TIDMSRC

RNS Number : 3752W

SigmaRoc PLC

11 December 2023

11 December 2023

SIGMAROC PLC

(" SigmaRoc ", the " Company " or the " Group ")

Result of General Meeting

Director / PDMR Dealings

SigmaRoc (AIM: SRC), the AIM quoted lime and limestone group, is

pleased to announce the results of its General Meeting held today

at the offices of Fieldfisher LLP, Riverbank House, 2 Swan Lane,

London, EC4R 3TT. All resolutions proposed at the meeting were duly

passed and the votes lodged in respect of each resolution are set

out in the table below.

The Acquisitions represent an opportunity to become Northern

Europe's leader in lime and a key supplier to the structural growth

markets critical for the green transition. Following the

Acquisitions, the pro forma revenue of the Enlarged Group for FY22

would be GBP1 billion with underlying EBITDA of GBP211 million

(assuming, in each case, exercise of the UK Call Option and Polish

Call Option). The Enlarged Group is expected to be significantly

cash generative with a free cash flow target in excess of GBP100

million per annum which is expected to enable the Enlarged Group to

de-gear at a rate of 0.5x per year with target leverage of 1.0x

.

The Targets, together, have a consistent performance track

record delivering FY22 revenue of EUR579.7 million and EBITDA of

EUR133.7 million and EBITDA margin in excess of 20 per cent. The

Acquisitions are expected to deliver revenue growth opportunities

and cost synergies resulting in at least EUR30 million of EBITDA

contribution by 31 December 2027.

Completion of the acquisition of the Deal 1 Targets is

conditional, inter alia, on Admission, which is expected to take

place at 8.00 a.m. on Thursday 4 January 2024.

Whereas the Deal 1 Targets are stand-alone entities, the Call

Option Targets (being the UK Target and the Polish Target) require

carving out of existing CRH businesses in order to be acquired. In

the event that the Company exercises its sole discretion to

exercise the relevant Call Option, completion of the acquisition of

the UK Target is expected by 28 March 2024, and completion of the

acquisition of the Polish Target is expected by 30 September 2024.

The total consideration payable by the Company for the Deal 1

Targets is EUR745 million (approximately GBP645 million). In the

event that both the UK Call Option and the Polish Call Option are

exercised, the total consideration payable by SigmaRoc for all of

the Targets is c.EUR1 billion (c.GBP870 million).

The voting was held on a poll. The votes received, including

those submitted by proxy, were as follows:

Votes % Votes % Against % of Votes

in Favour In against Votes ISC voted withheld

favour Total

Ordinary

resolution

to approve

the acquisition

of the

Deal 1

1 Targets 552,490,140 99.99 50,514 0.01 552,540,654 79.64 20,186,037

----------------- -------------- -------- -------------- ---------- ------------- ---------- -------------

Special

resolution

to authorise

the Directors

to allot

the Fundraising

2 Shares 549,813,702 99.52 2,661,952 0.48 552,475,654 79.63 20,251,037

----------------- -------------- -------- -------------- ---------- ------------- ---------- -------------

Ordinary

resolution

to authorise

the Board

to adopt

the New

Option

3 Plan 384,719,778 69.64 167,738,956 30.36 552,458,734 79.63 20,267,957

----------------- -------------- -------- -------------- ---------- ------------- ---------- -------------

Expected Timetable of Principal Events

Completion of the acquisition 8 a.m. on 4 January 2024

of the Deal 1 Targets, Admission

and dealings commence in the

Enlarged Share Capital on AIM

Issue of Fundraising Shares 8 a.m. on 4 January 2024

CREST accounts credited by 4 January 2024

Dispatch of definitive share Within 10 business days of Admission

certificates, where applicable

Carve Out(1) of UK Target expected 28 March 2024

by

Carve Out(1) of Polish Target 30 June 2024

expected by

Expected timing for UK Target 28 March 2024

(and Call Option) Completion

by(2)

Expected timing for Polish Target 30 September 2024

(and Call Option) Completion

by(3)

(1) The Carve Outs of the UK Target and the Polish Target are

required because the assets and businesses which will come to form

the UK Target and Polish Target are not at present standalone

entities and will need to be carved-out of existing CRH businesses

such that they are standalone entities, which can be acquired.

(2) Subject to the Company electing to exercise (in its sole

discretion) the UK Call Option

(3) Subject to receipt of the Polish Competition Office

Clearance and the Polish Purchaser electing to exercise (in its

sole discretion) the Polish Call Option

Notes:

Each of these times and dates is subject to change, particularly

depending on the timing of the Polish Competition Office Clearance

and the Carve Outs. Any changes to timing are at the absolute

discretion of the Company, the Nominated Adviser and the Joint

Bookrunners. Any changes to the expected timetable will be notified

by the Company through an RIS. References to times are to London,

UK times.

