost (71) (3) (56)

Corporation tax charge - (4) (134)

---------- ---------- --------------

Loss for the period (86) (92) (701)

Other comprehensive Income - - -

Loss for the financial period

attributable to equity holders

of the company (86) (92) (701)

========== ========== ==============

Basic and diluted profit per

share 4

Basic loss per share (0.01)p (0.02)p (0.09)p

========== ========== ==============

Diluted loss per share (0.01)p (0.02)p (0.09)p

========== ========== ==============

Adjusted basic earnings per

share 0.07p 0.02p 0.08p

========== ========== ==============

Adjusted diluted earnings per

share 0.07p 0.01p 0.07p

========== ========== ==============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 March 2023

Unaudited Unaudited Audited

As at 31 As at As at 30

March 31 March September

2023 2022 2022

Assets Note GBP'000 GBP'000 GBP'000

Non-current assets

Intangibles - Goodwill 4,209 1,854 4,209

Intangibles - Other 4,859 881 5,680

Property, plant and equipment 185 168 203

Right-of-use assets 73 68 100

Deferred tax asset 244 240 244

---------- ---------- -----------

9,570 3,211 10,436

Current assets

Stock 11 10 11

Trade and other receivables 4,301 2,305 4,254

Cash and cash equivalents 650 (43) 979

4,962 2,272 5,244

Total assets 14,532 5,483 15,680

========== ========== ===========

Equity

Shareholders' Equity

Called-up equity share capital 2,644 1,270 2,624

Share premium account 10,910 6,028 10,905

Reverse acquisition reserve (5,726) (5,726) (5,726)

Capital redemption reserve 3,337 3,337 3,337

Merger relief reserve 1,328 1,328 1,328

Share based payments 68 33 44

Accumulated losses (4,259) (3,564) (4,173)

Total Equity 8,302 2,706 8,339

---------- ---------- -----------

Liabilities

Current liabilities

Trade and other payables 4,176 2,309 4,230

Loans and other borrowings 161 - 161

Lease liabilities within one

year 50 46 57

Corporation tax 195 - 271

---------- ---------- -----------

4,582 2,355 4,719

Non-current liabilities

Loans and other borrowings 746 - 808

Lease liabilities after one

year 34 30 53

Other creditors 868 392 1,761

---------- ---------- -----------

1,648 422 2,622

Total liabilities 6,230 2,777 7,341

---------- ---------- -----------

Total Liabilities and Equity 14,532 5,483 15,680

========== ========== ===========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 31 March 2023

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Net cash inflow/(outflow)

from operations 829 7 (773)

Cash flows from financing

activities

Proceeds of share issue 25 - 6,500

Expenses of share issue - - (269)

Lease liability payments (37) (27) (80)

Bank Loans (62) (50) 902

Interest paid (71) - (56)

Net cash (outflow)/inflow

from financing

activities (145) (77) 6,997

---------- ---------- --------------

Net cash from investing activities

Disposal of fixed assets - - 20

Capital expenditure (37) (64) (115)

Acquisition of subsidiary (938) (525) (7,776)

Exceptional costs paid (38) (17) (543)

Net cash outflow from investing

activities (1,013) (606) (8,414)

---------- ---------- --------------

Net decrease in cash, cash

equivalents and overdrafts (329) (676) (2,190)

Cash, cash equivalents and

overdrafts at

beginning of period 979 633 633

Cash on acquisition of subsidiaries - - 2,536

Cash, cash equivalents and

overdrafts at end of period 650 (43) 979

========== ========== --------------

Analysis of cash, cash equivalents and overdrafts:

Cash at bank and in hand 1,379 214 1,529

Overdrafts (729) (257) (550)

-------

650 (43) 979

======= ======= =======

Reconciliation of profit for the period to cash outflow from operations

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Loss for the period (86) (92) (701)

Decrease/(increase) in stocks - 2 1

(Increase)/decrease in receivables (47) (206) (2,155)

Increase in payables 1 38 374

Depreciation and amortisation

charges 904 219 921

Impairment charge - - 567

Finance costs 71 3 56

Tax charge/(credit) - 4 134

Acquisition assets acquired (excluding

cash) - - 119

Exceptional acquisition costs 38 29 (24)

Profit on disposal of fixed assets - - (6)

Share based payment 24 10 21

Tax paid (76) - (80)

------------ ---------- -----------------

Net cash inflow from operations 829 7 (773)

============ ========== =================

Consolidated Statement of Changes in Equity

For the six months ended 31 March 2023

Share

Merger Capital Reverse Based

Share Share Relief Redemption Acquisition Payments Accumulated Total

Capital Premium Reserve Reserve Reserve Reserve Deficit Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30

September

2021 1,270 6,028 1,328 3,337 (5,726) 23 (3,472) 2,788

--------- --------- --------- ------------ ------------ ---------- ------------ --------

Share based

payments - - - - - 10 - 10

Loss for the

period - - - - - - (92) (92)

At 31 March

2022 1,270 6,028 1,328 3,337 (5,726) 33 (3,564) 2,706

--------- --------- --------- ------------ ------------ ---------- ------------ --------

Issue of

shares 1,354 4,877 - - - - - 6,231

Share based

payments - - - - - 11 - 11

Loss for the

period - - - - - - (609) (609)

