Versarien PLC Placing to raise GBP454,822 (7079S)

08 Novembre 2023 - 8:00AM

UK Regulatory

TIDMVRS

RNS Number : 7079S

Versarien PLC

08 November 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) 596/2014 (AS AMENDED) AS IT

FORMS PART OF THE DOMESTIC LAW OF THE UNITED KINGDOM BY VIRTUE OF

THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (AS AMENDED). UPON

PUBLICATION OF THIS ANNOUNCMENT, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

8 November 2023

Versarien plc

("Versarien" or the "Company")

Placing to raise GBP454,822

Versarien plc (AIM: VRS), the advanced materials engineering

group, announces it has raised GBP454,822 (before expenses) by way

of a placing (the "Placing") of 165,389,817 new ordinary shares in

the capital of the Company ("Placing Shares") at a price of 0.275

pence per share (the "Placing Price").

Highlights

-- Versarien has raised GBP454,822, before expenses, through the

placing of 165,389,817 new ordinary shares in the capital of the

Company at a price of 0.275 pence per share

-- The net proceeds of the Placing will be used for corporate

and working capital purposes, together with providing bridge

finance to extend the Company's cash runway ahead of any funds

received from asset sales

-- The issue of the Placing Shares is within existing

authorities granted by shareholders at the general meeting of the

Company held on 30 October 2023 and therefore no shareholder

approval is required for the Placing

Use of Proceeds and Turnaround Strategy

The net proceeds of the Placing will be used for corporate and

working capital purposes, together with providing bridge finance to

extend the Company's cash runway ahead of any funds received from

asset sales.

Versarien continues to pursue its stated turnaround

strategy:

-- to maintain and strengthen the Company's scientific teams;

-- use its know-how in construction and textiles to be a manufacturing light operation;

-- to licence Versarien's technology, brands and manufacturing understanding; and

-- divest non-core activities.

As previously announced, t he mature businesses and the

intellectual property and plant acquired from Hanwha Aerospace in

2020 continue to be marketed for sale and the Company is

progressing discussions with a number of interested parties. The

sale process for AAC Cyroma Limited, a manufacturer of moulded

products, is the most advanced. However, the timing of any asset

sales and the total quantum of the funds that may be received

remains uncertain.

Stephen Hodge, Chief Executive Officer of Versarien,

commented:

" As we have previously announced, the Company requires further

funding to continue its turnaround strategy and we welcome the

investor interest in this Placing. We continue to focus on this

strategy, pursuing an encouraging pipeline of commercial and

R&D projects , as well as technology licencing opportunities.

We look forward to updating shareholders on continuing progress in

the coming months."

Admission and Total Voting Rights

Application has been made for admission of the Placing Shares to

be admitted to trading on AIM ("Admission") on or around 13

November 2023. The Placing Shares will rank pari passu in all

respects with the Company's existing ordinary shares. Following

Admission, the total number of ordinary shares in the Company in

issue will be 496,169,507. This figure may be used by shareholders

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in the Company under the FCA's Disclosure

and Transparency Rules.

For further information please contact:

Versarien c/o IFC

Stephen Hodge, Chief Executive Officer

Chris Leigh, Chief Financial Officer

SP Angel Corporate Finance (Nominated

Adviser and Broker) +44 (0)20 3470

Matthew Johnson, Adam Cowl 0470

IFC Advisory Limited (Financial PR and

Investor Relations) +44 (0) 20 3934

Tim Metcalfe, Zach Cohen 6630

About Versarien:

The strategy of Versarien plc (AIM:VRS) is to be a development

led advanced materials company focussed on specific sectors that

will lead to a light manufacturing and licensing model.

For further information please see : http://www.versarien.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUPGWWGUPWPUM

(END) Dow Jones Newswires

November 08, 2023 02:00 ET (07:00 GMT)

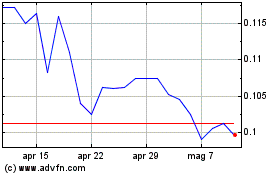

Grafico Azioni Versarien (LSE:VRS)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Versarien (LSE:VRS)

Storico

Da Mag 2023 a Mag 2024