TIDMSOLI

RNS Number : 6315V

Solid State PLC

05 December 2023

05 December 2023

Solid State plc

( "Solid State", the " Group " or the "Company" )

Interim Results

Analyst Briefing & Investor Presentation

Solid State plc (AIM: SOLI), the specialist value added

component supplier and design-in manufacturer of computing, power,

and communications products, is pleased to announce its Interim

Results for the six months ended 30 September 2023.

Highlights in the period include:

H1 2023/24 H1 2022/23 Change

Revenue GBP88.1m GBP59.4m +48%

Operating profit margin 7.9% 7.5% +40bps

Adjusted operating profit margin* 9.2% 9.3% -10 bps

Profit before tax GBP6.1m GBP4.2m +45%

Adjusted profit before tax* GBP7.3m GBP5.2m +39%

Diluted earnings per share 39.1p 36.4p +7%

Adjusted diluted earnings per share 46.8p 45.3p +3%

Interim dividend 7.0p 6.5p +8%

Net cash flow from operating activities GBP8.3m GBP0.50m +1,560%

* Adjusted performance metrics are reconciled in note 5, the

adjustments relate to IFRS 3 acquisition amortisation, share based

payments charges and non-recurring charges in respect of

acquisition costs and fair value adjustments.

H1 2023/24 H1 2022/23 Change

Net cash / (net debt)** GBP(3.9)m GBP(16.1)m -76%

Open order book @ 30 September 2023 / 30

September 2022 GBP99.7m GBP112.5m -11%

** Net cash / debt includes net cash with banks GBP8.8m (H1

2022/23: GBP16.0m), bank loans of GBP12.7m (H1 2022/23: GBP17.7m)

the fair value of deferred contingent consideration of GBPnil (H1

2022/23: GBP14.4m) and excludes the right of use lease liabilities

of GBP1.8m (H1 2022/23: GBP2.7m).

Financial highlights:

-- Delivered organic revenue growth in excess of 35% while

maintaining operating margins at 9.2% (FY23 9.2%)

-- Strong cash generation results in net debt continuing to reduce to GBP3.9m (FY23 GBP8.1m)

-- Robust orderbook of GBP108.6m at 31 October 2023 combined

with a strong prospect pipeline, gives the Directors confidence in

meeting full year consensus analyst expectations(1) .

Commercial and operational highlights:

-- US Components restructure and Custom Power integration activities are largely complete.

-- Rebranding of Components division sales channel under the

"Solsta" brand launched at the beginning of H2 with group branding

refresh to follow next year.

-- The pipeline of new design wins across the Group remains

strong in all target markets, which gives the Board confidence that

the underlying growth drivers in our target markets remain.

Commenting on the results and prospects, Nigel Rogers, Chairman

of Solid State, said:

"We continue to work with customers to leverage our specialist

design-in capabilities, placing the Group in a strong position,

both regionally and globally, in our target growth markets. Solid

State remains ambitious with a growth strategy focused on

developing Group talent, product innovation and further

internationalisation of our operations to deliver on our 2030

goals.

"The performance in the Period reflects a very pleasing out-turn

given the broader economic and geopolitical influences."

(1) The Company considers the average of the most recently

published research forecasts prior to this announcement by all

providers - Cavendish Capital Markets Ltd and WH Ireland plc to

represent market expectations for Solid State.

Market Expectations FY23/24 FY24/25

Revenue GBP155.3m GBP152.3m

Adjusted profit before GBP12.5m GBP12.5m

tax*

Net (debt) / cash (GBP3.0m) GBP1.0m

Analyst Briefing: 2.00 p.m. today, Tuesday 5 December 2023

A hybrid briefing for Analysts will be hosted by Gary Marsh,

Chief Executive, and Peter James, Group Finance Director, at 2.00

p.m. today, Tuesday 5 December 2023 to review the results and

prospects. Analysts wishing to attend should contact Walbrook PR on

solidstate@walbrookpr.com or on 020 7933 8780. Please include

whether you would like to attend in person at 75 King William St,

EC4N 7BE, or online.

Investor Presentation: 10.30 a.m. on Wednesday 6 December

2023

Gary Marsh, Chief Executive; Peter James, Group Finance

Director; and, John Macmichael, Managing Director of Solsta, the

Group's components division, will hold a presentation to cover the

results and prospects at 10.30 a.m. on Wednesday 6 December 2023.

The presentation will be hosted through the digital platform

Investor Meet Company. Investors can sign up to Investor Meet

Company for free and add to meet Solid State plc via the following

link

https://www.investormeetcompany.com/solid-state-plc/register-investor

. Investors who have already registered and added to meet the

Company will automatically be invited.

Questions can be submitted pre-event to

solidstate@walbrookpr.com , or in real time during the presentation

via the "Ask a Question" function.

Investor Site Visits to Head Office in Redditch

Solid State holds site visits to its head office in Redditch

where operations from both the Systems and Components divisions can

be seen. Interested investors should contact

solidstate@walbrookpr.com .

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

For further information please contact:

Solid State plc Via Walbrook

Gary Marsh - Chief Executive

Peter James - Group Finance Director

Cavendish Capital Markets Limited

(Nominated Adviser & Broker)

Adrian Hadden / Callum Davidson (Corporate

Finance)

Jasper Berry / Tim Redfern (Sales) 020 7397 8900

Walbrook PR (Financial PR) 020 7933 8780

Tom Cooper / Nick Rome / Joe Walker 0797 122 1972

solidstate@walbrookpr.com

Analyst Research Reports: For further analyst information and

research see the Solid State plc website:

https://solidstateplc.com/research/

Notes to Editors:

Solid State plc (SOLI) is a value added electronics group

supplying commercial, industrial and defence markets with durable

components, assemblies, manufactured units and power units for use

in specialist and harsh environments. The Group's mantra is -

'Trusted technology for demanding environments'. To see an

introductory video on the Group - https://bit.ly/3kzddx7

Operating through two main divisions: Systems (Steatite, Active

Silicon & Custom Power) and Components (Solsta, Pacer, Willow

Technologies & AEC); the Group specialises in complex

engineering challenges often requiring design-in support and

component sourcing for computing, power, communications,

electronic, electro-mechanical and opto-electronic products.

Headquartered in Redditch, UK, Solid State employs approximately

400 staff across the UK and US, serving specialist markets with

high barriers to entry in industrial, defence and security,

transportation, medical and energy.

