TIDMSUH

RNS Number : 8061H

Sutton Harbour Group PLC

01 August 2023

1 August 2023

Sutton Harbour Group Plc (the "Group")

Results for the year ended 31 March 2023

Sutton Harbour Group plc ("Sutton Harbour", or the "Company"),

the AIM listed owner and operator of Sutton Harbour in Plymouth and

specialist in waterfront regeneration projects and operation of

waterfront real estate, marinas and Plymouth Fisheries, announces

audited results for the year ended 31 March 2023. The statutory

accounts for 2023 are expected to be available on the Group's

website ( www.suttonharbourgroup.com ) later today.

Highlights

-- The first new development project at Sutton Harbour in a

decade, Harbour Arch Quay, is under construction and due for

completion in August 2023.

-- Successful refurbishment of Old Barbican Market now fully let

to three high quality national retail operators.

-- Record trading year for the marinas with near capacity

occupancy during year ended 31 March 2023.

-- Strong trading by marinas and car parks reflected in

increased valuation of the owner occupied property portfolio at

GBP38.3m (2022: GBP36.1m).

-- Investment property estate remains 89% occupied (2022: 89%).

-- Energy price spike and higher interest costs have contributed

to a loss during the year. Energy prices have declined at the start

of the new financial year and the Company is securing more cost

effective supplies.

Financial Highlights

Note 2023 2022

Adjusted (loss)/profit before * GBP(0.096)m GBP0.366m

tax

----------------- ----------------------- ---------------------

Net financing costs GBP1.150m GBP0.789m

----------------- ----------------------- ---------------------

Net assets GBP56.1m GBP56.2m

----------------- ----------------------- ---------------------

Net asset per share 43.1p 43.3p

----------------------- ---------------------

Valuation of property portfolio ** GBP55.5m GBP54.3m

----------------- ----------------------- ---------------------

Year-end net debt GBP29.6m GBP24.4m

----------------------- ---------------------

*Before accounting for fair value adjustments to property asset

valuation.

**Comprises investment and owner occupied portfolios.

Excludes land held as development inventory.

Valuation as at 31 March 2023.

Philip Beinhaker, Executive Chairman, commented:

" The Board is pleased with the successful delivery of new

developments to meet objectives of sustaining and enhancing the

attractiveness and amenity of the Sutton Harbour area and to create

long term value growth from the assets. The investments made in the

past year are proof that sustainable success is achievable with

improvements to the Harbour environment for the benefit of

visitors, workers and residents. "

For further information, please contact

Sutton Harbour Group plc

Philip Beinhaker - Executive

Chairman

Corey Beinhaker - Chief Operating

Officer

Natasha Gadsdon - Finance Director 01752 204186

Strand Hanson Ltd (Nomad and

Broker)

James Dance

Richard Johnson 020 7409 3494

Executive Chairman's Statement

Introduction

I am pleased to report on a successful year of progress for the

year ended 31 March 2023, notwithstanding the material challenges

in the economy:

-- The Company has been engaged in the delivery of two key

property projects during the financial year, in line with the

strategy to improve the quality, value and sustainability of the

Sutton Harbour area:

Harbour Arch Quay - construction of the waterfront 14 apartment

building is due to be substantially completed in August 2023,

whereafter occupations of the 12 (of 14) apartments already

exchanged will follow. This is the first new building developed by

the Company at Sutton Harbour since 2009.

Old Barbican Market - the historic former fishmarket building

has undergone a full refurbishment, including a new roof on the

listed structure and separation of the 7,500 sq ft space into three

c. 2,500 sq ft retail spaces. All three units are let to higher

quality national operators: Cornish Bakery, Pavers and Loungers,

stimulating footfall and adding to the diversity and vibrancy of

the area.

-- Marinas - the marinas achieved another record season with

berths occupied effectively to capacity during the year.

-- The nature of the Company's operations and level of debt

carried has exposed the Company to significant cost increases as a

result of rising interest rates and the extreme energy cost spike

in the second half of the year. Energy costs have declined at the

start of the current financial year and the Company is securing

more cost effective contracts and with more stability in

supply.

