TIDMS32

RNS Number : 9233Q

South32 Limited

23 October 2023

QUARTERLY REPORT

September 2023

-- FY24 production guidance remains unchanged across all operations.

-- Manganese ore production increased by 4% , with a quarterly record

at South Africa Manganese and a strong start to the year at Australia

Manganese.

-- Alumina production increased by 3%, as Brazil Alumina recovered

from temporary port infrastructure outages, while Worsley Alumina

completed planned calciner maintenance.

-- Hillside Aluminium continued to test its maximum technical capacity

and low-carbon aluminium(1) production from Brazil Aluminium and

Mozal Aluminium increased by 2%.

-- Illawarra Metallurgical Coal production decreased by 33%, as the

operation commenced an extended planned longwall move at the Dendrobium

mine. A new industrial agreement covering deputies at the Appin

mine was finalised subsequent to the end of the quarter.

-- Sierra Gorda payable copper production decreased by 8%, as higher

throughput delivered by the plant de-bottlenecking project was offset

by lower planned copper grades.

-- Cannington payable zinc equivalent production decreased by 6%, due

to lower planned zinc grades in the quarter, with the operation

remaining on-track to deliver 11% production growth in FY24.

-- Cerro Matoso payable nickel production decreased by 19%, as the

operation was impacted by planned plant maintenance and a temporary

disruption to gas supply.

-- We commenced federal permitting at our Hermosa project under FAST-41

and remain on-track to complete the feasibility study for the Taylor

zinc-lead-silver deposit in Q2 FY24.

South32 Chief Executive Officer, Graham Kerr : "We have

maintained annual production guidance for all of our operations

with a strong start to the year at our manganese operations, a 34

per cent increase in production at Brazil Alumina and continued

growth in low-carbon aluminium volumes.

"With macroeconomic conditions creating headwinds for many of

our commodities, we remain focused on driving operating performance

and cost efficiencies. This focus, along with our production growth

in commodities critical for a low-carbon future, positions us well

to capture higher margins as market conditions improve.

"Our disciplined approach to capital management allowed us to

return a further US$22 million with the continuation of our US$2.4

billion capital management program, and following the end of the

period, pay our US$145 million fully-franked ordinary dividend in

respect of the prior six months.

"During the quarter, we continued to advance our portfolio of

high-quality growth options in critical commodities. At our Hermosa

project, we commenced federal permitting for the Taylor and Clark

deposits under FAST-41 and remain on-track to complete Taylor's

feasibility study in the December 2023 quarter."

Production summary

YTD

South32 share YTD FY23 FY24 YoY 1Q23 4Q23 1Q24 QoQ

Alumina production (kt) 1,257 1,290 3% 1,257 1,249 1,290 3%

Aluminium production

(kt) 279 288 3% 279 286 288 1%

Payable copper production

(kt) 19.0 16.0 (16%) 19.0 17.3 16.0 (8%)

Payable silver production

(koz) 2,748 3,375 23% 2,748 3,522 3,375 (4%)

Payable lead production

(kt) 24.6 28.5 16% 24.6 28.3 28.5 1%

Payable zinc production

(kt) 14.0 13.2 (6%) 14.0 16.2 13.2 (19%)

Payable nickel production

(kt) 9.6 8.3 (14%) 9.6 10.2 8.3 (19%)

Metallurgical coal production

(kt) 1,270 1,043 (18%) 1,270 1,504 1,043 (31%)

Manganese ore production

(kwmt) 1,460 1,518 4% 1,460 1,455 1,518 4%

Unless otherwise noted: percentage variance relates to performance

during the September 2023 quarter compared with the September 2022

quarter (YoY), or the September 2023 quarter compared with the June

2023 quarter (QoQ); production and sales volumes are reported on an

attributable basis.

Corporate Update

-- Supporting our commitment to deliver improved safety performance,

we continued to implement our multi-year Safety Improvement Program,

including significant investment in safety leadership through our

'Lead Safely Every Day' training.

