TIDMSEC

Strategic Equity Capital PLC

RESULTS FOR THE YEARED 30 JUNE 2023

The Directors of Strategic Equity Capital plc are pleased to announce the

Company's results for the year ended 30 June 2023.

+-----------------------------+----------+----------+--------+

|Capital Return |As at |As at |% change|

| | | | |

| |30 June |30 June | |

| | | | |

| |2023 |2022 | |

+-----------------------------+----------+----------+--------+

|Net asset value ("NAV") per |342.47p |316.21p |8.3% |

|Ordinary share# | | | |

+-----------------------------+----------+----------+--------+

|Ordinary share price |309.00p |280.00p |10.4% |

+-----------------------------+----------+----------+--------+

|Comparative index* |4,970.43 |5,164.05 |(3.7)% |

+-----------------------------+----------+----------+--------+

|Discount of Ordinary share |(9.8)% |(11.5)% | |

|price to NAV | | | |

+-----------------------------+----------+----------+--------+

|Average discount of Ordinary |(7.4)% |(12.6)% | |

|share price to NAV for the | | | |

|year | | | |

+-----------------------------+----------+----------+--------+

|Total assets (£'000) |170,784 |177,198 |(3.6)% |

+-----------------------------+----------+----------+--------+

|Equity Shareholders' funds |170,223 |175,030 |(2.7)% |

|(£'000) | | | |

+-----------------------------+----------+----------+--------+

|Ordinary shares in issue with|49,704,711|55,352,088| |

|voting rights | | | |

+-----------------------------+----------+----------+--------+

+--------------------------------------------+----------+----------+

|Performance |Year ended|Year ended|

| | | |

| |30 June |30 June |

| | | |

| |2023 |2022 |

+--------------------------------------------+----------+----------+

|NAV total return for the year |9.2% |(9.2)% |

+--------------------------------------------+----------+----------+

|Share price total return for the year |11.2% |(9.5)% |

+--------------------------------------------+----------+----------+

|Comparative index* total return for the year|(0.4)% |(14.6)% |

+--------------------------------------------+----------+----------+

|Ongoing charges |1.22% |1.08% |

+--------------------------------------------+----------+----------+

|Ongoing charges (including performance fee) |1.22% |1.08% |

+--------------------------------------------+----------+----------+

|Revenue return per Ordinary share |3.53p |2.43p |

+--------------------------------------------+----------+----------+

|Dividend yield |0.81% |0.71% |

+--------------------------------------------+----------+----------+

|Proposed final dividend for the year |2.50p |2.00p |

+--------------------------------------------+----------+----------+

+----------------------+-------+-------+

|Year's Highs/Lows |High |Low |

+----------------------+-------+-------+

|NAV per Ordinary share|346.28p|279.69p|

+----------------------+-------+-------+

|Ordinary share price |320.00p|258.00p|

+----------------------+-------+-------+

# Net asset value or NAV, the value of total assets less current liabilities.

The net asset value divided by the number of shares in issue produces the net

asset value per share.

*FTSE Small Cap (ex Investment Trusts) index

Chairman's Statement

Results for the Year

I am pleased to report that, despite difficult market conditions, during the 12

months to 30 June 2023, the Company's NAV per share (on a total return basis)

increased by 9.2%. The FTSE Small Cap (ex Investment Trusts) Total Return Index

("FTSE Small Cap Index"), which we use for comparison purposes only, decreased

by 0.4%. Over the same period, the share price of the Company increased by 11.2%

on a total return basis.

NAV performance during the period was encouraging, reflecting the focus on

higher quality companies exposed to areas of structural growth where they have a

degree of pricing power. The Board believes that continuing to prioritise

companies with resilient business fundamentals and strong balance sheets should

enable the Company to continue outperforming over the medium to long term.

The Company's Strategy and Investment Process are discussed in detail in the

Investment Manager's Report on pages 6 to 8 of the Annual Report.

As a direct result of our deliberate and distinctive investment process, the

Company provides notable benefits for investors:

· Performance

Our performance has been strong relative to our peers and has been positive even

in falling markets driven by the idiosyncratic nature of returns. This is a

reflection of the skills of our fund manager Ken Wotton and his team and the

benefits of taking a private equity approach to public markets. The construction

of the portfolio has been deliberately designed to offer a real return. There

continues to be demonstrable and significant private equity interest in UK

stocks given compelling valuations, for example Medica (see page 23 of the

Annual Report), and the potential upside on the Company's other investments

remains substantial in the view of the Investment Manager.

· Risk Management

For investors looking for high quality, but relatively cheap, small UK cap

exposure, SEC offers low correlations and a low beta to the broader market.

This, together with low valuations, see below, provides a strong margin of

safety to underpin the long-term upside potential of the portfolio.

· Valuation

SEC currently offers investors an attractive discount at four different levels:

- UK equities stand at a substantial discount to global markets, currently at

a 15 year low;

- Within the UK market, smaller capitalisation stocks are on a notable

discount to large caps;

- The SEC portfolio of companies are both cheaper (and higher quality) than UK

small Cap indices;

- Investors are today able to purchase SEC shares at a significant discount to

NAV.

Discount and Discount Management

The average discount to NAV of the Company's shares during the period was 7.4%,

compared to the equivalent 12.6% figure from the prior year. The discount range

was 3.3% to 12.5%.

Many of the measures implemented in Q1 2022 to address the persistent share

price discount to NAV are now complete. These included a 10 per cent. tender

offer; the implementation of a share buyback programme with 5,598,886 shares

repurchased during the 2022 calendar year; and a commitment by Gresham House to

use £5 million of its cash resources to purchase shares in the Company. Gresham

House now has a 10.7% equity stake in the Company. These have been successful,

resulting in the discount narrowing from 11.5% at the beginning of the period to

9.8% at the end of the period. For comparison, over the same period the average

UK Smaller Company Investment Trust discount increased from 8.2% to 11.5%.

Other measures, also implemented in Q1 2022, remain ongoing. These include: a

buy back policy to return 50 per cent. of proceeds from profitable realisations,

at greater than a 5 per cent. discount on an ongoing basis, in each financial

year; an ongoing commitment by Gresham House Asset Management to reinvest 50 per

cent. of its management fee per quarter in shares if the Company's shares trade

at an average discount of greater than 5 per cent. for the quarter; and the

deferral of an annual continuation resolution in favour of the implementation of

a 100 per cent. realisation opportunity for shareholders in 2025.

Marketing

A priority of the Board over the last eighteen months has been a focused

marketing plan and strategy to increase awareness of the Company and to ensure a

clear investment proposition is presented to the market.

