TIDMTRIN

RNS Number : 9162N

Trinity Exploration & Production

28 September 2023

This announcement contains inside information as stipulated

under the UK version of the Market Abuse

Regulation No 596/2014 which is part of English Law by virtue of

the European (Withdrawal) Act 2018, as

amended. On publication of this announcement via a Regulatory

Information Service, this information is

in the public domain.

28 September 2023

Trinity Exploration & Production plc

("Trinity" or "the Company" or "the Group")

Interim Results

Resilient base business supporting transformation catalysts

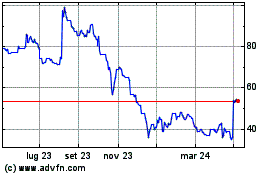

Trinity Exploration & Production plc (AIM: TRIN) , the

independent E&P company focused on Trinidad and Tobago

("T&T"), announces its unaudited interim results for the

six-month period ended 30 June 2023 ("H1 2023" or "the

Period").

Strategic Highlights

-- Jacobin-1 was confirmed as an oil discovery on 7 August 2023.

Subsequently, the Well Services Limited Rig 60 drilling rig rigged

down and a heavy-duty workover rig, Rigtech Rig # 9 , mobilised to

the wellsite to run the completion, perforate and tie the well into

production facilities. Final testing of equipment is currently in

progress and initial production is anticipated within days. Oil

produced will immediately be sold to the state oil company,

Heritage .

-- Trinity was successful in its bid for the onshore Buenos

Ayres block, further leveraging our competitive advantage in the

Palo Seco area, onshore Trinidad subject to receiving the licence

from the Ministry of Energy.

-- The Company is progressing, with Petrofac, a Concept

Screening study for the development of further reserves and

resources in its Galeota Block. Initial findings from Petrofac's

study are encouraging. These concepts are now being economically

assessed and ranked and, together with development studies on the

existing Trintes field, will form part of an integrated approach to

unlock further value from Trinity's East Coast Asset.

-- Gas sampling and analyses that will underpin the Company's

evaluation of its Scope 1 emissions was completed during the

period. In H2 2023 analysis of gas rate quantification will be

undertaken to enable the Company to quantify its Scope 1 emissions

by the end of the year.

H1 2023 Operational Highlights

H1 2023 saw production levels broadly maintained against H1 2022

with a programme of recompletions and workovers.

-- H1 2023 average net sales volume was 2,861 bopd (H1 2022: 2,974 bopd).

Sales volumes were supported by three recompletions ("RCPs") (H1

2022: 11) and 6 2 workovers and reactivations ("WOs") (H1 2022: 61)

undertaken during the Period including 7 workovers started at the

end of 2022 completed in 2023, with swabbing continuing across the

onshore and West Coast assets. Four additional RCPs are being

worked up for execution in H2 2023.

-- The ABM-151 well in the Brighton Marine block, offshore the

West Coast of Trinidad, was returned to production on 21 March 2023

following an extensive refurbishment of surface facilities and the

installation of remote surveillance technology. Between restart and

the end of the period the well flowed at an average rate of 175

bopd. The well produced on average 130 bopd during H1 2023 and

Trinity continues to monitor the well closely.

H1 2023 Financial Highlights

-- Average oil price realisation of USD 65.2/bbl for H1 2023 (H1

2022: USD 90.1/bbl). During the Period, the realised price that the

Company received for Onshore and West Coast oil sales was an

average discount of 20.6% to Brent; wider than the standard

discount of approximately 15%. East Coast oil sales are made under

a fixed arrangement that is a 15% discount to Brent.

The Company remains unhedged.

-- Cash balance of USD 11.3 million as at 30 June 2023 (YE 2022:

USD 12.1 million) reflecting a combination of strong operating cash

generation, no hedging or hedging losses incurred and limited

investment in capex, including only the initial cost to support the

drilling of Jacobin-1. The Jacobin-1 drilling and completion costs

are anticipated to exceed initial estimates due to additional

drilling days as a result of drilling challenges encountered and

additional testing and data acquisition scope than originally

considered. While the impact of the increased well costs will

result in lower than anticipated cash balances, we remain on track

to continue to invest in our growth options and commence our maiden

interim dividend.

-- Strong net cashflows generated from operating activities as

at H1 2023 USD 6.3 million (H1 2022: USD 2.9 million).

-- Revenues were reduced 30% to USD 33.8 million (H1 2022: USD

48.5 million) driven by lower oil prices and, to a lesser extent,

lower volumes.

-- Cash operating costs of USD 20.1/bbl (H1 2022: USD 17.6/bbl)

driven by supply chain increases, increased maintenance activities

across the assets, including supporting labour to complete these

activities, and the overall impact of lower sales production (2,861

in H1 2023 vs 2,974 in H1 2022) contributed to the higher cash

operating costs (per bbl) in H1 2023 vs H1 2022 . This excludes the

initial cost incurred on the Trintes Bravo fire incident in H1 2023

of USD 0.1 million. Remediation work is expected to continue into

H2 2023.

-- General and administrative costs of USD 6.3/bbl (H1 2022: USD

6.6/bbl) mainly due to lower consultancy fees incurred and levies

driven by lower oil prices.

-- Average operating break-even for H1 2023 was moderately

increased at USD 34.5/bbl (unaudited) (H1 2022: USD 32.4/bbl)

resulting from a higher operating cost and slightly lower sales

volume .

-- The Group had drawn borrowings (overdraft) of USD 2.0 million

at 30 June 2023 (YE 2022: USD 2.7 million).

Corporate Highlights

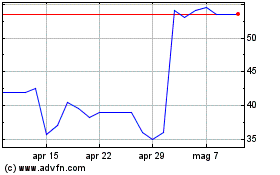

Inaugural Dividend

As announced in the Company's 2022 Full Year Results on 1 June

2023, the Group will pay its first interim dividend of 0.5 pence

per ordinary share to be paid on 26 October 2023 to all

shareholders on the register on 6 October 2023 (the "Record

Date").

The Dividend will be paid by electronic transfer. The Company's

Registrar will provide an option for non-UK shareholders to receive

payments in another currency.

Increased Overdraft Facility from USD 5.0 million to USD 8.0

million

Trinity agreed to an upsized credit facility with FirstCaribbean

International Bank (Trinidad & Tobago) Limited ("CIBC

FirstCaribbean") on 25 August 2023, providing for an increase of

the facility from USD 5 million to USD 8 million.

The increased facility will provide Trinity with the flexibility

to follow-up on the play-opening Jacobin-1 well, targeting further

onshore activity and to progress development planning for the

Company's material Galeota East Coast offshore asset.

Jeremy Bridglalsingh, Chief Executive Officer of Trinity,

commented:

"The first six months of 2023 saw Trinity progressing important

catalysts within our refreshed strategy.

First, our Jacobin-1 well successfully intersected multiple

oil-bearing sands. Success with Jacobin increases our confidence in

the portfolio of Hummingbird prospects that forms a cornerstone of

our revitalised onshore strategy.

Second, in June we were successful in our bid for the Buenos

Ayres block which lies immediately to the west of our existing Palo

Seco licences. We have started the acquisition of the Buenos Ayres

EIA ahead of the formal award of the licence to progress this

strategic option with pace.

Third, we appointed Petrofac to undertake a Concept Screening

study for the development of further reserves and resources on our

Galeota East Coast asset, using a low cost, more flexible approach

than originally envisaged.

Lastly, our maiden interim dividend will be paid in October,

representing an important aspect of our capital allocation policy

that was designed to provide our shareholders with a cash return,

in addition to the growth options currently being pursued.

I look forward to continuing to update shareholders on our

further progress at a very busy and exciting time for Trinity

".

