TIDMTHR

RNS Number : 9621M

Thor Energy PLC

20 September 2023

20 September 2023

Thor Energy Plc

("Thor" or the "Company")

Equity Placing to Accelerate Uranium Drilling

Wedding Bell and Radium Mountain Projects, USA

The directors of Thor Energy Plc ("Thor" or the "Company") (AIM,

ASX: THR, OTCQB: THORF) are pleased to announce a successful

capital raise of AUD$1m to accelerate exploration activities at the

Company's 100% owned uranium assets, located in the historic

uranium-vanadium mining district within the Uravan Mineral Belt, in

Colorado and Utah, USA (Figure 1).

Highlights:

-- The Company has raised gross proceeds of AUD$1m via a placing

of 23,809,524 new ordinary shares and Australian Securities

Exchange-listed ("ASX") CDI's ("Ordinary Shares") (the "Placing

Shares") at a price of AUD$0.042 (4.2 cents) per Ordinary Share

(the "Placing"), well above the 15 VWAP of $0.0384.

-- Strategic small placement limited to AUD$1m saw strong demand

with scale-backs.

-- Strong support was received from existing and new

shareholders, strengthening the Company's share register. GBA

Capital Pty Ltd acted as lead manager for the Placing.

-- Funds raised will be used to accelerate drilling activities

at the USA uranium and vanadium assets, including the proposed

4000m RC drilling program at the Radium Mountain/Wedding Bell

Project, Colorado followed by a maiden drilling campaign at

Vanadium King Project, Utah.

-- Drilling Contractor Boart Longyear is secured, with drilling

to commence in September 2023.

Nicole Galloway Warland, Managing Director of Thor Energy,

commented:

"We are very excited to complete this strategic placement of

AUD$1M to accelerate drilling at Rim Rock, Groundhog and Section 23

uranium prospects at the Radium Mountain/Wedding Bell Project, as

well as completing a maiden drilling program at our Vanadium King

Project. The recent airborne magnetic survey defined several

targets worthy of drill follow-up.

"We are highly encouraged to receive the ongoing support from

the Company's existing shareholders and are also delighted to

welcome new investors to our share register who recognise the

significant potential of our USA uranium portfolio.

"We look forward to updating the market in due course with the

development of our US drilling activities."

Figure 1: USA Uranium and Vanadium Project Location Map within

the Uravan Mineral Belt.

Capital Raise

The Company has raised gross proceeds of AUD$1,000,000 via the

placing of 23,809,524 Placing Shares at a price of AUD$0.042 per

Placing Share.

All placees will also receive one option for each Placing Shares

subscribed, being a total of 23,809,524 options (the "Placement

Options"). All Placement Options will be issued under the existing

ASX listed options (ASX: THROD) which are exercisable at AUD$0.09

(9 cents) and expire in January 2025.

The funds raised will be utilised for exploration activities at

the Company's uranium projects in the United States, as well as for

general working capital purposes.

The Placing price represents a discount of 6.67% to the last

ASX-traded price of AUD$0.045 on 15 September 23 but is a 9.38%

premium to the VWAP of the last 15 trading days, prior to that

date.

The Company will also grant 5,800,000 options to GBA Capital as

part consideration for services provided as lead manager for the

capital raise ("Broker Options"). These will be of the same class

as those options issued to Australian places (ASX: THROD), having

an exercise price of AUD$0.09 and expiring in January 2025.

Share Issue

The Company expects to issue 23,809,524 Ordinary Shares at

AUD$0.042 per share to raise AUD$1 million, and the 29,609,524 ASX

listed options utilising the Company's existing shareholder

authorities and placement capacity available under ASX listing

rules 7.1 and 7.1A.

Settlement and dealings

Application will be made for the Placing Shares to be admitted

to trading on ASX and AIM ("Admission") and it is expected that

Admission will become effective on or around 27 September 2023. The

Placing Shares will rank pari passu with the Company's existing

issued Ordinary Shares.

Total Voting Rights

For the purposes of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules ("DTRs"), following Admission of

the Placing Shares, Thor will have 269,350,808 Ordinary Shares in

issue with voting rights attached. Thor holds no shares in

treasury. The figure of 269,350,808 may be used by shareholders in

the Company as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in the Company, under the ASX Listing

Rules or the DTRs.

The Board of Thor Energy Plc has approved this announcement and

authorised its release.

