TIDMSMJ

RNS Number : 6191W

Smart(J.)&Co(Contractors) PLC

18 April 2023

J. SMART & CO. (CONTRACTORS) PLC

INTERIM REPORT

FOR THE SIX MONTHS TO

31st JANUARY 2023

J. SMART & CO. (CONTRACTORS) PLC

CHAIRMAN'S REVIEW

INTERIM REPORT

Unaudited Group profit for the six months to 31st January 2023

amounted to GBP260,000 compared with GBP6,334,000 for the

corresponding period last year. This decrease in profit was largely

due to there being no profit from investment sales of commercial

property as was the case in the previous year.

In accordance with our normal practice, there has been no

revaluation of our investment properties at the end of the half

year. If a half year revaluation had taken place, we believe that

the valuation may have had a detrimental effect on the headline

figures, due to a decrease in yields.

The private housing development at Winchburgh, Canal Quarter, is

progressing well on site and there have been sales completed.

However, whilst reservations were encouraging until the end of

2022, there have been next to no reservations in 2023. The majority

of the development will be complete at the end of the current

financial year.

The construction of the second phase at Belgrave Point,

Bellshill continues apace, with completion due later in 2023, after

the financial year end. Interest is promising at present.

The residential development at Clovenstone Gardens has commenced

and as the first completions are not due until the middle of 2024,

no marketing has taken place yet.

We continue to see rises in the prices of construction

materials, which still affects the viability of all types of

potential projects. The erosion of profits of recently completed

and soon to be completed projects has not abated. Moreover, this

erosion of profit on our private housing developments will be

exacerbated by the recent lull in reservations. The delays in

processing contracting work and commencing new private housing work

continue.

INTERIM DIVID

The Board announces an interim dividend of 0.96p per share

(2022, 0.96p) to be paid on 5th June 2023 to shareholders on the

register at the close of business on 5th May 2023. The interim

dividend will cost the Company no more than GBP389,000.

FUTURE PROSPECTS

There will be further private housing sales this year, albeit

not as many as had been expected. As predicted, the current

economic issues of interest rate rises, high inflation and the cost

of living crisis, have had an impact on consumer confidence in the

housing sector, which has resulted in a near standstill in

reservations.

Whilst commercial property values may fall, as predicted, due to

the decrease in investment yields, lettings of both our industrial

stock and office stock remain steady. Rental levels, more so in the

industrial sector than the office sector, have not fallen yet and

are still robust.

Whilst no external contracts with housing associations have been

secured, we have agreed a contract with a manufacturing company for

a new office facility and an industrial unit extension. This

contract will likely commence prior to the end of the financial

year.

Whilst we might make an underlying profit, it is unlikely to be

better than the underlying profit last year, due to the

aforementioned reasons and the lack of recovery of overhead

costs.

It is evident that due to the potential decrease in commercial

property values, as described above, we may make a minimal headline

profit or indeed a headline loss.

D.W. SMART

18th April 2023 Chairman

CONSOLIDATED INCOME STATEMENT

6 Months 6 Months Year

ended ended ended

31.1.23 31.1.22 31.7.22

Notes (Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

Group construction activities 5,438 6,231 9,597

Less: Own construction work capitalised (3,318) (1,072) (2,167)

-------------- ------------- -----------

REVENUE 2,120 5,159 7,430

Cost of sales (2,083) (4,712) (5,853)

-------------- ------------- -----------

GROSS PROFIT 37 447 1,577

Other operating income 3,528 3,596 7,012

Net operating expenses (3,471) (3,813) (7,295)

-------------- ------------- -----------

OPERATING PROFIT BEFORE PROFIT

ON SALE AND NET SURPLUS ON VALUATION

OF INVESTMENT PROPERTIES 94 230 1,294

Profit on sale of investment

properties - 6,055 6,055

Net surplus on valuation of investment

properties - - 473

-------------- ------------- -----------

OPERATING PROFIT 94 6,285 7,822

Share of (losses)/profits in

Joint Ventures (17) 27 254

Income from financial assets 28 31 63

(Loss)/profit on sale of financial

assets (15) 4 17

Net surplus/(deficit) on valuation

of financial assets 113 (8) (121)

Finance income 63 1 141

Finance costs (6) (6) (12)