-- We remain focused on driving cost performance to mitigate industry-wide

inflationary pressure. During the quarter, we initiated a Group-wide

review that is expected to deliver a reduction in expenditure across

our operations and functions in FY24 and FY25.

-- Net debt(2) increased by US$299M to US$782M during the September

2023 quarter with lower commodity prices, and a temporary build in

working capital of US$250M as we made payments accrued in the prior

period and our high value aluminium inventory increased by US$100M.

We expect to lower our aluminium inventory position to normalised

levels during the December 2023 quarter, as Brazil Aluminium makes

its first planned export sales and we drawdown inventory in our Southern

African value chain.

-- We invested in productivity and improvement activities across our

portfolio, allocating US$180M to safe and reliable, and improvement

and life extension, capital expenditure(3) . This included our planned

investment to support Illawarra Metallurgical Coal's transition to

a more efficient single longwall configuration at the Appin mine

from FY25 and additional ventilation capacity to enable mining in

Appin's Area 7 until at least 2039(4) .

-- We received net distributions(5) of US$33M (South32 share) from our

equity accounted investments (EAI) during the September 2023 quarter,

including US$15M from our manganese business and US$18M from Sierra

Gorda.

-- We allocated US$22M to our on-market share buy-back during the September

2023 quarter, purchasing a further 10M shares at an average price

of A$3.34 per share. Our US$2.4B capital management program is 95%

complete with US$112M remaining to be returned ahead of its extension

or expiry on 1 March 2024(6) .

-- Subsequent to the end of the quarter, we paid a fully-franked ordinary

dividend of US$145M in respect of the June 2023 half year.

-- Our FY24 Underlying effective tax rate (ETR) is expected to reflect

the corporate tax rates and earnings of the jurisdictions in which

we operate(7) , including our manganese business and Sierra Gorda

on a proportional consolidated basis (including royalty related taxes

for Australia Manganese and Sierra Gorda). The impact of permanent

differences can have a disproportionate effect on our Underlying

ETR when profit margins are compressed.

-- Separately, the Group made tax payments of US$39M (excluding EAIs)

during the September 2023 quarter, as cash tax normalised following

one-off portfolio related tax payments in the prior period.

Development and Exploration Update

Hermosa project

-- We invested US$71M of growth capital expenditure as we progressed

construction of key infrastructure and commenced federal permitting

for our Taylor zinc-lead-silver and Clark battery-grade manganese

deposits.

-- We expect to complete the feasibility study and an independent peer

review for the Taylor deposit in the December 2023 quarter and announce

the study results and a final investment decision in the March 2024

quarter.

-- We commissioned the second water treatment plant, a key milestone

in our critical path dewatering activity, and are on-track to commence

construction of the Clark exploration decline in the December 2023

quarter.

-- We submitted a mine plan of operations for both the Taylor and Clark

deposits with the US Forest Service, commencing the federal permitting

process under FAST-41(8) .

-- We directed US$6M to capitalised exploration during the September

2023 quarter, as we continued exploration drilling at our copper-lead-zinc-silver

Peake prospect, to follow-up recent high-grade copper exploration

results(9) .

Greenfield exploration

-- We invested US$9M in our greenfield exploration opportunities during

the September 2023 quarter, including a first time exploration drilling

program at our 100% owned Roosevelt project in Alaska.

-- Consistent with our focus on adding prospective base metals options,

we acquired an additional 4.9% equity interest in Aldebaran Resources

Inc. (Aldebaran Resources) for approximately US$8M, taking our ownership

to 14.8%. Aldebaran Resources has an earn-in to acquire an 80% interest

in the Altar copper project in San Juan, Argentina.

Other exploration

-- We invested US$15M (US$11M capitalised) in exploration programs at

our existing operations and development options during the September

2023 quarter, including US$6M at the Hermosa project (noted above,

all capitalised), US$1M at Ambler Metals (all capitalised) and US$2M

for our Sierra Gorda EAI (all capitalised).

