TIDMSCT

RNS Number : 0250R

Softcat PLC

24 October 2023

SOFTCAT plc

("Softcat", the "Company")

Preliminary results for the year ended 31 July 2023

Another year of strong organic growth, profitability and cash

generation

Softcat plc (LSE: SCT.L), a leading UK provider of IT

infrastructure products and services, today announces its full year

results to 31 July 2023. The results demonstrate continued strong

growth enabling both sustained investment to support our future

ambitions and the proposal of a progressive ordinary dividend and a

special dividend.

Financial Summary Year ended

31 July 31 July

2023 2022 Change

GBPm GBPm

Revenue(a) 985.3 1,077.9 (8.6%)

Gross invoiced income(b) 2,563.3 2,507.5 2.2%

Gross profit 373.8 327.2 14.2%

Operating profit 140.9 136.1 3.5%

Cash conversion %(c) 93.2% 76.2%

Total ordinary dividend

(p) 25.0p 23.9p

Final dividend (p) 17.0p 16.6p

Special dividend (p) 12.6p 12.6p

Basic earnings per share

(p) 56.2p 55.5p 1.3%

Highlights for the year ended 31 July 2023

-- Strong performance across both halves of the year, extending

our record of unbroken organic year-on-year growth in gross

invoiced income, gross profit and operating profit.

-- Double-digit gross profit per customer growth, while also

attracting new customers , driving further growth in the customer

base.

-- Continued investment across all areas of the business, including headcount growth of 20.5%.

-- A final dividend of 17.0p, resulting in a full year total

ordinary dividend of 25.0p, up 4.6%, and the special dividend

maintained at 12.6p.

-- Strong balance sheet position with cash conversion of 93.2%

(FY2022: 76.2%) with cash and cash equivalents of GBP122.6m

(FY2022: GBP97.3m).

-- Outlook: Double digit gross profit growth anticipated to

continue. Expectations(d) for operating profit for FY2024

unchanged, with growth second half weighted.

(a) Revenue is reported under IFRS 15, the international

accounting standard for revenue. IFRS 15 requires judgements be

made to determine whether Softcat acts as principal or agent in

certain trading transactions. These judgements, coupled with slight

variations of business model and contractual arrangements between

IT Solutions Providers, means the impact of IFRS 15 across the peer

group is not uniform. Income prior to the IFRS 15 adjustment is

referred to as gross invoiced income, which is an Alternative

Performance Measure (APM).

(b) Gross invoiced income reflects gross income billed to

customers adjusted for deferred and accrued revenue items. This is

an Alternative Performance Measure (APM). For further information

on this, please refer to the CFO Report on page 7.

(c) Cash conversion is defined as net cash generated from

operating activities before tax but after capital expenditure, as a

percentage of operating profit. This is also an Alternative

Performance Measure. For further information on this, please refer

to the CFO Report on page 7.

(d) Market expectations refers to the mean Analyst consensus

operating profit estimate as at the 23rd October 2023, available at

https://www.softcat.com/about-us/investor-centre.

Graham Charlton , Softcat CEO, commented,

"I am pleased to report on our FY2023 results which represent

another record year for Softcat. Our unique culture and relentless

dedication to delivering the best customer service in the industry

continue to serve us well.

We once again made progress on both selling deeper into existing

customers , with double-digit gross profit per customer growth,

while also attracting new customers , delivering 1.9% growth in the

customer base.

We continued our investments for future growth, growing

headcount by 20.5% to 2,315, by investing across all departments.

We are evolving our customer offering in response to the changing

technology landscape, keeping pace with emerging customer needs.

The rate of change in our industry, with respect to the technology

we are selling, the channels through which it is sold and the way

it is consumed, is significant. However, the customers' need for

advice and support in navigating this increasing complexity and the

need to deploy the right technology for their circumstances to

remain competitive, is constant. This gives organisations like

Softcat an exciting opportunity to take a bigger share of an

ever-growing market.

The Company remains in a very strong financial position, and we

have great confidence in our long-term growth and cash generation.

In recognition of this, we are again recommending the payment of a

special dividend.

A huge thank you to all the fantastic people at Softcat for

their incredible dedication to each other and our customers , their

efforts and attitude continue to be the bedrock of our success. I'd

also like to thank our partners for their support and look forward

to another exciting year ahead ."

Outlook

The Company is well positioned to continue to deliver

double-digit gross profit growth through the year, driving further

market share gains. We expect full year FY2024 operating profit to

be in line with market expectations.

We expect the operating profit growth to be second half

weighted, with modest growth in the first half of the year

principally reflecting the strong gross profit performance in the

comparative period in the first half.

We see significant and expanding opportunity in our market and

will continue to invest to capitalise on this exciting growth

potential.

Analyst and investor call

The management team will host an investor and analyst briefing

at 9.30am UK time, on Tuesday 24 October 2023. To join the

briefing, please use the following access details:

Webcast Link:

https://www.investis-live.com/softcat/651bcb2537a2c50c0033265b/vavaa

Please register approximately 10 minutes prior to the start of

the call.

For further information, please contact:

Softcat plc: +44 (0)1628 403 403

Graham Charlton, Chief Executive

Officer

Katy Mecklenburgh, Chief Financial

Officer

FTI Consulting LLP: +44 (0)20 3727 1000

Ed Bridges

Matt Dixon

Forward-looking statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". By their nature, such

statements involve risk and uncertainty since they relate to future

events and circumstances. Actual results may, and often do, differ

materially from any forward-looking statements.

Any forward-looking statements in this announcement reflect

management's view with respect to future events as at the date of

this announcement. Save as required by law or by the Listing Rules

of the UK Listing Authority, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement following any change in its expectations or to reflect

subsequent events or circumstances following the date of this

announcement.

This announcement has been determined to contain inside

information.

Chief Executive Officer's Review

Sales Strategy and Execution

Our sales strategy remains unchanged: we continue to look to

acquire new customers and gain an ever greater share of wallet with

existing customers.

Gross profit growth, our primary measure of income, grew by

14.2% despite very strong comparative figures, and our annual

customer engagement survey, completed by a larger set of customers

than ever before, delivered very positive results with an NPS of 62

(FY2022: 55) showing improvements across every category.

Our customer base grew by 1.9%, passing through 10,000. We

continue to benefit from their insight and feedback on where they

are taking their technology in the years to come and the problems

they are trying to solve. Gross profit per customer also grew

strongly, up 12.2% in the year, as we retained our focus on

delivering high quality service and solutions for both existing and

new customers.

The opportunity we have across all segments of our customer base

for further wallet share gains in the years to come, capitalising

on the full breadth and depth of our technology proposition across

software, hardware and services, and within datacentre, security

networking and workplace technologies, is as exciting as ever.

