TIDMVRS

RNS Number : 1783C

Versarien PLC

09 June 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN

9 June 2023

Versarien Plc

("Versarien", the "Company" or the "Group")

Interim Results for the six months ended 31 March 2023

Versarien Plc (AIM: VRS), the advanced engineering materials

group, announces its unaudited interim results for the six months

ended 31 March 2023.

Financial Summary

-- Group revenues of GBP2.62 million (2022: GBP3.89 million)

-- Graphene revenues of GBP0.09 million (2022: GBP0.97 million)

-- Adjusted LBITDA* of GBP2.01 million (2022: GBP0.31 million)

-- Loss before tax of GBP3.40 million (2022: GBP2.16 million)

-- Cash of GBP0.76 million as at 31 March 2023 (30 September

2022: GBP1.35 million), with placing to raise gross proceeds of

GBP0.53 million post period end

*Adjusted LBITDA (Loss Before Interest, Tax, Depreciation and

Amortisation) excludes Exceptional items, Share-based payment

charges and other losses)

Turnaround Strategy

As announced on 29 March 2023, the Company has engaged

experienced strategy and turnaround specialist, David Stone, and

his firm Prompt Business Strategies Limited, to aid the Company in

developing its strategic plans which are:

-- To maintain and strengthen the Group's scientific teams

supported by grant funding applications

-- To use the Group's internally generated know-how in the areas

of construction and textiles to be a manufacturing light operation

as Versarien works with its prospective customers

-- As commercial traction develops to licence Versarien's

technology, brands and manufacturing know-how

-- To divest non-core activities and Asian assets to reduce the

requirement for funding from the capital markets

Diane Savory, Non-executive Chair of Versarien, commented:

" The period under review was extremely challenging from a

financial perspective, both from a balance sheet point of view and

with the decline in Graphene revenues reflecting the ending of the

DSTL development contract. However, following the Annual General

Meeting we have, with the assistance of David Stone and his team,

been developing a strategy that focuses on maintaining appropriate

IP to support our core end-sectors of construction and textiles

whilst reducing cash-outflows to a level that can be supported by

proposed asset sales, marketing of which is in process. We believe

this strategy will ensure a brighter future for Versarien."

For further information please contact:

Versarien Plc

c/o IFC

Diane Savory - Non-executive Chair

Chris Leigh - Chief Financial Officer

Stephen Hodge - Chief Technology Officer

SP Angel Corporate Finance (Nominated Adviser

and Joint Broker)

Matthew Johnson

Adam Cowl +44 (0) 20 3470 0470

IFC Advisory Limited (Investor Relations)

Tim Metcalfe

Zach Cohen +44 (0) 20 3934 6630

Notes to Editors:

The strategy of Versarien Plc (AIM:VRS) is to be a recognised

graphene company with a wide portfolio of high-quality verified

materials supported by its own UK based research and development

driving recurring revenue growth through its innovative graphene

product applications.

For further information please see: http://www.versarien.com

Chair's Statement

Following the AGM we have, with the assistance of David Stone

and his team at Prompt Strategies Limited, been developing a

strategy that focuses on maintaining appropriate IP to support our

commercial goals in our core end-sectors of construction and

textiles, whilst reducing cash-outflows to a level that can be

supported by proposed asset sales.

Our core objectives are:

-- to maintain and, as appropriate, strengthen our scientific

teams supported by grant funding applications;

-- use our internally generated know-how in the areas of

construction and textiles to be a manufacturing light operation as

we work with our prospective customers; and

-- as commercial traction develops to licence our technology,

brands and manufacturing know-how in order to generate revenue and

shareholder value.

Historically, the Group has been mainly reliant upon support

from the capital markets, strategic investors, grant funding and

loans to provide working capital to support its operations, both in

the UK and abroad, in anticipation of the graphene sector gaining

traction. With such traction not yet having been achieved, coupled

with a diminishing appetite in the capital markets for small cash

consuming technology businesses, the Company has little alternative

but to restructure its business in anticipation of being able to

create future shareholder value. In doing so, there is a fine line

to balance between protecting IP, continuing research and

development to maintain commercial knowledge, and maximising both

medium and longer term value, whilst also generating sufficient

working capital for Group purposes.

The strategic focus for the Group is on developing its

commercial graphene applications (Cementene and Graphene Wear),

whilst operating from a significantly reduced cost base that

maintains sufficient resource within the Group to maximise the

market opportunity.