Production Summary

Production guidance FY23 YTD FY24 FY24e (a) Comments

(South32 share)

Worsley Alumina

Alumina production (kt) 3,839 972 4,000 Calciner maintenance completed in Q1 FY24

Further calciner maintenance scheduled in

Q3 FY24

Brazil Alumina (non-operated)

Alumina production (kt) 1,262 318 1,400 Recovered from temporary port

infrastructure outages

Brazil Aluminium (non-operated)

Aluminium production (kt) 69 24 100

Hillside Aluminium(10)

Aluminium production (kt) 719 180 720

Mozal Aluminium(10)

Aluminium production (kt) 345 84 365

Sierra Gorda (non-operated)

Payable copper equivalent production(11)

(kt) 86.5 20.3 89.0

Payable copper production (kt) 70.7 16.0 67.0

Payable molybdenum production (kt) 1.2 0.4 2.5

Payable gold production (koz) 28.8 6.3 22.5

Payable silver production (koz) 630 145 550

Cannington

Payable zinc equivalent production(12) (kt) 259 .6 70.3 287.2

Payable silver production (koz) 11,183 3,230 12,500

Payable lead production (kt) 101.7 28.5 115.0

Payable zinc production (kt) 59.2 13.2 62.0

Cerro Matoso

Payable nickel production (kt) 40.8 8.3 40.5 Planned maintenance and a temporary

disruption to

third-party gas supply

Illawarra Metallurgical Coal

Four longwall moves planned

Total coal production (kt) 6,520 1,168 5,000 in FY24

Metallurgical coal production (kt) 5,497 1,043 4,400

Energy coal production (kt) 1,023 125 600

Australia Manganese

Manganese ore production (kwmt) 3,545 890 3,400

South Africa Manganese

Manganese ore production (kwmt) 2,108 628 2,000

a. The denotation (e) refers to an estimate or forecast year.

Worsley Alumina (86% share)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Alumina production (kt) 920 972 6% 920 1,012 972 6% (4%)

Alumina sales (kt) 885 913 3% 885 1,111 913 3% (18%)

Worsley Alumina saleable production decreased by 4% (or 40kt) to

972kt in the September 2023 quarter as we completed planned

calciner maintenance. FY24 production guidance remains unchanged at

4,000kt with the refinery expected to deliver production at

nameplate capacity of 4.6Mt (100% basis) over the year. Further

planned calciner maintenance is scheduled for the March 2024

quarter.

Sales decreased by 18% in the September 2023 quarter as a

shipment slipped to the December 2023 quarter.

During the September 2023 quarter, we converted the first coal

fired boiler to natural gas, which will improve energy security and

reduce the refinery's operational greenhouse gas emissions(13) .

The second boiler conversion is on-track to be completed in the

June 2024 half year.

Brazil Alumina (36% share, NON-OPERATED)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Alumina production (kt) 337 318 (6%) 337 237 318 (6%) 34%

Alumina sales (kt) 313 272 (13%) 313 242 272 (13%) 12%

Brazil Alumina saleable production increased by 34% (or 81kt) to

318kt in the September 2023 quarter as the refinery continued its

recovery from the temporary port infrastructure outages in the

prior quarter. FY24 production guidance remains unchanged at

1,400kt.

Brazil AluminIUM (40% share, NON-OPERATED)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Aluminium production (kt) 8 24 200% 8 24 24 200% 0%

Aluminium sales (kt) 3 8 167% 3 26 8 167% (69%)

Brazil Aluminium saleable production was largely unchanged at

24kt in the September 2023 quarter as the smelter continued to

ramp-up all three potlines. FY24 production guidance remains

unchanged at 100kt.

During the September 2023 quarter, we progressed activity to

commence export sales of our share of the smelter's aluminium

production, having established initial sales volumes with domestic

customers. We expect to commence export sales and drawdown our

inventory position to normalised levels during the December 2023

quarter.