We estimate that our share of the addressable UK market is

around 5%. While conditions were challenging during the second half

of the year, with customers noticeably slowing their rate of

investment and some larger, more complex deals being delayed or

subject to more stringent procurement processes, we remain as

positive as ever about the medium- and long-term prospects for our

industry. We have the largest commercial team in the UK market and

will continue to invest with intent across all functions as we

build capacity and new capabilities to maintain our relevance in a

market evolving at pace.

We will also maintain our position as a key partner to both

established and emerging technology vendors, evolving our skills

around the ever-changing portfolios of services and products coming

to market.

People and Culture

Our culture remains as strong as ever as evidenced by the

results of our annual employee satisfaction survey which showed an

employee NPS of 63 (as surveyed in October 2022 (FY2022: 52)).

Despite our growth in headcount, we continue to not only preserve

our strong culture but also evolve it as society adjusts to the

world of hybrid working. Having a highly motivated and engaged

workforce was the founding principle of Softcat 30 years ago and

remains our number one priority, allowing us to attract and retain

talented people with an outstanding attitude. Our employees

reported that they were particularly happy with our stance on

remote working and inclusivity.

Hybrid working at Softcat has settled into a healthy and natural

rhythm - staff have the freedom to choose a formula that works for

them and we have worked hard to foster an understanding that

circumstances are different for everyone and that there isn't an

easily prescribed formula that can be mandated across the business.

At the same time, it is clear that as an organisation we benefit

from as much time as possible spent together and it has been highly

encouraging to see our people's response to that. Our offices are

vibrant during the middle of the week when teams interact and our

partners visit, but also purposefully populated by those who need

the space at either end of the working week.

Our annual Kick Off event was hosted face to face in September

2023 for the second time since the pandemic, proving to be a bigger

success than ever based on employee feedback and very motivating

for the 2,100 employees who attended. Our partner forum and charity

ball were also hosted in person and it's terrific to see how both

Softcat people and our partners enjoy coming together as a single

team.

The labour market eased during the year and we were able to

increase headcount by 20.5%. This represents rapid expansion of our

sales team (up 24.1%) as well as strong growth in supporting

specialist and technical teams (up 13.5%). Expansion of the

business operations teams was slower (up 11.3%) following very

significant investment during FY2022 in those teams to support the

new finance system implementation and other developments.

Our learning and development initiatives continue to bear fruit

and we are delighted with the number of employees going through our

various programmes including the Sales Development Programme, the

Specialist Acceleration Programme, our Tech Starter programme and

other initiatives including inclusivity, sustainability and cyber

security training.

Our leadership transition was completed smoothly during the

summer of 2023 as previously communicated. Katy Mecklenburgh joined

us as CFO on 19 June and has settled excellently into the Softcat

culture. I'd like to formally welcome her to the Company and am

very confident she has a big role to play in our future

success.

Ease of doing business

During the previous year we implemented a new finance system,

alongside which we developed new data management processes and

integration layers. This has established a modern system

architecture which we are now augmenting with external data feeds,

creating exciting new possibilities for analytics and reporting.

This in turn can form the basis for new ways of working and,

potentially, the application of AI technology to advance our

operating model in significant ways. For example, enabling

automated lead generation, enhancing the efficiency of our account

managers to navigate the enormity and complexity of our customer

proposition, and significantly more effective resource

allocation.

We also continue to invest in developing the skills and digital

platforms necessary to embrace new distribution and consumption

models. This includes the adoption of the various marketplaces

released by the public cloud providers and distributors, as well as

the growing number of subscription-based hardware offerings. Demand

for these innovations is variable but developing and we have the

plans in place to ensure we are best placed to support both

customers and vendors as they reach maturity.

Addressable market

Along with the trends discussed above that we are seeing in the

distribution and consumption of IT infrastructure, the market is

also witnessing rapid introduction of new and exciting

technologies.

Hybrid models of compute and storage, placing data and workloads

in the most appropriate and cost-effective location for the task,

are producing more thoughtful approaches from customers on the

design of their environments and that plays strongly into our

design and advice capabilities.

The impact of AI is building rapidly. Datacentres, wherever they

are located, are beginning to be designed around the need to handle

the demands of this new technology and we only see this increasing.

Datacentres are already created for specific needs, but we expect

even greater differentiation around specific tasks to be

increasingly factored into design choices. Perhaps the most

significant impact from AI in the short term comes from its

deployment in mainstream desktop applications. This will have

immediate implications for the cost of those applications, the

technology being expensive to run, but also promises exciting new

productivity gains and possibly even the transformation of some

elements of the operating model for certain customers. Apart from

the licensing of AI-enabled applications, customers will also need

to think about where they are hosted and the devices they are

deployed upon. Operating systems will need to be refreshed and

end-user device estates re-evaluated. Cyber security continues to

be a major concern for customers and while AI is already being

deployed within security software, its application will also

transform the threat landscape. As a result, we expect to see

continued innovation in this space which will mean the constant

upgrading of organisation's defences will only become a greater

necessity.

Our UK customers continue to ask for our support in their

overseas operations, and so we have invested further in our

multinational operation across Europe, APAC and the US. We now have

9 people operating out of our US branch and a desire to add more

resource as that business grows. This presence in the US will

enable us to better understand that market, providing insights that

will benefit our wider operations and inform future strategy.

Diversity, Inclusion and Sustainability

Our word of the year in FY2023 was 'Connect' and it has been

great to see the Company settle well into a productive hybrid

working pattern this year , evidenced by a strong employee NPS

score mentioned of 63. We were also featured in the top 50 Great

Places to Work in Europe.

Our community networks have once again played a strong role in

developing the organisation towards being a more inclusive place to

work. This has included raising awareness across the Company of

minority groups through our ongoing allyship programme, and we have

continued to support The Technology Channel for Racial Equality to

improve racial equality across our industry. 17% of Softcat

employees are now from ethnic minority backgrounds.

From a gender diversity perspective, we have met our first

target of 35% women in the business, well ahead of schedule, and

this includes now having 36% female representation on our senior

leadership team . We were pleased to be recognised by Great Places

to Work in the following categories:

o 1(st) in the UK's Best Workplaces in Tech

o 6(th) in the UK's Best Workplace for Women

We were also pleased to be awarded the Bronze Award by Stonewall

for the progress we have made for our LGBTQ+ community and were

ranked 124(th) in the UK Workplace Equality Index. We have collated

data for the first time on our employees sexual orientation,

disability, neurodiversity, and socio-economic background to better

inform company policy in a number of areas in the future.

We were delighted to be able to host our Charity Ball again

during last financial year, for the first time since the pandemic,

and in total, across the year, raised GBP470,000 for charitable

causes.

During the year we received more recognition for the strides we

are making with our carbon reduction plans. We were awarded

five-star status by HP in their partner programme and were named

Lenovo ESG Partner of the Year.

We continue to work through key industry bodies and contribute

to thought leadership in this space and were involved with CRN,

Canalys, GTDC, and PWC to influence change across the channel with

respect to product data, circular economy and other sustainability

initiatives.