In order to generate further funds for the Group, as previously

announced, marketing of the mature businesses for sale is in

process, as is the IP and assets previously acquired from Hanwha in

December 2020. Based on certain asset sale assumptions our

projections suggest that we would have sufficient resources for a

further period of 24 months. However, we are at an early stage of

marketing so nothing is certain in this respect and further

announcements will be made in due course, as appropriate.

In order to generate required funding Versarien has used its

placing authorities from the last two annual general meetings to

place new equity at share prices which have been considerably lower

than historic averages. The asset sales process is underway, but

whilst the timing and quantum is not yet certain, the Company is

cautiously optimistic of the outcome.

The specifics of the turnaround strategy are as follows:

-- to adopt a manufacturing light approach followed by licencing

of technology manufacturing know-how and brands;

-- to reduce research and development infrastructure costs

whilst maintaining or increasing current staffing levels;

-- selling the non-core businesses of Total Carbide and AAC Cyroma;

-- selling the IP and assets that originated in the acquisition from Hanwha Aerospace;

-- reducing the costs of running the parent company; and

-- reducing the manufacturing and infrastructure costs at

Longhope whilst maintaining current staffing levels.

These actions will result in a much-simplified Group with

significantly fewer staff. The appointment of a new CEO will be

deferred until the asset sale process is completed.

Diane Savory OBE

Non-executive Chair

Chief Technology Officer's Review

The current environment remains challenging and the recent

announcement of the UK's National semiconductor strategy was

disappointing from a graphene viewpoint. The potential GBP1bn

investment over the next decade is a start, but pales in comparison

to US and EU pledges of GBP42bn and GBP37bn, respectively. Graphene

is mentioned by name only once, yet is seen as an enabling material

by experts in the field for the majority of the quantum

technologies that are promised. Versarien's IP portfolio and CVD

assets acquired from Hanwha are ideally placed to manufacture the

highest quality graphene required for our UK semiconductor industry

given the right support and environment, but in the circumstances,

we believe disposing of these assets is strategically the correct

move.

Our R&D team has been slimmed down significantly in recent

months both due to cost cutting to concentrate on our strategic

objectives, together with staff being attracted elsewhere, but I

remain highly optimistic in being able to retain the key people

that can help solidify our R&D and commercialisation efforts.

We have continued to gain traction in our focus markets of

construction and textiles, with more trial data to support the

benefits of graphene and the impacts it can have on sustainability,

and key demonstrators with our partners such as Costain, National

Highways and most recently, Banagher. Our Graphene-Wear textile

coatings, used in Umbro's Pro Training Elite kit, continue to gain

traction with further seasonal launches in progress.. Graphene-Wear

is being continually developed with other 2D material based

formulations and is proving attractive where multi-colours can be

achieved.

It is interesting to see a very different dynamic within the UK

and global graphene sectors emerging, with first movers going

through financial difficulties, yet other UK private companies

gaining from large private investments. This has certainly provided

a more competitive UK graphene landscape. The UAE's graphene and 2D

materials research is also developing rapidly through the creation

of its Research and Innovation Centre for 2D Materials (RIC-2D).

Although Versarien has not yet been awarded any projects as part of

its RIC-2D Fund, we have several discussions ongoing to deliver

Versarien products and technologies to the region, with my

invitation to take part in the 2D Materials Symposium hosted by

Khalifa University ("KU") and the EU's Graphene Flagship project,

in May 2023, an opportunity to have wider discussions with KU

academic and commercial teams.

Gnanomat continues to make technological progress. Having

successfully delivered phase 1 of its development contract with a

large Thai oil and gas company it is now in negotiations for

further development work estimated at circa EUR170,000 to be

completed over the next few months for use in high-performance

pseudo-capacitor applications.

Dr Stephen Hodge

Chief Technology Officer

Chief Financial Officer's review

The period under review was extremely challenging from a

financial perspective. The last Annual Report referred to there

being a material uncertainty related to going concern and the need

to raise additional funding.

In March 2023 we utilised the remaining authority from the 2022

AGM to issue 10.6 million shares at a price of 3p per share,

raising GBP0.32 million gross, and in May 2023 we used the

authority granted by shareholders at the 2023 AGM to issue 42.5

million shares at 1.25p per share, raising GBP0.53 million gross.

Clearly, the Board would have preferred to issue equity at higher

share prices, but the Company's current circumstances have not

enabled it to do so.