Gain on measurement of subsidiary

company - - 28

-------------- ------------- -----------

PROFIT BEFORE TAX 260 6,334 8,192

Taxation 5 (30) (1,268) (1,571)

-------------- ------------- -----------

PROFIT ATTRIBUTABLE TO EQUITY SHAREHOLDERS 230 5,066 6,621

-------------- ------------- -----------

EARNINGS PER SHARE 7

Basic and diluted 0.56p 12.12p 15.90p

-------------- ------------- -----------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 Months 6 Months Year

ended ended ended

31.1.23 31.1.22 31.7.22

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

PROFIT FOR THE PERIOD 230 5,066 6,621

-------------- ------------- -----------

OTHER COMPREHENSIVE INCOME

Items that will not be subsequently reclassified

to Income Statement:

Remeasurement gains on defined benefit

pension scheme - - 7,219

Deferred taxation on remeasurement

gains on defined benefit pension

scheme - - (1,804)

-------------- ------------- -----------

TOTAL ITEMS THAT WILL NOT BE SUBSEQUENTLY

RECLASSIFED TO INCOME STATEMENT - - 5,415

-------------- ------------- -----------

TOTAL OTHER COMPREHENSIVE INCOME - - 5,415

-------------- ------------- -----------

TOTAL COMPREHENSIVE INCOME FOR

THE PERIOD, NET OF TAX 230 5,066 12,036

-------------- ------------- -----------

ATTRIBUTABLE TO EQUITY SHAREHOLDERS 230 5,066 12,036

-------------- ------------- -----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital

Redemption Retained

Notes Share Capital Reserve Earnings Total

GBP000 GBP000 GBP000 GBP000

As at 1st August 2022 818 190 123,668 124,676

Profit for the period - - 230 230

Other comprehensive income - - - -

Total comprehensive income for

period - - 230 230

-------------- ------------ ---------- -------------

TRANSACTIONS WITH OWNERS, RECORDED DIRECTLY IN EQUITY

Shares purchased and cancelled (4) - (305) (309)

Transfer to Capital Redemption

Reserve - 4 (4) -

Dividends 6 - - (923) (923)

-------------- ------------ ---------- -------------

Total transactions with

owners (4) 4 (1,232) (1,232)

-------------- ------------ ---------- -------------

As at 31st January

2023 814 194 122,666 123,674

-------------- ------------ ---------- -------------

As at 1st August 2021 - as previously

reported 840 168 112,376 113,384

Restatement relating to

pension surplus 10 - - 2,353 2,353

-------- ------- -------- -------------

As at 1st August 2021 -

restated 840 168 114,729 115,737

Profit for the period - - 5,066 5,066

Other comprehensive income - - - -

Total comprehensive income for

period - - 5,066 5,066

-------- ------- -------- -------------

TRANSACTIONS WITH OWNERS, RECORDED DIRECTLY IN EQUITY

Shares purchased and cancelled (4) - (260) (264)

Transfer to Capital Redemption

Reserve - 4 (4) -

Dividends 6 - - (948) (948)

-------- ------- -------- -------------

Total transactions with

owners (4) 4 (1,212) (1,212)

-------- ------- -------- -------------

As at 31st January 2022 836 172 118,583 119,591

-------- ------- -------- -------------

As at 1st August 2021 840 168 114,729 115,737

Profit for the period - - 6,621 6,621

Other comprehensive income - - 5,415 5,415

Total comprehensive income for

period - - 12,036 12,036

-------- ------- -------- -------------

TRANSACTIONS WITH OWNERS, RECORDED DIRECTLY IN EQUITY

Shares purchased and cancelled (22) - (1,727) (1,749)

Transfer to Capital Redemption

Reserve - 22 (22) -

Dividends 6 - - (1,348) (1,348)

-------- ------- -------- -------------

Total transactions with

owners (22) 22 (3,097) (3,097)

-------- ------- -------- -------------

As at 31st July 2022 818 190 123,668 124,676

-------- ------- -------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

6 Months 6 Months Year

ended ended ended

31.1.23 31.1.22 31.7.22

(Unaudited) (Unaudited) (Audited)