The development of Enexo, our in-house sustainability reporting

and action planning platform, is ongoing. During the year we have

seen more uptake from customers, suppliers and partners to measure

and manage the impact of scopes 1-3 in our value chain.

Company-wide training has also been carried out, reaching 98%

adoption during our first round of carbon literacy coaching.

We have also worked hard to improve our compliance with TCFD

reporting requirements - satisfying 9 of the 11 recommended

disclosures.

A huge thank you again to the very special team we have at

Softcat for their efforts during the past year. The Company is in

great health and perfectly positioned for future growth.

Board composition and succession planning

Lynne Weedall was appointed as interim Chair of the Nomination

Committee and interim Senior Independent Director (SID) in January

2023 following the resignation of Karen Slatford on health grounds.

Following a review of Board composition, the Board is pleased to

confirm with immediate effect that Lynne is appointed as Chair of

the Nomination Committee on a permanent basis. The Company

announced in August 2023 that Jacqui Ferguson will join the Board

as a Non-Executive Director in January 2024. The Board has agreed

that Lynne will retain the role of interim SID, which will

transition to Jacqui on a permanent basis at some point in

2024.

Chief Financial Officer's Review

Financial Summary FY2023 FY2022 Change

Revenue GBP985.3m GBP1,077.9m (8.6%)

Revenue split

Software GBP188.8m GBP150.0m 25.9%

Hardware GBP610.6m GBP797.9m (23.5%)

Services GBP185.9m GBP130.0m 42.9%

Gross invoiced income

(GII) 1 GBP2,563.3m GBP2,507.5m 2.2%

GII split

Software GBP1,543.5m GBP1,365.3m 13.0%

Hardware GBP617.8m GBP810.2m (23.7%)

Services GBP402.0m GBP332.0m 21.1%

Gross profit (GP) GBP373.8m GBP327.2m 14.2%

Gross profit margin 37.9% 30.4% 7.5%

Operating profit GBP140.9m GBP136.1m 3.5%

Operating profit margin 14.3% 12.6% 1.7%

Gross profit per customer

2 GBP37.0k GBP33.0k 12.2%

Customer base 3 10.1k 9.9k 1.9%

Cash conversion 4 93.2% 76.2% 17.0%

1 Gross invoiced income reflects gross income billed to

customers adjusted for deferred and accrued revenue items. This is

an Alternative Performance Measure (APM). For further information

on this, please refer to the CFO Report on page 7.

2 Gross profit per customer is defined as GP divided by the

customer base.

3 Customer base is defined as the number of customers who have

transacted with Softcat in both of the preceding twelve-month

periods.

4 Cash conversion ratio is net cash generated from operating

activities before taxation, net of capital expenditure, as a

percentage of operating profit. This is also an Alternative

Performance Measure. For further information on this, please refer

to the CFO Report on page 9.

Gross profit, revenue and gross invoiced income

Softcat operates in a fast-growing and constantly changing

market, catering to the IT infrastructure requirements of corporate

entities and public sector organisations across the UK and Ireland.

Our strategy is to provide a comprehensive range of technology

solutions (spanning workplace, datacentre, cloud, networking and

security solutions) across software, hardware and services,

delivered through highly engaged employees who provide exceptional

customer service, to attract new customers and increase sales to

our existing customer base.

Our FY2023 results reflect our ability to continue to deliver

against this strategy. Gross profit (GP), our primary measure of

income, grew by 14.2% to GBP373.8m, in line with expectations,

against a tough FY2022 comparable in which a mid-market customer

accounted for marginally more than 10% of our Gross Invoiced Income

(GII), primarily driven by one-off, low-margin datacentre hardware

sales.

Excluding these FY2022 one-off transactions, GP growth was broad

based and underlying software, services and hardware GP all grew

double-digit. Hardware sales were also impacted by soft market

demand for client devices but this was offset by strong underlying

growth in networking and datacentre solutions. After adjusting for

the one-off transactions, all technology areas also grew

double-digit with particularly strong growth in networking, as

supply chain issues receded during the year, and in security, which

continues to be an area of focus for our customers. Growth was also

strong across all customer segments, with double-digit underlying

growth across enterprise, mid-market and public sector,

demonstrating our continued relevance across our target

markets.

In the second half of the year GP grew by 11.2%, following a

very strong first half performance of 17.9%, with growth impacted

by customers delaying some discretionary spend and large projects

being slower to close as customers applied stricter procurement

processes.

FY2023 revenue declined by (8.6)%, driven by a (23.7)% decline

in hardware GII. This decline in hardware GII, which is reported on

a gross basis within the revenue number (unlike software and some

services revenue which are netted down), was driven by the one-off

transactions in the base year as mentioned above. Excluding these

one-off transactions hardware GII increased marginally compared to

the prior year.

GII growth of 2.2% was driven by strong growth in both software

and services, up by 13.0% and 21.1% respectively, largely offset by

the decline in hardware sales mentioned above. GII grew more slowly

than GP in the period, with GP as a percentage of GII expanding by

1.5%. Margin expansion was driven by the FY2022 one-off

transactions, which diluted the comparative gross margin and

several positive mix effects, with the year-on- year decline in

lower margin client devices, and strong growth in higher margin

datacentre, networking and security solutions driving a positive

margin impact.

Customer KPIs

During the year average GP per customer grew by 12.2% to

GBP37.0k (2022: GBP33.0k) and the customer base increased to

10,100, up 1.9% on the prior year. We won new customers from a

broad range of industries with initial sales balanced across our

core business lines, consistent with sales to existing customers as

described above.

Despite this further strong progress and being confirmed again

as the largest reseller in the UK by CRN, our industry remains

highly fragmented. Our latest estimates, based on multiple industry

sources including CRN and Gartner, suggest we have around 5% of

total addressable market value. This comprises a trading

relationship with c.20% of potential customers with whom we have an

average share of wallet of c.20% - 25%. As a result, we continue to

have a fantastic opportunity for future growth by continuing to

concentrate on our simple strategy of seeking to sell deeper into

existing accounts by building trust and loyalty over time, while

gradually expanding our customer base year on year.

Operating profitability and investment in future growth

Operating profit of GBP140.9m (FY2022: GBP136.1m) increased by

3.5% year-on-year reflecting the 14.2% increase in GP offset by a

21.9% rise in operating costs. Cost growth was in line with

expectations, driven by increased commissions due to higher GP,

alongside a 19.8% increase in average headcount, investments in pay

and IT and a return to pre COVID-19 levels of staff events and

travel.

The investment in headcount was across all areas of the business

including sales operations, technical capabilities, and core

support functions to ensure we are appropriately resourced to

support future growth. Average salary costs increased by 7.5% over

the year, driven by inflationary pay awards across existing staff

and an increase in new hire salaries reflecting the current

inflationary environment and ensuring we remain competitive within

the market.