-- To support repayment of a third party loan, the Company's

progress with active and future property projects and to improve

cash headroom Related Party Loans totalling GBP2.955m were drawn

down from two major shareholders during the year. Post-period end,

in May 2023, subscription for new equity shares by the major

shareholder provided GBP2.923m (before expenses) to further support

the Company's operations and projects in the face of ongoing higher

costs and to permit reduction of bank loan debt .

Results and Financial Position

FINANCIAL HIGHLIGHTS 2023 2022

Net Assets GBP56.067m GBP56.211m

------------ ------------

Net Asset value per share 43.1p 43.3p

------------ ------------

(Loss)/Profit before tax (GBP2.021m) GBP0.561m

from continuing operations

------------ ------------

Adjusted profit/(loss) before (GBP0.096m) (GBP0.366m)

tax excluding fair value

adjustments

------------ ------------

(Loss) after tax (GBP2.036m) (GBP0.259m)

------------ ------------

Basic (loss) after tax per

share (1.57p) (0.20p)

------------ ------------

Dividend per share 0.0p 0.0p

------------ ------------

Total Comprehensive Income (GBP0.144m) GBP5.641m

for the year attributable

to shareholders

------------ ------------

Total Comprehensive Income

per share (0.11p) 4.33p

------------ ------------

Net Debt GBP29.259m GBP24.408m

------------ ------------

Gearing (Net Debt/Net Assets) 52.2% 43.4%

------------ ------------

The adjusted loss before taxation for the year was GBP0.096m

(2022: GBP0.366m profit before taxation) which excludes non-cash

fair value adjustments. In this financial year these adjustments

relate to property asset valuation, undertaken by external valuers

as at 31 March 2023. The loss before taxation for the year under

review as per the Income Statement, inclusive of the aforementioned

adjustments, was GBP2.021m (2022: GBP0.561m profit before tax).

Gross profit for the year was GBP2.246m down GBP0.102m compared to

the previous period to 31 March 2022 (GBP2.348m), reflecting the

impact of the higher energy costs in the second half year.

Net debt (including lease liabilities) increased to GBP29.259m

as at 31 March 2023 from GBP24.408m at 31 March 2022, an increase

of GBP4.851m. This includes GBP2.372m at 31 March 2023 in respect

of a specific development loan (maximum GBP5m facility) for the

construction of Harbour Arch Quay. The increase in development

property inventory during the year to GBP37.048m (31 March 2022:

GBP31.861m), includes the Harbour Arch Quay development which

amounted to GBP6.940m at the year end.

Gearing (Net debt: net assets) as at 31 March 2023 stood at

52.2% (31 March 2022: 43.4%). Net finance costs of GBP1.150m in the

year (2022: GBP0.789m) are stated after capitalisation of interest

of GBP0.555m (2022: GBP0.343m).

As at 31 March 2023, net assets were GBP56.067m (31 March 2022:

GBP56.211m), a net asset value of 43.1p per ordinary share (31

March 2022: 43.3p per ordinary share). The movement includes the

valuation of the Group's property assets which gave rise to an

overall valuation surplus of GBP0.510m, as reconciled in the table

below, of which a GBP1.925m deficit relates to the investment

property portfolio and a net GBP2.435m surplus relates to the

owner-occupied properties. These valuation results reflect the

strength and continued strong performance of the marina and car

park assets, set against the impact of a general weaker market

sentiment towards office and retail space. The Company's investment

portfolio has continued to be well let and with demand for the few

available properties. During the year a 27 year old office building

has been decanted as leases expired with refurbishment of the

building intended.