Restated

Note 10

GBP000 GBP000 GBP000

NON-CURRENT ASSETS

Property, plant and equipment 1,315 1,256 1,207

Investment properties 81,140 76,175 77,777

Investments in Joint Ventures 1,515 1,294 1,532

Financial assets 1,357 1,183 1,069

Trade and other receivables 3,010 3,010 3,010

Retirement benefit surplus 15,096 7,863 15,096

Deferred tax assets 13 179 13

-------------- ------------- -----------

103,446 90,960 99,704

-------------- ------------- -----------

CURRENT ASSETS

Inventories 16,760 7,999 12,454

Contract assets 150 52 16

Corporation tax asset 322 - -

Trade and other receivables 2,196 2,925 2,442

Monies held on deposit 49 48 48

Cash and cash equivalents 25,803 38,907 31,796

-------------- ------------- -----------

45,280 49,931 46,756

-------------- ------------- -----------

TOTAL ASSETS 148,726 140,891 146,460

-------------- ------------- -----------

NON-CURRENT LIABILITIES

Deferred tax liabilities 8,172 5,956 8,172

Lease liabilities 212 213 212

8,384 6,169 8,384

-------------- ------------- -----------

CURRENT LIABILITIES

Trade and other payables 4,511 2,839 2,306

Lease liabilities 1 - 1

Corporation tax liability - 983 44

Bank overdraft 12,156 11,309 11,049

-------------- ------------- -----------

16,668 15,131 13,400

-------------- ------------- -----------

TOTAL LIABILITIES 25,052 21,300 21,784

-------------- ------------- -----------

NET ASSETS 123,674 119,591 124,676

-------------- ------------- -----------

EQUITY

Called up share capital 814 836 818

Capital redemption reserve 194 172 190

Retained earnings 122,666 118,583 123,668

-------------- ------------- -----------

TOTAL EQUITY 123,674 119,591 124,676

-------------- ------------- -----------

CONSOLIDATED STATEMENT OF CASH FLOWS

6 Months 6 Months Year

ended ended ended

31.1.23 31.1.22 31.7.22

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

CASH FLOWS FROM OPERATING ACTIVITIES

Profit after tax 230 5,066 6,621

Tax charge for year 30 1,268 1,571

-------------- ------------- -----------

Profit after tax 260 6,334 8,192

Adjustment for:

Share of losses/(profits) from

Joint Ventures 17 (27) (254)

Depreciation 194 169 399

Unrealised valuation surplus on investment

properties - - (473)

Unrealised valuation (surplus)/deficit

on financial assets (113) 8 121

Profit on sale of property, plant and

equipment (60) (5) (29)

Profit on sale of investment

property - (6,055) (6,055)

Loss/(profit) on sale of financial

assets 15 (4) (17)

Gain on remeasurement of subsidiary

company - - (28)

Change in retirement benefits - - (14)

Increase on monies held on (1)

deposit - -

Interest received (63) (1) (20)

Interest paid 6 6 12

Change in inventories (4,306) (468) (4,584)

Change in contract assets (134) 194 230

Change in receivables - current 246 20 503

Change in payables 2,205 (211) (1,113)

-------------- ------------- -----------

CASH OUTFLOW FROM OPERATING ACTIVITIES (1,734) (40) (3,130)

Tax paid (396) (250) (914)

-------------- ------------- -----------

NET CASH OUTFLOW FROM OPERATING ACTIVITIES (2,130) (290) (4,044)

-------------- ------------- -----------

CASH FLOWS FROM INVESTING ACTIVITIES

Additions to property, plant

and equipment (323) (184) (380)

Additions to investment properties (45) (20) (54)

Expenditure on own work capitalised

- investment properties (3,318) (1,072) (2,167)

Proceeds of sale of property, plant

and equipment 81 9 48

Proceeds of sale of investment

property - 24,032 24,032

Purchase of financial assets (368) (47) (47)

Proceeds of sale of financial

assets 178 44 58

Acquisition of investment in Subsidiary

- net cash acquired - - 97

Interest received 63 1 20

Loan to Joint Venture - (1,440) (1,440)

Investment in Joint Ventures - - (50)

NET CASH (OUTFLOW)/INFLOW FROM INVESTING

ACTIVITIES (3,732) 21,323 20,117

-------------- ------------- -----------

CASH FLOWS FROM FINANCING ACTIVITIES

Interest costs on leases (6) (6) (12)