Cost growth decelerated in H2 to 12.7% compared to 32.4% in H1.

This was driven by several factors: firstly lower GP growth

resulted in lower commissions in H2 compared to H1; secondly the

phasing of the new ERP system implementation costs, with more

impacting H2 than H1 in FY2022; thirdly travel and entertainment

costs which remained constrained in H1 FY2022 due to COVID-19 but

returned to normal in H2 with in person customer meetings and

incentive trips back to pre-pandemic levels; and lastly, while the

full year cost was broadly in-line, bad debt write-offs

year-on-year were more front half weighted in FY2023.

As a result of the investments in headcount, wages and salaries,

IT and travel and entertaining our operating to GP margin decreased

to 37.7 % (2022: 41.6%) as forecast and previously

communicated.

Corporation tax charge

The effective tax rate for 2023 was 21.0% (2022: 18.9%),

reflecting the increase in the UK statutory rate to 25.0% from

19.0% in April 2023 together with the relatively marginal impact of

non-deductible expenses and share-based payment transactions. Our

tax strategy continues to be focused on paying the right amount of

tax in the right jurisdiction, at the right time.

Cash and balance sheet

Cash conversion, defined as net cash generated from operating

activities before tax but after capital expenditure, as a

percentage of operating profit, was 93.2% (2022: 76.2%). The

improvement on prior year reflects a return to normal levels of

year-end receivables following a temporary expansion last year

following the implementation of a new finance system and is towards

the top of the target range of 85%-95%.

Cash at the FY2023 balance sheet date was GBP122.6m (FY2022:

GBP97.3m) and the company remains debt free.

Under our capital allocation framework the first priority is to

invest behind future organic growth and our second priority is to

deliver on our progressive ordinary dividend policy. Additional

excess capital is then either allocated to strategic investments or

returned to shareholders. In FY2023, as outlined above we have

continued to invest in people costs and IT to further drive organic

growth and the proposed ordinary dividend is an increase of 4.6%

vs. FY2022, while excess cash will be returned to shareholders via

a special dividend.

Dividend

A final ordinary dividend of 17.0p per share has been

recommended by the Directors and if approved by shareholders will

be paid on 19 December 2023. The final ordinary dividend will be

payable to shareholders whose names are on the register at the

close of business on 10 November 2023. Shares in the Company will

be quoted ex-dividend on 9 November 2023. The last day for dividend

reinvestment plan ('DRIP') elections to be received is 28 November

2023.

In line with the Company's stated intention to return excess

cash to shareholders a further special dividend payment of 12.6p

has been proposed. This has been calculated taking into account an

increase in the minimum cash holding from GBP60m to GBP75m,

reflecting the continued growth of the business. If approved this

will also be paid on 19 December 2023 alongside the final ordinary

dividend. This will bring the total amount returned to shareholders

since becoming a public company to GBP476.2m.

Alternative Performance Measures

The Company uses two non-Generally Accepted Accounting Practice

(non-GAAP) financial measures in addition to those reported in

accordance with IFRS. The Directors believe that these non-GAAP

measures which are set out below, assist in providing additional

useful information on the underlying trends, sales performance and

position of the Company.

Consequently, non-GAAP measures are used by the Directors and

management for performance analysis, planning and reporting and

have remained consistent with the prior year. These non-GAAP

measures comprise gross invoiced income (or 'GII') and cash

conversion.

1. Gross invoiced income is a measure which correlates closely

to the cash received by the business and therefore aids the users

understanding of working capital movements in the statement of

financial position and the relationship to sales performance and

the mix of products sold. Gross invoiced income reflects gross

income billed to customers adjusted for deferred and accrued

revenue as reported in the IFRS measure. A reconciliation of IFRS

Revenue to gross invoiced income is provided within Note 2 of the

financial statements.

2. Cash conversion ratio is net cash generated from operating

activities before taxation, net of capital expenditure, as a

percentage of operating profit. Cash conversion is an indicator of

the Company's ability to convert profits into available cash. A

reconciliation to the adjusted measure for cash conversion is

provided below:

2023 2022

GBP'000 GBP'000

Net cash generated from operating activities 104,802 83,644

Income taxes paid 29,793 25,344

Cash generated from operations 134,595 108,988

Purchase of property, plant and equipment (2,544) (1,890)

Purchase of intangible assets (701) (3,334)

Cash generated from operations, net of capital

expenditure 131,350 103,764

Operating Profit 140,898 136,145

Cash conversion ratio 93.2% 76.2%

Principal Risks and Uncertainties

The principal and emerging risks facing the Company have been

identified and evaluated by the Board. In summary, principal risks

include:

Risk Potential impacts Management and mitigation

BUSINESS STRATEGY

Failure to respond -- Loss of competitive -- Insight from ongoing

to market changes advantage industry analysis and subscriptions

including technology -- Reduced number input into annual strategy

offering, channel of customers and process

disintermediation, profit per customer -- Regular insights into

competitor landscape customer priorities including

and customer climate-related through

needs. the annual customer experience

(slight increase survey results and 'voice

in net risk) of the customer' surveys.

Multi-layered relationship

with strategic vendors and

executive sponsor alignment

-- Regular Quarterly Business

Reviews with vendors

OPERATIONAL

Customer dissatisfaction -- Reputational -- Dedicated Customer experience

(no change in damage team, who manage and escalate

net risk) -- Loss of customers customer dissatisfaction

-- Financial penalties cases

-- ISO20000-1 IT Service

Management and ISO-9001

Quality management certified

-- Ongoing customer service

excellence training

-- 'Big-deal review' process

Cyber security -- Inability to -- ISO27001 accredited processes.

risk & business deliver customer Company-wide information

interruption services security policy and mandatory

risk -- Reputational security-related training

(no change in damage -- Regular testing of disaster

net risk) -- Financial loss recovery plans and business

-- Customer dissatisfaction continuity plans

-- Established and documented

processes for incident management,

change of control, etc.

-- Ongoing upgrades to network.

-- All employees issued

with corporate devices with

standardised access monitoring

and control

-- Key software used is

from large multi-national

companies who have a 99.9%

SLA and who also provide

us with SOC2 reports that

provide assurance on their

processes and controls

-- Annual penetration test

by a third party

FINANCIAL

Macro-economic -- Short-term supply -- Customer base is well

factors including chain disruption diversi ed in terms of both

impact on customer -- Reduced margins revenue concentration but

sentiment, in -- Reduced customer also public and commercial

ationary pressures, demand sector exposure

interest and -- Reduced profit -- Close dialogue with supply

foreign currency per customer chain partners

volatility -- Higher operating -- Annual budget considers

(no change in costs the operating profit growth

net risk) -- Customer insolvencies expectations of the markets

and cash collection -- Operating costs are budgeted

challenges and reviewed regularly

-- Going concern and viability

statements are underpinned

by robust analysis of scenarios

Ineffective -- Increased bad -- Robust credit assessment

working capital debts process including use of

management (no -- Increased cost trade credit insurance

change in net of operations -- Regular review of the

risk) aged debt position by management

-- Defined treasury policy

covering liquidity management

processes and thresholds

-- Regular cash forecasting,

actual reporting and variance

analysis to highlight any

adverse trends and allow

sufficient time to respond

Failure to retain -- Uncompetitive -- Budgeting process and

competitive pricing leading regular reviews ensure costs

terms with our to loss of business are managed appropriately

suppliers and/or -- Reduced profitability/margins and in consideration of

right size our gross profit growth. Any

cost base compared out of budget spend needs

to gross profit management level approval

generated. -- Rebates form an important,

(no change in but only minority, element

net risk) of total operating pro t.

