TIDMSDI

RNS Number : 9521V

SDI Group PLC

07 December 2023

SDI Group plc

("SDI", the "Company", or the "Group")

Interim results for the six months ended 31 October 2023

SDI Group plc, the AIM quoted Group focused on the design and

manufacture of scientific and technology products for use in

digital imaging and sensing and control applications, is pleased to

announce its results for the six months to 31 October 2023.

Financial and Operational Highlights

-- Revenue increased by 1.6% to GBP32.2m (H1 FY23: GBP31.7m)

-- Organic revenue growth of 2.2%, excluding GBP6.4m COVID

related sales in H1 FY23. 20% revenue growth from acquisitions

-- Adjusted operating profit* for the period decreased to GBP4.4m ( H1 FY23 : GBP6.9m)

o Reported operating profit decreased to GBP3.4m ( H1 FY23 :

GBP5.6m)

-- Adjusted profit before tax* decreased to GBP3.7m ( H1 FY23: GBP6.5m)

o Reported profit before tax decreased to GBP2.7m ( H1 FY23:

GBP5.3m)

-- Adjusted diluted EPS* decreased to 2.68p (H1 FY23: 5.02p)

o Reported diluted EPS decreased to 1.89p (H1 FY23: 4.06p)

-- Cash generated by operations increased to GBP3.3m (H1 FY23: GBP1.9m)

-- Net debt (debt less cash) of GBP13.2m at 31 Oct 23 (30 Apr

23: GBP13.3m, 31 Oct 22: GBP15.4m). Facility headroom of GBP10.25m

+ GBP5m accordion

-- New acquisition added to the Group post period end - Peak Sensors

A copy of the shareholder presentation regarding the financial

results will be made available on the Company's website

www.sdigroup.com/investors/reports-presentations/ later today.

Ken Ford, Chairman of SDI Group, said:

" In the first half of the financial year revenues increased to

GBP32.2 million (H1 FY23: GBP31.7m), despite the expiry of the very

large profitable COVID contracts for cameras. Cash generated by

operations was GBP3.3m (H1 FY23: GBP1.9m). Profits have been

affected by some destocking, some of which is likely to be

temporary, alongside a slowdown in China and Germany. We now expect

to report FY24 adjusted profit before tax of between GBP7.9m and

GBP8.4m.

For over ten years SDI has consistently grown value by focusing

on a clear and straightforward strategy. We acquire private

companies at a significant discount to those on the quoted markets.

These subsidiaries are then encouraged to grow for the benefit of

all stakeholders. I am pleased to report that we have a number of

new acquisition opportunities under review. So, despite the recent

headwinds we look forward to the future with great confidence.

"

* before share based payments, acquisition costs and

amortisation of acquired intangible assets.

** excluding GBP6.4m COVID related revenues in H1 FY23, to aid

comparability.

Enquiries

SDI Group plc 01223 727144

Ken Ford, Chairman

Mike Creedon, CEO

Ami Sharma, CFO

www.sdigroup.com

Cavendish Capital Markets Limited 020 7220 0500

Ed Frisby/Seamus Fricker - Corporate Finance

Andrew Burdis/Sunila de Silva - ECM

SDI designs and manufactures scientific and technology products

for use in digital imaging and sensing and control applications

including life sciences, healthcare, astronomy, plastics and

packaging, manufacturing, precision optics, measurement

instrumentation and art conservation. SDI operates through its

companies: Atik Cameras, Synoptics, Graticules Optics, Sentek,

Astles Control Systems, Applied Thermal Control, MPB Industries,

Chell Instruments, Monmouth Scientific, Uniform Engineering,

Safelab Systems, Scientific Vacuum Systems Limited, LTE Scientific,

Fraser Anti-Static Techniques and Peak Sensors.

Corporate expansion is via organic growth within its subsidiary

companies and through the acquisition of complementary, niche

technology businesses with established reputations in global

markets.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Chairman's statement

Whilst the pandemic has ended, the changes in customer behaviour

the pandemic caused have continued into this financial year. The

COVID years saw over-ordering of products, partly driven by and

also leading to component shortages throughout the supply chain.

SDI has both benefitted and suffered from these customer behaviours

over the last three years, however, this over-ordering has now led

to some OEM's de-stocking as they rebalance to a more normalised

economic environment. This has impacted upon a small number of our

businesses, but we consider this a short-term phenomenon. The

strength of our business model, with a number of smaller niche

autonomous businesses operating in a multitude of markets, gives us

the ability to respond quickly to such market movements. We will

continue to control our costs carefully as we manage through this

stage of the economic cycle.

