Tetragon Financial Group Limited Edison issues update on Tetragon Financial Group

11 Agosto 2023 - 8:15AM

RNS Non-Regulatory

TIDMTFG

Tetragon Financial Group Limited

11 August 2023

London, UK, 11 August 2023

Edison issues update on Tetragon Financial Group (TFG)

Tetragon Financial Group (Tetragon) reported a 1.7% ROE in H123

and its NAV increased by 1.7% in total return terms. The portfolio

gained 3.0% on the back of TFG Asset Management (which remains

Tetragon's largest asset, representing 50% of its NAV), private

equity assets and its direct listed equity investments, while the

remaining asset classes had a limited impact on NAV. Tetragon

targets returns uncorrelated with broader equity markets and a

10-15% ROE (9.9% on average over the last five financial years, and

11.4% pa since IPO). In H123 Tetragon was a net investor and

increased its credit facility utilisation to 75% (US$300m),

deploying capital predominantly into private equity assets and

hedge funds, and further supporting the growth of TFG Asset

Management.

As at end H123 Tetragon had US$300m of its US$400m credit

facility drawn, translating into net gearing of 9.5% (FY22: 6.1%,

FY21: net cash of 0.3%). This compares to US$113m of undrawn

commitments as at end-June (likely to be drawn gradually in the

coming years), of which roughly half was made to fully controlled

managers. In H123 Tetragon distributed US$43.5m in dividends and

share repurchases to its shareholders (in line with its four-year

semi-annual average of US$43.2m). Tetragon's cash position in H123

was supported by US$119.4m in disposals and distributions, of which

US$32.3m came from CLOs and US$9.1m from a dividend paid by

Equitix.

Click here to view the full report.

All reports published by Edison are available to download free

of charge from its website

www.edisongroup.com

About Edison: E dison is a leading research and investor

relations consultancy, connecting listed companies to the widest

pool of global investors. By focusing on the volume and quality of

investors reached - across institutions, family offices, wealth

managers and retail investors - Edison can create and gauge intent

to purchase, even in the darkest pools of capital, and then make

introductions via non-deal roadshows, events or virtual

meetings.

Having been the first company in-market 17 years ago, Edison has

more than 100 employees and covers every economic sector.

Headquartered in London, Edison also has offices in New York,

Sydney and Wellington.

Edison is authorised and regulated by the Financial Conduct

Authority .

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information, please contact Edison:

Milosz Papst +44 (0)20 3077 5700

investmenttrusts@edisongroup.com

Michal Mordel +44 (0)20 3077 5700

investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison

on:

LinkedIn www.linkedin.com/company/edison-group-/

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRABGGDIRDBDGXG

(END) Dow Jones Newswires

August 11, 2023 02:15 ET (06:15 GMT)

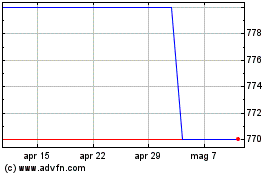

Grafico Azioni Tetragon Financial (LSE:TFGS)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tetragon Financial (LSE:TFGS)

Storico

Da Apr 2023 a Apr 2024