In the period under review, Group revenues decreased from GBP3.9

million to GBP2.6 million, a reduction of GBP1.3 million. The

mature businesses accounted for GBP0.3 million of the reduction,

but the main part relates to the technology businesses where we no

longer have the benefit of revenue from the DSTL development

contract.

The loss from operations was GBP3.13 million (2022: GBP1.86

million) with the comparative period having the revenues from the

DSTL contract which did not recur in the current period thus

affecting both gross margin and operational results.

The adjusted LBITDA for continuing operations was GBP2.01

million compared to GBP0.31 million for the comparative period in

2022, calculated as follows:

6 months ended 6 months ended

31 March 2023 31 March 2022

GBP'000 GBP'000

-------------- --------------

(Loss) from operations (3,130) (1,862)

-------------- --------------

Depreciation and Amortisation 683 713

-------------- --------------

Share based payments 264 561

-------------- --------------

Exceptional items 170 (44)

-------------- --------------

Other losses - 318

-------------- --------------

Adjusted LBITDA (2,013) (314)

-------------- --------------

Adjusted LBITDA (which is not a GAAP measure and is not intended

as a substitute for GAAP measures and may not be the same as that

used by other companies) is a measure used by management to reflect

the core operating performance of the underlying businesses rather

than the effects of non-core financial and non-cash expenses.

The reported loss before tax was GBP3.40 million (2022: GBP2.16

million). Group net assets at 31 March 2023 were GBP10.48 million

(30 September 2022: GBP11.60 million) with cash at the period end

of GBP0.76 million (30 September 2022: GBP1.35 million).

Net cash used in operating activities was GBP1.83 million (2022:

GBP0.96 million) and investment in development costs and equipment

was GBP0.14 million (2022: GBP1.70 million), net principal lease

payments were GBP 0.35 million (2022: GBP0.25 million) and CBILS

repayments GBP0.05 million (2022: GBP0.04 million) giving total

cash outflows of GBP2.37 million (2022: GBP2.95 million).

These activities were financed by net funds received from the

share issues of GBP2.02 million (2022:GBPnil and funds from

Innovate UK and sharing agreements of GBPnil (2022:GBP 2.41

million

The deficit of GBP0.35 million (2022: GBP0.54 million) together

with reduced drawings on the invoice finance facilities of GBP0.24

million (2022: GBP0.17 million increase) resulted in a cash

reduction of GBP0.59 million (2022: GBP0.37 million).

Technology Businesses

The Technology Businesses have seen a decrease in revenue to

GBP0.09 million from GBP0.97 million in the comparative period

following the successful completion of the DSTL development

project. Discussions relating to product supply are ongoing.

Further information is given in note 3, segmental information.

As stated in the last Annual Report, development costs primarily

relating to the GSCALE project were capitalised with a carrying

value of GBP4.15 million.

Goodwill arising on consolidation of GBP3.13 million relates to

the Technology Businesses and represents the excess of the fair

value of the Group's share of net assets of acquired subsidiaries

at the date of acquisition. It is usually reviewed annually for

impairment but, given the change of strategic direction a further

review has been carried out at the interim stage based on value in

use cash flow forecasts covering a five year period. This review

indicates no impairment is required and a further review will be

carried out at the year-end.

The change in strategy to a much-simplified structure has

resulted in a number of cost savings which are anticipated to flow

through in to the second half of this financial year. We are also

looking to reduce the manufacturing footprint at Longhope following

the adoption of the manufacturing light strategy.

Mature Businesses

The mature businesses have seen a revenue decline, principally

in AAC but remain broadly EBITDA positive. The disposal process for

both Total Carbide and AAC Cyroma is in progress.

Going Concern

The interim statements have been prepared on a going concern

basis as described in note 1, basis of preparation.

Chris Leigh

Chief Financial Officer

Consolidated Interim Financial Statements

Group statement of comprehensive income

For the 6 months ended 31 March 2023

31 March 31 March

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

Notes

Revenue 3 2,621 3,892

Cost of sales (2,138) (2,499)

---------- ----------

Gross profit 483 1,393

Other operating income 57 107

Other losses* - (318)

Operating expenses (including exceptional

items) (3,670) (3,044)

Loss from operations before exceptional

items (2,960) (1,906)

Exceptional items 4 (170) 44

Loss from operations (3,130) (1,862)

Finance charge (270) (302)

---------- ----------

Loss before income tax (3,400) (2,164)

Income Tax 5 - 81

---------- ----------

Loss for the period (3,400) (2,083)

---------- ----------

Loss attributable to:

- Owners of the parent company (3,199) (2,062)

- Non-controlling interest (201) (21)

---------- ----------

(3,400) (2,083)

---------- ----------

Loss per share attributable to the equity

holders of the Company:

Basic and diluted loss per share 6 (1.55)p (1.06)p

There is no other comprehensive income for the period.