Solid State was established in 1971 and admitted to AIM in June

1996. The Group has grown organically and by acquisition - having

made three acquisitions in the last three years.

CHAIRMAN'S FIRST HALF REVIEW

I am pleased to report that in the six months ended 30 September

2023 ("First Half", "Period" or "H1 2023/24") the Group has had a

record start to the year.

The Group's strategy and focus on ensuring we have sector,

product, and customer diversity to provide a resilient business

model has continued to prove its value and delivered significantly

improved organic revenue growth in the Period.

The geopolitical environment continues to drive government

spending in security and defence, with Group revenue in these

sectors continuing to increase, including the successful delivery

of the previously reported NATO contracts.

Furthermore, the Group has seen good cash generation in the

first half of the year, and we anticipate this continuing into the

second half as lead times continue to improve, and we look to

benefit from the associated working capital unwind.

Solid State has been successful in building on its relationships

with Tier 1 customers across our target growth markets of security

and defence, medical, transport, and industrial where we have seen

design and contract wins with certain larger ones announced during

the Period.

Environmental Social and Governance ("ESG")

ESG is at the core of Solid State's strategy, creating a

long-term sustainable business, which minimises our adverse impact

on the environment and maximises value for our stakeholders.

Our technology, products and systems are designed and engineered

to be high quality, often upgradable with a long life, which

inherently means we are starting from a strong position. These

characteristics help to differentiate us from our competitors and

enable us to be ambitious in how we operate, where we believe we

are a business leading on ESG in our sector.

For example, the Group is decommissioning an energy intensive

production line within its US operation, which will consequently

greatly reduce its CO(2) emissions.

Our ESG Committee continues to improve our communication with

stakeholders to articulate our ESG strategy and deliver on our

goals, including achieving net zero in Scope 1 and 2 emissions by

2050.

Board and leadership team

During the Period, we welcomed Sam Smith as an independent

Non-Executive Director to the Board of Directors with effect from 1

August 2023. Sam will sit on the Audit and Remuneration

Committees.

Peter Haining stood down as Non-Executive Director at the Annual

General Meeting ("AGM") earlier in the year but will continue to

serve as Company Secretary in the near term to ensure a smooth

transition.

The Board will seek to appoint a further independent

Non-Executive Director in the coming year.

We need to continue to develop talent within our senior

leadership team. Recruiting additional people in a still relatively

tight labour market elongates the process more than we would like.

However, we have made good progress in the Period, developing the

team, which puts the Group in a stronger position for the

future.

Outlook

The industry has seen lead times improving in many areas,

however, certain "golden components" where demand is particularly

high continue to dictate operational schedules.

As expected, defence and security aside, the improving component

lead times has resulted in the orderbook beginning to normalise as

customers focus on managing working capital.

The pipeline of new design wins across the Group remains strong

in all target markets, which gives the Board confidence that the

underlying growth drivers in our target markets remain.

Post Period-end we have seen strong order intake with the open

orderbook at the end of October increasing from the half-year

position of GBP99.7m to GBP108.6m (30 September 2022:

GBP112.5m).

As previously reported, it is encouraging to see the development

of multi-product, multi-year programmes with international

blue-chip clients. This is testament to the work done over the last

five years to develop the Group's product and service offering,

making Solid State ever more relevant and valuable to its

customers.

The record billings, combined with a stable six month orderbook,

gives the Board confidence in meeting the full-year expectations

for FY23/24.

We are continuing the execution of our strategy to achieve our

mid-term strategic goals. The Board has set goals to 2030 and

committed to seeking to maintain compound growth in Total

Shareholder Return ("TSR") in excess of 20%. This record start

provides a strong foundation to achieve this ambition in

FY23/24.

Nigel Rogers

Non-Executive Chairman

5 December 2023

CHIEF EXECUTIVE OFFICER'S REVIEW

I am pleased to report that the Group has delivered record

financial results for the Period with progress in the execution of

its growth strategy, building on the strong performance we have

seen over recent years.

Performance

The Group's long-standing relationships, commitment to customer

service, and a proactive approach to managing the semiconductor

supply chain challenges has meant we have invested in, and secured,

inventory in partnership with our customers. This has enabled us to

deliver revenues in the First Half to meet customer requirements,

which we did not expect to be able to fulfil until the Second

Half.

As a result of shipping this additional product, the full period

of contribution from Custom Power, as well as the GBP23.4m NATO

contracts, the First Half organic revenue growth in excess of 35%

on a constant currency basis is exceptionally strong.

On a full-year basis we expect to deliver strong organic revenue

growth exceeding 15%, which will be in line with recently upgraded

consensus revenue expectations. Group adjusted operating margins

are a key metric. Despite the dilution in mix with the NATO

contracts, adjusted operating margins have been maintained at 9.2%

as a result of the operational gearing from the strong billings

pulled forward. Where H2 billings are expected to return to more

normalised levels, the operational gearing means we may see slight

dilution on a full-year basis, however, there is potential for this

to be mitigated by a stronger mix in the Second Half.

Following the share issue on the acquisition of Custom Power in

August 2022, I am pleased to report a 3.3% growth in adjusted

diluted earnings per share over the prior year's record result

46.8p (H1 2022/23: 45.3p).

Strategy

Solid State's growth strategy combines organic and acquisitive

growth to actively target strategic customers in sectors with high

barriers to entry that require accreditations, long standing

credibility, and specialist skills and experience where our

technology adds tangible value.

The Group's key target markets include industrial, security and

defence, medical, transport, and energy.

Our four strategic pillars to drive growth remain:

-- Talent development embedding our ESG values;

-- Broadening our complementary product and technology portfolio;

-- Development of our "own brand" components and systems

offering, securing recurring revenue; and

-- Internationalisation of the Group.

The following key milestones represent critical steps in the

delivery of our strategy, and are cornerstones on which our 2030

plans and ambitions will continue to build:

-- With the appointment of Sam Smith as an independent

Non-Executive Director ("NED") we have continued to progress our

governance and leadership team structure to position the Group for

the next phase of growth;

-- As part of our environmental strategy, the decommissioning of

production for certain legacy products is now well advanced;

-- Launched the rebranding of our components division, which is

now trading as "Solsta" with a consistent Group brand refresh to

follow during the Second Half;

-- Delivered strong cash generation to settle deferred

consideration and pay down the Group's borrowings to position the

Group for future investments; and

-- Developed our technical capabilities and expertise to enhance the relevance and value-added differentiation of our offering to our Tier 1 customers.