Hillside Aluminium (100% SHARE)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Aluminium production (kt) 179 180 1% 179 180 180 1% 0%

Aluminium sales (kt) 162 170 5% 162 185 170 5% (8%)

Hillside Aluminium saleable production was unchanged at 180kt in

the September 2023 quarter as the smelter continued to test its

maximum technical capacity despite the impact of elevated

load-shedding. FY24 production guidance remains unchanged at

720kt(10) .

Sales decreased by 8% in the September 2023 quarter as a

shipment slipped to the December 2023 quarter.

Mozal Aluminium (63.7% share)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Aluminium production (kt) 92 84 (9%) 92 82 84 (9%) 2%

Aluminium sales (kt) 87 77 (11%) 87 114 77 (11%) (32%)

Mozal Aluminium saleable production increased by 2% (or 2kt) to

84kt in the September 2023 quarter as the smelter continued to

implement initiatives to achieve planned equipment utilisation and

pot stability, while managing the impact of elevated load-shedding.

FY24 production guidance remains unchanged at 365kt(10) , with

higher volumes expected across the remainder of the year as

nameplate production rates are achieved.

Sales decreased by 32% in the September 2023 quarter as we built

inventory following a significant planned drawdown in the prior

quarter. We expect to lower our inventory position to normalised

levels during the December 2023 quarter.

SIERRA GORDA (45% share)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Payable copper equivalent

production(11) (kt) 22.5 20.3 (10%) 22.5 22.5 20.3 (10%) (10%)

Payable copper production

(kt) 19.0 16.0 (16%) 19.0 17.3 16.0 (16%) (8%)

Payable copper sales (kt) 19.2 15.3 (20%) 19.2 18.0 15.3 (20%) (15%)

Sierra Gorda payable copper equivalent production(11) decreased

by 10% or (2.2kt) to 20.3kt in the September 2023 quarter as higher

plant throughput delivered by the de-bottlenecking project, was

more than offset by lower planned copper grades. FY24 production

guidance remains unchanged at 89.0kt payable copper equivalent

(copper 67.0kt, molybdenum 2.5kt, gold 22.5koz and silver

550koz).

Sierra Gorda progressed the feasibility study for the fourth

grinding line expansion, which has the potential to sustainably

lift plant throughput by 18% to 57 to 58Mtpa (100% basis). The

feasibility study remains on-track to be completed in the June 2024

half year.

Cannington (100% share)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Payable zinc equivalent production(12)

(kt) 61.1 70.3 15% 61.1 74.5 70.3 15% (6%)

Payable silver production

(koz) 2,568 3,230 26% 2,568 3,368 3,230 26% (4%)

Payable silver sales (koz) 1,704 2,873 69% 1,704 3,244 2,873 69% (11%)

Payable lead production (kt) 24.6 28.5 16% 24.6 28.3 28.5 16% 1%

Payable lead sales (kt) 18.7 25.6 37% 18.7 26.0 25.6 37% (2%)

Payable zinc production (kt) 14.0 13.2 (6%) 14.0 16.2 13.2 (6%) (19%)

Payable zinc sales (kt) 14.9 13.9 (7%) 14.9 21.8 13.9 (7%) (36%)

Cannington payable zinc equivalent production (12) decreased by

6% (or 4.2kt) to 70.3kt in the September 2023 quarter as average

zinc grades declined due to the sequencing of lower grade stopes.

FY24 guidance remains unchanged at 287.2kt payable zinc equivalent

production (silver 12,500koz, lead 115.0kt and zinc 62.0kt).

Cerro Matoso (99.9% share)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Payable nickel production

(kt) 9.6 8.3 (14%) 9.6 10.2 8.3 (14%) (19%)

Payable nickel sales (kt) 9.0 8.5 (6%) 9.0 10.4 8.5 (6%) (18%)

Cerro Matoso payable nickel production decreased by 19% (or

1.9kt) to 8.3kt in the September 2023 quarter as

plant availability was impacted by planned maintenance and a

temporary reduction in third-party gas supply, while nickel grades

were sequentially lower in accordance with the mine plan. FY24

production guidance remains unchanged at 40.5kt, with improved

plant throughput and nickel grades expected across the remainder of

the year.