* The other losses relate to the fair value assessment of the

Lanstead sharing agreements at the balance sheet date.

Group statement of financial position

As at 31 March 2023

31 March 30 September

2023 2022

Unaudited Audited

Note GBP'000 GBP'000

Assets

Non-current assets

Intangible Assets 7 10,585 10,636

Property, plant and equipment 5,363 5,861

Deferred taxation 25 25

Trade and other receivables 37 38

---------------------------------------------------- ---- ---------- ------------

16,010 16,560

---------------------------------------------------- ---- ---------- ------------

Current assets

Inventory 1,975 2,131

Trade and other receivables 1,955 2,155

Cash and cash equivalents 762 1,351

---------------------------------------------------- ---- ---------- ------------

4,692 5,637

---------------------------------------------------- ---- ---------- ------------

Total assets 20,702 22,197

---------------------------------------------------- ---- ---------- ------------

Equity

Called up share capital 2,047 1,941

Share premium 36,874 34,961

Merger reserve 1,256 1,256

Share-based payment reserve 5,023 4,759

Accumulated losses (32,893) (29,694)

---------------------------------------------------- ---- ---------- ------------

Equity attributable to owners of the parent company 12,307 13,223

Non-controlling interest (1,825) (1,624)

---------------------------------------------------- ---- ---------- ------------

Total equity 10,482 11,599

---------------------------------------------------- ---- ---------- ------------

Liabilities

Non-current liabilities

Trade and other payables 706 600

Deferred taxation - 67

Innovate Loan 5,000 5,000

Long-term borrowings 1,419 1,595

---------------------------------------------------- ---- ---------- ------------

7,125 7,262

---------------------------------------------------- ---- ---------- ------------

Current liabilities

Trade and other payables 2,183 1,957

Invoice discounting advances 425 660

Current portion of long-term borrowings 487 719

---------------------------------------------------- ---- ---------- ------------

3,095 3,336

---------------------------------------------------- ---- ---------- ------------

Total liabilities 10,220 10,598

---------------------------------------------------- ---- ---------- ------------

Total equity and liabilities 20,702 22,197

---------------------------------------------------- ---- ---------- ------------

Group statement of changes in equity

For 6 months ended 31 March 2023

Share Share-based Non-

Share premium Merger payment Accumulated controlling Total

capital account reserve reserve losses interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- -------- -------- -------- ----------- ----------- ------------ --------

At 1 April 2022 (unaudited) 1,941 34,948 1,256 4,405 (26,708) (1,401) 14,441

Issue of shares - 13 - - - - 13

Loss for the period - - - - (2,986) (223) (3,209)

Share-based payments - - - 354 - - 354

------------------------------- -------- -------- -------- ----------- ----------- ------------ --------

At 30 September 2022 (audited) 1,941 34,961 1,256 4,759 (29,694) (1,624) 11,599

------------------------------- -------- -------- -------- ----------- ----------- ------------ --------

Issue of shares 106 1,913 - - - - 2,019

Loss for the period - - - - (3,199) (201) (3,400)

Share-based payments - - - 264 - - 264

------------------------------- -------- -------- -------- ----------- ----------- ------------ --------

At 31 March 2023 (unaudited) 2,047 36,874 1,256 5,023 (32,893) (1,825) 10,482

------------------------------- -------- -------- -------- ----------- ----------- ------------ --------

Statement of Group cash flows

For the 6 months ended 31 March 2023

6 months 6 Months

ended ended

31 March 31 March

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

----------------------------------------------- ---------- -----------

Cash flows from operating activities

Cash used in operations (1,561) (830)

Interest paid (270) (135)

----------------------------------------------- ---------- -----------

Net cash used in operating activities (1,831) (965)

----------------------------------------------- ---------- -----------

Cash flows from investing activities

Purchase/capitalisation of intangible assets (98) (1,337)

Purchase of property, plant and equipment (45) (359)

----------------------------------------------- ---------- -----------

Net cash used in investing activities (143) (1,696)