In addition, Rebate programmes

tend to be industry standard

and not speci c to the Company,

while vendor aligned teams

ensure we optimise available

rebate structures

-- Ongoing training to sales

and operations teams to

keep pace with new vendor

programmes

PEOPLE

Loss of culture -- Reduced staff -- Culture sits at the heart

(no change in engagement of all changes that are

net risk) -- Negative impact made in Softcat. There is

on customer service regular communication from

-- Loss of talent Senior Leadership Team members

to employees at 'Kick off'

and 'All Hands' calls about

the importance of culture

-- Regional offices with

empowered local management

-- Quarterly management

satisfaction survey with

feedback acted upon

-- Regular staff events

and incentives

-- Enhanced internal communication

processes and events

Talent, Capability -- Lack of strategic -- Succession planning process

& Leadership direction in place.

risk -- Reduced staff -- Experienced and broad

(no change in engagement senior management team

net risk) -- Loss of talent -- Investment in robust

-- Loss of competitive recruitment and selection

advantage processes

-- Attrition tracked and

action taken as necessary

Regulatory

and Compliance

Compliance with -- Financial penalties -- Presence of a second

existing regulation/legislation -- Reputational line function (Governance

and being prepared damage Risk & Control, Information

for emerging -- Loss of customers Security, Legal and Company

regulation/legislation Secretarial)

(new risk) -- Management committee

in place to review second

line progress and report

to the Audit Committee

-- Ongoing engagement with

specialist third parties

where required

Climate change

In our consideration of emerging risks, climate change continues

as an area requiring greater analysis. During the year, in line

with the approach recommended by the Task Force on Climate-related

Financial Disclosures ('TCFD'), we conducted a formal assessment of

the potential impact of climate change to our business and supply

chain. Climate change is already a component of the risk of failure

to respond to market changes when considering the needs of our

customers and how products, services and solutions might be

affected by the drive towards carbon neutrality. We also have

robust business interruption plans in the event of a disruption to

our business. Our current analysis concluded that no other climate

change-related risk is a principal risk which needs to be

incorporated into the list of principal risks shown.

Going Concern

Please refer to note 2.1 under 'Basis of preparation'.

Cautionary Statement

This preliminary announcement has been prepared solely to

provide additional information to shareholders to assess the

Company's strategies and the potential for those strategies to

succeed. The preliminary announcement should not be relied on by

any other party or for any other purpose.

In making this preliminary announcement, the Company is not

seeking to encourage any investor to either buy or sell shares in

the Company. Any investor in any doubt about what action to take is

recommended to seek financial advice from an independent financial

advisor authorised by the Financial Services and Markets Act

2000.

Statement of Directors' responsibilities in relation to the

financial statements

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable United

Kingdom law and regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

have elected to prepare the Company's financial statements in

accordance with UK-adopted international accounting standards

('IFRSs').

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and of the profit or

loss of the Company for that period.

In preparing these financial statements the directors are

required to:

-- select suitable accounting policies in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors and

then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in IFRSs is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the Company's financial position and financial

performance;

-- state that UK-adopted international accounting standards have

been followed, subject to any material departures disclosed and

explained in the financial statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the Company financial statements comply with the Companies Act

2006. They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a strategic report, directors' report,

directors' remuneration report and corporate governance statement

that comply with that law and those regulations. The Directors are

responsible for the maintenance and integrity of the corporate and

financial information included on the Company's website.

Fair and balanced reporting

Having taken advice from the Audit Committee, the Board

considers the Annual Report and Accounts, taken as a whole, is

fair, balanced and understandable and that it provides the

information necessary for shareholders to assess the Company's

position and performance, business model and strategy.

Responsibility statement pursuant to FCA's Disclosure Guidance

and Transparency Rule 4 (DTR 4)

Each Director of the Company confirms that (solely for the

purpose of DTR 4) to the best of his or her knowledge:

-- the financial statements, prepared in accordance with

UK-adopted international accounting standards give a true and fair

view of the assets, liabilities, financial position and profit of

the Company;

-- the Annual Report, including the Strategic Report, includes a

fair review of the development and performance of the business and

the position of the Company, together with a description of the

principal risks and uncertainties that they face; and

-- they consider the Annual Report, taken as a whole, is fair,

balanced and understandable and provides the information necessary

for shareholders to assess the Company's position, performance,

business model and strategy.

Statement of Profit or Loss and Other Comprehensive Income

For the year ended 31 July 2023

2023 2022

GBP'000 GBP'000

Note

Revenue 3 985,300 1,077,946

Cost of sales (611,466) (750,736)

Gross profit 373,834 327,210

Administrative expenses (232,936) (191,065)

Operating profit 140,898 136,145

Finance income 1,171 252

Finance cost (205) (253)

Profit before taxation 141,864 136,144

Income tax expense 4 (29,835) (25,739)

Profit for the year 112,029 110,405

Foreign exchange differences on

translation of foreign branches (204) 3,562

Net gain/(loss) on cash flow hedge (799) -

(1,003) 3,562

Total comprehensive income for

the year 111,026 113,967

Profit attributable to:

Owners of the Company 112,029 110,405

Total comprehensive income attributable

to:

Owners of the Company 111,026 113,967

Basic earnings per ordinary share

(pence) 10 56.2 55.5

Diluted earnings per ordinary share

(pence) 10 56.0 55.3

All results are derived from continuing operations.