In a competitive marketplace, and for a relatively under-appreciated asset

class, communicating differentiation is vitally important. The Investment

Manager's highly disciplined private equity approach to public markets, with

constructive corporate engagement, thorough due diligence and a powerful network

of advisers, alongside an active, high conviction concentrated portfolio of only

15-20 companies, are a source of competitive advantage and sustained

performance. This is reflected in all communications including the Company's

webpage (www.strategicequitycapital.com).

The Company has also been developing new content to engage investors and

potential investors, including an innovative video series where the Investment

Manager has interviewed the chief executives of portfolio companies to provide

investors with a greater insight into the companies that the Company invests in.

Extending insights and views of the Investment Manager have also been

incorporated within the Company's co-ordinated PR programme to engage key

national, trade and specialist investment publications resulting in coverage

including in the Mail on Sunday, Daily Mail's This Money, Shares Magazine,

Interactive Investor, Investment Week, Trustnet and Citywire Funds Insider.

The Board is ambitious with its plans to build the profile and positioning of

the Company over time.

Gearing and Cash Management

The Company has maintained its policy of operating without a banking loan

facility. This policy is periodically reviewed by the Board in conjunction with

the Manager and remains under review.

Dividend

For the year ended 30 June 2023 the basic revenue return per share was 3.53p

(2022: 2.43p). Although the Company is predominantly focused on delivering long

term capital growth, due to the strongly cash generative nature of the majority

of the portfolio companies and low capital intensity, many pay an attractive

dividend. Accordingly, the Board is proposing a final dividend of 2.50p per

share for the year ending 30 June 2023 (2022: 2.00p per share), payable on 15

November 2023 to shareholders on the register as at 13 October 2023.

The Board

I am delighted to welcome Brigid Sutcliffe and Howard Williams to the Board as

non-executive Directors. Both joined in February 2023 and bring a wealth of

experience and knowledge that will be of enormous benefit to the Company.

It is intended that Brigid will take over as the Company's Audit Committee Chair

after Jo Dixon retires at the Company's AGM in November.

The Board would like to convey its sincere thanks to Jo for the significant

contribution she has made to the Company and for her excellent leadership of the

Audit Committee.

Outlook

The global macroeconomic and geopolitical environment remains highly uncertain,

although signs of normalising inflation (and implications for monetary policy)

are welcome. Closer to home the UK economy is proving to be relatively

resilient, although certain sectors (for example housing and construction) are

showing signs of challenge, which could promote further volatility in company

earnings and equity market ratings as macroeconomic developments unfold.

Despite these obvious challenges the Investment Manager is observing an

increasing number of attractive long term investment opportunities. Strong

underlying fundamentals across the existing portfolio provide a robust and

resilient platform for future investment returns. The significant dislocation

between current UK public market valuations and the comparators in private

markets provide good grounds for optimism about the prospects for positive

valuation momentum over the medium term.

The resilient positioning of the Company's portfolio should enable it to

outperform in the current challenging environment and continue to deliver

attractive long-term capital growth when markets stabilise. Furthermore, the

enhanced marketing programme and ongoing share buybacks should support the

Company's ability to maintain a structurally narrower share price discount to

NAV over the coming year.

The Board, once again, thanks you for your continued support.

William Barlow

Chairman

26 September 2023

The Investment Manager's Report

Investment Strategy

In the following section, we remind shareholders of our strategy and investment

process.

Our Strategic Public Equity strategy

The appointment of Gresham House as Manager in May 2020 and the subsequent

appointment of Ken Wotton as Lead Fund Manager in September 2020 resulted in a

refocus of the investment strategy ensuring that it is strictly applied and is

able to effectively leverage the experienced resource of the Gresham House

Strategic Equity team, the wider Group platform and its extensive network. We

set out this strategy in detail in the Company's 2022 Annual Report which we

summarise again below.

Investment focus

Our investment focus is to invest into high quality, publicly listed companies

which we believe can materially increase their value over the medium to long

term through strategic, operational or management change. To select suitable

investments and to assist in this process we apply our proprietary Strategic

Public Equity ("SPE") investment strategy. This includes a much higher level of

engagement with management than most investment managers adopt and is closer in

this respect to a private equity approach to investing in public markets

companies. Our path to achieving this involves constructing a high conviction,

concentrated portfolio; focusing on quality business fundamentals; undertaking

deep due diligence including engaging our proprietary network of experts and

assessing ESG risks and opportunities through the completion of the ESG decision

tool; and maintaining active stewardship of our investments. Through

constructive, active engagement with the management teams and boards of

directors, we seek to ensure alignment with shareholder objectives and to

provide support and access to other resource and expertise to augment a

company's value creation strategy.

We are long-term investors and typically aim to hold companies for three-to-five

years to back a thesis that includes an entry and exit strategy and a clearly

identified route to value creation. We have clear parameters for what we will

invest in and areas which we will deliberately avoid.

Smaller company focus

We believe that UK Smaller Companies represent a structurally attractive part of

the public markets. Academic research demonstrates that smaller companies in the

UK have delivered substantial outperformance over the long term (see Figure 1 on

page 6 in the Annual Report). This is partially because there are a large number

of under-researched and under-owned businesses that typically trade at a

valuation discount to larger companies (see Figure 2 on page 7 in the Annual

Report) and relative to their prospects. A highly selective investor with the

resources and experience to navigate successfully this part of the market can

find exceptional long-term investment opportunities.

The key attractions of smaller companies are:

· Inefficient markets - Smaller companies remain under-researched and below

the radar for most investors thus creating an opportunity for those willing to

devote time and resource to this area.

· A large universe - Most UK listed companies are in the smaller companies

category and are listed on the main market or AIM. Two-thirds of UK listed

companies have a market capitalisation below £500m, offering a large opportunity

set for smaller company specialists.

· Valuation discounts - Such discounts, arising for whatever reason, present

attractive entry points at which the intrinsic worth of a company's long-term

prospects are undervalued.

· M&A activity - Smaller companies often offer strategic opportunities within

their niche markets and can become attractive, bolt-on acquisitions to both

trade and private equity buyers. These buyers provide an additional source of

liquidity and realisation of value for smaller company investors.

Portfolio Construction

We will maintain a concentrated portfolio of 15-25 high conviction holdings with

prospects for attractive absolute returns over our investment holding period.

The majority of portfolio value is likely to be concentrated in the top 10-15

holdings with other positions representing potential "springboard" investments

where we are awaiting a catalyst to increase our stake to an influential,

strategic level.

Bottom-up stock picking determines SEC's sector weightings which are not

explicitly managed relative to a target benchmark weighting. The absence of

certain sectors such as oil & gas, mining, and banks, as well as limited

exposure to overtly cyclical parts of the market, and the absence of early stage

or pre-profit businesses typically result in a portfolio weighted towards, but

not exclusively, profitable cash generative service sector businesses

particularly in technology, healthcare, business services, financials and

industrials. The underlying value drivers are typically company specific and

exhibit limited correlation even within the same broad sectors. Figure 3 on page

7 of the Annual Report sets out the sector exposure of the Company as at 30 June

2023.