Purchase of own shares (309) (264) (1,749)

Dividends paid (923) (948) (1,348)

---------- ---------- ----------

NET CASH OUTFLOW FROM FINANCING ACTIVITIES (1,238) (1,218) (3,109)

---------- ---------- ----------

(DECREASE)/INCREASE IN CASH AND CASH

EQUIVALENTS (7,100) 19,815 12,964

---------- ---------- ----------

CASH AND CASH EQUIVALENTS AT BEGINNING

OF PERIOD 20,747 7,783 7,783

---------- ---------- ----------

CASH AND CASH EQUIVALENTS AT OF

PERIOD 13,647 27,598 20,747

---------- ---------- ----------

NOTES TO INTERIM FINANCIAL STATEMENTS

1. BASIS OF PREPARATION

J. Smart & Co. (Contractors) PLC is a company domiciled in

the United Kingdom. The condensed consolidated interim financial

statements of the Company for the six months ended 31st January

2023 comprise the Company and its Subsidiaries, together referred

to as the Group, and the Group's interest in jointly controlled

entities.

The condensed consolidated interim financial statements for the

six months to 31st January 2023 have been prepared in accordance

with the Disclosure and Transparency Rules of the Financial Conduct

Authority and with IAS 34: Interim Financial Reporting under UK

adopted International Accounting Standards.

The condensed consolidated interim financial statements for the

six months to 31st January 2023 do not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. The

condensed consolidated interim financial statements should be read

in conjunction with the annual financial statements for the year to

31st July 2022, which have been prepared in accordance with UK

adopted International Accounting Standards.

The statutory financial statements for the year to 31st July

2022 have been filed with the Registrar of Companies and a copy may

be obtained from Companies House. These have been audited and

contain an unqualified audit opinion, did not draw attention to any

matters by way of emphasis and did not contain a statement under

Section 498 of the Companies Act 2006.

The condensed consolidated interim financial statements have not

been audited or reviewed by the Company's auditor. A copy of the

interim financial statements will be available on the Company's

website www.jsmart.co.uk.

2. ACCOUNTING POLICIES

The condensed consolidated interim financial statements have

been prepared under the historical cost convention except where the

measurement of balances at fair value is required for investment

properties, financial assets and assets held by defined benefit

pension scheme.

The accounting policies adopted are consistent with those

followed in the preparation of the Group's annual financial

statements for the year ended 31st July 2022, with the exception of

the policies regarding the accounting for pension scheme

obligations and investment properties revaluations.

For the condensed consolidated interim financial statements, the

assets and liabilities of the pension scheme are estimated to be

unchanged from the values included at the previous year end. Also,

in accordance with long standing practice, the Group's investment

properties are revalued annually on 31st July each year and

therefore, no revaluation adjustment is made in the condensed

consolidated interim financial statements.

Standards, Amendments to Standards and Interpretations effective

in period

The following new standards, amendments to standards and

interpretations, which are relevant to the Group, were issued by

the International Accounting Standards Board and are mandatory for

the Group for the first time in the financial year to 31st July

2022:

-- IAS 37 (amended): Provisions, Contingent Liabilities and Contingent Assets.

-- IFRS 3 (amended): Business Combinations.

The Directors anticipate that there will be no material impact

of these amendments to standards on the financial statements.

Estimates and assumptions

The preparation of the condensed consolidated interim financial

statements requires management to make estimates and assumptions

concerning the future that may affect the application of accounting

policies and the reported amounts of assets, liabilities and income

and expenses. Management believes that the estimates and

assumptions used in the preparation of these accounts are

reasonable. However, actual outcomes may differ from those

anticipated.

Going concern

The financial statements have been prepared on a going concern

basis. The Directors have prepared a number of cashflows scenarios

taking account of trading activities around construction projects

in hand and anticipated projects, land acquisitions, rental income,

investment property acquisitions and disposals and other capital

expenditure. In each scenario reviewed by the Directors the Group

remains cash positive with no reliance on external funding and

therefore remains net debt free. The net assets of the Group are

GBP123,674,000 at 31st January 2023 and the Group's net current

assets amount to GBP28,612,000. Taking all of the information the

Directors currently have they are of the opinion that the Group is

well placed to manage its financial and business risks and have a

reasonable expectation that the Group has adequate financial

resources to continue in operational existence for a period of at

least twelve months from the date of approval of these financial

statements and therefore consider the adoption of the going concern

basis as appropriate for the preparation of these financial

statements.

3. PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties which could have a

material impact on the Group's performance for the remainder of the

current financial year remain the same as those detailed in the

Group's Annual Report and Financial Statements for the year to 31st

July 2022. The Directors regularly review the risks and

uncertainties facing the Group and their impact on the trading

performance of the Group and take appropriate actions to help

mitigate their impact on the Group's performance and future

prospects.

4. SEGMENTAL INFORMATION

IFRS 8: Operating Segments requires operating segments to be

identified on the basis of internal reporting about components of

the Group and they are regularly reviewed by the chief operating

decision maker to allow the allocation of resources to the segments

and to assess their performance. The chief operating decision maker

has been identified as the Board of Directors. The chief operating

decision maker has identified two distant areas of activities in

the Group being construction activities and investment property

activities.

All revenue and investment property income arises from

activities within the UK and therefore the Board of Directors does

not consider the business from a geographical perspective. The

operating segments are based on activity and performance of an

operating segment is based on a measure of operating results.

Other Operating

Income Operating Profit/(Loss)

External Internal Total

Revenue Revenue Revenue 31.1.23 31.1.22 31.7.22

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

31st JANUARY 2023 (Unaudited)

Construction activities 2,120 3,318 5,438 4 (2,099) - -

Investment property

activities - - - 3,464 2,193 - -

2,120 3,318 5,438 3,468 94 - -

--------- --------- --------- ---------------- ---------- -------- ---------

31st JANUARY 2022 (Unaudited)

Construction activities 5,159 1,072 6,231 4 - (1,628) -

Investment property

activities - - - 3,587 - 7,913 -

5,159 1,072 6,231 3,591 - 6,285 -

--------- --------- --------- ---------------- ---------- -------- ---------

31st JULY 2022 (Audited)

Construction activities 7,430 2,167 9,597 7 - - (2,487)

Investment property

activities - - - 6,976 - - 10,309

7,430 2,167 9,597 6,983 - - 7,822

--------- --------- --------- ---------------- ---------- -------- ---------

OPERATING PROFIT 94 6,285 7,822

Share of results of Joint

Ventures (17) 27 254

Finance and investment income 204 36 221

Finance and investment costs (21) (14) (133)

Gain on remeasurement of subsidiary company - - 28

---------- -------- ---------

PROFIT BEFORE TAX ON ORDINARY ACTIVITIES 260 6,334 8,192

---------- -------- ---------

5. TAXATION

The tax charge for the six months to 31st January 2023 is based

on the corporation tax rate at 21.01% (2022, 19.00%).

6. DIVIDS

6 Months 6 Months Year

Ended Ended Ended

31.1.23 31.1.22 31.7.22

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

ORDINARY DIVIDS

2021 Final Dividend of 2.27p per share - 948 948

2022 Interim Dividend of 0.96p per share - - 400

2022 Final Dividend of 2.27p per share 923 - -

------------- ------------- -----------

923 948 1,348

------------- ------------- -----------

The interim dividend of 0.96p per share for the year to 31st

July 2023 will be paid on 5th June 2023 to shareholders on the

register at 5th May 2023. The interim dividend will cost the

Company no more than GBP389,000.

7. EARNINGS PER SHARE

6 Months 6 Months Year

Ended Ended Ended

31.1.23 31.1.22 31.7.22

(Unaudited) (Unaudited) (Audited)

Profit attributable to Equity Shareholders

GBP000 230 5,066 6,621

Basic and diluted Earnings per share 0.56p 12.12p 15.90p

------------- ------------- -------------

Weighted average number of shares 40,758,094 41,810,610 41,638,109

------------- ------------- -------------

Basic earnings per share are calculated by dividing the profit

attributable to equity shareholders by the weighted average number

of shares in issue during the period.

During the six months to 31st January 2023 the Company purchased

for immediate cancellation 189,034 Ordinary Shares of 2p.

There is no difference between basic and diluted earnings per

share.

8. FAIR VALUE ASSETS

The Group's investment properties, financial assets and assets

held by defined benefit pension scheme are measured at fair value

after initial recognition.