Statement of Financial Position

As at 31 July 2023

2023 2022

GBP'000 GBP'000

Note

Non-current assets

Property, plant and equipment 11,348 11,270

Right-of-use-assets 9,969 6,162

Intangible assets 7,155 7,978

Deferred tax asset 2,997 2,508

31,469 27,918

Current assets

Inventories 6 3,591 5,104

Trade and other receivables 7 490,041 541,424

Income tax receivable - 296

Cash and cash equivalents 122,621 97,316

616,253 644,140

Total assets 647,722 672,058

Current liabilities

Trade and other payables 8 (359,627) (419,108)

Contract liabilities 9 (23,851) (31,564)

Lease liabilities (2,734) (2,716)

Income tax payable (6) -

(386,218) (453,388)

Non-current liabilities

Contract liabilities 9 (3,032) (3,620)

Lease liabilities (7,027) (3,950)

(10,059) (7,570)

Total liabilities (396,277) (460,958)

Net assets 251,445 211,100

Equity

Issued share capital 12 100 100

Share premium account 4,979 4,979

Cash flow hedge reserve (799) -

Reserves for own shares - -

Foreign exchange translation reserve 3,358 3,562

Retained earnings 243,807 202,459

Total equity 251,445 211,100

Statement of Changes in Equity

For the year ended 31 July 2023

Cash

flow Reserves

Share Share hedge Transl-ation for own Retained Total

capital premium reserve reserve shares earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 August

2021 100 4,979 - - - 174,065 179,144

Profit for the period - - - - - 110,405 110,405

Impact of foreign exchange

reserves - - - 3,562 - - 3,652

Total comprehensive

income for the year - - - 3,562 - 110,405 113,967

Share-based payment

transactions - - - - - 2,541 2,541

Dividends paid - - - - - (84,020) (84,020)

Dividend equivalents

paid - - - - - (215) (215)

Tax adjustments - - - - - (317) (317)

Balance at 31 July

2022 100 4,979 - 3,562 - 202,459 211,100

Balance at 1 August

2022 100 4,979 - 3,562 - 202,459 211,100

Profit for the period - - - - - 112,029 112,029

Impact of foreign exchange

reserves - - - (204) - - (204)

Net (loss) on cash flow

hedge - - (799) - - - (799)

Total comprehensive

income for the year - - (799) (204) - 112,029 111,026

Share-based payment

transactions - - - - - 3,330 3,330

Dividends paid - - - - - (74,175) (74,175)

Dividend equivalents

paid - - - - - (66) (66)

Tax adjustments - - - - - 230 230

Balance at 31 July

2023 100 4,979 (799) 3,358 - 243,807 251,445

Statement of Cash Flows

For the year ended 31 July 2023

2023 2022

GBP'000 GBP'000

Note

Net cash generated from operating

activities 11 104,802 83,644

Cash flows from investing activities

Finance income 1,171 252

Purchase of property, plant and equipment (2,544) (1,890)

Purchase of intangible assets (701) (3,334)

Net cash used in investing activities (2,074) (4,972)

Cash flows from financing activities

Issue of share capital - -

Dividends paid 5 (74,175) (84,020)

Payment of principal portion of lease

liabilities (2,839) (2,369)

Payment of interest portion of lease

liabilities (205) (253)

Net cash used in financing activities (77,219) (86,642)

Net increase/(decrease) in cash

and cash equivalents 25,509 (7,970)

Exchange (losses)/gains on cash and

cash equivalents (204) 3,562

Cash and cash equivalents at beginning

of year 97,316 101,724

Cash and cash equivalents at end

of year 122,621 97,316

Notes to the Financial Information

1.1 General information

Softcat plc (the "Company") is a public limited company,

incorporated and domiciled in the UK. Its registered address is

Fieldhouse Lane, Marlow, Buckinghamshire, SL7 1LW.

The annual financial information presented in this preliminary

announcement does not constitute the Company's statutory accounts

for the years ended 31 July 2023 or 2022 but is based on, and

consistent with, that in the audited financial statements for the

year ended 31 July 2023, and those financial statements will be

delivered to the Registrar of Companies following the Company's

Annual General Meeting. The auditor's report on those financial

statements was unmodified, did not contain an emphasis of matter

paragraph and did not contain any statement under section 498(2) or

(3) of the Companies Act 2006.

2. Accounting policies

2.1 Basis of preparation

These financial statements have been prepared in accordance with

UK-adopted international accounting standards (IFRS) in accordance

with the requirements of the Companies Act 2006. IFRS includes the

application of International Financial Reporting Standards ('IFRS')

as issued by the International Accounting Standards Board ('IASB')

and the IFRS Interpretations Committee ('IFRIC')

interpretations.

These financial statements have been prepared under the

historical cost convention and are presented in the Company's

presentational and functional currency of Pounds Sterling and all

values are rounded to the nearest thousand ('GBP'000'), except when

otherwise stated.

The Company applied all standards and interpretations issued by

the IASB that were effective as at 1 August 2022. The accounting

policies set out below have, unless otherwise stated (see below),

been applied consistently to all periods presented in these

financial statements.

The potential climate change-related risks and opportunities to

which the Company is exposed, as identified by management, are

disclosed in the Company's TCFD disclosures in the Annual Report.

Management has assessed the potential financial impacts relating to

the identified risks and exercised judgement in concluding that

there are no material financial impacts of the Company's climate

related risks and opportunities on the financial statements. These

judgements will be kept under review by management as the future

impacts of climate change depend on environmental, regulatory and

other factors outside of the Company's control which are not all

currently known.

Going Concern

Overview

In considering the going concern basis for preparing the

financial statements, the Directors consider the Company's

objectives and strategy, its principal risks and uncertainties in

achieving its objectives and its review of business performance and

financial position, which are all set out in the Strategic Report

(see pages 28 to 31) and Chief Financial Officer's review sections

(see pages 34 to 35]) of this Annual Report. Given the current

macro-economic environment and considering the latest guidance

issued by the FRC the Directors have undertaken a fully

comprehensive going concern review.

The Company has modelled three scenarios in its assessment of

going concern. These are:

-- The base case;

-- The severe but plausible case; and

-- The reverse stress test case.

Further details, including the analysis performed and conclusion

reached, are set out below.

The Directors have reviewed detailed financial forecasts for a

thirteen-month period from the date of this report (the going

concern period) until 30 November 2024. All the forecasts reflect

the payment of the FY2023 dividend of GBP59.0m which will be paid

in December 2023 subject to approval at the AGM.

The Company operates in a resilient industry. Our UK Corporate

customer base spend is increasingly non-discretionary as IT

continues to be vital to gain competitive advantage in an

increasingly digital age. Public Sector, a large and fast-growing

area of the business, continues to invest in technology to provide

efficient services to the public and this has continued apace

despite the pandemic and recent turbulence in the UK economy. The

Company strategy remains unchanged and will continue to focus on

increasing the customer base and spend per customer during the

going concern period.

Liquidity and financing position

At 31 July 2023, the Company held instantly accessible cash and

cash equivalents of GBP122.6m, with net current assets of

GBP230.0m. Note 21 to the financial statements in the Annual Report

includes the Company's objectives, policies and processes for

managing its capital, its financial risk management and its

exposures to credit risk and liquidity risk. Operational cash flow

forecasts for the going concern period are sufficient to support

the business with the GBP75.0m cash floor set by the Board not

being breached.

There is a sufficient level of liquidity headroom post

mitigation across the going concern forecast period in base and

severe but plausible scenarios considered and outlined in more

detail below.