Our smaller company focus and specialist expertise leads us to prioritise

companies with a market capitalisation between £100m and £300m at the point of

investment. This focus, in combination with the size of the Company and its

concentrated portfolio approach, provides the potential to build a strategic and

influential stake in the highest conviction holdings. In turn this provides a

platform to maximise the likelihood that our constructive active engagement

approach will be effective and ultimately successfully contribute to shareholder

value creation.

Once purchased there is no upper limit restriction on the market capitalisation

of an individual investment. We will run active positions regardless of market

capitalisation provided they continue to deliver the expected contribution to

overall portfolio returns and subject to exposure limits and portfolio

construction considerations.

The weighted average market capitalisation of portfolio holdings increased to

£252m as at 30 June 2023 compared to £231m as at 30 June 2022, largely

reflecting share price growth across the portfolio, particularly in the case of

the two largest holdings (Medica Group and XPS Pensions Group), both of which

were top performers throughout the period and traded at market capitalisations

greater than the portfolio average as at 30 June 2023. This level of average

market capitalisation supports the Investment Manager's strategy of focusing on

smaller market capitalisation companies where SEC has the potential to take a

meaningful equity stake as a platform to effectively apply its active engagement

strategy.

We set out a description of the Top 10 holdings as at 30 June 2023 on page 11 of

the Annual Report together with a high level summary of the investment case and

recent developments for each position.

Constructive Active Engagement Approach

As far as possible, SEC aims to build consensus with other stakeholders. We want

to unlock value for shareholders, but also create stronger businesses over the

long term. The objective is to develop a dialogue with management so that the

GHAM team and its network are seen as trusted advisors.

Operating with a highly-focused portfolio, SEC's management team can build and

maintain a deep understanding of its portfolio companies and their potential.

The team engages with company management teams and boards in a number of areas

including:

· Strategy - Working with boards to ensure that business strategy and

operations are effectively aligned with long term value creation and focused on

building strategic value within a company's market.

· Corporate activity - Support for acquisition and divestment activity through

advice, network introductions and the provision of cornerstone capital.

· Capital allocation - Seeking to work with boards to optimise capital

allocation by prioritising the highest return and value added projects and areas

of focus for investment of both capital and resource.

· Board composition - Ensuring that boards are appropriately balanced between

executive and non-executive directors and contain the right balance of skills

and experience; we actively use our talent network to introduce high quality

candidates to enhance the quality of investee company boards as appropriate.

· Management incentivisation - Ensuring that key management are appropriately

retained and incentivised to deliver long term shareholder value with schemes

that fit with GHAM's principles and are well aligned to our objectives as

shareholders.

· ESG - Leveraging the Gresham House sustainable investing framework and

central resource to help to identify, understand and monitor key ESG risks and

opportunities as well as seeking to drive enhancements to a company's approach

where there are critical material issues with a particular focus on corporate

governance.

· Investor Relations - Helping management teams to hone their equity story,

select appropriate advisors and target their investor relations activities in

the most effective way to ensure that value creation activity is understood and

reflected by the market.

Engagement is undertaken privately, leveraging the wider platform and resources

of the Gresham House group, as far as possible. The team will also work to

leverage its extensive network to the benefit of portfolio companies. We seek to

make introductions to our network in as collaborative way as appropriate where

we believe there is an opportunity to support initiatives to create shareholder

value.

In summary, we follow a practice of constructive corporate engagement and aim to

work with management teams in order to support and enhance shareholder value

creation. We attempt to build a consensus with other stakeholders and prefer to

work collaboratively alongside like-minded co-investors.

Portfolio review for the twelve months to 30 June 2023

Over the course of the twelve months to 30 June 2023 we continued to evolve the

portfolio at a more normalised pace than in the previous two financial years:

purchasing two new holdings which represented 4.3% of NAV at the end of the

period, and fully exiting four positions which represented 8.2% at the start of

the period. We have also exited our position in Medica post period end as its

recommended cash takeover offer from IK Partners completed, which represented

18% of closing NAV. As of 30 June 2023, the number of influential equity stakes

where GHAM funds, in aggregate, hold a 5% or more equity stake stood at 11, and

represented 77% of the portfolio by value at 30 June 2023.

Market Background

Over the twelve months to the end of June, the FTSE Smaller Companies (ex

Investment Trusts) Index ("the index") fell by 0.4% on a total return basis

underperforming the FTSE All Share (+3.9%) but outperforming the FTSE AIM (

-14.0%). Following the substantial style shift from growth to value in the first

half of 2022, the 12 months to 30 June 2023 saw a small revival of growth style

investing, with the MSCI UK Growth index outperforming its value peer. However,

energy and mining stocks (in which the Company does not invest) continued to

perform well given geopolitical developments, and were key contributors to the

overall index performance.

The UK equity market continued to be out of favour with asset allocators,

reaching 25 consecutive months of outflows by June 2023 (1). This continued

selling pressure from UK equities has weighed on valuations, with the UK at

multi-decade lows relative to other developed markets, particularly the US,

despite the drawdowns experienced last year (see figure 5 on page 9 of the

Annual Report). Whilst this demonstrates the value opportunities in the UK

market, we believe that the challenging macroeconomic backdrop further fuels the

need for careful assessment of the bottom up characteristics of each company.

This suits the private equity approach taken by the Manager to investing on

behalf of the Company.

Performance Review

The net asset value ("NAV") increased 9.2%, on a total return basis, over the

twelve months to the end of June, closing at 342.5p per share. This increase in

NAV reflected the positive returns delivered by the majority of portfolio

companies throughout the period, despite volatile equity market conditions as

geopolitical and macroeconomic concerns weighed on investor sentiment. The

Company outperformed its benchmark during the period, as the FTSE Smaller

Companies (ex Investment Trusts) index fell by 0.4% on a total return basis.

This reflected the relatively defensive positioning of the portfolio compared to

the wider market - focused on high quality businesses in less cyclical parts of

the market and with resilient business models and robust balance sheets.

Despite the market volatility experienced over the year, we remain confident

about the resilient underlying fundamentals of the portfolio companies and their

ability to withstand the macroeconomic headwinds that look set to persist

through the current financial year.