Enquiries

Trinity Exploration & Production Via Vigo Consulting

Jeremy Bridglalsingh, Chief Executive

Officer

Julian Kennedy, Chief Financial Officer

Nick Clayton, Non-Executive Chairman

SPARK Advisory Partners Limited (Nominated

Adviser & Financial Adviser)

Mark Brady

James Keeshan +44 (0)20 3368 3550

Cavendish Securities plc (Broker)

Leif Powis (Corporate Broking) +44 (0)20 7397 8900

Neil McDonald +44 (0)131 220 6939

Vigo Consulting Limited t rinity @vigoconsulting.com

Finlay Thomson/Patrick d' Ancona +44 (0)20 739 0 0230

About Trinity ( www.trinityexploration.com )

Trinity is an independent oil production company focused solely

on Trinidad and Tobago. Trinity operates producing and development

assets both onshore and offshore, in the shallow water West and

East Coasts of Trinidad. Trinity's portfolio includes current

production, significant near-term production growth opportunities

from low-risk developments and multiple exploration prospects with

the potential to deliver meaningful reserves/resources growth. The

Company operates all of its ten licences and, across all of the

Group's assets, management's estimate of the Group's 2P reserves as

at the end of 2022 was 17.96 mmbbls. Group 2C contingent resources

are estimated to be 48.88 mmbbls. The Group's overall 2P plus 2C

volumes are therefore 66.84 mmbbls.

Trinity is quoted on AIM, a market operated and regulated by the

London Stock Exchange Plc, under the ticker TRIN.

Qualified Person's Statement

The technical information contained in the announcement has been

reviewed and approved by Mark Kingsley, Trinity's Chief Operating

Officer. Mark Kingsley (BSc (Hons) Chemical Engineering, Birmingham

University) has over 35 years of experience in international oil

and gas exploration, development and production and is a Chartered

Engineer.

Disclaimer

This document contains certain forward-looking statements that

are subject to the usual risk factors and uncertainties associated

with the oil exploration and production business. Whilst the Group

believes the expectation reflected herein to be reasonable in light

of the information available to it at this time, the actual outcome

may be materially different owing to macroeconomic factors either

beyond the Group's control or otherwise within the Group's

control.

Summary of 2023 half-year performance

OPERATIONAL REVIEW

The Group achieved net sales of 2,861 bopd in H1 2023 (H1 2022:

2,974 bopd). Investment into production related activities such as

RCPs, workovers and swabbing, together with the already automated

wells enabled the Company to maintain a half year production rate

broadly in line with H1 2022.

Annual and Half Year Sales by Region

12m 2022 H1 2022 H2 2022 H1 2023

Onshore 1,655 1,688 1,623 1,512

East Coast 1,051 1,037 1,065 1,011

West Coast 269 249 288 338

Total 2,975 2,974 2,976 2,861

Onshore operations

-- H1 2023 average net sales were 1,512 bopd, a 10.4% decrease

on 2022 (H1 2022 1,688 bopd). This movement i s attributed to

expected natural decline coupled with deferral in volumes due to an

unplanned electrical interruption, which caused temporary shut in

for certain key wells in Q2 2023. Trinity continues to progress its

automation initiative to minimise the effects of electrical

shutdowns. A total of 54 WOs and reactivations were completed in H1

2023 (H1 2022: 43) in conjunction with 3 RCPs completed in H1 2023

(H1 2022: 11).

The H2 2023 work programme involves the progression of 4 RCPs

and ongoing base management via WOs, reactivations and swabbing

across all onshore fields.

East Coast operations

-- H1 2023 average net sales was 1,011 bopd (H1 2022: 1,037

bopd) an 2.5% decrease. The decrease in sales levels was as a

result of a combination of the impact of the Trintes Bravo

generator fire, mechanical failures of downhole pumps requiring

workovers, and delays to planned remedial platform topside work

which impacted the timing of returning the wells to production. A

total of 7 WOs were undertaken during H1 2023 (H1 2022: 13

WOs).

H2 2023 work programme will include routine WOs and

reactivations.

West Coast operations

-- H1 2023 average net sales were 338 bopd (H1 2022: 249 bopd).

The 35.7% increase in sales was the result of the successful

reactivation of ABM-151 and the continued stabilization of swabbing

production and stabilisation of the field's production. There was 1

WO conducted during this period (H1 2022: three WOs), and the

reactivation of ABM-151 produced at an average rate of 130 bopd

over the entire period.

H2 2023 work programme is expected to include continued

stabilisation of ABM-151, ongoing base management via WOs, and

swabbing operations.

H1 2023 Key Performance Indicators

The Group was profitable in H1 2023 under Alternative

Performance Measures ("APM") and IFRS basis. Lower oil price

realisations and relatively stable net sales volumes resulted in a

30% decrease in Revenues to USD 33.8 million (H1 2022: USD 48.5

million) and a 19% decrease in Adjusted EBITDA Note 20 in the

financial statements to USD 10.4 million (H1 2022: USD 12.8

million). The Period-end cash balance was USD 11.3 million (H1

2022: USD 15.0 million) marginally lower from the opening position

at the start of the period of $12.1 million. A summary of the

period-on-period operational and financial highlights are set out

below:

H1 2023 H1 2022 Change

%

Average realised oil price(1) USD/bbl 65.2 90.1 (28)

Average net sales(2) bopd 2,861 2,974 (4)

Revenues USD million 33.8 48.5 (30)

Cash balance USD million 11.3 15.0 (25)

IFRS Results

Operating Profit before SPT USD million 5.8 5.4 8

Total Comprehensive Income/(loss) USD million 0.7 (0.7) 197

Earnings per share - diluted USD cents 1.7 (0.9) 291

APM Results ( APM measures exclude non-cash items)

Adjusted EBITDA(3) USD million 10.4 12.8 (19)

Adjusted EBITDA(4) USD/bbl 20.1 23.7 (15)

Adjusted EBITDA margin(5) % 30.8 26.3 17

Adjusted EBIDA after Current

Taxes(6) USD million 6.7 4.8 40

Adj. EBIDA after Current Taxes

per share - diluted US cents 16.9 11.4 48

Consolidated operating break-even

(7) USD/bbl 34.5 32.4 6

Net cash plus working capital

surplus(8) USD million 10.9 18.6 (41)

Notes:

1. Realised price: Actual price received for crude oil sales per barrel ("bbl").

2. Average net sales: This refers to average sales attributable

to Trinity per day for all operations; lease operatorships,

farm-out operations and joint ventures.

3. Adjusted EBITDA: Operating Profit before Taxes for the

period, adjusted for Depreciation, Depletion & Amortisation

("DD&A") and other non-cash expenses, namely Share Option

Expenses, Impairment of Financial Assets, FX Gains/Losses and Fair

Value Gains/Losses on Derivative financial instruments. Adjusted

EBITDA for 2021 updated to include Covid-19 Expense

4. Adjusted EBITDA (USD/bbl): Adjusted EBITDA/sales volume over the Period.

5. Adjusted EBITDA Margin (%): Adjusted EBITDA/Revenues.

6. Adjusted EBIDA after Current Taxes: Adjusted EBITDA less

Supplemental Petroleum Taxes ("SPT"), Petroleum Profits Tax ("PPT")

and Unemployment Levy ("UL").

7. Group operating break-even: The realised price/bbl where the

Adjusted EBITDA/bbl for the Group is equal to zero.

8. Net cash plus working capital surplus: Current Assets less

Current Liabilities (other than Derivative financial asset /

liability and Provision for other liabilities).