We acquired Peak Sensors after the period end on 3 November

2023. Peak is a UK manufacturer of temperature sensors,

specialising in standard and bespoke thermocouples and resistance

thermometers. With over 25 years of experience, Peak serves various

industries, including glass, ceramic, incinerators (including

energy from waste), cement, and ovens. Peak exports to more than 85

countries in 6 continents, with approximately 17% overseas

sales.

Peak fits perfectly within our acquisition criteria and has

joined our Sensors and Control segment. It will be operated

separately from our existing businesses. We warmly welcome our new

colleagues to the SDI Group.

Board

We are pleased to welcome Stephen Brown to the Board. Stephen

joined SDI as Chief Operating Officer at the end of September. His

skills and experience, at AB Dynamics, BP, Rolls Royce and high

growth companies will be invaluable to SDI. Alongside the addition

of Louise Early and Andrew Hosty over FY23, the Board has a strong

blend of skills and experience to guide the Group as we continue to

grow through our buy and build strategy.

Trading and operations

The Group's trading has been mixed over the first half of FY24.

Applied Thermal Control have continued to see good demand in the

chiller product market. Astles Control Systems delivered a number

of chemical dosing equipment contracts and LTE Scientific ('LTE')

continued to execute on a large environmental test chambers

contract. Scientific Vacuum Systems ('SVS') has just received a

GBP2.3m order from a different OEM customer for two high tech

pieces of equipment for design and delivery over the next 18 month.

As expected at the time of its acquisition, SVS is proving to be a

'lumpy' order (and revenues) business. As a result of the events in

Ukraine, its major OEM customer has had to re-schedule it's planned

order profile, leading to a delay in placement of its next order

for its next sputtering machine. Their pipeline remains strong but

timing of order placement can be variable.

Monmouth has seen an increase in enquiries and orders for clean

rooms. Safelab continues to see a good market for fume cupboards

and Synoptics is progressing well with its colony counter product

brand, Synbiosis. However, a number of OEMs in the life and bio

sciences sector are finding the trading environment tough, leading

to short-term de-stocking. This is particularly the case in the

gel-doc market and this has significantly impacted upon Atik

Cameras and, to a much lesser degree, Synoptics. Fraser Anti-Static

Techniques ('FAST') has seen a slowdown in some of its geographic

markets which has had a slight impact on the business.

The SDI businesses that focus on the laboratory products market

have increased collaboration over the period with increased contact

between the different management teams. The businesses are actively

seeking and finding areas of co-operation to reduce costs and

enhance their total customer offer. A number of SDI laboratory

products businesses attended the UK Lab Innovations trade show

(some businesses for the first time) and a number are planning to

have a single stall at the 2024 fair. Anecdotally, footfall is now

increasing across these types of events and trade shows do provide

a good source for sales leads. We do sometimes travel further

afield for trade fairs, with Atik Cameras having attended Analytica

China this year.

Marketing teams from across the Group met again recently to

share best practice; subject matter included digital marketing. It

is expected that this forum will continue to meet. SDI management

attended a Group conference in November 2023 to discuss our

strategic plans. This provided a valuable forum for networking and

sharing business knowledge and opportunities.

We continue to invest. Safelab Systems implemented a new ERP

system over the last six months, going live in October 2023. This

new system should provide a platform for the business to grow. SDI

Group is implementing a new financial consolidation system, which

will aid efficiency when consolidating the Group's financial

results and provide scalability as we add new businesses.

Revenues

Group revenues increased by 1.6% to GBP32.2m (H1 FY23:

GBP31.7m). The increase was driven by 20% acquisition growth

compared to the first half of FY23, with both LTE and FAST, who

delivered in total GBP6.3m in non-organic sales (until the

anniversary of the acquisition). Both LTE and FAST are currently

trading ahead of expectations, and we are pleased with their

progress.

Organic revenue growth across the business was 2.2% after

excluding the comparative GBP6.4m H1 FY23 COVID related revenues.

On a reported basis, there was an organic decline of 18.4%.

Sales in Sensors & Control were 40% higher at GBP26.8m (H1

FY23: GBP19.2m), with organic growth of 6.7%. On a reported basis,

sales in our Digital Imaging segment reduced by 57% to GBP5.4m (H1

FY23: GBP12.5m). The Digital Imaging segment sales reduced by

12.1%**(H1 FY24 vs H1 FY23) as a result of the destocking noted

above.