Markets and Divisional review

During the Period, the Group has seen good demand and increased

billings for Internet of Things ("IoT") communications components

from customers in the energy and utilities sector, within our

industrial market.

Furthermore, the design and pipeline development within the

medical sector has been building with activity strong across both

divisions, including exciting new engineering projects and design

wins, which are expected to translate into production demand as we

head into FY24/25 and beyond.

The Components division delivered revenue of GBP31.4m (H1

2022/23: GBP35.3m), an 11.2% decrease on the prior year. FY22/23

was an exceptional year that ended 31.5% (GBP16.5m) up on FY21/22

after record customer demand, facilitated by the Division's

investment to secure product driven by the component shortages and

Covid-19 impact. This pulled forward demand to H1 2022/23 from H2

2022/23 and FY23/24 with some customers now destocking.

Post Period-end, the Division has launched new branding to trade

as "Solsta" and continues to raise awareness of the Durakool

product brand as the Group focuses on current technology for growth

markets. In addition, the team has made good progress in enlarging

the global third-party sales network and the internal support

resources to drive future growth.

Our System's division revenue increased by 136.2% to GBP56.7m

(H1 2022/23: GBP24.0m). As reported in November 2022, the Systems

division secured contract wins to supply communications equipment

to a client in the defence sector through NATO. These contracts

have been shipped in the Period driving the year-on-year growth, in

addition to a full Period of Custom Power, delivering a very strong

first half to the FY23/24.

While these contracts have diluted the margin mix within the

Systems business in the Period, they have contributed significantly

to the record start to the year and provide a foundation for

long-term recurring revenue in this sector as the Group targets

"through-life" support opportunities.

Having completed the acquisition of Custom Power in August 2022,

the US integration activities are largely complete; we received US

regulatory sign off on the export control environment enabling

efficient collaboration with the UK battery team.

The business performance continues to be consistent with

management expectations and has been resilient in the face of some

customer push outs/destocking. Positively, margins continue to

improve year on year (mitigating the destocking impact) where we

are realising commercial and operational best practice

synergies.

We are continuing to look at adding technical and commercial

talent both in the UK and the USA to boost the drive for

sustainable growth.

Pleasingly, post Period-end we have secured a design and build

programme for a smart battery in a hand held industrial device with

a new global client. Our international capabilities have opened the

opportunity for increased work share. We have commenced the design

and engineering phases, with US deliveries scheduled to commence

later in FY24/25. Opportunities for an enterprise charging solution

and transfer of technology to our UK facility are now underway.

Branding and Market positioning

As the Solid State Group has grown and expanded over the years,

it has made a number of acquisitions, each of which has brought

huge benefits in terms of people and capability. Solid State's core

values and strengths have remained the same, but the resulting

amalgamation of companies and brands has increased the complexity

of how the Group articulates "who it is, what it does and why it is

unique and different from its competitors".

A Group-wide exercise to ensure the branding and web presence

reflects the qualities of the Group and positions the operating

units suitably is under way to maximise market penetration and

cross-selling opportunities. The recently announced rebranding of

the Components division under the trading name of "Solsta" is a

first step in this exercise.

We are making good progress on the project to adopt the Custom

Power brand across the Group's Power offering, which is expected to

be completed during FY24/25.

People and leadership development

In the First Half we have seen several internal promotions, with

close to 25% of vacancies being filled from internal talent. We

continue to invest in new talent as well as adding depth to our

senior team across the Group, including five heads in engineering

as well as two senior heads to our Power business unit leadership

team. Continued investment in our people and developing our Group

leadership team is a critical driver for future growth as we strive

to replicate recent successes.

The work of the ESG Committee is enhancing internal

communications through our HR roadshows and our wellbeing

initiatives, including a hardship fund and occupational health

support. We have also established a Group Executive Committee

ensuring our leadership structure enables us to deliver the next

phase of the Group's growth.

M&A

The Board continues to actively explore attractive acquisition

opportunities across target markets both overseas and in the UK,

and the pipeline of opportunities is strong. We had several

opportunities that were investigated, which through initial due

diligence we did not progress as the opportunity did not meet our

requirements.

However, we also do have others that remain of interest, and we

are continuing to pursue. The acquisition pipeline for both

Divisions is healthy with particular focus on adding technology and

further internationalisation of the Group.

Gary Marsh

Chief Executive Officer

5 December 2023

KEY PERFORMANCE INDICATORS

The following key performance indicators are used by the Group

to monitor performance, working capital and forward prospects.

Alternative/Adjusted Performance Measures ("APMs"), identified

as "adjusted", are applied consistently throughout this report.

APMs are reconciled to the statutory UK-adopted IFRS measures in

Note 5. Note 30 to the 2023 Annual Report and Accounts defines APMs

and includes a narrative disclosure of the basis of recognition of

the APMs and the impact of the differences compared to the

statutory measures. All APMS are identified in this document as

"adjusted" throughout and any measure not flagged as "Adjusted" is

the statutory IFRS measure.

Revenue (million)

GBP88.1m

Definition

Revenue is measured as the value, net of sales taxes, of goods

sold and services provided to customers.

Reason for choice

This is a key driver for the business, enabling us to track our

progress in driving growth.

Adjusted operating margin (%)

9.2%

Definition

Earnings before interest, tax, amortisation of acquired

intangibles, acquisition costs and other adjustments for one-off

non-recurring items divided by revenue.

Reason for choice

Adjusted operating profit margin provides a consistent

year-on-year measure of the trading performance of the Group's

operations to enhance the quality of the earnings.

Cash generated from operations (million)

GBP9.1m

Definition

Cash flow for operating activities excluding investing and

financing activities.

Reason for choice

This provides a measure of the cash generated by the Group's

trading and provides visibility of the cash impact of the working

capital investment decisions. It represents the cash that is

generated to fund capital expenditure, interest payments, tax and

dividends.

Adjusted profit before tax (million)

GBP7.3m

Definition

Profit before taxation, amortisation of acquired intangibles,

acquisition-related costs and charges, share-based payments and

other adjustments for one-off non-recurring items.

Reason for choice

This measure is the critical metric that the operational

management control and influence delivering profit to drive the

total return achieved for shareholders.

Net debt (million)

GBP(3.9)m

Definition

Cash less borrowings, less deferred and contingent consideration

obligations excluding right-of-use lease obligations.