FINANCIAL REVIEW

Income Statement Analysis

H1 2023 H1 2022 Change

Production

Average realised oil price (USD/bbl) 65.2 90.1 (25)

Average net Sales (bopd) 2,861 2,974 (113)

Statement of Comprehensive Income USD'000 USD'000 USD'000

Operating revenues 33,754 48,515 (14,761)

Operating expenses (including realised

Derivative expense and Covid-19 costs

but excluding Non-cash items and SPT) (23,367) (35,712) 12,345

--------------------------------------------- --------- --------- ---------

Operating profit before Non-cash items

and SPT 10,387 12,803 (2,416)

DD&A (4,472) (3,884) (588)

Other Non-Cash Items (87) (3,568) 3,481

--------------------------------------------- --------- --------- ---------

Operating profit before SPT 5,828 5,351 477

SPT (3,247) (5,049) 1,802

Operating profit before exceptional

items 2,581 302 2,279

Exceptional items (371) - (371)

--------------------------------------------- --------- --------- ---------

Operating Profit after Exceptional

items 2,210 302 1,908

Finance income 25 24 1

Finance cost (1,124) (648) (476)

--------------------------------------------- --------- --------- ---------

Profit/(Loss) Before Taxation 1,111 (322) 1,433

Income Taxation expense (428) (76) (352)

--------------------------------------------- --------- --------- ---------

Profit/(Loss) After Taxation 683 (398) 1,081

Total Comprehensive Income/(Loss) for

the period

Exchange differences on translation

of foreign operations (6) (324) 318

--------------------------------------------- --------- --------- ---------

Total Comprehensive Income/(Loss) 677 (722) 1,399

Operating Revenues

Operating revenues of USD 33.8 million (H1 2022: USD 48.5

million) decreased due to lower realised oil prices and marginally

declining production volumes sold in the Period .

Operating expenses (excluding Non-cash items)

Operating expenses (excluding non-cash items) of USD (23.4)

million (H1 2022: USD (35.7) million) comprised:

-- Royalties of USD (9.7) million (H1 2022: USD (16.2) million),

mainly due to lower average oil prices and marginal decrease in

sales volume.

-- Production costs ("Opex") of USD (10.4) million (H1 2022: USD

(9.5) million), increased driven by supply chain increases,

increased repairs and maintenance activities across the Group's

assets including supporting labour to complete these

activities.

-- G&A expenditure of USD (3.3) million (H1 2022: USD (3.6)

million), mainly due to lower consultancy fees incurred and levies

driven by lower oil prices.

-- Realised derivative expense of nil. The Group is unhedged,

all hedging instruments expired on 31 December 2022 (H1 2022: (6.0)

million on account of effective hedging instruments during that

period and high oil prices).

-- COVID-19 related costs nil (H1 2022: USD (0.4) million).

Non-cash operating expenses

Non-cash operating expenses comprised:

-- Depreciation, Depletion and Amortisation ("DD&A") charges

of USD (4.5) million (H1 2022: USD (3.9) million).

-- Unrealised derivative (expenses)/income nil (H1 2022: USD

(3.2) million comprising the movement in the fair valuation of

effective crude oil derivatives during the period). There are no

hedging instruments effective for 2023.

-- Share option expense USD (0.3) million (H1 2022: USD (0.3) million).

-- Foreign exchange gain USD 0.1 million (H1 2022: USD 0.0 million).

Operating Profit Before Supplemental Petroleum Taxes ("SPT")

The operating profit before SPT for the Period amounted to USD

5.8 million (H1 2022: USD 5.4 million). The increase is mainly due

to a combination of lower revenues, no derivative expenses in 2023,

lower taxes and levies due to lower oil prices in 2023 and

effective cost management.

SPT

The Group incurred SPT charges in relation to its offshore

assets in H1 2023 of USD (3.3) million (H1 2022: (5.0) million), on

account of the realised oil price being higher than USD 50.0/bbl

throughout the Period. The onshore assets did not incur any SPT

liability as the realised price was below the SPT threshold of USD

75.0/bbl and there is an amount of unused Investment Tax Credit

("ITC") of USD 1.8 million which will be carried forward for future

use, limited to a one-year period. SPT is classified as "operating

expenses" rather than "income taxation" under IFRS.

Exceptional items

Exceptional items charge of USD (0.4) million (H1 2022: USD

(0.0) million) relates to:

-- USD (0.3) million incidental one-off costs due to the Cyber

incident which occurred in December 2022.

-- USD (0.1) million costs were incurred in the Period due to

the Trintes Bravo fire incident which occurred in H1 2023.

Net Finance Cost

Net finance costs for the period of USD (1.1) million (H1 2022:

USD (0.6) million), comprising:

-- Unwinding of the discount on the decommissioning provision of

USD (1.1) million (H1 2022: USD (0.6) million) mainly due to the

increase in the decommission provision from H1 2022.

Income Taxation

Taxation charge for the period was USD (0.4) million (H1 2022:

USD (0.1) million), comprising:

-- Petroleum Profits Tax ("PPT") of USD (0.3) million (H1 2022: USD (2.1) million).

-- Unemployment Levy ("UL") of USD (0.1) million (H1 2022: (0.8) million).

-- Deferred tax assets of nil (H1 2022: USD 2.8 million credit), refer to note 16.

As at 30 June 2023, the Group had unrecognised tax losses of USD

199.3 million (H1 2022: 207.4 million) which have no expiry

date.

Total Comprehensive Income/(Loss)

Total Comprehensive Income for the Period was USD 0.7 million

(H1 2022: USD (0.7) million loss).

Cash Flow Analysis

Opening Cash Balance

Trinity began the year with an initial cash balance of USD 12.1

million (2022: USD 18.3 million).

Summary of Statement of Cash Flows

H1 2023 H1 2022

USD'000 USD'000

Opening cash balance 12,131 18,312

------------------------------------------- -------- --------

Cash movement

Cash inflow from operating activities 6,769 7,713

Changes in working capital (37) (1,922)

Income taxation paid (475) (2,882)

------------------------------------------- -------- --------

Net cash inflow from operating activities 6,257 2,909

Net cash outflow from investing activities (5,576) (5,707)

Net cash outflow from financing activities (1,603) (331)

------------------------------------------- -------- --------

Decrease in cash and cash equivalents (922) (3,129)

Effects of foreign exchange rates on

cash 92 (233)

------------------------------------------- -------- --------

Closing cash balance 11,301 14,950

=========================================== ======== ========

Net cash inflow from operating activities

Net cash inflow from operating activities was USD 6.3 million

(H1 2022: USD 2.9 million):

-- Operating activities for H1 2023 generated an operating cash

flow before changes in working capital and income taxes of USD 6.8

million (H1 2022: USD 7.7 million).

-- Changes in working capital resulted in a net decrease of USD

0.0 million (H1 2022: net decrease of USD (1.9) million).

-- Income Taxation - PPT and UL paid USD (0.5) million (H1 2022:

USD (2.9) million) resulting from lower taxable profits resulting

from lower oil price.

Cash outflow from investing activities

Investing cash outflows for H1 2023 was USD (5.6) million (H1

2022: USD (5.7) million) which included infrastructure investments

across Trinity's assets, production capex including RCPs in H1

2023, ABM-151 reactivation, drilling planning and long lead

investment for Jacobin-1 exploration well, subsurface capex and

exploration and evaluation capex.

Net cash outflow from financing activities

The financing cash outflow for H1 2023 was USD (1.6) million,

comprising USD (0.7) million repayment of bank overdraft, USD (0.3)

million cash payment on leases and USD (0.6) million in purchase of

treasury shares.

Closing Cash Balance

Trinity's cash balance at 30 June 2023 was USD 11.3 million (31

December 2022: USD 12.1 million).

Statement of Financial Position Analysis

H1 2023 YE 2022 Change

USD'000 USD'000 USD'000

Assets:

Non-current Assets 101,322 96,940 4,382

Current Assets 26,174 27,424 (1,250)

Liabilities:

Non-Current Liabilities 55,634 54,764 870

Current Liabilities 15,372 13,469 1,903

Equity and Reserves:

Capital and Reserves to Equity

Holders 56,490 56,131 359

Cash plus working capital

surplus 10,947 14,204 (3,257)

Non-current Assets

Non-current assets increased by USD 4.4 million to USD 101.3

million at H1 2023 from USD 96.9 million at YE 2022:

-- Property, plant and equipment USD 44.1 million (YE 2022: USD

45.0 million) decrease of USD 0.9 million mainly relates to USD 3.2

million additions less DDA of USD 4.1 million.

-- Intangible assets USD 38.8 million (YE 2022: USD 33.5

million) increase of USD 5.3 million mainly relates to accrued

additions for Jacobin-1 Well less amortization of USD 0.1 million

(YE 2022: USD 0.2 million).