Investment properties are only valued annually by the Directors

at the year end and not for the purposes of the interim financial

statements. The Group considers all of its investment properties

fall within 'Level 3' of the fair value hierarchy as described by

IFRS 13: Fair Value Measurement. Level 3 valuations are those using

inputs for the asset or liability that are not based on observable

market data. The main unobservable inputs relate to estimated

rental value and equivalent yield.

The Group's financial assets consisted entirely of equities of

companies listed on quoted markets which fall within 'Level 1' of

the fair value hierarchy. Assets held by defined benefit pension

scheme consist of equities and bonds of companies listed on quoted

markets and cash which all fall within 'Level 1' of the fair value

hierarchy. Level 1 valuations are those using inputs which are

quoted prices (unadjusted) in active markets for identical assets

or liabilities the Group can access at the period end date.

9. RELATED PARTY TRANSACTION

Related parties are consistent with those disclosed in the

Group's Annual Report and Statement of Accounts for the year to

31st July 2022.

Related party transactions, including salary and benefits

provided to Directors and key management, were not material to the

financial position or performance of the Group for the period.

10. PRIOR YEAR ADJUSTMENT

During the year to 31st July 2022 the Group sought further

advice on the Group's right to a surplus arising on the pension

scheme from a firm of lawyers who specialise in this area. Their

advice was that the Group had an unconditional right to the surplus

based on the original Trust Deed and Deed of Variation and

therefore the full surplus arising on the calculation thereof under

IAS 19 (amended): Employee Benefits should be accounted for in the

financial statements. This revised advice impacted on the accounts

for the year to 31st July 2021 and resulted in the accounts for

that year being revised.

The impact of this new advice is that it is now clear to the

Group that the full surplus arising on the pension scheme should be

accounted for and should not have been reduced by the asset ceiling

adjustment to reduce the surplus to the present value of economic

benefits available in the form of reductions in future

contributions to the plan.

There has been no impact on the Consolidated Income Statement as

the asset ceiling adjustment was only accounted for in the

Consolidated Statement of Comprehensive Income. The pension scheme

asset in the Consolidated Statement of Financial Position has

increased as has deferred tax liability on the asset. It is only

the financial statements for the six months to 31st January 2022,

disclosed in this interim report, which are impacted upon by the

prior year adjustment, details of which are given below:

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

GBP000

Retirement benefit surplus - as previously

stated 4,725

Retirement benefit surplus - as restated 7,863

-------

Increase in asset 3,138

Increase in deferred tax adjustment based

on above increase (785)

-------

Increase in net assets of the Group 2,353

-------

Increase in retained earnings of Group 2,353

-------

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors named below, confirm on behalf of the Board of

Directors that to the best of their knowledge that the condensed

consolidated interim financial statements for the six months to

31st January 2023 have been prepared in accordance with IAS 34:

Interim Financial Reporting under UK adopted International

Accounting Standards. The condensed consolidated interim financial

statements include a fair review of the information required by

Disclosure and Transparency Rules 4.2.7 and 4.2.8, being:

-- an indication of important events that have occurred during

the six months to 31st January 2023 and their impact on the

condensed consolidated interim financial statements, and a

description of the principal risks and uncertainties for the

remaining six months of the financial year, and

-- material related party transactions in the six months to 31st

January 2023 and any material changes in the related party

transactions described in the last annual report.

The Directors of the Company are listed in the Annual Report and

Statement of Accounts for the year to 31st July 2022.

By order of the Board

D.W. SMART, Director J.R. SMART, Director

18th April 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLLSDITLIV

(END) Dow Jones Newswires

April 18, 2023 07:21 ET (11:21 GMT)

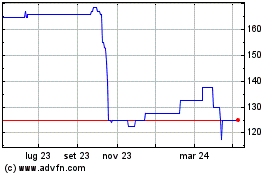

Grafico Azioni Smart (j.) & Co. (contra... (LSE:SMJ)

Storico

Da Mar 2024 a Apr 2024

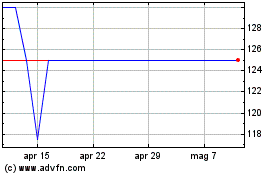

Grafico Azioni Smart (j.) & Co. (contra... (LSE:SMJ)

Storico

Da Apr 2023 a Apr 2024