Valuation Surplus/(Deficit) Accounting*

Owner Occupied

Portfolio

-

* Fisheries

GBP2.024m Credited to the Revaluation Reserve in

* Marinas the Balance Sheet

GBP0.411m Credited to the Revaluation Reserve in

* Car Parks the Balance Sheet

---------------------------- ---------------------------------------

Investment Property GBP(1.925)m Fair valuation adjustment recorded in

Portfolio the Income Statement

---------------------------- ---------------------------------------

TOTAL GBP0.510m

---------------------------- ---------------------------------------

Financing

In May 2022 the Company repaid a third party loan which had been

drawn down in 2020 to purchase strategic land. Security provided to

the lender was then released. This was funded by unsecured Related

Party Loans from two major shareholders totalling GBP2.3m on better

and more flexible terms than could be secured elsewhere. Later in

the financial year (December 2022 and March 2023) the Related Party

Loans were increased by GBP280,000 and GBP375,000 respectively to

improve cash liquidity. Terms of the loans allow for interest to be

rolled into the loan principal on a quarterly basis. The Related

Party Loans expire in May 2024.

The Company's general banking facility has been extended by one

year giving a new expiry date of December 2024. The committed

facilities of GBP24.9m reduce to GBP21.7m by 31 August 2023. The

Company is now preparing to put a new general banking facility in

place within the current financial year. During the past financial

year the Company met all banking covenant tests as agreed with the

bank.

A GBP5m development facility was put in place to fund the

construction costs of Harbour Arch Quay. This facility will be

repaid with the completion of sales of the apartments before the

expiry date of 13 September 2023.

During the financial year under review bank base rate rose from

0.75% as at 1 April 2022 to 4.25% at 31 March 2023. The progressive

rises throughout the year have resulted in material increases in

debt servicing costs. The board has discussed the merits of fixing

the interest rate by way of a hedge instrument every month, but to

date has not entered into any agreements due to the high cost of

doing so relative to the rate ruling at the time of obtaining

quotes and the expectation that rates are close to peaking.

Recognising the increasing cost of debt serving costs, the

Company has a strategy to further reduce debt levels and to improve

profitability:

-- To continue to improve the attractiveness of the Sutton

Harbour asset to benefit the Company's trading profitability and

investment property rentals.

-- Deliver profitable redevelopment of existing sites for sale

to improve working capital headroom and to reduce debt, and/or for

rent to improve revenue, profit and capital value growth

-- Consideration of the sale of non-strategic assets that have

achieved maturity and stability in value.

-- And thus rebalancing the debt : equity ratio of Company to

allow the reduction of debt and consequent saving of interest.

Taking into account the current level of bank borrowing, the

board does not recommend payment of a dividend on the year's

results.

Directors and Staff

There have been no Board changes during the year. Headcount as

at 31 March 2023 was 30 (31 March 2022: 32).

Operations Report

Marine

Both Sutton Harbour Marina and King Point Marinas achieved

record revenues for the year to 31 March 2023 with respective

average occupancies of 97% and 96%. The Company saw high demand for

berthing following the trend of the previous year and more

customers paying some 5 months in advance of the start of the

season to secure their preferred berth. In response to the

increased level of business some additional staffing resource has

been introduced to support the administrative and operational

functions running the marinas.

The outlook for the marinas remains strong with King Point

Marina fully let and a new 5 year lease for approximately one third

of the total berthing space to Princess Yachts completed in June

2023. The Company has increased fees, in line with inflation, as

have competitor marinas. Berth-holders at Sutton Harbour Marina

have been offered a discount to reflect the disruption of the

forthcoming lock work and occupancy is slightly lower this season

at 95%. Normal operations will resume by May 2024 once these works

are complete with the expectation that major lock works will not be

required for another 12-15 years (more information on these works

is given below).

Fisheries trading followed the slow trend of the last couple of

years with high fuel prices, competition from other south western

ports, intermittent poor weather and lower fish stocks all

contributing to a decline in the trading position. Landings of fish

in value terms were slightly lower than the previous year although

the volume of fuel sold was up on last year, albeit at a lower

overall margin charged by the Company to support fishermen to go to

sea and improve competitiveness. Against this trading picture,

demand for commercial units at Plymouth Fisheries has been strong,

such that all units are now let to fisheries related businesses and

there are no void premises. Rental incomes and related service

charges have therefore improved in the last year.