-- Deferred tax asset of USD 12.5 million (YE 2022: USD 12.5 million).

-- Abandonment fund and performance bond of USD 5.3 million (YE 2022: USD 5.1 million).

-- Right of use asset of USD 0.6 million (YE 2022: USD 0.8

million) relating to motor vehicles, office building, staff house

and office equipment leases that met the recognition criteria of a

lease under IFRS 16.

Current Assets

Current assets decreased by USD 1.2 million to USD 26.2 million

at H1 2023 from USD 27.4 million at YE 2022:

-- Cash and cash equivalents of USD 11.3 million (YE 2022: USD

12.1 million). Reduction of USD 0.8 million mainly due to repayment

of overdraft facility (USD 0.7 million) and a combination of strong

operating cash generation being impacted by increased capex,

including the initial cost to support the drilling of

Jacobin-1.

-- Trade and other receivables of USD 9.8 million (YE 2022: USD 10.7 million).

o Trade and other receivables (less impairment) of USD 4.1

million (YE 2022: USD 4.6 million)

o VAT recoverable of USD 4.2 million (YE 2022: USD 4.5

million).

o Prepayments and other receivables (less impairment) of USD 1.5

million (YE 2022: USD 1.6 million).

-- Inventories USD 5.1 million (YE 2022: USD 4.6 million). The

increase is mainly due to added inventories to support the

Jacobin-1 well.

Non-current Liabilities

Non-current liabilities increased to USD 55.6 million at H1 2023

from USD 54.7 million at YE 2022, primarily due to:

-- Provision for other liabilities (predominantly

decommissioning costs) of USD 53.5 million (YE 2022: USD 52.5

million). The increase is mainly due to unwinding of the discount

rate at H1 2023.

-- Deferred tax liability USD 1.9 million (YE 2022: USD 1.9 million).

-- Lease liability of USD 0.2 million (YE 2022: USD 0.3 million).

Current Liabilities

Current liabilities increased to USD 15.4 million at H1 2023 (YE

2022: USD 13.5 million) primarily due to:

-- Trade and other payables of USD 12.8 million (YE 2022: USD 9.9 million).

o Trade payables of USD 3.7 million (YE 2022: USD 2.6

million).

o Accruals and other payables of USD 7.6 million (YE 2022: USD

5.1 million) mainly increased due to the Jacobin-1 Well costs

accrued.

o SPT payable of USD 1.5 million (YE 2022: USD 2.2 million).

-- CIBC FirstCaribbean bank overdraft facility USD 2.0 million

(YE 2022: USD 2.7 million). The reduction is mainly due to partial

repayment of overdraft facility.

-- Lease liability of USD 0.4 million (YE 2022: USD 0.6 million).

Cash plus Working Capital Surplus

Cash plus working capital surplus calculated as Current Assets

less Current Liabilities (excluding Provisions for other

liabilities and Derivative assets/(liabilities)) decreased by 23%

to USD 10.9 million (YE 2022: USD 14.2 million).

Reconciliation between Adjusted EBIDA after Current Taxes and

Cash Inflow from Operating Activities

H1 2023 H1 2022

USD'000 USD'000

Adjusted EBIDA after Current Taxes 6,670 4,831

Exceptional items (371) --

Foreign exchange gain 142 41

Translation differences as per Statement

of Cash flows (142) (41)

Changes in Working Capital (37) (1,922)

Income tax incurred 470 2,882

Income tax paid (475) (2,882)

Cash flow from operating activities 6,257 2,909

APPIX 1: TRADING SUMMARY

A summary of realised price, production, royalties, Opex,

G&A and operating break-evens expenditure metrics is set out

below:

Trading Summary Table

Details H1 2023 H1 2022 Change %

Realised price (USD/bbl) 65.2 90.1 (28)

Sales (bopd)

Onshore 1,512 1,688 (10)

West Coast 338 249 36

East Coast 1,011 1,037 (2)

Group Consolidated 2,861 2,974 (4)

Metrics (USD/bbl)

Royalties/bbl - Onshore 24.3 38.9 (38)

Royalties/bbl - West Coast 12.0 16.7 (28)

Royalties/bbl - East Coast 12.7 19.1 (34)

Royalties/bbl - Consolidated 18.8 30.1 (38)

Opex/bbl - Onshore 16.9 14.0 21

Opex/bbl - West Coast 26.9 28.2 (5)

Opex/bbl - East Coast 22.5 22.2 2

Opex/bbl - Group Consolidated 20.1 17.6 14

G&A/bbl - Group Consolidated 6.3 6.6 (5)

Operating break-even (USD/bbl)

Onshore 22.8 18.5 23

West Coast 32.3 26.9 20

East Coast 26.3 27.2 (3)

Group Consolidated 34.5 32.4 6

Notes: Group consolidated operating break-even: The realised

price/bbl for which the adjusted EBITDA/bbl exclusive of net

derivative expense/income for the Group is equal to zero.

STATEMENT OF DIRECTORS' RESPONSIBILITY

The Directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with

International Accounting Standards ("IAS") and that the interim

management report includes:

-- an indication of important events that have occurred during

the first six (6) months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six (6) months of the financial

year; and

-- the management report, which is incorporated into the

directors' report, includes a fair review of the development and

performance of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face; and

-- material related party transactions in the first six (6)

months and any material changes in the related-party transactions

described in the last annual report.

A list of the current Directors is maintained on the Trinity

Exploration & Production plc website

www.trinityexploration.com.

By order of the Board

Jeremy Bridglalsingh

Chief Executive Officer

27 September 2023

INDEPENT REVIEW REPORT TO TRINITY EXPLORATION & PRODUCTION

plc

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with UK adopted International Accounting Standard 34 and the London

Stock Exchange AIM Rules for Companies.

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2023 which comprises of Condensed

Consolidated Statement of Comprehensive Income, Condensed

Consolidated Statement of Financial Position, Condensed

Consolidated Statement of Changes in Equity and Condensed

Consolidated Cash Flow Statements and notes to the Condensed

Consolidated Interim Financial Statements.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the London Stock Exchange AIM

Rules for Companies which require that the half-yearly report be

presented and prepared in a form consistent with that which will be

adopted in the Company's annual accounts having regard to the

accounting standards applicable to such annual accounts.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statements in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange AIM Rules for Companies for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

Matt Crane (Senior Statutory Auditor)

For and on behalf of BDO LLP, Statutory Auditor

Chartered Accountants

London, UK

27 September 2023

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Trinity Exploration & Production plc

Condensed Consolidated Statement of Comprehensive Income

for the period ended 30 June 2023

(Expressed in United States Dollars)

------------------------------------------------------------------------------------------------

Notes 6 months 6 months Year ended

to 30 June to 30 31 December

2023 June 2022 2022

$'000 $'000 $'000

(unaudited) (unaudited) (audited)

Operating Revenues

Crude oil sales 33,751 48,514 92,232

Other income 3 1 7

------------ ------------ -------------

33,754 48,515 92,239

Operating Expenses

Royalties (9,711) (16,204) (30,091)

Production costs (10,402) (9,498) (19,242)

Depreciation, depletion and amortisation 8-10 (4,472) (3,884) (7,617)

General and administrative expenses (3,254) (3,581) (7,181)

Net reversal / (impairment) of financial

assets 25 (45) 46

Share option expense 15 (254) (316) (647)

Covid-19 expenses -- (459) (579)

Foreign exchange gain/(loss) 142 41 (394)

Realised derivative expense 3,12 -- (6,011) (10,446)

Fair value expense on derivative

instruments -- (3,207) 2,883

(27,926) (43,164) (73,268)

------------ ------------ -------------

Operating Profit Before Supplemental

Petroleum Taxes ("SPT") 5,828 5,351 18,971

SPT (3,247) (5,049) (9,012)

Operating Profit Before Impairment

and Exceptional Items 2,581 302 9,959

Impairment 4 -- -- (6,050)

