Office of Rail and Road More competition needed in rail station catering (3944W)

12 Dicembre 2023 - 8:00AM

UK Regulatory

TIDMTTM TIDMSMWH

RNS Number : 3944W

Office of Rail and Road

12 December 2023

Rail Regulator calls for greater competition in railway station

catering

More competitive market would give better value for passengers,

taxpayers and station operators.

The Office of Rail and Road (ORR) has found that the railway

station catering market is not working as effectively as it should

be. Greater competition in this market would drive better value for

passengers and for taxpayers.

ORR is investigating this sector because it believes that a more

competitive market would provide better options for passengers and

allow station operators to increase investment in the railway. The

regulator's report finds that outlets can stay in the same hands

for extended periods because their leases are protected. Those who

run stations are not sufficiently incentivised to invite

competition for outlets. Even when unprotected leases come up for

renewal, the most common practice is to roll over or extend the

lease without an open competition. Competition for outlets is a

crucial factor across the market, because nearly half of all

stations (47%) with retail space have just one outlet.

These weaknesses in the station catering market also mean that

station operators may have less income to invest in improving

stations and services, increasing the need for taxpayer

support.

ORR's report finds that the features of the railway station

catering market may also contribute to an average 10% price premium

at stations compared to the high street.

ORR's investigation is continuing, and the next stage will focus

on what recommendations should be made to government, station

operators, funders and other stakeholders to improve the

functioning of the market.

Will Godfrey, Director, Economics, Finance and Markets, said:

"The railway station catering market isn't working as effectively

as it should be. More competition between companies to operate at

stations would bring real benefits to passengers and taxpayers.

"Because money earned from leases at stations ultimately makes

its way back to those who operate railway stations and

infrastructure, this is money that could be invested in improving

services for passengers or reducing the need for taxpayer

support.

"We will now work with the industry on the best way forward and

will make recommendations on how the market needs to change, with

the ultimate goal of improving value and outcomes for customers and

funders of the railway."

Notes to editor

1. Railway station catering market study | Office of Rail and

Road (orr.gov.uk) Station catering retailers earned total revenue

of around GBP700m in 2022/23. Station operators (Network Rail and

train operators combined) earned a little over GBP100m in rental

income from leasing outlets for catering services in 2022/23.

2. In total 2,367 railway stations fell within the scope of the

ORR's study. This includes all the mainline stations operated by

Network Rail and train operators funded by the UK and Scottish

governments.

3. Of the approximately 20% of stations which have catering

offered, almost half (47%) have only one outlet. This large number

of single-outlet stations acts as a natural barrier to head-to-head

competition at stations.

4. Protected leases: 24% of station outlets are currently

covered by 'protected' leases formed under Part II of the Landlord

and Tenant Act 1954. Such leases provide an automatic renewal on

similar lease terms (subject to rent reviews). There are grounds of

opposition for the landlord (usually the station operator) to

terminate protected leases, but in practice they are difficult to

apply.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IRSGZMMZNMDGFZM

(END) Dow Jones Newswires

December 12, 2023 02:00 ET (07:00 GMT)

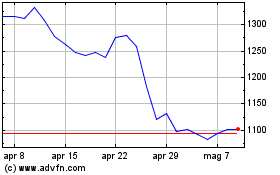

Grafico Azioni Wh Smith (LSE:SMWH)

Storico

Da Ott 2024 a Nov 2024

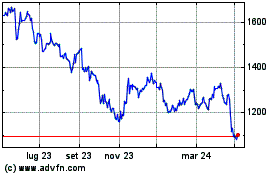

Grafico Azioni Wh Smith (LSE:SMWH)

Storico

Da Nov 2023 a Nov 2024