Sales decreased by 18% in the September 2023 quarter, reflecting

lower product availability. Price realisations for our ferronickel

product reflected a discount of 33% to the LME Nickel Index(14) ,

as market dynamics remained largely unchanged from the prior year

(FY23: 29% discount).

Illawarra Metallurgical Coal (100% sHARE)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Total coal production (kt) 1,595 1,168 (27%) 1,595 1,753 1,168 (27%) (33%)

Total coal sales(15) (kt) 1,390 1,196 (14%) 1,390 1,697 1,196 (14%) (30%)

Metallurgical coal production

(kt) 1,270 1,043 (18%) 1,270 1,504 1,043 (18%) (31%)

Metallurgical coal sales

(kt) 1,193 996 (17%) 1,193 1,529 996 (17%) (35%)

Energy coal production (kt) 325 125 (62%) 325 249 125 (62%) (50%)

Energy coal sales (kt) 197 200 2% 197 168 200 2% 19%

Illawarra Metallurgical Coal saleable production decreased by

33% (or 585kt) to 1,168kt in the September 2023 quarter as the

operation commenced an extended planned longwall move at the

Dendrobium mine. A new four-year industrial agreement covering

deputies at the Appin mine was finalised subsequent to the end of

the quarter.

FY24 production guidance remains unchanged at 5.0Mt with

production volumes expected to be weighted to H2 FY24, reflecting

the expected duration of planned longwall moves across the year

(two in Q2 FY24, two in Q4 FY24).

Australia Manganese (60% share)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Manganese ore production

(kwmt) 898 890 (1%) 898 869 890 (1%) 2%

Manganese ore sales (kwmt) 779 940 21% 779 866 940 21% 9%

Australia Manganese saleable production increased by 2% (or

21kwmt) to 890kwmt in the September 2023 quarter

as the operation achieved strong primary output, and continued

to operate the low-cost PC02 circuit above its design capacity,

delivering 11% of production (FY23: 11%). FY24 production guidance

remains unchanged at 3,400kwmt, subject to the impacts from the wet

season.

Sales increased by 9% in the September 2023 quarter, as improved

road haulage capacity and alternative shipping solutions supported

a planned drawdown in inventories. Our average realised price for

manganese ore sales was a discount of approximately 6% to the high

grade 44% manganese lump ore index(16) on a M-1 basis (FY23: 6%

discount), reflecting lower planned ore grades, as well as price

realisations for our PC02 product.

South Africa Manganese (ore 54.6% share)

South32 share YTD FY23 YTD FY24 YoY 1Q23 4Q23 1Q24 1Q24 vs 1Q23 1Q24 vs 4Q23

Manganese ore production

(kwmt) 562 628 12% 562 586 628 12% 7%

Manganese ore sales (kwmt) 473 518 10% 473 541 518 10% (4%)

South Africa Manganese continued its strong performance,

increasing saleable production by 7% (or 42kwmt) to a record

628kwmt in the September 2023 quarter. FY24 production guidance

remains unchanged at 2,000kwmt, with planned maintenance scheduled

for the December 2023 and March 2024 quarters.

Sales decreased by 4% in the September 2023 quarter, as

third-party port congestion impacted the timing of shipments. We

expect to complete additional shipments and drawdown inventories

during the December 2023 quarter.

Our realised price for manganese ore sales was a premium of

approximately 6% to the medium grade 37% manganese lump ore

index(17) on a M-1 basis (FY23: 6% premium), as we continued to

optimise our sales mix.

Notes

1. Refers to aluminium produced using renewable power.

2. Net debt number is unaudited and should not be considered as an

indication of or alternative to an IFRS measure of profitability,

financial performance or liquidity.

3. Group safe and reliable capital expenditure and improvement and

life extension capital expenditure (excluding EAIs). FY24 guidance

is US$690M.

4. The information in this announcement that relates to the Production

Target for Appin (up to 2039) of Illawarra Metallurgical Coal is

based on 21% Proved and 79% Probable Coal Reserves from Bulli (Appin).