The previous financial year was characterised by component

shortages and these have eased considerably. This helped Astles

Control Systems deliver more chemical dosing equipment sales in

comparison to the first half of last year. Applied Thermal Control

had a good trading period with the demand for scientific and

industrial cooling systems continuing to be strong. SVS had a

strong first half as they shipped a sputtering machine to a large

OEM customer. Monmouth Scientific has a strong order book and a

good sales pipeline but has experienced operational delays in

delivering product to its customers. This should ease over the

second half.

As noted earlier, Atik Cameras' major gel-doc OEM customer has

de-stocked significantly over the first half of FY24. This has

meant Atik's revenues have fallen short of expectations.

Encouragingly, Atik recently received an 18-month order from this

customer which will underpin future demand but this will not

recover lost first half revenues. Notably, Atik received its first

order for ChemiMos cameras over the period.

Profits

Gross margins held up well in the first half of FY24 at 63%,

flat compared to the comparative period. Overheads were higher than

the comparative period mainly due to acquisitions. Excluding this,

wages/overhead growth was modest.

In addition to the performance measures defined under IFRS, the

Group also provides adjusted results in which certain one-time and

non-cash charges are excluded, to help shareholders understand the

underlying operating performance. Adjustments for the period were

for the amortisation of acquired intangible assets, share-based

payments and acquisition costs totalling GBP1.0m (H1 FY23:

GBP1.2m).

Adjusted Group profit before tax decreased to GBP3.7m (H1 FY23:

GBP6.5m) as a result of the end of the COVID related contract in

FY23. Statutory Group profit before tax decreased to GBP2.7m (H1

FY23: GBP5.3m).

Our effective tax rate has increased to 24.9% (on statutory PBT)

(H1 FY23: 20%) with the growth coming from an increased corporation

tax rate.

Basic earnings per share reduced to 1.92p (H1 FY23: 4.15p);

diluted earnings per share decreased to 1.89p (H1 FY23: 4.06p).

Adjusted diluted earnings per share reduced to 2.68p (H1 FY23:

5.02p).

Cash flow

Cash generated from operations increased to GBP3.3m (H1 FY23:

GBP1.9m). Working capital increased by GBP2.3m over the period due

to a GBP2.7m reduction in customer advances, GBP1.4m of which was

due to SVS shipping equipment in October. Astles Control Systems

saw its customer advances reduce by GBP0.6m as it delivered

chemical dosing equipment and LTE reduced by GBP0.5m as it worked

on an environmental test chambers project for a major OEM.

GBP1.0m in deferred consideration relating to the acquisition of

Scientific Vacuum Systems Limited will be paid in the second half

of the year.

Net debt, or bank debt less cash, was GBP13.2m at 31 October

2023 compared to GBP13.3m at 30 April 2023 and GBP15.4m at 31

October 2022. This represents a net debt: EBITDA ratio of 1.1x

(rolling last 12 months calculation basis). At 31 October 2023, the

Group had GBP10.25m of headroom within its GBP25m committed loan

facility with HSBC. A GBP5m accordion option remains available to

the Group (at the discretion of HSBC) for future exercise.

The Group has sufficient access to funds, alongside its cash

flow, to acquire new companies and invest in our current portfolio

of businesses.

Acquisitions

On 3 November 2023, the Group acquired 100% of the share capital

of Peak Sensors (Holding) Limited for a total consideration of

c.GBP2.6m. On the date of the acquisition, the Peak Sensors group

of companies had an improved cash in hand position of c.GBP0.2m.

Peak Sensors Limited, the only trading entity in the acquired

group, operates from a single site in Chesterfield and has 14

employees.

Outlook

In the first half of the financial year revenues increased to

GBP32.2m (H1 FY23: GBP31.7m), despite the expiry of the very large

profitable COVID contracts for cameras. Cash generated by

operations was GBP3.3m (H1 FY23: GBP1.9m). Profits have been

affected by some destocking, some of which is likely to be

temporary, alongside a slowdown in China and Germany. We now expect

to report FY24 adjusted profit before tax of between GBP7.9m and

GBP8.4m.

For over ten years SDI has consistently grown value by focusing

on a clear and straightforward strategy. We acquire private

companies at a significant discount to those on the quoted markets.

These subsidiaries are then encouraged to grow for the benefit of

all stakeholders. I am pleased to report that we have a number of

new acquisition opportunities under review. So, despite the recent

headwinds we look forward to the future with great confidence.