(1) Source: Investec Market Review July 2023

Top Five Absolute Contributors to Performance

Security Valuation Period

30 June Contribution

2023 to return

£'000 (%)

Medica Group 30,881 5.82

XPS Pensions Group 25,459 4.92

Wilmington 9,482 2.28

Hostelworld 8,209 2.19

Ricardo 11,462 1.96

Medica, a leading provider of teleradiology services, was the subject of a

recommended cash takeover offer from IK Partners, a European private equity

firm, at a 32.5% premium, and the takeover has since completed (post period

-end). XPS Pensions, a pensions consulting, advisory and administration services

provider, which delivered results in excess of market expectations, resulting in

analyst upgrades, and divested a non-core business at a significantly accretive

valuation multiple to the wider group; Wilmington, a professional media

provider, which demonstrated strong operating fundamentals and forecast upgrades

whilst successfully refocussing the business on a digital first strategy in the

governance, risk and compliance market; Hostelworld, an online travel agent

focussed on the hostelling segment, following strong results (including a record

first quarter) and an improving industry outlook; and Ricardo, a global

strategic, environmental and engineering consultancy, which has delivered strong

performance particularly in its environmental & energy transition divisions,

which are key focus areas over the medium term.

Bottom Five Absolute Contributors to Performance

Security Valuation Period

30 June Contribution

2023 to return

£'000 (%)

Tribal 6,580 (5.24)

Inspired 10,327 (2.25)

R&Q Insurance Holdings 7,429 (1.76)

LSL Property Services 8,645 (0.91)

Tyman - (0.35)

In challenging equity market conditions certain portfolio holdings suffered from

share price weakness during the period, typically in response to short term

developments that, we believe, do not fundamentally change the long term values

of the holdings. The largest detractors included Tribal, an international

provider of student administration software, following a profit downgrade

resulting from an onerous contract; Inspired, which de-rated on no specific news

and despite delivering strong results and reaffirming expectations in line with

market consensus; R&Q Insurance Holdings, a global non-life specialty insurance

company, following weaker than expected interim results, and an equity raise

(through a preferred instrument) in order to bolster capital adequacy and

facilitate a separation of the group's two businesses in line with our view of

the optimal path to value creation for the group; LSL Property Services, a

leading provider of services to the UK residential property sector, which has

been impacted by the slowdown in activity within the UK housing market,

particularly within its surveying business; Tyman, a global building materials

and component manufacturer and distributor (which the Company has now fully

exited), which faced analyst downgrades reflecting end market challenges.

Portfolio Review

The portfolio remained highly focused with a total of 16 holdings and the top 10

accounted for around 80% of the NAV at the end of the period. 1% of the NAV was

held in cash at period end. This had subsequently increased to c. 13% by the end

of July 2023 following the receipt of the proceeds from the Medica Group

takeover.

Over the period positions in Nexus (IRR of -18%), Assetco (IRR of 30%), Tyman

(IRR of 23%), and IDOX (IRR of 6%) were fully exited, with Medica (IRR of 12% /

25% (2)) also fully exited post period end.

The Company currently has a number of key holdings that we believe trade at

material valuation discounts to comparable private market transaction values,

which provides a strong margin of safety underpinning the long term upside

potential of the portfolio.

Changes in sector weightings have seen exposure to Healthcare increase from

16.2% to 21.6%, with exposure to Financial Services increasing from 25.2% to

32.6%. The largest decrease has been in cash, which decreased from 9.3% to 0.7%

(although, as above, this increased substantially in July following the receipt

of Medica Group sale proceeds).

(2) 12% reflects the IRR from the Company's initial investment in Medica

Group in 2017. 25% reflects the IRR since Ken Wotton became Manager of the

Company in September 2020, and actively decided to upweight the Company's

holding in Medica Group

Top 10 Investee Company Review

(as at 30 June 2023)