Production Target cautionary statement - The Coal Reserves estimates

underpinning the Production Target have been prepared by Competent

Persons and reported in accordance with the JORC Code. The Coal

Resources and Coal Reserves estimates are available to view in South32's

FY23 Annual Report (http://www.south32.net) published on 8 September

2023. The stated Production Target is based on South32's current

expectations of future results or events and should not be solely

relied upon by investors when making investment decisions. Further

evaluation work and appropriate studies are required to establish

sufficient confidence that this target will be met.

5. Net distributions from our material equity accounted investments

(manganese and Sierra Gorda) includes net debt movements and dividends,

which are unaudited and should not be considered as an indication

of or alternative to an IFRS measure of profitability, financial

performance or liquidity.

6. Since inception, US$1.7B has been allocated to the on-market share

buy-back (788M shares at an average price of A$3.05 per share) and

US$525M returned in the form of special dividends.

7. The corporate tax rates of the geographies where the Group operates

include: Australia 30%, South Africa 27%, Colombia 35%, Mozambique

0%, Brazil 34% and Chile 27%. The Mozambique operations are subject

to a royalty on revenues instead of income tax. Sierra Gorda is

subject to a royalty related tax based on the amount of copper sold

and the mining operating margin, the rate is between 5% and 14%

for annual sales over 50kt of refined copper. This royalty is included

in tax expense.

8. Refer to market release "Hermosa Project Update" dated 8 May 2023.

In May 2023, our Hermosa project was confirmed by the US Federal

Permitting Improvement Steering Council, an independent federal

agency, as the first mining project added to the FAST-41 process.

9. Peake Prospect Exploration Target: The information in this announcement

that relates to Exploration Results for Peake prospect is extracted

from the announcement entitled (Hermosa Project - Mineral Resource

Estimate Update and Exploration Results) published on 24 July 2023

and is available to view on www.south32.net. The company confirms

that it is not aware of any new information or data that materially

affects the information included in the original market announcement.

The company confirms that the form and context in which the Competent

Person's findings are presented have not been materially modified

from the original market announcement.

10. Production guidance for Hillside Aluminium and Mozal Aluminium does

not assume any load-shedding impact on production.

11. Payable copper equivalent production (kt) was calculated by aggregating

revenues from copper, molybdenum, gold and silver, and dividing

the total Revenue by the price of copper. FY23 realised prices for

copper (US$3.51/lb), molybdenum (US$21.28/lb), gold (US$1,821/oz)

and silver (US$21.9/oz) have been used for FY23, Q1 FY24 and FY24e.

12. Payable zinc equivalent production (kt) was calculated by aggregating

revenues from payable silver, lead and zinc, and dividing the total

Revenue by the price of zinc. FY23 realised prices for zinc (US$2,151/t),

lead (US$1,919/t) and silver (US$21.1/oz) have been used for FY23,

Q1 FY24 and FY24e.

13. The first boiler conversion is expected to reduce the refinery's

operational greenhouse gas emissions by up to 205,000 tonnes per

annum or 6% from FY23 levels.

14. Our realised price for nickel sales during the September 2023 quarter

was US$6.19/lb, which represented a 33% discount to the average

LME Nickel index price of US$9.23/lb.

15. Illawarra Metallurgical Coal sales are adjusted for moisture and

will not reconcile directly to Illawarra Metallurgical Coal production.

16. The sales volume weighted average of the Metal Bulletin 44% manganese

lump ore index (CIF Tianjin, China) on the basis of a one-month

lag to published pricing (Month minus one or "M-1") was US$4.53/dmtu

in the September 2023 quarter.

17. The sales volume weighted average of the Metal Bulletin 37% manganese

lump ore index (FOB Port Elizabeth, South Africa) on the basis of

a M-1 basis was US$2.99/dmtu in the September 2023 quarter.