Ken Ford, Chairman

7 December 2023

Consolidated income statement

Unaudited for the six months ended 31 October 2023

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2023 2022 2023

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------

Revenue 32,215 31,720 67,577

----------

Costs of sales (11,908) (11,764) (24,810)

-------------------------- ------------ ------------ ----------

Gross Profit 20,307 19,956 42,767

----------

Other operating income 59 50 112

----------

Exceptional items -

Goodwill impairment - - (3,520)

----------

Other operating expenses (16,957) (14,383) (32,547)

-------------------------- ------------ ------------ ----------

Operating expenses (16,957) (14,383) (36,067)

----------

Operating profit 3,409 5,623 6,812

----------

Net financing expense (754) (318) (970)

-------------------------- ------------ ------------ ----------

Profit before taxation 2,655 5,305 5,842

----------

Income tax charge 7 (662) (1,061) (1,939)

-------------------------- ------------ ------------ ----------

Profit for the period 1,993 4,244 3,903

-------------------------- ------------ ------------ ----------

Attributable to:

----------

Equity holders of the

parent company 1,978 4,244 3,871

----------

Non-controlling interest 15 - 32

-------------------------- ------------ ------------ ----------

Profit for the period 1,993 4,244 3,903

----------

Earnings per share 5

----------

Basic earnings per

share 1.92p 4.15p 3.80p

----------

Diluted earnings per

share 1.89p 4.06p 3.72p

-------------------------- ------------ ------------ ----------

Consolidated statement of comprehensive income

Unaudited for the six months ended 31 October 2023

6 months 6 months to 12 months to

to 31 October 30 April

31 October 2022 2023

2023 Unaudited Audited

Unaudited GBP'000 GBP'000

GBP'000

------------------------------- ---- ------------ ------------ -------------

Profit for the period 1,993 4,244 3,903

-------------

Other comprehensive

income

-------------

Items that will not

subsequently be reclassified

to profit and loss:

-------------

Remeasurement of net

defined benefit liability - - 95

-------------

Items that will subsequently

be reclassified to profit

and loss:

-------------

Exchange differences

on translating foreign

operations (4) 170 142

-------------

Total comprehensive

profit for the period 1,989 4,414 4,140

------------------------------------- ------------ ------------ -------------

Attributable to:

-------------

Equity holders of the

parent company 1,974 4,414 4,108

-------------

Non-controlling interest 15 - 32

-------------------------------- --- ------------ ------------ -------------

Total comprehensive

profit for the period 1,989 4,414 4,140

-------------------------------- --- ------------ ------------ -------------

Consolidated balance sheet

Unaudited at 31 October 2023

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

---------------------------------- ----- ------------ ------------ ----------

Assets

----------

Non-current assets

----------

Intangible assets 40,584 47,264 41,350

Property, plant and equipment 14,630 15,015 14,688

Investments 24 - 24

Deferred tax asset 7 705 1,547 734

---------------------------------- ----- ------------ ------------ ----------

55,943 63,826 56,796

Current assets

Inventories 11,937 12,066 13,504

Trade and other receivables 10,086 11,566 11,980

Corporation tax asset 495 - -

Cash and cash equivalents 1,546 3,619 2,711

---------------------------------- ----- ------------ ------------ ----------

24,064 27,251 28,195

---------------------------------- ----- ------------ ------------ ----------

Total assets 80,007 91,077 84,991

---------------------------------- ----- ------------ ------------ ----------

Liabilities

----------

Non-current liabilities

----------

Borrowings 6 14,750 19,000 16,000

----------

Lease liabilities 6 5,989 6,304 5,996

----------

Deferred tax liability 7 5,162 5,795 5,336

---------------------------------- ----- ------------ ------------ ----------

25,901 31,099 27,332

---------------------------------- ----- ------------ ------------ ----------

Current liabilities

----------

Trade and other payables 9,768 16,543 15,444

----------

Provisions 77 88 67

----------

Lease liabilities 6 780 802 745

----------

Current tax payable - 1,889 111

---------------------------------- ----- ------------ ------------ ----------

10,625 19,322 16,367

----------

Total liabilities 36,526 50,421 43,699

---------------------------------- ----- ------------ ------------ ----------

Net assets 43,481 40,656 41,292

---------------------------------- ----- ------------ ------------ ----------

Equity

----------

Share capital 1,041 1,027 1,041

Merger reserve 2,606 2,606 2,606

Merger relief reserve 424 424 424

Share premium account 10,778 10,093 10,778

Share-based payment reserve 757 656 557

Foreign exchange reserve 177 209 181

Retained earnings 27,651 25,641 25,673

---------------------------------- ----- ------------ ------------ ----------

Total equity due to shareholders 43,434 40,656 41,260

---------------------------------- ----- ------------ ------------ ----------

Non-controlling interest 47 - 32

---------------------------------- ----- ------------ ------------ ----------

Net assets 43,481 40,656 41,292

---------------------------------- ----- ------------ ------------ ----------

Consolidated statement of cash flows

Unaudited for the six months ended 31 October 2023

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

---------------------------------------- ------ ------------ ------------ ----------