+------------+----------------+-----------------------------------------------+

|Company |Investment |Developments during the year |

| |Thesis | |

+------------+----------------+-----------------------------------------------+

|Medica | | |

| | · A niche | · Fully exited in July 2023 pursuant to the |

|18.1% of NAV|market leader in|Recommended Cash Offer from IK Partners |

| |the UK | |

|Healthcare |teleradiology | |

| |sector which is | |

| |acyclical and is| |

| |growing rapidly | |

| |driven by | |

| |increasing | |

| |healthcare | |

| |requirements and| |

| |a structural | |

| |shortage of | |

| |radiologists | |

| | | |

| | · Above market| |

| |organic growth | |

| |and | |

| |underappreciated| |

| |cash generation | |

| |characteristics | |

+------------+----------------+-----------------------------------------------+

|XPS | | |

| | · Leading | · Delivered FY23 results and outlook ahead of|

|14.9% of NAV|`challenger' |market expectations, leading to analyst |

| |brand in the |upgrades |

|Financial |pensions | · Elevated demand for pensions advisory (e.g.|

|Services |consulting, |risk transfer) given Gilt volatility and |

| |advisory and |changes in funding positions |

| |administration | · Announced the disposal of its non-core NPT |

| |market |business for a significantly accretive |

| | · Highly |valuation multiple to the wider group |

| |defensive - high| |

| |degree of | |

| |revenue | |

| |visibility and | |

| |largely non | |

| |-discretionary, | |

| |regulation | |

| |driven client | |

| |activity | |

| | · Significant | |

| |inflation pass | |

| |-through ability| |

| | · Highly | |

| |fragmented | |

| |sector with | |

| |recent M&A | |

| |activity, | |

| |providing | |

| |opportunity to | |

| |XPS as a | |

| |consolidator and| |

| |potential target| |

+------------+----------------+-----------------------------------------------+

|Brooks | | |

|Macdonald | · UK focused | · Positive net flows and 7.5% AUM growth in |

| |wealth |FY23 |

|7.0% of NAV |management | · Good progress in replacing previous |

| |platform; |management departures, which had weighed on the|

|Financial |structural |share price, including recently hiring Aviva's |

|Services |growth given |former CRO as CFO |

| |continuing | |

| |transition to | |

| |self-investment | |

| | · Opportunity | |

| |to leverage | |

| |operational | |

| |investments to | |

| |grow margin and | |

| |continue strong | |

| |cash flow | |

| |generation | |

| | · A | |

| |consolidating | |

| |market; | |

| |opportunity for | |

| |Brooks as both | |

| |consolidator and| |

| |potential target| |

| |with recent | |

| |takeover | |

| |interest for | |

| |sector peers | |

+------------+----------------+-----------------------------------------------+

|Ricardo | | |

| | · Global | · Successfully extended its McLaren |

|6.7% of NAV |strategic, |relationship (now in its fourth generation) |

| |environmental |demonstrating the stickiness of Ricardo's |

|Construction|and engineering |customer relationships |

|& Materials |consultancy | · Strong FY23 results with particularly high |

| | · Ongoing |growth in its Environmental & Energy Transition|

| |strategic |divisions, in line with the strategic ambition |

| |transformation | |

| |to refocus and | |

| |prioritise the | |

| |business towards| |

| |higher growth, | |

| |higher margin | |

| |and less capital| |

| |intensive | |

| |activities | |

| | · Strong | |

| |market position | |

| |underpinned by | |

| |significant | |

| |sector expertise| |

+------------+----------------+-----------------------------------------------+

|Fintel | | |

| | · Leading UK | · Extended its strategic distribution |

|6.3% of NAV |provider of |agreement with BlackRock |

| |technology | · In-line H1'23 results with positive |

|Financial |enabled |outlook, leading to analyst upgrades |

|Services |regulatory | · Announced two small bolt-ons and Fintel's |

| |solutions and |first investment through its early-stage |

| |services to |technology incubator, Fintel Labs |

| |IFAs, financial | |

| |institutions and| |

| |other | |

| |intermediaries | |

| | · | |

| |Strategically | |

| |valuable | |

| |technology | |

| |platform with | |

| |opportunity to | |

| |drive material | |

| |growth in | |

| |revenues and | |

| |margins through | |

| |supporting | |

| |customers' | |

| |digitisation | |

| |journeys | |

+------------+----------------+-----------------------------------------------+

|Inspired | | |

| | · UK B2B | · Strong FY22 results, Q1'23 momentum and |

|6.1% of NAV |corporate energy|FY23 outlook |

| |assurance, | · Demonstrable progress in cash conversion |

|Industrial |procurement and |and cross-sell |

|Goods & |optimisation | · New incentivisation agreement within its |

|Services |service provider|energy optimisation division, with performance |

| | · ESG |hurdles significantly ahead of market forecasts|

| |specialist, with| |

| |a track record | |

| |of advising blue| |

| |chip companies | |

| |on reducing | |

| |energy | |

| |consumption | |

| | · Leading | |

| |player in a | |

| |fragmented | |

| |industry; | |

| |significant | |

| |opportunity to | |

| |gain market | |

| |share through | |

| |client wins, | |

| |proposition | |

| |extension and | |

| |M&A | |

+------------+----------------+-----------------------------------------------+

|Wilmington | | |

| | · | · FY22 and H1'23 results in line with market |

|5.6% of NAV |International |expectations, which had increased through 2022 |

| |provider of B2B | · Repeat revenue now accounts for 79% of |

|Media |data and |revenue (H1'23) |

| |training in the | · Further portfolio optimisation including |

| |compliance, |the disposal of Spanish subsidiary Inese, in |

| |insurance, |line with Wilmington's portfolio management |

| |financial and |strategy |

| |healthcare | |

| |sectors | |

| | · New Chair, | |

| |CEO and CFO | |

| |incentivised to | |

| |re-focus the | |

| |business and | |

| |deliver a return| |

| |to organic | |

| |growth | |

+------------+----------------+-----------------------------------------------+

|Iomart | | |

| | · Integrated | · Existing Chair has expanded their role to |

|5.3% of NAV |datacentre and |become Executive Chair on a part time basis |

| |cloud services |(supported by the CEO) |

|Technology |provider | · FY23 results in line with market |

| | · Provides |expectations |

| |both self | · Two strategic bolt-ons in the period, most |

| |-managed |recently the acquisition of Extrinsica to |

| |infrastructure |double Iomart's Azure hybrid cloud capability |

| |and cloud | |

| |-managed | |

| |services, with | |

| |the latter being| |

| |a key strategic | |

| |focus area | |

| | · Highly cash | |

| |generative with | |

| |significant | |

| |recurring | |

| |revenue | |

| | · Structural | |

| |growth | |

| |opportunity from| |

| |hybrid cloud | |

| |adoption | |

+------------+----------------+-----------------------------------------------+

|LSL Property| | |

|Services | · Leading | · Announced in 2023 the transition of its |

| |provider of |estate agency business from ownership to |

|5.1% of NAV |services to the |franchise, which we believe reduces |

| |UK residential |cyclicality, capital intensity, and improves |

|Real Estate |property sector |the quality of earnings |

| |with activities | · Post-period end forecasts downgraded |

| |spanning |through lower UK housing / mortgage activity |

| |mortgage |levels, which particularly dampened the outlook|

| |broking, |for LSL's surveying business |

| |surveying and | |

| |estate agencies | |

| | · Significant | |

| |opportunity to | |

| |reallocate | |

| |capital to the | |

| |Financial | |

| |Services | |

| |division which | |

| |is strategically| |

| |valuable, high | |

| |growth and | |

| |underappreciated| |

| |by the market | |

+------------+----------------+-----------------------------------------------+

|Hostelworld | | |

| | · Category | · Record Q1 and H1 revenue delivered and |

|4.8% of NAV |leader within |guidance confidently reaffirmed, following |

| |the hostelling |forecast upgrades earlier in 2023 |

|Travel & |niche of the | |

|Leisure |online travel | |

| |agent sector | |

| | · Social media| |

| |led customer | |

| |acquisition and | |

| |engagement | |

| |strategy to | |

| |enhance | |

| |profitability | |

| |and customer | |

| |lifetime value | |

| | · Growth | |

| |driven by post | |

| |-Covid recovery | |

| |in international| |

| |travel and value| |

| |for money | |

| |positioning, | |

| |with average | |

| |order value and | |

| |customer | |

| |lifetime values | |

| |improving | |

+------------+----------------+-----------------------------------------------+

Outlook

The Investment Manager's core planning assumption is that continued geopolitical

and macroeconomic uncertainty will drive market volatility throughout the

remainder of 2023. The shift to a period of higher inflation and higher interest

rates has fundamentally impacted asset markets and equities in particular. It is

likely that increasing focus on company fundamentals and valuation discipline

will be required to outperform in this environment which plays to the strengths

of the Company's investment strategy and the Investment Manager's approach.

The elevated levels of corporate activity within the UK equity market continue

to play out and the volume of takeover activity amongst smaller companies has

not been seen since H2 2019, despite overall UK takeover volumes (of all sizes)

remaining marginally below H1 2022 levels. Bid premia in the period were also

elevated, providing further evidence of attractive valuations amongst UK smaller

companies despite the higher cost of capital environment today. The investment

process and private equity lens across public markets enables the identification

of investment opportunities with potential strategic value that could be

attractive acquisitions for both corporate and financial buyers.

We continue to believe that our fundamentals focused investment style has the

potential to continue outperforming over the long term. We see significant

opportunities for long term investors to back quality growth companies at

attractive valuations in an environment where agile smaller businesses with

strong management teams can take market share and build strong long-term

franchises. We will maintain our focus on building a high conviction portfolio

of less cyclical, high quality, strategically valuable businesses which we

believe can deliver strong returns through the market cycle regardless of the

performance of the wider economy.