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

For further information, please contact:

Thor Energy PLC

Nicole Galloway Warland, Managing Director Tel: +61 (8) 7324

Ray Ridge, CFO / Company Secretary 1935

Tel: +61 (8) 7324

1935

WH Ireland Limited (Nominated Adviser and Tel: +44 (0) 207

Joint Broker) 220 1666

Antonio Bossi / Darshan Patel

SI Capital Limited (Joint Broker) Tel: +44 (0) 1483

413 500

Nick Emerson

Yellow Jersey (Financial PR) thor@yellowjerseypr.com

Sarah Hollins / Shivantha Thambirajah / Tel: +44 (0) 20

Bessie Elliot 3004 9512

GBA Capital Pty Limited (Lead Manager) Tel: +61 (2) 9135

2902

Sebastian Jurd, Managing Director

Updates on the Company's activities are regularly posted on

Thor's website which includes a facility to register to receive

these updates by email, and on the Company's twitter page

@thorenergyplc

About Thor Energy Plc

The Company is focused on uranium and energy metals that are

crucial in the shift to a 'green' energy economy. Thor has a number

of highly prospective projects that give shareholders exposure to

uranium, nickel, copper, lithium and gold. Our projects are located

in Australia and the USA.

Thor holds 100% interest in three uranium and vanadium projects

(Wedding Bell, Radium Mountain and Vanadium King) in the Uravan

Belt Colorado and Utah, USA with historical high-grade uranium and

vanadium drilling and production results.

Thor owns 100% of the Ragged Range Project, comprising 92 km2 of

exploration licences with highly encouraging early-stage gold,

copper and nickel results in the Pilbara region of Western

Australia.

At Alford East in South Australia, Thor is earning an 80%

interest in oxide copper deposits considered amenable to extraction

via In-Situ Recovery techniques (ISR). In January 2021, Thor

announced an Inferred Mineral Resource Estimate(1).Thor also holds

a 30% interest in Australian copper development company

EnviroCopper Limited, which in turn holds rights to earn up to a

75% interest in the mineral rights and claims over the resource on

the portion of the historic Kapunda copper mine and the Alford West

copper project, both situated in South Australia, and both

considered amenable to recovery by way of ISR.(2)(3)

Thor holds 100% of the advanced Molyhil tungsten project,

including measured, indicated and inferred resources , in the

Northern Territory of Australia, which was awarded Major Project

Status by the Northern Territory government in July 2020. Thor

executed a $8m Farm-in and Funding Agreement with Investigator

Resources Limited (ASX: IVR) to accelerate exploration at the

Molyhil Project on 24th November 2022.(6)

Adjacent to Molyhil, at Bonya, Thor holds a 40% interest in

deposits of tungsten, copper, and vanadium, including Inferred

resource estimates for the Bonya copper deposit, and the White

Violet and Samarkand tungsten deposits. Thor's interest in the

Bonya tenement EL29701 is planned to be divested as part of the

Farm-in and Funding agreement with Investigator Resources

Limited.(6)

Notes

(1)

https://thorenergyplc.com/investor-updates/maiden-copper-gold-mineral-resource-estimate-alford-east-copper-gold-isr-project/

(2)

www.thorenergyplc.com/sites/thormining/media/pdf/asx-announcements/20172018/20180222-clarification-kapunda-copper-resource-estimate.pdf

(3)

www.thorenergyplc.com/sites/thormining/media/aim-report/20190815-initial-copper-resource-estimate---moonta-project---rns---london-stock-exchange.pdf

(4)

https://thorenergyplc.com/investor-updates/molyhil-project-mineral-resource-estimate-updated/

(5)

www.thorenergyplc.com/sites/thormining/media/pdf/asx-announcements/20200129-mineral-resource-estimates---bonya-tungsten--copper.pdf

(6)

https://thorenergyplc.com/wp-content/uploads/2022/11/20221124-8M-Farm-in-Funding-Agreement.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOELLMJTMTABBJJ

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

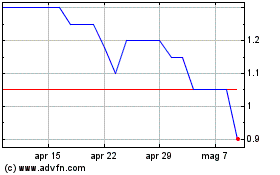

Grafico Azioni Thor Energy (LSE:THR)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Thor Energy (LSE:THR)

Storico

Da Mag 2023 a Mag 2024