Challenging economic environment

Management have, in all three scenarios, considered the

principal challenges to short term business performance which are

expected to be;

-- An economic downturn in the UK economy, aided by high

broad-based inflation and increasing interest rates; and

-- Higher risk of credit losses

Despite the challenging economic environment, the Company has

traded well, delivering double-digit year-on-year growth in gross

profit and operating profit growth in line with expectations,

following an expected rebound in travel and entertainment costs,

following periods of reduced spend due to the COVID-19 pandemic.

The Board continue to monitor the global and national economic

environment and organise operations accordingly.

Base case

The base case, which was approved by the Board in October 2023,

takes into account the FY2024 budget process which includes

estimated growth and increased cost across the going concern period

and is consistent with the actual trading experience through to

September 2023. The key inputs and assumptions in the base case

include:

-- Continued revenue growth in line with historic rates;

-- rebate income continues to be received in proportion to cost of sales as in FY2023;

-- employee commission is incurred in line with the gross margin; and

-- increased levels of cost to reflect continued investment in

our people and the businesses IT infrastructure.

The Company has taken a measured approach to the base case and

has balanced the expected trading conditions with available

opportunities in an increasingly resilient area of customer spend,

which is supported by the current financial position. In making our

forecasts we balanced our customer needs alongside employee

welfare. Year to date trading to the end of September 2023 is

consistent with the base case forecast.

Severe but plausible case

Given the current economic challenges facing our customer base

and supply chain, we have modelled a severe but plausible scenario.

In this case we have modelled a decline in revenue, versus the base

case, which is below any historic trend and more severe than

experienced during the height of the pandemic. Further impacts of

this scenario such as reduced margins and greater credit losses

have also been considered.

The key inputs and assumptions, compared to the base case,

include:

-- an average 7.5% reduction in revenue,

-- reduced gross profit margins of 1% in the period;

-- additional bad debt write offs of GBP5m across the forecast period;

-- extending the debtor days from historic levels achieved and

no change to historic supplier payment days;

-- paying a reduced interim dividend in line with lower

profitability but still within the range set out in the dividend

policy; and

-- both commission cost and rebate income adjusted downwards in

line with reduced profitability and cost of sales, but at the same

percentage rates as in the base case.

The purpose of this scenario was to consider if there was a

significant risk that the Company would move to being cash negative

in any of the months in the going concern period. Even at these

lower levels of activity, which the Directors believe is a highly

unlikely outcome, the Company continues to be profitable and

maintains a positive cash balance at all times. Despite this,

management have modelled further cost saving and working capital

action (see mitigating actions) that will enable the Company to

mitigate the impact of reduced cash generation further and achieve

the Boards desired minimum cash position, should this scenario

occur. The Directors are confident that they can implement these

actions if required.

Mitigating actions

There are several potential management actions that have not

been included in the severe but plausible forecast and it is

estimated that the total cash impact of these actions is in excess

of a GBP21m cost reduction on an annualised basis and additional

annual working capital savings of GBP30m. The actions which if

implemented would offset the reduced activity:

-- bonus costs scaled back in line with performance;

-- no interim dividend in H2 of FY2024;

-- savings in discretionary areas of spend;

-- delayed payment to suppliers foregoing early settlement discount; and

-- short term supplier payment management.

The mitigations are deemed achievable and reasonable as the

Company benefits from a flexible business model with a high

proportion of costs linked to performance.

Reverse stress test

The Directors have performed a reverse stress test exercise to

assess the impact on liquidity, should a scenario more extreme than

the severe but plausible scenario occur. The impact of these

conditions, when combined, would place a strain on liquidity and

raise short term concerns to the business, however, would not

result in cash falling below a nil position. The conditions go

significantly further than the severe but plausible scenario and

reflect a scenario that the business consider remote.

The four combined stresses modelled, compared to the base case,

are as follows:

-- reduction of 15% in Gross invoiced income, compared to the base case;

-- reduced achievable gross margin by 3%;

-- additional bad debt write offs of GBP10m per year across the forecast period; and

-- extending the debtor days by three days from historic levels

achieved and no change to historic supplier payment days.

All four inputs are greater than the business has ever

experienced in its history. In the modelled scenario, prior to

mitigations, cash may not be sufficient for day to day

operations.

Whilst the Board considers such a scenario to be remote a

programme of further actions to mitigate the impact, in excess of

those set out above, would be actioned should the likelihood of

such a scenario increase. The Board considers the forecasts and

assumptions used in the reverse stress test, as well as the event

that could lead to it, to be remote.

Going concern conclusion

Based on the forecast and the scenarios modelled, together with

the performance of the Company to date, the Directors consider that

the Company has sufficient liquidity headroom to continue in

operational existence for the thirteen-month period from the date

of this report (the going concern period) until 30 November 2024.

Accordingly, at the October 2023 Board meeting, the Directors

concluded from this analysis it was appropriate to continue to

adopt the going concern basis in preparing the financial

statements. Should the impact of these conditions be even more

prolonged or severe than currently forecast by the Directors under

the severe but plausible case scenario, the Company would need to

implement additional operational or financial measures.

Accounting policies

The preliminary announcement for the year ended 31 July 2023 has

been prepared in accordance with the accounting policies as

disclosed in Softcat plc's Annual Report and Accounts 2023, as

updated to take effect of any new accounting standards applicable

for the year.

3. Segmental information

The information reported to the Company's Chief Executive

Officer, who is considered to be the chief operating decision maker

for the purposes of resource allocation and assessment of

performance, is based wholly on the overall activities of the

Company. The Company has therefore determined that it has only one

reportable segment under IFRS 8, which is that of "value-added IT

reseller and IT infrastructure solutions provider". The Company's

revenue, results and assets for this one reportable segment can be

determined by reference to the statement of profit or loss and

other comprehensive income and statement of financial position. An

analysis of revenues and gross invoiced income by product, which

form one reportable segment, is set out below:

Revenue by type

2023 2022

GBP'000 GBP'000

Software 188,797 150,000

Hardware 610,638 797,897

Services 185,865 130,049

985,300 1,077,946

Gross invoiced income by type

2023 2023

GBP'000 GBP'000

Software 1,543,501 1,365,343

Hardware 617,844 810,241

Services 401,963 331,953

2,563,308 2,507,537

Revenue and gross invoiced income can also be disaggregated by

type of business:

Revenue by type of business

2023 2022

GBP'000 GBP'000

Small and medium 555,541 535,823

Enterprise 253,229 222,064

Public sector 176,530 320,059

985,300 1,077,946

Gross invoiced income by type of business

2023 2022

GBP'000 GBP'000

Small and medium 1,103,851 1,169,255

Enterprise 512,839 427,249

Public sector 946,618 911,033

2,563,308 2,507,537

Gross invoiced income reflects gross income billed to customers

adjusted for deferred and accrued revenue items and is consistent

with our previous application of IAS 18. Softcat will continue to

report gross invoiced income as an alternative financial KPI as

this is a measure which correlates closely to the cash received by

the business and therefore aids the users understanding of working

capital movements in the statement of financial position and the

relationship to sales performance and the mix of products sold. The

impact of IFRS 15 and principal versus agent consideration is an

equal reduction to both revenue and cost of sales.