Defined terms used throughout this announcement have the

meanings set out in the admission document published by the Company

on 23 November 2023 unless the context requires otherwise.

Information on SigmaRoc is available on the Company's website

at: www.sigmaroc.com .

For further information, please contact:

SigmaRoc plc Tel: +44 (0) 207 002

Max Vermorken (Chief Executive Officer) 1080

Garth Palmer (Chief Financial Officer) ir@sigmaroc.com

Tom Jenkins (Head of Investor Relations)

Liberum Capital Limited (Nominated Tel: +44 (0) 203 100

and Financial Adviser, Joint Bookrunner 2000

and Co-Broker)

Dru Danford / Ben Cryer / Mark Harrison

/ John More / Anake Singh

Tel: +44 (0) 20 7418

Peel Hunt (Joint Bookrunner and Co-Broker) 8900

Investment Banking

Mike Bell / Ed Allsopp / Ben Harrington

ECM Syndicate & Broking

Sohail Akbar / Jock Maxwell Macdonald

/ Tom Ballard

Rothschild & Co acting through Redburn Tel: +44 (0) 20 7000

Atlantic (Joint Bookrunner and Financial 2020

Adviser)

Adam Young / Ben Glaeser

BNP Paribas (Joint Bookrunner and Financial Tel: +44 (0) 20 7595

Adviser) 9523

Tom Snowball / Matt Randall / Lauren

Davies / Deepak Sran

Santander Group (Joint Bookrunner and Tel: +34 912572388

Financial Adviser)

Javier Mata / Oliver Tucker

Walbrook PR Ltd (Public Relations)

Tom Cooper / Nick Rome Tel: +44 20 7933 8780

/ sigmaroc@walbrookpr.com

Mob: +44 7971 221972

(Nick)

About SigmaRoc plc

SigmaRoc is an AIM-quoted lime and limestone group targeting

quarried materials assets in the UK and Northern Europe. It seeks

to create value by purchasing assets in fragmented materials

markets and extracting efficiencies through active management and

by forming the assets into larger groups. It seeks to de-risk its

investments via strong asset backing at its projects through the

selection of projects with strong asset-backing.

The information below (set out in accordance with the

requirements of EU Market Abuse Regulation) provides further

detail:

PDMR Notification Forms:

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name 1) David Barrett

2) Max Vermorken

3) Garth Palmer

4) Tim Hall

-------------------------- ---------------------------------------

Reason for the notification

2

-------------------------------------------------------------------

a) Position/status 1) Executive Chairman

2) Chief Executive Officer

3) Chief Financial Officer

4) Non-Executive Director

-------------------------- ---------------------------------------

b) Initial notification Initial Notification

/Amendment

-------------------------- ---------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name SigmaRoc plc

-------------------------- ---------------------------------------

b) LEI 213800Q3CJUERBGD1E44

-------------------------- ---------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------

a) Description of the Ordinary Shares of 1 pence each

financial instrument,

type of instrument ISIN: GB00BYX5K988

Identification code

-------------------------- ---------------------------------------

b) Nature of the transaction Subscription for new Ordinary Shares

-------------------------- ---------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1) 47.5 pence 421,054

----------- ----------

2) 47.5 pence 210,527

----------- ----------

3) 47.5 pence 157,895

----------- ----------

4) 47.5 pence 42,106

----------- ----------

-------------------------- ---------------------------------------

d) Aggregated information

Single transactions as in 4 c) above

Aggregated volume

Price

-------------------------- ---------------------------------------

e) Date of the transaction 11 December 2023

-------------------------- ---------------------------------------

f) Place of the transaction Outside of a trading venue

-------------------------- ---------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMUAVORONUUAAA

(END) Dow Jones Newswires

December 11, 2023 09:00 ET (14:00 GMT)

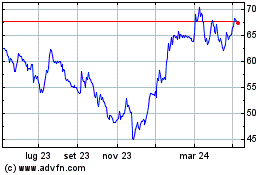

Grafico Azioni Sigmaroc (LSE:SRC)

Storico

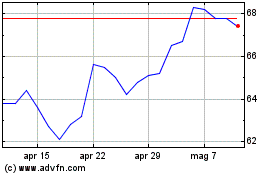

Da Apr 2024 a Mag 2024

Grafico Azioni Sigmaroc (LSE:SRC)

Storico

Da Mag 2023 a Mag 2024