TIDMTRB

RNS Number : 3793W

Tribal Group PLC

11 December 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

FOR IMMEDIATE RELEASE

11 December 2023

RECOMMED CASH ACQUISITION

of

Tribal Group Plc

by

Tiger Bidco 1 Ltd

(a newly formed company indirectly owned by Ellucian Company,

L.P.)

to be effected by means of a Scheme of Arrangement

under Part 26 of the Companies Act 2006

Results of adjourned Court Meeting and adjourned General Meeting

and Lapsing of Scheme

On 5 October 2023 the boards of Tiger Bidco 1 Ltd ("Bidco") and

Tribal Group plc ("Tribal") announced that they had reached

agreement on the terms of a recommended cash offer to be made by

Bidco to acquire the entire issued and to be issued share capital

of Tribal to be effected by means of a Court sanctioned scheme of

arrangement (the "Scheme") under Part 26 of the Companies Act 2006

(the "Acquisition").

On 1 November 2023, Tribal published and posted a circular to

Tribal Shareholders (the "Scheme Document"), setting out, amongst

other things, the background to, the terms of, and the reasons for

the Tribal Board recommending, the Acquisition. The Scheme Document

also contained, amongst other things, the Scheme and notices of the

Court Meeting and the General Meeting, which were convened for 27

November 2023. At the meetings held on 27 November 2023, both the

Court Meeting and General Meeting were adjourned until 12.00 p.m

and 12.15 p.m today, respectively.

Earlier today, Tribal convened the adjourned Court Meeting and

adjourned General Meeting in connection with the Acquisition.

At the adjourned Court Meeting, 135 out of 147 Scheme

Shareholders present and voting (whether in person or by proxy)

voted in favour of the Scheme, representing 68.29 per cent. in

value of the Scheme Shares. While the majority of Scheme

Shareholders voting and present at the Court Meeting voted in

favour of the Scheme, this did not meet the requirement that Scheme

Shareholders voting and present at the Court Meeting representing

75 per cent. or more in value of the Scheme Shares held by such

Scheme Shareholders must vote in favour of the Scheme.

At the adjourned General Meeting, 68.48 per cent. of the Tribal

Shareholders present and voting (whether in person or by proxy)

voted in favour of the Special Resolution, which was below the

minimum threshold (75 per cent. of those shares voted) needed to

approve the Special Resolution.

Further details of the voting results for the adjourned Court

Meeting and adjourned General Meeting are set out below.

Accordingly, certain of the conditions to the Scheme have not

been satisfied and the Scheme has lapsed.

The Court Hearing to sanction the Scheme, which was expected to

be held in the first quarter of 2024, will now not take place.

As a result, Tribal is no longer in an offer period as defined

by the City Code on Takeovers and Mergers (the "Code").

Voting results of the Court Meeting

The table below sets out the results of the poll at the

adjourned Court Meeting. Each Scheme Shareholder, present in person

or by proxy, was entitled to one vote per Scheme Share held at the

Voting Record Time.

Results Number % of Number of % of Number

of Court of Scheme Scheme Scheme Scheme of

Meeting Shareholders Shareholders Shares Shares Scheme

present present present and present Shares

and voting and voting voting in and voted

in person in person person or voting as a

or by proxy or by by proxy in % of

proxy person the

* or by issued

proxy* ordinary

share

capital*

FOR 135 91.84% 130,317,260 68.29% 61.41%

------------------------ ------------------------ ----------------------- ------------------- --------------------

AGAINST 12 8.16% 60,523,443 31.71% 28.52%

------------------------ ------------------------ ----------------------- ------------------- --------------------

TOTAL 147 100% 190,840,703 100% 89.93%

------------------------ ------------------------ ----------------------- ------------------- --------------------

*Rounded to two decimal places

Voting results of the General Meeting

The table below sets out the results of the poll at the

adjourned General Meeting. Each Tribal Shareholder, present in

person or by proxy, was entitled to one vote per Tribal Share held

at the Voting Record Time.