The energy price spike that affected the second half of the

financial year under review which took hold after the previous

fixed price expired increased energy prices to 3.5-4 times as much

as previous charged, even after allowing for the Government energy

price relief discount. Since 1 April 2023 energy prices have halved

from where they were, although this is still close to double the

price as pre October 2022. The Company will continue to be a

significant energy consumer to operate the harbour, lock and

fisheries plant as well as general heating and lighting consumption

across the estate which is recharged to tenants and other users

based on meter readings in the case of specific supply. To manage

the risk of volatility in energy prices the Company is in the

process of entering into a 5 year capped buying arrangement for the

procurement of gas and electricity requirements which offers

greater protection against future price volatility.

Starting in Autumn 2023 the Environment Agency will embark on a

six month programme to replace the cills of the Sutton Harbour

Lock, which is a flood defence to protect the City. These essential

works result in restrictions to harbour users at certain times when

passage through the lock will be constrained. The Group is

arranging for back-up alternatives to facilitate some of the

landing of fish at nearby locations which can be transported to the

Fishery Complex for fish processing and auction. This was the same

some 13 years previously when works were undertaken on the lock

gates, however the costs relating to the works themselves is being

funded by the Environment Agency.

Real Estate and Car Parking

Tenant occupancy by 31 March 2023 stood at 89% (31 March 2022

89%). There has been little change in the tenants mix over the

reporting year. The main changes have been the decanting of North

Quay House (a 17,750 sq ft 5-floor) office building and the letting

of the refurbished Old Barbican Market.

The Old Barbican Market is fully let with three new national

scale tenants with material covenants and has visibly stimulated

increased visitor footfall to the area. The sensitive and complete

restoration of the listed historic building has enhanced the

quality of the built environment and amenity in the Sutton

Harbour/Barbican area for years to come.

North Quay House has been continuously let to office tenants for

27 years. Following the vacation by most tenants the Company is

reviewing options for the building which would achieve best value

for the Company and to stimulate activity at Sutton Harbour. Demand

for office space in Plymouth has weakened and the Company judges

that the cost of refurbishment to modern standard office space is

unlikely to generate returns sufficient to justify the investment.

Following the success of the Harbour Arch Quay residential

development, the Company now intends to submit a planning

application to convert the building to residential accommodation

with ground floor commercial space. Subject to planning consent and

financing this development, which could provide 10 high quality

apartments over 5 floors together with on site parking, could be

delivered in 2024.

The car parks traded successfully throughout the financial year

achieving the best revenues to date. Prices have been raised in

line with inflation and other local parking facilities for the new

season. The car parks management agreement is due for renewal at

the end of 2023 and discussions with specialist management

companies will take place over the next few months to secure the

best terms for the Company.

The normal events programme organised, by the City Council and

other stakeholders, for the waterfront and nearby City Centre areas

have resumed, increasing visitor numbers which in turn support the

trading operations of many of our tenants. Together with the

Company's new developments and improvements these events promote

the vibrancy and popularity of the Sutton Harbour area for

visitors, workers and residents, thereby supporting the

sustainability of the Harbour and values of the Company's property

assets.

Regeneration

Harbour Arch Quay

The development construction is due to be completed by mid

August 2023, with occupation of sold apartments due to take place

immediately thereafter. Of the 14 apartments, including 2

penthouses, 12 are sold and the remaining two are being marketed.

The Company will be relocating its head office to the ground floor

space of the building. This is the first new development that the

Company has delivered at Sutton Harbour in 14 years and

re-establishes the Company's reputation as an active developer.

North Quay House

This asset has been described in more detail further above.

Sugar Quay

The Company has consent for a 170 apartment building on the

eastern quay of Sutton Harbour. Taking into account the market

absorption rate for the Harbour Arch Quay apartments, the length of

the build programme and the current economic outlook, the Company

is now working on modifying the approved plan for this site that

will allow for the development to be delivered in three distinct

phases.

Former Airport Site

The 5 year safeguard protecting against non-aviation uses of the

site, as recommended by the Government's Inspectors of planning

policy when the new Local Plan was determined in 2019, expires in

March 2024. Since the airport closed in December 2011, no funded

plan to resume airport operations from the site has been received.