Reason for choice

The Group has financial covenants agreed with its lenders that

are based on this definition of net debt, making it a KPI monitored

to ensure compliance. Furthermore, net debt is used to monitor the

Group's leverage position and ensure the Group maintains an

appropriate capital structure.

Book to bill ratio (rolling 12 months)

0.95

Definition

Last twelve months ("LTM") revenue divided by LTM order

intake.

Reason for choice

Monitoring the book to bill ratio provides a metric to monitor

growth in the open orderbook and, therefore, the prospects for

sustainable growth. While the LTM basis does eliminate some of the

short-term month-to-month volatility it should not be monitored in

isolation from the absolute revenue and open orderbook as

variations in bookings and billings will impact the ratio.

Profit before tax (million)

GBP6.1m

Definition

Profit before taxation.

Reason for choice

This measure is the critical statutory metric that the

operational management control and influence delivering profit to

drive the total return achieved for shareholders.

CHIEF FINANCIAL OFFICER'S REVIEW

Record organic revenue growth in the First Half reflects prudent

semiconductor strategy, strong customer demand and the delivery of

GBP23.4m of product fulfilling the NATO contracts announced in

November 2022, driving continued strong operating cash generation

of GBP8.3m.

Revenue

The Group delivered revenue in the Period of GBP88.1m (H1

2022/23: GBP59.4m), up 48.3% on the prior period.

The impact of currency has been a revenue headwind of circa

GBP1.0m with the average USD rate for the Period being $1.26:GBP1

(H1 2022/23: $1.21:GBP1), offset by the full year of Custom Power,

which means like-for-like organic revenue growth is in excess of

35%.

Gross margins

Underlying product margins in the First Half have been stable

across the Group, albeit as previously reported, the mix has been

diluted by the NATO billings. This results in the gross margins in

the Period being GBP27.3m (H1 2022/23: GBP18.8m) with the margin

percentage down 0.6ppt at 31.0% (H1 2022/23: 31.6%).

Overheads

The current year increase reflects a full six months of Custom

Power overheads (two months in H1 2022/23) in addition to increased

employee costs reflecting the impact of wage inflation combined

with investments in talent made in the second half of the prior

year and the first half of this year.

In addition, we have incurred approximately GBP0.5m to date in

relation to the closure of AEC production lines where legacy

end-of-life devices have been migrated to modern technology

solutions.

This results in sales, general and administrative expenses being

up GBP6.1m at GBP20.4m (H1 2022/23: GBP14.3m).

Operating margin

Adjusted performance metrics that provide clarity over the

Group's performance on an ongoing cash basis are consistent with

previous periods and adjust for the amortisation of acquisition

intangibles, non-recurring tax credits, acquisition fees and share

option expenses.

The Group has seen an operational gearing benefit from the

strong revenues, mitigating the modest dilution of the gross margin

as a result of the change in mix, which means our operating margins

continue to hold up well at 7.9% (H1 2022/23 7.5%). Adjusted

operating margins 9.2% (H1 2022/23: 9.3%).

PBT

Adjusted profit before tax ("PBT") has increased to GBP7.3m up

38.8% (H1 2022/23: GBP5.2m). Profit before tax was GBP6.1m (H1

2022/23: GBP4.2m).

Tax

The year-on-year effective tax rate has increased to 25.6% (H1

2022/23: 20.2%). This is principally as a result of the UK

corporate tax rate increasing from 19% to 25%, combined with the

increased size and profitability of the Group, meaning we are now

in the large company R&D tax credits scheme. The benefits from

the R&D tax credits are now reflected in operating margins

rather than the tax line.

PAT

Adjusted profit after tax ("PAT") has increased to GBP5.4m up

29.7% (H1 2022/23: GBP4.2m). Profit after tax was GBP4.5m (H1

2022/23: GBP3.3m).

EPS

A strong start to our financial year results in adjusted diluted

earnings per share ("EPS") at 46.8p (H1 2022/23: 45.3p) and with

basic EPS of 39.7p (H1 2022/23: 37.2p).

Dividend

The Board is committed to maintaining a progressive dividend

policy as part of delivering growth in shareholder returns, albeit

with the recent acquisitions and the growth ambitions, dividends

are expected to continue to be a smaller component of total

shareholder returns.

Given the strong trading performance in the First Half and

prospects for the full year, the Board has decided to declare an

increase in the interim dividend up 7.7% to 7p per share (H1

2022/23: 6.5p).

The interim dividend will be paid on 16 February 2024 to

shareholders on the register at the close of business on 26 January

2024. The shares will go ex-dividend on 25 January 2024.

Cashflow

Operating cash

Operating cash generation in the First Half has been a key area

of focus for the management team. The inflow of cash from operating

activities was GBP8.3m (H1 2022/23 GBP0.5m) reflecting the impact

of working proactively to manage working capital, combined with a

very strong period of trading, giving an adjusted operating cash

conversion of 102% (H1 2022/23: 9%).

Investing activities

Capex has maintained broadly in line with prior years at GBP1.3m

reflecting continued maintenance expenditure across the Group with

the primary project in the First Half being a refurbishment of the

Crewkerne Power engineering and sales offices, modernising the

facility.

In the First Half we have settled the year-end deferred

contingent consideration liability of GBP5.5m in relation to Active

Silicon and Custom Power in full.

Financing activities

Underpinned by the strong cash generation during the First Half,

we have seen repayment of GBP0.6m of term loans and GBP1.4m of the

Group's revolving credit facility ("RCF").

The First Half saw the final dividend payment of GBP1.5m, which

in the prior year was paid in the Second Half.

Statement of financial position

Inventory

Inventory levels across the Group have started to reduce from

year-end highs of GBP33.2m to GBP27.7m (H1 2022/23: GBP24.9m). Last

time builds arising from discontinuing legacy products has resulted

in a higher level of inventory at the half year, which is expected

to unwind through the Second Half and in the early part of

FY24/25.

Receivables

Receivables at the half year were GBP20.7m (H1 2022/23:

GBP24.7m; FY22/23: GBP19.7m) higher than the year-end, reflecting

the strong billings in the First Half and the impact of a number of

pull-ins where we were able to secure stock to fulfil customer

demand.

Net assets

The strong trading performance has seen net assets increase from

the year-end of GBP58.0m to GBP61.8m (H1 2022/23: GBP60.5m). The

foreign currency translational impact recognised in reserves the

First Half was GBP0.7m (H1 2022/23: GBP2.9m).