----------------------------------------------- ---------- -----------

Cash flows from financing activities

Share issue 2,040 0

Share issue costs (21) 0

Funds received from Innovate UK - 1,030

Funds received from sharing agreements - 1,377

Net funds (paid)/received from CBILS (52) (38)

Principal payment of leases under IFRS 16 (347) (248)

Invoice discounting loan (repayments)/proceeds (235) 173

----------------------------------------------- ---------- -----------

Net cash generated from financing activities 1,385 2,294

----------------------------------------------- ---------- -----------

Increase in cash and cash equivalents (589) (367)

Cash and cash equivalents at start of period 1,351 3,462

----------------------------------------------- ---------- -----------

Cash and cash equivalents at end of period 762 3,095

----------------------------------------------- ---------- -----------

Note to the statement of Group cash flows

For the 12 months ended 31 March 2023

6 months 6 months

ended ended

31 March 31 March

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

--------------------------------------------------- ---------- -----------

Loss before income tax (3,400) (2,164)

Adjustments for:

Share-based payments 264 561

Depreciation 534 372

Amortisation 149 341

Disposal of tangible assets - (1)

Finance cost 270 302

R&D Tax credit received - 81

Loss on FV movement of share agreement - 318

Increase/(Decrease) in trade and other receivables

and investments 200 158

(Increase)/Decrease in inventories 156 (253)

(Decrease)/Increase in trade and other payables 266 (545)

--------------------------------------------------- ---------- -----------

Cash used in operations (1,561) (830)

--------------------------------------------------- ---------- -----------

Notes to the unaudited interim statements

For the 6 months ended 31 March 2023

1. Basis of preparation

Versarien Plc is an AIM quoted company incorporated and

domiciled in the United Kingdom under the Companies Act 2006. The

Company's registered office is Units 1A-D, Longhope Business Park,

Monmouth Road, Longhope, Gloucestershire, GL17 0QZ.

The interim financial statements were prepared by the Directors

and approved for issue on 9 June 2023. These interim financial

statements do not comprise statutory accounts within the meaning of

section 434 of the Companies Act 2006. Statutory accounts for the

period ended 30 September 2022 were approved by the Board of

Directors on 20 February 2023 and delivered to the Registrar of

Companies. The report of the auditors on those accounts was

unqualified and did not contain statements under sections 498 (2)

or (3) of the Companies Act 2006. The report contained reference to

a material uncertainty related to going concern.

As permitted, these interim financial statements have been

prepared in accordance with UK AIM Rules and UK-adopted IAS 34,

"Interim Financial Reporting". They should be read in conjunction

with the annual financial statements for the period ended 30

September 2022, which have been prepared in accordance with

UK-adopted international accounting standards, consistent with the

IFRS framework adopted in UK law. The accounting policies applied

are consistent with those of the annual financial statements for

the period ended 30 September 2022, as described in those financial

statements. Where new standards or amendments to existing standards

have become effective during the year, there has been no material

impact on the net assets or results of the Group.

These interim financial statements have been prepared on a going

concern basis making the following assumptions:

-- The Group meets its day-to-day working capital requirements

through careful cash management and the use of its invoice

discounting facilities which are expected to continue;

-- As at 31 March 2023, the Group had cash balances totalling

GBP0.76 million with GBP0.18 million of headroom on its invoice

discounting facilities;

-- The Group has utilised its authority to issue 42.5 million

shares without pre-emption rights and raised GBP0.53 million gross

post period end and expects the placing authority to be renewed at

the next general meeting: and

-- The Group is following a turnaround strategy to cut costs and

sell certain assets anticipated to generate material cash

inflows

The Directors have prepared detailed projections of expected

future cash flows for a period of twelve months from the date of

issue of this interim statement.

The Group continues to apply for grants as part of its funding

strategy but is now primarily dependent upon cash inflows from the

sale of assets or from further issue of shares if there is a

requirement to bridge an intervening period. Consequently, this

represents a material uncertainty that may cast significant doubt

on the Group's ability to continue as a going concern and therefore

it may be unable to realise its assets and discharge its

liabilities in the normal course of business. The financial

statements do not include adjustments that would result if the

Group was unable to continue as a going concern.

Certain statements within this report are forward looking. The

expectations reflected in these statements are considered

reasonable. However, no assurance can be given that they are

correct. As these statements involve risks and uncertainties the

actual results may differ materially from those expressed or

implied by these statements. The interim financial statements have

not been audited.