Exceptional items 5 (371) -- (161)

------------ ------------ -------------

Operating Profit After Impairment

and Exceptional Items 2,210 302 3,748

Finance Income 7 25 24 48

Finance cost 7 (1,124) (648) (1,339)

------------ ------------ -------------

Profit/(Loss) Before Income Taxation 1,111 (322) 2,457

Income Taxation expense 6 (428) (76) (2,344)

------------ ------------ -------------

Profit/(Loss) for the period 683 (398) 113

Other Comprehensive Income / (loss)

Exchange differences on translation

of foreign operations (6) (324) (20)

------------ ------------ -------------

Total Comprehensive Income/(loss)

for the period 677 (722) 93

============ ============ =============

Earnings per share (expressed in

dollars per share)

Basic 21 0.02 (0.01) 0.00

Diluted 21 0.02 (0.01) 0.00

Trinity Exploration & Production plc

Condensed Consolidated Statement of Financial Position

for the period ended 30 June 2023

(Expressed in United States Dollars)

------------------------------------------------------------------------------------

Notes As at 30 As at 30 As at 31

June 2023 June 2022 December

2022

ASSETS $'000 $'000 $'000

(unaudited) (unaudited) (audited)

Non-current Assets

Property, plant and equipment 8 44,134 51,828 44,987

Right-of-use assets 9 572 608 838

Intangible assets 10 38,799 31,031 33,537

Abandonment fund 4,750 4,260 4,511

Performance bond 602 473 602

Deferred tax asset 16 12,465 14,294 12,465

------------ ------------ ----------

101,322 102,494 96, 940

------------ ------------ ----------

Current Assets

Inventories 5,100 4,283 4,615

Trade and other receivables 11 9,773 14,120 10,678

Cash and cash equivalents 11,301 14,950 12,131

------------ ------------ ----------

26,174 33,353 27,424

------------ ------------ ----------

Total Assets 127,496 135,847 124,364

============ ============ ==========

Equity

Capital and Reserves Attributable

to Equity Holders

Share capital 13 399 389 399

Share premium 13 -- -- --

Share based payment reserve 15 3,224 4,087 2,990

Reverse acquisition reserve (89,268) (89,268) (89,268)

Treasury shares 14 (2,088) -- (1,522)

Translation reserve (1,654) (1,971) (1,667)

Retained earnings 145,877 143,268 145,199

------------ ------------ ----------

Total Equity 56,490 56,505 56,131

Non-current Liabilities

Lease liabilities 9 239 202 341

Deferred tax liability 16 1,898 1,983 1,940

Provision for other liabilities 17 53,469 56,295 52,460

Employee benefits 28 11 23

------------ ------------ ----------

55,634 58,491 54,764

------------ ------------ ----------

Current Liabilities

Trade and other payables 18 12,833 11,533 9,932

Bank overdraft 19 2,000 2,700 2,700

Lease liabilities 9 394 492 584

Derivative financial liability 12 -- 6,090 --

Provision for other liabilities 145 36 249

Taxation Payable -- -- 4

------------ ------------ ----------

15,372 20,851 13,469

Total Liabilities 71,006 79,342 68,233

------------ ------------ ----------

Total Shareholders' Equity and

Liabilities 127,496 135,847 124,364

============ ============ ==========

Trinity Exploration & Production plc

Condensed Consolidated Statement of Changes in Equity

for the period ended 30 June 2023

(Expressed in United States Dollars)

Share Share Reverse Translation Retained Total

Capital Based Acquisition Treasury Reserve Earnings

Payment Reserve Shares

Reserve

$'000 $'000 $'000 $'000 $'000 $'000 $'000

--------- --------- ------------- ----------- ------------ ---------- -------

Balance at 1 January 2022 389 3,784 (89,268) -- (1,650) 143,666 56,921

Share based payment charge -- 305 -- -- -- -- 305

Capital Reorganisation -- -- -- -- -- -- --

Translation difference -- (2) -- -- 3 -- 1

Total comprehensive loss for

the period -- -- -- -- (324) (398) (722)

Balance at 30 June 2022

(unaudited) 389 4,087 (89,268) -- (1,971) 143,268 56,505

========= ========= ============= =========== ============ ========== =======

Balance at 1 January 2023 399 2,990 (89,268) (1,522) (1,667) 145,199 56,131

Share based payment charge -- 254 -- -- -- -- 254

LTIPs exercised -- (20) -- -- -- 15 (5)

Treasury shares (note 14) -- -- -- (566) -- -- (566)

Translation difference -- -- -- -- 19 (20) (1)

Total comprehensive profit

for the period -- -- -- -- (6) 683 677

Balance at 30 June 2023

(unaudited) 399 3,224 (89,268) (2,088) (1,654) 145,877 56,490

========= ========= ============= =========== ============ ========== =======

Trinity Exploration & Production plc

Condensed Consolidated Statement of Cashflows

for the period ended 30 June 2023

(Expressed in United States Dollars)

-----------------------------------------------------------------------------------------------------

Notes 6 months 6 months Year end

to 30 June to 30 June 31 December

2023 2022 2022

$'000 $'000 $'000

(unaudited) (unaudited) (audited)

Operating Activities

Profit /(Loss) before taxation 1,111 (322) 2,457

Adjustments for:

Translation difference (142) (41) 394

Finance Income (25) (24) (48)

Finance cost 7 71 94 229

Share option expense 254 316 647

Finance cost - decommissioning provision 7 1,053 554 1,110

Depreciation, depletion and amortisation 8-10 4,472 3,884 7,617

Impairment of property, plant and

equipment 8 -- -- 5,558

Inventory Impairment 5 -- -- 334

(Reversal of impairment)/impairment

loss on financial assets (25) 45 (46)

Fair value on derivative financial

instrument -- 3,207 (2,883)

Other non-cash items -- -- 158

6,769 7,713 15,527

------------ ------------ -------------

Changes In Working Capital

Increase in Inventory (485) (463) (1,129)

Decrease/(increase) in Trade and other

receivables 691 ( 3,657) (376)

(Decrease)/Increase in Trade and other

payables (243) 2,198 1,353

(37) (1,922) (152)

Income taxation paid (475) (2,882) (3,390)

------------ ------------ -------------

Net Cash Inflow From Operating Activities 6,257 2,909 11,985

Investing Activities

Exploration and Evaluation Assets (2,052) (363) (388)

Computer software and investment in

research & development (284) (24) (102)

Purchase of property, plant & equipment (3,240) (5,320) (15,016)

Performance bond released -- -- (130)

Net Cash Outflow From Investing Activities (5,576) (5,707) (15,636)

------------ ------------ -------------

Financing Activities

Finance income 25 24 48

Finance cost (28) (50) (94)

Proceeds from the issue of shares -- -- 10

Principal paid on lease liability (291) (261) (536)

Interest paid on lease liability (43) (44) (135)

Bank overdraft repayment (700) -- --

Acquisition of treasury shares (566) -- (1,522)

Net Cash Outflow From Financing Activities (1,603) (331) (2,229)

------------ ------------ -------------

Decrease in Cash and Cash Equivalents (922) (3,129) (5,880)

============ ============ =============

Cash And Cash Equivalents

At beginning of period 12,131 18,312 18,312

Effects of foreign exchange rates

on cash 92 (233) (301)

Decrease (922) (3,129) (5,880)

------------ ------------ -------------

At end of period 11,301 14,950 12,131

============ ============ =============

Trinity Exploration & Production plc

Notes to the Condensed Consolidated Financial Statements for the

period ended 30 June 2023

1 Background, Accounting Policies and Estimates

Background

Trinity Exploration & Production plc ("Trinity") is

incorporated and registered in England and trades on the

Alternative Investment Market ("AIM"), a market operated by London

Stock Exchange plc. Trinity ("the Company") and its subsidiaries

(together "the Group") are involved in the exploration, development

and production of oil reserves in Trinidad and Tobago

(T&T).