The following abbreviations have been used throughout this

report: US$ million (US$M); US$ billion (US$B); grams per tonne

(g/t); tonnes (t); thousand tonnes (kt); thousand tonnes per annum

(ktpa); million tonnes (Mt); million tonnes per annum (Mtpa);

ounces (oz); thousand ounces (koz); million ounces (Moz); thousand

wet metric tonnes (kwmt); million wet metric tonnes (Mwmt); million

wet metric tonnes per annum (Mwmt pa); dry metric tonne unit

(dmtu); thousand dry metric tonnes (kdmt).

Figures in Italics indicate that an adjustment has been made

since the figures were previously reported. The denotation (e)

refers to an estimate or forecast year.

Operating Performance

YTD YTD

South32 share FY23 FY24 1Q23 2Q23 3Q23 4Q23 1Q24

Worsley Alumina (86% share)

Alumina hydrate production (kt) 957 973 957 998 921 957 973

Alumina production (kt) 920 972 920 1,002 905 1,012 972

Alumina sales (kt) 885 913 885 976 845 1,111 913

Brazil Alumina (36% share)

Alumina production (kt) 337 318 337 354 334 237 318

Alumina sales (kt) 313 272 313 365 317 242 272

Brazil Aluminium (40% share)

Aluminium production (kt) 8 24 8 15 22 24 24

Aluminium sales (kt) 3 8 3 16 23 26 8

Hillside Aluminium (100% share)

Aluminium production (kt) 179 180 179 183 177 180 180

Aluminium sales (kt) 162 170 162 175 197 185 170

Mozal Aluminium (63.7% share)

Aluminium production (kt) 92 84 92 90 81 82 84

Aluminium sales (kt) 87 77 87 90 43 114 77

Sierra Gorda (45% share)

Ore mined (Mt) 8.8 5.9 8.8 6.6 5.1 5.5 5.9

5.

Ore processed (Mt) 5.4 5.5 5.4 5 .3 5. 1 5.4 5

Copper ore grade processed (%, 0. 0.

Cu) 0.45 37 0.45 0. 44 0.40 0. 40 37

Payable copper equivalent production(11) 22 22. 20

(kt) 22.5 20.3 22.5 .3 19.2 5 .3

Payable copper production (kt) 19.0 16.0 19.0 18.9 15.5 17.3 16.0

Payable copper sales (kt) 19.2 15.3 19.2 19.2 15.4 18.0 15.3

Payable molybdenum production 0.

(kt) 0.2 0.4 0.2 0.2 0. 3 0. 5 4

0. 0.

Payable molybdenum sales (kt) 0.3 4 0.3 0. 5 0. 2 0.3 4

Payable gold production (koz) 7.8 6 .3 7.8 7.5 6.2 7. 3 6.3

Payable gold sales (koz) 7.7 6.3 7.7 7.7 6. 4 7. 3 6.3

Payable silver production (koz) 180 145 180 158 138 154 145

Payable silver sales (koz) 179 140 179 166 137 157 140

Cannington (100% share)

Ore mined (kwmt) 639 551 639 484 469 631 551

Ore processed (kdmt) 518 562 518 624 452 562 562

Silver ore grade processed (g/t,

Ag) 179 206 179 171 191 210 206

Lead ore grade processed (%,

Pb) 5.6 5.8 5.6 5.4 5.5 5.8 5.8

Zinc ore grade processed (%,

Zn) 3.7 3.2 3.7 3.6 3.8 4.0 3.2

Payable zinc equivalent production(12)

(kt) 61.1 70.3 61.1 69.7 54.3 74.5 70.3

Payable silver production (koz) 2,568 3,230 2,568 2,906 2,341 3,368 3,230

Payable silver sales (koz) 1,704 2,873 1,704 3,379 2,412 3,244 2,873

Payable lead production (kt) 24.6 28.5 24.6 27.8 21.0 28.3 28.5

Payable lead sales (kt) 18.7 25.6 18.7 32.6 21.7 26.0 25.6

Payable zinc production (kt) 14.0 13.2 14.0 16.4 12.6 16.2 13.2

Payable zinc sales (kt) 14.9 13.9 14.9 12.6 8.8 21.8 13.9

Cerro Matoso (99.9% share)