The Company maintains that the site could be put to better use for

the economic and social benefit of the City by mixed use

redevelopment to include institutional, business space and housing

provision with the possibility of an aviation component. The

Company intends to submit a planning application to the Local

Planning Authority setting out the plan for development later this

year.

The Company has a long-term lease on the Property of the Former

Airport site with over 130 years remaining. In addition, the

Company has the right for an extension of the said lease. Since the

closure of the Airport in December 2011 the Company, under the

terms of the agreement with the Plymouth City Council, has been

managing the property faithfully. This management includes the

security of the land assets against trespassers, groundskeeping and

environmental management and site safety, all at considerable cost

to the Company, c GBP200,000 per annum.

The Company has also collaborated with the local authority

(Plymouth City Council or PCC) and other public bodies to enable

them to make productive use of the property. Some examples are:

-- Agreement via sublease to enable the PCC to have a cycle path

on the property alongside some of the adjacent roads;

-- Agreement with the local authority to enable the construction

contractor of the PCC to store large reinforced concrete bridge

beams on the property needed for the construction of a major new

highway; and

-- Use of the site by the Police and other public security

services for various training exercises.

Recently, the Company received a request from the NHS Derriford

Hospital to accommodate part of their need for parking of cars on

the site. This need arose from the construction works on the

hospital site, funded by the National Government, which displaced

staff parking. The Company approached the local authority as

free-holder of the site for this temporary use for a few years for

the benefit of the NHS/Derriford Hospital, which request was not

granted by Plymouth City Council.

The Company has more recently been approached by the

construction contractor of the Hospital works, to use some of the

land on a temporary basis to store construction related materials,

vehicles and equipment with commitment to return the site in the

same state as before this temporary use. The Company is making an

application to the PCC regarding this request, notwithstanding the

previous temporary car parking rejection, in the hope that the PCC

will recognise the importance of this need to deliver the essential

hospital improvements.

Financial Outlook

Trading at the start of the new financial year is steady and

consistent with recent trading. Demand for the Company's property,

services and facilities continues to be robust. The Company will

continue to be challenged with higher energy prices (although these

continue to fall from the winter peak), general inflation and the

consequential costs resulting from the lock cill replacement.

Higher interest rates represent the single biggest cost

pressure.

Summary

The Board is pleased with the successful delivery of new

developments to meet objectives of sustaining and enhancing the

attractiveness and amenity of the Sutton Harbour area and to create

long term value growth from the assets. The investments made in the

past year are proof that sustainable success is achievable with

improvements to the Harbour environment for the benefit of

visitors, workers and residents. This positive achievement is set

against the emergence of economic challenges of higher energy and

interest costs which have undermined profitability in the past

year. Looking to the future, in order to maintain the momentum with

current strategic plans, the Company is in discussions with the

current development funder, based on the productive results of the

work to date, towards securing the additional financing for

development of the Company's existing land assets in the coming

year. We look forward to updating the market in due course.

Philip Beinhaker

EXECUTIVE CHAIRMAN

31 July 2023

Consolidated Income Statement for

the year ended 31 March 2023

2023 2022

GBP000 GBP000

Revenue 8,161 7,194

Cost of sales (5,915) (4,846)

Gross profit 2,246 2,348

------------ ------------

Fair value adjustments on investment properties and fixed assets (1,925) 195

Administrative expenses (1,193) (1,193)

Operating ( loss)/profit (872) 1,350

------------ ------------

Finance income 1 -

Finance costs (1,150) (789)

------------ ------------

Net finance costs (1,149) (789)

------------ ------------

(Loss)/Profit before tax from continuing operations (2,021) 561

Taxation charge on (l oss) /profit from continuing operations (15) (820)

------------ ------------

(Loss) for the year from continuing operations (2,036) (259)

------------ ------------

(Loss) for the year attributable to owners of the parent (2,036) (259)

============ ============

Basic and diluted (loss) per share

from continuing operations

Diluted (loss) per share (1.57p) (0.20p)

