Ramsdens Holdings PLC Pre-Close Trading Update (7332O)

05 Ottobre 2023 - 8:00AM

UK Regulatory

TIDMRFX

RNS Number : 7332O

Ramsdens Holdings PLC

05 October 2023

5 October 2023

Ramsdens Holdings PLC

("Ramsdens" or the "Group")

Pre-Close Trading Update

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Record profits reflecting continued progress across the Group's

diversified income streams

Ramsdens Holdings PLC, the diversified financial services

provider and retailer, announces a pre-close trading update for the

year ended 30 September 2023 ("FY23" or the "Period").

The Group continued to trade well during the second half of the

Period, benefiting from the strength of its diversified business

model. As a result, the Board anticipates Profit Before Tax for the

Period to be a record result of more than GBP10m (FY22

GBP8.4m).

FY23 Highlights

- Foreign currency revenue increased year on year by

approximately 8%. The important summer trading period saw a mixture

of increased transaction volumes, lower average transaction values

and, as expected, a slight reduction in margins. We successfully

launched our multi-currency card in September 2023 and are

encouraged by initial sales and load volumes.

- Jewellery retail revenue again enjoyed strong growth

benefiting from the investments the Group has made to enhance its

retail proposition both in store and online during recent years.

Revenue increased more than 20% year on year supported by

particularly strong momentum online.

- The active pawnbroking loan book increased by approximately

20% to a record GBP10.3m as at 30 September 2023 (FY22: GBP8.6m),

with August being a record month for new lending. The median loan

value was GBP174 and repayment rates remained in line with

historical levels.

- Precious metal buying revenue increased by approximately 50%

year on year as consumer demand for realising value in unwanted or

damaged jewellery increased in part as a result of the higher

Sterling gold price.

- During the year, we opened eight new stores and acquired a

pawnbrokers in Bexleyheath. We are very pleased with the initial

performances of these stores so far.

Peter Kenyon, CEO of Ramsdens commented:

"We are pleased with the Group's continued delivery against its

long-term growth strategy, with good progress made during the

Period in each of our diversified income streams.

Our recent staff engagement survey results show we have a highly

engaged workforce who enjoy working for Ramsdens and serving our

growing customer base. I am grateful for our team's commitment

during the year and would like to take this opportunity to publicly

thank them all for their efforts.

While the economic backdrop is challenging and Ramsdens is not

immune to inflationary cost pressures, particularly energy and

payroll, the Board remains confident that Ramsdens is in a good

position to continue its positive momentum into the new financial

year underpinned by the Group's proven and diversified business

model, strong brand and clear growth strategy."

The Board expects to release its Annual Financial Report in

mid-January 2024.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014 as amended by The Market Abuse

(Amendment) (EU Exit) Regulations 2019. The person responsible for

making this announcement on behalf of the Company is Peter Kenyon,

Chief Executive.

Enquiries:

Ramsdens Holdings PLC Tel: +44 (0) 1642 579957

Peter Kenyon, CEO

Martin Clyburn, CFO

Liberum Capital Limited (Nominated Adviser) Tel: +44 (0) 20 3100 2000

Richard Crawley

Lauren Kettle

Hudson Sandler (Financial PR) Tel: +44 (0) 20 7796 4133

Alex Brennan

Emily Brooker

About Ramsdens

Ramsdens is a growing, diversified, financial services provider

and retailer, operating in the four core business segments of

foreign currency exchange, pawnbroking loans, precious metals

buying and selling and retailing of second hand and new jewellery.

Ramsdens does not offer unsecured high cost short term credit.

Headquartered in Middlesbrough, the Group operates from 161

stores within the UK (including 2 franchised stores) and has a

growing online presence.

Ramsdens is fully FCA authorised for its pawnbroking and credit

broking activities.

www.ramsdensplc.com

www.ramsdensforcash.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUSSNROUURRAA

(END) Dow Jones Newswires

October 05, 2023 02:00 ET (06:00 GMT)

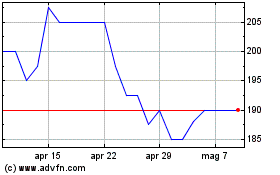

Grafico Azioni Ramsdens (LSE:RFX)

Storico

Da Mar 2024 a Apr 2024

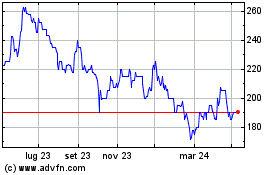

Grafico Azioni Ramsdens (LSE:RFX)

Storico

Da Apr 2023 a Apr 2024