Net debt

We saw net debt reduce from GBP8.1m at year-end to GBP3.9m (H1

2022/23: GBP16.1m) reflecting positive cash generation in the First

Half.

The settlement of the year-end deferred contingent consideration

liabilities in full means that at Period-end net debt comprises

cash with banks of GBP8.8m and borrowings of GBP12.7m.

Statement of Directors' responsibilities

The Directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with

International Accounting Standard 34, "Interim Financial

Reporting", as set out in the basis of preparation paragraph within

the accounting policies, and that the interim management report

herein includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months, and their impact on the condensed

consolidated interim financial information, and a description of

the principal risks and uncertainties for the remaining six months

of the financial year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

Forward-looking statements

Certain statements in this Half-Year Report are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, we can give no

assurance that these expectations will prove to be correct. Because

these statements involve risks and uncertainties, actual results

may differ materially from those expressed or implied by these

forward-looking statements. We undertake no obligation to update

any forward-looking statements whether arising as a result of new

information, future events or otherwise.

Peter James

Chief Financial Officer

5 December 2023

INTERIM CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Unaudited Unaudited

Six months Six months Audited

to to Year to

30 Sept 30 Sept 31 Mar

23 22 23

Continuing operations GBP'000 GBP'000 GBP'000

----------------------------------------------------- ----------- ----------- --------

Revenue 88,125 59,357 126,503

Cost of sales (60,830) (40,588) (86,829)

----------------------------------------------------- ----------- ----------- --------

Gross profit 27,295 18,769 39,674

----------------------------------------------------- ----------- ----------- --------

Sales, general and administration expenses (20,360) (14,296) (30,266)

----------------------------------------------------- ----------- ----------- --------

Profit from operations 6,935 4,473 9,408

----------------------------------------------------- ----------- ----------- --------

Finance costs (871) (291) (972)

----------------------------------------------------- ----------- ----------- --------

Profit before taxation 6,064 4,182 8,436

----------------------------------------------------- ----------- ----------- --------

Taxation expense (1,551) (843) (1,746)

----------------------------------------------------- ----------- ----------- --------

Adjusted profit after taxation 5,396 4,160 8,553

Adjustments to profit (883) (821) (1,863)

----------------------------------------------------- ----------- ----------- --------

Profit after taxation 4,513 3,339 6,690

----------------------------------------------------- ----------- ----------- --------

Profit attributable to equity holders of the

parent 4,502 3,343 6,693

Profit/(loss) attributable to non-controlling

interests 11 (4) (3)

----------------------------------------------------- ----------- ----------- --------

Other comprehensive (loss)/ income - FX on

overseas operations 652 2,905 (869)

Other comprehensive (loss)/ income - taxation (65) - (94)

----------------------------------------------------- ----------- ----------- --------

Adjusted total comprehensive income for the

period 6,048 7,065 7,684

Adjustments to total comprehensive income (948) (821) (1,957)

----------------------------------------------------- ----------- ----------- --------

Total comprehensive income for the period 5,100 6,244 5,727

----------------------------------------------------- ----------- ----------- --------

Comprehensive income attributable to equity

holders of the parent 5,089 6,248 5,730

Comprehensive income attributable to non-controlling

interests 11 (4) (3)

----------------------------------------------------- ----------- ----------- --------

Earnings per share (see Note 6)

Basic EPS from profit for the period 39.7p 37.2p 64.5p

Diluted EPS from profit for the period 39.1p 36.4p 63.1p

----------------------------------------------------- ----------- ----------- --------

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 SEPTEMBER 2023 (UNAUDITED)

Shares

Share Foreign Capital held Non-

Share premium exchange redemption Retained in controlling Total

capital reserve reserve reserve earnings treasury Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Balance at 31

March 2022 428 3,625 33 5 23,042 (57) 27,076 - 27,076

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Issue of new

shares 138 26,850 - - - - 26,988 - 26,988

Dividends - - - - - - - - -

Transactions

with

non-controlling

interests - - - - - - - 50 50

Share-based

payment

credit - - - - 113 - 113 - 113

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Transactions

with

owners in their

capacity as

owners 138 26,850 - - 113 - 27,101 50 27,151

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Result for the

period - - - - 3,343 - 3,343 (4) 3,339

Foreign exchange - - 2,905 - - - 2,905 - 2,905

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Total

comprehensive

income - - 2,905 - 3,343 - 6,248 (4) 6,244

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Balance at 30

September 2022 566 30,475 2,938 5 26,498 (57) 60,425 46 60,471

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Issue of new

shares 1 (1) - - - - - - -

Transfer of

treasury

shares to All

Employee

Share Plan - - - - (152) 152 - - -

Dividends - - - - (2,235) - (2,235) - (2,235)

Share-based

payment

credit - - - - 438 - 438 - 438

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Transactions

with

owners in their

capacity as

owners 1 (1) - - (1,949) 152 (1,797) - (1,797)

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Result for the

period - - - - 3,350 - 3,350 1 3,351

Other

comprehensive

income - - - - (94) - (94) - (94)

Foreign exchange - - (3,774) - - - (3,774) - (3,774)

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Total

comprehensive

income - - (3,774) - 3,256 - (518) 1 (517)

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Purchase of

treasury

shares - - - - - (203) (203) - (203)

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Balance at 31

March 2023 567 30,474 (836) 5 27,805 (108) 57,907 47 57,954

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Dividends - - - - (1,529) - (1,529) - (1,529)

Share-based

payment

credit - - - - 243 - 243 - 243

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Transactions

with

owners in their

capacity as

owners - - - - (1,286) - (1,286) - (1,286)

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Result for the

period - - - - 4,502 - 4,502 11 4,513

Other

comprehensive

income - - - - (65) - (65) - (65)

Foreign exchange - - 652 - - - 652 - 652

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Total

comprehensive

income - - 652 - 4,437 - 5,089 11 5,100

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

Balance at 30

September 2023 567 30,474 (184) 5 30,956 (108) 61,710 58 61,768

---------------- -------- -------- --------- ----------- ---------- --------- --------- ------------ --------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2023