Portfolio as at 30 June 2023

% of % of

% of

invested

invested

portfolio

portfolio

at at

Date of Cost Valuation 30 June 30 June

net

first

Company Sector Investment £'000 £'000 2023 2022

Assets

Classification

Medica Group Healthcare Mar 2017 19,120 30,881 18.2% 13.3%

18.1%

XPS Pensions Financial Jul 2019 16,850 25,459 15.0% 11.8%

14.9%

Group Services

Brooks Financial Jun 2016 10,563 11,916 7.0% 7.4%

7.0%

Macdonald Services

Ricardo Construction & Sep 2021 9,107 11,462 6.8% 2.5%

6.7%

Materials

Materials

Fintel Financial Oct 2020 10,076 10,800 6.4% 5.8%

6.3%

Services

Inspired Industrial Jul 2020 13,713 10,327 6.1% 8.4%

6.1%

Energy Goods &

Services

Wilmington Media Oct 2010 6,818 9,482 5.6% 7.4%

5.6%

Iomart Technology Mar 2022 8,473 9,074 5.4% 3.0%

5.3%

LSL Property Real Estate Mar 2021 13,256 8,645 5.1% 6.5%

5.1%

Services

Hostelworld Travel & Oct 2019 6,505 8,209 4.8% 5.3%

4.8%

Leisure

R&Q Insurance Financial Jun 2022 10,308 7,429 4.3% 1.7%

4.4%

Holdings Services

Tribal Technology Dec 2014 11,742 6,580 3.9% 9.0%

3.9%

Benchmark Healthcare Jun 2019 6,733 6,120 3.6% 4.3%

3.6%

Ten Travel & Oct 2020 3,464 5,539 3.3% 4.6%

3.3%

Entertainment Leisure

Carr's Group Industrial

Goods

Services]

& Services Mar 2023 3,603 4,296 2.5% -

2.5%

Netcall Technology Mar 2023 3,168 3,055 1.8% -

1.8%

Total 169,274

99.4%

Investments

Cash 1,242

0.7%

Net current (293)

(0.1)%

liabilities

Total 170,223

100.0%

shareholders'

funds

Ken Wotton

Gresham House Asset Management

26 September 2023

Statement of Comprehensive Income

Year ended 30 June 2023

Revenue Capital

return return Total

£'000 £'000 £'000

Investments

Gains on investments held - 10,602 10,602

at fair value

through profit or loss

- 10,602 10,602

Income

Dividends 3,782 - 3,782

Interest 78 - 78

Total income 3,860 - 3,860

Expenses (1,228) - (1,228)

Investment Manager's fee

Other expenses (803) - (803)

Total expenses (2,031) - (2,031)

Net return before taxation 1,829 10,602 12,431

Taxation - - -

Net return and total 1,829 10,602 12,431

comprehensive income for

the year

Return per Ordinary share 3.53p 20.44p 23.97p

The total column of this statement represents the Statement of Comprehensive

Income prepared in accordance with IFRS. The supplementary revenue and capital

return columns are both prepared under guidance published by the AIC. All items

in the above statement derive from continuing operations. No operations were

acquired or discontinued during the year.

Statement of Comprehensive Income

Year ended 30 June 2022

Revenue Capital

return return Total

£'000 £'000 £'000

Investments

Losses on investments held - (21,776) (21,776)

at fair value

through profit or loss

- (21,776) (21,776)

Income

Dividends 4,173 - 4,173

Interest 6 - 6

Total income 4,179 - 4,179

Expenses (1,564) - (1,564)

Investment Manager's fee

Other expenses (1,128) - (1,128)

Total expenses (2,692) - (2,692)

Net return before taxation 1,487 (21,776) (20,289)

Taxation - - -

Net return and total 1,487 (21,776) (20,289)

comprehensive income for

the year

Return per Ordinary share 2.43p (35.53)p (33.10)p

Balance Sheet

As at As at

30 June 2023 30 June 2022

£'000 £'000

Non-current assets

Investments held at fair 169,274 159,950

value though profit and

loss

Current assets

Trade and other 268 885

receivables

Cash and cash equivalents 1,242 16,363

1,510 17,248

Total assets 170,784 177,198

Current liabilities

Trade and other payables (561) (2,168)

Net assets 170,223 175,030

Capital and reserves

Share capital 6,353 6,353

Share premium account 11,300 11,300

Special reserve 3,590 19,767

Capital reserve 142,952 132,350

Capital redemption reserve 2,897 2,897

Revenue reserve 3,131 2,363

Total shareholders' equity 170,223 175,030

Net asset value per share 342.47p 316.21p

Ordinary shares in issue 49,704,711 55,352,088

Statement of Changes in Equity

For the year Share Share Special Capital Capital Revenue Total

ended capital premium reserve redemption reserve

reserve reserve

30 June 2023 account

£'000 £'000 £'000 £'000 £'000 £'000 £'000

1 July 2022 6,353 11,300 19,767 132,350 2,897 2,363

175,030

Net return - - - 10,602 - 1,829

12,431

and total

comprehensive

income for

the year

Dividends - - - - - (1,061)

(1,061)

paid

Share buy - - (16,177) - - -

(16,177)

-backs

30 June 2023 6,353 11,300 3,590 142,952 2,897 3,131

170,223

For the year Share Share Special Capital Capital Revenue Total

ended capital premium reserve redemption reserve

reserve reserve

30 June 2022 account

£'000 £'000 £'000 £'000 £'000 £'000 £'000

1 July 2021 6,986 31,737 24,567 154,126 2,264 1,889

221,569

Net return - - - (21,776) - 1,487

(20,289)

and total

comprehensive

income for

the year

Dividends - - - - - (1,013)

(1,013)

paid

Share buy (633) (20,437) (4,800) - 633 -

(25,237)

-backs

30 June 2022 6,353 11,300 19,767 132,350 2,897 2,363

175,030

Statement of Cash Flows

Year Ended 30 June Year Ended 30 June

2023 2022

£'000 £'000

Operating activities

Net return before taxation 12,431 (20,289)

Adjustment for (10,602) 21,776

(gains)/losses on

investments

Operating cash flows before 1,829 1,487

movements in working capital

Decrease/(increase) in 374 (219)

receivables

Increase/(decrease) in 22 (19)

payables

Purchases of portfolio (30,473) (36,443)

investments

Sales of portfolio 30,463 70,129

investments

Net cash flow from operating 2,215 34,935

activities

Financing activities

Equity dividend paid (1,061) (1,013)

Shares bought back in the (16,275) (25,139)

year

Net cash outflow from (17,336) (26,152)

financing activities

(Decrease)/increase in cash (15,121) 8,783

and cash equivalents for

year

Cash and cash equivalents at 16,363 7,580

the start of the year

Cash and cash equivalents at 1,242 16,363

30 June

Principal and Emerging Risks

The Board believes that the overriding risks to shareholders are events and

developments which can affect the general level of share prices, including, for

instance, inflation or deflation, economic recessions and movements in interest

rates and currencies which are outside of the control of the Board.