Basis of Preparation

These condensed consolidated interim financial statements for

the six months ended 30 June 2023 have been prepared in accordance

with international accounting standards as adopted in the United

Kingdom. The condensed consolidated interim financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2022, which have also been prepared

in accordance with IFRS.

The results for the six months ended 30 June 2023 and 30 June

2022 have been reviewed, not audited, and do not comprise statutory

accounts within the meaning of section 434 of the Companies Act

2006. Statutory accounts for the year ended 31 December 2022 were

approved by the board of directors and delivered to the Registrar

of Companies. The report of the independent auditors on those

accounts was unqualified. The interim report has been reviewed by

the auditor.

Going Concern

The Board has adopted the going concern basis in preparing the

condensed consolidated interim financial statements.

In making their going concern assessment, the Board have

considered the Group's current financial position, budget and cash

flow forecast. The base case cashflow forecast at a minimum

contemplated a 12-month outlook illustrating the ability of the

Group to operate on a going concern basis one year post completion

of the interim review. The base cashflow forecast demonstrated that

the Group will remain with a positive cash flow position, and as

such being able to meet its liabilities as they fall due.

The base case cashflow forecast was prepared considering the

follow:

-- Future oil prices assumed to be in line with the forward

curve prevailing at 1 September 2023, with an average Brent oil

price of USD 87.15/bbl in the period September to December 2023.

The Brent forward price curve applied in the cash flow forecast

starts at USD 88.20/bbl in September 2023, and fluctuates to USD

86.12/bbl in December 2023 through to USD 80.72/bbl in December

2024.

-- Average forecast production for the period 1 September 2023

to December 2023 of 2,809 bopd and for the 12 months to December

2024 of 2,719 bopd with production being maintained by RCPs, WOs

and swabbing activities and Jacobin-1 well a modest annualised

average 80 bopd in 2024.

-- SPT not being incurred on the onshore assets in H2 2023 and

2024 due to lower realised oil prices than the SPT threshold for

small onshore operators USD 75.0/bbl.

-- Maintained overdraft at USD 2.0 million.

-- Trinity continuing to progress planned growth and business development opportunities.

Management considered a separate stressed scenario

including:

-- the effect of reductions in Brent oil prices at $60.0/bbl

being sustained across the forecast period, noting that the base

case pricing is in line with market prices; and

-- the compounded impact of a reduction in production by 10%.

The stressed case cash flow forecast allows for the impact of

mitigating actions that are within the Group's control which

include:

-- Reducing non-core and discretionary opex and administrative

costs across the forecast period.

-- Reducing discretionary capital expenditure and capital returns over the forecast period.

The stressed case cashflow forecasts demonstrate that the

Group's cash balances are maintained under such scenarios and as

such are sufficient to meet the Group's obligations as they fall

due.

As a result, at the date of approval of the interim financial

statements, the Board have a reasonable expectation that the Group

has sufficient and adequate resources to continue in existence for

at least twelve months post approval of these financial statements

and is poised for continued growth. For this reason, the Board have

concluded it is appropriate to continue to adopt the going concern

basis of accounting in the preparation of the condensed

consolidated interim financial statements.

Accounting policies

The accounting policies adopted are consistent with those of the

previous financial year 31 December 2022 and corresponding interim

reporting period, except for those set out in the standards

below:

- New standards and amendments effective for periods beginning

on 1 January 2023 and therefore relevant to these condensed

consolidated interim financial statements

-- IAS 1 Presentation of Financial Statements and IFRS Practice

Statement 2 (Amendment - Disclosure of Accounting Policies)

-- IAS 8 Accounting policies, Changes in Accounting Estimates

and Errors (Amendment - Definition of Accounting Estimates)

-- IAS 12 Income Taxes (Amendment - Deferred Tax related to

Assets and Liabilities arising from a Single Transaction)

Cash and cash equivalents

For the purpose of presentation in the condensed consolidated

statement of cash flows, cash and cash equivalents includes cash on

hand, deposits held at call with financial institutions, and other

short-term, highly liquid investments with original maturities of

three months or less that are readily convertible to known amounts

of cash.

Trade receivables

Trade receivables are amounts due from the Group's sole customer

for crude oil sold in the ordinary course of business. They are

generally due for settlement within 30 days and therefore are all

classified as current. Trade receivables are recognised initially

at the amount of consideration that is unconditional unless they

contain significant financing components, when they are recognised

at fair value.

Impairment of financial assets

The Group applied the simplified approach to determine

impairment of its trade and other receivables. The simplified

approach requires expected lifetime losses to be recognised from

initial recognition of the receivables. This involves determining

the expected loss rates using a provision matrix that is based on

the Group's historical default rates observed over the expected

life of the receivables and adjusted for forward looking estimates.

This is then applied to the gross carrying amount of the

receivables to arrive at the loss allowance for the period.

Financial assets recognition of impairment provisions under IFRS

9 is based on the expected credit losses ("ECL") model. The ECL

model is applicable to financial assets classified at amortised

cost and contract assets under IFRS 15: Revenue from Contracts with

Customers. The measurement of ECL reflects an unbiased and

probability weighted amount that is available without undue cost or

effort at the reporting date, about past events, current conditions

and forecasts of future economic conditions.

Trade and other payables

Trade and other payables are recognised initially at fair value

and subsequently measured at amortised cost using the effective

interest rate method.

Segment Information

Management have considered the requirements of IFRS 8 Operating

Segments, in regard to the determination of operating segments, and

concluded that the Group has only one significant operating segment

being the exploration and development, production and extraction of

hydrocarbons.

All revenue is generated from crude oil sales in Trinidad and

Tobago ("T&T") to one customer, Heritage Petroleum Company

Limited ("Heritage"). All non-current assets of the Group are

located in T&T.

Derivative financial instruments and hedging activities

The Company has not applied hedge accounting and all derivatives

are measured at fair value through profit and loss.

Estimates

The preparation of condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 31 December

2022. Reference can be made note 3 (Critical Accounting Estimates

and Judgements), in the Annual Report December 2022.

2 Financial risk management

Financial risk factors

The Group's activities expose it to a variety of financial

risks: market risk (including currency risk, fair value interest

rate risk, cash flow interest rate risk and price risk), credit

risk and liquidity risk. The Group's overall risk management

program seeks to minimise potential adverse effects on the Group's

financial performance.

The condensed consolidated interim financial statements do not

include all financial risk management information and disclosures

required in the annual financial statements; they should be read in

conjunction with the Group's annual financial statements for 2022,

which can be found at www.trinityexploration.com .

Liquidity risk

Prudent liquidity risk management implies maintaining sufficient

cash and short-term funds and the availability of funding through

an adequate amount of committed credit facilities. Management

monitors rolling forecasts of the Group's liquidity and cash and

cash equivalents on the basis of expected cash flow. As at 30 June

2023, the Group held cash at bank of $11.3 million (2022: $12.1

million).

Credit risk

Credit risk arises from Cash and Cash equivalents, deposits with

banks and financial institutions, as well as credit exposures to

customers, including outstanding receivables. For banks and

financial institutions, management determines the placement of

funds based on its judgement and experience to minimise risk.

All sales are made to a state-owned entity -Heritage.

3 Derivative expense

30 June 30 June 31 December

2023 2022 2022

$'000 $'000 $'000

Realised derivative expense -- (6,011) (10,446)

FV of derivative financial instruments -- (3,207) 2,883

Total expense -- (9,218) (7,563)

================== ======== ==============

All derivative instruments expired at 31 December 2022. The

Group does not have any derivative instruments in place for

2023.

4 Impairment

30 June 30 June 31 December

2023 2022 2022

$'000 $'000 $'000

Impairment of inventory -- -- 334

Impairment of property, plant and

equipment -- -- 5,558

Other impairment of property, plant

and equipment -- -- 158

========= ======== ============

Total expense -- -- 6,050

========= ======== ============

Management performed an indicator of impairment assessment at 30

June 2023. Crude oil price forecast were noted to be depressed at

30 June 2023 which showed a potential impairment of USD 1.6

million. However, oil prices recovered post 30 June 2023.