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

------------------------------------------------ --------- --------- --------

Assets

Non-current assets

Intangible assets 40,858 47,198 41,563

Property, plant and equipment 4,939 4,838 4,718

Right-of-use lease assets 1,792 2,652 1,981

Deferred tax asset 305 3,143 375

------------------------------------------------ --------- --------- --------

Total non-current assets 47,894 57,831 48,637

------------------------------------------------ --------- --------- --------

Current assets

Inventories 27,704 24,940 33,228

Trade and other receivables 20,656 24,711 19,699

Cash and cash equivalents - on deposit - 8,929 4,032

Cash and cash equivalents - available on demand 8,812 7,117 8,192

------------------------------------------------ --------- --------- --------

Total current assets 57,172 65,697 65,151

------------------------------------------------ --------- --------- --------

Total assets 105,066 123,528 113,788

------------------------------------------------ --------- --------- --------

Liabilities

------------------------------------------------------ -------- -------- --------

Current liabilities

Trade and other payables (16,298) (17,040) (23,735)

Deferred and contingent consideration on acquisitions

- current - (14,414) (5,679)

Current borrowings (1,351) (2,122) (1,279)

Contract liabilities (7,323) (5,209) (5,380)

Corporation tax liabilities (1,578) (1,312) (1,110)

Right of use lease liabilities (1,118) (1,338) (1,057)

Provisions - current (327) - (323)

------------------------------------------------------ -------- -------- --------

Total current liabilities (27,995) (41,435) (38,563)

------------------------------------------------------ -------- -------- --------

Non-current liabilities

Non-current borrowings (11,354) (15,628) (13,383)

Provisions (892) (717) (715)

Deferred tax liability (2,339) (3,867) (2,187)

Right-of-use lease liabilities (718) (1,410) (986)

------------------------------------------------------ -------- -------- --------

Total non-current liabilities (15,303) (21,622) (17,271)

------------------------------------------------------ -------- -------- --------

Total liabilities (43,298) (63,057) (55,834)

------------------------------------------------------ -------- -------- --------

Total net assets 61,768 60,471 57,954

------------------------------------------------------ -------- -------- --------

Share capital 567 566 567

Share premium reserve 30,474 30,475 30,474

Capital redemption reserve 5 5 5

Foreign exchange reserve (184) 2,938 (836)

Retained earnings 30,956 26,498 27,805

Shares held in treasury (108) (57) (108)

------------------------------------------------------ -------- -------- --------

Capital and reserves attributable to equity

holders of the parent 61,710 60,425 57,907

Non-controlling interests 58 46 47

------------------------------------------------------ -------- -------- --------

Total equity 61,768 60,471 57,954

------------------------------------------------------ -------- -------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Unaudited Unaudited

Six months Six months Audited

to to Year to

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

---------------------------------------------------- ----------- ----------- --------

Operating activities

Profit before taxation 6,064 4,182 8,436

Adjustments for:

Property, plant and equipment depreciation 782 458 1,159

Right-of-use asset depreciation 529 433 965

Amortisation 1,370 922 2,035

Profit on disposal of property, plant and equipment - (19) (45)

Impairment of property, plant and equipment 246 - -

Share-based payment expense 243 113 551

Finance costs 871 291 972

Recognition of increase in deferred contingent

consideration - - (326)

---------------------------------------------------- ----------- ----------- --------

Profit from operations before changes in working

capital and provisions 10,105 6,380 13,747

---------------------------------------------------- ----------- ----------- --------

Decrease/(Increase) in inventories 5,600 (3,370) (12,457)

(Increase)/Decrease in trade and other receivables (887) (2,736) 1,767

(Decrease)/Increase in trade and other payables (5,709) 305 6,380

---------------------------------------------------- ----------- ----------- --------

Cash generated from operations 9,109 579 9,437

Income taxes paid (858) (79) (573)

Income taxes recovered - - 184

---------------------------------------------------- ----------- ----------- --------

Net cash flows from operating activities 8,251 500 9,048

---------------------------------------------------- ----------- ----------- --------

Investing activities

Purchase of property, plant and equipment (1,040) (730) (1,145)

Capitalised own costs and purchase of intangible

assets (252) (183) (1,197)

Proceeds from sale of property, plant and equipment 5 47 153

Payments for acquisition of subsidiaries net

of cash acquired - (24,531) (28,662)

Settlement of deferred consideration in respect

of prior year acquisitions (5,535) (4,625) (4,625)

---------------------------------------------------- ----------- ----------- --------

Net cash flows from investing activities (6,822) (30,022) (35,476)

---------------------------------------------------- ----------- ----------- --------

Financing activities

Issue of ordinary shares - 26,988 26,988

Repurchase of ordinary shares into treasury - - (203)

Borrowings drawn - 14,505 15,872

Borrowings repaid (2,036) (156) (2,772)

Payment obligations for right-of-use assets (609) (458) (1,093)

Interest paid (726) (270) (865)

Dividends paid to equity shareholders (1,529) - (2,235)

Transactions with non-controlling interests - 50 50

---------------------------------------------------- ----------- ----------- --------

Net cash flows from financing activities (4,900) 40,659 35,742

---------------------------------------------------- ----------- ----------- --------

(Decrease)/Increase in cash and cash equivalents (3,471) 11,137 9,314

---------------------------------------------------- ----------- ----------- --------

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

----------------------------------------------------- --------- --------- --------

Translational foreign exchange on opening cash 59 83 (14)

Net (decrease)/increase in cash and cash equivalents (3,471) 11,137 9,314

Net cash and cash equivalents brought forward 12,224 2,924 2,924

----------------------------------------------------- --------- --------- --------

Net cash and cash equivalents carried forward 8,812 14,144 12,224

----------------------------------------------------- --------- --------- --------

Unaudited Unaudited Audited

as at as at as at

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

------------------------------------------------ --------- --------- --------

Represented by:

Cash and cash equivalents - available on demand 8,812 7,117 8,192

Cash and cash equivalents - on deposit - 8,929 4,032

Cash and cash equivalents - overdraft facility - (1,902) -

------------------------------------------------ --------- --------- --------

Net cash and cash equivalents 8,812 14,144 12,224

------------------------------------------------ --------- --------- --------

NOTES TO THE INTERIM REPORT

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

1. Basis of preparation of interim financial information

General information

Solid State PLC (the "Company") is a public company

incorporated, domiciled and registered in England and Wales in the

United Kingdom. The registered number is 00771335 and the

registered address is: 2 Ravensbank Business Park, Hedera Road,

Redditch B98 9EY.

The interim financial statements are unaudited and do not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

March 2023, prepared in accordance with UK-adopted International

Accounting Standards, have been filed with the Registrar of

Companies. The Auditor's Report on these accounts was unqualified,

did not include any matters to which the auditors drew attention by

way of emphasis without qualifying their report and did not contain

any statements under section 498 of the Companies Act 2006.