The principal risks and uncertainties are set out on pages 17 and 18 of the

Annual Report.

Responsibility statement of the Directors in respect of the Annual Financial

Report

We confirm that to the best of our knowledge:

· the financial statements, prepared in accordance with the applicable set of

accounting standards, give a true and fair view of the assets, liabilities,

financial position and profit or loss of the Company; and

· the Strategic Report includes a fair review of the development and

performance of the business and the position of the issuer, together with a

description of the principal risks and uncertainties that it faces.

We consider the Annual Report and accounts, taken as a whole, is fair, balanced

and understandable and provides the information necessary for shareholders to

assess the Company's position and performance, business model and strategy.

Going Concern

In assessing the Company's ability to continue as a going concern the Directors

have also considered the

Company's investment objective, detailed on the inside front cover, risk

management policies, detailed on

pages 17 and 18 of the 2023 Annual Report, capital management (see note 16 to

the financial statements), the nature of its portfolio and expenditure

projections and believe that the Company has adequate resources, an appropriate

financial structure and suitable management arrangements in place to continue in

operational existence for the foreseeable future and for at least 12 months from

the date of this Report. In addition, the Board has had regard to the Company's

investment performance (see page 3 of the 2023 Annual Report) and the price at

which the Company's shares trade relative to their NAV (see page 3 of the 2023

Annual Report).

The Directors performed an assessment of the Company's ability to meet its

liabilities as they fall due. In performing this assessment, the Directors took

into consideration:

· cash and cash equivalents balances and, from a liquidity perspective, the

portfolio of readily realisable securities which can be used to meet short-term

funding commitments;

· the ability of the Company to meet all of its liabilities and ongoing

expenses from its assets;

· revenue and operating cost forecasts for the forthcoming year;

· the ability of third-party service providers to continue to provide

services; and

· potential downside scenarios including stress testing the Company's

portfolio for a 25% fall in the value of the investment portfolio; a 50% fall in

dividend income and a buy back of 5% of the Company's ordinary share capital,

the impact of which would leave the Company with a positive cash position.

Based on this assessment, the Directors are confident that the Company will have

sufficient funds to continue to meet its liabilities as they fall due for at

least 12 months from the date of approval of the financial statements, and

therefore have prepared the financial statements on a going concern basis.

Related Party Transactions and transactions with the Investment Manager

Fees paid to Directors are disclosed in the Directors` Remuneration Report on

page 39 of the 2023 Annual Report. Full details of Directors` interests are set

out on page 40 of the 2023 Annual Report.

City of London Investment Management is considered a related party by virtue of

their holding of 28.9% of the Company's total voting rights. Further details are

noted on page 27 of the 2023 Annual Report.

The amounts payable to the Investment Manager, which is not considered to be a

related party, are disclosed in note 3. The amount due to the Investment Manager

for management fees at 30 June 2023 was £311,000 (2022: £349,000). The amount

due to the Investment Manager for performance fees at 30 June 2023 was £nil

(2022: £nil).

As detailed on page 4 of the 2023 Annual Report, the Investment Manager,

directly and indirectly through its in-house funds, has continued to purchase

shares in the Company.

Notes

1.1 Corporate information

Strategic Equity Capital plc is a public limited company incorporated and

domiciled in the United Kingdom and registered in England and Wales under the

Companies Act 2006 whose shares are publicly traded. The Company is an

investment company as defined by Section 833 of the Companies Act 2006.

The Company carries on business as an investment trust within the meaning of

Sections 1158/1159 of the UK Corporation Tax Act 2010.

The financial statements of Strategic Equity Capital plc for the year ended 30

June 2023 were authorised for issue in accordance with a resolution of the

Directors on 26 September 2023.

1.2 Basis of preparation and statement of compliance

The financial statements of the Company have been prepared in accordance with

international accounting standards in conformity with the requirements of the

Companies Act 2006, and reflect the following policies which have been adopted

and applied consistently. Where presentational guidance set out in the Statement

of Recommended Practice ("SORP") for investment trusts issued by the AIC in

February 2019 is consistent with the requirements of IFRS, the Directors have

sought to prepare financial statements on a basis compliant with the

recommendations of the SORP.

The financial statements of the Company have been prepared on a going concern

basis.

Convention

The financial statements are presented in Sterling, being the currency of the

Primary Economic Environment in which the Company operates, rounded to the

nearest thousand, unless otherwise stated to the nearest one pound.

Segmental reporting

The Directors are of the opinion that the Company is engaged in a single segment

of business, being investment business.

As such, no segmental reporting disclosure has been included in the financial

statements.

2. Income

Year ended 30 June 2023

Revenue Capital

return return Total

£'000 £'000 £'000

Income from investments

UK dividend income 3,782 - 3,782

3,782 - 3,782

Other operating income

Liquidity interest 78 - 78

Total income 3,860 - 3,860

Year ended 30 June 2022

Revenue Capital

return return Total

£'000 £'000 £'000

Income from investments

UK dividend income 4,173 - 4,173

4,173 - 4,173

Other operating income

Liquidity interest 6 - 6

Total income 4,179 - 4,179

3. Investment Manager's fee

Year ended 30 June 2023

Revenue Capital

return return Total

£'000 £'000 £'000

Management fee 1,228 - 1,228

1,228 - 1,228

Year ended 30 June 2022

Revenue Capital

return return Total

£'000 £'000 £'000

Management fee 1,564 - 1,564

1,564 - 1,564

A basic management fee is payable to the Investment Manager at annual rate of

0.75% of the NAV of the Company. The basic management fee accrues daily and is

payable quarterly in arrears.

The Investment Manager is also entitled to a performance fee, details of which

are set out below.

The Company's performance is measured over rolling three-year periods ending on

30 June each year, by comparing the NAV total return per share over a

performance period against the total return performance of the FTSE Small Cap

(ex Investment Trusts) Index. A performance fee is payable if the NAV total

return per share (calculated before any accrual for any performance fee to be

paid in respect of the relevant performance period) at the end of the relevant

performance period exceeds both: (i) the NAV per share at the beginning of the

relevant performance period as adjusted by the aggregate amount of (a) the total

return on the FTSE Small Cap (ex Investment Trusts) Index (expressed as a

percentage) and (b) 2.0% per annum over the relevant performance period

("Benchmark NAV"); and (ii) the high watermark (which is the highest NAV per

share by reference to which a performance fee was previously paid).