Sensitivity analysis on revised oil price forecast carried out

using 1 September 2023 pricing curve showed there were no material

impairment charges to the Group's assets. Subsequent to 1 September

2023, oil prices continue to trend upwards and as such no

impairment indicators were identified at H1 2023. Another

impairment assessment will be performed at the year-end.

5 Exceptional Items

Items that are material either because of their size, their

nature, or that are non-recurring are considered as exceptional

items and are presented within the line items to which they best

relate. During the current period, exceptional items as detailed

below have been included in the condensed consolidated statement of

comprehensive income. An analysis of the amounts presented as

exceptional items in these condensed interim financial statements

are highlighted below.

30 June 30 June 31 December

2023 2022 2022

$'000 $'000 $'000

ICT incident cost 280 -- 161

Bravo fire incident cost 91 -- --

Exceptional items charge 371 -- 161

======== ======== ============

-- ICT incident cost captures expenditures related to the

response on the cyber incident which occurred in December 2022.

-- Bravo Fire incident costs related to initial costs incurred

in responding to the incident in H1 2023.

6 Income taxation expense

a. Taxation 30 June 30 June 31 December

2023 2022 2022

Current tax $'000 $'000 $'000

Petroleum profits tax 336 2,058 2,404

Unemployment levy 134 824 960

Deferred tax

* Current period

Movement in asset due to tax losses

recognised (Note 16) -- (2,764) (935)

Movement in liability due to accelerated

tax depreciation (note 16) (42) (42) (85)

Income tax expense 428 76 2,344

======== ======== ============

Current tax: The Group's effective tax rate varies based on

jurisdiction.

30 June 31 December

Tax rates: 30 June 2023 2022 2022

$'000 $'000 $'000

Corporation Tax UK 19% 19% 19%

Corporation Tax TT 30% 30% 30%

Petroleum Profits Tax 50% 50% 50%

Unemployment levy 5% 5% 5%

Deferred tax:

The Group has a deferred tax asset of $12.5 million on its

condensed consolidated statement of financial position which is the

amount it expects to recover within 3 years based on the expected

taxable profits generated by Group companies over that period.

7 Finance income

30 June 30 June 31 December

2023 2022 2022

$'000 $'000 $'000

Interest income 25 24 48

======== ======== ============

Finance costs

30 June 30 June 31 December

2023 2022 2022

$'000 $'000 $'000

Decommissioning - Unwinding of

discount (1,053) (554) (1,110)

Interest and other expenses on

overdraft (28) (50) (94)

Interest on leases (43) (44) (135)

-------- -------- ------------

(1,124) (648) (1,339)

======== ======== ============

8 Property, Plant and Equipment

Plant Leasehold Oil &

& Equipment & Buildings Gas Property Total

$'000 $'000 $'000 $'000

-------------- ------------- -------------- ----------

Opening net book amount at 1

January 2023 4,255 1,271 39,461 44,987

Additions 868 12 2,368 3,248

DD&A charge for period (293) (96) (3,712) (4,101)

Closing net book amount at 30

June 2023 4,830 1,187 38,117 44,134

============== ============= ============== ==========

At 30 June 2023

Cost 19,061 3,495 325,865 348,421

Accumulated DD&A and impairment (14,231) (2,308) (287,748) (304,287)

Closing net book amount at 30

June 2023 4,830 1,187 38,117 44,134

============== ============= ============== ==========

Plant Leasehold Oil &

& Equipment & Buildings Gas Property Total

$'000 $'000 $'000 $'000

-------------- ------------- -------------- ----------

Opening net book amount at 1

January 2022 2,919 1,388 45,200 49,507

Additions 1,803 66 3,964 5,833

DD&A charge for period (275) (93) (3,146) (3,514)

Translation difference -- -- 2 2

Closing net book amount at 30

June 2022 4,447 1,361 46,020 51,828

============== ============= ============== ==========

At 30 June 2022

Cost 18,059 3,478 322,504 344,041

Accumulated DD&A and impairment (13,612) (2,117) (276,486) (292,215)

Translation difference -- -- 2 2

Closing net book amount at 30

June 2022 4,447 1,361 46,020 51,828

============== ============= ============== ==========

Plant Leasehold Oil &

& Equipment & Buildings Gas Assets Total

$'000 $'000 $'000 $'000

-------------- ------------- -------------- ----------

Year ended 31 December 2022

Opening net book amount at 1

January 2022 2,919 1,388 45,200 49,507

Disposals -- -- -- --

Transfers -- -- (2,451) (2,451)

Additions 1,999 71 13,062 15,132

Adjustment for decommissioning

estimate -- -- (4,595) (4,595)

Impairment charge (note 4) (62) -- (5,654) (5,716)

DD&A charge for year (601) (188) (6,101) (6,890)

Closing net book amount 31 December

2022 4,255 1,271 39,461 44,987

============== ============= ============== ==========

At 31 December 2022

Cost 18,193 3,483 323,497 345,173

Accumulated DD&A and impairment (13,938) (2,212) (284,036) (300,186)

Closing net book amount 4,255 1,271 39,461 44,987

============== ============= ============== ==========

9 Leases

(i) Amounts recognised in the condensed consolidated statement of financial position.

The condensed consolidated statement of financial position shows

the following amounts relating to leases:

31 December

30 June 2023 30 June 2022 2022

$'000 $'000 $'000

Right-of-use assets

Non-current assets 572 608 838

============= ============= ============

Lease Liabilities

Current 394 492 584

Non-current 239 202 341

633 694 925

============= ============= ============

The ROU assets relate to motor vehicles, office building, staff

house and office equipment leases that met the recognition criteria

of a Lease under IFRS 16.

(ii) Amounts recognised in the condensed consolidated statement of comprehensive income.

The condensed consolidated statement of comprehensive income

shows the following amounts relating to leases:

30 June 30 June 31 December

2023 2022 2022

$'000 $'000 $'000

Depreciation charge of ROU

assets

Depreciation (265) (258) (534)

======== ======== ============

Interest expense (including

finance cost) (43) (44) (135)

======== ======== ============

The total cash outflow for leases in June 2023 was $0.3 million

(June 2022: $0.3 million)

10 Intangible Assets

Computer Software Exploration and evaluation Research and Development Total

assets

$'000 $'000 $'000 $'000

Opening net book amount at 1

January 2023 405 32,903 229 33,537

Additions 204 5,084 80 5,368

Amortisation charge for the

year (106) -- -- (106)

At 30 June 2023 503 37,987 309 38,799

------------------ ------------------------------ ------------------------- -------

Opening net book amount at 1

January 2022 496 30,217 46 30,759

Additions 24 219 141 384

Amortisation charge for the

year (112) -- -- (112)

Closing net book amount at 30

June 2022 408 30,436 187 31,031

------------------ ------------------------------ ------------------------- -------

Opening net book amount at 1

January 2022 496 30,217 46 30,759

Additions 102 235 183 520

Transfers -- 2,451 -- 2,451

Amortisation charge for the

year (193) -- -- (193)

Closing net book amount at 31

December 2022 405 32,903 229 33,537

================== ============================== ========================= =======

-- Computer Software: Costs incurred in connection with software.

-- Exploration and Evaluation asset: The opening balance mainly

represents the cost for the TGAL 1 exploration well and

classification of PS-4 acquisition cost to E&E costs. Additions

during H1 2023 related to the drilling of Jacobin exploration well

of USD 5.0 million.

-- Research and Development: In 2023, costs incurred in

connection with various renewable energy initiatives.

11 Trade and Other Receivables

30 June 30 June 31 December

2023 2022 2022

Due within one year $'000 $'000 $'000

Trade receivables 4,067 6,650 4,643

Less: provision for impairment of trade

receivables (1) (6) (4)

-------- -------- ------------

Trade receivables: net 4,066 6,644 4,639

Prepayments 866 1,084 969

VAT recoverable 4,182 5,364 4,544

Other receivables 693 1,174 582

Less: Provision for Impairment of other

receivables (34) (146) (56)

-------- -------- ------------

9,773 14,120 10,678

======== ======== ============

The fair value of trade and other receivables approximate their

carrying amounts.