Basis of preparation

These condensed interim financial statements for the six months

ended 30 September 2023 have been prepared in accordance with IAS

34, "Interim financial reporting", as contained in UK-adopted

International Accounting Standards.

The condensed interim financial statements should be read in

conjunction with the annual financial statements for the year ended

31 March 2023, which have been prepared in accordance with

UK-adopted International Accounting Standards.

The consolidated interim financial statements have been prepared

in accordance with the recognition and measurement principles of

UK-adopted International Accounting Standards expected to be

effective for the year ending 31 March 2024.

Going concern

In assessing going concern, the Directors gave careful

consideration of the potential impact of the principal risks and

uncertainties that the business faces, including direct and

indirect supply chain disruption risks in addition to inflation on

the cash flows and liquidity of the Group over the next 18-month

period.

We have seen customers maintaining strong order cover to help to

manage global electronics supply chain issues. The most significant

impact on the Group's future performance is the potential for an

unwinding of customer stock holdings as the uncertainty arising

from the extended electronic component lead times improves and

there is a need to manage working capital and cash more tightly.

Management has taken all possible actions to minimise and mitigate

the potential impact of this unwind; however, there is potential

for some rescheduling of demand/destocking in the second half of

FY23/24 and, potentially, into FY24/25. While the actions do not

mitigate the risk fully, it still positions the Group to manage the

impact as effectively as possible (as demonstrated historically

over the last two trading years).

In assessing going concern for the period ended 30 September

2023, the financial modelling applied various sensitivity scenarios

to a base case to 31 March 2025, which was prepared based on an

extension of the budget for FY23/24.

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for at

least the next 12 months, therefore, it is appropriate to adopt a

going concern basis for the preparation of the interim financial

information. Accordingly, this interim financial information does

not include any adjustments to the carrying amount or

classification of assets and liabilities that would result if the

Group and Company were unable to continue as a going concern.

2. Accounting policies

The accounting policies are unchanged from the financial

statements for the year ended 31 March 2023, other than as noted

below.

Financial instruments

The carrying value of cash, trade and other receivables, other

equity instruments, trade and other payables, and borrowings also

represent their estimated fair values.

All the Group's financial instruments, as disclosed, are

considered to fall under Level 1, except for deferred contingent

consideration due on acquisitions that are classified as Level 3

instruments. The contingent consideration in relation to Custom

Power's last 12-month revenue threshold within the18-month period

post acquisition remains assessed at GBPNil value based on the

discounted future forecasts prepared, as described in Note 1.

Additional disclosure of the basis of measurement and policies

in respect of financial instruments are described on pages 108 to

113 of our 31 March 2023 Annual Report and remain unchanged at 30

September 2023.

Estimates

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income, and expense. Actual

results may differ from these estimates.

In preparing these condensed interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the consolidated financial

statements for the year ended 31 March 2023.

Recent accounting developments

The accounting policies adopted are consistent with those of the

previous financial year, and in preparing the interim financial

statements, there were no standards, amendments or interpretations

applied for the first time that had a material impact for the

Group.

3. Principal risks and uncertainties

The principal risks and uncertainties impacting the Group are

described on pages 46 to 48 of our 31 March 2023 Annual Report and

remain unchanged at 30 September 2023. The exception is that

acquisition risk is now low as no new companies have been acquired

in the last 12 months.

They include: acquisitions, legislative environment and

compliance, competition, product/technology change, supply chain

interruption and cost inflation, retention of key employees,

failure of, or malicious damage to, IT systems, natural disasters,

and forecasting and financial liquidity.

4. Segmental information

Unaudited Unaudited

Six months Six months Audited

to to Year to

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

-------------- ----------- ----------- --------

Revenue

Systems 56,732 24,013 57,517

Components 31,393 35,344 68,986

-------------- ----------- ----------- --------

Group revenue 88,125 59,357 126,503

-------------- ----------- ----------- --------

5. Adjusted profit measures

Unaudited Unaudited

Six months Six months Audited

to to Year to

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

------------------------------------------------------- ----------- ----------- --------

Acquisition fair value adjustments within cost

of sales - 90 88

Acquisition fair value adjustments and reorganisation

costs - 178 304

Decrease in deferred contingent consideration

of Active Silicon - - (326)

Amortisation of acquisition intangibles 910 661 1,602

Share-based payments 243 114 551

Imputed interest on deferred consideration

unwind 34 - 136

Taxation effect (304) (222) (492)

Movement of deferred tax assets in other comprehensive

income 65 - 94

------------------------------------------------------- ----------- ----------- --------

Total adjustments to other comprehensive income 948 821 1,957

------------------------------------------------------- ----------- ----------- --------

Gross profit 27,295 18,769 39,674

Adjusted gross profit 27,295 18,859 39,762

------------------------------------------------------- ----------- ----------- --------

Operating profit 6,935 4,473 9,408

Adjusted operating profit 8,088 5,516 11,627

------------------------------------------------------- ----------- ----------- --------

Operating profit margin percentage 7.9% 7.5% 7.4%

Adjusted operating profit margin percentage 9.2% 9.3% 9.2%

------------------------------------------------------- ----------- ----------- --------

Profit before tax 6,064 4,182 8,436

Adjusted profit before tax 7,251 5,225 10,791

------------------------------------------------------- ----------- ----------- --------

Profit after tax 4,513 3,339 6,690

Adjusted profit after tax 5,396 4,160 8,553

------------------------------------------------------- ----------- ----------- --------

Other comprehensive income 5,100 6,244 5,727

Adjusted other comprehensive income 6,048 7,065 7,684

------------------------------------------------------- ----------- ----------- --------

6. Earnings per share

The earnings per share is based on the following:

Unaudited Unaudited

Six months Six months Audited

to to Year to

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

-------------------------------------------------- ----------- ----------- ----------

Adjusted earnings post tax attributable to equity

holders of the parent 5,385(1) 4,164(2) 8,556(3)

Earnings post tax attributable to equity holders

of the parent 4,502 3,343 6,693

-------------------------------------------------- ----------- ----------- ----------

Weighted average number of shares 11,327,000 8,998,193 10,374,314

Diluted weighted average number of shares 11,516,279 9,193,936 10,604,768

-------------------------------------------------- ----------- ----------- ----------

