TIDMSVE

RNS Number : 7113B

Starvest PLC

06 June 2023

6 June 2023

Half-year report - six months ended 31 March 2023

Chairman's statement

Over the six months to 31 March 2023, Starvest (the "Company")

benefited somewhat from the resilience of the natural resources

sector in an atmosphere of continued inflation and economic effects

of conflict in eastern Europe. Commodity prices, including gold,

remain ed relatively high, providing a solid foundation for our

investee companies.

The Company's portfolio value and net asset value increased 5%

and 3% respectively during the six months to 31 March 2023, since

the Company's financial year-end. Our discount to net asset value

was 31% on 31 March 2023, compared to a discount of 29% on 30

September 2022.

The natural resources sector is forecast to continue to make

gains in the post-pandemic economic recovery period. We also expect

the sector to benefit from large-scale infrastructure and

climate-focused projects at the forefront of government spending

plans and private sector investment.

As part of routine operations, the Board regularly reviews its

portfolio positions and may make adjustments to its holdings to

take advantage of market conditions. The Board is currently

considering opportunities more likely to better align the intrinsic

value of the Company's portfolio with shareholder interests.

During the last six months, Greatland Gold (LON:GGP), which

makes up substantially the largest part of our portfolio value,

advanced its Paterson projects. Havieron, a joint venture with

Newcrest Mining, continued to increase the resource base at the

project through surface drilling, and decline development has

accelerated over the period; a definitive feasibility study is

expected before the end of calendar 2023. During May 2023, Havieron

joint venture partner Newcrest Mining accepted a US$19.1 billion

buyout offer from the world's largest gold miner, Newmont. We

believe this will bring a positive new dynamic to the Paterson

project area over the coming months. Greatland is also

concentrating on early-stage exploration targets within its other

licences and has reported significant drill results in 100%-owned

Rudall tenement, as well as strong mineralisation pathfinders at

100%-owned Scallywag, and a new joint venture agreement with Rio

Tinto allowing Greatland to explore an additional 1,884sq km of

prospective terrain in the Paterson region.

Ariana Resources (LON:AAU) continues to focus on exploration and

development in south-eastern Europe, in particular with work on the

Tavsan mine infrastructure in Türkiye. Its 75%-held subsidiary,

West Tethyan Resources, signed an earn-in agreement on a gold

project in Kosova. West Tethyan currently has a strategic agreement

with Ariana and Newmont stemming from the five-year, US$2.5 million

strategic alliance Ariana has with Newmont.

Following the release of a definitive feasibility study in late

November 2022, Cora Gold (LON:CORA) completed a capital raise of

approximately US$20m in ordinary shares and convertible loans in

early March 2023. Funds will be used primarily to commence

development of the Company's flagship Sanankoro Gold Project in

southern Mali.

Kefi Minerals (LON:KEFI) continued with development of the Tulu

Kapi gold mine in Ethiopia and remains on target to start full

production during 2023, with full financing near completion. Kefi

has also made significant advances on its Saudi Arabia projects and

expects to complete a definitive feasibility study this year at the

Jabil Qitman gold project; and a pre-feasibility study is near

completion at its Hawiah copper-gold project.

Other investee companies continue their efforts as well. Oracle

Power (LON:ORCP) has recently revised its strategy to focus more on

green hydrogen energy in Pakistan, advancing plans for the project

with strategic partners in relation to land, fuel cell development

and offtake agreements. It also recently signed an MoU to continue

its coal power station plans in Pakistan; as well as entering a

farm-in agreement on its gold exploration assets in Western

Australia.

Sunrise Resources (LON:SRES) continues to advance its

pozzolan-perlite project in Nevada, USA towards mine permitting,

while Alba (LON:ALBA) is developing its Welsh gold deposits and its

spin-out company GreenRoc, in which it holds a 45% stake, advances

its Greenland graphite and ilmenite projects.

Despite the prolonged increases in global interest rates to stem

inflationary pressures, we continue to believe that the effects of

expansionary monetary policies, continued fiscal stimulus and

geopolitical tensions favour a positive outlook for gold and

precious metals in the longer term.