Operating activities

----------

Net profit for the period 1,993 4,244 3,903

Depreciation and amortisation 2,005 2,010 4,256

Finance costs and income 754 318 970

Impairment of intangibles - - 3,520

Changes in provisions 10 (75) (96)

Taxation expense in the income

statement 662 1,061 1,939

Employee share-based payments 200 140 351

------------------------------------------------ ------------ ------------ ----------

Operating cash flow before

movement in working capital 5,624 7,698 14,843

Changes in inventories 1,567 (1,906) (2,929)

Changes in trade and other receivables 1,894 (1,070) 2,689

Changes in trade and other payables (5,770) (2,847) (3,730)

------------------------------------------------ ------------ ------------ ----------

Cash generated from operations 3,315 1,875 10,873

Interest paid (754) (318) (970)

Income taxes paid (1,413) (691) (2,161)

------------------------------------------------ ------------ ------------ ----------

Cash generated from operating

activities 1,148 866 7,742

Cash flows from investing activities

Capital expenditure on fixed

assets (556) (443) (1,085)

Sale of property plant and equipment 20 10 84

Expenditure on development and

other intangibles (232) (183) (323)

Acquisition of subsidiaries,

net of cash - (16,523) (21,056)

Net cash used in investing

activities (768) (17,139) (22,380)

Cash flows from financing activities

Payments of lease liabilities (384) (386) (789)

Proceeds from bank borrowings - 15,000 15,000

Repayment of borrowings (1,250) - (3,000)

Issues of shares & proceeds

from option exercises - - 892

------------------------------------------------ ------------ ------------ ----------

Net cash (used in)/from financing

activities (1,634) 14,614 12,103

------------------------------------------------ ------------ ------------ ----------

Net decrease in cash and cash

equivalents (1,254) (1,659) (2,535)

Cash and cash equivalents,

beginning of period 2,711 5,106 5,106

Foreign currency movements

on cash balances 89 172 140

------------------------------------------------ ------------ ------------ ----------

Cash and cash equivalents,

end of period 1,546 3,619 2,711

------------------------------------------------ ------------ ------------ ----------

Consolidated statement of changes in equity

Unaudited for the six months ended 31 October 2023

6 months to Non-controlling

31 October Merger Share-based interest

2023 - Share Merger relief Foreign Share payment Retained GBP'000

unaudited capital reserve reserve exchange premium reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- --------- --------- -------- ------------ --------- ---------------- ---------

Balance at

1 May 2023 1,041 2,606 424 181 10,778 557 25,673 32 41,292

Shares issued - - - - - - - - -

Tax in respect

to share - - - - - - - - -

options

Share based

payments - - - - - - - - -

transfer

Share based

payments - - - - - 200 - - 200

--------------- -------- -------- --------- --------- -------- ------------ --------- ---------------- ---------

Transactions

with owners - - - - - 200 - - 200

--------------- -------- -------- --------- --------- -------- ------------ --------- ---------------- ---------

Profit for

the period - - - - - - 1,978 15 1,993

Foreign

exchange

on

consolidation

of

subsidiaries - - - (4) - - - - (4)

--------------- -------- -------- --------- --------- -------- ------------ --------- ---------------- ---------

Total

comprehensive

income for

the period - - - (4) - - 1,978 15 1,989

--------------- -------- -------- --------- --------- -------- ------------ --------- ---------------- ---------

Balance at

31 October

2023 1,041 2,606 424 177 10,778 757 27,651 47 43,481

--------------- -------- -------- --------- --------- -------- ------------ --------- ---------------- ---------

6 months to Non-controlling

31 October Merger Share-based interest

2022 - Share Merger relief Foreign Share payment Retained GBP'000

unaudited capital reserve reserve exchange premium reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Balance at