EPS

Basic EPS from profit for the period 39.7p 37.2p 64.5p

Diluted EPS from profit for the period 39.1p 36.4p 63.1p

-------------------------------------------------- ----------- ----------- ----------

Adjusted EPS

Adjusted basic EPS from profit for the period 47.5p 46.3p 82.5p

Adjusted diluted EPS from profit for the period 46.8p 45.3p 80.7p

-------------------------------------------------- ----------- ----------- ----------

(1) Calculated as Adjusted profit after taxation (GBP5,396k)

excluding non-controlling interest profit (GBP11k)

(2) Calculated as Adjusted profit after taxation (GBP4,160k)

excluding non-controlling interest loss (GBP(4)k)

(3) Calculated as Adjusted profit after taxation (GBP8,553k)

excluding non-controlling interest loss (GBP(3)k)

7. Dividends

Dividends paid during the period from 1 April 2022 to 30

September 2023 were as follows:

Final dividend year ended 31 March

5 October 2022 2022 13.25p per share

Interim dividend year ended 31

16 February 2023 March 2023 6.5p per share

Final dividend year ended 31 March

29 September 2023 2023 13.5p per share

The Directors are intending to pay an interim dividend for the

year ending 31 March 2024 on 16 February 2024 of 7.0p per share.

This dividend has not been accrued at 30 September 2023.

8. Share capital

Unaudited Unaudited Audited

Six months Six months Year

as at as at as at

30 Sept 30 Sept 31 Mar

23 22 23

------------------------------- ----------- ----------- ----------

Allotted issued and fully paid

Number of ordinary 5p shares 11,346,394 11,322,394 11,346,394

------------------------------- ----------- ----------- ----------

Unaudited Unaudited Audited

Six months Six months Year

as at as at as at

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

------------------------------- ----------- ----------- --------

Allotted issued and fully paid

Ordinary 5p shares 567 566 567

------------------------------- ----------- ----------- --------

The ordinary shares carry no right to fixed income, the holders

are entitled to receive dividends as declared, and are entitled to

one vote per share at shareholder meetings.

Full details of movements in reserves are set out in the

consolidated statement of changes in equity on page 10.

The following describes the nature and purpose of each reserve

within owners' equity.

Reserve Description and purpose

------------------ --------------------------------------------------------------

Amount subscribed for share capital in excess of nominal

Share premium value.

------------------ --------------------------------------------------------------

Amounts transferred from share capital on redemption

Capital redemption of issued shares.

------------------ --------------------------------------------------------------

Cumulative net gains and losses recognised in the consolidated

Retained earnings statement of comprehensive income.

------------------ --------------------------------------------------------------

Shares held in Shares held by the Group for future staff share plan

treasury awards.

------------------ --------------------------------------------------------------

Foreign exchange translation differences arising from

the translation of the financial statements of foreign

Foreign exchange operations.

------------------ --------------------------------------------------------------

Non-controlling

interest Equity attributable to non-controlling shareholders.

------------------ --------------------------------------------------------------

9. Non-current assets

Unaudited Unaudited Audited

Six months Six months Year

as at as at as at

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

----------------------------- ----------- ----------- --------

Goodwill 30,051 34,554 29,726

Acquisition intangibles 9,699 12,152 10,523

Research and development 479 125 682

Software 629 367 632

----------------------------- ----------- ----------- --------

Intangible assets 40,858 47,198 41,563

Property plant and equipment 4,939 4,838 4,718

Right-of-use assets 1,792 2,652 1,981

Deferred tax asset 305 3,143 375

----------------------------- ----------- ----------- --------

Total non-current assets 47,894 57,831 48,637

----------------------------- ----------- ----------- --------

10. Net debt

Unaudited Unaudited Audited

Six months Six months Year

as at as at as at

30 Sept 30 Sept 31 Mar

23 22 23

GBP'000 GBP'000 GBP'000

---------------------------------------------- ----------- ----------- --------

Cash and cash equivalents - overdraft - (1,902) -

Bank borrowing due within one year (1,351) (220) (1,279)

Bank borrowing due after one year (11,354) (15,628) (13,383)

---------------------------------------------- ----------- ----------- --------

Total borrowings (12,705) (17,750) (14,662)

---------------------------------------------- ----------- ----------- --------

Deferred consideration on acquisitions within

one year - (14,414) (5,679)

Cash and cash equivalents - on deposit - 8,929 4,032

Cash and cash equivalents - on demand 8,812 7,117 8,192

---------------------------------------------- ----------- ----------- --------

Net debt (3,893) (16,118) (8,117)

---------------------------------------------- ----------- ----------- --------

The Group initially drew down two GBP6.5m term loans totalling

GBP13.0m. The first tranche is interest only and committed for

three years from the 5 August 2022, and the second tranche is

repayable over five years with quarterly repayments. Both tranches

bear variable interest based on a margin over base rate.

The cash on deposit was utilised in the Period to fully settle

the deferred consideration on the Custom Power acquisition. The

remaining Active Silicon consideration was also fully settled.

The Group has retained its GBP7.5m revolving credit facility,

which is committed to November 2024 and bears variable interest

based on a margin over base rate.

Lease liabilities are excluded from the Group's definition of

net debt and a separate roll-forward of lease liabilities will be

presented in the full-year report to the year ending 31 March

2024.

11. Related party transactions

Consistent with the year ended 31 March 2023, the ongoing

related party transactions in the Period were those with the

trading companies that are used by the Non-Executive Directors for

their consultancy services. These transactions are disclosed in the

Remuneration Report in the Annual Report to the 31 March 2023, and

will be updated in the full-year report to the year ending 31 March

2024.

eTech Developments Limited ("eTech") made sales to the Group

totalling GBP241k and purchases from the Group totalling GBP36k. As

at 30 September 2023, GBP200k is owed to the Group from eTech and

GBP8k is owed from eTech to the Group. There are no other material

related party transactions.

12. Post balance sheet events

Post Period-end, 3,500 new shares of 5p each were issued due to

an employee share option exercise.

The UK-based Components Division launched new branding to trade

as "Solsta".

The statement will be available to download on the Company's

website: www.solidstateplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFITFLLSIIV

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

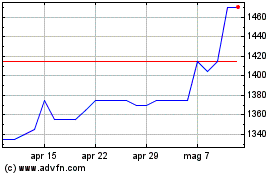

Grafico Azioni Solid State (LSE:SOLI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Solid State (LSE:SOLI)

Storico

Da Apr 2023 a Apr 2024