From continuing operations (1.57p) (0.20p)

Consolidated Statement of Other Comprehensive Income for

the year ended 31 March 2023

2023 2022

GBP000 GBP000

(L oss) for the year (2,036) (259)

Items that will not be reclassified subsequently to profit or loss:

Revaluation of property, plant and equipment 2,435 7,016

Deferred tax in respect of property revaluation (543) (1,116)

Items that may be reclassified subsequently to profit or loss:

Effective portion of changes in fair value of cash flow hedges - -

Other comprehensive income for the year, net of tax 1,892 5,900

------------ ------------

Total comprehensive (loss)/income for the year attributable to owners of the parent (144) 5,641

============ ============

Consolidated Balance Sheet

As at 31 March 2023

2023 2022

GBP000 GBP000

Non-current assets

Property, plant and equipment 38,540 36,398

Investment property 17,205 18,195

Inventories 13,363 13,216

69,108 67,809

------------ ------------

Current assets

Inventories 23,749 18,734

Trade and other receivables 2,092 1,810

Tax recoverable 5 9

Cash and cash equivalents 1,095 970

26,941 21,523

------------ ------------

Total assets 96,049 89,332

------------ ------------

Current liabilities

Bank Loans 3,200 -

Other Loans 5,477 2,275

Trade and other payables 3,301 1,880

Lease liabilities 66 165

Deferred income 2,132 2,225

14,176 6,545

------------ ------------

Non-current liabilities

Bank loans 21,600 22,863

Lease liabilities 10 75

Deferred government grants 646 646

Deferred tax liabilities 3,550 2,992

25,806 26,576

------------ ------------

Total liabilities 39,982 33,121

------------ ------------

Net assets 56,067 56,211

============ ============

Issued capital and reserves attributable

to owners of the parent

Share capital 16,406 16,406

Share premium 13,972 13,972

Other reserves 24,072 22,180

Retained earnings 1,617 3,653

Total equity 56,067 56,211

============ ============

Consolidated Statement

of Changes

in Equity

For the year ended 31

March 2023

Share Share Revaluation Merger Hedging Retained Total

capital premium reserve reserve reserve earnings equity

------------Other reserves------------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------- -------- ---------------- ----------- ----------- --------- -------

Balance at 1 April

2021 16,266 10,695 12,409 3,871 - 3,912 47,153

Comprehensive income

Loss for the year - - - - - (259) (259)

Other comprehensive

income

Share Issue 140 3,277 - - - - 3,417

Revaluation of property,

plant and equipment - - 7,016 - - - 7,016

Deferred tax on revaluation - - (1,116) - - - (1,116)

Total comprehensive

income 140 3,277 5,900 - - (259) 9,058

-------- -------- ---------------- ----------- ----------- --------- -------

Balance at 1 April

2022 16,406 13,972 18,309 3,871 - 3,653 56,211

Comprehensive income

Loss for the year - - - - - (2,036) (2,036)

Other comprehensive

income

Share issue - - - - - -

Revaluation of property,

plant and equipment - - 2,435 - - - 2,435

Deferred tax on revaluation - - (543) - - - (543)

Total other comprehensive

income - - 1,892 - - (2,036) (144)

-------- -------- ---------------- ----------- ----------- --------- -------

Total balance at 31

March 2023 16,406 13,972 20,201 3,871 - 1,617 56,067

======== ======== ================ =========== =========== ========= =======

Consolidated Cash Flow Statement

For the year ended 31 March 2023

2023 2022

GBP000 GBP000

------- ------------

Cash (used in)/generated from total operating

activities (2,658) 59

Cash flows from investing activities

Net expenditure on investment property (935) (52)

Expenditure on property, plant and equipment (97) (196)

Proceeds from disposal - 262

Cash (used/(generated) in investing activities (1,032) 14

------- ------------

Cash flows from financing activities

Proceeds from issue of share capital - 3,417

Interest paid (1,009) (1,033)

Loan drawdown 7,263 (2,337)