The Investment Manager is entitled to 10% of any excess of the NAV total return

over the higher of the Benchmark NAV per share and the high watermark. The

aggregate amount of the Management Fee and the Performance Fee in respect of

each financial year of the Company shall not exceed an amount equal to 1.4% per

annum of the NAV of the Company as at the end of the relevant financial period.

A performance fee of £nil been accrued in respect of the year ended 30 June 2023

(30 June 2022: £nil).

4. Other expenses

Year ended 30 June 2023

Revenue Capital

return return Total

£'000 £'000 £'000

Secretarial services 171 - 171

Auditors' remuneration for:

Audit services* 65 - 65

Directors' remuneration 161 - 161

Other expenses^ 406 - 406

803 - 803

Year ended 30 June 2022

Revenue Capital

return return Total

£'000 £'000 £'000

Secretarial services 153 - 153

Auditors' remuneration for:

Audit services* 43 - 43

Directors' remuneration 140 - 140

Other expenses^ 792 - 792

1,128 - 1,128

*No non-audit fees were incurred during the year

^Other expenses in the previous year include £412,000 of costs in relation to

the Company's General Meeting and Circular to approve the various proposals

outlined in the 9 February 2022 Stock Exchange announcement.

5. Taxation

Year ended 30 June 2023

Revenue Capital

return return Total

£'000 £'000 £'000

Corporation tax at 20.50% - - -

- - -

Year ended 30 June 2022

Revenue Capital

return return Total

£'000 £'000 £'000

Corporation tax at 19.00% - - -

- - -

As at 30 June 2023 the total current taxation charge in the Company's revenue

account is lower than the standard rate of corporation tax in the UK.

6. Dividends

Under the requirements of Sections 1158/1159 of the Corporation Tax Act 2010 no

more than 15% of total income may be retained by the Company. These requirements

are considered on the basis of dividends declared in respect of the financial

year as shown below.

30 June 30 June

2023 2022

£'000 £'000

Final dividend proposed of 2.50p (2022: 2.00p) per share 1,235 1,061

The following dividends were declared and paid by the Company in the financial

year:

30 June 30 June

2023 2022

£'000 £'000

Final dividend: 2.00p (2022: 1.60p) per share 1,061 1,013

Dividends have been solely paid out of the Revenue reserve.

7. Return per Ordinary share

Year ended 30 June 2023

Revenue Capital

return return Total

pence pence Pence

Return per Ordinary share 3.53 20.44 23.97

3.53 20.44 23.97

Year ended 30 June 2022

Revenue Capital

return return Total

pence pence Pence

Return per Ordinary share 2.43 (35.53) (33.10)

2.43 (35.53) (33.10)

Returns per Ordinary share are calculated based on 51,853,838 (30 June 2022:

61,286,517) being the weighted average number of Ordinary shares, excluding

shares held in treasury, in issue throughout the year.

8. Investments

30 June 2023

£'000

Investment portfolio summary:

Quoted investments at fair value through profit or loss 169,274

169,274

30 June 2022

£'000

Investment portfolio summary:

Quoted investments at fair value through profit or loss 159,950

159,950

Under IFRS 13, the Company is required to classify fair value measurements using

a fair value hierarchy that reflects the subjectivity of the inputs used in

measuring the fair value of each asset. The fair value hierarchy has the

following levels:

Investments whose values are based on quoted market prices in active markets are

classified within level 1 and include active quoted equities.

The definition of level 1 inputs refers to `active markets', which is a market

in which transactions take place with sufficient frequency and volume for

pricing information to be provided on an ongoing basis. Due to the liquidity

levels of the markets in which the Company trades, whether transactions take

place with sufficient frequency and volume is a matter of judgement, and depends

on the specific facts and circumstances. The Investment Manager has analysed

trading volumes and frequency of the Company's portfolio and has determined

these investments as level 1 of the hierarchy.

Financial instruments that trade in markets that are not considered to be active

but are valued based on quoted market prices, dealer quotations or alternative

pricing sources supported by observable inputs are classified within level 2. As

level 2 investments include positions that are not traded in active markets

and/or are subject to transfer restrictions, valuations may be adjusted to

reflect illiquidity and/or non-transferability, which are generally based on

available market information.

Level 3 instruments include private equity, as observable prices are not

available for these securities the Company has used valuation techniques to

derive the fair value. In respect of unquoted instruments, or where the market

for a financial instrument is not active, fair value is established by using

recognised valuation methodologies, in accordance with IPEV Valuation

Guidelines.

The level in the fair value hierarchy within which the fair value measurement is

categorised is determined on the basis of the lowest level input that is

significant to the fair value of the investment.

The following table analyses within the fair value hierarchy the Company's

financial assets and liabilities (by class) measured at fair value at 30 June

2023.

Financial instruments at fair value through profit or loss

30 June 2023 Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Equity investments 169,274 - - 169,274

Liquidity funds - 1 - 1

Total 169,274 1 - 169,275

30 June 2022 Level 1 Level 2 Level 3 Total

£'000 £'000 £'000 £'000

Equity investments 159,950 - - 159,950

Liquidity funds - 2,463 - 2,463

Total 159,950 2,463 - 162,413

There were no transfers between levels for the year ended 30 June 2023 (2022:

none).

9. Nominal Share capital

Number £'000

Allotted, called up and fully paid Ordinary shares

of 10p each:

Ordinary shares in circulation at 30 June 2022 63,529,206 6,353

Shares held in Treasury at 30 June 2022 (8,177,118) (818)

Ordinary shares in issue per Balance Sheet at 30 June 2022 55,352,088 5,535

Shares bought back during the year to be held in Treasury (5,647,377) (564)

Ordinary shares in issue per Balance Sheet at 30 June 2023 49,704,711 4,971

Shares held in Treasury at 30 June 2023 13,824,495 1,382

Ordinary shares in circulation at 30 June 2023 63,529,206 6,353

These are not statutory accounts in terms of Section 434 of the Companies Act

2006. Full audited accounts for the year to 30 June 2023 will be sent to

shareholders in October 2023 and will be available for inspection at 1 Finsbury

Circus, London EC2M 7SH, the registered office of the Company. The full annual

report and accounts will be available on the Company's website

www.strategicequitycapital.com

The audited accounts for the year ended 30 June 2023 will be lodged with the

Registrar of Companies.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/strategic-equity-capital-plc/r/annual-financial-report,c3842702

END

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

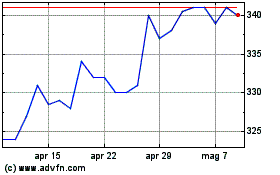

Grafico Azioni Strategic Equity Capital (LSE:SEC)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Strategic Equity Capital (LSE:SEC)

Storico

Da Mag 2023 a Mag 2024