During the year there was no direct customer (FY2022: one) that

individually accounted for greater than 10% of both the Company's

total revenue and gross invoiced income, and a considerably lower

proportion of gross profit. Gross invoiced income and revenue

generated from this customer in FY2022 was GBP251.3m and GBP227.5m

respectively.

Reconciliation of gross invoiced income

to revenue

2023 2022

GBP'000 GBP'000

Gross invoiced income 2,563,308 2,507,537

Income to be recognised as agent under

IFRS 15 (1,578,008) (1,429,573)

Revenue 985,300 1,077,964

The total revenue for the Company has been derived from its

principal activity as an IT reseller. Substantially all of this

revenue relates to trading activities undertaken in the United

Kingdom.

4. Taxation

2023 2022

GBP'000 GBP'000

Current Tax

Current income tax charge in the year 30,414 25,979

Adjustment in respect of current income

tax in previous years (160) 52

Foreign tax effects - 1

Deferred Tax

Temporary differences (419) (293)

Total tax charge for the year 29,835 25,739

5. Dividends

2023 2022

GBP'000 GBP'000

Declared and paid during the year:

Special dividend on ordinary shares (12.6p

per share (2022: 20.5p)) 25,122 40,806

Final dividend on ordinary shares (16.6p

per share (2022: 14.4p)) 33,098 28,663

Interim dividend on ordinary shares (8.0p

per share (2022: 7.3p)) 15,955 14,551

74,175 84,020

A final dividend of 17.0p per share has been recommended by the

Directors and if approved by shareholders will be paid on 19

December 2023. The final ordinary dividend will be payable to

shareholders whose names are on the register at the close of

business on 10 November 2023. Shares in the Company will be quoted

ex-dividend on 9 November 2023. The dividend reinvestment plan

('DRIP') election date is 28 November 2023.

In line with the Company's stated intention to return excess

cash to shareholders, a further special dividend payment of 12.6p

has been proposed. If approved this will also be paid on 19

December 2023 alongside the final ordinary dividend.

The Board recommends the final and special dividend for

shareholders' approval.

6. Inventories

2023 2022

GBP'000 GBP'000

Finished goods and goods for resale 3,591 5,104

The amount of any write down of inventory recognised as an

expense in the year was GBPnil in both years.

7. Trade and other receivables

2023 2022

GBP'000 GBP'000

Trade and other receivables 429,569 497,308

Provision against receivables (3,920) (4,958)

Net trade receivables 425,649 492,350

Unbilled receivables 34,508 26,192

Prepayments 6,344 4,338

Accrued income 9,270 10,534

Deferred costs 14,270 8,010

490,041 541,424

8. Trade and other payables

2023 2023

GBP'000 GBP'000

Trade payables 254,907 280,769

Other taxes and social security 13,699 23,078

Accruals 90,222 115,261

Other creditors 799 -

359,627 419,108

9. Contract liabilities

Contract liabilities are comprised of:

2023 2022

GBP'000 GBP'000

Deferred income 26,883 35,184

Deferred income is further broken down

as:

Short term deferred income 23,851 31,564

Long term deferred income 3,032 3,620

26,883 35,184

10. Earnings per share

2023 2022

Pence Pence

Earnings per share

Basic 56.2 55.5

Diluted 56.0 55.3

The calculation of the basic earnings per share and diluted

earnings per share is based on the following data:

2023 2022

GBP'000 GBP'000

Earnings

Earnings for the purposes of earnings

per share being profit for the year 112,029 110,405

The weighted average number of shares is given below:

2023 2022

000's 000's

Number of shares used for basic earnings

per share 199,237 198,976

Number of shares expected to be issued

at nil consideration following exercise

of share options 922 656

Number of shares used for diluted earnings

per share 200,159 199,632

11. Notes to the cash flow statement

2023 2022

GBP'000 GBP'000

Cash flow from operating activities

Operating profit 140,898 136,145

Depreciation of property, plant and

equipment 2,466 2,373

Depreciation of right-of-use assets 2,127 1,594

Amortisation of intangibles 1,525 558

Loss on disposal of fixed assets - -

Dividend equivalents paid (66) (215)

Cost of equity settled employee share

schemes 3,330 2,541

Operating cash flow before movements

in working capital 150,280 142,996

Decrease in inventories 1,513 33,307

(Increase)/decrease in trade and other

receivables 51,383 (211,694)

(Decrease)/increase in trade and other

payables (68,581) 144,379

Cash generated from operations 134,595 108,988

Income taxes paid (29,793) (25,344)

Net cash generated from operating activities 104,802 83,644

12. Share capital

2023 2022

GBP'000 GBP'000

Allotted and called up

Ordinary shares of 0.05p each 100 100

Deferred shares* of 1p each - -

100 100

*At 31 July 2023 deferred shares had an aggregate nominal value

of GBP189.33 (2022: GBP189.33).

Deferred shares do not have rights to dividends and do not carry

voting rights.

13. Post balance sheet events

Dividend

A final dividend of 17.0p per share has been recommended by the

Directors and if approved by shareholders will be paid on 19

December 2023. The final ordinary dividend will be payable to

shareholders whose names are on the register at the close of

business on 10 November 2023. Shares in the Company will be quoted

ex-dividend on 9 November 2023. The dividend reinvestment plan

('DRIP') election date is 28 November 2023.

In line with the Company's stated intention to return excess

cash to shareholders, a further special dividend payment of 12.6p

has been proposed. If approved this will also be paid on 19

December 2023 alongside the final ordinary dividend.

Corporate Information

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of financial information differs from

legislation in other jurisdictions.

Directors

G Watt

G Charlton

K Mecklenburgh

R Perriss

V Murria

L Weedall

M Prakash

Secretary

Luke Thomas

Company registration number

02174990

Registered office

Solar House

Fieldhouse Lane

Marlow

Buckinghamshire

SL7 1LW

Auditor

Ernst & Young LLP

1 More London Place

London

SE1 2AF

Softcat plc LEI

213800N42YZLR9GLVC42

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFVDILLVFIV

(END) Dow Jones Newswires

October 24, 2023 02:05 ET (06:05 GMT)

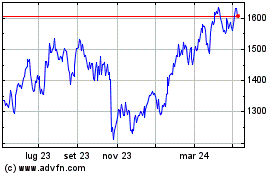

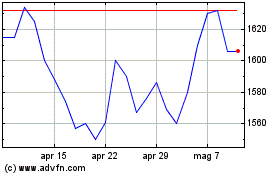

Grafico Azioni Softcat (LSE:SCT)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Softcat (LSE:SCT)

Storico

Da Mag 2023 a Mag 2024