The Group applies the IFRS 9 simplified model for measuring ECL

which uses a lifetime expected loss allowance and are measured on

the days past due criterion.

Trade receivables - Heritage net sales receipts have been

collected on a timely basis. Since the Joint Interest Billing

("Jibs") balances are outstanding, an ECL was calculated at 30 June

2023 of $0.0 million (31 December 2022: $0.1 million) against Other

receivables.

VAT recoverable - As at 31 December 2022 the VAT recoverable

amount was $4.7m. During the period ending 30 June 2023, net

refunds received amounted to $2.7 million and the Group generated

refunds of $2.1 million.

12 Derivative Financial Liabilities

The following table compares the carrying amounts and fair

values of the group's financial assets and financial liabilities as

at 30 June 2022.

As at 30 As at June As at 31

June 2023 2022 December

2022

$'000 $'000 $'000

Derivative Liability -- (6,090) --

---------- ----------- --------------

Total -- (6,090) --

========== =========== ==============

The group considers that the carrying amount of the following

financial assets and financial liabilities are a reasonable

approximation of their fair value:

- Trade receivables

- Trade payables

- Cash and cash equivalents

Fair Value Hierarchy

The level in the fair value hierarchy within which the

derivative financial asset is categorised is determined on the

basis of the lowest level input that is significant to the fair

value measurement.

The derivative financial assets are classified in their entirety

into only one of the three levels.

The fair value hierarchy has the following level:

- Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities

- Level 2 - inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly (i.e. as prices) or indirectly (i.e. derived from

prices)

- Level 3 - inputs for the asset or liability that are not based

on observable market data (unobservable inputs).

Level 2 recurring fair value measurements:

As at 30 As at 31 December

As at 30 June 2022 2022

June 2023

$'000 $'000 $'000

Opening balance -- (2,883) (2,883)

Opening derivative instrument

realised -- 2,883 2,883

Derivative expense (loss in -- (6,090) --

fair value)

---------------- -------------- --------------------

Closing balance -- (6,090) --

================ ============== ====================

All derivative instruments expired at 31 December 2022. The

Group does not have any derivative instruments in place for

2023.

13 Share Capital

Number of Share Share Total

shares capital premium

$'000 $'000 $'000

As at 1 January 2023

and 30 June 2023 39,884,637 399 -- 399

=========== ========= ========= =======

The Company does not have a limited amount of authorised share

capital.

14 Treasury Shares

Treasury shares are shares in the Company that are held by the

Company. In September 2022, the Group announced a share buyback

programme and subsequently announced a second and third tranche of

its share buyback programme which ended on 30 June 2023.

Number of Cost Total

shares repurchased $'000 $'000

Share buyback 1,549,000 2,088 2,088

15 Share Based Payment Reserve

The share-based payments reserve is used to recognise:

- The grant date fair value of options issued to employees but

not exercised.

- The grant date fair value of share awards issued to

employees.

- The grant date fair value of deferred share awards granted to

employees but not yet vested; and

- The issue of shares held by the Employee Share Trust to

employees.

During 2023 the Group had in place share-based payment

arrangements for its employees and Executive Directors, the LTIP.

The Share Option Plan is fully vested and expensed. The current

year charge through share-based payments are in relation to the

LTIP arrangements shown below:

30 June 31 December

30 June 2023 2022 2022

$'000 $'000 $'000

At 1 January 2,990 3,784 3,784

Share based payment expense 254 305 622

Long term incentive plan -- -- --

Lapsed options released to

retained earnings -- -- (1,416)

LTIPs exercised and released (20) -- --

to retained earnings

Translation difference -- (2) --

At 30 June/31 December 3,224 4,087 2,990

============= ============ ==============

There were no new issue of LTIPs for 2023 as at 30 June

2023.

16 Deferred Income Taxation

The analysis of deferred income taxes is as follows:

30 June 30 June 31 December

2023 2022 2022

Deferred tax assets: $'000 $'000 $'000

-Deferred tax assets to be recovered

in more than 12 months (12,465) (14,294) (12,465)

========= ========= ============

Deferred tax liabilities:

-Deferred tax liabilities to be settled

in more than 12 months 1,898 1,983 1,940

========= ========= ============

The deferred tax balances are analysed below:

1 January 30 June 31 Dec 30 June

2022 Movement 2022 Movement 2022 Movement 2023

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Deferred tax

assets

Tax losses recognised (11,530) (2,764) (14,294) 1,829 (12,465) -- (12,465)

(11,530) (2,764) (14,294) 1,829 (12,465) -- (12,465)

========== ========= ========= ========= ========= ========= =========

Deferred tax

liabilities

Accelerated tax

depreciation 13,839 -- 13,839 -- 13,839 -- 13,839

Fair value uplift (11,815) (41) (11,856) (43) (11,899) (42) (11,941)

2,024 (41) 1,983 (43) 1,940 (42) 1,898

========== ========= ========= ========= ========= ========= =========

There was no change to the deferred tax asset (DTA) at 30 June

2023. A review was performed using the oil price forward curve at

30 June 2023 which showed a potential reduction of $1.4 million

from $ 12.5 million. Sensitivity analysis on a revised oil price

forecasts carried out using 1 September 2023 pricing curve showed

the DTA increased to $14.0 million due to the steady increase in

crude oil prices. Based on the crude price volatility no changes

were made to the DTA held at 30 June 2023 and as at 31 December

2023 a further assessment would be performed.

Deferred income tax assets are recognised for tax loss

carry-forwards to the extent that the realisation of the related

tax benefit through future taxable profits are probable. The Group

recognises deferred tax assets over a 3 year outlook which is

conservative and consistent with prior periods. The Group has

unrecognised tax losses amounting to $ 199.3 million which have no

expiry date (2022: $ 207.4 million).

Deferred tax assets and liabilities are not shown offset in this

condensed consolidated statement of financial position. Deferred

tax assets and liabilities can only be offset if an entity has a

legal right to settle current tax amounts on a net basis and

Deferred Tax amounts are levied by the same tax authority (as per

IAS 12).

17 Provisions and Other Liabilities

Non-Current: Decommissioning Closure of

cost pits Total

$'000 $'000 $'000

6 months ended 30 June 2023

Opening amount as at 1 January 2023 51,857 603 52,460

Unwinding of discount 1,053 -- 1,053

Revision to estimates -- -- --

Translation differences (45) 1 (44)

---------------- ----------- --------

Closing balance as at 30 June 2023 52,865 604 53,469

================ =========== ========

6 months ended 30 June 2022

Opening amount as at 1 January 2022 55,220 470 55,690

Unwinding of discount 554 -- 554

Revision to estimates -- (3) (3)

Translation differences 54 -- 54

---------------- ----------- --------

Closing balance as at 30 June 2022 55,828 467 56,295

================ =========== ========

Year ended 31 December 2022

Opening amount as at 1 January 2022 55,220 470 55,690

Unwinding of discount 1,110 -- 1,110

Revision to estimates (4,595) -- (4,595)

Additions -- 138 138

Translation differences 122 (5) 117

Closing balance at 31 December 2022 51,857 603 52,460

================ =========== ========

Litigation

Current: Other provisions claims Total

$'000 $'000 $'000

6 months ended 30 June 2023

Opening amount as at 1 January 2023 112 136 248

Settlements (103) -- (103)

----------------- ----------- ------

Closing balance as at 30 June 2023 9 136 145

================= =========== ======

6 months ended 30 June 2022

Opening amount as at 1 January 2022 0 46 46

Settlements -- (10) (10)

================= =========== ======

Closing balance as at 30 June 2022 0 36 36

================= =========== ======

Year ended 31 December 2022

Opening amount as at 1 January 2021 0 46 46

Additions 112 91 203

----------------- ----------- ------

Closing balance at 31 December 2022 112 137 249