Callum N Baxter

Chairman

6 June 2023

Statement of Comprehensive Income

6 months 6 months Year ended

to 31 March to 31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

Administrative expenses (154,040) (155,472) (305,944)

(Loss)/gain on disposal of financial

assets - (29,383) (53,398)

Movement in fair value of financial

assets through profit and loss 308,500 (2,195,966) (7,234,928)

Investment income - 29,628 53,428

-------------- --------------- ----------------

Operating profit/(loss) 154,460 (2,351,193) (7,540,842)

Profit/(loss) on ordinary activities

before tax 154,460 (2,351,193) (7,540,842)

Tax on (loss) on ordinary activities - 587,798 1,671,086

-------------- --------------- ----------------

Profit/(loss) attributable

to equity holders of the parent 154,460 (1,763,395) (5,869,756)

============== =============== ================

Earnings per share - see note

3

Basic 0.26 pence (3.04 pence) (10.09 pence)

Diluted 0.26 pence (3.04 pence) (10.09 pence)

Statement of Financial Position

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2023 March 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

Non-current assets

Financial assets at fair

value through profit or

loss 6,464,672 11,625,035 6,156,173

------------- ------------ --------------

Total non-current assets 6,464,672 11,625,035 6,156,173

------------- ------------ --------------

Current assets

Trade and other receivables 36,768 53,615 77,424

Cash and cash equivalents 284,016 157,715 406,106

------------- ------------ --------------

Total current assets 320,784 211,330 483,530

------------- ------------ --------------

Current liabilities

Trade and other payables (33,069) (70,636) (41,776)

------------- ------------ --------------

Total current liabilities (33,069) (70,636) (41,776)

------------- ------------ --------------

Non-current liabilities

Provision for deferred tax - (1,083,288) -

------------- ------------ --------------

Total non-current liabilities - (1,083,288) -

------------- ------------ --------------

Net assets 6,752,387 10,682,441 6,597,297

============= ============ ==============

Capital and reserves

Called up share capital 582,824 581,144 582,824

Share premium account 1,888,863 1,868,696 1,888,863

Retained earnings 4,280,700 8,232,601 4,126,240

------------- ------------ --------------

Total equity shareholders'

funds 6,752,387 10,682,441 6,597,927

============= ============ ==============

Statement of Cash Flows

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2023 March 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Operating profit/(loss) 154,460 (2,351,192) (7,540,842)

Shares issued in settlement

of salaries and fees - 21,847 43,694

Movement in fair value of investments (308,499) 2,195,966 7,234,928

(Loss)/profit on sale of current

asset investments - 29,383 53,398

Decrease/(increase) in debtors 40,656 9,923 (13,885)

Decrease in creditors (8,707) (14,991) (43,851)

------------ ------------ --------------

Net cash used in operating

activities (122,090) (109,064) (266,558)

------------ ------------ --------------

Cash flows from investing activities

Sale of current asset investments - 188,503 594,388

Net cash generated from investing

activities - 188,503 594,388

------------ ------------ --------------

Net (decrease)/increase in

cash and cash equivalents (122,090) 79,439 327,830

Cash and cash equivalents at

beginning of period 406,106 78,276 78,276

------------ ------------ --------------

Cash and cash equivalents at

end of period 284,016 157,716 406,106

============ ============ ==============

Statement of Changes in Equity

Total Equity

Retained attributable

Share capital Share premium earnings to shareholders

GBP GBP GBP GBP

At 30 September 2021 579,820 1,848,173 9,995,996 12,423,989

============= ============= =========== ================

Loss for the period - - (1,763,395) (1,763,395)

Total recognised income

and expenses for the

period - - (1,763,395) (1,763,395)

Shares issued 1,324 20,523 - 21,847

Total contribution

by and distributions

to owners 1,324 20,523 - 21,847

At 31 March 2022 581,144 1,868,696 8,232,601 10,682,441

============= ============= =========== ================

Loss for the period - - (4,106,361) (4,106,361)

------------- ------------- ----------- ----------------

Total recognised income

and expenses for the

period - - (4,106,361) (4,106,361)

Shares issued 1,680 20,167 - 72,839

Total contribution

by and distributions

to owners 1,680 20,167 - 72,839

At 30 September 2022 582,824 1,888,863 4,126,240 6,597,927

============= ============= =========== ================

Profit for the period - - 154,460 154,460

Total recognised income

and expenses for the

period - - 154,460 154,460

Shares issued - - - -

Total contributions - - - -

by and distributions

to owners

At 31 March 2023 582,824 1,888,863 4,280,700 6,752,387

============= ============= =========== ================

Interim report notes

1. Interim report

The information relating to the six-month periods to 31 March

2023 and 31 March 2022 is unaudited.