1 May 2022 1,022 2,606 424 39 9,905 320 21,476 - 35,792

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Shares issued 5 - - - 188 - - - 193

Tax in respect

to share

options - - - - - - 117 - 117

Share based

payments

transfer - - - - - 196 (196) - -

Share based

payments - - - - - 140 - - 140

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Transactions

with owners 5 - - - 188 336 (79) - 450

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Profit for

the period - - - - - - 4,244 - 4,244

Foreign

exchange

on

consolidation

of

subsidiaries - - - 170 - - - - 170

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Total

comprehensive

income for

the period - - - 170 - - 4,244 - 4,414

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Balance at

31 October

2022 1,027 2,606 424 209 10,093 656 25,641 - 40,656

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Consolidated statement of changes in equity (continued)

Unaudited for the six months ended 31 October 2023

12 months Non-controlling

to 30 April Merger Share-based interest

2023 - audited Share Merger relief Foreign Share payment Retained GBP'000

capital reserve reserve exchange premium reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Balance at

30 April 2022 1,022 2,606 424 39 9,905 320 21,476 - 35,792

Shares issued 19 - - - 873 - - - 892

Tax in respect

to share

options - - - - - - 117 - 117

Share based

payments

transfer - - - - - (114) 114 - -

Share based

payments - - - - - 351 - - 351

Transactions

with owners 19 - - - 873 237 231 - 1,360

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Profit for

the year - - - - - - 3,871 32 3,903

---------------- ---------

Actuarial gain

on defined

benefit

pension - - - - - - 95 - 95

---------------- ---------

Foreign

exchange

on

consolidation

of

subsidiaries - - - 142 - - - - 142

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Total

comprehensive

income - - - 142 - - 3,966 32 4,140

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Balance at

30 April 2023 1,041 2,606 424 181 10,778 557 25,673 32 41,292

--------------- -------- -------- --------- --------- --------- ------------ --------- ---------------- ---------

Notes to the interim financial statements

1. General information and basis of preparation

SDI Group plc (the "Company"), a public limited company, is the

Group's ultimate parent. It is registered in England and Wales. The

consolidated interim financial statements of the Company for the

period ended 31 October 2023 comprise the Company and its

subsidiaries (together referred to as the "Group").

The unaudited consolidated interim financial statements are for

the six months ended 31 October 2023. These interim financial

statements have been prepared using the recognition and measurement

principles of International Accounting Standards in conformity with

the requirements of the Companies Act 2006. The consolidated

interim financial information has been prepared under the

historical cost convention, as modified by the recognition of

certain financial instruments at fair value. The consolidated

interim financial statements are presented in British pounds (GBP),

which is also the functional currency of the ultimate parent

company.

The consolidated interim financial information was approved by

the Board of Directors on 7 December 2023.

The financial information set out in this interim report does

not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The figures for the year ended 30 April 2023

have been extracted from the statutory financial statements of SDI

Group plc which have been filed with the Registrar of Companies.

The auditor's report on those financial statements was unqualified

and did not contain a statement under section 498(2) or 498(3) of

the Companies Act 2006. The financial information for the six

months ended 31 October 2023 and for the six months ended 31

October 2022 has not been audited or reviewed by the auditors

pursuant to the Financial Reporting Council's relevant

guidance.

2. Principal accounting policies

The principal accounting policies adopted in the preparation of

the condensed consolidated interim information are consistent with

those followed in the preparation of the Group's financial

statements for the year ended 30 April 2023.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

interim financial statements.

3. Alternative Performance Measures

The Group uses Adjusted Operating Profit, Adjusted Profit Before

Tax, Adjusted Diluted EPS and Net Operating Assets as supplemental

measures of the Group's profitability and investment in business

related assets, in addition to measures defined under IFRS. The

Group considers these useful due to the exclusion of specific items

that are considered to hinder comparison of underlying

profitability and investments of the Group's segments and

businesses and is aware that shareholders use these measures to

evaluate performance over time. The adjusting items for the

alternative measures of profit are either recurring but non-cash

charges (share-based payments and amortisation of acquired

intangible assets) or exceptional items (reorganisation costs and

acquisition costs).