Loan repaid (2,275) -

Lease finance received - 62

Cash payments of lease liabilities (164) (148)

Grants received - 8

Net cash generated/(used) from financing activities 3,815 (31)

------- ------------

Net increase in cash and cash equivalents 125 42

Cash and cash equivalents at beginning of the

year 970 928

Cash and cash equivalents at end of the year 1,095 970

------- ------------

Reconciliation of financing activities for the year ended 31 March 2023

Cash

2023 flow 2022 Cash flow 202 1

GBP000 GBP000 GBP000 GBP000 GBP000

------- ------- ------- ---------- -------

Bank loans 24,800 2 ,000 22,800 (2,400) 25,200

Other loans 6,306 3,968 2,338 63 2,275

------- ------- ------- ---------- -------

Lease liabilities 7 6 ( 164) 240 (87) 327

------- ------- ------- ---------- -------

Total debt 31,182 5,804 25,378 (2,424) 27,802

------- ------- ------- ---------- -------

Segment results

For the year ended 31 March 2023

Real

Marine Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- ------------ ------------- --------

Revenue 6,016 1,374 771 - 8,161

Segmental Gross

Profit before

Fair value adjustment

and unallocated

expenses 974 965 449 (142) 2,246

Fair value adjustment

on investment

properties and

fixed assets (1,925) - - (1,925)

------- -------- ------------ ------------- --------

Segmental Profit 321

Unallocated:

Administrative

expenses (1,193)

Operating profit (872)

Financial income 1

Financial expense (1,150)

--------

Profit before

tax from continuing

activities (2,021)

Taxation (15)

--------

Loss for the

year from continuing

operations (2,036)

--------

Depreciation

charge

Marine 355

Car Parking 19

Administration 16

----

390

----

Year ended Real

31 March 2022 Marine Estate Car Parking Regeneration Total

GBP000 GBP000 GBP000 GBP000 GBP000

------- -------- ------------ ------------- --------

Revenue 4,771 1,427 736 260 7,194

Gross profit

prior to non-recurring

items 1,199 922 389 (162) 2,348

Fair value adjustment

on investment

properties and

fixed assets (185) 380 - - 195

------- -------- ------------ ------------- --------

Segment profit 2,543

Unallocated:

Administrative

expenses (1,193)

Operating profit 1,350

Finance income -

Finance expenses (789)

--------

Loss before

tax from continuing

activities 561

Taxation (820)

--------

Loss for the year from continuing operations (259)

Depreciation

charge

Marine 335

Car Parking 40

Administration 17

----

392

----

Notes to the Consolidated Financial Statements

1. General Accounting Policies

Basis of preparation

The results for the year to 31 March 2023 have been extracted

from the audited consolidated financial statements, which are

expected to be published by mid-August 2023.

The financial information set out above does not constitute the

Company's statutory accounts for the years to 31 March 2023 or 2022

but is derived from those accounts. Statutory accounts for the year

ended 31 March 2022 were delivered to the Registrar of Companies

following the Annual General Meeting on 22 September 2022 and the

statutory accounts for 2023 are expected to be published on the

Group's website (www.suttonharbourgroup.com) shortly, posted to

shareholders at least 21 days ahead of the Annual General Meeting

("AGM") to be held on 13 September 2023 and, after approval at the

AGM, delivered to the Registrar of Companies.

The auditor, PKF Francis Clark, has reported on the accounts for

the year ended 31 March 2023; their report includes a reference to

the valuation of Plymouth City Airport (former airport site) to

which the auditors drew attention by way of emphasis of matter

without qualifying their report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR WPUAAMUPWGQG

(END) Dow Jones Newswires

August 01, 2023 02:00 ET (06:00 GMT)

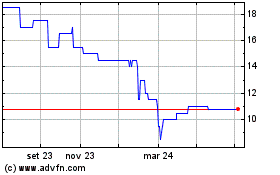

Grafico Azioni Sutton Harbour (LSE:SUH)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Sutton Harbour (LSE:SUH)

Storico

Da Mag 2023 a Mag 2024