The information relating to the year ended 30 September 2022 is

extracted from the audited accounts of the Company which have been

filed at Companies House and on which the auditors issued an

unqualified audit report.

2. Basis of preparation

This report has been prepared in accordance with applicable

United Kingdom accounting standards, including Financial Reporting

Standard 102 - 'The Financial Reporting Standard applicable in the

United Kingdom and Republic of Ireland' ('FRS102'), and with the

Companies Act 2006. Although the information included herein does

not constitute statutory accounts within the meaning of section 435

of the Companies Act 2006, the accounting policies that have been

applied are consistent with those adopted for the statutory

accounts for the year ended 30 September 2022.

The Company will report again for the full year to 30 September

2023.

The Company's investments at 31 March 2023 are stated at the

current market value based on market quoted prices at the close of

business on 31 March 2023. The Chairman's statement includes a

valuation based on market quoted prices at the close of business on

31 March 2023.

3. Earnings per share

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2023 March 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

Profit/(loss) for the period/

year: 154,460 (1,763,395) (5,869,756)

------------- --------------- ----------------

Weighted average number of

Ordinary shares of GBP0.01

in issue 58,282,493 58,080,245 58,181,646

------------- --------------- ----------------

Earnings per share - basic 0.27 pence (3.04 pence) (10.09 pence)

and diluted

============= =============== ================

Investment portfolio

Starvest now holds trade investments in the companies listed

below; of these the following companies comprise 99% of the

portfolio value as at 31 March 2023:

Exploration for gold in Wales,

* Alba Mineral Resources plc oil in England, lead-zinc in Ireland,

and investment in GreenRoc graphite

in Greenland

www.albamineralresources.com

Gold-silver production and exploration

* Ariana Resources plc in Turkey, and precious metal exploration

in Eastern Europe

www.arianaresources.com

Gold exploration in West Africa

* Cora Gold Limited www.coragold.com

Gold exploration and development

* Greatland Gold plc in Australia

www.greatlandgold.com

Gold and copper exploration and

* Kefi Minerals plc development in Ethiopia and Saudi

Arabia

www.kefi-minerals.com

Coal and green hydrogen development

* Oracle Power plc in Pakistan and gold exploration

in Australia

www.oraclepower.co.uk

Other direct and indirect mineral exploration companies:

Oil and gas exploration in Bulgaria

* Block Energy plc (formerly Goldcrest Resources plc) www.blockenergy.co.uk

Exploration for industrial minerals

* Sunrise Resources plc in United States, Finland, Australia

and Ireland

www.sunriseresourcesplc.com

Other investee companies are listed in the Company's 2022 annual

report available on request or from the Company web site -

www.starvest.co.uk

Copies of this interim report are available free of charge by

application in writing to the Company Secretary at the Company's

registered office, Salisbury House, London Wall, London EC2M 5PS,

by email to info@starvest.co.uk or from the Company's website -

www.starvest.co.uk

Enquiries to:

Starvest PLC

Mark Badros or Gemma Cryan 02077 696 876 or

info@starvest.co.uk

Grant Thornton UK LLP (Nomad)

Colin Aaronson, Harrison Clarke or Ciara Donnelly 02073 835

100

SI Capital Ltd (Broker)

Nick Emerson or Sam Lomanto 01483 413 500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUAWQUPWGQA

(END) Dow Jones Newswires

June 06, 2023 02:00 ET (06:00 GMT)

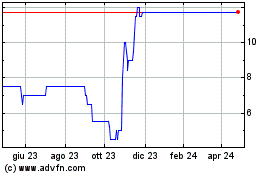

Grafico Azioni Starvest (LSE:SVE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Starvest (LSE:SVE)

Storico

Da Apr 2023 a Apr 2024