The following table is included to define the term Adjusted

Operating Profit:

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------ ----------

Operating Profit (as reported) 3,409 5,623 6,812

----------

Adjusting items (all costs):

----------

Non-underlying items

----------

Share based payments 200 140 351

----------

Amortisation of acquired intangible

assets 758 823 1,795

----------

Exceptional items

----------

Impairment of intangibles - - 3,520

----------

Acquisition costs 62 267 331

------------------------------------- ------------ ------------ ----------

Total adjusting items within

Operating Profit 1,020 1,230 5,997

----------

Adjusted Operating Profit 4,429 6,853 12,809

------------------------------------- ------------ ------------ ----------

Adjusted Profit Before Tax is defined as follows:

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- ------------ ------------ ----------

Profit Before Tax (as reported) 2,655 5,305 5,842

------------

Adjusting items (as above) 1,020 1,230 5,997

------------

Adjusted Profit Before Tax 3,675 6,535 11,839

--------------------------------- ------------ ------------ ----------

3. Alternative Performance Measures (continued)

Adjusted EPS is defined as follows:

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------- ------------ ------------ ------------

Profit for the Period (as

reported) 1,993 4,244 3,903

------------

Adjusting items (as above) 1,020 1,230 5,918*

------------

Less: taxation on adjusting

items calculated at the UK

statutory rate (190) (234) (369)

------------ ------------ ------------

Adjusted profit for the period 2,823 5,240 9,452

------------

Divided by diluted weighted

average number of shares in

issue (Note 6) 105,242,068 104,411,856 104,799,252

------------

Adjusted Diluted EPS 2.68p 5.02p 9.02p

-------------------------------- ------------ ------------ ------------

*impairment of intangible assets is net of tax

Net Operating Assets is defined as follows:

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------- ----------- ----------- ---------

Net Assets 43,481 40,656 41,292

---------

Deferred tax asset (705) (1,547) (734)

---------

Corporation tax asset (495) (569) -

---------

Cash and cash equivalents (1,546) (3,619) (2,711)

---------

Borrowings (current and non-current) 21,519 26,106 22,741

---------

Deferred consideration 961 2,460 961

---------

Deferred tax liability 5,162 5,795 5,336

---------

Current tax payable - 1,889 111

-------------------------------------- ----------- ----------- ---------

Total adjusting items within

Net Assets 24,896 30,515 25,704

---------

Net Operating Assets 68,377 71,171 66,996

-------------------------------------- ----------- ----------- ---------

4. Segmental analysis

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------ ----------

Revenues

----------

Digital Imaging 5,405 12,529 20,870

----------

Sensors & Control 26,810 19,191 46,707

----------

Group 32,215 31,720 67,577

----------

Adjusted operating profit

----------

Digital Imaging 645 4,692 6,873

----------

Sensors & Control 4,780 2,914 8,045

----------

Other (996) (753) (2,109)

------------------------------------- ------------ ------------ ----------

Group 4,429 6,853 12,809

----------

Amortisation of acquired intangible

assets

----------

Digital Imaging (92) (92) (175)

----------

Sensors & Control (666) (735) (1,620)

----------

Group (758) (827) (1,795)

----------

Adjusted Operating Profit has been defined in Note 3.

Analysis of amortisation of acquired intangible assets has been

included separately as the Group considers it to be an important

component of profit which is directly attributable to the reported

segments.

The Other category includes costs which cannot be allocated to

the other segments and consists principally of Group head office

costs.

4. Segmental analysis (continued)

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ----------- ----------- ---------

Operating Assets excluding acquired

intangible assets

---------

Digital Imaging 7,452 8,191 7,585

---------

Sensors & Control 28,875 29,868 32,155

---------

Other 1,013 676 1,075

------------------------------------- ----------- ----------- ---------

Group 37,340 38,735 40,815

---------

Acquired intangible assets

---------

Digital Imaging 4,759 4,932 4,844

---------

Sensors & Control 35,141 41,675 35,888

---------

Group 39,900 46,607 40,732

---------

Operating Liabilities

---------

Digital Imaging (1,298) (3,133) (1,489)

---------

Sensors & Control (7,062) (10,383) (11,024)

---------

Other (503) (655) (2,038)

------------------------------------- ----------- ----------- ---------

Group (8,863) (14,171) (14,551)

---------

Net Operating Assets

---------

Digital Imaging 10,913 9,990 10,940

---------

Sensors & Control 56,954 61,160 57,019

---------

Other 510 21 (963)

------------------------------------- ----------- ----------- ---------

Group 68,377 71,171 66,996

------------------------------------- ----------- ----------- ---------

Net operating assets has been defined in Note 3.

5. Earnings per share

The calculation of the basic earnings per share is based on the

profits attributable to the shareholders of SDI Group plc divided

by the weighted average number of shares in issue during the

period. All profit per share calculations relate to continuing

operations of the Group.