Ore mined (kwmt) 1,332 940 1,332 1,420 1,189 1,619 940

Ore processed (kdmt) 666 594 666 726 713 702 594

Ore grade processed (%, Ni) 1.63 1.57 1.63 1.65 1.58 1.62 1.57

Payable nickel production (kt) 9.6 8.3 9.6 10.8 10.2 10.2 8.3

Payable nickel sales (kt) 9.0 8.5 9.0 10.8 10.6 10.4 8.5

Illawarra Metallurgical Coal

(100%)

Total coal production (kt) 1,595 1,168 1,595 1,736 1,436 1,753 1,168

Total coal sales(15) (kt) 1,390 1,196 1,390 1,795 1,477 1,697 1,196

Metallurgical coal production

(kt) 1,270 1,043 1,270 1,483 1,240 1,504 1,043

Metallurgical coal sales (kt) 1,193 996 1,193 1,485 1,195 1,529 996

Energy coal production (kt) 325 125 325 253 196 249 125

Energy coal sales (kt) 197 200 197 310 282 168 200

Australia Manganese (60% share)

Manganese ore production (kwmt) 898 890 898 946 832 869 890

Manganese ore sales (kwmt) 779 940 779 873 743 866 940

Ore grade sold (%, Mn) 44.3 42.9 44.3 44.1 44.0 43.1 42.9

South Africa Manganese (54.6%

share)

Manganese ore production (kwmt) 562 628 562 531 429 586 628

Manganese ore sales (kwmt) 473 518 473 559 492 541 518

Ore grade sold (%, Mn) 38.5 39.0 38.5 39.8 38.8 39.4 39.0

Forward-looking statements

This release contains forward-looking statements, including

statements about trends in commodity prices and currency exchange

rates; demand for commodities; production forecasts; plans,

strategies and objectives of management; capital costs and

scheduling; operating costs; anticipated productive lives of

projects, mines and facilities; and provisions and contingent

liabilities. These forward-looking statements reflect expectations

at the date of this release, however they are not guarantees or

predictions of future performance. They involve known and unknown

risks, uncertainties and other factors, many of which are beyond

our control, and which may cause actual results to differ

materially from those expressed in the statements contained in this

release. Readers are cautioned not to put undue reliance on

forward-looking statements. Except as required by applicable laws

or regulations, the South32 Group does not undertake to publicly

update or review any forward-looking statements, whether as a

result of new information or future events. Past performance cannot

be relied on as a guide to future performance. South32 cautions

against reliance on any forward-looking statements or guidance.

Further information

INVESTOR RELATIONS MEDIA RELATIONS

Ben Baker Jamie Macdonald Miles Godfrey

M +61 403 763 086 M +61 408 925 140 M +61 415 325 906

E Ben.Baker@south32.net E Jamie.Macdonald@south32.net E Miles.Godrey@south32.net

Approved for release to the market by Graham Kerr, Chief

Executive Officer

JSE Sponsor: The Standard Bank of South Africa Limited

23 October 2023

South32 Limited

(Incorporated in Australia under the Corporations Act 2001

(Cth))

(ACN 093 732 597)

ASX / LSE / JSE Share Code: S32; ADR: SOUHY

ISIN: AU000000S320

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPGUWUUPWPPP

(END) Dow Jones Newswires

October 23, 2023 02:04 ET (06:04 GMT)

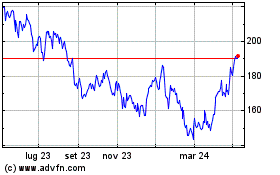

Grafico Azioni South32 (LSE:S32)

Storico

Da Mar 2024 a Apr 2024

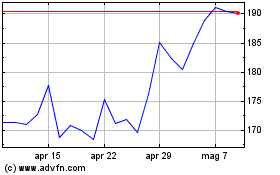

Grafico Azioni South32 (LSE:S32)

Storico

Da Apr 2023 a Apr 2024