3. Segmental information

The segment analysis for the 6 months to 31 March 2023 is as

follows:

Central Technology Mature Intra-group TOTAL

Businesses Businesses Adjustments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------- ----------- ----------- ------------ -------

Revenue - 87 2,534 - 2,621

Gross Margin - (277) 760 - 483

Other gains/(losses) - - - - -

Other operating

income - 54 3 - 57

Operating expenses (916) (1,801) (947) (6) (3,670)

------------------------ ------- ----------- ----------- ------------ -------

(Loss)/ profit

from operations (916) (2,024) (184) (6) (3,130)

------------------------ ------- ----------- ----------- ------------ -------

Finance income/(charge) (170) (39) (61) - (270)

------------------------ ------- ----------- ----------- ------------ -------

(Loss)/profit

before tax (1,086) (2,063) (245) (6) (3,400)

------------------------ ------- ----------- ----------- ------------ -------

The segment analysis for the 6 months to 31 March 2022 is as

follows:

Central Technology Mature Discontinued Intra-group TOTAL

Businesses Businesses Operations Adjustments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ------- ----------- ----------- ------------ ------------ -------

Revenue - 966 2,843 83 - 3,892

Gross Margin - 679 695 19 - 1,393

Other gains/(losses) (318) - - - - (318)

Other operating

income - 105 2 - - 107

Operating expenses (971) (1,293) (797) (5) 22 (3,044)

------------------------ ------- ----------- ----------- ------------ ------------ -------

(Loss)/ profit

from operations (1,289) (509) (100) 14 22 (1,862)

------------------------ ------- ----------- ----------- ------------ ------------ -------

Finance income/(charge) (236) (28) (38) - - (302)

------------------------ ------- ----------- ----------- ------------ ------------ -------

(Loss)/profit

before tax (1,525) (537) (138) 14 22 (2,164)

------------------------ ------- ----------- ----------- ------------ ------------ -------

4. Exceptional items

Exceptional items relate to redundancy costs principally in

relation to the closure of Versarien Graphene Inc.

5. Taxation

The tax charge on the results for the period has been estimated

at GBPnil (2022: GBPnil). At the last year end the Group had

GBP25.52 million of trading losses carried forward to set-off

against future trading profits. Taxation received in the

comparative period relates to R&D tax credit.

6. Loss per share

The loss per share has been calculated by dividing the loss

after taxation of GBP3,199,000 (2022: GBP2,062,000) by the weighted

average number of shares in issue of 205,983,636 (2022:

194,179,790) during the period.

The calculation of the diluted earnings per share is based on

the basic earnings per share adjusted to allow for the issue of

shares on the assumed conversion of all dilutive options. However,

in accordance with IAS33 "Earnings per Share", potential Ordinary

shares are only considered dilutive when their conversion would

decrease the profit per share or increase the loss per share. As at

31 March 2023 there were 15,205,850 (2022: 14,677,130) potential

Ordinary shares that have been disregarded in the calculation of

diluted earnings per share as they were considered non-dilutive at

that date.

7. Intangible assets

31 March 31 March

2023 2022

Unaudited Audited

GBP'000 GBP'000

-------------------- ---------- --------

Goodwill 3,132 3,132

Patents, trademarks

and other 3,304 3,355

Development costs 4,149 4,149

-------------------- ---------- --------

Total 10,585 10,636

-------------------- ---------- --------

8. Dividends

As stated in the 2013 AIM Admission document, the Board's

objective is to continue to grow the Group's business and it is

expected that any surplus cash resources will, in the short to

medium term, be re-invested into the research and development of

the Group's products. Consequently, the Directors will not be

recommending a dividend for the foreseeable future. However, the

Board intends that the Company will recommend or declare dividends

at some future date once they consider it commercially prudent for

the Company to do so, bearing in mind its financial position and

the capital resources required for its development.

9. Interim Report

This interim announcement is available on the Group's website at

www.versarien.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUMWQUPWGBR

(END) Dow Jones Newswires

June 09, 2023 02:00 ET (06:00 GMT)

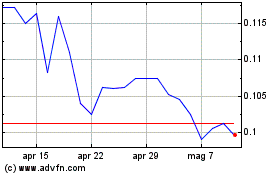

Grafico Azioni Versarien (LSE:VRS)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Versarien (LSE:VRS)

Storico

Da Mag 2023 a Mag 2024