Special Resolution Number of Shares % of Shares present % of Shares

present and and voting in present

voting in person person or by proxy* and voting

or by proxy in person

or by proxy

as a % of

the issued

ordinary

share capital*

FOR 131,463,019 68.48% 61.95%

------------------ --------------------- ----------------

AGAINST 60,517,183 31.52% 28.52%

------------------ --------------------- ----------------

TOTAL 191,980,202 100% 90.46%

------------------ --------------------- ----------------

WITHHELD** 3,613 0.002% 0.002%

------------------ --------------------- ----------------

* Rounded to two decimal places

** A vote withheld is not a vote in law and is not counted in

the calculation of the proportion of votes 'For' or 'Against' the

Special Resolution

The total number of Tribal Shares in issue at the Voting Record

Time was 212,221,746. Tribal does not hold any ordinary shares in

treasury. Consequently, the total number of voting rights in Tribal

at the Voting Record Time was 212,221,746.

Capitalised terms used but not otherwise defined in this

announcement have the meanings given to them in the Scheme Document

published on 1 November 2023 in relation to the Acquisition.

Enquiries:

Tribal Enquiries via Alma

Richard Last, Chairman

Mark Pickett, Chief Executive Officer

Diane McIntyre, Chief Financial Officer

William Blair International, Limited

(Lead Financial Adviser and Rule 3 Adviser

to Tribal)

Dominic Emery

Hanan Lee

Tanya Sazonova

Henry Nicholls +44 20 7868 4440

Haris Chronopoulos

Investec Bank plc (Joint Financial Adviser,

NOMAD and Joint Broker to Tribal)

Virginia Bull

Nick Prowting

Carlo Spingardi

Tom Brookhouse +44 20 7597 5970

Singer Capital Markets Advisory LLP (Joint

Broker to Tribal)

Shaun Dobson

Tom Salvesen

Alex Bond +44 20 7496 3000

Alma Strategic Communications (PR Adviser

to Tribal)

Caroline Forde

Hannah Campbell +44 20 3405 0205

Notices

William Blair International, Limited ("William Blair"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority ("FCA"), is acting exclusively for Tribal and no

one else in connection with the subject matter of this Announcement

and will not be responsible to anyone other than Tribal for

providing the protections afforded to the clients of William Blair,

or for providing advice in connection with the subject matter of

this Announcement. Neither William Blair nor any of its

subsidiaries, branches or affiliates owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of William Blair in connection with the

subject matter of this Announcement, any statement contained herein

or otherwise.

Investec Bank plc ("Investec"), which is authorised in the

United Kingdom by the Prudential Regulation Authority ("PRA") and

regulated in the UK by the FCA and the PRA, is acting exclusively

for Tribal and no one else in connection with the subject matter of

this Announcements and shall not be responsible to anyone other

than Tribal for providing the protections afforded to clients of

Investec, nor for providing advice in connection with the

Acquisition or any matter referred to herein. Neither Investec nor

any of its subsidiaries, branches or affiliates owes or accepts any

duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of Investec in connection with

the subject matter of this Announcement, any statement contained

herein or otherwise.

Singer Capital Markets Advisory LLP ("Singer Capital Markets"),

which is authorised and regulated in the UK by the FCA, is acting

exclusively for Tribal and no one else in connection with the

subject matter of this Announcement and shall not be responsible to

anyone other than Tribal for providing the protections afforded to

clients of Singer Capital Markets, nor for providing advice in

connection with the Acquisition or any matter referred to herein.

Neither Singer Capital Markets nor any of its subsidiaries,

branches or affiliates owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Singer Capital Markets in connection with the

subject matter of this Announcement, any statement contained herein

or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OUPFFMFLFEDSEIE

(END) Dow Jones Newswires

December 11, 2023 09:58 ET (14:58 GMT)

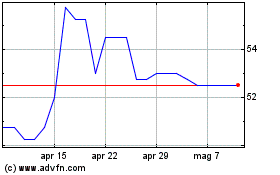

Grafico Azioni Tribal (LSE:TRB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tribal (LSE:TRB)

Storico

Da Apr 2023 a Apr 2024