Weighted Earnings

Profit average per share

for the period number of amount in

GBP'000 shares pence

----------------------------- ---------------- ------------ -----------

Basic earnings per share:

-----------

Period ended 31 October

2023 1,993 104,050,044 1.92

-----------

Period ended 31 October

2022 4,244 102,215,980 4.15

-----------

Year ended 30 April 2023 3,903 102,761,812 3.80

-----------

Dilutive effect of share

options :

-----------

Period ended 31 October

2023 1,192,024

-----------

Period ended 31 October

2022 2,195,876

-----------

Year ended 30 April 2023 2,037,440

-----------

Diluted earnings per share:

-----------

Period ended 31 October

2023 1,993 105,242,068 1.89

-----------

Period ended 31 October

2022 4,244 104,411,856 4.06

-----------

Year ended 30 April 2023 3,903 104,799,252 3.72

----------------------------- ---------------- ------------ -----------

6. Borrowings

*Restated

31 October 31 October 30 April

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------- ------------- ------------- ----------

Within one year:

Leases 780 802 745

780 802 745

-------------------------------- ------------- ------------- ----------

After one year and within five

years:

Bank finance 14,750 19,000 16,000

Leases 5,208 5,476 5,215

-------------------------------- ------------- ------------- ----------

19,958 24,476 21,215

-------------------------------- ------------- ------------- ----------

After more than five years:

-------------------------------- ------------- ------------- ----------

Leases 781 828 781

-------------------------------- ------------- ------------- ----------

Total borrowings 21,519 26,106 22,741

-------------------------------- ------------- ------------- ----------

*see note 9

Bank finance relates to amounts drawn down under the Group's

bank facility with HSBC Bank plc, which is secured against all

assets of the Group. On 1 November 2021 the Group renewed and

expanded its committed loan facility with HSBC to GBP20m, with an

accordion option of an additional GBP10m and with a termination

date of 1 November 2024 extendable for two further years. On 30

November 2022, the Group reached agreement with HSBC to exercise

GBP5m of an available GBP10m accordion option, which increased the

committed loan facility from GBP20m to GBP25m. The balance of the

accordion option (GBP5m) remains available to the Group (at the

discretion of HSBC) for future exercise. On 29 March 2023 the

termination date was extended by a further year to 1 November 2025.

This is extendable by another year at HSBC's discretion. The

revolving facility is available for general use. The facility has

covenants relating to leverage (net debt to EBITDA) and interest

cover.

7. Taxation

The Group has estimated an effective tax rate of 24.9% (H1 FY23:

20%) for the year and has applied this rate to the profit before

tax for the period.

8. Post balance sheet events

On 3 November 2023 the Group completed the acquisition of Peak

Sensors for an initial consideration of c.GBP1.6m in cash plus

further expected payments up to c.GBP1.0m depending on net assets

delivered at completion. Peak Sensors comprises three companies:

Peak Sensors (Holding) Limited and two wholly owned subsidiaries,

Peak Sensors Limited and Peak Sensors (Property) Limited. Peak

Sensors Limited is the main trading company employing all members

of staff.

Peak Sensors is a leading UK manufacturer of temperature

sensors, specialising in standard and bespoke thermocouples and

resistance thermometers which are used in various industries,

including glass, ceramic, incinerators (including energy from

waste), cement, and ovens. For the year ended 31 March 2023, Peak

Sensors achieved revenues of approximately GBP2.1m, EBIT of

c.GBP0.3m, and the Peak group's statutory profit before tax was

c.GBP0.4m (consolidated, unaudited).

The acquisition is expected to be earnings enhancing in the

first full year of ownership.

9. Prior year restatement

The amounts owed after more than five years and after one year

and within five years were updated to include the correct split. As

a result of this correction, the amounts owed after more than five

years has increased by GBP781,000 to GBP781,000 and the amounts

owed after one year and within five years has decreased by

GBP781,000 to GBP5,215,000. The correction had no impact on the

presentation of current and non-current liabilities as per the

Statement of Financial Position.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPGMGPUPWPUQ

(END) Dow Jones Newswires

December 07, 2023 02:00 ET (07:00 GMT)

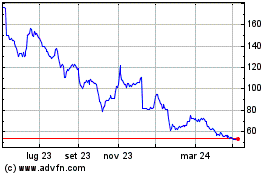

Grafico Azioni Sdi (LSE:SDI)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Sdi (LSE:SDI)

Storico

Da Mag 2023 a Mag 2024