At 30

September

2022 2,624 10,905 1,328 3,337 (5,726) 44 (4,173) 8,339

--------- --------- --------- ------------ ------------ ---------- ------------ --------

Issue of

shares 20 5 - - - - - 25

Share based

payments - - - - - 24 - 24

Loss for the

period - - - - - - (86) (86)

At 31 March

2023 2,644 10,910 1,328 3,337 (5,726) 68 (4,259) 8,302

--------- --------- --------- ------------ ------------ ---------- ------------ --------

Notes to the interim financial statements

1. Basis of preparation

These consolidated interim financial statements have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the European Union and on a

historical basis, using the accounting policies which are

consistent with those set out in the Group's annual report and

accounts for the year ended 30 September 2022. The interim

financial information for the six months ended 31 March 2023, which

complies with IAS 34 'Interim Financial Reporting' were approved by

the Board of Directors on 29 June 2023.

The unaudited interim financial information for the six months

ended 31 March 2023 does not constitute statutory accounts within

the meaning of Section 435 of the Companies Act 2006. The

comparative figures for the year ended 30 September 2022 are

extracted from the statutory financial statements which have been

filed with the Registrar of Companies and contain an unqualified

audit report and did not contain statements under Section 498 to

502 of the Companies Act 2006.

2. Principal Accounting Policies

The principal accounting policies adopted are consistent with

those of the annual financial statements for the year ended 30

September 2022.

3. Segmental Reporting

In the opinion of the Directors, the Group has one class of

business, being that of specialist cleaning and decontamination

services. Although the Group operates in only one geographic

segment, which is the UK, it has also analysed the sources of its

business into the segments of Contract Maintenance, Contract

Reactive or Ad Hoc work.

Unaudited 6 months ended Unaudited 6 months ended

31 March 2023 31 March 2022

Contract Contract Ad Total Contract Contract Ad Total

Maintenance Reactive Hoc Maintenance Reactive Hoc

Work Work Work Work Work Work

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 6,807 1,181 1,332 9,320 3,268 933 924 5,125

Gross profit 1,883 296 305 2,484 520 281 355 1,156

Profit before

amortisation

and

exceptional

items 689 36 48 773 38 20 26 84

Total Assets 13,213 450 869 14,532 2,466 1,334 1,683 5,483

------------- ---------- -------- -------- ------------- ---------- -------- --------

Total Liabilities (5,665) (193) (372) (6,230) (1,249) (675) (853) (2,777)

------------- ---------- -------- -------- ------------- ---------- -------- --------

4. Earnings per Share (basic and adjusted)

The calculations of earnings per share (basic and adjusted) are

based on the net loss and a djusted profit before amortisation of

acquired intangible assets and exceptional items* respectively and

the ordinary shares in issue during the period.

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

Net Loss for period (86) (88) (701)

============== ============ ==============

Adjustments:

Amortisation on acquired intangible

assets 821 147 743

Exceptionals 38 29 543

Adjusted profit before amortisation

of

acquired intangible assets

and exceptional items 773 88 585

============== ============ ==============

Number Number Number

Weighted average shares in

issue for basic earnings per

share 1,055,369,702 508,006,026 718,622,464

Weighted average dilutive

share options and warrants 91,750,707 62,247,272 62,247,272

-------------- ------------ --------------

Average number of shares used

for dilutive earnings per

share 1,147,120,409 570,253,298 780,869,736

============== ============ ==============

pence pence pence

Basic loss per share (0.01)p (0.02)p (0.09)p

============== ============ ==============

Diluted loss per share (0.01)p (0.02)p (0.09)p

============== ============ ==============

Adjusted basic earnings per

share 0.07p 0.02p 0.08p

============== ============ ==============

Adjusted diluted earnings

per share 0.07p 0.02p 0.07p

============== ============ ==============

*These measures are explained and reconciled in the Alternative

Performance Measures section in Note 5 below.

5. Alternative Performance Measures

The Board monitors performance principally through adjusted

comparative performance measures. Adjusted profit and earnings per

share measures exclude certain items including amortisation of

acquired intangible assets and exceptional items. The Board

believes that these alternative measures provide a clearer

understanding of the Group's underlying trading performance, as

they exclude one-off and non-cash items.

They key measures used as APMs are reconciled below:

HY 2023 HY 2022

GBP'000 GBP'000

--------------------------------------------------- --------- ---------

Loss before tax as per Statement of Comprehensive

Income (86) (88)

Amortisation of acquired intangible assets 821 147

Exceptional items 38 29

--------- ---------

Adjusted profit before amortisation of acquired

intangible assets and exceptional items 773 88

Interest 71 2

Depreciation 83 72

Adjusted EBITDA 927 162

========= =========

Copies of this Interim Report are available from the Company

Secretary, Holly House, Shady Lane, Birmingham B44 9ER and on the

Company's website www.reactsc.co.uk/react-group-plc

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UWVRROSUNUUR

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

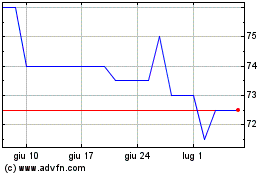

Grafico Azioni React (LSE:REAT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni React (LSE:REAT)

Storico

Da Apr 2023 a Apr 2024