Naked Wines PLC Trading Statement (0649A)

18 Gennaio 2024 - 8:00AM

UK Regulatory

TIDMWINE

RNS Number : 0649A

Naked Wines PLC

18 January 2024

18 January 2024

Naked Wines plc

("Naked Wines" or "Group")

Peak trading in line with expectations, GBP7m SG&A reduction

announced

Trading over Q3, the peak quarter for the business, has been in

line with the company's expectations:

-- Constant currency sales -10% versus prior year, in line with

expectations, showing an improving trend from -18% during H124

-- Average repeat customer base 12% smaller

-- Sales per repeat customer 2% higher

-- New customers acquired +35% on prior year with 70% increase in new customer investment

-- YTD forecast payback at 1.4x remaining broadly in line with

H1 trend as we continue to balance scale and cashflow with

investment economics

-- Q3 Adj EBIT expected to be GBP3-5m, consistent with expectations

-- Stabilisation of Q3 closing net cash position year on year at

GBP3m (Q3 FY23: GBP4m). Total liquidity available of GBP45m

The Group is delivering on key initiatives including the

execution of further SG&A and inventory reductions as indicated

alongside half year reporting:

-- Cost saving actions taken this month to reduce annual run

rate of SG&A (excluding adjusted items) by a further GBP7m to

GBP30-33m in FY25 (FY24 guidance GBP37-40m)

-- One-off cash costs of c.GBP3m to execute to be reported as an adjusted item in FY24

-- Closing Q3 inventory levels of GBP163m vs GBP173m at end Q3 FY23

Rowan Gormley, Executive Chairman, said:

"I'm delighted with how the team pulled together to deliver a

well-executed peak trading season. As we saw at the half year, the

reason sales are down on prior year is entirely due to a smaller

repeat customer base reflecting lower investment in customer

recruitment in the previous year. But for the first time we are

seeing signs of new customer acquisition coming back to life which

should support further improvement in the top line trend. We have

also seen a stabilisation in net cash levels year on year and

continue to expect cash generation in the second half of FY25.

Notwithstanding this, we have to recognise that we are a smaller

company post Covid and our cost base has to reflect this. We have

therefore taken the painful but necessary decision to reduce

SG&A costs by GBP7m per year, securing our profit potential.

Sadly this means that we will be losing a number of valued

colleagues who have been informed of our plans. Reflecting this

change across all levels of the organisation we have decided to

reduce the size of the board and would like to thank Melanie Allen

for her service to the Company as a Non-Executive Director.

I remain committed to building a leaner and stronger Naked as we

continue to address the challenging revenue trends. I'd like to

thank the team, our suppliers and our shareholders for their

patience and support as we continue to drive these changes."

For further information, please contact:

Naked Wines plc IR@nakedwines.com

Rowan Gormley, Executive Chairman

James Crawford, Chief Financial

Officer

Clara Melia / Catherine Miles

Investec (NOMAD & Joint Broker) Tel: 0207 597 5970

David Flin / Ben Farrow

Jefferies (Joint Broker) Tel: 0207 029 8000

Ed Matthews / Gill O'Driscoll

Instinctif (Financial PR) Tel: 07917 178 920 / 07931 598

Guy Scarborough / Damian Reece 593

About Naked Wines plc

Naked Wines connects everyday wine drinkers with the world's

best independent winemakers.

Why? Because we think it's a better deal for everyone. Talented

winemakers get the support, funding and freedom they need to make

the best wine they've ever made. The wine drinkers who support them

get much better wine at much better prices than traditional

retail.

It's a unique business model. Naked Wines customers (who we call

Angels) commit to a fixed prepayment each month which goes towards

their next purchase. In turn. Naked funds the production costs for

winemakers, generating savings that are passed back to its

customers. It creates a virtuous circle that benefits both wine

drinker and winemaker.

Our mission is to change the way the whole wine industry works

for the better. In the last financial year we served more than

792,000 Angels in the US, UK and Australia, making us a leading

player in the fast-growing direct-to-consumer wine market.

Our customers have direct access to 293 of the world's best

independent winemakers making over 2,000 quality wines in 22

different countries. We collaborate with some of the world's best

independent winemakers like Matt Parish (Beringer, Stags' Leap) and

eight-time Winemaker of the Year Daryl Groom (Penfolds Grange).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQKOBQOBKDNDD

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

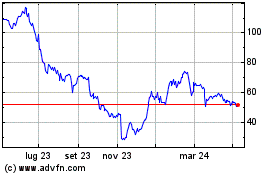

Grafico Azioni Naked Wines (LSE:WINE)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Naked Wines (LSE:WINE)

Storico

Da Mar 2024 a Mar 2025